Resources

About Us

Space Economy Market by Segment (Upstream, Downstream, Space-for-Space), Application (Satellite Communication, Earth Observation, Navigation, Space Exploration, Space Tourism, In-Space Manufacturing), End-User (Government & Military, Commercial, Civil), and Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Global Forecast to 2036

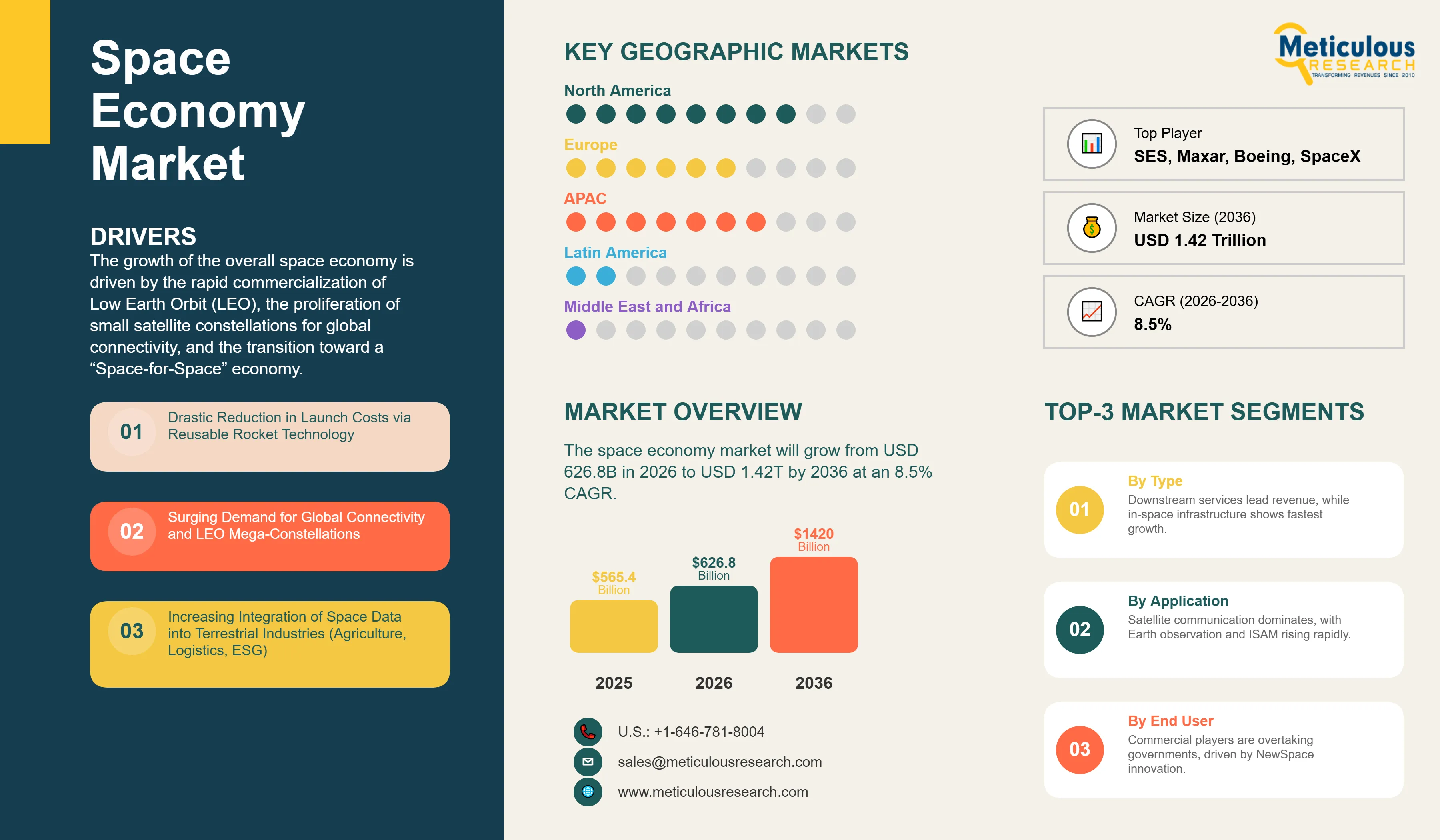

Report ID: MRICT - 1041708 Pages: 285 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global space economy was valued at USD 565.4 billion in 2025. The market is expected to reach approximately USD 1.42 trillion by 2036 from USD 626.8 billion in 2026, growing at a CAGR of 8.5% from 2026 to 2036. The growth of the overall space economy is driven by the rapid commercialization of Low Earth Orbit (LEO), the proliferation of small satellite constellations for global connectivity, and the transition toward a “Space-for-Space” economy. As launch costs continue to decline due to reusable rocket technology, space has evolved from a government-led strategic domain into a vibrant commercial frontier. The integration of space-based data into terrestrial industries—such as agriculture, logistics, and climate monitoring—coupled with the emergence of in-space manufacturing and lunar exploration initiatives, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

The space economy represents the full range of activities and the use of resources that create value and benefits to human beings in the course of exploring, researching, understanding, managing, and utilizing space. It has moved beyond the traditional “Upstream” activities of building and launching rockets to a massive “Downstream” ecosystem where space-derived data and services are integrated into the fabric of the global economy. The market is currently in the “Space 4.0” era, characterized by a shift from government-exclusive missions to a collaborative environment where private companies drive innovation, reduce costs, and create new markets.

The market includes a diverse range of sectors, from the manufacturing of advanced satellite components and launch vehicles to the provision of high-speed satellite internet, precision navigation (PNT), and high-resolution Earth observation. A critical emerging frontier is the “Space-for-Space” economy, which involves activities that take place entirely in space, such as satellite servicing, orbital debris removal, and the production of specialized materials in microgravity. These activities are laying the groundwork for permanent human presence on the Moon and eventually Mars, creating a self-sustaining economic loop beyond Earth’s atmosphere.

The global geopolitical landscape is also a major factor, with nations viewing space as a critical infrastructure for national security and economic sovereignty. This has led to increased investments in “sovereign space capabilities,” where countries develop their own launch sites and satellite constellations to ensure independent access to space. At the same time, international collaborations like the Artemis Accords are fostering a legal and economic framework for sustainable lunar exploration, opening up new opportunities for commercial partnerships in deep space.

The Proliferation of Mega-Constellations and LEO Commercialization

The market is witnessing a massive influx of small satellites into Low Earth Orbit (LEO), driven by the demand for global, low-latency broadband and real-time Earth observation. Mega-constellations are transforming the telecommunications landscape, providing connectivity to remote regions and enabling the Internet of Things (IoT) on a global scale. This trend is driving a “high-volume, low-cost” manufacturing approach in the satellite industry, where satellites are produced on assembly lines rather than as bespoke scientific instruments. The resulting data explosion is fueling a secondary market for AI-driven space analytics, where satellite imagery is used to predict crop yields, track carbon emissions, and monitor global supply chains.

Transition Toward In-Space Infrastructure and Services

As the number of active satellites grows, the market is shifting toward “In-Space Servicing, Assembly, and Manufacturing” (ISAM). This includes life-extension missions for aging satellites, orbital refueling, and the assembly of large structures that are too big to be launched in a single rocket fairing. The development of commercial space stations is a key part of this trend, providing a platform for microgravity research and industrial production. Companies are exploring the manufacturing of high-quality fiber optics, protein crystals, and even human tissues in space, where the absence of gravity allows for superior material properties. This “orbital industrialization” is expected to be a major revenue driver in the second half of the forecast period.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 1.42 Trillion |

|

Market Size in 2026 |

USD 626.8 Billion |

|

Market Size in 2025 |

USD 565.4 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 8.5% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Segment, Application, End-User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Drastic Reduction in Launch Costs

A primary driver of the space economy is the significant reduction in the cost of reaching orbit, largely due to the success of reusable launch vehicles. Lower launch costs have lowered the barrier to entry for startups and smaller nations, leading to a surge in space-based innovation. This “democratization of space” allows for more frequent launches and the deployment of larger, more complex constellations, creating a virtuous cycle of increased demand and further cost reductions. The emergence of heavy-lift vehicles like Starship is expected to further accelerate this trend, enabling the transport of massive payloads for lunar bases and orbital colonies.

Opportunity: The Emergence of the Lunar Economy

The return to the Moon, led by NASA’s Artemis program and similar initiatives by China and Russia, presents a multi-billion dollar opportunity for the private sector. The “Lunar Economy” involves the development of lunar landers, habitats, power systems, and resource extraction technologies (In-Situ Resource Utilization - ISRU). Private companies are being contracted to deliver cargo to the lunar surface, providing a steady revenue stream for the emerging deep-space industry. As the Moon becomes a “proving ground” for Mars missions, the demand for long-duration life support systems and autonomous lunar rovers will create a new market for specialized space hardware.

Why Does the Downstream Segment Lead the Market?

The downstream segment, comprising satellite-enabled services, ground equipment, and data analytics, accounts for around 70-75% of the overall space economy in 2026. This dominance is due to the vast array of terrestrial industries that rely on space assets for their daily operations. From GPS-guided logistics and satellite TV to weather forecasting and financial transaction timing, the “Space-for-Earth” value proposition is well-established and generates consistent recurring revenue. The integration of satellite data with 5G networks and AI is further expanding the downstream market, creating new applications in autonomous driving and precision agriculture.

The upstream segment (launch vehicles and satellite manufacturing) is also growing, but it is increasingly seen as an “enabler” for the more lucrative downstream services. However, the “Space-for-Space” segment is expected to witness the highest growth rate as the orbital infrastructure for servicing and manufacturing matures.

How is Satellite Communication Evolving?

Based on application, the Satellite Communication segment holds the largest share of the overall market in 2026, accounting for around 40-45% of the overall market. The shift from traditional Geostationary (GEO) satellites to LEO constellations is the primary trend here, enabling high-speed internet that competes with terrestrial fiber. This is particularly critical for bridging the digital divide and supporting the “connected everything” vision of the future.

The Earth Observation segment is also witnessing significant growth, driven by the need for climate monitoring and ESG (Environmental, Social, and Governance) reporting. High-revisit-rate constellations allow for near-real-time monitoring of any point on Earth, providing invaluable insights for insurance, commodity trading, and disaster management.

How is North America Maintaining Dominance in the Global Space Economy?

North America holds the largest share of the global space economy in 2026. The largest share of this region is primarily attributed to the massive investments from both the public and private sectors. The U.S. government remains the world’s largest spender on space, but it is the vibrant “NewSpace” ecosystem—led by companies like SpaceX, Blue Origin, and Lockheed Martin—that drives the majority of the innovation. The region’s well-developed supply chain, access to capital, and favorable regulatory environment make it the global hub for space activity.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific is expected to witness the fastest growth, driven by the rapid advancement of China’s space program and the commercial success of India’s ISRO. China is building its own satellite constellations and lunar infrastructure, while India is becoming a preferred destination for low-cost commercial launches. Europe’s growth is supported by the European Space Agency (ESA) and the EU’s focus on “Strategic Autonomy,” with significant investments in the Galileo (navigation) and Copernicus (Earth observation) programs. The region is also a leader in space sustainability and debris removal technologies.

The companies such as SpaceX, Lockheed Martin Corporation, Northrop Grumman Corporation, and The Boeing Company lead the global space economy with their dominant positions in launch services and satellite manufacturing. Meanwhile, specialized players including Rocket Lab, Maxar Technologies, Planet Labs, and SES S.A. focus on small-satellite launches, high-resolution imagery, and global telecommunications. Emerging manufacturers and integrated players such as Blue Origin, Sierra Space, Astroscale, and Varda Space Industries are strengthening the market through innovations in reusable heavy-lift rockets, commercial space stations, and in-space manufacturing.

The global space economy is projected to reach a valuation of USD 1.42 trillion by 2036, expanding from USD 626.8 billion in 2026. This significant growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.5% over the forecast period, reflecting the transition toward a fully commercialized orbital and lunar economy.

The Downstream segment (Satellite Services, Data Analytics, Ground Equipment) is anticipated to maintain its dominance, accounting for the largest market share in 2026. This is due to the widespread integration of space-based data into terrestrial industries like telecommunications, logistics, and agriculture.

Satellite Communication commands the largest share of the market. The dominance is driven by the deployment of LEO mega-constellations that provide global, low-latency broadband, fundamentally changing the telecommunications landscape.

Asia-Pacific is forecast to exhibit the fastest CAGR during the 2026–2036 period. This accelerated growth is fueled by massive national investments in China and India, coupled with a rapidly expanding commercial space sector in the region.

The market is being fundamentally reshaped by two major trends: the Proliferation of LEO Mega-Constellations for global connectivity, and the Transition toward In-Space Servicing, Assembly, and Manufacturing (ISAM) for long-term orbital infrastructure.

Key market players include SpaceX (Launch services and Starlink), Lockheed Martin (Satellite manufacturing and deep-space exploration), and Maxar Technologies (Earth observation and space infrastructure), all of whom are focused on providing end-to-end solutions for the modern space economy.

Published Date: Feb-2026

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates