Resources

About Us

Quantum Communication Market by Offering (Solutions, Services), Technology (Quantum Key Distribution (QKD), Quantum Random Number Generator (QRNG), Quantum-Safe Cryptography (QSC)), Transmission Medium (Fiber-based, Free-space/Satellite-based), Vertical (BFSI, Government & Defense, IT & Telecommunications), and Region – Global Forecast to 2036

Report ID: MRICT - 1041702 Pages: 278 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Quantum Communication Market Size?

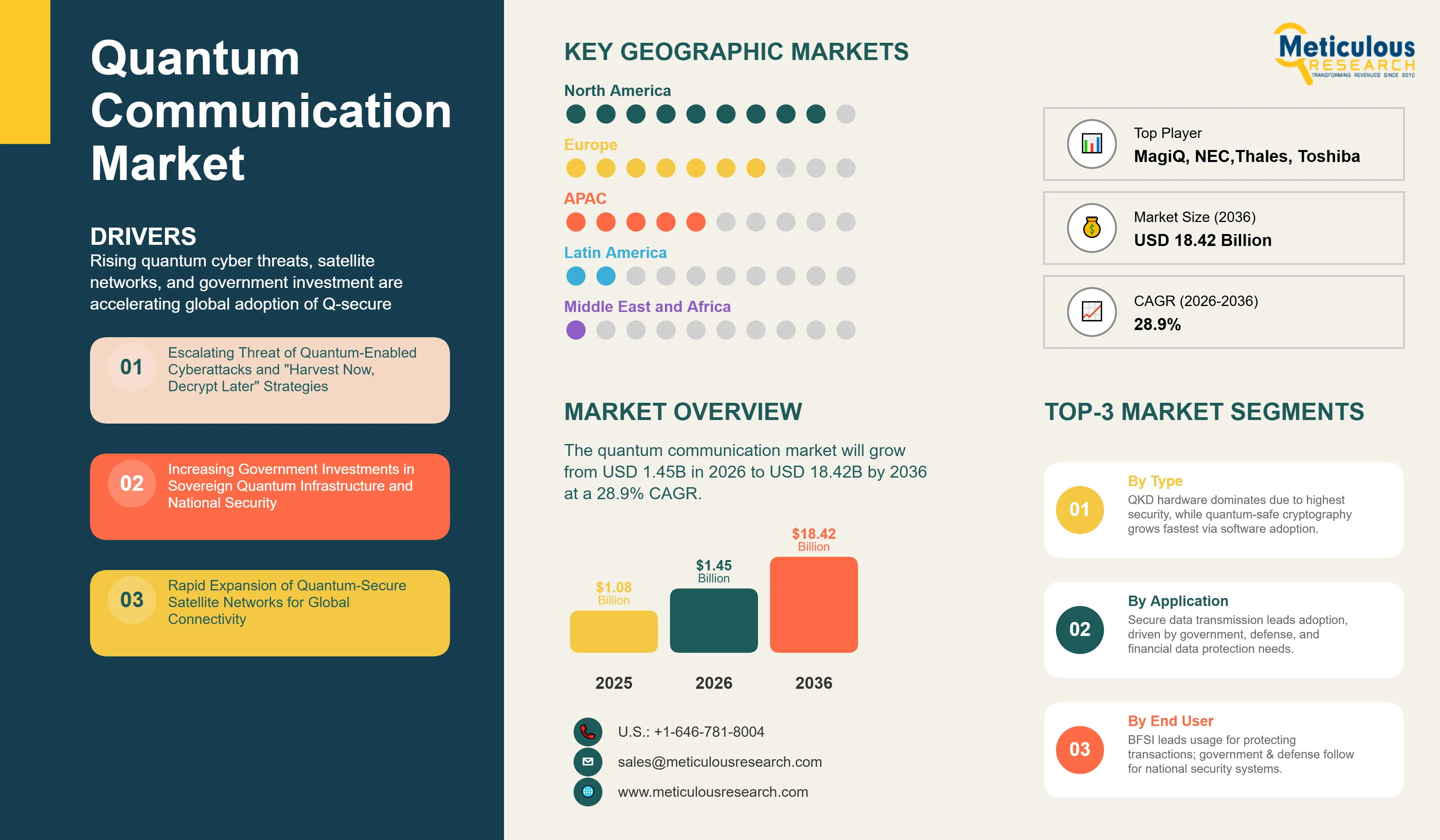

The global quantum communication market was valued at USD 1.08 billion in 2025. The market is expected to reach approximately USD 18.42 billion by 2036 from USD 1.45 billion in 2026, growing at a CAGR of 28.9% from 2026 to 2036. The growth of the overall quantum communication market is driven by the escalating threat of quantum-enabled cyberattacks on traditional encryption standards, the rapid expansion of quantum-secure satellite networks, and the increasing government investments in sovereign quantum infrastructure. As organizations transition toward “quantum-resistant” architectures to protect high-value data from “harvest now, decrypt later” strategies, quantum communication has evolved from a theoretical research domain into a critical pillar of national and corporate security. The proliferation of fiber-based quantum networks in urban centers, coupled with the development of long-distance satellite-to-ground quantum links, continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Quantum communication represents a revolutionary paradigm in information security that leverages the fundamental principles of quantum mechanics—such as superposition and entanglement—to enable ultra-secure data transmission. Unlike classical communication, which relies on mathematical complexity for security, quantum communication provides “information-theoretic security,” where any attempt to intercept or measure the quantum state of a transmitted key inherently disturbs the system, alerting the legitimate users to the presence of an eavesdropper. The market is defined by the convergence of advanced photonics, cryogenic engineering, and cryptographic software, creating a high-stakes sector focused on building the “Quantum Internet” of the future.

The market includes a diverse range of systems, from high-speed fiber-based QKD systems for metropolitan area networks (MANs) to sophisticated satellite payloads designed for global quantum key distribution. These systems are increasingly integrated with existing telecommunications infrastructure, allowing for a hybrid approach where quantum-secured keys are used to encrypt classical data streams. The ability to provide tamper-proof communication channels has made quantum communication the technology of choice for government agencies, financial institutions, and critical infrastructure operators looking to future-proof their data against the eventual arrival of cryptographically relevant quantum computers (CRQCs).

The global cybersecurity landscape is undergoing a fundamental shift, moving away from traditional public-key infrastructure (PKI) toward quantum-resilient solutions. This drive is supported by the rapid advancement of single-photon detectors and quantum repeaters, which are extending the range and reliability of quantum links. At the same time, the growing focus on “sovereign quantum capability” is encouraging nations to develop their own quantum communication standards and hardware, further expanding the market for specialized components and professional integration services.

The market is witnessing a significant shift toward space-based quantum communication to overcome the distance limitations of terrestrial fiber networks. Satellite-to-ground quantum links are now being deployed to create global quantum-secure networks, enabling secure communication between continents without the need for trusted nodes. Leading aerospace and defense contractors are developing modular quantum payloads for Low Earth Orbit (LEO) and Geostationary Orbit (GEO) satellites, providing a scalable solution for government and military users who require secure communication in remote or contested environments. This trend is driving the demand for high-precision optical ground stations and advanced satellite tracking systems.

As the industry prepares for the “Q-Day”—the point at which quantum computers can break current encryption—there is a growing trend toward integrating Quantum-Safe Cryptography (QSC) into standard software stacks. Organizations are adopting a “crypto-agile” approach, where software-based post-quantum algorithms are used alongside hardware-based QKD to provide multi-layered security. This hybrid model allows for a smoother transition to quantum-secure architectures, enabling businesses to protect their data today while building the infrastructure for tomorrow. The development of standardized QSC protocols by international bodies is further accelerating the adoption of these solutions across the enterprise sector.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 18.42 Billion |

|

Market Size in 2026 |

USD 1.45 Billion |

|

Market Size in 2025 |

USD 1.08 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 28.9% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Europe |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Offering, Technology, Transmission Medium, Vertical, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A primary driver of the quantum communication market is the growing recognition of the “harvest now, decrypt later” threat, where malicious actors collect encrypted data today with the intent of decrypting it once powerful quantum computers become available. This has created an urgent demand for quantum-secure solutions among organizations that handle data with long-term value, such as national security secrets, medical records, and intellectual property. The transition toward quantum-resistant standards is no longer seen as a future luxury but as a present-day necessity for maintaining data integrity and national sovereignty.

The development of the “Quantum Internet”—a network that connects quantum computers and sensors via quantum communication links—presents a massive growth opportunity. Governments and private consortia are investing in large-scale quantum testbeds and metropolitan quantum networks to explore new applications in distributed quantum computing and ultra-precise time synchronization. As these networks expand, there will be a significant demand for quantum repeaters, switches, and routers, creating a new market for specialized networking hardware. The collaborative nature of these projects is also driving the development of open standards and interoperable quantum communication protocols.

The solutions segment, comprising QKD hardware, QRNG chips, and quantum-secure routers, accounts for around 70-75% of the overall quantum communication market in 2026. This dominance is attributed to the high capital expenditure required for the initial physical deployment of quantum-secure infrastructure. Hardware-based solutions like QKD provide the highest level of security by utilizing the laws of physics, making them the preferred choice for mission-critical applications in government and finance. The increasing miniaturization of quantum components, such as chip-scale QRNGs for mobile devices, is further expanding the reach of these solutions into the consumer electronics market.

However, the services segment (including professional consulting, managed security services, and integration) is expected to grow at a significant CAGR as organizations seek expert guidance on navigating the complex transition to quantum-secure architectures. The ability to provide “Quantum-Security-as-a-Service” (QSaaS) is becoming a key differentiator for leading cybersecurity firms.

Based on technology, the Quantum Key Distribution (QKD) segment holds the largest share of the overall market in 2026, accounting for around 60-65% of the overall market. QKD is the most mature quantum communication technology, with numerous commercial deployments already active in metropolitan networks and data center interconnects. Its ability to provide provably secure key exchange makes it the gold standard for high-security communication.

The Quantum-Safe Cryptography (QSC) segment is expected to grow at the fastest CAGR during the forecast period. Unlike QKD, which requires specialized hardware, QSC is a software-based approach that can be implemented on existing classical hardware. This makes it highly scalable and cost-effective for protecting large-scale enterprise networks and internet-facing applications. The finalization of post-quantum cryptographic standards is a major catalyst for the rapid adoption of QSC solutions.

Based on vertical, the BFSI segment holds the largest share of the overall market in 2026, accounting for around 35-40% of the overall market. Financial institutions are prime targets for cyberattacks, and the potential compromise of high-frequency trading data or customer financial records by quantum computers poses an existential threat to the global economy. As a result, banks and insurance companies are early adopters of QKD and quantum-secure data center links to protect their core infrastructure.

The government & defense segment is also a major contributor, driven by the need for secure diplomatic communication and military command-and-control systems. The healthcare segment is witnessing increasing interest as providers look to protect sensitive genomic data and patient records from long-term decryption threats.

North America holds the largest share of the global quantum communication market in 2026. The largest share of this region is primarily attributed to the massive federal investments in quantum research, a robust ecosystem of technology giants and specialized startups, and the early adoption of quantum-secure standards by the U.S. government. The presence of leading players like IBM, Microsoft, and specialized firms like Quantinuum and IonQ, along with a strong focus on national security, has made North America the primary driver of quantum communication innovation.

Europe is expected to witness the fastest growth, driven by the EuroQCI initiative, which aims to build a secure quantum communication infrastructure across the entire European Union. Countries like Germany, France, and the Netherlands are leading the way in developing quantum repeaters and metropolitan quantum networks. In Asia-Pacific, market growth is supported by ambitious national quantum programs in China, Japan, and South Korea. China, in particular, has deployed the world’s longest terrestrial QKD network and is a leader in space-based quantum communication, driving significant demand for quantum hardware in the region.

The companies such as Toshiba Corporation, Thales Group, ID Quantique (SK Telecom), and NEC Corporation lead the global quantum communication market with their advanced QKD systems and extensive experience in telecommunications infrastructure. Meanwhile, specialized players including QuintessenceLabs, MagiQ Technologies, QuantumXchange, and AQT (Alpine Quantum Technologies) focus on high-performance quantum-safe cryptographic solutions and specialized quantum hardware. Emerging manufacturers and integrated players such as Arqit, KETS Quantum Security, Qubitekk, and SpeQtral are strengthening the market through innovations in satellite-based quantum links and chip-scale quantum security components.

The global quantum communication market is projected to reach a valuation of USD 18.42 billion by 2036, expanding from USD 1.45 billion in 2026. This significant growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 28.9% over the forecast period, reflecting the urgent transition toward quantum-secure architectures.

The Solutions segment (QKD Hardware, QRNG Chips, QSC Software) is anticipated to maintain its dominance, accounting for the largest market share in 2026. This is primarily due to the high capital investment required for the initial physical deployment of quantum-secure infrastructure across government and corporate networks.

The Quantum Key Distribution (QKD) technology commands the largest share of the market. The dominance is driven by its ability to provide information-theoretic security for key exchange, making it the preferred choice for high-value data protection in the BFSI and government sectors.

Europe is forecast to exhibit the fastest CAGR during the 2026–2036 period. This accelerated growth is fueled by large-scale regional initiatives like EuroQCI and the rapid deployment of cross-border quantum communication infrastructure to ensure regional data sovereignty.

The market is being fundamentally reshaped by two major trends: the Proliferation of Space-Based QKD for global secure links, and the Integration of Quantum-Safe Cryptography (QSC) into existing IT software stacks for scalable enterprise security.

Key market players include Toshiba (Metropolitan QKD networks), Thales (Quantum-secure satellite payloads), and ID Quantique (QRNG chips and QKD systems), all of whom are focused on providing end-to-end quantum-secure solutions for a wide range of industries.

Published Date: Aug-2022

Published Date: Apr-2023

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates