Resources

About Us

Synthetic Biology Market Size, Share, Forecast, & Trends Analysis by Product (Enzymes, Oligonucleotide, DNA) Technology (Gene Synthesis, Genome Editing, Sequencing, Cloning) Application (Life Sciences, Chemical, Food) End User – Global Forecast to 2032

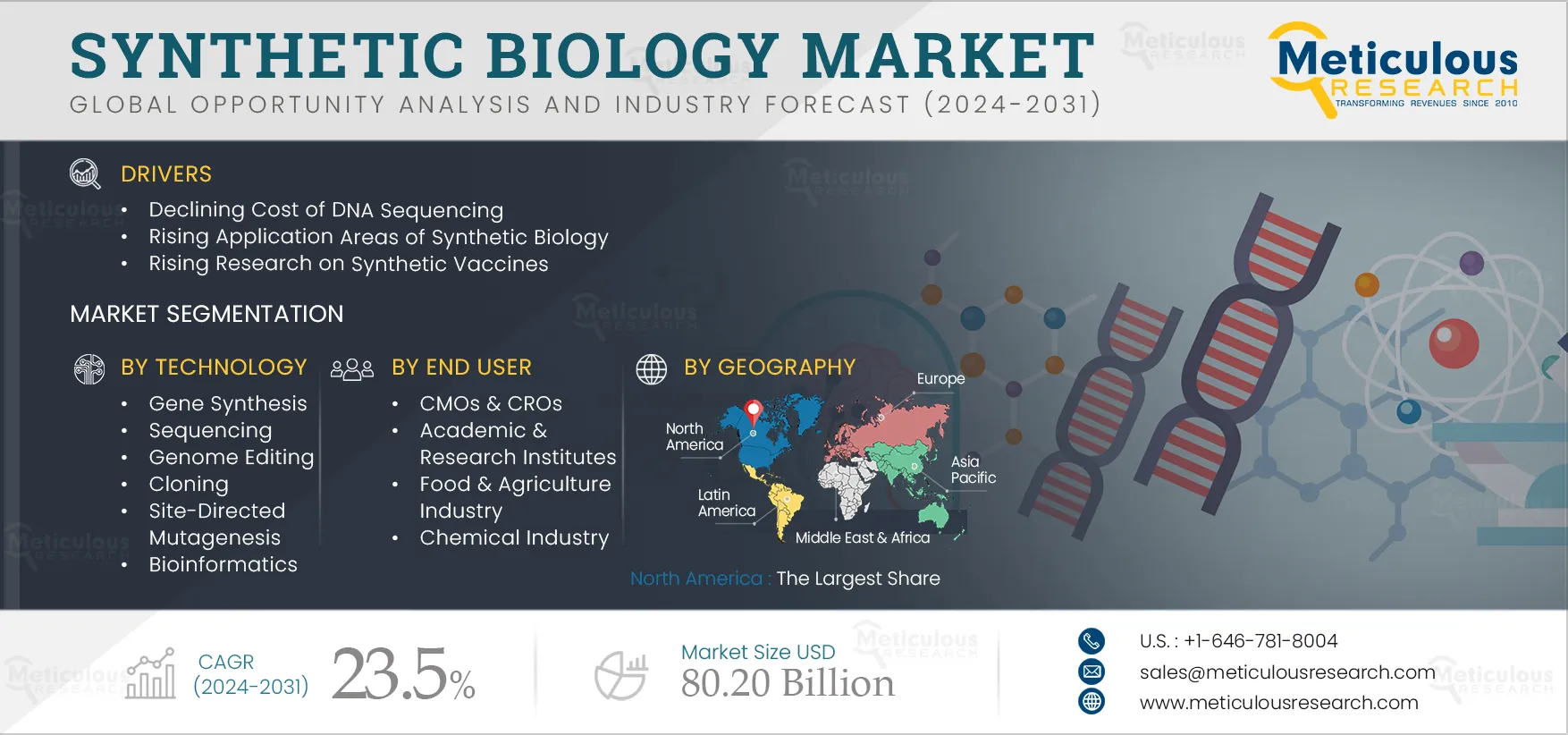

Report ID: MRHC - 1041143 Pages: 310 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market can be attributed to various factors, such as the declining cost of sequencing, increased funding in synthetic biology, rising application area of synthetic biology, advancements in gene engineering technologies, and rising research on synthetic vaccines. Furthermore, rising R&D funding, rising focus on personalized medicine, increasing demand for biofuel, and innovations in synthetic biology are expected to offer growth opportunities.

Genetic engineering refers to the direct manipulation of an organism's DNA. In synthetic biology, genome engineering tools are used to enable a new genetic design through the modification of the existing genome. With the advancements in genome engineering, such as zinc-finger nucleases (ZFNs), transcription activator-like effector nucleases (TALENs), and clustered regularly interspaced short palindromic repeat (CRISPR)–Cas-associated nucleases are used in synthetic biology to easily edit genes. CRISPR technology is an innovative technology for targeted genome editing. The precision, simplicity, and speed of CRISPR genome editing make it an ideal tool in the field of synthetic biology.

Additionally, in synthetic biology, these technologies can be used to identify genes involved in specific pathways to modify the genetic structure with the desired effect. Thus, the advancements in genome engineering technology are boosting the research of synthetic biology.

The synthetic biology field has gained traction in recent years owing to its applications in biomedicine, vaccines, drug discovery, diagnostics, biofuels, and others. The key players operating in the market are raising funding for advancements in synthetic biology.

In January 2024, D-Nome (India), a synthetic biology startup, raised USD 1.5 million in a seed funding round from Ankur Capital (India), Campus Fund (India), and other investors. The investment is being used to build rapid point-of-care diagnostics for human infectious diseases and other applications using synthetic biology and genomics.

Click here to: Get Free Sample Pages of this Report

Integration of Artificial intelligence (AI) and machine learning (ML) in Synthetic Biology

The major issue facing the synthetic biology industry is the inability to accurately predict biological systems. AI and ML provide the predictive ability required in the synthetic biology process. AI can be used to select the target, design the pathway needed to produce the desired target, help optimize and engineer biological systems, scale up production, and extract the desired product.

Additionally, AI can be used to analyze the effectiveness of microorganism strains created by synthetic biology data and predict whether a strain will scale commercially or not. This will help in the selection of high-quality strains to produce a quality product. Synthetic biology companies are also using AI to cater to various application areas.

Increasing Preference for Biofuel

Biofuel is a fuel derived from biomass such as animal waste, plant material, or algae. Since such feedstock material can be readily replaced, biofuel is considered a source of renewable energy, unlike fossil fuels such as natural gas, petroleum, and coal. Synthetic biology can help in biofuel production in two ways, including improving existing methods of biofuel production from plants and generating industrial microbes through engineering host organisms as cell factories, which can generate energy from traditional and non-traditional forms of feedstock.

The demand for biofuel is expected to increase due to the increasing demand for transport fuel, robust biofuel policies, and abundant feedstock potential. According to The International Energy Agency (France), an autonomous intergovernmental organization, the demand for biofuel is expected to increase by 38 billion liters between 2024 and 2028.

Increasing Focus on Personalized Medicine

Personalized/precision medicine uses an individual’s genomic information to offer targeted treatments. As precision medicine is based on individuals’ genetic makeup, it can overcome the limitations of traditional medicines and provide effective treatment. The growing interest in personalized medication, particularly in the fields of gene therapy, cancer, and cell therapy, has increased the need for synthetic biology products. Synthetic biology is used for pathway modeling to understand the mechanisms of cellular signaling and for discovering new therapeutic targets for the treatment of various diseases.

Rising funding for personalized medicine research and growing approvals are creating opportunities to use synthetic biology products in this field.

Based on product, the synthetic biology market is segmented into oligonucleotide and synthetic DNA, Xeno-nucleic acids, enzymes, cloning technologies kits, chassis organisms, and other products. In 2025, the oligonucleotide and synthetic DNA segment is expected to account for the largest share of 35% of synthetic biology market. The large share of this segment is attributed to the wide use of oligonucleotide and synthetic DNA in biomedical research.

The versatility and programmability of synthetic DNA and oligonucleotides are increasing their demand in biomedical research. For instance, synthetic oligonucleotides are being tested for therapeutic applications to target abnormally expressed genes in case of a wide array of diseases ranging from viral infections to psychoneurological diseases.

However, the enzymes segment is projected to witness the highest growth rate of 25.6% during the forecast period of 2025–2032. Enzymes act as catalysts during biochemical reactions. Growing demand for synthetic enzymes in various end-use industries is driving the market growth. Synthetic enzymes are used in life science research, textiles, cosmetics, and biofuels. For instance, in life science research, synthetic enzymes such as CRISPR-associated nucleases like CAS9 are used for precise genome editing to make the required modification in DNA sequences of organisms. Genome editing has been extensively used in drug discovery and personalized medicine, thereby increasing the demand for synthetic enzymes.

Based on technology, the synthetic biology market is segmented into gene synthesis, sequencing, genome editing, cloning, site-directed mutagenesis, bioinformatics, and other technologies. In 2025, the gene synthesis segment is expected to account for the largest share of the synthetic biology market. Gene synthesis refers to chemically synthesizing a strand of DNA base-by-base. The synthesized strand is then amplified with PCR and used for multiple applications. It is the fundamental step required in any genomic study. The large share of gene synthesis is attributed to accelerated life sciences R&D and emerging application areas like metabolic engineering. Synthetic genes enable researchers to use genetic constructs, bypassing the time-consuming process of cloning and assembling from the natural source. Thus, gene synthesis reduces the overall time required for cost-cutting and improves precision, owing to which its demand is the highest.

Based on application, the synthetic biology market is segmented into life science & healthcare application, industrial & chemical application, food & agriculture application, and environmental application. In 2025, the life science & healthcare application segment is expected to account for the largest share of 41% of the synthetic biology market. The large share is attributed to the availability of funding for life science & healthcare research, increasing demand for personalized therapies, and high disease prevalence necessitating newer therapies to be launched in the market.

In June 2024, the Commonwealth Government’s Medical Research Future Fund (MRFF) (Australia) invested USD 9.75 million in establishing MedChem Australia, a new national medicinal chemistry initiative, to accelerate the identification of early-stage drug candidates. The use of synthetic biology products helps produce therapeutic proteins such as enzymes and antibodies in engineered microorganisms at low cost and on a large scale; thus, the adoption of synthetic biology tools is increasing in life science and healthcare.

Based on end user, the synthetic biology market is segmented into pharmaceutical, biotechnology, & MedTech companies, CMOs & CROs, academic & research institutes, the food & agriculture industry, the chemical industry, environmental agencies, and other end users. In 2025, the pharmaceutical, biotechnology, & MedTech companies’ segment is expected to account for the largest share of the synthetic biology market. The large share of the segment is attributed to the need to develop new therapies owing to increasing disease prevalence and increased spending on pharmaceutical R&D. For instance, global pharmaceutical R&D expenditure is expected to reach USD 213 billion in 2026 from USD 179 billion in 2020 (Source: International Federation of Pharmaceutical Manufacturers & Associations (IFPMA)). Additionally, pharmaceutical & biotechnology companies' shift from traditional screening methods to synthetic biology technologies such as high throughput screening (HTS) is contributing to the large share of the segment. Additionally, pharmaceutical & biotechnology, & MedTech companies are relying on synthetic biology for developing IVD tests, optimizing production processes, and designing novel therapeutics, further contributing to the large share of the segment.

However, the academic & research institutes segment is projected to witness a considerable growth rate during the forecast period of 2025–2032. The academic & research institutes contribute to clinical research by using synthetic biology to engineer the biological system to study metabolic pathways, gene regulation, cellular signaling, and gene expression. In the case of clinical research, the contribution of academic institutes in initiating clinical trials is more as compared to commercial entities. Thus, with the growing need to accelerate and fast-track research across various industries, especially life sciences, the demand for synthetic biology products in academic & research institutes is expected to increase.

In 2025, North America is expected to account for the largest share of the 36.8% of synthetic biology market. The large share of the region is attributed to the substantial R&D investments by life sciences companies for drug discovery & development, the presence of key market players in the region, government initiatives supporting research and development, accelerated research to develop biofuels, and high focus on the textile industry. The textile industry in the region is growing owing to the increasing spending on fashion and apparel among the middle-income population groups. For instance, exports of fibers, textiles and apparel were USD 34 billion in 2022 compared with USD 28.4 billion in 2021 (source: U.S. Department of Commerce data for Export Group). The region also leads in the advanced R&D in clinical research. The surge in R&D spending by pharmaceutical companies is anticipated to drive the demand for synthetic biology products, driving the market. According to the European Federation of Pharmaceutical Industries and Associations (Belgium), in the U.S., the pharmaceutical R&D expenditure annual growth rate was 15.6% from 2018-2022 compared to 13.6% from 2013-2017.

Moreover, the market in Asia-Pacific is slated to register the highest growth rate of 24.9% during the forecast period. The countries in Asia-Pacific, including China, India, and South Korea, are projected to offer significant growth opportunities for the vendors in this market. The expansion in the end-use industries such as pharmaceutical, food, chemical, cosmetics, textile, and others are driving the demand for synthetic biology. The bio-textile industry is expanding in the region, and many players are investing in this area. For instance, in April 2025, Hyosung TNC (South Korea) invested USD 1 billion in bio-textile materials plants in Vietnam’s Ba Ria-Vung Tau province. The manufacturing plant is expected to be operational in 2026. Additionally, the demand for biofuel is expected to increase in India owing to the government policies mandating biofuels. In 2018 India launched a National Policy on Biofuels with a blending target for biodiesel (5% by 2032) and ethanol (20% blending by 2032). Such developments in the region drive the growth of the market in Asia-Pacific.

The report offers a competitive landscape based on an extensive assessment of the product offerings and geographic presence of leading market players and the key growth strategies adopted by them over the past few years 2020–2025. The key players operating in the global synthetic biology market are Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Agilent Technologies, Inc. (U.S.), Novozymes A/S (Denmark), Codexis, Inc. (U.S.), Creative Biogene Inc. (U.S.), Amyris, Inc. (U.S.), Precigen, Inc. (U.S.), Illumina, Inc. (U.S.), New England Biolabs (U.S.), Ginkgo Bioworks (U.S.), Genscript Biotech Corp. (U.S.), Eurofins Scientific SE (France), and Twist Bioscience (U.S.).

In November 2024, Synlogic, Inc. (U.S.) received a USD 2.5 million payment under the company’s collaboration with F. Hoffmann-La Roche AG (Switzerland). The company collaborated in 2021 to develop Synthetic Biotic medicine used in the treatment of inflammatory bowel disease (IBD).

In July 2024, Sumitomo Chemical Co., Ltd (Japan) collaborated with Ginkgo Bioworks (U.S.) to develop functional chemicals with synthetic biology.

|

Particulars |

Details |

|

Number of Pages |

310 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

23.5% |

|

Estimated Market Size (Value) |

$80.20 billion by 2032 |

|

Segments Covered |

By Product

By Technology

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Denmark, Switzerland, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

The key players operating in the global synthetic biology market are Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Germany), Agilent Technologies, Inc. (U.S.), Novozymes A/S (Denmark), Codexis, Inc. (U.S.), Creative Biogene Inc. (U.S.), Amyris, Inc. (U.S.), Precigen, Inc. (U.S.), Illumina, Inc. (U.S.), New England Biolabs (U.S.), Ginkgo Bioworks (U.S.), Genscript Biotech Corp. (U.S.), Eurofins Scientific SE (France), and Twist Bioscience (U.S.). |

The Synthetic Biology Market encompasses the research, development, and application of synthetic biology techniques, which involve designing and engineering biological systems for various applications, including medicine, agriculture, and biofuels.

The Synthetic Biology Market was valued at approximately $80.2 billion by 2032.

The market is expected to reach $80.2 billion by 2032, from an estimated $18.31 billion in 2025.

The market size for 2025 is estimated to be $18.31 billion.

The global outlook for the Synthetic Biology Market is positive, with significant growth anticipated due to advancements in technology, increased funding, and the expanding application of synthetic biology in various fields.

The market is projected to grow substantially, with an estimated value increase from $18.31 billion in 2025 to $80.2 billion by 2032.

The Synthetic Biology Market is expected to grow at a CAGR of 23.5% from 2025 to 2032.

North America is expected to account for the largest share, approximately 36.8%, of the Synthetic Biology Market in 2025, driven by substantial R&D investments and the presence of key market players in the region.

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Jun-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates