Resources

About Us

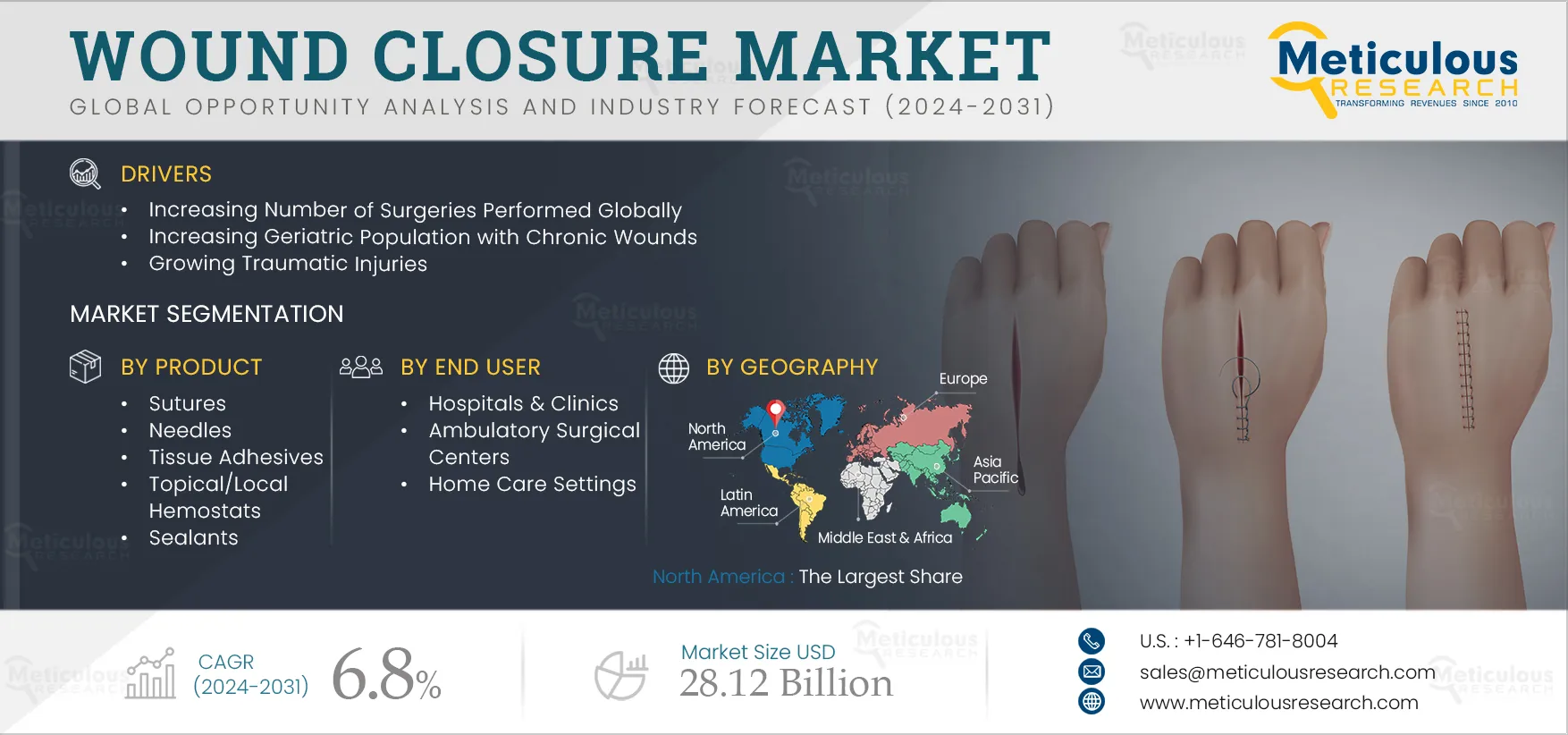

Wound Closure Market Size, Share, Forecast, & Trends Analysis by Product (Suture, Needle, Tissue Adhesive, Sealant [Fibrin, Synthetic], Skin Stapler, Dressing [Foam, Film, Hydrogel]) Wound (Surgical, Trauma, Burn, DFU) End User - Global Forecast to 2032

Report ID: MRHC - 1041153 Pages: 330 May-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market can be attributed to the increasing number of surgeries, growth in chronic wound cases among the geriatric population, the growing incidence of traumatic injuries, increasing awareness about wound care, and the rising focus on infection prevention.

Moreover, technological advancements in wound closure products and the demand for wound closure in aesthetic procedures are expected to offer growth opportunities for the players operating in this market.

Medical conditions, including work-related injuries, cardiovascular diseases, cancer, and neurological diseases, require surgical interventions.

According to a WHO study, cesarean section was the most common type of surgery performed globally in 2021, accounting for 21% of all births. This number is expected to rise further over the next ten years, with cesarean sections estimated to account for nearly a third (29%) of all deliveries in 2032. By 2032, the highest rates of C-section surgery are projected to be in Eastern Asia (63%), Latin America & the Caribbean (54%), Western Asia (50%), Northern Africa (48%), Southern Europe (47%), and Australia & New Zealand (45%).

Thus, the increasing number of surgeries is boosting the demand for various wound closure products, including sutures, needles, skin staplers, and dressings.

Click here to: Get Free Sample Pages of this Report

Growth in the geriatric population has led to a rise in chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Diabetes is a long-term condition that leads to diabetic foot ulcers. According to data published by the National Institutes of Health (NIH) in August 2024, the incidence of diabetic foot ulcers around the world ranges from 9.1 to 26.1 million yearly. Approximately 15 to 25% of people with diabetes mellitus are diagnosed with diabetic foot ulcers in their lifetime.

Furthermore, according to the International Diabetes Federation (IDF), in 2022, the prevalence of Diabetic Foot Ulcers (DFU) in African countries was between 10% and 30%. Also, the prevalence of diabetic foot ulcers throughout Europe in 2022 ranged between 1.0% (Denmark) and 17.0% (Belgium). Further, in the IDF Middle East & North Africa Region, DFU prevalence was between 5.0% and 20% in 2022, while DFU recurrence ranged between 31.0% (Egypt) to 43.0% (Turkey). In Brazil, the prevalence of DFU was 21.0% in 2022. Such chronic injuries require regular treatment to avoid severe infections and emergency conditions, driving the demand for various wound closure products.

Advanced wound closure products offer effective healing while lowering the possibility of complications. Technological advancements in wound closure products have improved both patient experience and outcomes. Traditional sutures need to be removed once the incision heals, which can increase the risk of complications and irritation for patients. The introduction of absorbable sutures has addressed this issue. These sutures are made of materials that degrade in the body over time, which reduces the need for suture removal. They keep the incision closed during the healing phase and slowly disintegrate, simplifying the healing process and reducing patient discomfort.

In addition, surgical sealants and tissue adhesives are gaining popularity as alternatives to traditional staples and sutures. These solutions ensure effective and safe wound closure by sticking the connective tissue edges together. They provide benefits such as faster action, decreased tissue stress, less scarring, and better appearance. Some surgical adhesives are antimicrobial and lower the risk of wound infection. These benefits are driving the demand for advanced wound closure products, generating growth opportunities for market players.

The demand for wound closure in aesthetic surgical procedures is increasing as it minimizes scarring and provides better cosmetic outcomes. Patients undergoing cosmetic procedures want to improve their physical appearance while reducing visible scarring. Effective wound closure techniques are critical for achieving invisible scars, particularly in treatments involving excisions and wounds. Advanced wound closure techniques, such as tiny sutures, the use of surgical adhesives, and multilayer closure, produce notable cosmetic results by promoting wound closure with reduced scarring.

In addition, patients undergoing aesthetic procedures expect less downtime and quick recovery. Effective wound closure procedures cause less pain, promote faster healing, and enable shorter recovery times. Advanced wound closure technologies that promote faster wound closure and reduce post-operative problems are in high demand in the aesthetics industry.

Bioactive wound care solutions actively speed up and promote the healing process. They contain biologically active components, including extracellular matrix components and growth factors that aid tissue regeneration and increase cellular activity. These solutions improve wound closure results by creating an environment favorable for healing.

In addition, bioactive dressings provide improved moisture management characteristics. They can regulate moisture levels in the wound bed, creating the perfect atmosphere for healing. Some dressings absorb additional exudate while also supplying moisture to dry wounds. This moisture balance stimulates granulation tissue production, minimizes scarring, and facilitates wound closure.

Based on product, the wound closure market is segmented into sutures, needles, tissue adhesives, topical/local hemostats, sealants, skin staplers, wound dressings, wound closure devices, and other products & accessories. In 2025, the wound dressings segment is expected to account for the largest share of 60.9% of the wound-closure market. The large market share of this segment can be attributed to the advancements in wound dressings, such as film dressings and foam dressings, which offer benefits such as reduced risk of wound breakdown, lower risk of infection, and faster healing. Furthermore, market players are focused on introducing innovative offerings to cater to the growing demand for wound dressings. For instance, in June 2022, Medline Industries, LP (U.S.) launched the Optifoam Gentle EX Foam Dressing to help reduce pressure injuries.

Also, the wound dressings segment is projected to register the highest growth rate of 6.2% during the forecast period 2025–2032.

Based on wound type, the wound closure market is segmented into acute wounds and chronic wounds. In 2025, the acute wounds segment is expected to account for the larger share of the wound closure market. The segment’s large market share can be attributed to the increasing number of surgical and traumatic injuries and burn cases all over the world. According to the World Health Organization’s (WHO) 2024 data, annually, 180,000 deaths are caused due to burns globally. Thus, the increasing number of burn injury cases drives the demand for advanced wound care products.

Based on end user, the wound closure market is segmented into hospitals & clinics, ambulatory surgical centers, home care settings, and other end users. In 2025, the hospitals & clinics segment is expected to account for the largest share of 53.9% of the wound closure market. The large market share of this segment can be attributed to the growing number of patient visits to hospitals & clinics for wound care & management and surgical procedures, the presence of highly skilled healthcare professionals, ease in accessibility, increasing healthcare expenditures, improving hospital infrastructure in emerging economies, and the increasing adoption of advanced wound closure products among hospitals & clinics.

In 2025, North America is expected to account for the largest share of 38.3% of the wound closure market, followed by Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America’s significant market share can be attributed to the presence of major wound closure companies such as 3M Company (U.S.), Johnson & Johnson Services, Inc. (U.S.), and Cardinal Health, Inc. (U.S.), the high adoption of advanced wound closure devices in hospitals & clinics, the increasing cases of chronic wounds such as diabetic foot ulcers, and favorable reimbursement policies in the region.

However, Asia-Pacific is slated to register the highest growth rate of 7.8% during the forecast period. The growth of this regional market is driven by the rising awareness about wound care & management, improving healthcare systems in countries such as China and India, increasing healthcare expenditures, and the growing demand for cost-effective advanced wound closure products.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the wound closure market are 3M Company (U.S.), Medtronic plc (Ireland), Cardinal Health, Inc. (U.S.), Johnson & Johnson Services, Inc. (U.S.), B. Braun Melsungen AG (Germany), Essity AB (Sweden), Medline Industries, LP (U.S.), Stryker Corporation (U.S.), Smith & Nephew plc (U.K.), Integra LifeSciences Corporation (U.S.), Organogenesis Inc. (U.S.), Coloplast A/S (Denmark), Convatec Group plc (U.K.), and Corza Medical (U.S.). The top 4-5 players are expected to collectively hold a 40-45% share of the wound closure market.

In July 2024, SYNDEO Medical (Belgium) partnered with Clozex Medical, Inc. (U.S.) to boost patient care and transform wound closure solutions across the globe.

In August 2020, Futura Surgicare Pvt Ltd (India) launched Dolphin Sutures, a knotless wound closure device to alter the suturing experience for surgeons and establish the groundwork for creating new surgical methods that impact surgeons’ restoration and healing experience.

|

Particulars |

Details |

|

Number of Pages |

330 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.8% |

|

Market Size (Value) |

USD 28.12 Billion by 2032 |

|

Segments Covered |

By Product

By Wound Type

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, Switzerland, Belgium, Rest of Europe), Asia-Pacific (India, China, Japan, Australia, South Korea, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa |

|

Key Companies Profiled |

3M Company (U.S.), Medtronic plc (Ireland), Cardinal Health, Inc. (U.S.), Johnson & Johnson Services, Inc. (U.S.), B. Braun Melsungen AG (Germany), Essity AB (Sweden), Medline Industries, LP (U.S.), Stryker Corporation (U.S.), Smith & Nephew plc (U.K.), Integra LifeSciences Corporation (U.S.), Organogenesis Inc. (U.S.), Coloplast A/S (Denmark), Convatec Group plc (U.K.), and Corza Medical (U.S.) |

This study offers a detailed assessment of the wound closure market and analyzes the market sizes & forecasts based on product, wound type, and end user. This report also provides value analyses of various segments and subsegments of the wound closure market at the regional and country levels.

The wound closure market is projected to reach $28.12 billion by 2032, at a CAGR of 6.8% during the forecast period.

Among all products covered in this report, in 2025, the wound dressings segment is expected to account for the largest share of the market. The large market share of this segment is attributed to advancements in wound dressings, such as film dressings and foam dressings, which offer benefits such as reduced risk of wound breakdown, lower risk of infection, and faster healing.

Among all wound types covered in this report, in 2025, the acute wounds segment is expected to account for the larger share of the wound closure market. The large market share of this segment can be attributed to the increasing number of burn cases, traumatic injuries, and surgeries performed globally.

The growth of this market can be attributed to the increasing number of surgeries, growth in chronic wound cases among the geriatric population, the growing incidence of traumatic injuries, increasing awareness about wound care, and the rising focus on infection prevention.

Moreover, technological advancements in wound closure products and the demand for wound closure in aesthetic procedures are expected to offer growth opportunities for the players operating in this market.

The key players profiled in the wound closure market report are 3M Company (U.S.), Medtronic plc (Ireland), Cardinal Health, Inc. (U.S.), Johnson & Johnson Services, Inc. (U.S.), B. Braun Melsungen AG (Germany), Essity AB (Sweden), Medline Industries, LP (U.S.), Stryker Corporation (U.S.), Smith & Nephew plc (U.K.), Integra LifeSciences Corporation (U.S.), Organogenesis Inc. (U.S.), Coloplast A/S (Denmark), Convatec Group plc (U.K.), and Corza Medical (U.S.).

Emerging economies, such as China and India, are expected to provide significant growth opportunities for market players due to the growing healthcare infrastructure, increased spending on advanced wound closure and management products, and rising awareness regarding wound care in these countries.

Published Date: May-2024

Published Date: May-2024

Published Date: Feb-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates