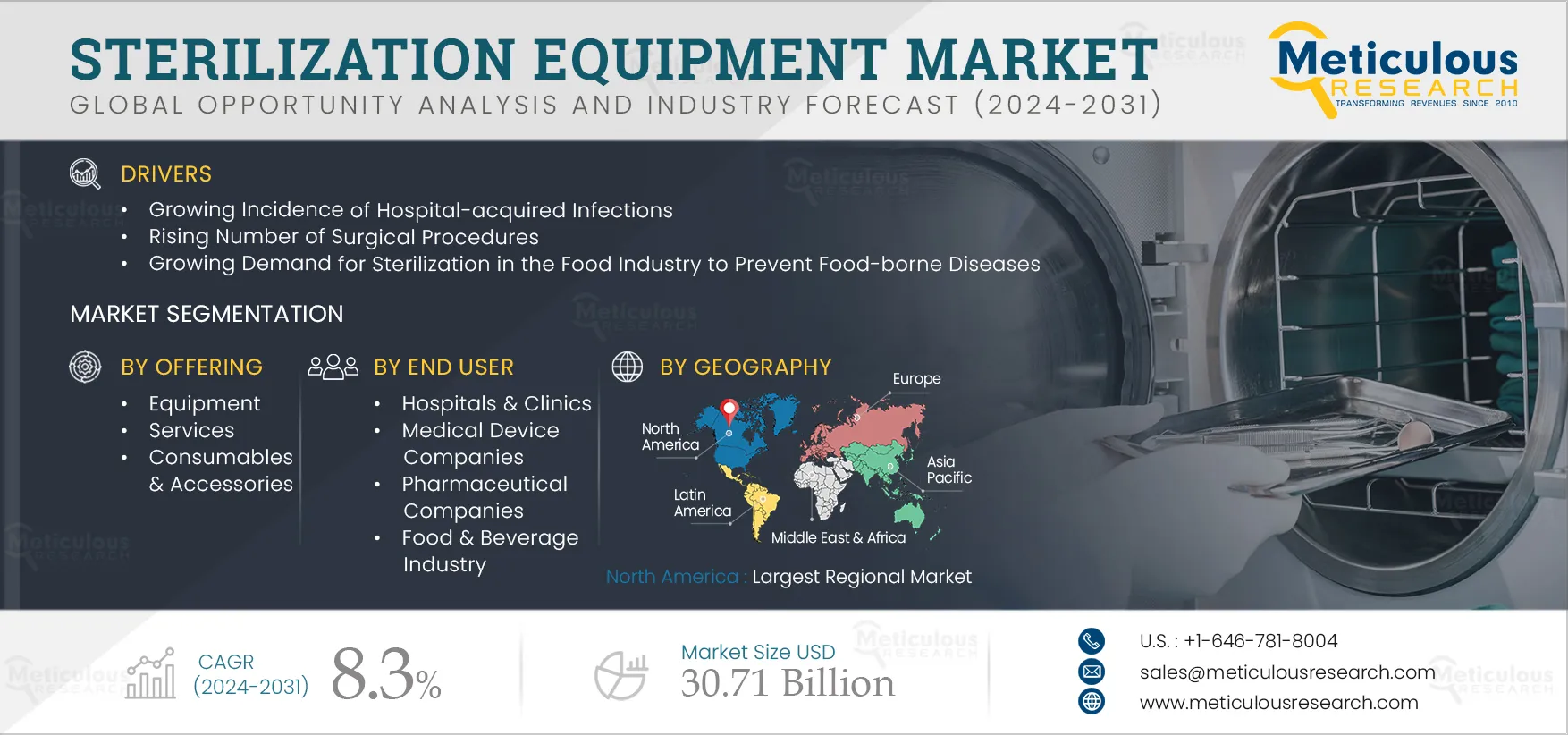

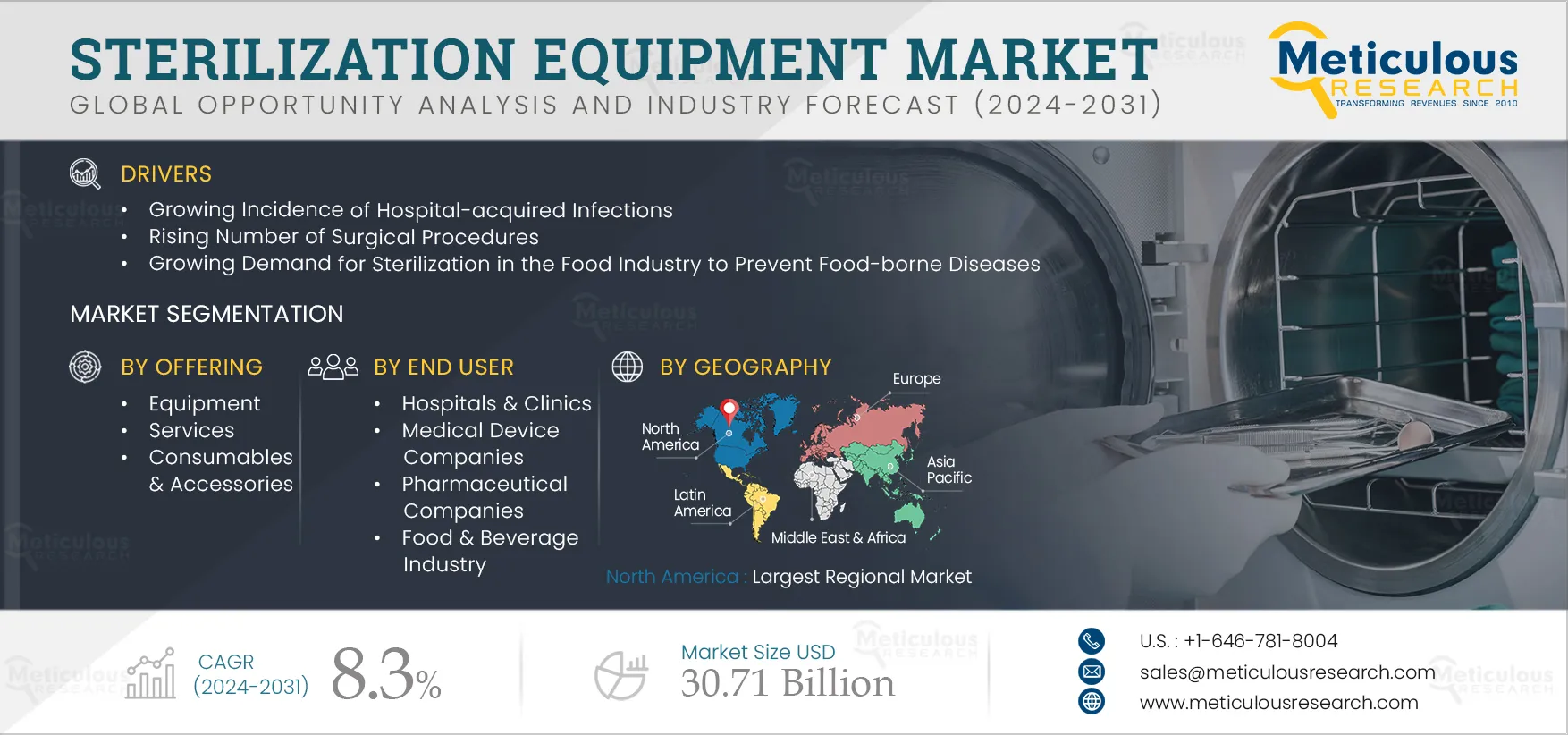

Sterilization Equipment Market SIze & Forecast

The Sterilization Equipment Market is projected to reach $30.71 billion by 2031, at a CAGR of 8.3% from 2024 to 2031. Sterilization is one of the key processes in many industries, including healthcare & non-healthcare. In the healthcare sector, this process plays an important role in eliminating, destroying, or killing biological entities to maintain a hygienic or sterile environment. This process is widely used in hospitals to prevent hospital-acquired infections and in medical device manufacturing industries to maintain a sterile processing environment within the facility during production or experiments as per the need. The entire sterilization process has been carried out as per the standards designed by various authorities.

The growth of the sterilization equipment market is driven by the growing incidence of hospital-acquired infections and the rising number of surgical procedures. The growing demand for sterilization in the food industry to prevent food-borne diseases and the increasing demand for sterilization from the pharmaceutical and biotechnology industries also contribute to the market’s growth. Factors such as the increasing use of e-beam sterilization, growing demand for sterilization products in emerging markets, and the use of supercritical CO2 sterilization technology gaining traction in the medical devices industry are some of the opportunities in this industry. Non-compliance with sterilization standards in the healthcare sector is challenging market growth. However, the harmful effects of ethylene oxide and concerns regarding the safety of reprocessed instruments restrain the growth of the market.

Growing Incidence of Hospital-acquired Infections

Hospital-acquired Infections (HAIs), also known as nosocomial infections, are the ones acquired in hospitals or any other healthcare facility, that first appear in 48 hours or more after hospital admission or within 30 days after discharge. Hospital-acquired infections are caused by viral, bacterial, and fungal pathogens. The most common types of these infections are bloodstream infection (BIS), pneumonia, urinary tract infection (UTI), and surgical site infection (SSI). These infections not only threaten the patient’s health & life but also prolong hospital stays and thereby create an additional economic burden to patients and the healthcare system. These infections contribute to approximately 7% and 10% of the total reported infections in developed and developing countries, respectively.

Apart from these developed regions/countries, HAIs are considered as serious problems for healthcare systems, where public health infrastructure and technology for infection prevention remain underdeveloped. According to data provided by the World Health Organization (WHO), in May 2022, out of every 100 patients in acute-care hospitals, seven patients in high-income countries, and 15 patients in low- and middle-income countries acquire at least one healthcare-associated infection (HAI) during their hospital stay. Moreover, a major challenge observed was the delayed response to the outbreaks, which was around 50% HAI studies of Ebola, severe acute respiratory syndrome (SARS), and Middle East respiratory syndrome (MERS) in Asia and West Africa. In countries of the Mano River Union (Guinea, Sierra Leone, and Liberia), almost all HAI cases of Ebola were related to delayed response. Moreover, policy and lack of standard case definition were responsible for this international catastrophe. Additionally, poor training was found to have an impact on the spread of these infections. Thus, to overcome these challenges, it is necessary to have proper sterilization systems across healthcare facilities, such as sterilizer machines and sterilization services, and hence, are expected to drive the market in the near future.

Rising Demand of Sterilization in Food Industry to Prevent Food-Borne Diseases

Food-borne diseases are one of the major public health concerns, globally. According to the World Health Organization (WHO), nearly 600 million people, i.e., 1 in 10 people globally, suffer from food-borne infections every year. Of these, nearly 230,000 people succumb to death. There are a number of food-borne disease cases across the world. For instance, as per the data from the U.S. FDA, in 2020, organizations, namely the CDC, FDA, and local partners, are currently investigating a multitask outbreak of Listeria monocytogenes infections linked to enoki mushrooms distributed by Guan’s Mushroom Co. (U.S.). Thus, Guan’s Mushroom Co. recalled all of its 200g/7.05 oz packages of enoki mushrooms imported from Korea on March 23, 2020.

Thus, the food industry is increasingly focusing on the sterile processing of devices and machines to prevent the occurrence of food-borne infections. The Food and Agriculture Organization of the UN (FAO) and the WHO have defined guidelines for the use of low doses of irradiation in food sterilization. Today, e-beam sterilization is widely used in the food processing industry to ensure the quality of food and prevent occurrences of food-borne diseases. As the food industry is becoming more global in nature, sterilization practices are being adopted across the ecosystem including food traders, processing organizations, transporters, and distributors. Many of the key food exporting countries across the globe are increasingly focusing on strengthening sterilization practices in their respective food industries. With this, e-beam and gamma sterilization are gaining greater adoption in the food industry. This is, in turn, contributing to the growth of the overall sterilization equipment market, globally.

Click here to: Get Free Sample Pages of this Report

Key Findings of the Sterilization Equipment Market Study:

Among Offerings, the Equipment Segment is Expected to Account for the Largest Share of the Market in 2024

Among offerings, in 2024, the equipment segment is expected to account for the largest share of the market. The effectiveness of sterilization equipment in sterilizing the reusable medical instruments, surgical instruments, and other materials required for various microbial-safe environments, the rising number of HAIs, the increasing need for food safety, and the growing prevalence of chronic diseases aging population support the growth of the market. For instance, as per data published by the United Nations, in 2020, nearly 727 million people (9.3% of the global population) were over the age of 65. This number is projected to increase to over 1.5 billion (16% of the global population) by 2050. This would also increase the number of hospitalizations, which would increase the demand for sterilized equipment, driving the growth of the segment.

Among End Users, the Hospitals & Clinics Segment is Expected to Account for the Largest Share of the Market in 2024

Among end users, in 2024, the hospitals & clinics segment is expected to account for the largest share of the market. The large share of the segment is attributed to factors such as the growing incidence of hospital-acquired infections (HAIs) and the rising number of surgical procedures. Apart from these factors, increasing chronic diseases associated with the aging population, growing awareness among people for quality care, rising number of hospitalizations due to sudden outbreaks of infections, such as COVID-19, and focus on reducing the healthcare burden caused due to HAIs also contribute to the segment’s large share. For instance, according to the Robert Koch Institute (Germany), an estimated 400,000–600,000 patients get hospital-acquired infections every year, of which 10,000–15,000 succumb to these infections. The rising incidence rate of hospital-acquired infections is expected to drive the demand for sterile processing equipment.

North America: Largest Regional Market

The large share of the segment is primarily due to the growing hospital & outpatient visits, rising number of surgical procedures, growing number of cases with HAIs, growing healthcare expenditure, growth in the pharma & biotech industry, and increasing aging population with chronic diseases. Moreover, government initiatives to reduce HAIs, implementation of effective sterilization services and sterilization machines, availability of advanced infrastructure, and presence of key players also contribute to its largest share in the global sterilization equipment market.

Sterilization Equipment Market: Key Companies

The key players profiled in the global sterilization equipment market are STERIS plc. (U.S.), Getinge AB (Sweden), 3M Company (U.S.), Advanced Sterilization Products (U.S.), MMM Group (Germany), MATACHANA group (Spain), Cardinal Health, Inc. (U.S.), Sotera Health (U.S.), Belimed AG (Switzerland), Benchmark Scientific, Inc. (U.S.), Andersen Sterilizers, Inc. (U.S.), and Steelco S.P.A. (A Part of Miele & Cie. Kg) (Italy).

The report includes a competitive landscape based on an extensive assessment of the market categorized by product type, application, and end user. The report also provides insights into the presence of major market players and their key growth strategies in the last three to four years.

Sterilization Equipment Market Report Summary :

|

Particular

|

Details

|

|

Page No

|

~520

|

|

Format

|

PDF

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

CAGR

|

8.3%

|

|

Market Size (Value)

|

$30.71 billion by 2031

|

|

Segments Covered

|

By Offering

- Equipment

- Heat/Steam Sterilization Equipment

- Moist Heat Sterilizers

- Gravity Displacement Autoclaves

- High-speed Pre-vacuum Sterilizers

- Dry Heat Sterilizers

- Static Air Sterilizers

- Forced Air Sterilizers

- Low-Temperature Sterilization Equipment

- Hydrogen Peroxide/Gas Plasma Sterilizers

- Ethylene Oxide Sterilizers

- Ozone-Based Sterilizers

- Formaldehyde Sterilizers

- Other Low-Temperature Sterilization Equipment

(Note: Other low-temperature sterilization equipment primarily includes nitrogen dioxide sterilization and vaporized peracetic acid (VPA)-based sterilizers)

- Radiation Sterilization Equipment

- Filtration Sterilization Equipment

- Services

- Ethylene Oxide Sterilization Services

- Gamma Sterilization Services

- E-Beam Sterilization Services

- Steam Sterilization Services

- Other Sterilization Services

(Note: Other sterilization services include primarily include services of the following technologies: vaporized hydrogen peroxide, hydrogen peroxide, hydrogen peroxide gas plasma sterilization, X-ray sterilization, NO2, peracetic acid, and dry heat sterilization)

- Consumables & Accessories

- Sterilization Indicators

- Biological Indicators

- Chemical Indicators

- Sterilant

- Instrument Packaging & Pouches

- Other Consumables & Accessories

(Note: Other consumables & accessories include trolleys, carts, baskets, containers, trays, and racks)

By End User

- Hospitals & Clinics

- Medical Device Companies

- Pharmaceutical Companies

- Food & Beverage Industry

- Other End Users

(Note: Other end users primarily include contract research organizations and dietary supplements manufacturing companies)

|

|

Countries Covered

|

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (Saudi Arabia, U.A.E., South Africa, and Rest of Middle East & Africa)

|

|

Key Companies

|

STERIS plc. (U.S.), Getinge AB (Sweden), 3M Company (U.S.), Advanced Sterilization Products (U.S.), MMM Group (Germany), MATACHANA group (Spain), Cardinal Health, Inc. (U.S.), Sotera Health (U.S.), Belimed AG (Switzerland), Benchmark Scientific, Inc. (U.S.), Andersen Sterilizers, Inc. (U.S.), and Steelco S.P.A. (A Part of Miele & Cie. Kg) (Italy)

|

Key questions answered in the report: