Resources

About Us

AI Music Generation & Composition Software Market Size, Share, & Forecast by Music Genre, Customization Options, Licensing Model (Royalty-Free, Exclusive), and End-User (Content Creators, Game Developers) - Global Forecast (2026-2036)

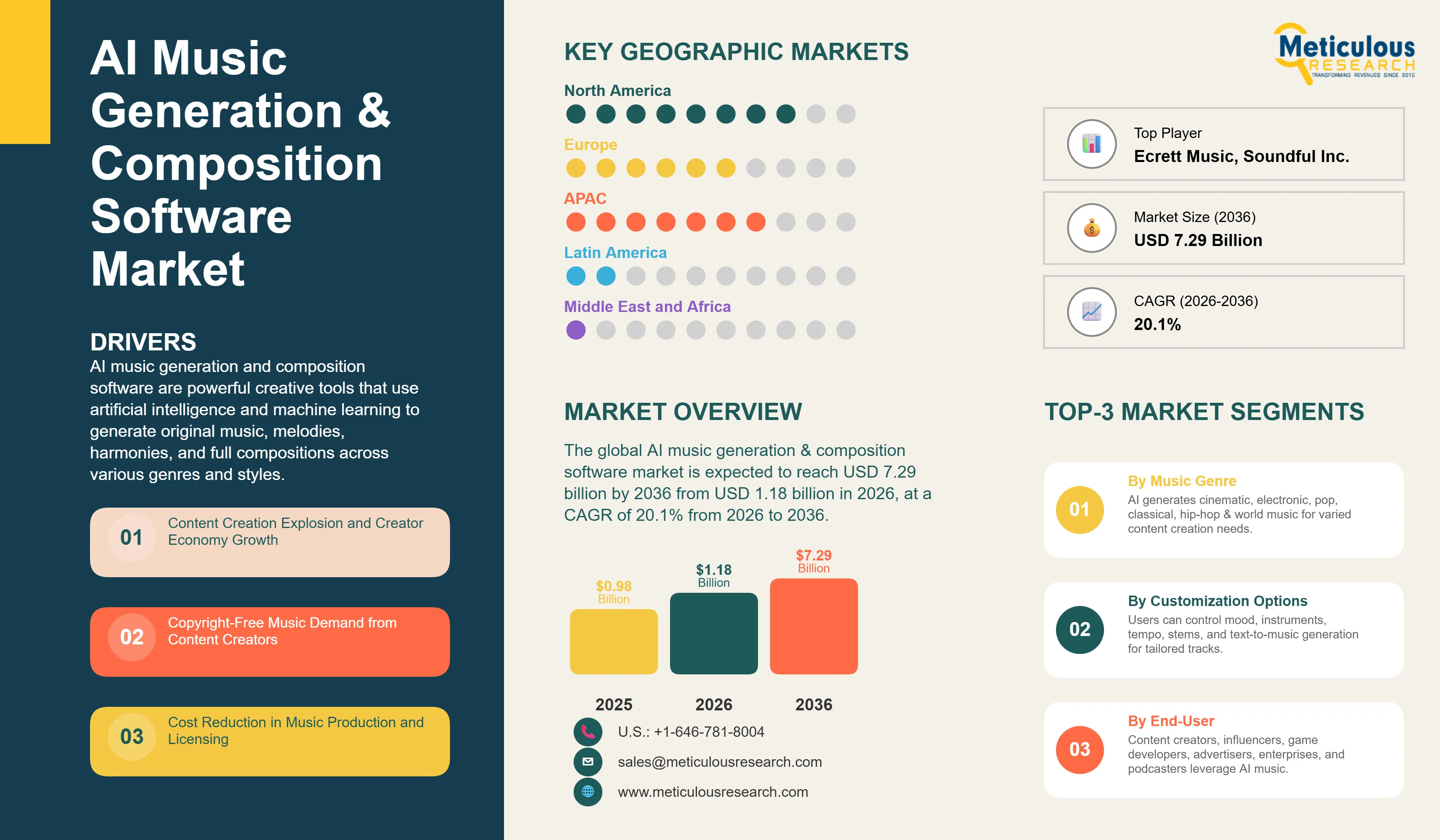

Report ID: MRICT - 1041690 Pages: 293 Jan-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global AI music generation & composition software market is expected to reach USD 7.29 billion by 2036 from USD 1.18 billion in 2026, at a CAGR of 20.1% from 2026 to 2036.

AI music generation and composition software are powerful creative tools that use artificial intelligence and machine learning to generate original music, melodies, harmonies, and full compositions across various genres and styles. They allow users without musical training to create professional-quality soundtracks, background music, and audio content. The goal is to make music creation accessible to everyone, cut down production costs and time, eliminate copyright issues by creating original works, offer endless creative variations, and provide personalized music experiences.

These AI systems employ advanced technologies such as generative adversarial networks (GANs) to create realistic musical sequences, transformer models to grasp musical structure and context, recurrent neural networks (RNNs) to generate patterns over time, and deep learning algorithms trained on millions of musical pieces. They also use style transfer techniques to adapt compositions to different genres and real-time generation engines to create music on demand.

AI music systems can produce complete songs featuring melody, harmony, rhythm, and instrumentation. They can adjust to specific moods, genres, and tempo needs. These systems can create limitless variations without redundancy, respond to user inputs for customization, integrate smoothly with video editing and content creation processes, and generate copyright-free music to avoid licensing issues.

The system gives content creators quick access to custom music, allows for cost-effective soundtrack production, enables non-musicians to make professional audio, speeds up creative processes, and opens up new opportunities for personalized and interactive music experiences. This helps video creators, game developers, advertisers, app developers, and media producers tackle music licensing challenges, lower production costs, maintain creative control, and deliver captivating audio experiences.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

AI Music Generation and Composition Software is changing the way we create music. It makes music production accessible and disrupts traditional economics in the field. In the past, quality music production required expensive studio time, professional musicians, and significant musical training. This created barriers for content creators, small businesses, and independent developers. Complicated music licensing, high costs, and copyright risks also made it difficult for creators who needed soundtracks. AI music generation removes these barriers. It allows anyone to create professional-quality, original music quickly, using simple interfaces that don’t require musical knowledge. This technology tackles major issues such as music licensing complexities, the high costs associated with quality tracks, and the risks of copyright infringement from unauthorized music usage, which can lead to content takedowns and legal trouble. It addresses creative limits that exist with stock music libraries and the delays that custom compositions often involve. Small creators also face financial obstacles in accessing professional music. By generating original compositions on demand, AI music platforms offer unlimited royalty-free music, remove copyright concerns, allow instant customization, cut costs by over 90% compared to traditional licensing, and speed up creative workflows from days or weeks to minutes.

Several important trends are transforming the AI music generation market. These include a shift from basic melody generation to full production, which involves instrumentation, mixing, and mastering. Rapid advancements in generative AI models are producing more realistic and creative compositions. Integration with content creation tools has made adding music to videos easier. We are also seeing the rise of interactive and adaptive music that reacts to user inputs and game states in real time. AI music copilots are emerging, assisting human musicians instead of replacing them. Factors such as a surge in content creators on platforms like YouTube and TikTok, the growing recognition of music's role in engaging videos, the maturity of AI technology for commercial-quality output, clearer regulations around ownership of AI-generated content, and creators' willingness to pay for tools that simplify the process have all contributed to the rapid adoption of AI music as a mainstream creative tool in the creator economy, advertising, gaming, and media production.

The AI music generation market is moving toward more advanced platforms that offer complete music production capabilities and integrate smoothly into creators’ workflows. Today’s AI music systems go way beyond just basic melody creation. They handle full productions that include multi-instrument arrangements with drums, bass, melody, and harmony. These systems also provide professional mixing and mastering, ensuring balanced levels and high audio quality. They can dynamically arrange music with structures for intro, verse, chorus, and outro, as well as adapt to specific genres and emotional tones of the content. Platforms like AIVA, Soundraw, Mubert, and others can compete with professional composers in various applications. The shift from basic MIDI sequences to broadcast-quality productions represents a significant evolution in capability, making AI music suitable for professional purposes.

Customization and control features are rapidly improving, allowing users to direct AI creativity while still keeping it accessible. Modern platforms use advanced interaction methods, including text-to-music generation. This allows users to describe the desired mood or style in everyday language. They also provide control using sliders for tempo, energy, instruments, and mood. Some platforms analyze uploaded tracks and generate similar compositions, while others support real-time editing of generated music. Stem separation gives users individual instrument tracks for detailed customization. These interfaces balance creative control with simplicity, making it possible for non-musicians to create music with basic descriptions while experienced users can access advanced features. The blend of natural language interfaces and precise controls makes AI music accessible to all skill levels.

Integrating with content creation platforms is creating seamless experiences for creators. Leading platforms connect with popular tools like Adobe Premiere Pro and After Effects for video editing, Final Cut Pro for Apple users, DaVinci Resolve for professional production, YouTube Studio for quick soundtrack addition, and mobile editing apps for creators on the go. This integration allows creators to produce and add music without leaving their editing programs. They can preview music synced with video content, automatically adjust music length to match video duration, and export projects with the music already included. Some platforms even offer browser extensions to generate music directly in the editing interface. This workflow integration reduces frustrations and speeds up adoption by eliminating the need to switch tools or deal with complicated imports and exports.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 1.18 Billion |

|

Revenue Forecast in 2036 |

USD 7.29 Billion |

|

Growth Rate |

CAGR of 20.1% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Music Genre, Customization Options, Licensing Model, Delivery Method, End-User, Pricing Model, Output Quality, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, U.K., Germany, France, Japan, China, South Korea, India, Australia, Brazil, Mexico, UAE |

|

Key Companies Profiled |

AIVA Technologies SARL, Amper Music Inc. (Shutterstock), Soundraw Inc., Mubert Inc., Loudly GmbH, Boomy Corporation, Beatoven.ai, Soundful Inc., Ecrett Music, MuseNet (OpenAI), Jukebox (OpenAI), MusicLM (Google), AudioCraft (Meta), Stable Audio (Stability AI), Udio, Suno AI, Splash Music, Humtap Inc., WaveAI, Tracksy |

Driver: Creator Economy Explosion and Video Content Proliferation

The rapid growth of content creators across platforms and the rise of video content is creating huge demand for accessible, affordable music solutions. The creator economy has grown significantly. Over 50 million people worldwide see themselves as creators. YouTube has over 800 million creators, TikTok has more than 1 billion users making content, Instagram creators number in the hundreds of millions, and podcasts have surpassed 5 million active shows. These creators produce vast amounts of video content that need background music. YouTube alone gets over 500 hours of video uploaded every minute. Music has a strong effect on content performance. Videos with fitting soundtracks get 30-50% more engagement, keep viewers’ attention longer, effectively convey emotion and tone, and create a professional polish that sets quality content apart. Unfortunately, creators face challenges with music. Licensing can be complex and costly for small creators. Unauthorized music use can lead to copyright strikes, resulting in content removal and penalties for channels. Limited stock music libraries create repetitive and generic soundtracks. Additionally, many creators struggle to customize music for specific needs. AI music generation directly addresses these issues. It provides unlimited original music, removes licensing complexity and copyright risks, offers infinite variations to avoid repetition, allows for instant customization to meet content needs, and delivers professional quality at a fraction of traditional costs—often $10-30 per month compared to hundreds per track. The demand from creators for music tools that solve these problems is driving the swift adoption of AI music.

Driver: Music Licensing Complexity and Copyright Enforcement

Growing copyright enforcement on content platforms and the complexity of music licensing are pushing creators toward AI-generated alternatives. Platforms like YouTube, Instagram, and TikTok use advanced Content ID systems to identify copyrighted music and enforce rights. Using unauthorized music can lead to content removal, loss of monetization, channel strikes, and even legal issues. Even music from licensed stock libraries can complicate things. Different licenses apply for various uses, such as personal, commercial, or broadcast. There may be geographic restrictions and requirements for attribution, as well as challenges in verifying licenses. For creators who monetize content, music licensing can be complicated and costly. Synchronization rights, mechanical rights, and performance rights must all be considered. Using commercial music often means paying multiple rights holders, which adds to costs and administrative work. AI music generation eliminates these challenges by creating original compositions with clear usage rights. Platforms typically offer simple royalty-free or subscription-based licensing with unlimited usage rights, permissions for commercial use, no attribution requirements, and perpetual licenses that ensure content remains usable indefinitely. The straightforward and secure nature of AI music licensing compared to traditional options offers significant value for creators, advertisers, and media producers.

Opportunity: Gaming Industry and Interactive Music Applications

The gaming industry presents a considerable growth opportunity for AI music generation through dynamic and adaptive music systems that respond to gameplay in real-time. Traditional game music relies on pre-composed tracks that trigger based on game states, which can lead to repetitive experiences and limit responsiveness to player actions. AI-generated adaptive music allows for dynamic soundtracks that react to game intensity, adjusting tempo and intensity during combat or exploration. It can also adapt to player choices, reflecting narrative consequences through music. This creates unique experiences with procedurally generated music that varies with each playthrough while maintaining musical coherence through seamless transitions. This interactivity enhances immersion and replayability. Major game developers and middleware providers are adopting AI music generation for various applications. These include indie game soundtracks, where budgets may not allow for full orchestral scores, mobile games needing varied music without large file sizes, procedurally generated games like roguelikes and open-world titles that require endless music variation, and live service games that continually add new content and need fresh music. Companies like Unity, through partnerships, and the Unreal Engine ecosystem, along with specialized gaming audio middleware, are integrating AI music generation capabilities. As the gaming industry continues to grow, projected to be worth over $250 billion by 2030, the demand for cost-effective and adaptive music solutions opens up significant market opportunities.

Opportunity: Enterprise and Advertising Applications

Enterprise applications such as advertising, corporate videos, e-learning, and presentations represent a major untapped opportunity for AI music generation. Businesses generate large amounts of video content, including product demos, training videos, social media marketing, presentations, webinars, and advertisements—all of which can benefit from fitting background music. However, corporate users encounter challenges related to procurement complexity from licensing, which often requires legal review and contracts. They also face cost barriers since quality stock music can be expensive to scale. Many corporate users lack expertise in music production, making it harder to maintain brand consistency in audio identity across content. AI music platforms focused on enterprises provide solutions to these issues. They offer simple procurement through SaaS subscriptions which avoids complex licensing, cost-effective unlimited music generation that eliminates per-track fees, user-friendly interfaces that require no musical training, and brand customization options to create music that aligns with brand audio guidelines. Early adopters in the enterprise space include marketing agencies producing content for clients at scale, e-learning providers needing extensive audio for courses, corporate communications teams making internal videos, and small businesses creating social media content. Specialized platforms targeting enterprises are emerging, featuring team collaboration, brand presets, and usage analytics. The huge volume of corporate content production, paired with a clear return on investment from lowered licensing costs, creates a substantial market opportunity.

By Music Genre:

The cinematic and ambient segment is expected to hold the largest share in 2026. This genre is popular because of its atmospheric soundscapes and mood-setting qualities that improve content without overpowering narration or dialogue. YouTube creators often rely on cinematic music for travel vlogs, tutorials, product reviews, and storytelling. Corporate video producers use it for brand videos, presentations, and ads. Podcast producers incorporate cinematic elements for intros, outros, and transitions. Leading AI platforms provide extensive cinematic libraries that include sub-genres like epic/inspirational, peaceful/meditative, tension/suspense, and uplifting/hopeful tracks. The versatility and wide applicability across content types make cinematic and ambient music the leading genre in AI music generation.

The electronic and lo-fi segment is growing quickly, fueled by its popularity as background music for studying, working, and gaming streams. Lo-fi hip-hop has become a cultural phenomenon through 24/7 YouTube streams and Spotify playlists, leading to a high demand for copyright-free lo-fi music. It is used in studying and productivity content, gaming streams, lifestyle vlogs, and coding streams. AI platforms focus on developing lo-fi capabilities with distinctive features like vinyl crackle, jazz-influenced progressions, and mellow synthesizers. This segment benefits from clear aesthetic expectations that fit well with current AI music generation tools.

The corporate and motivational segment targets business and professional content. It offers upbeat, positive music for presentations, training videos, marketing materials, and website backgrounds. AI music generation effectively serves this segment with quick customization that matches brand guidelines, consistent quality, cost-effectiveness, and vast libraries for frequent content production.

By Customization Options:

The AI-assisted customization segment is expected to lead the market in 2026. It offers the right balance between creative control and ease of use. Key features include mood and energy level sliders, instrument selection and mix controls, duration customization, tempo adjustment, and key/scale selection. This approach opens up music creation by making professional-quality customization available to non-musicians. Key users include YouTube creators, podcast producers, small business owners, and marketing professionals. Platforms like Soundraw, Beatoven.ai, and AIVA focus on AI-assisted customization with user-friendly interfaces that balance simplicity and control.

The text-to-music generation segment represents cutting-edge technology that creates complete compositions from natural language descriptions. Users describe the desired music with prompts like "upbeat electronic music with piano, energetic and motivational, 2 minutes." Leading platforms include Google's MusicLM, Meta's AudioCraft, and Stability AI's Stable Audio. Current limitations involve variable output quality and limited duration, but rapid development suggests significant improvements within 2-3 years. Use cases include content creators experimenting with unique soundtracks, game developers creating adaptive music, and advertisers testing musical directions.

By Licensing Model:

The royalty-free licensing segment is likely to dominate in 2026. It provides users with perpetual usage rights without ongoing royalty payments. This model offers predictable costs, compatibility with platform monetization, ease of multi-platform distribution, and flexible archiving options. Standard licenses usually cover worldwide distribution rights, unlimited views/plays, and commercial use. This segment benefits independent content creators, small businesses, agencies, and platforms that embed music generation. Market leadership reflects a crucial need for music licensing that fits with digital platform monetization models like YouTube AdSense.

The attribution-based free segment offers free music access in exchange for crediting the music source. Users benefit from zero monetary cost, while platforms gain brand exposure and attract users. Common implementations include free tiers with limited monthly downloads, educational licenses, and non-profit licenses. However, limitations typically restrict commercial use and broadcast distribution. This segment serves students, hobby creators, non-profit organizations, and trial users testing platforms.

By Delivery Method:

The web-based platforms segment is expected to hold the largest share in 2026. It provides music generation accessible from browsers without requiring software installation. Benefits include no installation requirements, compatibility across devices, automatic updates, and collaborative features. Leading platforms include Soundraw, Mubert, Beatoven.ai, and AIVA. These platforms use cloud-based generation with responsive designs optimized for desktop, tablet, and mobile browsers. This segment enjoys lower user acquisition barriers and straightforward technical support.

The API and developer tools segment is experiencing rapid growth. It allows programmatic music generation for applications, games, and automated workflows. Key capabilities include music generation endpoints, customization controls, batch processing, and webhook notifications. Use cases range from game developers creating adaptive soundtracks to app developers adding background music, marketing automation producing personalized videos, and content management systems. This implementation includes RESTful APIs, SDKs in various languages, and WebSocket connections. Pricing generally follows usage-based models that charge per generation or per minutes of music.

By End-User:

The content creators and influencers segment is expected to account for the largest share. It is driven by millions of YouTube, TikTok, Instagram, and podcast creators who need constant music. Their requirements include high volume demands, copyright safety, monetization compatibility, and affordability. AI music generation meets these needs by offering unlimited tracks, guaranteed copyright protection, platform-friendly licensing, and accessible subscription pricing. Creator workflows involve browsing genres, previewing selections, customizing duration and energy, and downloading for editing. The segment reflects the growth of the creator economy, with over 50 million individuals worldwide identifying as content creators.

The game developers segment includes high-value users who need adaptive, dynamic music that responds to gameplay states. Applications involve indie studios with tight budgets, mobile developers seeking lightweight solutions, and AAA studios exploring AI for procedural content. AI music supports gaming through adaptive soundtrack generation, procedural music creation, dynamic arrangement, and efficient resource use. Implementation methods include real-time generation, pre-generated asset libraries, and hybrid systems. Market growth is driven by the indie game boom, trends in procedural generation, and integrations with game engines.

The advertising and marketing agencies segment requires high-volume music production for client campaigns across various brands. AI music generation addresses agencies' needs with quick ideation, brand customization, cost efficiency, and clear commercial licensing. Typical workflows include creative briefings, exploring musical directions, client revisions, and final production. Use cases cover social media advertising, video ads, radio spots, and experiential marketing. Market penetration rises as agencies show a return on investment through time savings, cost reduction, and creative flexibility.

Regional Insights:

In 2026, North America is expected to have the largest share of the global AI music generation market. North America's lead comes from a vibrant content creator ecosystem, with YouTube, podcasting, and independent film production primarily based in the U.S. and Canada. This region hosts top AI technology companies and startups like OpenAI and Google, along with specialized music AI firms. The entertainment industry has welcomed AI music, with advertising agencies, production studios, and media companies being early users. There is also strong venture capital backing music AI innovation. The United States stands out due to millions of YouTube creators needing music, a large podcasting community seeking intro and outro music, and the advertising sector using AI music for commercial projects. Additionally, there is a cultural acceptance of AI creative tools. Major AI music companies, including Amper Music (now Shutterstock) and AIVA, have built a strong presence and customer base in North America.

Asia-Pacific is set to grow at the fastest rate during the forecast period. This growth stems from the rapid rise of social media and short-form video platforms like TikTok, Douyin, and Kwai, which produce a large number of content creators. The gaming industry is also growing, especially in China, South Korea, and Japan, which raises the demand for game soundtracks. The population of content creators is expanding across China, India, Southeast Asia, and Oceania. Moreover, AI technology development in China and Japan is improving music generation capabilities. China plays a significant role in this regional growth through the ByteDance (TikTok/Douyin) creator ecosystem, generating a huge demand for music. The gaming sector requires affordable soundtracks, and China benefits from local AI capabilities in music generation as well as government support for AI industry growth. India represents a new opportunity with a rapidly growing creator economy, high YouTube usage, and a cost-sensitive market that values affordable AI solutions.

Europe is a major market known for its strong creative industries in the UK, Germany, and France. It has a culture of music technology innovation, especially in the UK and Scandinavia. The region has a large group of independent content creators and filmmakers. Data privacy considerations also impact platform choices, with many creators opting for GDPR-compliant solutions. The UK leads with a concentration of creative professionals, a rich music production history, and a dynamic technology startup scene.

The major players in the AI music generation & composition software market include AIVA Technologies SARL (Luxembourg), Amper Music Inc. (Shutterstock) (U.S.), Soundraw Inc. (Japan), Mubert Inc. (U.S./Estonia), Loudly GmbH (Austria), Boomy Corporation (U.S.), Beatoven.ai (India), Soundful Inc. (U.S.), Ecrett Music (Japan), MuseNet (OpenAI) (U.S.), Jukebox (OpenAI) (U.S.), MusicLM (Google) (U.S.), AudioCraft (Meta) (U.S.), Stable Audio (Stability AI) (UK), Udio (U.S.), Suno AI (U.S.), Splash Music (Australia), Humtap Inc. (U.S.), WaveAI (U.S.), and Tracksy (U.S.), among others.

The AI music generation market is expected to grow from USD 1.18 billion in 2026 to USD 7.29 billion by 2036.

The AI music generation market is expected to grow at a CAGR of 20.1% from 2026 to 2036.

Major players include AIVA, Amper Music (Shutterstock), Soundraw, Mubert, Loudly, Boomy, Beatoven.ai, Soundful, and emerging platforms from OpenAI, Google, Meta, and Stability AI.

Main factors include creator economy explosion, music licensing complexity and copyright enforcement, gaming industry adaptive music needs, enterprise and advertising applications, and AI technology advancement enabling commercial-quality output.

North America leads in 2026 due to concentrated creator ecosystem and AI technology companies, while Asia-Pacific is expected to register highest growth during 2026-2036.

Published Date: Aug-2025

Published Date: Oct-2024

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates