Resources

About Us

Smart Electric Panel Market Size, Share & Forecast 2025-2035 | Growth Analysis by Product Offering, Communication Technologies, Application Type, & Geography

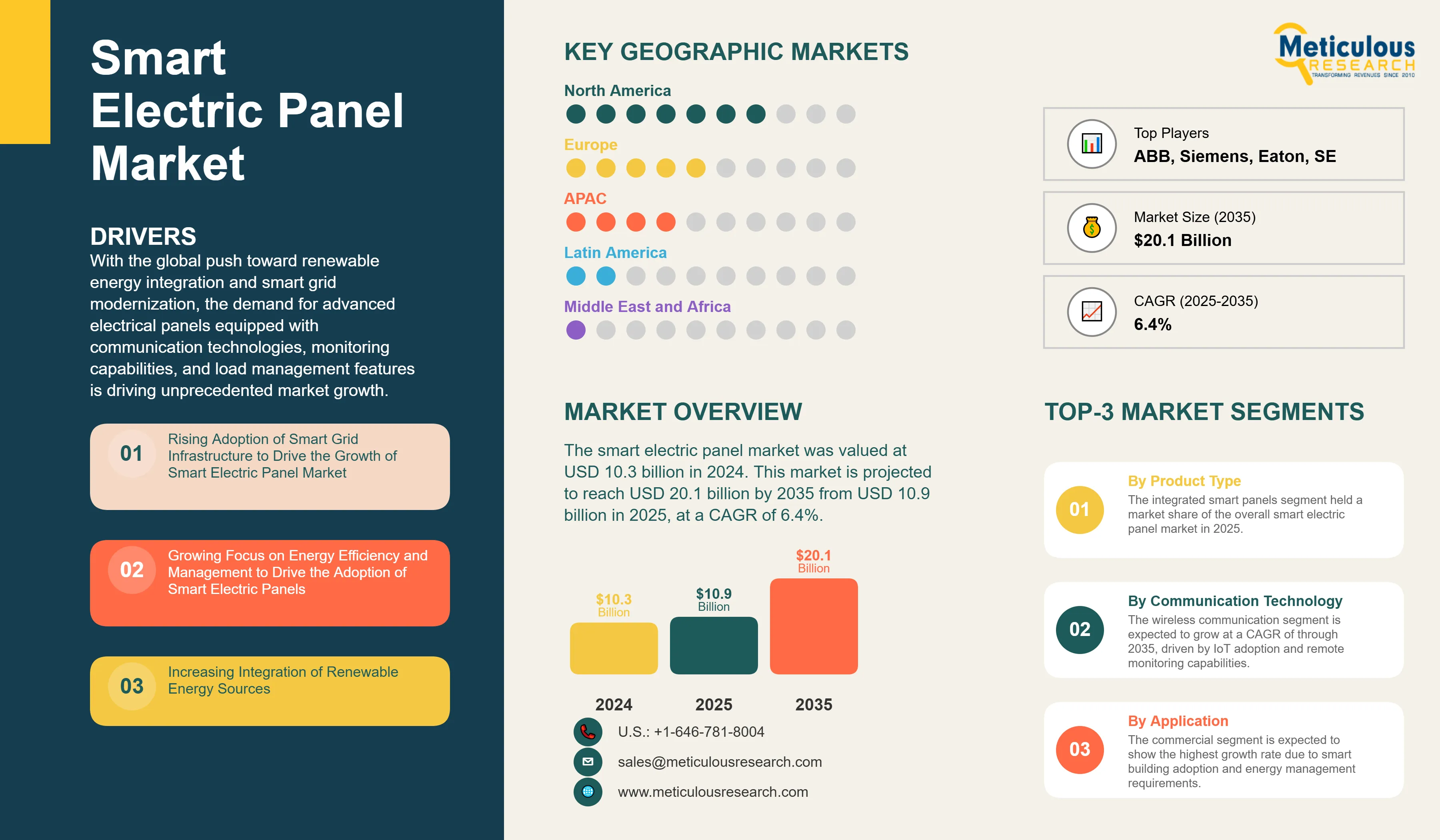

Report ID: MREP - 1041524 Pages: 185 Jul-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe smart electric panel industry continues to expand rapidly as utilities, commercial enterprises, and residential consumers increasingly adopt intelligent electrical infrastructure to enhance energy efficiency and grid reliability. With the global push toward renewable energy integration and smart grid modernization, the demand for advanced electrical panels equipped with communication technologies, monitoring capabilities, and load management features is driving unprecedented market growth.

Government initiatives supporting grid modernization and energy efficiency standards are accelerating the transition from traditional electrical panels to smart alternatives. For instance, the rising adoption of electric vehicles and distributed energy resources requires sophisticated electrical infrastructure capable of managing bidirectional power flows and dynamic load balancing. Smart electric panels serve as critical components in these applications, enabling real-time energy monitoring, automated load management, and seamless integration with renewable energy sources and energy storage systems.

The industry is experiencing significant technological transformation through IoT integration, AI-powered energy management, and cloud-based monitoring platforms. Leading manufacturers are investing heavily in wireless communication technologies, cybersecurity features, and interoperability standards to improve grid resilience, reduce energy costs, and enhance operational efficiency. These technological advances are enabling utilities and end-users to optimize energy consumption while maintaining high safety standards and achieving better return on investment. For instance, the integration of advanced analytics and predictive maintenance capabilities in smart electric panels is helping prevent electrical failures and optimize energy distribution patterns, demonstrating the industry's commitment to technology-driven infrastructure improvements.

Hardware Segment Projected to Showcase the Largest Growth During the Forecast Period

The hardware segment, particularly integrated smart panels and retrofit smart panel solutions, is projected to show significant growth during the forecast period, representing approximately 60-65% of the total smart electric panel market. These hardware solutions include smart circuit breakers, energy monitoring devices, communication modules, and load management systems that enable intelligent electrical distribution and control.

The growth in hardware solutions is attributed to increasing infrastructure modernization projects, with governments and utilities worldwide investing in smart grid technologies. The complexity of electrical systems in modern buildings continues to increase as facilities integrate renewable energy sources, energy storage systems, and electric vehicle charging infrastructure that require sophisticated electrical panel capabilities.

Major smart electric panel manufacturers such as Schneider Electric, ABB, Siemens, and Eaton have significantly expanded their hardware product portfolios. These providers have collectively increased their smart panel production capacity by 20% to meet growing demand across residential, commercial, and industrial applications. The integration of IoT sensors and wireless communication technologies is enabling smart panels to provide comprehensive energy management and monitoring capabilities.

North America Region to Exhibit the Highest Growth During the Forecast Period

The North America region is estimated to grow significantly during the forecast period, mainly driven by government mandates for grid modernization, increasing renewable energy adoption, and growing emphasis on energy efficiency. The United States leads the region with substantial investments in smart grid infrastructure and building automation systems.

The region's growth is supported by federal and state incentives for smart electrical infrastructure adoption. The Infrastructure Investment and Jobs Act allocated significant funding for electrical grid modernization, creating opportunities for smart electric panel deployment across utility, commercial, and residential segments. Canada follows with provincial programs promoting energy efficiency and smart building technologies.

Major smart electric panel deployments and partnerships are accelerating regional growth. For instance, utility companies across North America are implementing advanced metering infrastructure and distribution automation systems that require smart electrical panels for optimal performance. The region's focus on electric vehicle adoption and renewable energy integration further drives demand for intelligent electrical distribution systems.

Smart Electric Panel Market Analysis

The smart electric panel industry faces challenges from high initial installation costs, cybersecurity concerns, and interoperability issues across different communication protocols and platforms. Regulatory compliance requirements under various electrical codes and standards create complexity for manufacturers and installers. The lack of standardization across different regions and the need for skilled technical workforce continue to impact market penetration rates.

Despite these constraints, the market offers substantial growth opportunities through smart city initiatives, industrial automation expansion, and integration with emerging technologies like artificial intelligence and machine learning. The adoption of cloud-based energy management platforms and predictive analytics is helping users optimize energy consumption while reducing operational costs. Government policies supporting renewable energy integration and carbon reduction provide sustainable growth pathways for smart electrical infrastructure.

Based on product type, the smart electric panel market is segmented into integrated smart panels, retrofit smart panels, solar-ready/hybrid panels, battery-integrated panels, and load management panels. The integrated smart panels segment held a market share of the overall smart electric panel market in 2025 and is expected to grow at the highest CAGR due to new construction projects and infrastructure development.

Based on communication technology, the market is segmented into wired and wireless communication technologies. The wireless communication segment is expected to grow at a CAGR of through 2035, driven by IoT adoption and remote monitoring capabilities.

Based on application, the market is segmented into residential, commercial, industrial, and institutional/infrastructure applications. The commercial segment is expected to show the highest growth rate due to smart building adoption and energy management requirements.

Regional Market Analysis

North America leads the smart electric panel market with significant government support for grid modernization and smart city initiatives. The region's regulatory environment favors smart electrical infrastructure deployment, with streamlined approval processes and incentive programs driving manufacturer growth and innovation.

Europe continues to expand its smart electric panel infrastructure to meet renewable energy integration targets and carbon reduction goals. The region's emphasis on energy efficiency standards and smart building certifications creates opportunities for advanced electrical panel solutions serving both new construction and retrofit applications.

Asia-Pacific demonstrates strong growth in smart electric panel adoption, with countries like China, Japan, and India investing heavily in electrical infrastructure modernization. The region's rapid urbanization and industrial development support advanced electrical panel deployment including smart factory and smart city applications.

Latin America focuses on improving electrical grid reliability and integrating renewable energy sources through smart electrical infrastructure. The region's emphasis on energy access and grid stability creates opportunities for comprehensive smart electric panel solutions serving diverse applications.

Smart Electric Panel Market Share

Major players like Schneider Electric SE, ABB Ltd., Siemens AG, Eaton Corporation plc, and GE Vernova Inc. compete strongly in the smart electric panel industry. These companies focus on strategic acquisitions, technology investments, and partnerships with utilities and system integrators to strengthen their market positions and expand product capabilities. As demand grows for intelligent electrical infrastructure across utility, commercial, and residential segments, companies invest heavily in R&D, manufacturing capacity expansion, and cybersecurity enhancement initiatives.

Leading manufacturers are forming strategic partnerships with technology companies, utilities, and building automation providers to create integrated electrical management solutions. These collaborations enable better grid integration, improved energy efficiency, and enhanced safety features under various electrical standards and codes. The market is also witnessing increased investment in smart electrical infrastructure platforms that can scale operations and integrate advanced communication technologies.

Smart Electric Panel Market Companies

Major players operating in the smart electric panel industry include:

Smart Electric Panel Industry News

March 2025: Schneider Electric launched the One Digital Grid Platform, an integrated and AI-powered platform designed to enhance grid resiliency, reliability and efficiency. This launch is expected to accelerate grid modernization and deliver cleaner, more affordable energy while benefitting from lower total cost of ownership.

June 2024: ABB has launched the ReliaHome™ Smart Panel, a residential smart electric panel equipped with PanelGuard technology for advanced energy management. This launch empowering homeowners to take control of their energy use by providing insights needed to save energy and costs.

Smart Electric Panel Industry Segmentation

The smart electric panel market includes hardware components, software platforms, and services for intelligent electrical distribution and energy management in residential, commercial, and industrial applications. The report excludes traditional electrical panels without smart capabilities and focuses exclusively on connected, intelligent electrical infrastructure solutions.

The smart electric panel market is segmented by product type, communication technology, voltage rating, application, end user, and geography. By product type, the market includes integrated smart panels, retrofit smart panels, solar-ready/hybrid panels, battery-integrated panels, and load management panels. By communication technology, the market covers wired and wireless communication technologies. The report provides comprehensive market analysis and forecasts for each segment.

|

Particulars |

Details |

|

Number of Pages |

195 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.4% |

|

Market Size (Value)in 2025 |

USD 10.9 Billion |

|

Market Size (Value) in 2035 |

USD 20.1 Billion |

|

Segments Covered |

By Product Offering

By Communication Technology

By Application

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

Schneider Electric SE, ABB Ltd., Siemens AG, Eaton Corporation plc, GE Vernova Inc. (spun off from General Electric in April 2024), Span.IO Inc., Leviton Manufacturing Co., Inc., Mitsubishi Electric Corporation, Legrand SA, Rockwell Automation, Inc., Honeywell International Inc., Emerson Electric Co., Hubbell Incorporated, Larsen & Toubro Ltd., Omron Corporation, Johnson Controls International plc, TGOOD Global Ltd., Delta Electronics, Inc., CHINT Group Corporation, and Atom Power Inc. |

The Smart Electric Panel Market size is expected to reach USD 10.9 billion in 2025 and grow at a CAGR of 6.4% to reach USD 20.1 billion by 2035.

In 2025, the Smart Electric Panel Market size is expected to reach USD 10.9 billion.

Schneider Electric SE, ABB Ltd., Siemens AG, Eaton Corporation plc, and GE Vernova Inc. are the major companies operating in the Smart Electric Panel Market.

The North America region is estimated to grow at the highest CAGR over the forecast period (2025-2035).

In 2025, integrated smart panels account for the largest market share in the Smart Electric Panel Market.

What years does this Smart Electric Panel Market report cover, and what was the market size in 2024?

In 2024, the Smart Electric Panel Market size was estimated at USD 10.3 billion. The report covers historical market size data and forecasts through 2035.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Smart Electric Panel Market, by Product Type

3.2.2. Smart Electric Panel Market, by Communication Technology

3.2.3. Smart Electric Panel Market, by Application

3.2.4. Smart Electric Panel Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising Adoption of Smart Grid Infrastructure

4.2.1.2. Growing Focus on Energy Efficiency and Management

4.2.1.3. Increasing Integration of Renewable Energy Sources

4.2.1.4. Government Initiatives for Grid Modernization

4.2.1.5. Rising Demand for Real-time Energy Monitoring

4.2.2. Restraints

4.2.2.1. High Initial Installation and Setup Costs

4.2.2.2. Cybersecurity Concerns and Data Privacy Issues

4.2.2.3. Lack of Technical Expertise and Skilled Workforce

4.2.2.4. Regulatory and Compliance Complexities

4.2.3. Opportunities

4.2.3.1. Expansion in Emerging Markets

4.2.3.2. Integration with IoT and AI Technologies

4.2.3.3. Growing Electric Vehicle Charging Infrastructure

4.2.3.4. Increasing Home Automation and Smart Building Adoption

4.2.4. Trends

4.2.4.1. Cloud-based Energy Management Platforms

4.2.4.2. Wireless Communication and Remote Monitoring

4.2.4.3. Integration with Energy Storage Systems

4.2.4.4. Advanced Analytics and Predictive Maintenance

4.2.5. Challenges

4.2.5.1. Interoperability Issues Across Different Platforms

4.2.5.2. Standardization Across Different Regions

4.2.5.3. Retrofitting in Existing Infrastructure

4.3. Porter’s Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Sustainability Impact on Smart Electric Panel Market

4.4.1. Environmental Sustainability Factors

4.4.1.1. Energy Efficient Smart Panel Technologies

4.4.1.2. Reduced Carbon Footprint through Optimal Energy Management

4.4.2. Market Response to Sustainability Demands

4.4.2.1. Green Building Certifications and Standards

4.4.2.2. Manufacturer-led Sustainable Design Initiatives

4.4.3. Market Opportunities Created by Sustainability Focus

4.4.3.1. Eco-friendly Manufacturing Processes

4.4.3.2. Challenges in Sustainable Material Sourcing

5. Smart Electric Panel Market Assessment—By Product Offering

5.1. Overview

5.2. Hardware

5.2.1. Integrated Smart Panels

5.2.2. Retrofit Smart Panel

5.2.3. Solar-Ready/Hybrid Panels

5.2.4. Battery-Integrated Panels

5.2.5. Load Management Panels

5.3. Software and Digital Solutions

5.4. Services

6. Smart Electric Panel Market Assessment—By Communication Technology

6.1. Overview

6.2. Wired Communication Technologies

6.3. Wireless Communication Technologies

7. Smart Electric Panel Market Assessment—By Application

7.1. Overview

7.2. Residential

7.3. Commercial

7.4. Industrial

7.5. Institutional and Infrastructure

8. Smart Electric Panel Market Assessment —By Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. Germany

8.3.2. France

8.3.3. U.K.

8.3.4. Italy

8.3.5. Spain

8.3.6. Netherlands

8.3.7. Rest of Europe (RoE)

8.4. Asia-Pacific

8.4.1. China

8.4.2. Japan

8.4.3. India

8.4.4. South Korea

8.4.5. Australia

8.4.6. Rest of Asia-Pacific (RoAPAC)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

8.6.1. Saudi Arabia

8.6.2. United Arab Emirates (UAE)

8.6.3. Rest of Middle East & Africa (RoMEA)

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Contemporary Stalwarts

9.5. Market Share/Ranking Analysis, by the Key Players, 2024

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

10.1. Schneider Electric SE

10.2. ABB Ltd.

10.3. Siemens AG

10.4. Eaton Corporation plc

10.5. GE Vernova Inc. (Spun off from General Electric in April 2024)

10.6. Span.IO Inc.

10.7. Leviton Manufacturing Co., Inc.

10.8. Mitsubishi Electric Corporation

10.9. Legrand SA

10.10. Rockwell Automation, Inc.

10.11. Honeywell International Inc.

10.12. Emerson Electric Co.

10.13. Hubbell Incorporated

10.14. Larsen & Toubro Ltd.

10.15. Omron Corporation

10.16. Johnson Controls International plc

10.17. TGOOD Global Ltd.

10.18. Delta Electronics, Inc.

10.19. CHINT Group Corporation

10.20. Atom Power Inc.

11. Appendix

11.1. Available Customization

11.2. Related Reports

LIST OF TABLES

Table 1. LIST OF TABLES

Table 2. Global Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 3. Global Hardware Market, by Type, 2025–2035 (USD Million)

Table 4. Global Integrated Smart Panels Market, by Country/Region, 2025–2035 (USD Million)

Table 5. Global Retrofit Smart Panel Market, by Country/Region, 2025–2035 (USD Million)

Table 6. Global Solar-Ready/Hybrid Panels Market, by Country/Region, 2025–2035 (USD Million)

Table 7. Global Battery-Integrated Panels Market, by Country/Region, 2025–2035 (USD Million)

Table 8. Global Load Management Panels Market, by Country/Region, 2025–2035 (USD Million)

Table 9. Global Software and Digital Solutions Market, by Country/Region, 2025–2035 (USD Million)

Table 10. Global Services Market, by Country/Region, 2025–2035 (USD Million)

Table 11. Global Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 12. Global Wired Communication Technologies Market, by Country/Region, 2025–2035 (USD Million)

Table 13. Global Wireless Communication Technologies Market, by Country/Region, 2025–2035 (USD Million)

Table 14. Global Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 15. Global Smart Electric Panel Market for Residential, by Country/Region, 2025–2035 (USD Million)

Table 16. Global Smart Electric Panel Market for Commercial, by Country/Region, 2025–2035 (USD Million)

Table 17. Global Smart Electric Panel Market for Industrial, by Country/Region, 2025–2035 (USD Million)

Table 18. Global Smart Electric Panel Market for Institutional and Infrastructure, by Country/Region, 2025–2035 (USD Million)

Table 19. North America: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 20. North America: Hardware Market, by Type, 2025–2035 (USD Million)

Table 21. North America: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 22. North America: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 23. U.S.: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 24. U.S.: Hardware Market, by Type, 2025–2035 (USD Million)

Table 25. U.S.: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 26. U.S.: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 27. Canada: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 28. Canada: Hardware Market, by Type, 2025–2035 (USD Million)

Table 29. Canada: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 30. Canada: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 31. Europe: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 32. Europe: Hardware Market, by Type, 2025–2035 (USD Million)

Table 33. Europe: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 34. Europe: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 35. Germany: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 36. Germany: Hardware Market, by Type, 2025–2035 (USD Million)

Table 37. Germany: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 38. Germany: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 39. France: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 40. France: Hardware Market, by Type, 2025–2035 (USD Million)

Table 41. France: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 42. France: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 43. U.K.: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 44. U.K.: Hardware Market, by Type, 2025–2035 (USD Million)

Table 45. U.K.: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 46. U.K.: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 47. Italy: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 48. Italy: Hardware Market, by Type, 2025–2035 (USD Million)

Table 49. Italy: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 50. Italy: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 51. Spain: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 52. Spain: Hardware Market, by Type, 2025–2035 (USD Million)

Table 53. Spain: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 54. Spain: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 55. Netherlands: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 56. Netherlands: Hardware Market, by Type, 2025–2035 (USD Million)

Table 57. Netherlands: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 58. Netherlands: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 59. Rest of Europe: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 60. Rest of Europe: Hardware Market, by Type, 2025–2035 (USD Million)

Table 61. Rest of Europe: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 62. Rest of Europe: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 63. Asia-Pacific: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 64. Asia-Pacific: Hardware Market, by Type, 2025–2035 (USD Million)

Table 65. Asia-Pacific: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 66. Asia-Pacific: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 67. China: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 68. China: Hardware Market, by Type, 2025–2035 (USD Million)

Table 69. China: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 70. China: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 71. Japan: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 72. Japan: Hardware Market, by Type, 2025–2035 (USD Million)

Table 73. Japan: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 74. Japan: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 75. India: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 76. India: Hardware Market, by Type, 2025–2035 (USD Million)

Table 77. India: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 78. India: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 79. South Korea: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 80. South Korea: Hardware Market, by Type, 2025–2035 (USD Million)

Table 81. South Korea: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 82. South Korea: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 83. Australia: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 84. Australia: Hardware Market, by Type, 2025–2035 (USD Million)

Table 85. Australia: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 86. Australia: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 87. Rest of Asia-Pacific: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 88. Rest of Asia-Pacific: Hardware Market, by Type, 2025–2035 (USD Million)

Table 89. Rest of Asia-Pacific: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 90. Million)

Table 91. Rest of Asia-Pacific: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 92. Latin America: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 93. Latin America: Hardware Market, by Type, 2025–2035 (USD Million)

Table 94. Latin America: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 95. Latin America: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 96. Brazil: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 97. Brazil: Hardware Market, by Type, 2025–2035 (USD Million)

Table 98. Brazil: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 99. Brazil: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 100. Mexico: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 101. Mexico: Hardware Market, by Type, 2025–2035 (USD Million)

Table 102. Mexico: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 103. Mexico: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 104. Rest of Latin America: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 105. Rest of Latin America: Hardware Market, by Type, 2025–2035 (USD Million)

Table 106. Rest of Latin America: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 107. Rest of Latin America: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 108. Middle East & Africa: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 109. Middle East & Africa: Hardware Market, by Type, 2025–2035 (USD Million)

Table 110. Middle East & Africa: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 111. Middle East & Africa: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 112. Saudi Arabia: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 113. Saudi Arabia: Hardware Market, by Type, 2025–2035 (USD Million)

Table 114. Saudi Arabia: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 115. Saudi Arabia: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 116. United Arab Emirates: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 117. United Arab Emirates: Hardware Market, by Type, 2025–2035 (USD Million)

Table 118. United Arab Emirates: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 119. United Arab Emirates: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

Table 120. Rest of Middle East & Africa: Smart Electric Panel Market, by Product Type, 2025–2035 (USD Million)

Table 121. Rest of Middle East & Africa: Hardware Market, by Type, 2025–2035 (USD Million)

Table 122. Rest of Middle East & Africa: Smart Electric Panel Market, by Communication Technology, 2025–2035 (USD Million)

Table 123. Rest of Middle East & Africa: Smart Electric Panel Market, by Application, 2025–2035 (USD Million)

LIST OF FIGURES

Figure 1. Research Process

Figure 2. Secondary Components Referenced for This Study

Figure 3. Primary Research Techniques

Figure 4. Key Executives Interviewed

Figure 5. Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6. Market Sizing and Growth Forecast Approach

Figure 7. In 2025, the Hardware segment to Account for the Largest Share

Figure 8. In 2025, the Wireless Communication Technologies to Account for the Largest Share

Figure 9. In 2025, the Smart Electric Panel Market for Residential sector to Account for the Largest Share

Figure 10. Asia-Pacific to be the Fastest-growing Regional Market

Figure 11. Impact Analysis of Market Dynamics

Figure 12. Global Smart Electric Panel Market: Porter's Five Forces Analysis

Figure 13. Global Smart Electric Panel Market, by Product Type, 2025 Vs. 2035 (USD Million)

Figure 14. Global Smart Electric Panel Market, by Communication Technology, 2025 Vs. 2035 (USD Million)

Figure 15. Global Smart Electric Panel Market, by Application, 2025 Vs. 2035 (USD Million)

Figure 16. Global Smart Electric Panel Market, by Region, 2025 Vs. 2035 (USD Million)

Figure 17. North America: Smart Electric Panel Market Snapshot (2025)

Figure 18. Europe: Smart Electric Panel Market Snapshot (2025)

Figure 19. Asia-Pacific: Smart Electric Panel Market Snapshot (2025)

Figure 20. Latin America: Smart Electric Panel Market Snapshot (2025)

Figure 21. Middle East & Africa: Smart Electric Panel Market Snapshot (2025)

Figure 22. Key Growth Strategies Adopted by Leading Players (2022–2025)

Figure 23. Global Smart Electric Panel Market Competitive Benchmarking, by Product Type

Figure 24. Competitive Dashboard: Global Smart Electric Panel Market

Figure 25. Global Smart Electric Panel Market Share/Ranking, by Key Player, 2024 (%)

Figure 26. Schneider Electric SE: Financial Overview (2024)

Figure 27. ABB Ltd.: Financial Overview (2024)

Figure 28. Siemens AG: Financial Overview (2024)

Figure 29. Eaton Corporation plc: Financial Overview (2024)

Figure 30. GE Vernova Inc.: Financial Overview (2024)

Published Date: Jan-2026

Published Date: Jun-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates