Resources

About Us

Smart Warehousing Market Size, Share, & Forecast by Technology (Automation & Robotics, IoT & Sensors, AI & Machine Learning, Cloud Computing), Component (Hardware, Software, Services), Application (Inventory Management, Order Fulfillment, Workforce Management), and End-User Industry - Global Forecast (2026-2036)

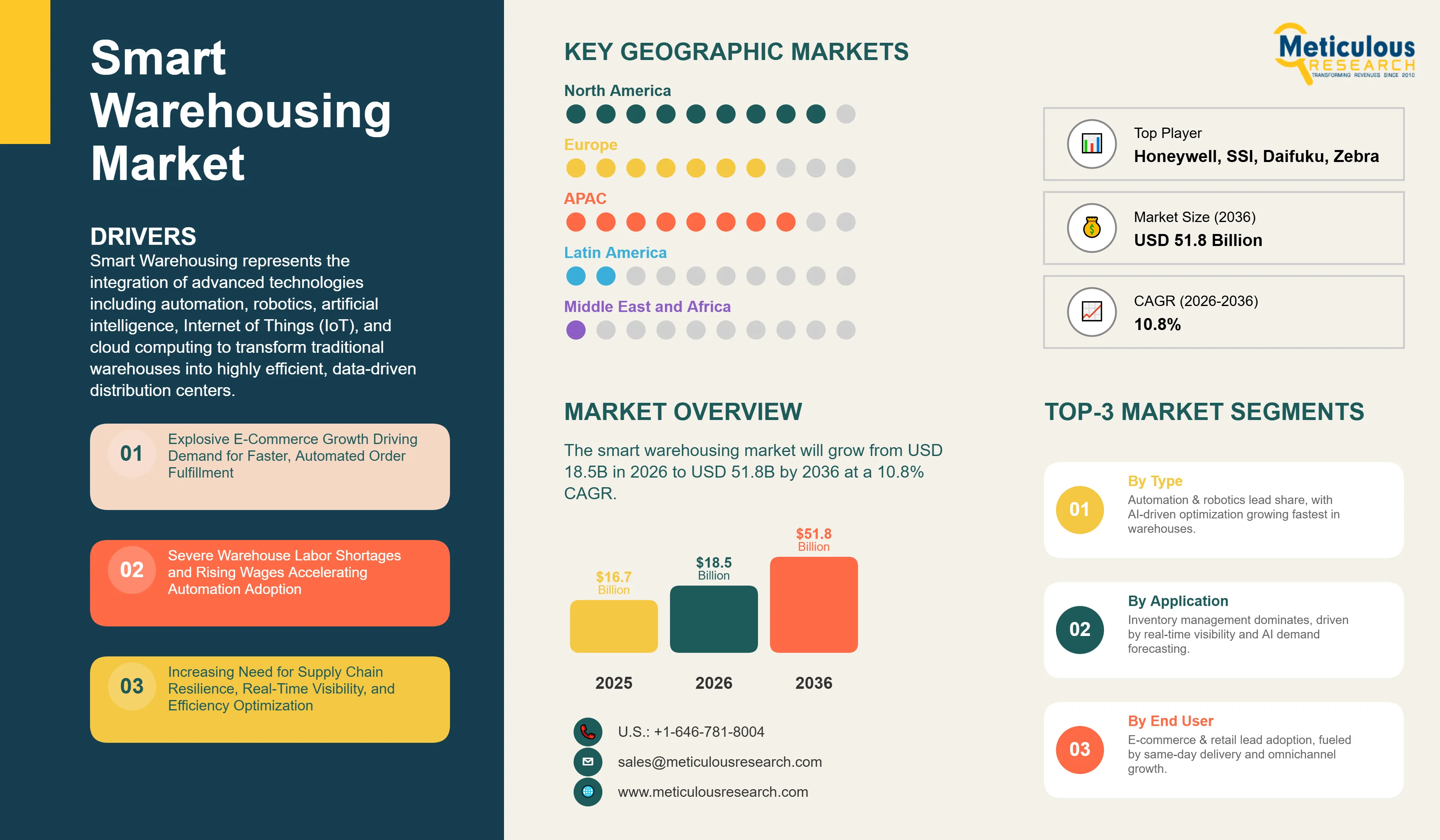

Report ID: MRICT - 1041709 Pages: 291 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global smart warehousing market is expected to reach USD 51.8 billion by 2036 from USD 18.5 billion in 2026, at a CAGR of 10.8% from 2026 to 2036.

Smart Warehousing represents the integration of advanced technologies including automation, robotics, artificial intelligence, Internet of Things (IoT), and cloud computing to transform traditional warehouses into highly efficient, data-driven distribution centers. These intelligent facilities employ autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) for material handling, automated storage and retrieval systems (AS/RS) maximizing vertical space utilization, robotic picking and packing systems achieving speeds of 600-1,200 picks per hour, conveyor and sortation systems automating product flow, and collaborative robots (cobots) working alongside human workers for enhanced productivity. IoT sensor networks monitor inventory levels in real-time, track asset locations with centimeter-level accuracy using RFID and Bluetooth Low Energy (BLE) technologies, measure environmental conditions including temperature and humidity for sensitive products, and detect equipment maintenance needs before failures occur through predictive analytics. Artificial intelligence and machine learning algorithms optimize warehouse operations by forecasting demand patterns with 85-95% accuracy, determining optimal inventory placement based on velocity and seasonality, coordinating robot fleet management to prevent congestion and maximize throughput, dynamically routing orders to minimize travel distance and picking time, and continuously learning from operational data to improve efficiency. Warehouse management systems (WMS) integrated with enterprise resource planning (ERP) and transportation management systems (TMS) provide end-to-end visibility across supply chains, while cloud-based platforms enable real-time data access, scalability without infrastructure investment, and seamless integration with e-commerce platforms and marketplaces. Smart warehouses offer transformative benefits including 25-40% reduction in operating costs through labor optimization and space utilization, 99.9% inventory accuracy eliminating stockouts and overstock situations, 2-5x increase in order fulfillment speed meeting same-day and next-day delivery expectations, 50-70% improvement in space utilization through optimized storage density and vertical automation, 30-50% reduction in picking errors through automation and barcode/vision verification, and enhanced worker safety by automating dangerous tasks and reducing repetitive strain injuries. These facilities serve critical functions across diverse industries from e-commerce fulfillment centers handling millions of SKUs and processing 100,000+ daily orders, to retail distribution centers supporting omnichannel operations, third-party logistics (3PL) providers managing multi-client inventories, manufacturing facilities implementing just-in-time inventory, pharmaceutical and healthcare distribution requiring precise temperature control and compliance tracking, and cold chain logistics maintaining product integrity for perishable goods throughout storage and distribution.

1. In 2026, North America is estimated to account for the largest share of the global smart warehousing market, driven by rapid e-commerce growth, early adoption of warehouse automation by major retailers and 3PL providers, presence of leading technology vendors including Amazon Robotics, Honeywell, and Zebra Technologies, and substantial capital investment in supply chain modernization exceeding $50 billion annually.

2. Asia-Pacific is projected to register the highest CAGR during the forecast period, fueled by massive manufacturing and logistics expansion in China and India, government initiatives supporting Industry 4.0 and smart manufacturing, rapid e-commerce penetration creating fulfillment infrastructure demand, rising labor costs driving automation adoption, and increasing foreign direct investment in modern warehouse facilities.

3. Based on technology, the automation and robotics segment is estimated to hold the largest share of the market in 2026, driven by autonomous mobile robots (AMRs) deployment exceeding 500,000 units globally, automated storage and retrieval systems (AS/RS) reducing picking times by 60-75%, robotic piece-picking systems handling diverse SKUs, and goods-to-person automation eliminating unproductive travel time.

4. Based on component, the hardware segment is expected to witness significant growth during the forecast period, driven by RFID and barcode scanner deployments, IoT sensor networks, autonomous robot installations, automated conveyor systems, and warehouse control system infrastructure supporting complex automation implementations.

5. Based on application, the inventory management segment dominates the market in 2026, representing the most critical warehouse function requiring real-time visibility of stock levels, locations, and movement across millions of SKUs, with AI-powered demand forecasting achieving 90%+ accuracy and preventing stockouts costing retailers $1.1 trillion annually in lost sales.

6. The AI and machine learning segment is expected to grow at a significant CAGR during the forecast period, driven by predictive analytics optimizing inventory placement, machine learning algorithms improving picking route efficiency by 20-30%, computer vision enabling automated quality inspection, and AI-powered demand forecasting reducing excess inventory by 15-25%.

7. The e-commerce and retail end-user segment accounts for the largest share, driven by Amazon operating 1,500+ fulfillment centers globally with extensive robotics deployment, omnichannel retail requiring distributed inventory across stores and warehouses, same-day and next-day delivery expectations necessitating automated fulfillment, and peak season demand surges requiring flexible capacity.

8. The U.S. smart warehousing market is projected to grow at a CAGR of around 10% during the forecast period 2026 to 2036, driven by labor shortages with 490,000 unfilled warehouse positions, rising minimum wages increasing automation ROI, e-commerce sales exceeding $1 trillion annually, and supply chain resilience investments post-pandemic disruptions.

9. China is expected to lead the Asia-Pacific smart warehousing market, driven by government Made in China 2025 initiative promoting automation, JD.com and Alibaba operating highly automated mega-warehouses, rapid logistics network expansion supporting 1 billion+ online shoppers, manufacturing sector automation, and development of domestic robotics and automation technology.

10. In 2026, Germany is projected to account for significant share of the European smart warehousing market, driven by Industry 4.0 leadership in manufacturing and logistics, major automotive and manufacturing sectors requiring sophisticated warehouse operations, strong engineering capabilities in automation technology, and stringent quality and efficiency requirements driving technology adoption.

Click here to: Get Free Sample Pages of this Report

Smart Warehousing represents a fundamental transformation of logistics and distribution operations, addressing critical challenges facing modern supply chains including explosive e-commerce growth, labor shortages, rising customer expectations, and cost pressures. Traditional warehouses operating with manual processes, paper-based systems, and forklift-centric material handling face severe limitations including low inventory accuracy (typically 60-80%), slow order fulfillment cycles (24-48 hours for standard orders), high operating costs (labor representing 50-65% of warehouse expenses), limited scalability during demand surges, and workplace safety concerns with injury rates 2-3x higher than other industries. Smart warehouses leverage technology to overcome these limitations, achieving inventory accuracy exceeding 99.9% through RFID and barcode scanning, order fulfillment in 2-4 hours enabling same-day delivery, 25-40% operating cost reduction through automation and optimization, flexible capacity scaling through modular robotics and software, and 50-70% reduction in workplace injuries through automation of dangerous tasks. The global warehouse automation market has experienced explosive growth driven by Amazon's pioneering use of Kiva robots (now Amazon Robotics) demonstrating 20-25% productivity improvement, COVID-19 pandemic highlighting supply chain fragility and accelerating automation adoption, e-commerce penetration reaching 20-30% of total retail in developed markets, labor market tightness with unemployment below 4% in major economies creating recruitment challenges, and technological maturation reducing robotics costs while improving capabilities. Smart warehousing adoption varies significantly by industry and company size, with large e-commerce companies and 3PL providers leading implementation due to high transaction volumes justifying capital investment, automotive and electronics manufacturers requiring precise inventory control for just-in-time production, pharmaceutical and healthcare distributors needing compliance and traceability, and grocery and food distributors implementing cold chain automation. Mid-market adoption is accelerating as robotics-as-a-service (RaaS) models reduce upfront investment, cloud-based WMS eliminate on-premise infrastructure requirements, and modular automation solutions enable phased implementation matching budget constraints.

The smart warehousing market is transitioning from isolated automation projects to holistic integrated systems, with leading operators implementing comprehensive technology stacks spanning multiple vendors and capabilities. Advanced implementations demonstrate sophisticated orchestration including warehouse control systems (WCS) coordinating multiple automation technologies (AMRs, AS/RS, sortation systems, conveyors) from different vendors, warehouse execution systems (WES) providing real-time task optimization and adaptive workflows responding to changing conditions, warehouse management systems (WMS) with embedded AI optimizing inventory placement, replenishment, and order routing, integration platforms connecting warehouses with enterprise systems (ERP, TMS, OMS) and external partners (suppliers, carriers, marketplaces), and edge computing infrastructure enabling real-time decision-making without cloud latency. This systems integration complexity is driving demand for specialized integration services and middleware solutions connecting disparate technologies into unified operations.

Autonomous mobile robots (AMRs) have emerged as the dominant automation technology, representing a paradigm shift from fixed automation infrastructure to flexible, scalable robotic solutions. Unlike traditional automated guided vehicles (AGVs) following fixed paths using magnetic strips or wires, AMRs navigate dynamically using simultaneous localization and mapping (SLAM), computer vision, and lidar sensors, adapting routes in real-time to avoid obstacles and optimize efficiency. Leading AMR deployments demonstrate compelling advantages including deployment without facility modifications (no floor infrastructure required), scalability by adding/removing robots based on demand without construction, flexibility to reassign robots to different tasks through software configuration, and rapid ROI typically 12-24 months versus 3-5 years for fixed automation. Amazon operates over 500,000 autonomous robots across its fulfillment network including drive units moving inventory pods to workers, sortation robots directing packages to appropriate lanes, and cart transport robots moving materials. Third-party logistics providers including DHL, XPO Logistics, and FedEx have deployed thousands of AMRs from vendors like Locus Robotics, 6 River Systems, and Fetch Robotics. Technology advancement is accelerating with modern AMRs navigating complex environments at 2-3 meters per second, coordinating fleet operations preventing congestion among hundreds of simultaneous robots, operating 16-18 hours daily with autonomous charging, and integrating computer vision for quality inspection and inventory verification. Costs have declined dramatically from $100,000+ per robot in 2010 to $25,000-50,000 currently for basic models, while robotics-as-a-service (RaaS) offerings from vendors like Locus Robotics enable deployment for $3,000-5,000 per robot monthly with no upfront capital investment. This cost reduction and flexible business model is democratizing AMR access to mid-market warehouses previously unable to justify automation investment.

Artificial intelligence and machine learning are transforming warehouse operations from reactive to predictive and prescriptive, enabling optimization impossible through traditional rules-based systems. AI applications span the entire warehouse workflow including demand forecasting using machine learning models analyzing historical data, seasonality, promotions, and external factors (weather, events, economic indicators) to predict future demand with 90-95% accuracy, inventory optimization determining optimal stock levels, reorder points, and safety stock balancing availability against carrying costs, slotting optimization continuously analyzing pick frequency and product affinity to position fast-moving items in prime locations reducing travel distance 15-25%, order batching algorithms grouping orders to minimize travel while meeting service level commitments, labor forecasting predicting staffing requirements by hour and skill type based on expected order volume and complexity, and predictive maintenance analyzing equipment sensor data to schedule maintenance preventing unexpected failures. Computer vision systems powered by deep learning neural networks enable automated quality inspection identifying damaged products with 95-99% accuracy, inventory verification confirming quantities and SKU accuracy without manual counting, and safety monitoring detecting unsafe worker behaviors or equipment conditions. These AI systems continuously learn and improve from operational data, adapting to changing conditions including new product introductions, seasonal demand shifts, and process modifications. Leading warehouse operators report 20-30% productivity improvement from AI-powered optimization versus rule-based approaches, 50-70% reduction in stockouts and overstock situations through improved forecasting, and 30-40% reduction in equipment downtime through predictive maintenance. Cloud-based AI platforms from major vendors and specialized providers are making sophisticated machine learning accessible to mid-market warehouses without requiring in-house data science expertise.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 18.5 Billion |

|

Revenue Forecast in 2036 |

USD 51.8 Billion |

|

Growth Rate |

CAGR of 10.8% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2020-2024 |

|

Forecast Period |

2026-2036 |

|

Report Coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

Technology, Component, Application, End-User Industry, Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Zebra Technologies Corporation, Dematic (KION Group), Daifuku Co. Ltd., SSI Schaefer, Swisslog (KUKA AG), Locus Robotics, 6 River Systems (Shopify), GreyOrange, Fetch Robotics (Zebra Technologies), Manhattan Associates, Blue Yonder (Panasonic), Oracle Corporation, SAP SE, Körber AG, and others |

Explosive E-Commerce Growth and Changing Consumer Expectations: E-commerce sales have grown from $1.3 trillion globally in 2014 to over $5.7 trillion in 2024, representing 20-25% of total retail in developed markets and continuing 15-20% annual growth. This explosion creates unprecedented demand for warehouse capacity and fulfillment speed, with consumers expecting same-day or next-day delivery as standard service. Amazon Prime's two-day (and increasingly same-day) delivery has reset expectations across retail, forcing competitors to invest in fulfillment infrastructure matching these capabilities. Traditional warehouse operations cannot meet these demands, with manual picking and packing processes requiring 24-48 hours for order fulfillment versus 2-4 hours needed for same-day delivery. Smart warehousing technologies including automation, AI optimization, and real-time inventory visibility enable the speed and accuracy required for modern e-commerce, with automated facilities processing 100,000+ daily orders versus 10,000-20,000 for manual operations of similar size.

Severe Labor Shortages and Rising Labor Costs: Warehouse and distribution employment in major economies faces critical shortages, with the United States reporting 490,000 unfilled positions as of 2024, representing 40-50% more openings than applicants. This shortage is driven by demographic shifts with aging workforces, competition from other sectors offering better working conditions, physically demanding nature of warehouse work deterring younger workers, and geographic concentration of warehouses in areas with limited labor pools. Labor costs are rising rapidly, with average warehouse wages increasing 15-25% from 2019-2024 in tight labor markets, and mandatory minimum wage increases in major states (California $16/hour, New York $15/hour) further pressuring costs. Warehouse labor typically represents 50-65% of operating expenses, making these increases unsustainable for many operators. Automation provides compelling ROI, with typical payback periods of 18-24 months for AMR deployments and 2-3 years for comprehensive automation, while eliminating dependency on scarce labor and reducing exposure to wage inflation.

Pressure for Supply Chain Resilience and Operational Efficiency: COVID-19 pandemic exposed supply chain fragility, with warehouse closures, workforce shortages due to illness, and demand volatility creating severe disruptions. Companies experienced stockouts of essential products, order backlogs extending weeks, and inability to scale operations matching demand surges. This highlighted need for resilient, flexible warehouse operations capable of continuing through disruptions and rapidly scaling capacity. Smart warehouses provide this resilience through automation enabling operations with reduced workforce, AI-powered demand forecasting improving inventory positioning, real-time visibility preventing stockouts, and flexible robotics scaling capacity without construction delays. Additionally, competitive pressure and margin compression force continuous efficiency improvement, with smart warehousing delivering 25-40% operating cost reduction, 99.9% inventory accuracy versus 70-80% manual, and 50-70% space utilization improvement through vertical automation and optimized storage density.

High Capital Investment and Implementation Complexity: Comprehensive smart warehouse implementations require substantial capital investment, typically $5-15 million for mid-size facilities (200,000-500,000 sq ft) and $50-100 million+ for large distribution centers exceeding 1 million square feet. Costs include robotics and automation equipment ($3-8 million), warehouse management and control systems ($500,000-2 million), facility modifications including floor reinforcement and power infrastructure ($1-3 million), systems integration and software development ($1-2 million), and change management and workforce training ($500,000-1 million). Implementation timelines extend 12-24 months from planning through full deployment, during which operations may be disrupted and ROI negative. Technical complexity involves integrating multiple vendors' technologies, customizing software for specific workflows, testing and debugging automation, and training workforce on new systems. Many mid-market warehouse operators lack capital budgets and technical expertise for these implementations, limiting adoption to larger enterprises despite attractive long-term economics.

Technology Obsolescence and Rapid Innovation Cycles: Warehouse automation technology evolves rapidly, with new capabilities and vendors emerging continuously. Companies investing in fixed automation infrastructure (conveyors, AS/RS) face 15-20 year useful lives with limited flexibility for modification. This creates risk that technology becomes obsolete or inadequate for changing business requirements before capital is fully amortized. For example, traditional goods-to-person systems designed for small SKU profiles cannot accommodate oversized items now common in e-commerce, requiring expensive retrofits or replacement. Similarly, legacy warehouse management systems lacking AI capabilities require costly upgrades or replacement to leverage modern optimization. Rapid innovation also creates uncertainty about optimal timing for investment, with companies delaying projects awaiting next-generation technology offering superior ROI, potentially falling behind early adopters who achieve competitive advantages through automation.

Integration Challenges with Legacy Systems and Processes: Most warehouses operate legacy enterprise systems including decades-old warehouse management systems, ERP platforms, and transportation management systems with limited API capabilities and inflexible architectures. Integrating modern automation and AI requires extensive custom development, middleware platforms, and data migration efforts costing $500,000-2 million and taking 6-12 months. Process changes required for automation adoption face organizational resistance, with workforce concerns about job security, managers unfamiliar with data-driven decision-making, and cultural barriers to technology adoption. These integration challenges are particularly acute for companies operating multiple warehouses with diverse systems and processes, requiring standardization efforts before automation deployment. Failed implementations due to inadequate change management and systems integration create risk and discourage investment.

Robotics-as-a-Service (RaaS) Business Models Democratizing Access: Traditional warehouse automation required large upfront capital investment ($5-15 million) limiting adoption to major enterprises. Robotics-as-a-Service (RaaS) business models pioneered by vendors including Locus Robotics, 6 River Systems, and GreyOrange eliminate upfront costs through monthly subscription fees of $2,000-5,000 per robot, including hardware, software, maintenance, and support. This shifts automation from capital expenditure to operating expense, making adoption feasible for mid-market warehouses and seasonal operations. RaaS provides additional advantages including flexible capacity scaling by adding/removing robots matching demand fluctuations, technology upgrades included in subscription ensuring access to latest capabilities, and reduced technical risk with vendor responsible for maintenance and performance. Market opportunity is substantial with an estimated 100,000+ warehouses globally that could benefit from automation but lack capital budgets, representing addressable market of $10-20 billion for RaaS offerings.

Expansion into Micro-Fulfillment Centers and Urban Logistics: Consumer demand for same-day and instant delivery (1-2 hours) is driving development of micro-fulfillment centers (MFCs) - highly automated small warehouses (10,000-50,000 sq ft) located in urban areas close to customers. These facilities use automated storage and retrieval systems, robotic picking, and automated sortation in compact footprints, processing 1,000-5,000 daily orders with minimal labor. Grocery retailers including Albertsons, Kroger, and Ahold Delhaize are deploying MFCs powered by vendors like Takeoff Technologies, AutoStore, and Dematic, achieving order fulfillment in 15-30 minutes versus 2-4 hours for traditional dark stores. E-commerce companies are establishing urban fulfillment networks with 20-30 MFCs serving major metro areas, enabling profitable same-day delivery. Market opportunity is substantial with top 100 U.S. metro areas requiring an estimated 2,000-3,000 MFCs for comprehensive coverage, representing $10-15 billion investment in automation infrastructure.

Emerging Markets Warehouse Modernization and E-Commerce Growth: Developing markets in Asia-Pacific, Latin America, and Middle East are experiencing rapid e-commerce growth (20-30% annually) from low penetration bases, creating demand for modern warehouse infrastructure. China operates over 500,000 warehouses with only 20-30% meeting modern standards, presenting modernization opportunity exceeding $50 billion. India's logistics sector requires an estimated $200 billion infrastructure investment including automated warehouses supporting e-commerce companies Flipkart, Amazon India, and Myntra. Southeast Asian markets including Indonesia, Vietnam, and Thailand are attracting foreign direct investment in logistics infrastructure from regional and global 3PL providers. These markets benefit from government initiatives supporting logistics modernization, availability of lower-cost labor making automation ROI more challenging but improving as wages rise, and leapfrogging directly to modern technology rather than upgrading legacy infrastructure. Local automation vendors including Chinese robotics companies and regional systems integrators are emerging to serve these markets with cost-optimized solutions.

The smart warehousing market is expected to grow from USD 18.5 billion in 2026 to USD 51.8 billion by 2036.

The smart warehousing market is expected to grow at a CAGR of 10.8% from 2026 to 2036.

Major players include Honeywell International, Zebra Technologies, Dematic, Daifuku, SSI Schaefer, Swisslog, Locus Robotics, 6 River Systems, GreyOrange, Fetch Robotics, Manhattan Associates, Blue Yonder, Oracle, SAP, Körber, AutoStore, and Geek+, among others.

Main factors include explosive e-commerce growth requiring faster fulfillment, severe labor shortages and rising labor costs, pressure for supply chain resilience post-pandemic, consumer expectations for same-day delivery, and robotics-as-a-service models reducing capital barriers to automation adoption.

North America is estimated to account for the largest share in 2026 due to early automation adoption by major retailers and 3PLs, while Asia-Pacific is expected to register the highest growth rate during 2026-2036 driven by massive manufacturing and logistics expansion in China and India.

1. Introduction

1.1. Market Definition

1.2. Market Scope

1.3. Currency and Pricing

1.4. Limitations

1.5. Stakeholders

2. Research Methodology

2.1. Research Process

2.2. Secondary Research

2.3. Primary Research

2.4. Market Size Estimation

2.4.1. Bottom-Up Approach

2.4.2. Top-Down Approach

2.5. Market Forecasting

2.6. Data Triangulation

2.7. Assumptions

3. Executive Summary

4. Market Insights

4.1. Introduction

4.2. Drivers

4.3. Restraints

4.4. Opportunities

4.5. Challenges

4.6. Key Trends

4.7. Pricing Analysis

4.8. Value Chain Analysis

4.9. Porter's Five Forces Analysis

5. Global Smart Warehousing Market, by Technology

5.1. Introduction

5.2. Automation and Robotics

5.2.1. Autonomous Mobile Robots (AMRs)

5.2.2. Automated Guided Vehicles (AGVs)

5.2.3. Automated Storage and Retrieval Systems (AS/RS)

5.2.4. Robotic Picking and Packing Systems

5.2.5. Conveyor and Sortation Systems

5.2.6. Collaborative Robots (Cobots)

5.3. IoT and Sensors

5.3.1. RFID Systems

5.3.2. Barcode Scanners and Readers

5.3.3. Environmental Sensors

5.3.4. Location Tracking Systems

5.4. AI and Machine Learning

5.4.1. Demand Forecasting

5.4.2. Predictive Maintenance

5.4.3. Route Optimization

5.4.4. Computer Vision and Quality Inspection

5.5. Cloud Computing

5.6. Digital Twin Technology

6. Global Smart Warehousing Market, by Component

6.1. Introduction

6.2. Hardware

6.2.1. Sensors and Tracking Devices

6.2.2. Robotic Systems

6.2.3. Automated Material Handling Equipment

6.2.4. Communication Infrastructure

6.3. Software

6.3.1. Warehouse Management Systems (WMS)

6.3.2. Warehouse Control Systems (WCS)

6.3.3. Warehouse Execution Systems (WES)

6.3.4. Analytics and Reporting Platforms

6.4. Services

6.4.1. Consulting and Design

6.4.2. Integration and Implementation

6.4.3. Maintenance and Support

6.4.4. Managed Services

7. Global Smart Warehousing Market, by Application

7.1. Introduction

7.2. Inventory Management

7.3. Order Fulfillment and Picking

7.4. Receiving and Put-Away

7.5. Packing and Shipping

7.6. Returns Management

7.7. Workforce Management

7.8. Yard and Dock Management

8. Global Smart Warehousing Market, by End-User Industry

8.1. Introduction

8.2. E-commerce and Retail

8.3. Third-Party Logistics (3PL)

8.4. Manufacturing

8.4.1. Automotive

8.4.2. Electronics

8.4.3. Industrial Manufacturing

8.5. Food and Beverage

8.6. Pharmaceutical and Healthcare

8.7. Apparel and Fashion

8.8. Others

9. Smart Warehousing Market, by Geography

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Netherlands

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.4.6. Singapore

9.4.7. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. UAE

9.6.2. Saudi Arabia

9.6.3. South Africa

9.6.4. Rest of Middle East & Africa

10. Competitive Landscape

10.1. Introduction

10.2. Market Share Analysis

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leader

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

11. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

11.1. Honeywell International Inc.

11.2. Zebra Technologies Corporation

11.3. Dematic (KION Group)

11.4. Daifuku Co. Ltd.

11.5. SSI Schaefer

11.6. Swisslog (KUKA AG)

11.7. Locus Robotics

11.8. 6 River Systems (Shopify)

11.9. GreyOrange

11.10. Fetch Robotics (Zebra Technologies)

11.11. Manhattan Associates

11.12. Blue Yonder (Panasonic)

11.13. Oracle Corporation

11.14. SAP SE

11.15. Körber AG

11.16. Vanderlande Industries

11.17. Beumer Group

11.18. Geek+ (Beijing Geekplus Technology)

11.19. AutoStore

11.20. Attabotics

11.21. Others

12. Appendix

12.1. Questionnaire

12.2. Available Customization

Published Date: Sep-2025

Published Date: Sep-2025

Published Date: Jan-2025

Published Date: Sep-2024

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates