Resources

About Us

RISC-V Microcontroller & Microprocessor Market by Product Type (MCU, MPU, SoC), Core Type (32-Bit, 64-Bit), Application (Consumer Electronics, Automotive, Industrial IoT, Data Centers, Aerospace) — Global Forecast to 2035

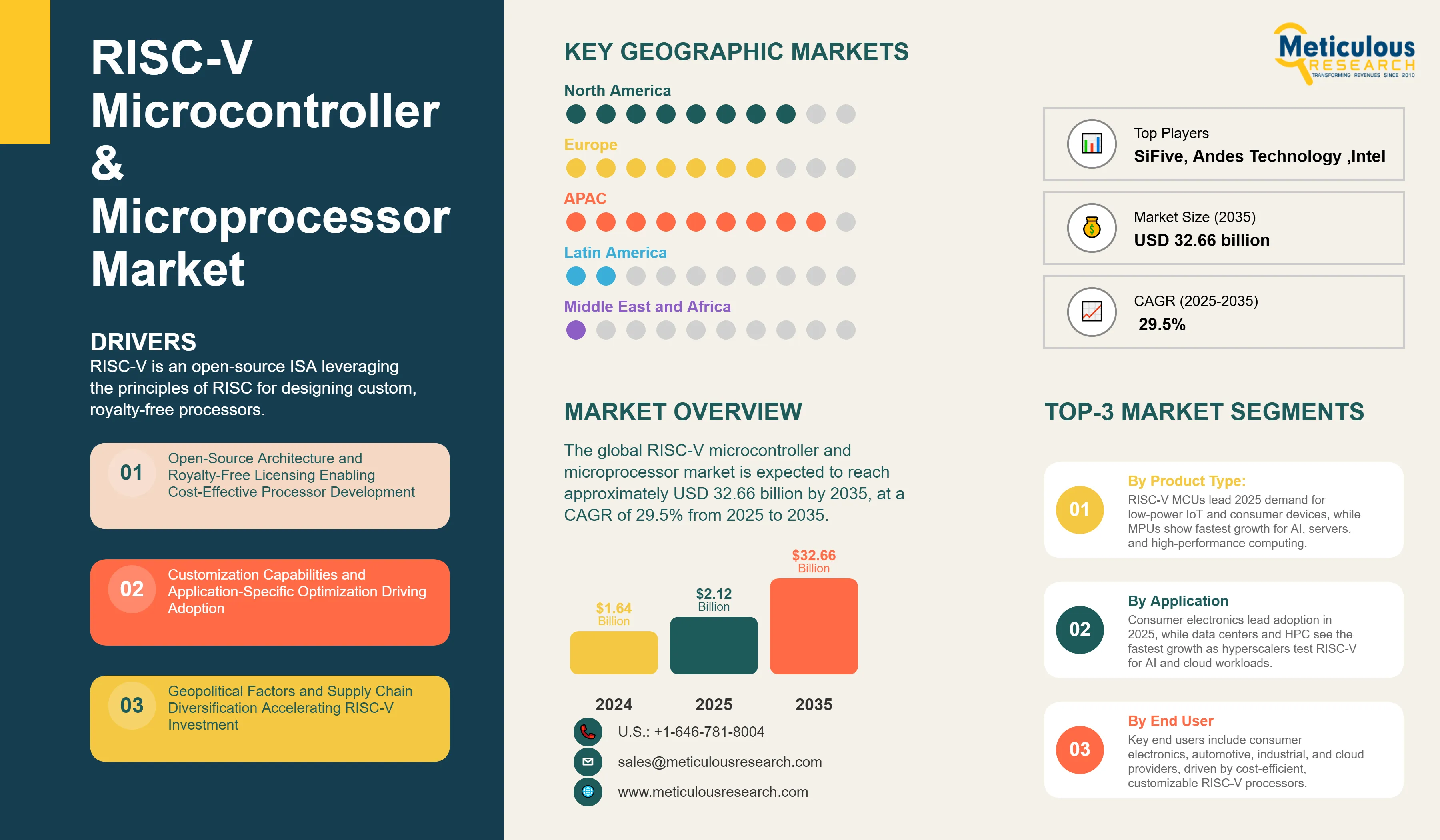

Report ID: MRSE - 1041631 Pages: 205 Dec-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global RISC-V microcontroller and microprocessor market is expected to reach approximately USD 32.66 billion by 2035 from USD 2.12 billion in 2025, at a CAGR of 29.5% from 2025 to 2035.

RISC-V is an open-source ISA leveraging the principles of RISC for designing custom, royalty-free processors. As opposed to proprietary architectures like ARM and x86, RISC-V specifications are made available under permissive open-source licenses, allowing developers and semiconductor companies to design, customize, and build processors without having to pay licensing fees or royalties. This open architecture has drawn significant interest from major technology companies, startups, academic institutions, and government-backed initiatives looking to lessen dependence upon proprietary chip technologies.

Key Market Highlights:

Click here to: Get Free Sample Pages of this Report

RISC-V represents a fundamental shift in the semiconductor industry, offering an open-source alternative to proprietary processor architectures that have dominated the market for decades. Developed in 2010 at the University of California, Berkeley, RISC-V has evolved from an academic project into a commercially viable architecture supported by RISC-V International, a global non-profit organization.

RISC-V provides a base ISA that can be extended with standard or custom extensions, enabling developers to create processors optimized for specific applications independent of the licensing constraints associated with proprietary architectures. This flexibility has attracted interest across diverse sectors that range from ultra-low-power IoT devices to high-performance data center processors and AI accelerators.

Several factors, such as increasing semiconductor costs, supply chain fragilities, geopolitical tension affecting chip access, and emerging demand for application-specific processors, have acted in concert to drive the marketplace momentum. Major technology companies including Alibaba, Google, NVIDIA, Qualcomm, and Intel have invested in RISC-V development, while startups like SiFive, Codasip, and Andes Technology have emerged as leading providers of commercial RISC-V IP cores.

Key Trends Shaping the Market:

The RISC-V market is witnessing significant growth driven by the conjunction of open-source hardware philosophy and rising demand for bespoke, affordable processor solutions. The adoption rate has accelerated over the last few years for the architecture in embedded systems, IoT devices, and consumer electronics, while its reach is increasing in automotive, industrial, and data center applications.

Artificial intelligence and machine learning capabilities represent one of the key growth vectors. RISC-V's support for vector extensions and custom accelerators makes it well-suited for edge AI and neural network inference applications. Companies are developing AI-enabled RISC-V processors that perform real-time inference tasks locally, supporting such applications as smart devices, predictive maintenance, autonomous systems, and computer vision without the need for cloud connectivity.

Geopolitical factors have played an important role in RISC-V's adoption, particularly in China, where firms are accelerating the move towards RISC-V architectures to reduce dependencies on proprietary ISAs with export controls. Similarly, the European Union has invested deeply in RISC-V-based chip development through programs such as DARE, eProcessor, and EuroHPC in its endeavor to increase digital sovereignty and supply chain resilience.

This is particularly true in automotive, one of the fastest‑growing adoption areas. In March 2025, Infineon Technologies announced its first automotive microcontroller family based on RISC‑V, as an expansion of its AURIX brand and a key step toward open‑standard automotive computing. RISC‑V–based designs can meet functional safety and real‑time requirements, making the architecture suitable for applications ranging from ADAS and electronic power steering to zonal architectures in next‑generation vehicles.

Market Scope:

|

Parameter |

Details |

|---|---|

|

Market Size Value in 2025 |

USD 2.12 Billion |

|

Revenue Forecast in 2035 |

USD 32.66 Billion |

|

Growth Rate (CAGR) |

29.5% from 2025 to 2035 |

|

Base Year for Estimation |

2024 |

|

Historical Data |

2023–2024 |

|

Forecast Period |

2025–2035 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2035 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product Type, Core Type, Application, End User, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Germany, U.K., France, Italy, Netherlands, China, Japan, South Korea, Taiwan, India, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

|

Key Companies Profiled |

SiFive Inc., Andes Technology Corporation, Codasip S.R.O., StarFive Technology Co. Ltd., Infineon Technologies AG, GigaDevice Semiconductor Inc., Microchip Technology Inc., Espressif Systems (Shanghai) Co. Ltd., Nuclei System Technology Co. Ltd., Ventana Micro Systems Inc., Imagination Technologies, GreenWaves Technologies, Bluespec Inc., Syntacore, Alibaba Group (T-Head Semiconductor), Western Digital Corporation, Renesas Electronics Corporation, NXP Semiconductors N.V., Qualcomm Incorporated, Intel Corporation |

Market Dynamics:

Driver: Open-source Architecture with Royalty-free Licensing

The open-source nature of RISC-V, combined with its no-royalties licensing model, acts as the principal driver for its adoption. While proprietary architectures like ARM charge hefty licensing fees and royalties per chip manufactured, the RISC-V architecture will enable semiconductor companies and system developers to build custom processors without ongoing royalties and fees. This cost advantage will be particularly welcome in the high-volume applications of IoT, consumer electronics, and industrial automation, where licensing fees could take a serious bite out of product margins. The open specification also allows public auditing of architectural designs, improving security and transparency.

Driver: Customization and Application-Specific Optimization

RISC-V's modular architecture allows developers to build application-optimized processors with a choice of standard or custom extensions. That capability provides the leeway for domain-specific chips with instruction sets that can be better tailored to AI/ML workloads, signal processing, cryptographic operations, or real-time control applications. The option to customize processor cores unhindered by restrictions imposed by proprietary architectures has driven significant corporate interest in differentiated silicon solutions.

Driver: Geopolitical Factors and Supply Chain Diversification

There has been recent acceleration in the adoption of RISC-V, driven by geopolitical tensions and trade restrictions in particular, as companies in China seek out alternatives to ARM and x86 architectures subject to export controls. Government-backed initiatives in China, India, and the European Union position RISC-V as a strategic technology for achieving semiconductor independence and supply chain resilience. These national programs are driving substantial investment in RISC-V research, development, and manufacturing capabilities.

Opportunity: Expansion in Automotive Electronics

The automotive industry offers high growth opportunities for the adoption of RISC-V. Flexibility in the architecture, with functions for safety and real-time processing, positions RISC-V for automotive applications across the board, from ADAS and infotainment to battery management and electronic control units. License-free cores offer cost elasticity to Tier-1 suppliers, allowing for a greater variety of product versions without exponential royalty increases. With Infineon launching its line of RISC-V automotive microcontrollers, mainstream adoption has achieved a new milestone in this industry segment.

Opportunity: Data Center and High-Performance Computing

RISC-V is now moving into the data center and high-performance computing verticals, outside embedded applications. The likes of Alibaba, Ventana Micro Systems, and SiFive are pushing server-class RISC-V processors for AI inference, cloud micro-services, and general-purpose computing workloads. Hyperscalers are benchmarking RISC-V servers for cost advantages in license-free cores and chiplet packaging, positioning the architecture for gradual penetration in data center applications.

Challenge: Ecosystem Maturity and Software Support

Although the RISC-V ecosystem has grown significantly, it remains less mature than established ARM and x86 ecosystems. Though rapidly improving, software toolchains, operating system support, debugging tools, and middleware libraries still trail proprietary alternatives in some areas of application. The transition to RISC-V requires significant investment in porting and optimizing software from companies, extending timelines and adding to initial project costs.

Segment Analysis:

By Product Type:

Driven by strong demand in IoT devices, consumer electronics, industrial applications, and embedded systems for low-power, customized RISC-V cores, the MCU segment is expected to hold the largest share of the market in 2025. Commercial RISC-V microcontrollers have been introduced by leading companies like GigaDevice, Espressif Systems, and Renesas, among others, which boast competitive performance and power consumption compared to traditional ARM-based solutions.

The microprocessor segment is expected to grow with the highest CAGR during the forecast period, owing to the increasing demand for high-performance computing capabilities in data centers, servers, and application processors. Companies such as SiFive, Ventana Micro Systems, and Alibaba's T-Head Semiconductor are working on advanced RISC-V microprocessors targeting server and AI workloads.

By Core Type:

Based on core type, the 64-bit segment commands the largest share of the market in 2025, owing to the high demand for greater processing capability across automotive, data centers, and high-performance computing applications. 64-bit RISC-V cores provide the memory addressing and processing capabilities needed for high-end applications, such as AI inference, server workloads, and advanced embedded systems.

However, the 128-bit segment is projected to record the fastest CAGR during the forecast period, driven by emerging requirements such as ultra-high-performance computing, advanced cryptographic operations, and next-generation AI accelerators.

By Application:

On the basis of application, the consumer electronics segment captures the largest market share of the total revenue in 2025, driven by adoption of RISC-V cores in smart TVs, wearables, home automation devices, smartphones, and audio/video equipment. The cost advantages of license-free RISC-V cores make them an attractive option for high-volume consumer applications where margins are constrained.

The data centers and HPC market is anticipated to grow at the fastest CAGR through 2035, as hyperscalers and enterprise customers begin to explore RISC-V for AI inference and cloud computing.

Regional Insights:

Asia-Pacific holds the largest share of the global RISC-V market in 2025. Strong semiconductor manufacturing infrastructure, strategic government initiatives on indigenous processor development, and robust adoption in consumer electronics and IoT applications are some key reasons behind the growth of this market. China continues to drive the regional market, aiming to use RISC-V as a path to independent chip capabilities and reduce dependency on foreign technologies that have export restrictions in place. Design-in-India campaigns and an emerging startup ecosystem add new capacity for assembly and test in India, with companies like Mindgrove planning volume MCU shipments.

North American RISC-V market is mainly driven by the robust innovation environment, strong startup ecosystem, and massive investments by major technology companies. This market is primarily driven by the U.S., supported by government programs promoting alternative processor architectures along with significant demand from applications in automotive, data centers, and IoT.

Key Players:

The key players operating in the global RISC-V microcontroller and microprocessor market are SiFive Inc. (U.S.), Andes Technology Corporation (Taiwan), Codasip S.R.O. (Czech Republic), StarFive Technology Co. Ltd. (China), Infineon Technologies AG (Germany), GigaDevice Semiconductor Inc. (China), Microchip Technology Inc. (U.S.), Espressif Systems (Shanghai) Co. Ltd. (China), Nuclei System Technology Co. Ltd. (China), Ventana Micro Systems Inc. (U.S.), Imagination Technologies (U.K.), GreenWaves Technologies (France), Bluespec Inc. (U.S.), Syntacore (Russia), Alibaba Group/T-Head Semiconductor (China), Western Digital Corporation (U.S.), Renesas Electronics Corporation (Japan), NXP Semiconductors N.V. (Netherlands), Qualcomm Incorporated (U.S.), and Intel Corporation (U.S.), amongst other companies.

The RISC-V microcontroller and microprocessor market is expected to grow from USD 2.12 billion in 2025 to USD 32.66 billion by 2035.

The RISC-V microcontroller and microprocessor market is expected to grow at a CAGR of 29.5% from 2025 to 2035.

The major players in the RISC-V microcontroller and microprocessor market include SiFive Inc., Andes Technology Corporation, Codasip S.R.O., StarFive Technology Co. Ltd., Infineon Technologies AG, GigaDevice Semiconductor Inc., Microchip Technology Inc., Espressif Systems (Shanghai) Co. Ltd., Nuclei System Technology Co. Ltd., Ventana Micro Systems Inc., Imagination Technologies, GreenWaves Technologies, Bluespec Inc., Syntacore, Alibaba Group (T-Head Semiconductor), Western Digital Corporation, Renesas Electronics Corporation, NXP Semiconductors N.V., Qualcomm Incorporated, and Intel Corporation, among others.

The key factors driving the RISC-V microcontroller and microprocessor market include the open-source architecture and royalty-free licensing enabling cost-effective processor development, customization capabilities allowing application-specific optimization across diverse sectors, geopolitical factors accelerating investment in indigenous chip technologies for supply chain diversification, growing adoption of IoT devices and smart connected products requiring energy-efficient processors, expansion of AI and edge computing applications driving demand for customizable processor cores with vector extensions, and increasing investments from major technology companies and government-backed initiatives worldwide.

Asia-Pacific region will lead the global RISC-V microcontroller and microprocessor market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Product Type

3.3. Market Analysis, by Core Type

3.4. Market Analysis, by Application

3.5. Market Analysis, by Geography

3.6. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global RISC-V Microcontroller and Microprocessor Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Open-Source Architecture and Royalty-Free Licensing Enabling Cost-Effective Processor Development

4.2.2. Customization Capabilities and Application-Specific Optimization Driving Adoption

4.2.3. Geopolitical Factors and Supply Chain Diversification Accelerating RISC-V Investment

4.3. Global RISC-V Microcontroller and Microprocessor Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. Ecosystem Maturity and Software Toolchain Limitations

4.3.2. Competition from Established ARM and x86 Architectures

4.4. Global RISC-V Microcontroller and Microprocessor Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Expansion in Automotive Electronics and Functional Safety Applications

4.4.2. Growth in Data Centers and High-Performance Computing Markets

4.5. Global RISC-V Microcontroller and Microprocessor Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Fragmentation of Custom Extensions and Binary Portability Issues

4.5.2. Certification and Compliance Requirements in Safety-Critical Applications

4.6. Global RISC-V Microcontroller and Microprocessor Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Integration of AI and Vector Processing Extensions for Edge Computing

4.6.2. Government-Backed Initiatives for Semiconductor Independence

4.7. Porter’s Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Open-Source Hardware on the Global Semiconductor Industry

5.1. Introduction to Open-Source ISA and Its Evolution

5.2. RISC-V vs. Proprietary Architectures: Comparative Analysis

5.3. Ecosystem Development and Community Collaboration

5.4. Government Initiatives and National Semiconductor Programs

5.5. Impact on IP Licensing Models and Industry Economics

5.6. Security Considerations in Open-Source Processor Design

5.7. Standardization Efforts and Compliance Frameworks

5.8. Impact on Market Growth and Industry Transformation

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Players

7. Global RISC-V Microcontroller and Microprocessor Market, by Product Type

7.1. Introduction

7.2. Microcontroller (MCU)

7.2.1. 32-Bit RISC-V MCU

7.2.2. 64-Bit RISC-V MCU

7.3. Microprocessor (MPU)

7.3.1. Application Processors

7.3.2. Server-Class Processors

7.4. System-on-Chip (SoC)

7.5. Application-Specific Integrated Circuits (ASICs)

8. Global RISC-V Microcontroller and Microprocessor Market, by Core Type

8.1. Introduction

8.2. 32-Bit Cores

8.3. 64-Bit Cores

8.4. 128-Bit Cores

9. Global RISC-V Microcontroller and Microprocessor Market, by Application

9.1. Introduction

9.2. Consumer Electronics

9.2.1. Smartphones and Tablets

9.2.2. Wearables

9.2.3. Smart TVs and Home Entertainment

9.2.4. Home Automation and Smart Appliances

9.3. Automotive

9.3.1. Advanced Driver Assistance Systems (ADAS)

9.3.2. In-Vehicle Infotainment

9.3.3. Electronic Control Units (ECUs)

9.3.4. Battery Management Systems

9.4. Industrial and IoT

9.4.1. Industrial Automation

9.4.2. Smart Sensors and Meters

9.4.3. Building Automation

9.4.4. Connected Devices

9.5. Data Centers and High-Performance Computing

9.6. Telecommunications

9.7. Aerospace and Defense

9.8. Healthcare and Medical Devices

9.9. Other Applications

10. RISC-V Microcontroller and Microprocessor Market, by Geography

10.1. Introduction

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Italy

10.3.5. Netherlands

10.3.6. Switzerland

10.3.7. Rest of Europe

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. South Korea

10.4.4. Taiwan

10.4.5. India

10.4.6. Southeast Asia

10.4.7. Rest of Asia-Pacific

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Rest of Latin America

10.6. Middle East & Africa

10.6.1. Saudi Arabia

10.6.2. UAE

10.6.3. South Africa

10.6.4. Rest of Middle East & Africa

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

11.1. SiFive Inc.

11.2. Andes Technology Corporation

11.3. Codasip S.R.O.

11.4. StarFive Technology Co. Ltd.

11.5. Infineon Technologies AG

11.6. GigaDevice Semiconductor Inc.

11.7. Microchip Technology Inc.

11.8. Espressif Systems (Shanghai) Co. Ltd.

11.9. Nuclei System Technology Co. Ltd.

11.10. Ventana Micro Systems Inc.

11.11. Imagination Technologies

11.12. GreenWaves Technologies

11.13. Bluespec Inc.

11.14. Syntacore

11.15. Alibaba Group (T-Head Semiconductor)

11.16. Western Digital Corporation

11.17. Renesas Electronics Corporation

11.18. NXP Semiconductors N.V.

11.19. Qualcomm Incorporated

11.20. Intel Corporation

11.21. Others

12. Appendix

12.1. Questionnaire

12.2. Available Customization

Published Date: Dec-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates