What is the Sleep Software Market Size?

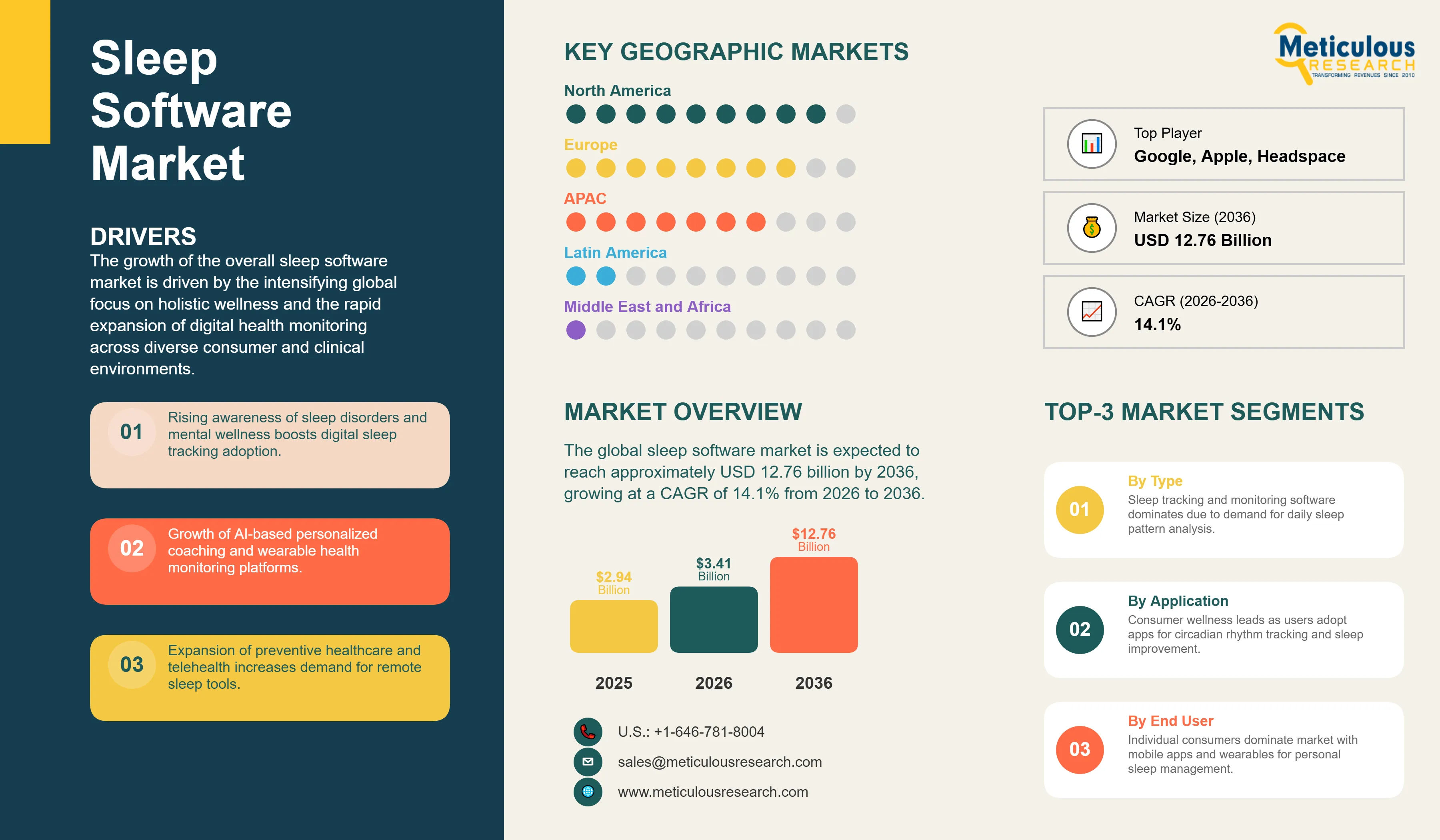

The global sleep software market was valued at USD 2.94 billion in 2025. The market is expected to reach approximately USD 12.76 billion by 2036 from USD 3.41 billion in 2026, growing at a CAGR of 14.1% from 2026 to 2036. The growth of the overall sleep software market is driven by the intensifying global focus on holistic wellness and the rapid expansion of digital health monitoring across diverse consumer and clinical environments. As enterprises seek to integrate more intelligence into their health management frameworks and address the increasing demand for personalized sleep optimization and real-time circadian rhythm tracking, advanced sleep software platforms have become essential for maintaining behavioral consistency and therapeutic performance. The rapid expansion of AI-driven sleep coaching and the increasing need for high-performance biometric analysis and intervention continue to fuel significant growth of this market across all major geographic regions.

Market Highlights: Global Sleep Software Market

- In terms of revenue, the global sleep software market is projected to reach USD 12.76 billion by 2036.

- The market is expected to grow at a CAGR of 14.1% from 2026 to 2036.

- North America dominates the global sleep software market with the largest market share in 2026, driven by high prevalence of sleep disorders and the presence of leading digital health innovators and wellness technology companies.

- Asia-Pacific is expected to witness the fastest growth during the forecast period, supported by increasing smartphone penetration and the rapid adoption of health and wellness applications in China, India, and Southeast Asia.

- By deployment, the mobile apps segment holds the largest market share in 2026, particularly in supporting consumer-driven sleep tracking and personalized sleep coaching.

- By application, the consumer wellness segment holds the largest market share in 2026, due to its proven efficacy in handling daily sleep optimization and providing scalable, user-friendly sleep improvement tools.

- By end-user, the individual consumers segment holds the largest share of the overall market in 2026.

Market Overview and Insights

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Sleep software systems represent critical digital frameworks used to provide automated sleep pattern analysis and behavioral intervention while allowing for real-time progress tracking and optimization. These systems include mobile sleep trackers for consumers, clinical sleep management platforms for healthcare providers, and AI-powered sleep coaches for personalized interventions, which are designed to operate in diverse user environments. The market is defined by high-precision modules such as machine learning-driven sleep stage detection and biometric correlation algorithms, which significantly enhance sleep quality insights and therapeutic agility in complex health management applications. These systems are indispensable for healthcare professionals and wellness-focused individuals seeking to optimize their sleep protocols and achieve breakthrough health outcomes.

The market includes a diverse range of solutions, ranging from simple sleep diary applications for basic tracking to complex multilayer systems for high-performance sleep disorder management and professional clinical services. These systems are increasingly integrated with advanced components such as wearable device connectivity and AI-powered personalization to provide services such as customized sleep schedules and improved diagnostic accuracy. The ability to provide stable, high-precision insights while minimizing user effort has made advanced sleep software technology the choice for markets where user engagement and clinical outcomes are paramount.

The global wellness sector is pushing hard to modernize health monitoring capabilities, aiming to meet AI-driven personalization and hyper-connected lifestyle targets. This drive has increased the adoption of high-density sleep analytics platforms, with advanced behavioral science techniques helping to stabilize health outcomes for complex circadian architectures. At the same time, the rapid growth in the preventive healthcare and corporate wellness markets is increasing the need for high-reliability, evidence-based sleep improvement solutions.

What are the Key Trends in the Sleep Software Market?

Proliferation of AI-driven Personalized Sleep Coaching

Developers across the sleep software industry are rapidly shifting to data-optimized architectures, moving well beyond traditional passive sleep tracking toward high-intelligence, personalized coaching systems. Calm's latest AI-powered sleep stories deliver significantly higher engagement rates, while Headspace's recent updates have slashed time-to-sleep metrics in clinical studies. The real game-changer comes with "adaptive" sleep programs featuring integrated behavioral science that maintain peak effectiveness even in varying user lifestyle environments. These advancements make personalized sleep optimization practical and cost-effective for everyone from individual wellness enthusiasts to global corporate wellness programs chasing employee health excellence and lower healthcare costs.

Innovation in Wearable Integration and Biometric Analysis

Innovation in wearable device connectivity is rapidly driving the sleep software market, as these integrations become more seamless and multi-functional. Developers are now designing platforms that combine the convenience of smartphone interfaces with the precision of clinical-grade sensors in a single ecosystem, saving valuable health monitoring time and simplifying user engagement. These systems often involve advanced heart rate variability analysis and SpO2 monitoring capable of detecting ultra-fine physiological patterns without compromising data privacy or system reliability.

At the same time, growing focus on preventive healthcare is pushing developers to create solutions tailored to early detection of sleep disorders and holistic wellness integration. These systems help reduce healthcare costs through proactive sleep intervention and the use of validated behavioral therapy protocols. By combining high-density biometric data with robust therapeutic frameworks, these new designs support both technological advancement and patient-centric care, strengthening the resilience of the broader digital health value chain.

Market Summary:

|

Parameter

|

Details

|

|

Market Size by 2036

|

USD 12.76 Billion

|

|

Market Size in 2026

|

USD 3.41 Billion

|

|

Market Size in 2025

|

USD 2.94 Billion

|

|

Market Growth Rate (2026-2036)

|

CAGR of 14.1%

|

|

Dominating Region

|

North America

|

|

Fastest Growing Region

|

Asia-Pacific

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2036

|

|

Segments Covered

|

Deployment, Type, Technology, Application, End-User, and Region

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

Market Dynamics

Drivers: Rising Sleep Disorders and Mental Health Awareness

A key driver of the sleep software market is the rapid movement of the global wellness industry toward data-backed, highly personalized digital health solutions. Global demand for accessible sleep improvement tools, effective stress management, and mental wellness support has created significant incentives for the adoption of sleep software products. The trend toward "quantified self" movements and the integration of sleep hygiene into daily wellness routines drive organizations toward scalable solutions that sleep software technology can uniquely provide. It is estimated that as consumer adoption of health monitoring rises and therapeutic tools become more accessible through 2036, the need for robust, evidence-based sleep platforms increases significantly; therefore, AI modules and cloud-based behavioral therapy, with their ability to ensure high-quality intervention delivery, are considered a crucial enabler of modern preventive healthcare strategies.

Opportunity: Corporate Wellness Programs and Telehealth Integration

The rapid growth of the corporate wellness market and telehealth platforms provides great opportunities for the sleep software market. Indeed, the global surge in employer-sponsored wellness initiatives has created a compelling demand for systems that can improve employee productivity and integrate seamlessly into existing healthcare benefits. These applications require high reliability, data privacy compliance, and the ability to handle high-volume user environments, all attributes that are met with advanced sleep software solutions. The preventive healthcare market is set to expand significantly through 2036, with sleep software products poised for an expanding share as employers seek to maximize workforce health and minimize absenteeism costs. Furthermore, the increasing demand for remote patient monitoring and digital therapeutics is stimulating demand for clinical-grade sleep platforms that provide evidence-based outcomes and integration flexibility.

Deployment Insights

Why Do Mobile Apps Lead the Market?

The mobile apps segment accounts for a significant portion of the overall sleep software market in 2026. This is mainly attributed to the ubiquitous use of smartphones and the convenience of accessing sleep tools within personal device ecosystems. Mobile applications offer the most comprehensive way to ensure consistent user engagement across diverse demographics and usage scenarios. The consumer wellness and personal health sectors alone consume a large share of mobile sleep app downloads, with major platforms in North America and Europe demonstrating the technology's capability to handle millions of concurrent users. However, the wearable device integration segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for continuous biometric monitoring in clinical sleep management and professional athlete performance optimization.

Application Insights

How Does the Consumer Wellness Segment Dominate?

Based on application, the consumer wellness segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of self-directed health optimization efforts and the growing awareness of sleep's impact on overall wellbeing. Current wellness-focused consumers are increasingly adopting comprehensive sleep management platforms to ensure optimal circadian rhythm alignment and personal health standards. The clinical sleep management segment is expected to witness steady growth during the forecast period. The shift toward telemedicine integration and the complexity of diagnosed sleep disorder treatment are pushing the requirement for advanced clinical platforms that can handle diverse patient populations and treatment protocols while ensuring absolute reliability for healthcare-critical sleep interventions.

Technology Insights

How Are AI-powered Analytics Reshaping the Market?

AI-powered analytics technology holds the largest share of the global sleep software market in 2026, driven by its proven efficacy in detecting complex sleep patterns and predicting sleep quality outcomes. This technology enables personalized recommendations and adaptive coaching strategies, making it the preferred choice for both consumer apps and clinical platforms. Leading developers continue to refine machine learning algorithms to achieve unprecedented accuracy in sleep stage detection and intervention timing. Cognitive behavioral therapy for insomnia (CBT-I) technologies are experiencing the fastest growth during the forecast period, driven by clinical validation studies and healthcare provider adoption. These evidence-based digital therapeutics offer structured treatment protocols delivered through automated systems, providing cost-effective alternatives to traditional in-person therapy. Sound therapy and ambient noise technologies represent established segments, valued for their simplicity and immediate sleep onset benefits.

Type Insights

How Does Sleep Tracking & Monitoring Dominate?

The sleep tracking & monitoring segment commands the largest share of the global sleep software market in 2026. This dominance stems from fundamental consumer desire to understand sleep patterns, measure sleep quality metrics, and identify improvement opportunities. Large-scale consumer adoption in lifestyle optimization and health monitoring drives demand, with advanced platforms from providers like Apple Health, Google Fit, and Fitbit enabling reliable performance across diverse user demographics. However, the sleep improvement programs segment is poised for accelerated growth through 2036, fueled by expanding recognition of sleep's role in chronic disease prevention and mental health management. Developers face increasing pressure to deliver measurable outcomes through structured intervention programs that combine behavioral science, personalized coaching, and progress tracking in comprehensive wellness solutions.

End-User Insights

Why Do Individual Consumers Lead the Market?

The individual consumers segment commands the largest share of the global sleep software market in 2026. This dominance stems from direct consumer purchasing decisions, subscription model economics, and the personal nature of sleep improvement journeys. Large-scale adoption in wellness-oriented demographics drives demand, with platforms offering freemium models and premium subscriptions enabling widespread accessibility. However, the healthcare providers segment is poised for steady growth through 2036, fueled by expanding applications in sleep clinic operations and telehealth consultations. Clinical adoption faces mounting pressure to integrate sleep software into electronic health records and treatment workflows, where standardized clinical modules provide evidence-based therapeutic tools complementing traditional sleep medicine practices.

Regional Insights

How is North America Maintaining Dominance in the Global Sleep Software Market?

North America holds the largest share of the global sleep software market in 2026. The largest share of this region is primarily attributed to high awareness of sleep disorders and the presence of leading digital health companies, particularly in the United States. The US alone accounts for a significant portion of global sleep software revenue, with its position as a leader in health technology innovation driving sustained growth. The presence of major platforms like Calm, Headspace, and Sleep Cycle, alongside a well-developed app ecosystem, provides a robust market for both consumer and clinical sleep solutions.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific and Europe together account for a substantial share of the global sleep software market. The growth of these markets is mainly driven by increasing smartphone adoption and rising health consciousness in urban populations. The demand for advanced sleep software in Asia-Pacific is mainly due to large-scale digital health initiatives and rapidly growing middle-class populations in China, India, and Southeast Asian countries. In Europe, leadership in digital therapeutics regulation and strong emphasis on preventive healthcare are driving adoption of clinically-validated sleep solutions. Countries like Germany, the UK, and the Netherlands are at the forefront, with significant focus on integrating evidence-based sleep interventions into national health systems and corporate wellness programs to ensure the highest levels of healthcare outcomes and cost efficiency.

Key Players

The companies such as Calm.com, Inc. (US), Headspace Inc. (US), Sleep Cycle AB (Sweden), and Nox Medical (Iceland) lead the global sleep software market with a comprehensive range of consumer wellness and clinical monitoring solutions, particularly for mobile-first and subscription-based applications. Meanwhile, players including Fitbit (Google LLC), Apple Inc., Garmin Ltd., and Withings focus on wearable-integrated sleep tracking and health ecosystem platforms targeting the hardware-software integration segment. Emerging developers and integrated players such as Sleepio (Big Health Ltd.), SleepScore Labs, Dreem (Beacon Biosignals), and Somnoware are strengthening the market through innovations in CBT-I digital therapeutics and clinical-grade sleep analysis platforms.

Key Questions Answered