Resources

About Us

AI for 3D Asset Generation & Texturing Market Size, Share, & Forecast by Asset Type, AI Model, Integration, and End-User (Games, Metaverse, VFX) - Global Forecast (2026-2036)

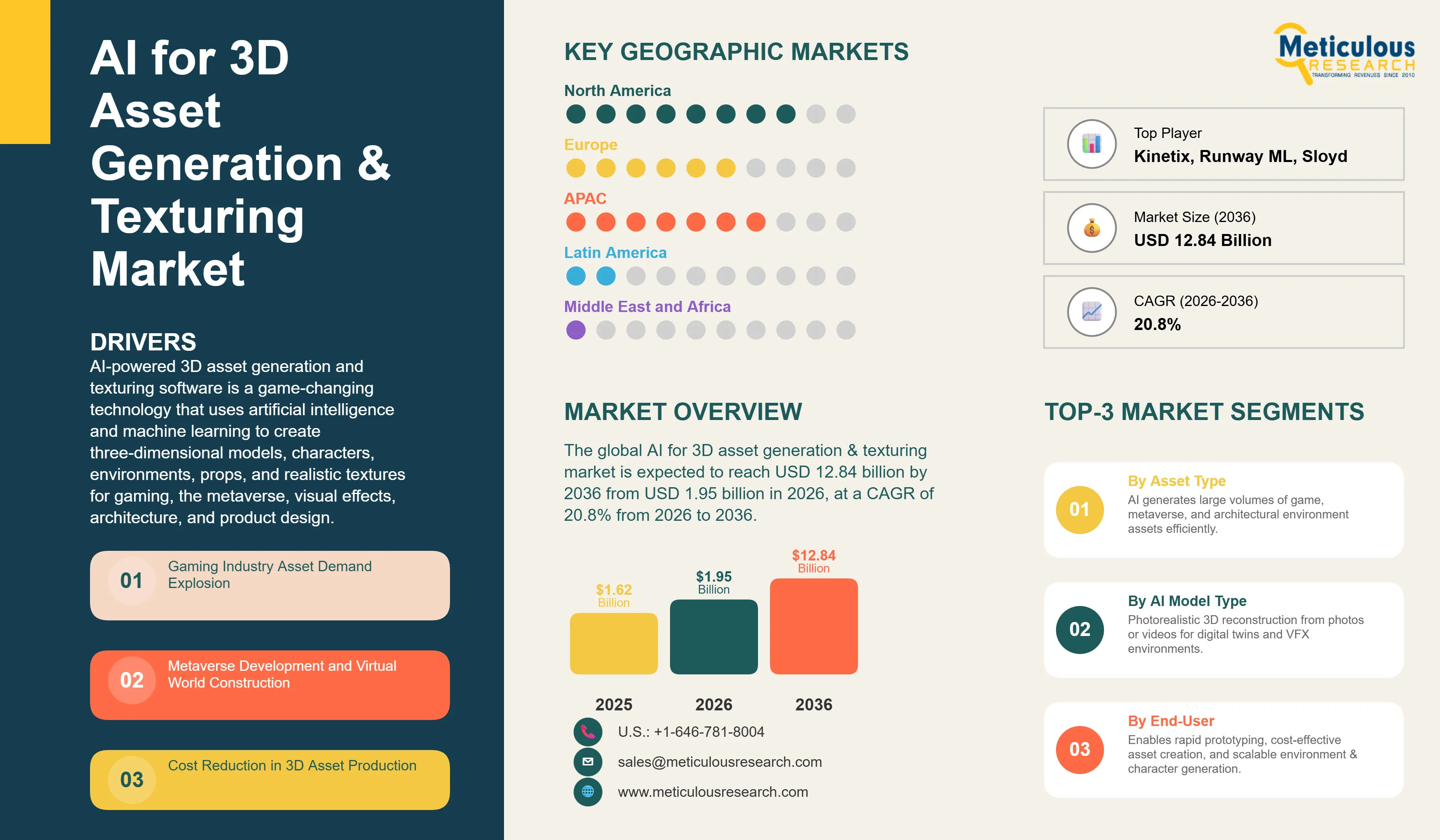

Report ID: MRICT - 1041691 Pages: 293 Jan-2026 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global AI for 3D asset generation & texturing market is expected to reach USD 12.84 billion by 2036 from USD 1.95 billion in 2026, at a CAGR of 20.8% from 2026 to 2036.

AI-powered 3D asset generation and texturing software is a game-changing technology that uses artificial intelligence and machine learning to create three-dimensional models, characters, environments, props, and realistic textures for gaming, the metaverse, visual effects, architecture, and product design. These systems allow creators without deep 3D modeling skills to produce professional-quality assets. They significantly cut production times from weeks to hours, remove boring manual texturing tasks, offer endless creative options, and reduce development costs by 60-80% compared to traditional methods.

These AI systems use technologies like Neural Radiance Fields (NeRFs) for realistic 3D reconstruction from 2D images. They also feature text-to-3D diffusion models that convert natural language descriptions into complete models, GANs for high-quality texture creation and material synthesis, procedural generation algorithms for making variations and populations, and PBR (Physically Based Rendering) material generation for realistic surface properties. They process point clouds for scanning-to-model conversion, automate UV mapping, and optimize real-time rendering.

AI 3D generation systems can create complete game-ready assets with proper topology and LOD (Level of Detail) variants. They provide photorealistic textures with normal maps, roughness, and metallic properties. These systems can produce entire environment sets while maintaining artistic coherence, rigged and animated character models, and seamless tileable textures. They adjust to various art styles, from photorealism to stylized looks. They can handle user refinements, integrate with industry-standard 3D software like Blender, Maya, and Unreal Engine, and create royalty-free assets to avoid licensing issues.

This technology gives game developers the ability to prototype quickly. It allows metaverse builders to efficiently create vast virtual worlds. VFX studios can speed up pre-visualization and asset creation. Indie creators can compete with AAA production quality, and it opens doors for personalized and user-generated 3D content on a massive scale.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

AI for 3D Asset Generation and Texturing is changing how digital content is created. It tackles major issues in game development, metaverse building, visual effects production, and virtual product design. In the past, making high-quality 3D assets required skilled artists, costly software, and weeks or even months of work. Creating a single game character could take between 100 and 200 hours to model, texture, and rig. AAA game environment assets often needed whole teams working for years. This made it hard for independent developers, small studios, and new creators who couldn’t afford large art teams.

Creating 3D assets is complex. It requires many specialized skills, such as modeling geometry with proper topology, making UV maps for textures, painting or photographing those textures, generating normal maps and PBR materials, rigging models for animation, creating LOD variants for better performance, and ensuring everything works with game engines. Each step demands expertise and time. The industry also struggles with high asset licensing costs, limited customization options in asset marketplaces, repetitive manual work in texturing and creating variations, and the challenge of keeping consistent art direction across large projects.

AI-driven 3D generation removes these obstacles. It lets anyone create professional-quality assets using simple text descriptions or image uploads. It cuts down asset creation time by 90-95%, taking it from weeks to just hours or minutes. It generates game-ready topology and technical specifications automatically, gives unlimited variations while keeping style consistency, removes licensing issues by generating original outputs, and opens up 3D content creation to indie developers and small teams.

Several key trends are reshaping the AI 3D generation market. These include moving from basic primitive generation to full production-ready assets with all necessary technical specs, improving photorealism quality to nearly match hand-crafted assets, integrating AI generation into professional 3D software through plugins and APIs, creating text-to-3D models that generate from natural language descriptions, developing NeRF technology for photorealistic reconstruction from photos, and using AI-assisted texturing to automatically create complete PBR material sets.

Several factors are driving the rapid adoption of AI 3D generation. The growth of diffusion models and neural rendering techniques, the rising demand for 3D content due to gaming and metaverse expansion, budget constraints in game development, the shortage of skilled 3D artists, and creators' openness to using AI tools to speed up their workflows have all played a role. Game developers, metaverse platforms, VFX studios, architectural visualization firms, and product designers are bringing AI 3D generation into their production processes.

From Primitives to Production-Ready Assets

The AI 3D generation market is moving from creating basic shapes to complete, game-ready assets with all necessary technical details. Earlier AI 3D systems produced simple geometric forms that required much manual cleanup and optimization. Modern platforms like Kaedim, Masterpiece Studio, Luma AI, and Meshy create assets with clean topology suitable for animation, automatic UV mapping, multiple LOD variants for better performance, proper polygon counts for platform requirements, and rigged skeletons ready for animation. These systems also generate normal maps, roughness maps, metallic maps, and ambient occlusion automatically, resulting in complete PBR material sets. They export in standard formats like FBX, OBJ, GLTF, and USD, which work with Unity, Unreal Engine, Blender, and Maya. This change from concept to production-ready output marks a significant shift, making AI-generated assets fit for commercial game releases and professional VFX projects.

Text-to-3D and Multimodal Input Systems

Easy input methods are making 3D asset creation accessible through natural language and image-based generation. Leading platforms now offer text-to-3D generation, allowing users to describe assets in simple terms, such as "medieval fantasy castle with stone walls and wooden gates." They also provide image-to-3D conversion that creates models from single photos or sketches, multiview synthesis that generates models from several angles, style reference systems that ensure artistic consistency, and iterative refinement through conversational AI that understands requests for changes. These tools remove the technical hurdles of 3D modeling software, allowing concept artists, game designers, and non-technical creators to generate assets based on their ideas. This blend of natural language processing with 3D generation represents a significant shift, much like how text-to-image generation impacted 2D art creation.

Seamless Integration with Professional Workflows

AI 3D platforms are being integrated directly into popular software and game engines, enabling easy adoption. Major developments include Blender plugins for AI asset generation within its familiar interface, Unity and Unreal Engine marketplace plugins for in-engine generation, support for Maya and 3ds Max in professional studios, automatic importation with correct material assignments, and API access for generating assets programmatically in automated workflows. This integration allows professionals to use AI generation without leaving behind their favorite tools and processes. Artists can create base assets with AI and refine them using traditional techniques. This hybrid method, combining the speed of AI with the artistic control of humans, is becoming standard in the industry. AI handles the repetitive and time-consuming tasks, allowing artists to focus on their creative vision and final details.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 1.95 Billion |

|

Revenue Forecast in 2036 |

USD 12.84 Billion |

|

Growth Rate |

CAGR of 20.8% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Asset Type, AI Model Type, Texturing Capability, Integration Type, End-User, Deployment Model, Pricing Model, Output Format, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, U.K., Germany, France, Japan, China, South Korea, India, Australia, Brazil, Mexico, UAE |

|

Key Companies Profiled |

NVIDIA (GET3D), Kaedim, Masterpiece Studio, Luma AI, Meshy, Scenario, Leonardo.ai, Sloyd, Ponzu, Promethean AI, Runway ML, Poly (Google), DeepMotion, Inworld AI, Ready Player Me, Polycam, 3DFY, Spline AI, Krikey AI, Mirage, CommonSim, Kinetix |

Driver: Gaming Industry Explosion and Asset Demand

The rapid growth of the gaming industry and the relentless demand for 3D content are creating an enormous need for efficient asset generation solutions. The global gaming market has surpassed USD 200 billion in revenue, with over 3 billion players worldwide. Games are becoming more complex. Modern AAA titles contain 50,000-100,000 unique 3D assets. Open-world games require vast environments filled with millions of objects. Live-service games need constant content updates to keep players engaged, and mobile games demand optimized assets for different device capabilities. The development cost crisis is getting worse. AAA game budgets now exceed USD 200-300 million, and 3D art makes up 40-50% of these costs. Production timelines have stretched to 5-7 years, and artist teams have grown to hundreds of specialists.

Independent and small studio developers face particularly severe challenges. They lack the resources for large art teams and cannot compete with AAA production quality using traditional methods. They need rapid prototyping for iterative game design and must minimize costs to stay profitable. Asset marketplace limitations add to these problems. Purchased assets often appear in multiple games, creating visual repetition. Customization requires 3D expertise, licensing costs add up quickly, and it is hard to find assets that have a consistent style.

AI 3D generation addresses these issues directly. It enables rapid prototyping of game mechanics using placeholder assets within hours. It can create thousands of environment assets while maintaining artistic coherence, generate variations for characters and creatures for diverse populations, produce game-ready assets at 10-20% of traditional costs, and empower small teams to achieve AAA-quality visuals. For a mobile game that needs 500 environmental assets, traditional production might cost USD 150,000-250,000 and take 6-9 months. AI generation reduces this to USD 5,000-15,000 and 2-4 weeks. This economic shift is driving quick adoption among indie studios, mobile developers, and even AAA studios for rapid iteration and prototyping stages.

Driver: Metaverse Development and Virtual World Construction

The rise of metaverse platforms and virtual worlds is creating demand for 3D content on a scale that traditional methods cannot meet. Leading metaverse platforms such as Roblox, Decentraland, The Sandbox, Spatial, and Meta's Horizon Worlds collectively host hundreds of millions of users, creating and exploring virtual experiences. The content needs are enormous. Metaverse worlds require millions of unique assets, user-generated content platforms need tools for non-3D artists, virtual real estate requires customizable buildings and environments, and avatar customization calls for endless clothing and accessory variations.

Traditional 3D creation cannot keep up with metaverse demands. Professional 3D artists are unable to produce enough content, most users lack 3D modeling skills, manual creation is too slow for dynamic, user-driven worlds, and cost barriers prevent broad participation. The financial model of metaverse platforms relies on user-generated content. These platforms earn revenue from transactions and virtual goods sales, creator economies distribute earnings to creators, platform success depends on content variety and volume, and accessibility impacts creator participation rates.

AI 3D generation allows for scalability in the metaverse by letting non-technical users create assets from text descriptions. It can produce endless variations of buildings and decorations, create personalized avatars and clothing from photos or descriptions, populate vast worlds with diverse environmental assets, and remove technical barriers to content creation. Platforms are integrating AI generation directly. Roblox is partnering with AI companies for creator tools, Decentraland is exploring AI building assistants, user-facing platforms are offering AI asset generation as premium features, and metaverse development platforms are including AI generation SDKs. The vision of persistent, user-created virtual worlds requires AI-powered content generation to become a reality, creating a massive and growing market opportunity.

Opportunity: VFX and Film Production Acceleration

The visual effects and film production industry offers significant potential for AI 3D generation through pre-visualization, digital doubles, and environment creation. Modern blockbuster films contain over 2,000-3,000 VFX shots with extensive 3D asset requirements, including digital environments, sets, character and creature models, vehicle and prop assets, and background element populations. Pre-visualization serves as animated storyboarding for planning shots and sequences. It helps directors visualize scenes before costly shooting, facilitates communication between departments, and allows for creativity to evolve. Currently, previz requires a lot of time and expense from 3D artists, limiting its usage.

AI 3D generation speeds up VFX workflows. It enables rapid previz asset creation from script descriptions, generates digital environment concepts for location scouting and set design, creates population characters and background elements at scale, produces quick iterations on creature and character designs, and builds virtual sets for production and LED volumes. Major studios are looking into AI integration. Netflix and Disney are exploring AI tools for more efficient production. VFX houses like ILM and Weta are experimenting with AI asset generation. Virtual production stages need rapid 3D environment creation, and indie filmmakers now have access to VFX capabilities that used to require large budgets.

Use cases include concept visualization with quick 3D mockups of script descriptions, background asset generation for crowd scenes or environment population, digital doubles for stunt work or tricky shots, and building virtual production environments. The cost-benefit analysis is compelling. Traditional previz costs USD 1,000-3,000 per minute of animation. AI-accelerated previz can cut costs by 60-80% and time by 70-90%. For a film needing 30 minutes of previz, this could save USD 20,000-60,000 and weeks of production time. As virtual production and LED volumes become standard, the demand for quick 3D environment generation will grow, creating substantial market opportunities.

Opportunity: Enterprise Applications Beyond Entertainment

Enterprise applications in architecture, product design, e-commerce, and training simulations represent valuable opportunities for AI 3D generation. The architecture and real estate sectors create a huge demand for architectural visualization, requiring 3D building models and interior designs, marketing through virtual tours and property visuals, urban planning using city-scale 3D models, and interior design with furniture arrangements. Traditional architectural visualization costs USD 500-2,000 per image and takes weeks to produce, limiting the extent of property visualization.

Product design and e-commerce involve 3D product models for online retail, configuration and customization tools, virtual showrooms and catalogs, and AR previews for mobile shopping. E-commerce platforms increasingly need 3D models. Companies like Amazon and Shopify are pushing for 3D product displays. Consumer preference for 3D visualization can boost conversion rates by 40-60%. Traditional product modeling costs USD 100-500 per SKU, which is too high for catalogs with thousands of products.

AI 3D generation meets enterprise needs by creating architectural models from floor plans and descriptions, automatically building 3D product models from photos, rapidly constructing virtual showroom environments, and enabling AR experiences without costly 3D production. Early enterprise adopters include furniture retailers generating 3D catalogs from product photos, architectural firms using AI for quick concept visualization, automotive companies creating configurator assets, and real estate developers producing property visuals. Specialized platforms for enterprises are emerging, offering photogrammetry-to-3D conversion, CAD file optimization, batch processing for catalog generation, and white-label solutions for deployment. The enterprise market opportunity is considerable. The global architectural visualization market exceeds USD 3 billion, and e-commerce 3D visualization represents a multi-billion dollar opportunity as online retail increasingly demands 3D product experiences.

By Asset Type

The Environment and Props Segment is expected to hold the largest share in 2026. This segment leads due to the large amount of environmental assets needed for game development, metaverse worlds, and architectural visualization. An open-world game typically requires tens of thousands of environmental objects such as rocks, trees, vegetation, buildings, furniture, vehicles, and decorative props. Creating this volume manually is time-consuming and costly. AI generation excels at creating environments because these assets usually have simpler shapes than characters, variations are useful for avoiding repetitive settings, and technical needs are less demanding compared to animated characters.

Key use cases include populating game levels with rocks, plants, debris, and architectural elements; building metaverse worlds that need various buildings and decorative items; visualizing architecture with furniture, fixtures, and landscaping; and providing background elements and set dressing for VFX. AI platforms like Scenario, Sloyd, and Promethean AI focus on generating environments with style-consistent asset families, procedural variation systems, tileable and modular components, and automatic LOD creation. The market gains from its broad application across all 3D industries, high demand that generates strong returns on investment for AI, and relative technical simplicity that allows for quick AI success.

The Character and Creature Segment involves complex, high-value assets that are rapidly growing. Character creation is often the most time-consuming and skilled part of 3D production. AAA game characters typically need 150-250 hours and specialized skills in anatomy, clothing, and facial features. AI character generation is progressing quickly, with platforms like Ready Player Me and DeepMotion offering humanoid character creation from photos or descriptions, creature generation with both fantastical and realistic options, automatic rigging and skeletal setups, and facial feature customization.

Applications include generating NPCs (non-player characters) for games, creating and customizing metaverse avatars, producing digital doubles and crowd characters for VFX, and developing virtual influencers and digital humans. Technical challenges being tackled include correct topology for facial animation, realistic clothing and hair simulation, anatomical accuracy, and ensuring ethnic diversity and representation. This segment commands high prices due to its complexity, serves valuable applications like AAA games and VFX, and benefits from rapid AI advancements in human representation.

By AI Model Type

The Text-to-3D Diffusion Models Segment is expected to dominate the market in 2026. These models represent advanced AI technology that applies diffusion breakthroughs (like those used in DALL-E and Midjourney for 2D) to 3D generation. Text-to-3D models create complete 3D assets from natural language descriptions, making it easy for anyone who can describe their needs. Leading platforms include Luma AI's Genie, which generates text-to-3D assets in seconds; Meshy, which supports detailed text prompts for precision; Kaedim, which combines text with image inputs; and NVIDIA's GET3D, which is pushing the cutting edge of research.

The user workflow is straightforward: enter a text description (for example, “futuristic sci-fi helmet with blue glowing details”), optionally define the art style or add reference images, generate within seconds to minutes, and refine with additional text instructions. Benefits include easy access for non-technical users, quick iterations on creative ideas, no need for 3D modeling experience, and an intuitive natural language interface. Current limitations include occasional geometric artifacts that require cleanup, limited precise control compared to manual modeling, and generation times ranging from 30 seconds to 5 minutes per asset.

This segment is experiencing rapid growth as model capabilities improve each month. It aligns naturally with creator workflows and processes and has a low barrier to entry that drives market expansion. As text-to-3D models reach photorealistic quality and gain improved control, they are set to become the preferred method for 3D creation, particularly for indie developers, content creators, and non-specialist users.

The NeRF and Photogrammetry-Based Models Segment delivers photorealistic reconstruction from images. Neural Radiance Fields (NeRFs) represent groundbreaking technology for capturing real-world objects and environments as 3D assets by synthesizing 3D scenes from 2D photos. This method creates photorealistic 3D models from video scans or sets of photos, accurately captures lighting and material properties, allows for the creation of digital twins of real-world objects, and supports virtual production and location scanning.

Leading platforms include Luma AI's smartphone-based NeRF capture, Polycam for scanning objects and spaces, RealityCapture for processing photogrammetry, and NVIDIA Instant NeRF for swift reconstruction. Use cases extend to 3D modeling of products from photographs for e-commerce, architectural scanning for as-built records and renovations, VFX environment capture for virtual production backgrounds, and digital archiving for heritage preservation. Technical advantages include photorealistic quality matched to the source material, accurate material and lighting capture, and digitization of real-world objects. Challenges involve needing multiple input images (20-100+ photos), processing times from minutes to hours, and potential mesh cleanup for game engine use.

By Integration Type

The Plugin and API Integration Segment is expected to capture the largest share in 2026. Professional 3D artists and developers prefer AI generation that integrates smoothly into their existing workflows rather than standalone applications that require import/export. This segment includes Blender add-ons and plugins, integrations for Unity and Unreal Engine marketplaces, plugins for Maya, 3ds Max, and Cinema 4D, and RESTful APIs for programmatic access.

Benefits of integration include removing import/export hassles, keeping familiar software interfaces, enabling hybrid AI-assisted workflows where artists fine-tune AI outputs, and supporting automation and batch processing with APIs. Leading implementations feature one-click generation within 3D software, automatic material assignments and scene setups, version control and iteration management, and customization options that match software capabilities.

This segment serves professional studios and developers, benefits from established ecosystems and marketplaces for 3D software, and enables "AI co-pilot" workflows that combine human creativity with AI efficiency. Market growth is fueled by the preference of professional users for integrated tools, partnerships among 3D software vendors and official integrations, and developers building plugins and extensions. Blender's open-source nature makes it a favored platform for AI plugin development, while Unity and Unreal's asset stores distribute AI generation plugins to millions of game developers.

The Standalone Web Platforms Segment focuses on accessibility and ease of use. Web-based platforms like Masterpiece Studio, Meshy, and Scenario provide browser-based 3D generation with no installation necessary, user-friendly interfaces for non-tech-savvy users, and cloud processing and storage. These platforms cater to indie creators without 3D software skills, allow for quick prototyping and concept visualization, help educators and students learn 3D concepts, and offer simple, accessible tools for small studios.

Features include drag-and-drop interfaces, preset style templates, real-time previews and iterations, and direct exports to game engines. The segment benefits from a low barrier to entry, requiring no expensive software licenses and being accessible from any device. Growth drivers include a widening creator base beyond traditional 3D professionals, freemium business models that attract users, and mobile and tablet support for creation on any device.

By End-User

The Game Developers Segment is expected to see the highest growth during the forecast period. The gaming industry is the largest and fastest-growing market for AI 3D generation, fueled by endless content demands, budget constraints, and a need for rapid iteration. Indie game studios (with 1-20 members) face unique challenges, including limited budgets that demand maximum efficiency, small teams where members take on multiple roles, competition with AAA production values, and quick prototyping for testing game mechanics.

AI 3D generation allows indie developers to create game-ready assets in hours instead of weeks, generate thousands of environmental assets maintaining style consistency, produce character and creature variations for game populations, and deliver professional visuals at just 5-10% of traditional costs. Mobile game developers benefit from optimized asset generation that meets performance requirements, quick content updates for live-service games, and cost efficiency for free-to-play models.

AAA studios utilize AI for rapid prototyping during pre-production, generating placeholder assets for game mechanics testing, creating variations and populations of environmental assets, and speeding up concept and pre-visualization processes. Market growth is driven by a surge in indie game development (thousands of new studios annually), an expanding mobile gaming market that needs optimized 3D content, a live-service game model that demands constant new content, and integration with Unity and Unreal Engine workflows.

The Metaverse and Virtual World Platforms Segment represents an emerging and high-growth opportunity. Metaverse platforms like Roblox, Decentraland, and The Sandbox make 3D creation accessible to millions of users, many of whom lack 3D modeling skills. Requirements for these platforms include user-friendly creation tools that are easy for non-artists to use, scalable content generation that can support millions of user worlds, customization and personalization options for avatars and spaces, and rapid creation that aligns with user creativity.

AI 3D generation supports the scalability of the metaverse by allowing text-based asset creation for any user, generating endless variations for buildings and decorations, creating personalized avatars from photos or descriptions, and filling worlds with diverse environmental assets. Implementation involves platform-integrated AI generation tools, marketplaces for AI-generated assets, API access for third-party applications, and mobile capabilities that enable creation on any device. Growth factors include a metaverse user base exceeding 500 million, platform economics relying on user-generated content, and the familiarity of Gen Z and Gen Alpha with AI creative tools.

Regional Insights

North America is expected to hold the largest share of the global AI 3D asset generation market in 2026. This leadership comes from a concentration of major game development studios, including EA, Activision Blizzard, Epic Games, and countless indie studios. The VFX industry also plays a role, with companies like ILM, Weta, and Digital Domain supporting major Hollywood productions. Additionally, several AI research institutions and startups are pushing the limits of generative AI, along with substantial venture capital investment in AI creative tools.

The United States drives the market growth with millions of game developers using Unity and Unreal Engine. There is also a large base of content creators exploring 3D content and a trend toward early adoption of metaverse platforms and virtual production. Corporate investment in AI research and development is significant. Major AI 3D companies like NVIDIA and Runway ML, along with many startups, are based in North America. The region enjoys cultural acceptance of AI creative tools, strong intellectual property protections for AI-generated content, and established channels for business-to-business sales to studios and companies.

Asia-Pacific is expected to see the highest compound annual growth rate (CAGR) during the forecast period. This rapid growth is driven by the world's largest gaming industry in China, South Korea, and Japan, featuring companies like Tencent, NetEase, and Nintendo. The region has a massive mobile gaming market with billions of players and thousands of developers. Metaverse initiatives from tech giants like ByteDance and Alibaba are also contributing, along with a cost-conscious development culture that emphasizes efficiency in AI.

China leads the Asia-Pacific market, benefiting from a domestic gaming industry that generates over USD 50 billion annually. Mobile-first development demands optimized 3D assets, and there is strong government support for AI development. The indie developer ecosystem is also growing. The region sees the emergence of domestic AI 3D platforms catering to local developers, integration with popular Chinese game engines and tools, and educational programs training developers in AI-supported workflows.

South Korea enhances this growth through its advanced gaming culture and esports infrastructure, leadership in mobile gaming with hits like PUBG Mobile, early adoption of metaverse concepts, and a strong education system that produces skilled developers. Japan's market draws from its console and mobile gaming history, the demand for anime and stylized art in AI generation, VR/AR content development, and a culture of technical innovation.

India offers emerging opportunities with a rapidly growing population of game developers. This cost-sensitive market values AI efficiency and focuses on mobile gaming. Technical education and AI expertise are on the rise here. The Asia-Pacific region's large existing gaming markets, rapid mobile gaming expansion, cost benefits from adopting AI, and cultural openness to AI tools position it for the fastest market growth globally.

Europe also represents a significant market with strong creative industries and technical innovation. The UK leads in adopting these technologies, bolstered by a vibrant game development scene that includes studios like Rocksteady and Creative Assembly. The VFX industry in the UK supports global film production and there are strong AI research institutions along with a startup ecosystem focused on creative AI tools. Germany brings technical expertise in simulation and visualization, applications in automotive and industrial design, a strong gaming development culture, and a privacy-conscious approach to AI that aligns with GDPR.

France benefits from government support for creative industries and gaming, a solid tradition in animation and VFX, a growing startup scene, and a cultural appreciation for digital art and creativity. The Nordic region, including Sweden, Finland, and Denmark, shows high adoption rates for AI. It has a successful indie game development culture, creators of popular games like Minecraft and Angry Birds, a design-focused technical culture, and a tendency to adopt new creative technologies early.

The major players in the AI for 3D asset generation & texturing market include NVIDIA (GET3D) (U.S.), Kaedim (UK), Masterpiece Studio (U.S.), Luma AI (U.S.), Meshy (U.S.), Scenario (France), Leonardo.ai (Australia), Sloyd (Denmark), Ponzu (U.S.), Promethean AI (U.S.), Runway ML (U.S.), Poly (Google) (U.S.), DeepMotion (U.S.), Inworld AI (U.S.), Ready Player Me (Estonia), Polycam (U.S.), 3DFY (U.S.), Spline AI (U.S.), Krikey AI (U.S.), Mirage (U.S.), CommonSim (U.S.), and Kinetix (France), among others.

The AI 3D asset generation market is expected to grow from USD 1.95 billion in 2026 to USD 12.84 billion by 2036.

The AI 3D asset generation market is expected to grow at a CAGR of 20.8% from 2026 to 2036.

Major players include NVIDIA, Kaedim, Masterpiece Studio, Luma AI, Meshy, Scenario, Leonardo.ai, Sloyd, Promethean AI, Runway ML, and emerging platforms from Google, Meta, and specialized startups.

Main factors include explosive gaming industry growth and asset demand, metaverse development requiring scalable content creation, cost reduction in 3D production (60-80% savings), VFX and film production acceleration needs, and text-to-3D AI advancement enabling accessible creation.

North America leads in 2026 due to concentrated game development and VFX industries plus AI innovation leadership, while Asia-Pacific is expected to register highest growth during 2026-2036 driven by massive gaming markets in China, South Korea, and Japan.

Published Date: Aug-2025

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates