Resources

About Us

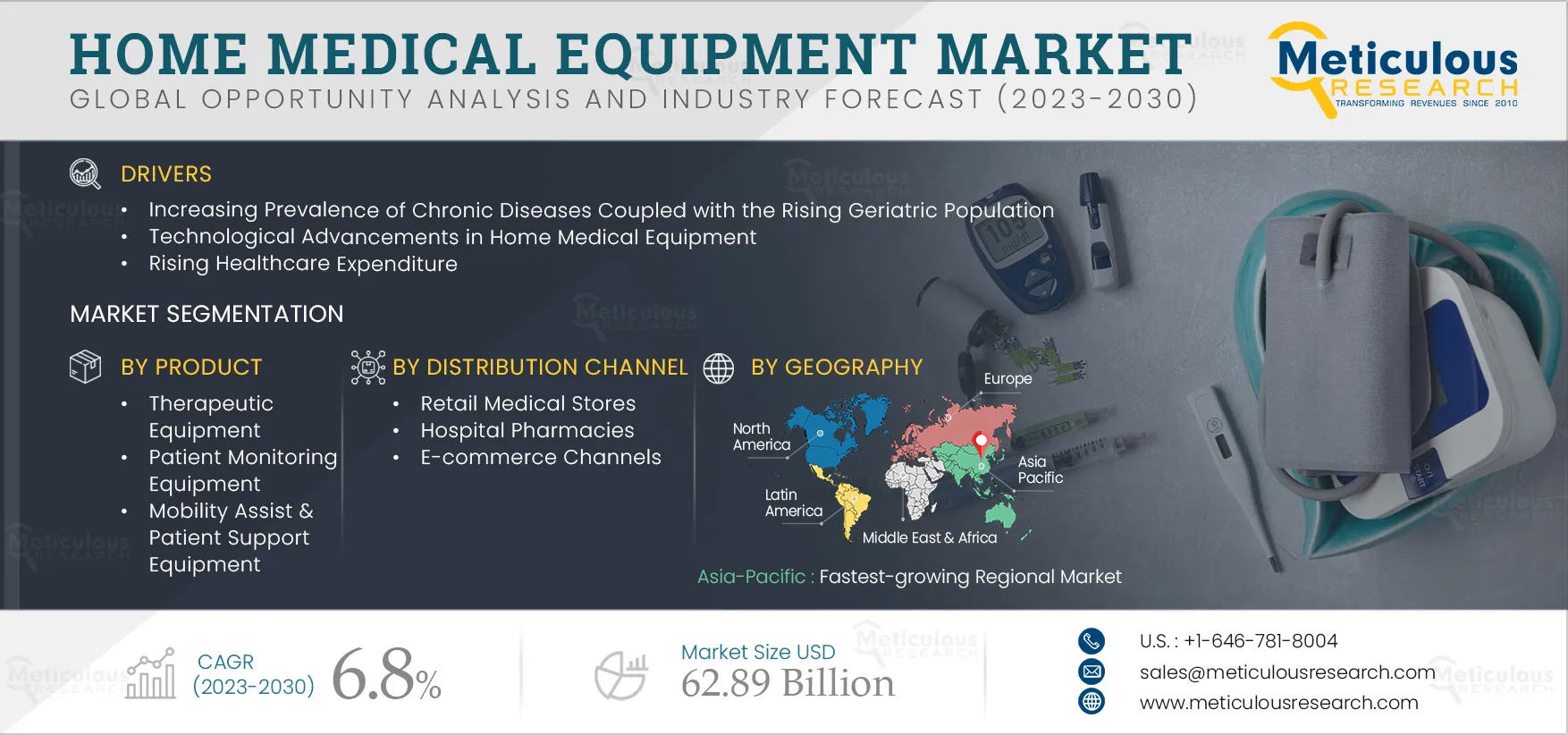

Home Medical Equipment Market by Product (Therapeutic [CPAP, Nebulizer, Ventilator, Dialysis, IV Equipment] Monitoring [Cardiac, Glucose, Temperature, Apnea] Mobility Assist [Walker, Wheelchair, Scooter]) Distribution Channel – Global Forecast to 2030

Report ID: MRHC - 104155 Pages: 280 Jun-2023 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe Home Medical Equipment Market is projected to reach $62.89 billion by 2030, at a CAGR of 6.8% from 2023 to 2030. Home medical equipment is used at home for medical or home care purposes. Home medical equipment enables patients to carry out essential daily activities independently within their homes and facilitates their participation in activities outside their homes. Patients use home medical equipment & services to control several conditions, including respiratory diseases, cardiovascular diseases, mobility disorders, wound care, and diabetes. Home medical equipment is mostly used when a patient or individual requires prolonged care or stays in healthcare facilities.

The increasing prevalence of chronic diseases coupled with the rising geriatric population, technological advancements in home medical equipment, rising healthcare expenditure, and high adoption of self-health management practices are driving the growth of this market. Furthermore, emerging economies are expected to offer significant market growth opportunities. However, the high costs of medical equipment and the absence of reimbursement for home medical equipment are expected to restrain the market's growth.

According to the United Nations World Population Prospects, between 2022 and 2050, the geriatric population is projected to grow at rates exceeding 3% in Central and Southern Asia, Sub-Saharan Africa, Oceania (excluding Australia and New Zealand), Northern Africa, and Western Asia. The expanding elderly population increasingly relies on home medical equipment to address their growing healthcare needs for conditions such as cardiovascular diseases, respiratory diseases, cancer, and diabetes. According to the National Council on Aging (NCOA), around 95% of people over 65 have at least one chronic condition, while 80% have two or more. For instance, in the U.S., diabetes in older individuals is a serious and growing public health issue, and it is estimated that 40% of people with diabetes are above the age of 65 when they are first diagnosed.

Thus, the rise in the elderly population and the subsequent increase in the prevalence of chronic diseases are expected to boost the demand for home medical equipment, driving the growth of this market.

Click here to: Get Free Sample Pages of this Report

Technological advancements in home healthcare medical equipment have revolutionized the healthcare sector. Technologies like artificial intelligence help with diagnosis and treatment planning, telemedicine allows patients to get medical care remotely through video conferencing technology, remote monitoring systems allow patients to be monitored from their homes, and wearable devices can track vital signs and other health data. These advancements are making it easier for patients to get home care, improving the efficiency & accuracy of medical treatments.

Moreover, wireless technologies are revolutionizing home medical equipment, enabling significant improvements in patient mobility both within hospitals and at home. By integrating wireless protocols such as 802.11b into patient monitors, individuals can now leave the confines of the hospital while still being continuously monitored for vital signs such as blood pressure, electrocardiogram readings, and temperature. These advancements in wireless technologies increased the demand for healthcare services in the comfort of one's home. The introduction of portable, compact, and easily accessible home medical equipment has played a crucial role in driving the growth of the home medical equipment market.

Based on the product, the home medical equipment market is segmented into therapeutic equipment, patient monitoring equipment, and mobility assist & patient support equipment. The therapeutic equipment segment is further sub-segmented into home respiratory therapeutics equipment, oxygen delivery equipment, home IV equipment, and home dialysis equipment. In 2023, the therapeutics segment is expected to account for the largest share of the home medical equipment market. The large market share of this segment is attributed to the growing demand for devices such as home dialysis equipment, ventilators, and nebulizers used in home care settings to manage chronic diseases like respiratory disorders.

Based on the distribution channels, the home medical equipment market is segmented into retail medical stores, hospital pharmacies, and e-commerce channels. The e-commerce channels segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising penetration of e-commerce retailers in the home medical equipment market. Furthermore, E-commerce platforms offer numerous advantages, such as swift home delivery, convenient payment options, flexible return and refund policies, robust system security, and privacy measures. Additionally, E-commerce channels allow patients to make purchases anytime and from anywhere, eliminating the need for physical visits to medical stores.

Asia-Pacific is projected to register the highest CAGR during the forecast period. The growth of this regional market is attributed to growing investments in home healthcare in emerging countries like China, Japan, and India, the rising preference for home-based treatments due to higher hospitalization costs, government initiatives promoting home care, and the growing prevalence of chronic diseases due to the aging population.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants between 2020 and 2023. The key players profiled in the home medical equipment market report are Abbott Laboratories (U.S.), Amedisys, Inc (U.S.), Baxter Healthcare (U.S.), Convatec (U.K.), Fisher & Paykel Healthcare (New Zealand), Fresenius Medical Care AG & Co. KGaA (Germany), Becton, Dickinson and Company (U.S.), GE HealthCare (U.S.), Invacare Corporation (U.S.), Medtronic (Ireland), Hill-Rom Holdings, Inc. (U.S.), Smith & Nephew plc (U.K.), and Inogen, Inc. (U.S.).

|

Particular |

Details |

|

Page No |

~280 |

|

Format |

|

|

Forecast Period |

2023-2030 |

|

Base Year |

2022 |

|

CAGR |

6.8% |

|

Market Size (Value) |

$62.89 billion by 2031 |

|

Segments Covered |

By Product

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Switzerland, Netherlands, Belgium, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of APAC), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa (UAE, Saudi Arabia, Rest of Middle East & Africa) |

|

Key Companies |

Abbott Laboratories (U.S.), Amedisys, Inc (U.S.), Baxter Healthcare (U.S.), Convatec (U.K.), Fisher & Paykel Healthcare (New Zealand), Fresenius Medical Care AG & Co. KGaA (Germany), Becton, Dickinson and Company (U.S.), GE HealthCare (U.S.), Invacare Corporation (U.S.), Medtronic (Ireland), Hill-Rom Holdings, Inc. (U.S.), Smith & Nephew plc (U.K.), and Inogen, Inc. (U.S.). |

This study covers the market size and forecasts for various home medical equipment offered by key companies and distributed through retail medical stores, hospital pharmacies, and e-commerce channels.

The home medical equipment market is projected to reach $62.89 billion by 2030, at a CAGR of 6.8% during the forecast period.

In 2023, the therapeutics equipment segment is expected to account for the largest share of the home medical equipment market. The growing demand for devices such as home dialysis equipment, ventilators, and nebulizers used in home care settings to manage chronic diseases like respiratory disorders contributes to this segment's large market share.

The e-commerce channels segment is projected to register the highest CAGR over the forecast period. The growth of this segment is attributed to the increasing presence of e-commerce retailers. E-commerce platforms offer advantages such as swift home delivery, convenient payments, flexible return policies, and robust security measures. They allow patients to make purchases anytime, anywhere, eliminating the need for physical store visits. These benefits drive the growth of the e-commerce channels segment.

Based on geography, which region is expected to account for the largest share of the market in 2023?

Based on geography, North America is expected to account for the largest share of the market in 2023. North America’s major market share can be attributed to several factors, including the presence of prominent market players, the well-established healthcare sector, the high adoption of home medical equipment, and the rising geriatric population.

The growth of this market is driven by technological advancements in home medical equipment, rising healthcare expenditure, and high adoption of self-health management practices. Furthermore, emerging economies are expected to offer significant market growth opportunities.

The key players profiled in the home medical equipment market report are Abbott Laboratories (U.S.), Amedisys, Inc (U.S.), Baxter Healthcare (U.S.), Convatec (U.K.), Fisher & Paykel Healthcare (New Zealand), Fresenius Medical Care AG & Co. KGaA (Germany), Becton, Dickinson and Company (U.S.), GE HealthCare (U.S.), Invacare Corporation (U.S.), Medtronic (Ireland), Hill-Rom Holdings, Inc. (U.S.), Smith & Nephew plc (U.K.), and Inogen, Inc. (U.S.).

Published Date: Jan-2025

Published Date: May-2024

Published Date: Feb-2023

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates