Resources

About Us

Psoriasis Treatment Market Size, Share, Forecast, & Trends Analysis by Treatment (TNF Inhibitor, Interleukin, Corticosteroids, Calcitrol, Retinoids, Calcineurin, Methotrexate) Disease (Plaque Psoriasis, Psoriatic Arthritis) – Global Forecast to 2032

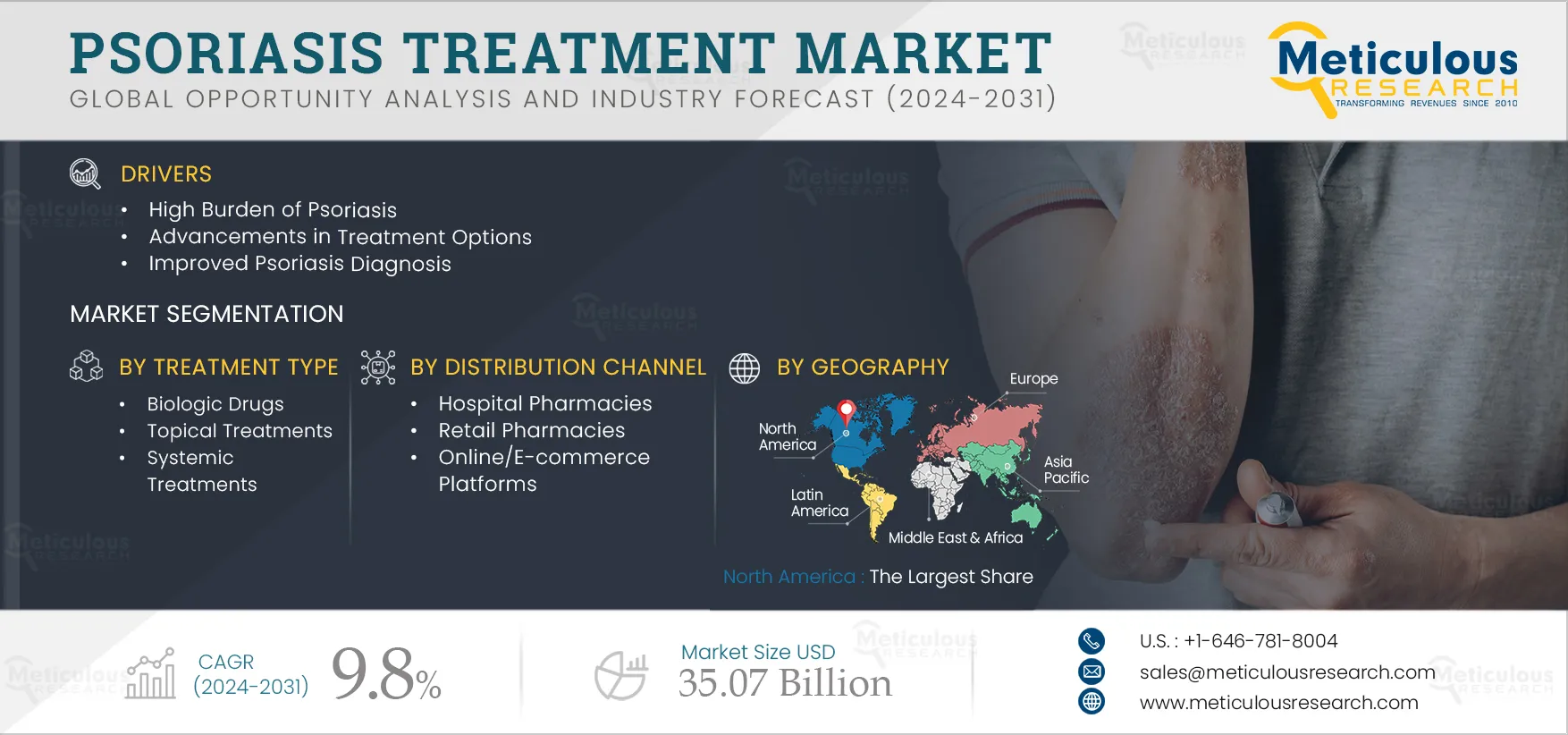

Report ID: MRHC - 1041225 Pages: 240 Jun-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by the high burden of psoriasis, advancements in treatment options, improved psoriasis diagnosis, improved understanding of disease pathogenesis, high rate of elderly people being more susceptible to psoriasis. Moreover, the rising awareness regarding psoriasis, growing use of combination therapies for treatment, and growing research regarding psoriasis are expected to generate growth opportunities for the players operating in the psoriasis treatment market.

The burden of psoriasis encompasses a range of physical, emotional, and social challenges for individuals affected by the condition. Psoriasis, a chronic autoimmune disorder, manifests as red, scaly patches on the skin, often accompanied by itching, pain, and discomfort. Beyond its visible symptoms, psoriasis can significantly impact the quality of life, leading to feelings of embarrassment, self-consciousness, and low self-esteem.

The significant impact of psoriasis fuels the growth of the psoriasis treatment market. Affecting millions worldwide, psoriasis causes recurring skin inflammation and lesions, deeply impacting patients both physically and emotionally. According to the National Psoriasis Foundation, around 125 million people, or 2-3% of the global population, are affected by psoriasis. As a chronic condition, psoriasis requires ongoing treatment. The visible symptoms and associated health problems exacerbate the burden for patients. Despite current treatments, many individuals do not experience sufficient relief, indicating a substantial need for better options. Consequently, the extensive global burden of psoriasis drives the adoption of treatment options, propelling the market growth.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

The elderly are at a higher risk of developing psoriasis due to various factors. With age, the immune system tends to weaken, leading to less efficient regulation of inflammatory responses, which play a significant role in psoriasis. Moreover, older individuals often contend with other chronic ailments or medications that can either trigger psoriasis or hinder its treatment. Age-related changes in the skin, such as thinning and decreased elasticity, can also heighten susceptibility to psoriasis lesions. Additionally, stress, which may be more prevalent among the elderly due to life transitions and health issues, is a recognized trigger for psoriasis flare-ups. Consequently, the increasing elderly population worldwide is expected to fuel the demand for psoriasis treatment. As per the United Nations, the proportion of individuals aged 65 and above is rising rapidly, with the global percentage projected to escalate from 10% in 2022 to 16% by 2025.

In the realm of psoriasis treatment, personalized medicine approaches are gaining ground, spurred by a deeper understanding of the disease's underlying mechanisms. These strategies aim to customize treatment plans to match the unique characteristics of individual patients. Through the incorporation of advanced diagnostic tools like biomarker-based diagnostics, genetic testing, and patient-specific disease profiling, healthcare providers can pinpoint the most suitable treatment options for each patient. For instance, genetic testing can offer insights into treatment response and the likelihood of experiencing adverse effects, aiding in medication selection. Moreover, treatment algorithms based on factors such as patient demographics and disease severity facilitate the creation of personalized treatment regimens for every patient. As personalized medicine continues to advance, it holds great promise for enhancing treatment effectiveness, minimizing side effects, and boosting patient satisfaction in managing psoriasis.

The movement towards steroid-free topicals within the psoriasis treatment market reflects a growing demand for safer and more sustainable therapeutic choices. Unlike traditional steroid-based treatments, steroid-free topicals provide effective relief from psoriasis symptoms without the potential side effects associated with prolonged steroid use, such as skin thinning and resistance development. These formulations often utilize innovative ingredients like calcineurin inhibitors or vitamin D analogs, which target inflammation and abnormal skin cell growth without compromising the skin's integrity. As patients increasingly seek alternatives to corticosteroids, steroid-free topicals emerge as a promising option for addressing mild to moderate psoriasis while mitigating treatment-related risks.

Combination therapies for psoriasis treatment involve using two or more treatment modalities simultaneously to enhance efficacy and address multiple aspects of the disease. These approaches are particularly useful for patients with moderate to severe psoriasis or those who have not responded adequately to monotherapy. One common combination involves the use of topical treatments alongside phototherapy. Topical treatments may include corticosteroids, vitamin D analogs, calcineurin inhibitors, or tar preparations, which can be applied directly to affected areas. Phototherapy, which involves exposure to ultraviolet light, can complement topical treatments by targeting inflammation and slowing down the excessive growth of skin cells.

Another combination approach includes combining systemic medications with biologic agents. Systemic medications such as methotrexate, cyclosporine, or acitretin work internally to modulate the immune system and reduce inflammation. Biologic agents, on the other hand, are proteins that target specific molecules involved in the immune response, such as tumor necrosis factor-alpha (TNF-alpha) or interleukins. Combining these two types of medications can provide a more comprehensive approach to managing psoriasis by targeting different pathways involved in the disease process. Combination therapies offer a potent approach to managing psoriasis, effectively keeping the condition in check for extended periods.

Moreover, healthcare providers can tailor treatments to suit each patient's specific requirements, ensuring optimal outcomes. This personalized approach to treatment aligns with the increasing demand for tailored healthcare solutions, presenting a significant opportunity for market players. By integrating various treatments, providers can address diverse patient needs and preferences, enhancing their competitiveness in the market.

Based on treatment type, the market is segmented into biologic drugs, topical treatments, and systemic treatments. In 2025, the biologic drugs segment is expected to account for the largest share of 43.7% of the psoriasis treatment market. The largest market share of this segment is attributed to their high efficacy and targeted approach in treating moderate to severe psoriasis, ongoing research and development efforts, along increasing adoption by healthcare providers.

Similarly, the biologics drugs segment is projected to witness the highest growth rate of 7.4% during the forecast period of 2025–2032. The expansion of this segment is propelled by the increasing acceptance of Interleukin inhibitors, attributed to their notable effectiveness and favorable safety records. As both patients and healthcare providers increasingly favor biologic therapies over conventional systemic medications, coupled with continuous progress in biologic drug innovation, the momentum continues to grow. Moreover, the concerted efforts of industry players to introduce new biologic drugs for psoriasis further stimulate the segment's advancement. For instance, in March 2024, Eli Lilly and Company (U.S.) unveiled Copellor, an interleukin inhibitor drug designed for psoriasis treatment in India.

Based on disease type, the psoriasis treatment market is segmented into plaque psoriasis, psoriatic arthritis, and others. In 2025, the plaque psoriasis segment is expected to account for the largest share of 56.3% of the psoriasis treatment market. The large segmental share is attributed to the high prevalence of plaque psoriasis, increasing accuracy in psoriasis, improved diagnostic techniques, growing use of combination therapies, and the launch of new drugs for plaque psoriasis.

However, the psoriatic arthritis segment is expected to grow at the highest CAGR of 7.1% during the forecast period of 2025-2032. Psoriatic arthritis, a form of inflammatory arthritis often accompanying psoriasis, affects approximately 30% of individuals with psoriasis. With heightened awareness of this condition and advancements in diagnostic techniques, the demand for treatments addressing psoriatic arthritis is anticipated to rise, thereby fueling the growth of this segment.

Based on administration route, the psoriasis treatment market is segmented into oral, topical, and injectable. In 2025, the injectable segment is expected to account for the largest share of the psoriasis treatment market. This segment is driven by the increasing adoption of biologic therapies, which are mainly administered via injections, advancements in injection technology such as prefilled syringes and autoinjectors, and the expanding availability and accessibility of injectable medications through various distribution channels, including specialty pharmacies and online platforms.

The increasing adoption of biologic therapies, primarily administered via injections, is driving significant growth within the segment. Biologic drugs are highly effective in treating moderate to severe psoriasis, prompting widespread usage by healthcare providers. Moreover, advancements in injection technology, including prefilled syringes and autoinjectors, have enhanced patient convenience and comfort, further amplifying the demand for injectable medications. Additionally, the escalating prevalence of chronic conditions like psoriasis and psoriatic arthritis necessitates long-term treatment strategies, with injectable therapies often preferred for their consistent dosing and monitoring capabilities. Consequently, this segment is poised to exhibit the highest CAGR during the forecast period.

Based on distribution channel, the psoriasis treatment market is segmented into hospital pharmacies, retail pharmacies, and online/e-commerce platforms. In 2025, the hospital pharmacies segment is expected to account for the largest share of the market. Hospitals play a pivotal role as primary hubs for diagnosing and treating psoriasis, with hospital pharmacies serving as crucial distribution channels for psoriasis medications. These pharmacies typically maintain extensive stocks of medications to meet the diverse requirements of psoriasis patients, encompassing biologic, systemic, and topical treatments. Furthermore, healthcare practitioners within hospitals often prescribe medications for acute or severe psoriasis cases, resulting in a heightened volume of prescriptions fulfilled through hospital pharmacies.

However, the online/e-commerce platforms segment is expected to grow at the highest CAGR during the forecast period. The expansion of this market segment can be attributed to the widespread adoption of e-commerce platforms, which have transformed the accessibility of healthcare products for consumers. The growing prevalence of digitalization and the convenience of online shopping have further propelled this trend. Online platforms provide a vast array of products, enabling patients to compare prices, peruse reviews, and gather information about various treatment options—all from the comfort of their homes.

In 2025, North America is expected to account for the largest share of 43.1% of the psoriasis treatment market. Among the U.S. and Canada, in 2025, the U.S. is expected to account for the largest share of the psoriasis treatment market in North America. The large market share is attributed to the high prevalence of psoriasis, high adoption rate of personalized therapies, well-developed health infrastructure, and continuous research and development for psoriasis, translating into new treatment approaches and drugs.

However, Asia-Pacific is slated to register the highest CAGR of 10.2% during the forecast period. The growth of this region is attributed to the rising psoriasis prevalence, growing demand for quality healthcare, shift towards medicine for dermatology conditions from homemade remedies, and a large population base.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. The key players operating in the psoriasis treatment market are AbbVie Inc. (U.S.), AstraZeneca Plc (U.K.), Boehringer Ingelheim (Germany), Celgene Corporation (U.S.), Eli Lilly and Company (U.S.), Johnson and Johnson (U.S.), Merck KGaA (Germany), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Takeda Pharmaceutical Company Limited (Japan), Biogen, Inc. (U.S.), LEO Pharma A/S (Denmark), Sun Pharmaceutical Industries Ltd. (India), and Dr. Reddy’s Laboratories Ltd. (India).

|

Particular |

Details |

|

Page No |

240 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

9.8% |

|

Market Size (Value) |

$35.07 billion by 2032 |

|

Segments Covered |

By Treatment Type

By Disease Type

By Administration Route

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Netherlands, Switzerland, Poland, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, New Zealand, Rest of APAC), Latin America (Brazil, Mexico, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

AbbVie Inc. (U.S.), AstraZeneca Plc (U.K.), Boehringer Ingelheim (Germany), Celgene Corporation (U.S.), Eli Lilly and Company (U.S.), Johnson and Johnson (U.S.), Merck KGaA (Germany), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Takeda Pharmaceutical Company Limited (Japan), Biogen, Inc. (U.S.), LEO Pharma A/S (Denmark), Sun Pharmaceutical Industries Ltd. (India), and Dr. Reddy’s Laboratories Ltd. (India). |

The psoriasis treatment market covers the market sizes & forecasts by treatment type, disease type, administration route, and distribution channel. The psoriasis treatment market studied in this report involves the value analysis of various segments and sub-segments of the psoriasis treatment market at regional and country levels.

The psoriasis treatment market is projected to reach $35.07 billion by 2032, at a CAGR of 9.8% during the forecast period.

In 2025, the biologic drugs segment is expected to account for the largest share of the psoriasis treatment market.

The psoriasis treatment market is driven by the high burden of psoriasis, advancements in treatment options, improved psoriasis diagnosis, high rate of elderly people being more susceptible to psoriasis. Moreover, the rising awareness regarding psoriasis, growing use of combination therapies for treatment, and growing research regarding psoriasis are expected to generate growth opportunities for the players operating in the psoriasis treatment market.

The key players operating in the psoriasis treatment market are AbbVie Inc. (U.S.), AstraZeneca Plc (U.K.), Boehringer Ingelheim (Germany), Celgene Corporation (U.S.), Eli Lilly and Company (U.S.), Johnson and Johnson (U.S.), Merck KGaA (Germany), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Takeda Pharmaceutical Company Limited (Japan), Biogen, Inc. (U.S.), LEO Pharma A/S (Denmark), Sun Pharmaceutical Industries Ltd. (India), and Dr. Reddy’s Laboratories Ltd. (India).

The countries India and China are projected to offer significant growth opportunities for the vendors in this market due to rising psoriasis prevalence, growing demand for quality healthcare, a shift towards medicine for dermatology conditions from homemade remedies, and a large population base.

1. Overview

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency and Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of The Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.3.3. Market Share Analysis

2.4. Assumptions For the Study

3. Executive Summary

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. High Burden of Psoriasis

4.2.1.2. Advancements in Treatment Options

4.2.1.3. Improved Psoriasis Diagnosis

4.2.1.4. Elderly People More Susceptible to Psoriasis

4.2.2. Restraints

4.2.2.1. High Costs of Psoriasis Treatments

4.2.2.2. Side Effects of Medications

4.2.3. Opportunities

4.2.3.1. Rising Awareness Regarding Psoriasis

4.2.3.2. Growing Use of Combination Therapies for Treatment

4.2.3.3. Growing Research Regarding Psoriasis

4.2.4. Challenges

4.2.4.1. Stringent Regulatory & Approval Process of Drugs

4.3. Trends

4.3.1. Targeted Therapies

4.3.2. Steroid-free Topicals

4.4. Factor Analysis

4.5. Product Pipeline Analysis

4.6. Regulatory Analysis

4.7. Porter's Five Forces Analysis

4.8. Fundings & Investments Analysis

5. Psoriasis Treatment Market Assessment—by Test Type

5.1. Overview

5.2. Biologic Drugs

5.2.1. TNF Inhibitors

5.2.1.1. Infliximab

5.2.1.2. Adalimumab

5.2.1.3. Etanercept

5.2.1.4. Other TNF Inhibitors

5.2.2. Interleukin Inhibitors

5.2.2.1. Guselkumab

5.2.2.2. Risankizumab

5.2.2.3. Tildrakizumab

5.2.3. Other Biologic Drugs

5.3. Topical Treatments

5.3.1. Corticosteroids

5.3.1.1. Hydrocortisone

5.3.1.2. Desonide

5.3.1.3. Betamethasone

5.3.1.4. Other Corticosteroids

5.3.2. Vitamin D Analogs

5.3.2.1. Calcitrol

5.3.2.2. Calcipotriol

5.3.2.3. Tacalcitol

5.3.3. Retinoids

5.3.4. Calcineurin Inhibitors

5.4. Systemic Treatments

5.4.1. Methotrexate

5.4.2. Cyclosporine

5.4.3. Acitretin

5.4.4. Other Systemic Treatments

6. Psoriasis Treatment Market Assessment—by Disease Type

6.1. Overview

6.2. Plaque Psoriasis

6.3. Psoriatic Arthritis

6.4. Other Types

7. Psoriasis Treatment Market Assessment—by Administration Route

7.1. Overview

7.2. Oral

7.3. Topical

7.4. Injectable

8. Psoriasis Treatment Market Assessment— by Distribution Channel

8.1. Overview

8.2. Hospital Pharmacies

8.3. Retail Pharmacies

8.4. Online/E-commerce Platforms

9. Psoriasis Treatment Market Assessment—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Netherlands

9.3.7. Switzerland

9.3.8. Poland

9.3.9. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. India

9.4.3. Japan

9.4.4. Australia

9.4.5. New Zealand

9.4.6. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis/ Market Ranking Analysis, by Key Players (2024)

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis*)

11.1. AbbVie Inc. (U.S.)

11.2. AstraZenca Plc (U.K.)

11.3. Boehringer Ingelheim (Germany)

11.4. Celgene Corporation (U.S.)

11.5. Eli Lilly and Company (U.S.)

11.6. Johnson and Johnson (U.S.)

11.7. Merck KGaA (Germany)

11.8. Novartis AG (Switzerland)

11.9. Pfizer Inc. (U.S.)

11.10. Takeda Pharmaceutical Company Limited (Japan)

11.11. Biogen, Inc. (U.S.)

11.12. LEO Pharma A/S (Denmark)

11.13. Sun Pharmaceutical Industries Ltd. (India)

11.14. Dr. Reddy’s Laboratories Ltd. (India)

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 2 Global Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 3 Global Biologic Drugs Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 4 Global TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 5 Global TNF Inhibitors Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 6 Global Infliximab Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 7 Global Adalimumab Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 8 Global Etanercept Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 9 Global Other TNF Inhibitors Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 10 Global Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 11 Global Interleukin Inhibitors Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 12 Global Guselkumab Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 13 Global Tildrakizumab Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 14 Global Other Biologic Drugs Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 15 Global Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 16 Global Topical Treatment Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 17 Global Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 18 Global Corticosteroids Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 19 Global Desonide Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 20 Global Betamethasone Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 21 Global Etanercept Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 22 Global Other Cortocisteroids Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 23 Global Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 24 Global Vitamin D Analogs Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 25 Global Calcitriol Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 26 Global Calcipotriol Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 27 Global Tacalcitol Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 28 Global Retinoids Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 29 Global Calcineurin Inhibitors Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 30 Global Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 31 Global Systemic Treatments Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 32 Global Methotrexate Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 33 Global Cyclosporine Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 34 Global Other Systemic Treatments Market for Psoriasis, by Country/Region, 2022–2032 (USD Million)

Table 35 Global Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 36 Global Plaque Psoriasis Treatment Market, by Country/Region, 2022–2032 (USD Million)

Table 37 Global Psoriatic Arthritis Treatment Market, by Country/Region, 2022–2032 (USD Million)

Table 38 Global Other Psoriasis Treatment Market, by Country/Region, 2022–2032 (USD Million)

Table 39 Global Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 40 Global Psoriasis Treatment Market for Oral Administration, by Country/Region, 2022–2032 (USD Million)

Table 41 Global Psoriasis Treatment Market for Topical Administration, by Country/Region, 2022–2032 (USD Million)

Table 42 Global Psoriasis Treatment Market for Injectable Administration, by Country/Region, 2022–2032 (USD Million)

Table 43 Global Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 44 Global Psoriasis Treatment Market for Hospital Pharmacies, by Country/Region, 2022–2032 (USD Million)

Table 45 Global Psoriasis Treatment Market for Retail Pharmacies, by Country/Region, 2022–2032 (USD Million)

Table 46 Global Psoriasis Treatment Market for Online/E-commerce Platforms, by Country/Region, 2022–2032 (USD Million)

Table 47 Global Psoriasis Treatment Market, by Country/Region, 2022–2032 (USD Million)

Table 48 North America: Psoriasis Treatment Market, by Country, 2022–2032 (USD Million)

Table 49 North America: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 50 North America: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 51 North America: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 52 North America: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 53 North America: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 54 North America: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 55 North America: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 56 North America: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 57 North America: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 58 North America: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 59 North America: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 60 U.S.: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 61 U.S.: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 62 U.S.: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 63 U.S.: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 64 U.S.: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 65 U.S.: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 66 U.S.: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 67 U.S.: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 68 U.S.: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 69 U.S.: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 70 U.S.: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 71 Canada: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 72 Canada: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 73 Canada: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 74 Canada: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 75 Canada: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 76 Canada: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 77 Canada: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 78 Canada: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 79 Canada: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 80 Canada: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 81 Canada: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 82 Europe: Psoriasis Treatment Market, by Country/Region, 2022–2032 (USD Million)

Table 83 Europe: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 84 Europe: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 85 Europe: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 86 Europe: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 87 Europe: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 88 Europe: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 89 Europe: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 90 Europe: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 91 Europe: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 92 Europe: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 93 Europe: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 94 Germany: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 95 Germany: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 96 Germany: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 97 Germany: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 98 Germany: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 99 Germany: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 100 Germany: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 101 Germany: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 102 Germany: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 103 Germany: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 104 Germany: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 105 France: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 106 France: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 107 France: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 108 France: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 109 France: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 110 France: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 111 France: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 112 France: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 113 France: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 114 France: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 115 France: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 116 U.K.: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 117 U.K.: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 118 U.K.: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 119 U.K.: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 120 U.K.: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 121 U.K.: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 122 U.K.: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 123 U.K.: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 124 U.K.: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 125 U.K.: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 126 U.K.: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 127 Italy: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 128 Italy: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 129 Italy: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 130 Italy: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 131 Italy: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 132 Italy: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 133 Italy: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 134 Italy: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 135 Italy: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 136 Italy: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 137 Italy: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 138 Spain: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 139 Spain: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 140 Spain: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 141 Spain: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 142 Spain: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 143 Spain: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 144 Spain: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 145 Spain: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 146 Spain: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 147 Spain: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 148 Spain: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 149 Netherlands: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 150 Netherlands: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 151 Netherlands: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 152 Netherlands: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 153 Netherlands: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 154 Netherlands: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 155 Netherlands: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 156 Netherlands: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 157 Netherlands: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 158 Netherlands: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 159 Netherlands: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 160 Switzerland: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 161 Switzerland: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 162 Switzerland: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 163 Switzerland: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 164 Switzerland: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 165 Switzerland: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 166 Switzerland: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 167 Switzerland: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 168 Switzerland: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 169 Switzerland: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 170 Switzerland: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 171 Poland: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 172 Poland: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 173 Poland: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 174 Poland: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 175 Poland: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 176 Poland: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 177 Poland: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 178 Poland: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 179 Poland: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 180 Poland: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 181 Poland: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 182 Rest of Europe: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 183 Rest of Europe: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 184 Rest of Europe: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 185 Rest of Europe: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 186 Rest of Europe: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 187 Rest of Europe: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 188 Rest of Europe: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 189 Rest of Europe: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 190 Rest of Europe: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 191 Rest of Europe: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 192 Rest of Europe: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 193 Asia-Pacific: Psoriasis Treatment Market, by Country/Region, 2022–2032 (USD Million)

Table 194 Asia-Pacific: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 195 Asia-Pacific: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 196 Asia-Pacific: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 197 Asia-Pacific: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 198 Asia-Pacific: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 199 Asia-Pacific: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 200 Asia-Pacific: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 201 Asia-Pacific: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 202 Asia-Pacific: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 203 Asia-Pacific: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 204 Asia-Pacific: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 205 China: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 206 China: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 207 China: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 208 China: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 209 China: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 210 China: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 211 China: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 212 China: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 213 China: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 214 China: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 215 China: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 216 India: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 217 India: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 218 India: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 219 India: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 220 India: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 221 India: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 222 India: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 223 India: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 224 India: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 225 India: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 226 India: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 227 Japan: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 228 Japan: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 229 Japan: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 230 Japan: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 231 Japan: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 232 Japan: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 233 Japan: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 234 Japan: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 235 Japan: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 236 Japan: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 237 Japan: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 238 Australia: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 239 Australia: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 240 Australia: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 241 Australia: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 242 Australia: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 243 Australia: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 244 Australia: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 245 Australia: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 246 Australia: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 247 Australia: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 248 Australia: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 249 New Zealand: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 250 New Zealand: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 251 New Zealand: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 252 New Zealand: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 253 New Zealand: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 254 New Zealand: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 255 New Zealand: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 256 New Zealand: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 257 New Zealand: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 258 New Zealand: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 259 New Zealand: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 260 Rest of Asia-Pacific: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 261 Rest of Asia-Pacific: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 262 Rest of Asia-Pacific: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 263 Rest of Asia-Pacific: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 264 Rest of Asia-Pacific: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 265 Rest of Asia-Pacific: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 266 Rest of Asia-Pacific: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 267 Rest of Asia-Pacific: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 268 Rest of Asia-Pacific: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 269 Rest of Asia-Pacific: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 270 Rest of Asia-Pacific: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 271 Latin America: Psoriasis Treatment Market, by Country/Region, 2022–2032 (USD Million)

Table 272 Latin America: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 273 Latin America: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 274 Latin America: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 275 Latin America: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 276 Latin America: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 277 Latin America: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 278 Latin America: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 279 Latin America: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 280 Latin America: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 281 Latin America: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 282 Latin America: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 283 Brazil: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 284 Brazil: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 285 Brazil: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 286 Brazil: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 287 Brazil: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 288 Brazil: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 289 Brazil: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 290 Brazil: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 291 Brazil: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 292 Brazil: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 293 Brazil: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 294 Mexico: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 295 Mexico: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 296 Mexico: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 297 Mexico: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 298 Mexico: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 299 Mexico: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 300 Mexico: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 301 Mexico: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 302 Mexico: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 303 Mexico: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 304 Mexico: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 305 Rest of Latin America: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 306 Rest of Latin America: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 307 Rest of Latin America: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 308 Rest of Latin America: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 309 Rest of Latin America: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 310 Rest of Latin America: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 311 Rest of Latin America: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 312 Rest of Latin America: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 313 Rest of Latin America: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 314 Rest of Latin America: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 315 Rest of Latin America: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 316 Middle East & Africa: Psoriasis Treatment Market, by Treatment Type, 2022–2032 (USD Million)

Table 317 Middle East & Africa: Biologic Drugs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 318 Middle East & Africa: TNF Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 319 Middle East & Africa: Interleukin Inhibitors Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 320 Middle East & Africa: Topical Treatment Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 321 Middle East & Africa: Corticosteroids Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 322 Middle East & Africa: Vitamin D Analogs Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 323 Middle East & Africa: Systemic Treatments Market for Psoriasis, by Type, 2022–2032 (USD Million)

Table 324 Middle East & Africa: Psoriasis Treatment Market, by Disease Type, 2022–2032 (USD Million)

Table 325 Middle East & Africa: Psoriasis Treatment Market, by Administration Route, 2022–2032 (USD Million)

Table 326 Middle East & Africa: Psoriasis Treatment Market, by Distribution Channel, 2022–2032 (USD Million)

Table 327 Recent Developments, by Company, 2021-2024

List of Figures

Figure 1 Research Process

Figure 2 Secondary Sources Referenced for This Study

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 Global Psoriasis Treatment Market, by Treatment Type, 2025 Vs.2032 (USD Million)

Figure 8 Global Psoriasis Treatment Market, by Disease Type, 2025 Vs.2032 (USD Million)

Figure 9 Global Psoriasis Treatment Market, by Administration Route, 2025 Vs.2032 (USD Million)

Figure 10 Global Psoriasis Treatment Market, by Distribution Channel, 2025 Vs.2032 (USD Million)

Figure 11 Global Psoriasis Treatment Market, by Geography

Figure 12 Impact Analysis of Market Dynamics

Figure 13 Global Psoriasis Treatment Market, by Treatment Type, 2025 Vs.2032 (USD Million)

Figure 14 Global Psoriasis Treatment Market, by Disease Type, 2025 Vs.2032 (USD Million)

Figure 15 Global Psoriasis Treatment Market, by Administration Route, 2025 Vs.2032 (USD Million)

Figure 16 Global Psoriasis Treatment Market, by Distribution Channel, 2025 Vs.2032 (USD Million)

Figure 17 North America: Psoriasis Treatment Market Snapshot

Figure 18 Europe: Psoriasis Treatment Market Snapshot

Figure 19 Asia-Pacific: Psoriasis Treatment Market Snapshot

Figure 20 Latin America: Psoriasis Treatment Market Snapshot

Figure 21 Key Growth Strategies Adopted by Leading Players (2021–2025)

Figure 22 Psoriasis Treatment Market: Competitive Benchmarking, by Treatment Type

Figure 23 Psoriasis Treatment Market: Competitive Benchmarking, by Region

Figure 24 Psoriasis Treatment Market: Competitive Dashboard

Figure 25 Global Psoriasis Treatment Market: Market Share/Market Ranking Analysis, by Key Players, 2024

Figure 26 AbbVie Inc.: Financial Overview (2024)

Figure 27 AstraZeneca Plc: Financial Overview (2024)

Figure 28 Boehringer Ingelheim: Financial Overview (2024)

Figure 29 Eli Lilly and Company: Financial Overview (2024)

Figure 30 Johnson and Johnson: Financial Overview (2024)

Figure 31 Merck KGaA: Financial Overview (2024)

Figure 32 Novartis AG: Financial Overview (2024)

Figure 33 Pfizer Inc.: Financial Overview (2024)

Figure 34 Takeda Pharmaceutical Company Limited: Financial Overview (2024)

Figure 35 Biogen, Inc.: Financial Overview (2024)

Figure 36 Sun Pharmaceutical Industries Ltd.: Financial Overview (2024)

Figure 37 Dr. Reddy’s Laboratories Ltd.: Financial Overview (2024)

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates