Resources

About Us

Smart Thermostat Market Analysis and Forecast Size, Share, Forecast & Trends by Technology (Wi-Fi, LoRaWAN, Zigbee, and Other Technologies) Product (Standalone, Connected, and Learning) Installation, and End-Use - Global Forecast to 2035

Report ID: MRICT - 1041590 Pages: 230 Sep-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportSmart Thermostat Market Analysis and Forecast Booms as Energy Efficiency, IoT Integration, and Regulatory Support Drive Growth

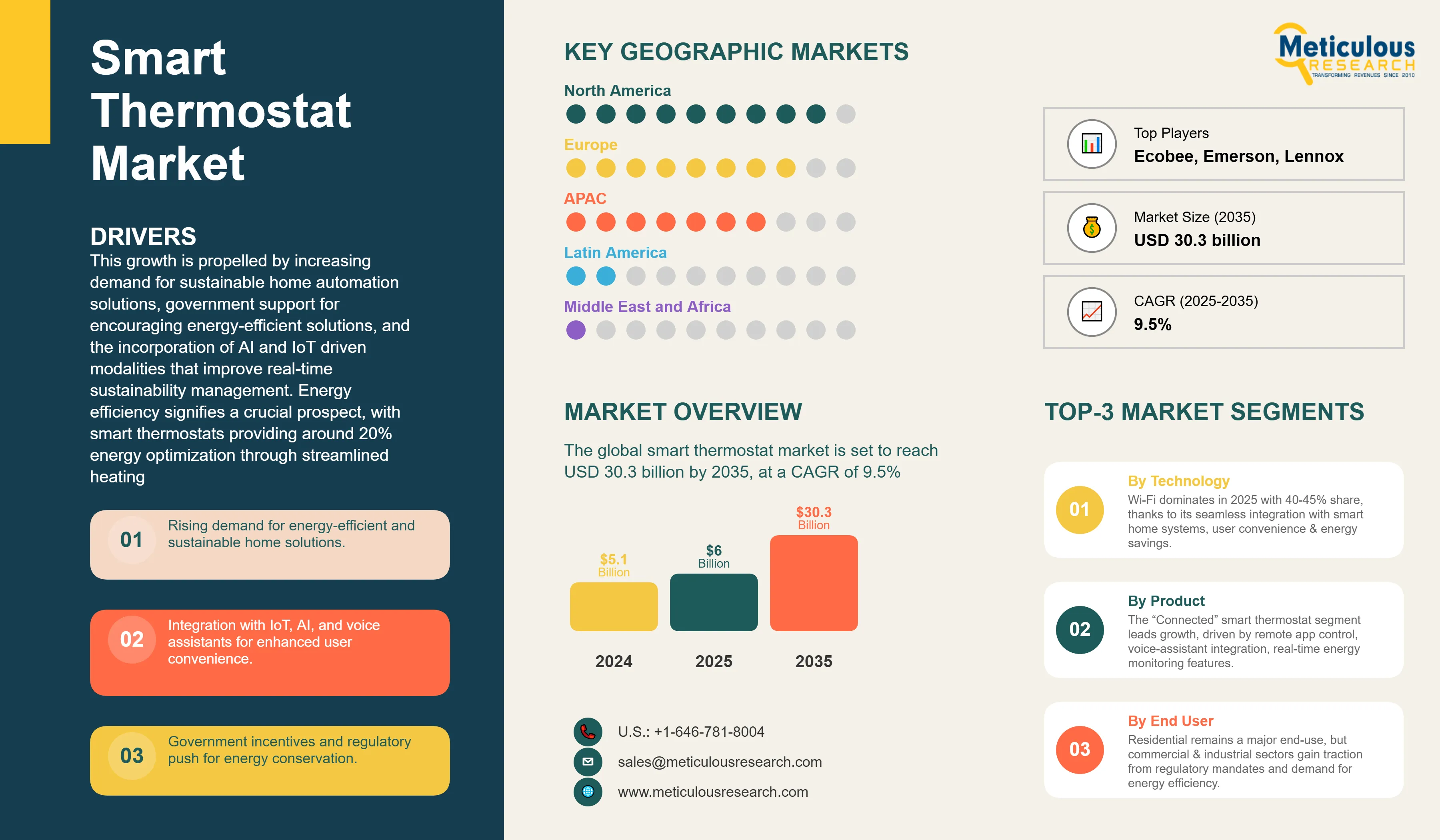

The global smart thermostat market was valued at USD 5.1 billion in 2024 and is set to reach USD 30.3 billion by 2035 from USD 6.0 billion in 2025, at a CAGR of 9.5%. This growth is propelled by increasing demand for sustainable home automation solutions, government support for encouraging energy-efficient solutions, and the incorporation of AI and IoT driven modalities that improve real-time sustainability management. Energy efficiency signifies a crucial prospect, with smart thermostats providing around 20% energy optimization through streamlined heating and cooling operations, real-time utilization monitoring, and smart temperature functions, built on occupancy patterns.

Moreover, broader integration with smart grids, renewable energy systems, and commercial real estate will amplify demand, positioning smart thermostats as a cornerstone of connected energy ecosystems. With their ability to optimize heating and cooling costs while aligning with global decarbonization and net-zero goals, smart thermostats represent both a consumer convenience technology and a strategic enabler of sustainable energy transitions. Government initiatives worldwide promote smart thermostat adoption through rebate programs, tax incentives, and Energy Star certification requirements, accelerating market penetration across diverse consumer segments and commercial applications.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The competitive landscape of the market is defined by the presence of several global leaders and specialized innovators, including Google Nest, Honeywell Home, Ecobee, Emerson Electric Co. (Sensi), Lennox International, Carrier Corporation, Tado GmbH, Trane Technologies, Siemens AG, Bosch Thermotechnology, Control4 Corporation, ADT Inc., Cielo WiGle, MRCOOL, and Radio Thermostat Company of America. These companies are leveraging their strong technological expertise, diversified product portfolios, and extensive distribution networks to strengthen market presence. Competition is intensifying as players pursue strategic mergers and acquisitions, partnerships, and R&D investments to integrate advanced capabilities such as IoT-enabled connectivity, AI-driven analytics, and energy-efficient solutions.

Recent Developments

Apple Expands Energy Management in Home App with EnergyKit

In June 2025, Apple is introducing a new framework named EnergyKit to iOS 26 and iPadOS 26, which improves energy management in the smart home. EnergyKit allows smart thermostats (and other IoT devices) to lower or shift use of electricity depending on cost and availability of clean energy through the Home app.

Ecobee Released the Smart Thermostat Essential

In January 2025, Ecobee Released the Smart Thermostat Essential, a lower-cost model (~USD 129.99) with touchscreen, support for Alexa, Apple Home, Google Assistant

Resideo Launches Entry-Level Matter-Compatible Thermostat for Budget-Conscious Users

In January 2025, Resideo introduced a new Honeywell Home X2S Smart Thermostat at the price of USD 79.99, aiming at customers with a limited budget and in search of simplicity. It is a thermostat certified with the Matter protocol, guaranteeing wide platform compatibility with Apple Home, Amazon Alexa, Google Home, and Samsung SmartThings.

Google Nest Launched the 4th-generation Nest Learning Thermostat

In August 2024, Google Nest launched the 4th-generation Nest Learning Thermostat with a larger curved display, AI enhancements, “Soli” radar, and wider compatibility with heat pumps & more HVAC systems. Also introduced “Dynamic Farsight” display behavior.

Key Market Drivers

Key Market Restraints

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Growing Demand for Energy Efficiency |

Increased adoption of smart thermostats in residential and commercial buildings |

Integration with AI-driven energy management systems across smart cities |

▲ +3.5% |

|

2. Integration with Smart Home Ecosystems |

Rise in installations due to compatibility |

Full interoperability with home automation systems |

▲ +3.2% |

|

|

3. Government Incentives for Energy Conservation |

Boost in sales from rebates and tax benefits for ENERGY STAR-certified devices |

Widespread regulatory mandates for smart thermostat adoption |

▲ +2.9% |

|

|

Restraints |

1. High Initial Costs |

Limits adoption among price-sensitive consumers despite long-term savings |

Decreasing hardware costs with mass production reduces the barrier |

▼ −1.5% |

|

2. Compatibility Issues with Older HVAC Systems |

Restricts adoption without additional retrofitting hardware |

Development of universal adapters and backward-compatible models expands reach |

▼ −1.3% |

|

|

Opportunities |

1. Emerging Market Expansion |

Increasing adoption in Asia-Pacific and Latin America with rising smart home penetration |

Smart thermostat integration in mass-market housing projects |

▲ +3.0% |

|

2. Renewable Energy Integration |

Early adoption in homes with solar power for optimal energy usage |

Widespread use in energy storage and grid balancing systems |

▲ +2.7% |

|

|

Trends |

1. AI & Predictive Climate Control |

Popularization of self-learning thermostats |

Becomes a standard feature for all smart thermostat models |

▲ +2.4% |

|

Challenges |

1. Intense Market Competition |

Price pressure due to numerous players offering similar features |

Consolidation and differentiation through advanced features |

▼ −1.0% |

Regional Analysis

North America Leads the Market Through Early Adoption and Government Incentive Programs

North America leads the global smart thermostat market, accounting for more than 60% market share in 2025, supported by strong consumer adoption, advanced infrastructure, and favourable regulatory frameworks. The United States drives this leadership with its high penetration of smart home ecosystems, widespread use of IoT-enabled devices, and robust utility-driven demand response programs that incentivize the adoption of energy-efficient technologies. Federal initiatives such as the Inflation Reduction Act (IRA, 2022), combined with state-level energy efficiency mandates, are accelerating the installation of smart thermostats in both residential and commercial buildings. Canada further complements regional growth through its green building standards and carbon reduction initiatives, encouraging the deployment of connected energy management solutions. With a mature technology landscape, early consumer adoption, and policy-driven momentum, North America also sets the pace for innovation and market growth globally.

Europe Emerges as the Fastest-Growing Smart Thermostat Market

Europe is emerging as the fastest-growing region in the global smart thermostat market, driven by stringent energy efficiency regulations, aggressive climate targets, and rapid adoption of smart home technologies. The European Union’s Energy Performance of Buildings Directive (EPBD) and the broader Fit for 55 packages, which mandate a 55% reduction in carbon emissions by 2030, are compelling households and businesses to invest in intelligent energy management systems. Countries such as Germany, the UK, France, and the Nordic nations are at the forefront, fuelled by strong government incentives, high energy prices, and rising consumer awareness of sustainability. The increasing integration of smart thermostats with renewable energy systems and smart grids further supports market expansion, enabling households to optimize energy use while contributing to grid stability. With a combination of regulatory pressure, financial incentives, and growing consumer demand for energy-efficient smart homes, Europe is positioned to deliver the highest CAGR globally, establishing itself as a critical growth engine for the smart thermostat industry.

Urban Scale and Smart-City Ambitions Driving Rapid Expansion in China

China is projected to expand at a notable more than 11% growth rate during the analysis period. The country is witnessing rapid expansion in the smart thermostat market, driven by its vast urban scale and ambitious smart-city initiatives. Government-led programs under initiatives and the country’s carbon neutrality target by 2060 are pushing the adoption of intelligent energy management systems as part of a nationwide push for sustainability and efficiency. Rising middle-class consumer demand for connected lifestyles, combined with large-scale deployments in commercial real estate and public housing projects, is further boosting adoption. Additionally, strong support for IoT integration, AI-driven automation, and renewable energy applications positions China as one of the fastest-growing smart thermostat markets globally. By aligning smart home technologies with its smart-city ambitions, China is creating a scalable model where energy efficiency, digital innovation, and urban sustainability converge to fuel long-term growth.

Rapid Adoption Driven by Energy Efficiency Policies in Germany

Germany accounted for considerable revenue share in 2024 in the Europe region. It is experiencing rapid adoption of smart thermostats, fueled by stringent energy efficiency policies and strong regulatory alignment with the European Union’s climate targets. The country’s commitment to the Energiewende (energy transition), combined with its obligation to meet the EU’s Fit for 55 and Energy Performance of Buildings Directive (EPBD) mandates, is accelerating the deployment of intelligent energy management systems in both residential and commercial sectors. High energy prices and consumer sensitivity to heating costs further amplify demand, as smart thermostats provide automated optimization and measurable cost savings. Additionally, government-backed incentives for smart heating systems, building retrofits, and renewable integration are lowering adoption barriers, making energy-efficient technologies more accessible. With these combined drivers, Germany stands out as one of the fastest-growing markets in Europe, positioning smart thermostats as a critical enabler of the nation’s low-carbon, energy-resilient future.

Segmental Analysis

The Wi-Fi Technology Segment to Dominate the Market with the Highest Revenue Share of 40-45%

The Wi-Fi technology segment is expected to command largest share of 40-45% in the smart thermostat market in 2025. Its direct control and automation feature is driven by its connectivity to smart home environments, like Amazon Alexa, Google Assistant, and Apple HomeKit, perhaps establishing it as the most versatile piece of IoT gadgets. Smart features, such as the adaptive schedule, geofencing, and learning algorithms, enable users to control energy consumption and have already helped to save up to 20-25% on heating and cooling. Recent advancements are based on improvements in connections, user interface, and real-time monitoring of energy, adding more to its popularity. On the other hand, other technologies, such as ZigBee and Bluetooth, have smaller market shares because of their range and compatibility difficulties. In general, Wi-Fi-integrated smart thermostats are convenient, energy-saving, and feature-rich, which is why they are the most popular technology in the market.

Connected Segment is Driving Market Growth Owing to Increasing Demand for Wi-Fi-enabled Products

By product type, the connected smart thermostat segment is set to grow at 9.5% growth rate over the forecast period, owing to the increasing consumer demand for Wi-Fi-enabled products that enable remote control of such devices through mobile applications and compatibility with wider smart home systems. The success of voice-activated help, application-based calendar, and energy use monitoring has enhanced the estimation of connected thermostats to be the leading option amongst the residential and light-commercial population. According to the U.S. Department of Energy, approximately half of all thermostat sales are connected models, and about 30% of residential thermostats in the U.S. and Canada are connected. For instance, Google Nest Thermostat enables consumers to pre-set temperature and get energy reports, which can easily be integrated with other products such as Amazon Alexa, Google Assistant, and is one of the most popular connected thermostats in the world.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 6.0 billion |

|

Revenue forecast in 2035 |

USD 30.3 billion |

|

CAGR (2025-2035) |

9.5% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Technology (Wi-Fi, LoRaWAN, Zigbee, and Other Technologies), Product (Standalone, Connected, and Learning), Installation, End-Use, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

Google Nest, Honeywell Home, Ecobee, Emerson Electric Co. (Sensi), Lennox International, Carrier Corporation, Tado GmbH, Trane Technologies, Siemens AG, Bosch Thermotechnology, Control4 Corporation, ADT Inc., Cielo WiGle, MRCOOL, and Radio Thermostat Company of America, and Other Key Players. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models. |

Market Segmentation

The Smart Thermostat Market size is estimated to be USD 6.0 billion in 2025 and grow at a CAGR of 9.5% to reach USD 30.3 billion by 2035.

In 2024, the Smart Thermostat Market size was estimated at USD 5.1 billion, with projections to reach USD 6.0 billion in 2025.

Google Nest (Alphabet Inc.), Honeywell Home (Resideo Technologies), Ecobee, Emerson Electric Co. (Sensi), and Lennox International are the major companies operating in the Smart Thermostat Market Analysis and Forecast.

The Asia Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035), driven by digital transformation and technological autonomy initiatives.

By technology, in 2025, Wi-Fi is estimated to account for the largest market share in the smart thermostat market.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Smart Thermostat Market, by Technology

3.2.2. Smart Thermostat Market, by Product

3.2.3. Smart Thermostat Market, by Installation

3.2.4. Smart Thermostat Market, by End-Use

3.2.5. Smart Thermostat Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising demand for energy-efficient and sustainable home solutions.

4.2.1.2. Integration with IoT, AI, and voice assistants for enhanced user convenience.

4.2.1.3. Government incentives and regulatory push for energy conservation.

4.2.1.4. Increasing adoption in commercial buildings and smart city projects.

4.2.2. Restraints

4.2.2.1. High initial purchase and installation costs.

4.2.2.2. Compatibility issues with older HVAC systems.

4.2.2.3. Concerns over data privacy and cybersecurity threats.

4.2.3. Opportunities

4.2.3.1. Expansion in emerging markets with growing smart home adoption.

4.2.3.2. Integration with renewable energy and energy management platforms.

4.2.4. Trends

4.2.4.1. AI-driven predictive temperature control and automation.

4.2.4.2. Growing interoperability through Matter and other smart home standards.

4.2.5. Challenges

4.2.5.1. Intense market competition from established and new players.

4.2.5.2. Consumer reluctance in non-tech-savvy segments to adopt smart devices.

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Smart Thermostat Market

4.4.1. AI & Machine Learning Integration

4.4.1.1. Learns user habits to optimize heating/cooling schedules.

4.4.1.2. Predictive adjustments based on occupancy and weather forecasts.

4.4.1.3. Reduces energy consumption while maintaining comfort.

4.4.2. Enhanced Connectivity & Integration

4.4.2.1. Supports Wi-Fi, Bluetooth, and Zigbee/Matter protocols.

4.4.2.2. Seamless control via smartphones, tablets, and voice assistants.

4.4.2.3. Integration with other IoT devices for full smart home automation.

5. Impact of Sustainability on Smart Thermostat Market

5.1. AI for combating misinformation & fostering digital trust

5.2. Promoting ethical AI frameworks for algorithmic transparency

5.3. Diversity & inclusion challenges in training datasets

5.4. Bias mitigation in AI-driven content curation

5.5. Energy-efficient AI models for large-scale Installations

5.6. Community wellbeing: Reducing toxicity and improving digital environments

5.7. Corporate Sustainability Strategies in Smart Thermostat Sector

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Smart Thermostat Market Assessment—By Technology

7.1. Overview

7.2. Wi-Fi

7.3. LoRaWAN

7.4. Zigbee

7.5. Bluetooth/BLE

7.6. Thread

7.7. Other Technologies

8. Smart Thermostat Market Assessment—By Product

8.1. Overview

8.2. Standalone

8.3. Connected

8.4. Learning

8.5. Voice-Enabled

9. Smart Thermostat Market Assessment—By Installation

9.1. Overview

9.2. Retrofit

9.3. New Installation

10. Smart Thermostat Market Assessment—By End-Use

10.1. Overview

10.2. Commercial

10.3. Residential

10.4. Industrial

11. Smart Thermostat Market Assessment—By Geography

11.1. Overview

11.2. North America

11.2.1. U.S.

11.2.2. Canada

11.3. Europe

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Netherlands

11.3.5. Switzerland

11.3.6. Rest of Europe

11.4. Asia-Pacific

11.4.1. China

11.4.2. Japan

11.4.3. South Korea

11.4.4. Taiwan

11.4.5. India

11.4.6. Singapore

11.4.7. Australia

11.4.8. Rest of Asia-Pacific

11.5. Latin America

11.5.1. Brazil

11.5.2. Mexico

11.5.3. Argentina

11.5.4. Rest of Latin America

11.6. Middle East & Africa

11.6.1. UAE

11.6.2. Saudi Arabia

11.6.3. Israel

11.6.4. South Africa

11.6.5. Rest of Middle East & Africa

12. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

12.1. Google Nest (Alphabet Inc.)

12.2. Honeywell Home (Resideo Technologies)

12.3. Ecobee (Generac Holdings)

12.4. Emerson Electric Co. (Sensi Smart Thermostat)

12.5. Lennox International

12.6. Carrier Corporation

12.7. Tado GmbH (Germany)

12.8. Trane Technologies

12.9. Siemens AG

12.10. Bosch Thermotechnology

12.11. Control4 Corporation

12.12. ADT Inc.

12.13. Cielo WiGle

12.14. MRCOOL

12.15. Radio Thermostat Company of America

12.16. Other Key Players

13. Appendix

13.1. Available Customization

13.2. Related Reports

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Jul-2024

Published Date: Jun-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates