Resources

About Us

Maritime Satellite Communication Market by Component (Hardware, Software, Services), Technology (VSAT, Mobile Satellite Services), Frequency Band (L-band, C-band, Ku-band, Ka-band), Service Type (Voice, Data, Video, Tracking & Monitoring, Distress & Safety), Vessel Type, and Connectivity (GEO, LEO, MEO, Hybrid) - Global Forecast to 2036

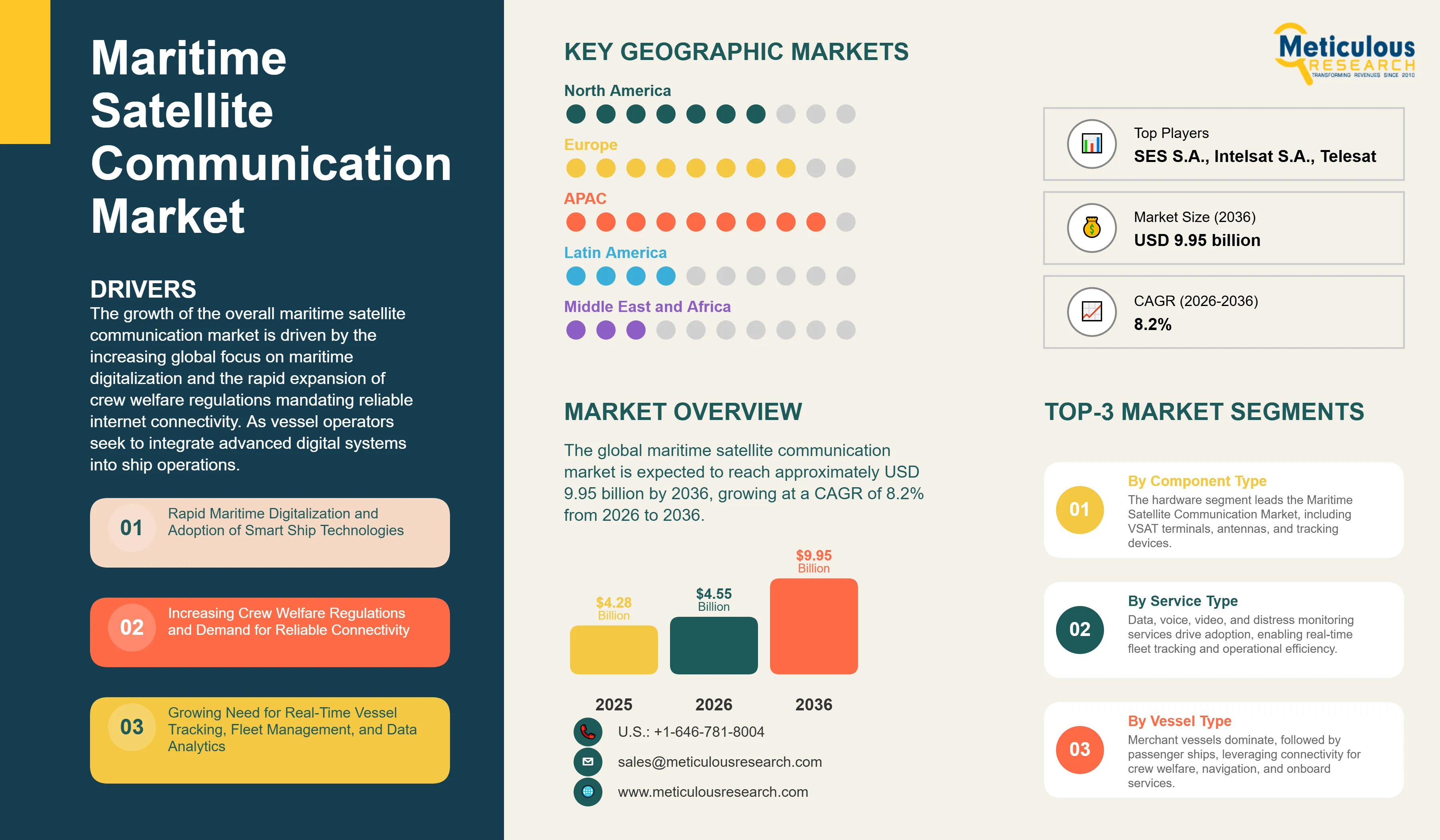

Report ID: MRICT - 1041721 Pages: 232 Feb-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global maritime satellite communication market was valued at USD 4.28 billion in 2025. The market is expected to reach approximately USD 9.95 billion by 2036 from USD 4.55 billion in 2026, growing at a CAGR of 8.2% from 2026 to 2036. The growth of the overall maritime satellite communication market is driven by the increasing global focus on maritime digitalization and the rapid expansion of crew welfare regulations mandating reliable internet connectivity. As vessel operators seek to integrate advanced digital systems into ship operations and ensure compliance with international maritime standards, satellite communication infrastructure has become essential for maintaining operational efficiency and crew satisfaction. The rapid deployment of low-earth-orbit constellations and the growing need for real-time data analytics in vessel tracking and fleet management continue to fuel significant growth of this market across all major maritime regions.

Click here to: Get Free Sample Pages of this Report

Maritime satellite communication systems are essential for connectivity. They use satellite technologies to deliver reliable communication services and improve operations with connected digital infrastructure. These systems consist of integrated hardware, software, and services that enable voice, data, and video transmission across the maritime value chain. The market features high-efficiency technologies like hybrid multi-orbit connectivity and flat-panel antenna systems, which greatly improve signal reliability and bandwidth performance in tough ocean conditions. These systems are crucial for vessel operators aiming to boost their operational efficiency and meet strict safety and regulatory standards.

The market offers a variety of solutions, from basic L-band mobile terminals for essential voice and distress communications to advanced Ka-band VSAT systems that provide high-speed broadband connectivity. These systems increasingly integrate components like electronically steered antennas and multi-orbit satellite networks to offer services such as real-time fleet tracking and predictive maintenance for ship equipment. The ability to maintain stable, high-bandwidth connectivity while ensuring service reliability in extreme weather has made maritime satellite technology a preferred choice for businesses prioritizing operational safety and communication continuity.

The global maritime sector is working hard to modernize vessel capabilities, aiming to achieve digital transformation goals and enhance crew welfare. This push has led to a rise in the adoption of hybrid connectivity solutions, with advanced LEO constellations reducing latency and improving data throughput for ultra-high-definition video calls and cloud-based fleet management systems. Meanwhile, rapid growth in regulatory requirements and expanded remote vessel monitoring is increasing the demand for high-reliability and secure digital solutions.

What are the Key Trends in the Maritime Satellite Communication Market?

Rapid Expansion of LEO Constellation Deployment and Hybrid Network Integration

Maritime service providers are quickly adopting hybrid multi-orbit architectures, moving beyond traditional single-orbit systems to integrated LEO-GEO setups. Recent installations from major satellite operators offer much lower latency and higher throughput. Global shipping operators are also seeing substantial bandwidth cost reductions through these hybrid networks. A key advancement is the introduction of flat-panel antenna systems with advanced beam steering technology that ensures reliable connectivity even during vessel maneuvers and in harsh weather. These improvements make high-precision maritime connectivity practical and affordable for everyone, from regional ferry operators to global shipping lines seeking greater operational efficiency and crew satisfaction.

Innovation in Crew Welfare Connectivity and Regulatory Compliance Solutions

Innovation in crew welfare connectivity and automated compliance reporting systems is rapidly transforming the maritime satellite communication market, as vessel processes become more digitalized and keeping crew members becomes more important. Service providers are creating solutions that combine the reliability of traditional GEO satellites with the benefits of LEO networks on unified platforms, saving bandwidth costs and simplifying vessel communication setups. These systems typically feature advanced network management and real-time monitoring, which handle complex compliance reporting without sacrificing operational security or service reliability.

Additionally, the increasing focus on environmental compliance and emissions reporting is pushing operators to develop maritime satellite solutions designed for automated data transmission and regulatory documentation. These systems reduce the administrative burden through integrated vessel monitoring platforms and cloud-based reporting dashboards. By combining high-capacity data connectivity with strong compliance support, these new designs promote both operational progress and regulatory compliance, enhancing the overall resilience of the maritime communication ecosystem.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 406.52 Billion |

|

Market Size in 2026 |

USD 82.95 Billion |

|

Market Size in 2025 |

USD 71.82 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 17.2% |

|

Dominating Region |

Asia-Pacific |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Component, Technology, Frequency Band, Service Type, Vessel Type, Connectivity, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Maritime Digitalization and Crew Welfare Mandates

A key driver of the maritime satellite communication market is the rapid movement of the global shipping industry toward comprehensive digital transformation and crew-centric operational models. Global demand for seamless vessel tracking, real-time weather updates, and cloud-based fleet management has created significant incentives for the adoption of maritime satellite infrastructure. The trend toward automated vessel systems and the integration of IoT devices into unified digital platforms drive operators toward scalable solutions that maritime satellite communication can uniquely provide. It is estimated that as crew welfare regulations become more stringent and vessel operations become increasingly data-driven through 2036, the need for robust, high-bandwidth connectivity increases significantly; therefore, advanced VSAT systems and hybrid multi-orbit networks, with their ability to ensure reliable data transmission, are considered a crucial enabler of modern maritime operational strategies.

Opportunity: Hybrid Multi-Orbit Networks and Expansion of Autonomous Vessels

The rapid growth of hybrid satellite network architectures and autonomous vessel technologies provides great opportunities for the maritime satellite communication market. Indeed, the global surge in LEO constellation deployment has created a compelling demand for systems that can handle high-throughput data transmission and provide ultra-low latency for remote vessel operations and autonomous navigation systems. These applications require high reliability, cyber resilience, and the ability to handle high-bandwidth sensor data, all attributes that are met with advanced maritime satellite solutions. The autonomous vessel market is set to expand significantly through 2036, with maritime satellite communication poised for an expanding share as operators seek to maximize operational safety and minimize human intervention. Furthermore, the increasing demand for integrated shore-based monitoring and smart vessel management systems is stimulating demand for modular digital solutions that provide seamless data transmission and operational flexibility.

Why Does the Hardware Segment Lead the Market?

The hardware segment accounts for a significant portion of the overall maritime satellite communication market in 2026. This is mainly attributed to the essential role of this technology in supporting VSAT terminals, stabilized antenna systems, and satellite modems within modern vessel communication environments. These systems offer the most direct way to establish reliable connectivity across diverse maritime applications and challenging oceanic conditions. The commercial shipping and offshore energy sectors alone consume a large share of maritime satellite hardware, with major installations in Asia-Pacific and Europe demonstrating the technology's capability to handle high-reliability communication requirements. However, the services segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for managed connectivity services, technical support, and cybersecurity solutions in complex maritime digital transformations.

How Does the Ku-band Segment Dominate?

Based on frequency band, the Ku-band segment holds the largest share of the overall market in 2026. This is primarily due to the mature VSAT infrastructure and the widespread availability of Ku-band satellite capacity across major global shipping routes. Current maritime VSAT deployments are increasingly utilizing Ku-band frequencies to ensure cost-effective broadband connectivity while maintaining service reliability across diverse weather conditions.

The Ka-band segment is expected to witness the fastest growth during the forecast period. The shift toward high-throughput satellite systems and the deployment of next-generation Ka-band constellations are pushing the requirement for advanced maritime systems that can deliver significantly higher data rates while maintaining compact antenna profiles for vessel installation.

Why Does VSAT Lead the Market?

The VSAT technology segment commands the largest share of the global maritime satellite communication market in 2026. This dominance stems from its superior ability to deliver high-bandwidth broadband connectivity, support multiple simultaneous applications, and provide cost-effective data transmission for extended periods, making it the technology of choice for high-performance maritime operations. Large-scale deployments in commercial shipping, offshore energy platforms, and cruise vessels drive demand, with advanced VSAT systems from providers enabling reliable performance in challenging maritime environments.

However, the mobile satellite services segment maintains steady demand through 2036, particularly for L-band communications that serve essential safety and distress applications. Manufacturers continue to optimize these systems for high-reliability, low-bandwidth applications where global coverage and service continuity are paramount for maritime safety compliance.

How is the Merchant Vessels Segment Maintaining Dominance?

Based on vessel type, the merchant vessels segment holds the largest share of the overall market in 2026. This is primarily attributed to the enormous global fleet size and the growing adoption of digital fleet management systems across container ships, bulk carriers, and tankers. The segment benefits from increasing operational efficiency requirements and the need for reliable crew welfare connectivity during extended voyages.

The passenger vessels segment, encompassing cruise ships and ferries, is expected to witness rapid growth during the forecast period. The demand for premium passenger connectivity experiences and the competitive pressure to offer onboard internet services comparable to shore-based broadband are driving substantial investments in high-capacity maritime satellite systems.

How is Asia-Pacific Maintaining Dominance in the Global Maritime Satellite Communication Market?

Asia-Pacific holds the largest share of the global maritime satellite communication market in 2026. The largest share of this region is primarily attributed to the massive commercial shipping volumes and the presence of the world's largest shipbuilding and vessel operating centers, particularly in China, Japan, and South Korea. China alone accounts for a significant portion of global maritime trade, with its position as a leading shipowner and port operator driving sustained growth. The presence of major shipping companies and a well-developed maritime supply chain provides a robust market for both traditional and advanced satellite communication solutions.

Which Factors Support Europe and North America Market Growth?

Europe and North America together account for a substantial share of the global maritime satellite communication market. The growth of these markets is mainly driven by the need for regulatory compliance and the modernization of aging vessel fleets in the offshore energy and passenger cruise sectors. The demand for advanced satellite systems in Europe is mainly due to its stringent maritime safety regulations and the presence of leading cruise operators such as those based in Germany, Italy, and the United Kingdom.

In North America, the leadership in offshore energy operations and the push for enhanced maritime domain awareness are driving the adoption of high-reliability satellite solutions. The United States and Canada are at the forefront, with significant focus on integrating advanced satellite communication systems into coast guard operations and commercial fishing fleets to ensure the highest levels of safety and operational efficiency.

The companies such as Inmarsat Global Limited (Viasat, Inc.), Iridium Communications Inc., KVH Industries, Inc., and Marlink Group lead the global maritime satellite communication market with a comprehensive range of VSAT and mobile satellite solutions, particularly for large-scale commercial shipping and offshore energy applications. Meanwhile, players including Speedcast International Limited, Hughes Network Systems, LLC, Intellian Technologies, Inc., and Cobham SATCOM (Satcom Technologies) focus on specialized hardware manufacturing, antenna systems, and managed connectivity services targeting the cruise and merchant vessel sectors. Emerging operators and integrated service providers such as Thuraya Telecommunications Company, Satcom Global Limited, Eutelsat Group (OneWeb), and SES S.A. are strengthening the market through innovations in LEO constellation deployment and hybrid multi-orbit network solutions.

The global maritime satellite communication market is expected to grow from USD 4.55 billion in 2026 to USD 9.96 billion by 2036.

The global maritime satellite communication market is projected to grow at a CAGR of 8.2% from 2026 to 2036.

Ku-band is expected to dominate the market in 2026 due to its widespread adoption in mature VSAT infrastructure and cost-effective broadband delivery. However, the Ka-band segment is projected to be the fastest-growing segment owing to the deployment of high-throughput satellites and the demand for higher data rates in premium connectivity applications.

LEO constellations and hybrid networks are transforming the maritime satellite landscape by delivering lower latency, higher throughput, and improved cost-efficiency. These technologies drive the adoption of advanced platforms like flat-panel antennas and multi-orbit management systems, enabling vessel operators to support complex digital operations and meet stringent crew welfare requirements while maintaining service reliability across diverse maritime environments.

Asia-Pacific holds the largest share of the global maritime satellite communication market in 2026. The largest share of this region is primarily attributed to the massive shipping volumes and the presence of leading shipbuilding and vessel operating centers.

The leading companies include Inmarsat Global Limited (Viasat, Inc.), Iridium Communications Inc., KVH Industries, Inc., Marlink Group, and Speedcast International Limited.

Published Date: Feb-2026

Published Date: Feb-2026

Published Date: Aug-2024

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates