Resources

About Us

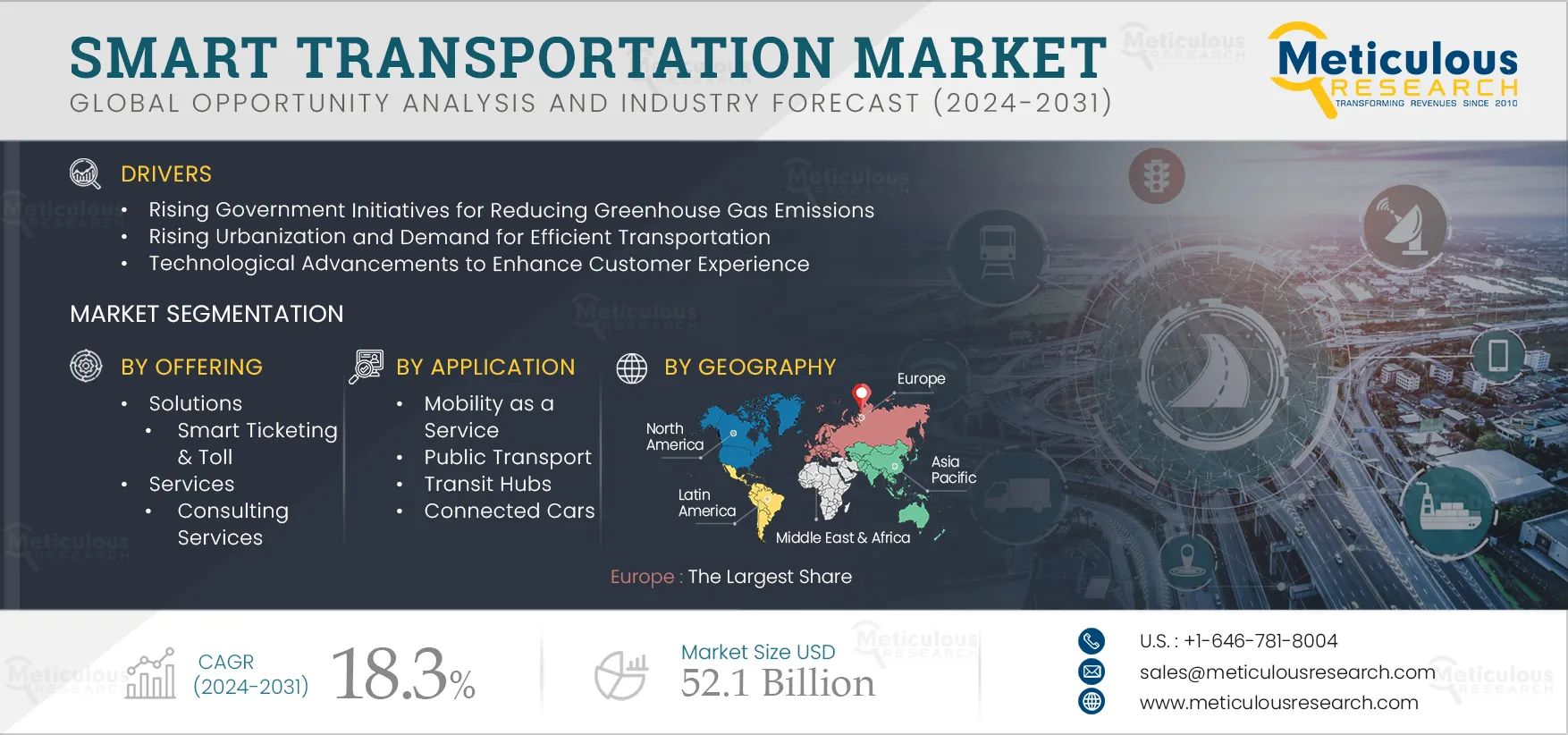

Smart Transportation Market Size, Share, Forecast, & Trends Analysis by Mode (Roadways, Railways, Airways, Others), Offering (Solutions (Smart Ticketing & Toll, Parking Management, Other) & Services), Application (MaaS, Route Information & Guidance, Others) - Geography - Global Forecast to 2031

Report ID: MRICT - 104506 Pages: 250 Jun-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe Smart Transportation Market is expected to reach $52.1 billion by 2031, at a CAGR of 18.3% from 2024 to 2031. The growth in this market is driven by factors such as rising government initiatives for reducing greenhouse gas emissions, rising urbanization, and demand for efficient transportation and technological advancements to enhance customer experience. In addition, the emergence of autonomous vehicles, increasing investments in smart city projects, and decline in vehicle ownership with the advancement of MaaS are expected to provide opportunities for market growth. However, the lack of standardized and uniform technology is expected to restrain the growth of the market. The high initial cost of deployment challenges market growth.

The transportation sector is a significant contributor to greenhouse gas emissions, with demand consistently growing worldwide and expected to increase further in the coming years. According to the International Energy Agency (IEA) in its Energy Technology Perspectives report, global transport is projected to double by 2070, car ownership rates are anticipated to rise by 60%, and the demand for passenger and freight aviation is expected to triple. These trends are likely to result in a substantial increase in transport emissions, adversely impacting the environment.

Recognizing this serious challenge, governments around the globe are implementing robust initiatives to deploy smart transportation systems aimed at reducing greenhouse gas emissions. For example, in 2021, the Finnish government introduced measures to reduce emissions from aviation, focusing on renewable aviation fuels and carbon pricing. Similarly, the Dutch government has taken significant steps to combat climate change, such as enacting the Climate Act and the National Climate Agreement, which aim to make all new passenger cars emission-free by 2030. Additionally, initiatives to promote electric vehicles through tax relaxations and the development of approximately 1.8 million charging points by 2030 are some of the proactive measures being undertaken to support smart transportation systems.

Governments worldwide are also modernizing existing public transportation systems and enhancing navigational tools to address emission issues effectively. These promising steps to reduce greenhouse gas emissions are driving the demand for smart transportation solutions.

Click here to: Get a Free Sample Copy of this Report

Presently, more than half of the world’s population lives in urban areas, and the migration towards cities is expected to continue at an even faster pace over the next few decades. By 2050, the global population is projected to reach around 9.8 billion, and it is estimated that more than twice as many people in the world will be living in urban areas (6.7 billion) than in rural settings (3.1 billion). Most of the population in urban areas prefer to drive to their respective work; this creates several traffic issues such as jams, accidents, noise pollution, and loss of valuable time, especially during rush hours.

The challenge of congestion is a perennial issue for cities around the world and is consistently getting more complex with every passing year. The increasing population in cities is straining urban transportation systems. People who live and work across major cities of the world are faced with increasing levels of congestion, delays, total travel time, costs, frustration, accidents, and loss of life. Smart transportation utilizes information technology and artificial intelligence to efficiently manage and coordinate urban transportation systems. Smart transportation networks allow travelers to be aware of the traffic for better coordination and to ensure the safety of the drivers. Thus, all such factors are expected to drive the market growth in the forecast period.

Rapid improvements in public transport infrastructure in recent decades have reduced the desire to drive, especially in major cities. Many consumers have also opted to forgo vehicle ownership in favor of shared mobility, which allows them short-term access to transportation as needed. This approach is often more cost-effective since users only pay for transportation when required, avoiding the continuous expenses associated with car ownership and maintenance. Even public transportation providers may rely on shared mobility solutions.

Mobility-as-a-Service (MaaS) enables users to book various transportation services through applications, including e-bikes, e-scooters, taxis, or public transportation, in different combinations throughout their journey. MaaS has emerged as a viable alternative to personal vehicle ownership, often facilitating mobility in cities with inadequate public transportation options. MaaS platforms are evolving toward deeper integration with transport network tools and journey planners to assist with real-time planning and in-app services such as payments, bookings, and ticketing. Therefore, advancements in Mobility-as-a-Service (MaaS) are expected to create significant opportunities for market growth.

The Internet of Things (IoT) is driving significant changes in smart transportation systems, and with the enhanced connectivity offered by 5G, IoT applications are expected to expand across various domains. Businesses are leveraging IoT sensors to inform decision-making processes and develop systems that address the needs of modern logistics. In transportation, numerous processes are becoming smart, potentially leading to future standardization of communication between business transportation systems and city transportation systems.

In intelligent transportation systems, IoT sensors and devices gather critical data, such as travel times and weather conditions, and communicate this information to other devices and systems. Organizations use this data in multiple ways. For example, a smart truck can automatically adjust the environmental conditions inside a trailer carrying highly sensitive goods or interact with intelligent traffic systems. Additionally, data from environmental sensors and digital weather systems can alert drivers about impending icy or rough road conditions.

The increasing need to optimize supply chain processes, the reduced cost of powerful sensors and controllers, enhanced internet connectivity, growth in information and communication technology, and the rise in government initiatives for smart cities are major factors driving the adoption of IoT in smart transportation solutions.

Based on transportation mode, the smart transportation market is segmented into roadways, railways, airways, and maritime. In 2024, the roadways segment is expected to account for the largest share of above 55.7% of the global smart transportation market. The large share of this segment is attributed to the rising need for better and sustainable roadways, increasing demand for safer roads, the rising need to reduce traffic congestion, and government initiatives for smart roadways. In addition, the growing trend toward the adoption of smart cities is also expected to drive segment growth.

However, the railways segment is expected to grow at the highest CAGR during the forecast period. The trend of globalization & urbanization accelerated the demand for smart railway solutions, promoting safe and reliable advanced services and operational efficiency to passengers. Besides, the rise in the number of rail accidents and increasing initiatives by governments worldwide to implement advanced technologies for the development of smart railway systems are also expected to drive the segment growth.

Based on offering, the smart transportation market is broadly segmented into solutions and services. In 2024, the solutions segment is expected to account for the largest share of above 63.8% of the global smart transportation market. The large share of this segment is attributed to the growing concerns toward public safety, growing traffic congestion, favorable government initiatives towards effective traffic management implementation, the rising investment in smart cities across the world, and the rising focus of market players to launch innovative smart transportation solutions.

However, the services segment is expected to grow at the highest CAGR during the forecast period. The growing concern of organizations to gain visibility for diagnosing and troubleshooting problems before hampering operations or end-user experiences is expected to drive the adoption of smart transportation services. Furthermore, the rising need for technical support and upgradation of smart transportation solutions to ensure optimum utilization of these solutions is also supporting the growth of the smart transportation services market.

Based on application, the smart transportation market is segmented into mobility as a service, route information and route guidance, public transport, transit hubs, connected cars, and other applications. In 2024, the connected cars segment is expected to account for the largest share of above 29.2% of the global smart transportation market. The large share of this segment is attributed to the rise in consumer demand for connectivity solutions, a surge in the need for constant connectivity, an increase in dependency on technology, and the upsurge in the tech-savvy population. Moreover, the connected cars segment is expected to grow at the highest CAGR during the forecast period.

In 2024, Europe is expected to account for the largest share of above 29.6% of the smart transportation market. The large share of the region is attributed to the well-established transportation infrastructure, increasing passenger transport and the rising government spending on improving the urban transport and traffic system of the region. Moreover, flourishing cross-border trade is promoting traffic in the region, leading to the rising demand for smart transportation in the European economies.

However, the Asia-Pacific region is expected to grow at the highest CAGR of above 20.0% during the forecast period. The growth of the market is attributed to the increasing investment by countries such as India, Japan, and China in megacities to modernize their transportation networks to facilitate enhanced trade exchanges, growing number of vehicles, and rising demand for road safety and traffic management.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the smart transportation market are Thales Group (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), Cubic Corporation (U.S.), Alstom (France), Bentley Systems, Inc. (U.S.), Toshiba Corporation (Japan), Harris Corporation (U.S.), Saab AB (Sweden), Veson Nautical (U.S.), BASS Software Ltd. (Norway) and Indra Sistemas (Spain).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

18.3% |

|

Market Size (Value) |

USD 52.1 Billion by 2031 |

|

Segments Covered |

By Transportation Mode

By Offering

By Application

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Spain, Sweden, Denmark, and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Malaysia, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Thales Group (France), Huawei Technologies Co., Ltd. (China), Siemens AG (Germany), IBM Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), Cubic Corporation (U.S.), Alstom (France), Bentley Systems, Inc. (U.S.), Toshiba Corporation (Japan), Harris Corporation (U.S.), Saab AB (Sweden), Veson Nautical (U.S.), BASS Software Ltd. (Norway), and Indra Sistemas (Spain). |

The Smart Transportation Market focuses on innovative technologies and services aimed at enhancing the efficiency, safety, and sustainability of transportation systems through IoT, autonomous vehicles, and data analytics.

The Smart Transportation Market is projected to reach $52.1 billion by 2031, reflecting a growing demand for smarter, more efficient transportation solutions globally, driven by urbanization and technological advancements.

The market is anticipated to grow at a CAGR of 18.3% from 2024 to 2031, indicating robust growth due to rising government initiatives, urbanization, and advancements in smart transportation technologies.

The Smart Transportation Market size is estimated to be $52.1 billion by 2031, reflecting increasing investments in smart technologies and the growing need for efficient transportation solutions in urban areas.

Key players in the Smart Transportation Market include Thales Group, Huawei Technologies, Siemens AG, IBM, Cisco Systems, SAP, Cubic Corporation, Alstom, Bentley Systems, Toshiba, and Indra Sistemas, among others.

A significant trend is the rising adoption of IoT in smart transportation solutions, leveraging enhanced connectivity from technologies like 5G to optimize logistics and improve transportation efficiency.

Key drivers include government initiatives aimed at reducing greenhouse gas emissions, increasing urbanization, demand for efficient transportation systems, and technological advancements enhancing customer experiences.

The market segments include transportation modes (roadways, railways, airways, maritime), offerings (solutions, services), and applications (mobility as a service, route information, public transport, connected cars).

The global outlook is positive, with strong growth projected, especially in the Asia-Pacific region, driven by significant investments in smart city projects and infrastructure modernization for enhanced transportation systems.

The market is expected to grow significantly, reaching $52.1 billion by 2031, fueled by urbanization, technological advancements, and increasing governmental focus on sustainable and efficient transportation solutions.

The Smart Transportation Market is projected to grow at a CAGR of 18.3% from 2024 to 2031, reflecting the ongoing evolution of transportation systems through advanced technologies and innovative solutions.

Europe is expected to hold the largest market share, accounting for over 29.6% of the Smart Transportation Market in 2024, due to its established transportation infrastructure and government investments in smart solutions.

Published Date: Jan-2025

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Aug-2024

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates