Resources

About Us

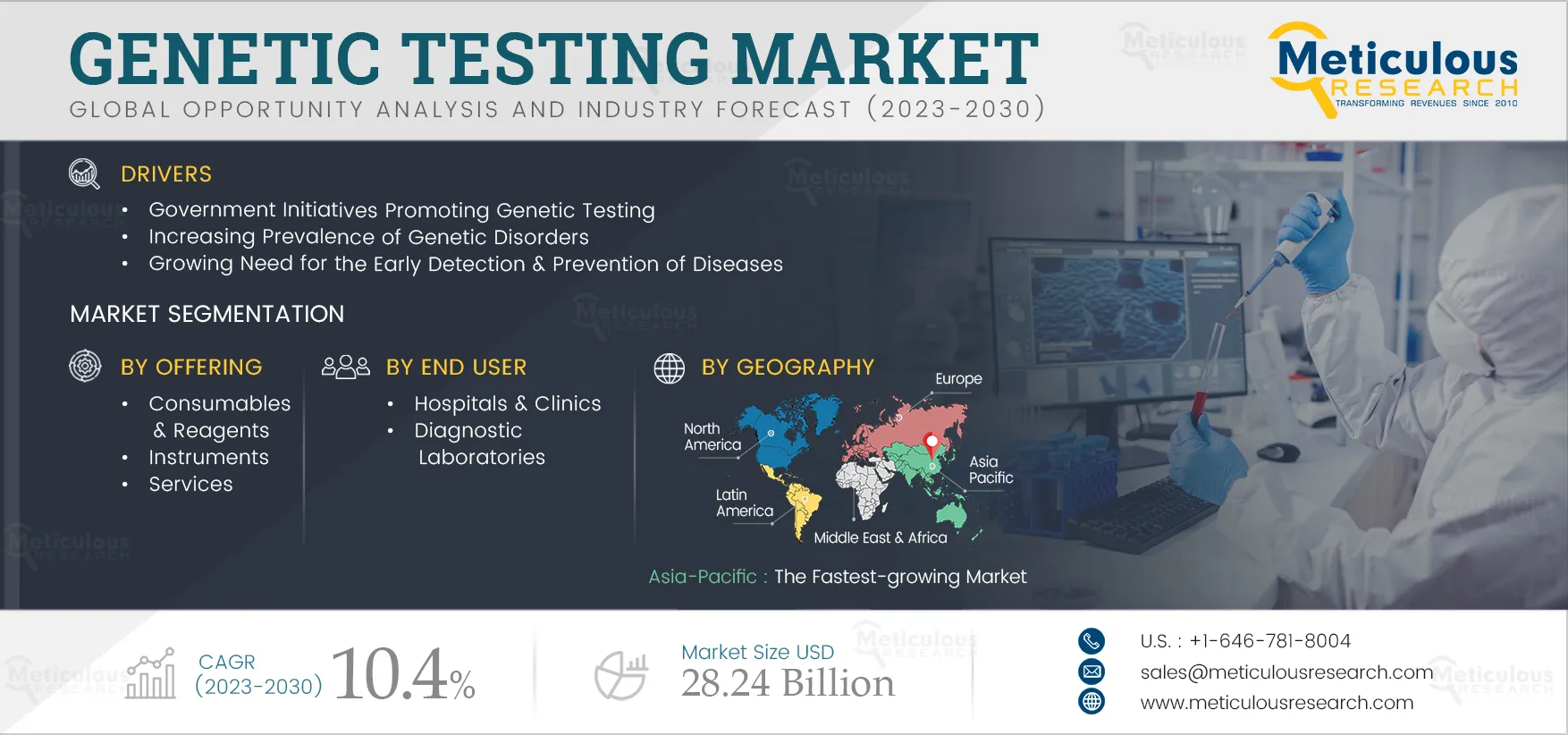

Genetic Testing Market by Offering (Consumables, Reagents, Instruments, Services), Test Type (Diagnostic, Prenatal, Carrier, Newborn, Preimplantation), Method (Molecular, Chromosomal), End User (Hospitals, Diagnostic Laboratories) - Global Forecast to 2030

Report ID: MRHC - 104686 Pages: 177 Apr-2023 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportGenetic Testing Market is anticipated to attain $28.24 billion by 2030, with a CAGR of 10.4% from 2023 to 2030. Genetic testing encompasses the examination of chromosomes, proteins, and specific metabolites to identify heritable disease-related genotypes, mutations, phenotypes, or karyotypes for clinical purposes. Applications include prenatal testing, predictive and presymptomatic testing, diagnostic testing, carrier testing, and preimplantation testing, often employing high-throughput sequencing technologies such as next-generation sequencing.

A growing number of tests are being developed to analyze multiple genes that may increase or decrease a person’s risk of diseases, such as cancer or diabetes. Such tests and other applications of genomic technologies have the potential to help prevent common diseases and improve the health of individuals and populations.

The growth of this market is mainly driven by government initiatives promoting genetic testing, the increasing prevalence of genetic disorders, a growing need for the early detection & prevention of diseases, the increasing applications of genetic testing in oncology, and the decreasing costs of sequencing procedures. However, the high cost of genetic testing in low-income countries and the social and ethical implications of genetic testing restrain the growth of the genetic testing market.

The growing potential of direct-to-consumer genetic testing and the emerging field of genetic counseling are expected to create growth opportunities for the players operating in this market. However, the low chances of positive, actionable mutations and concerns regarding the security & privacy of genetic data are major challenges to market growth.

The outbreak of COVID-19 in March 2020 was a public health crisis and led to nationwide lockdowns and restrictions in many countries worldwide. The majority of the health services & resources were diverted to prioritizing COVID-19. Similarly, laboratory resources and skilled personnel for genetic and genomic testing were directed toward fighting the COVID-19 pandemic. The volume of genetic testing decreased during the pandemic due to growing cases of infections due to its variants like Delta and Omicron. The pandemic negatively impacted the demand for genetic testing due to the prioritization of healthcare resources for COVID-19.

The stringent lockdowns and restrictions led to supply chain disruption leading to delays in delivering the laboratory reagents and equipment. These factors impacted the growth of the market to a certain extent; however, the market is gaining traction as the situation is normalizing. Countries around the world enhanced their genomics capabilities during the pandemic to identify the spread of the virus. The COVID-19 pandemic has increased the adoption of advanced technologies such as NGS for various applications, including epidemiology, metagenomic analysis, and diagnostics. The widespread adoption of enhanced genomic technologies by many countries around the world offers a great opportunity for the genetic testing market.

Click here to: Get Free Sample Pages of this Report

Increasing Applications of Genetic Testing in Oncology to Drive Market Growth

Cancer is a genome disease, and major strides have been made in understanding and treating this heterogeneous collection of diseases. This comprises the initial identification of oncogenes and tumor suppressor genes for the development of the first generation of targeted therapies, culminating in the full annotation of the genomic landscape of the most common cancer types.

The global prevalence of cancer is expected to increase from 19.2 million new cases in 2020 to 24.0 million new cases in 2030, as per International Agency for Research on Cancer. Also, the mortalities from cancer are expected to increase from 9.9 million deaths in 2020 to 12.9 million deaths in 2030. Oncology biomarkers can provide affordable, reliable, accurate, non-invasive, and sensitive information to help effectively manage cancer. Early cancer detection can lead to positive results.

Sequencing technologies like NGS are increasingly used for genetic profiling in targeted cancer therapy applications due to the decreasing costs and turnaround time of NGS, improvements in bioinformatics analyses, and the harmonization of the knowledge base to facilitate the clinical interpretation of genetic results.

Growing Potential of Direct-to-Consumer Genetic Testing to Offer Growth Opportunities for the Market

Direct-to-consumer genetic testing (DCGT) allows individuals to gain a deeper understanding of their genetic information without involving their physicians. This area is growing majorly due to consumers’ increasing awareness about the links between genetics and diseases, enhancing the evolution of patients' health, and precision medicine designed around individual genetic profiles. For accurate genetic testing, companies are working to improve the detection of carrier status and ease of consumer use.

In recent years, the number of DTC genetic tests performed has increased significantly and is expected to show strong growth in the future. Moreover, growing consumer use and subsequent follow-up with healthcare providers and insurers can be further anticipated to propel the growth of DTC genetic testing.

In 2023, the Consumables & Reagents Segment is Expected to Account for the Largest Share of the Genetic Testing Market

Based on offering, the genetic testing market is segmented into consumables & reagents, instruments, and services. In 2023, the consumables & reagents segment is expected to account for the largest share of the genetic testing market. The large market share of this segment is attributed to the recurring purchase of reagents and kits, new launches of kits & reagents, and increased demand for clinical diagnostics tests for diagnostic testing, prenatal testing, newborn screening, preimplantation testing, and other applications.

In 2023, the Prenatal Testing Segment is Expected to Account for the Largest Share of the Genetic Testing Market

Based on test type, the genetic testing market is segmented into prenatal testing, predictive and presymptomatic testing, diagnostic testing, carrier testing, newborn screening, and preimplantation testing. In 2023, the prenatal testing segment is expected to account for the largest share of the genetic testing market. Prenatal testing detects whether the fetus has any abnormalities, such as certain hereditary or spontaneous genetic disorders. Also, prenatal testing is currently the best way to understand the genetic risk associated with an infant’s health. Due to this, its use is increasing rapidly in developed and developing countries.

In 2023, the Molecular Tests Segment is Expected to Account for the Largest Share of the Genetic Testing Market

Based on method, the genetic testing market is segmented into molecular tests, chromosomal tests, and biochemical tests. In 2023, the molecular tests segment is expected to account for the largest share of the genetic testing market. Molecular tests vary in scope and include a targeted single variant, single gene, gene panel, and whole exome sequencing/whole genome sequencing. The large market share of this segment is attributed to factors such as advancements in technology and the ability to perform sequencing at single nucleotide resolution with cheaper, faster, and with the utmost accuracy by using whole genome sequencing (WGS) and whole exome sequencing (WES) technology.

In 2023, the Hospitals & Clinics Segment is Expected to Account for the Largest Share of the Genetic Testing Market

Based on end user, the genetic testing market is segmented into hospitals & clinics, diagnostic laboratories, and other end users. In 2023, the hospitals & clinics segment is expected to account for the largest share of the genetic testing market. The large market share of this segment is attributed to factors such as the increased utilization of advanced sequencing technologies in hospitals and the increasing adoption of genetic tests for the early-stage detection, diagnosis, and treatment of rare and common diseases across the globe.

Asia-Pacific: The Fastest-growing Market

Asia-Pacific is slated to register the highest growth rate in the genetic testing market during the forecast period. The growth of this Asia-Pacific is driven by the advancing healthcare infrastructure in the region, a large patient pool coupled with the growing adoption of advanced genomics technologies, the growing prevalence of various chronic diseases, and the increasing affordability of genomic testing.

Key Players

The report includes a competitive landscape based on an extensive assessment of product portfolio, test type, method, end user, geographic presence, and the key growth strategies adopted by leading market players in the industry in the last three to four years. The key players profiled in the genetic testing market are Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), OPKO Health Inc. (U.S.), Natera, Inc. (U.S.), PerkinElmer, Inc. (U.S.), Myriad Genetics, Inc. (U.S.), Centogene N.V. (Germany), Konica Minolta, Inc. (Japan), Fulgent Genetics, Inc. (U.S.), and Laboratory Corporation of America Holdings (U.S.).

Scope of the Report:

Genetic Testing Market, by Offering

Genetic Testing Market, by Test Type

Genetic Testing Market, by Method

Genetic Testing Market, by End User

Genetic Testing Market, by Geography

Key questions answered in the report:

The genetic testing market report covers the market sizes & forecasts based on offering, test type, method, end user, and geography. The genetic testing market studied in this report involves the value analysis of various segments and subsegments of the genetic testing market at the regional and country levels.

The genetic testing market is projected to reach $ 28.24 billion by 2030, at a CAGR of 10.4% during the forecast period of 2023–2030.

The genetic testing market is segmented into consumables & reagents, instruments, and services. In 2023, the consumables & reagents segment is expected to account for the largest share of the genetic testing market due to recurring demand for assays, reagents & consumables and high demand for genetic diagnostic testing.

The genetic testing market is segmented into diagnostic testing, predictive and presymptomatic testing, newborn screening, prenatal testing, preimplantation testing, and carrier testing. In 2023, the prenatal testing segment is expected to account for the largest share of the genetic testing market due to the high prevalence of various chronic diseases, increased demand for early disease diagnosis, and increased awareness among patients.

The genetic testing market is segmented into molecular tests, chromosomal tests, and biochemical tests. In 2023, the molecular tests segment is expected to account for the largest share of the genetic testing market due to high accuracy, wide applicability, and ability to perform sequencing at a single nucleotide level.

The genetic testing market is segmented into hospitals & clinics, diagnostic laboratories, and other end users. In 2023, the hospitals & clinics segment is expected to account for the largest share of the genetic testing market due to the high number of hospitalized patients, increased preference for genetic testing, and advanced healthcare infrastructure in hospitals.

The growth of this market is mainly driven by government initiatives promoting genetic testing, the increasing prevalence of genetic disorders, a growing need for the early detection & prevention of diseases, the increasing applications of genetic testing in oncology, and the decreasing costs of sequencing procedures. Also, the growing potential of direct-to-consumer genetic testing and the emerging field of genetic counseling are expected to create growth opportunities for players in this market. However, the low chances of positive, actionable mutations and concerns regarding the security & privacy of genetic data are major challenges to market growth.

The high cost of genetic testing in low-income countries and the social and ethical implications of genetic testing are restraining the growth of the genetic testing market.

The key players operating in the genetic testing market are Illumina, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), OPKO Health Inc. (U.S.), Natera, Inc. (U.S.), PerkinElmer, Inc. (U.S.), Myriad Genetics, Inc. (U.S.), Centogene N.V. (Germany), Konica Minolta, Inc. (Japan), Fulgent Genetics, Inc. (U.S.), and Laboratory Corporation of America Holdings (U.S.).

The Asia-Pacific region is slated to witness the highest growth rate during the forecast period and offer significant growth opportunities for the players operating in this market. The growth of this market is driven by the large patient pool, advancing healthcare infrastructure, increasing disposable income of the patients, rising prevalence of chronic diseases, and accelerating economic growth of many countries in this region.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates