Resources

About Us

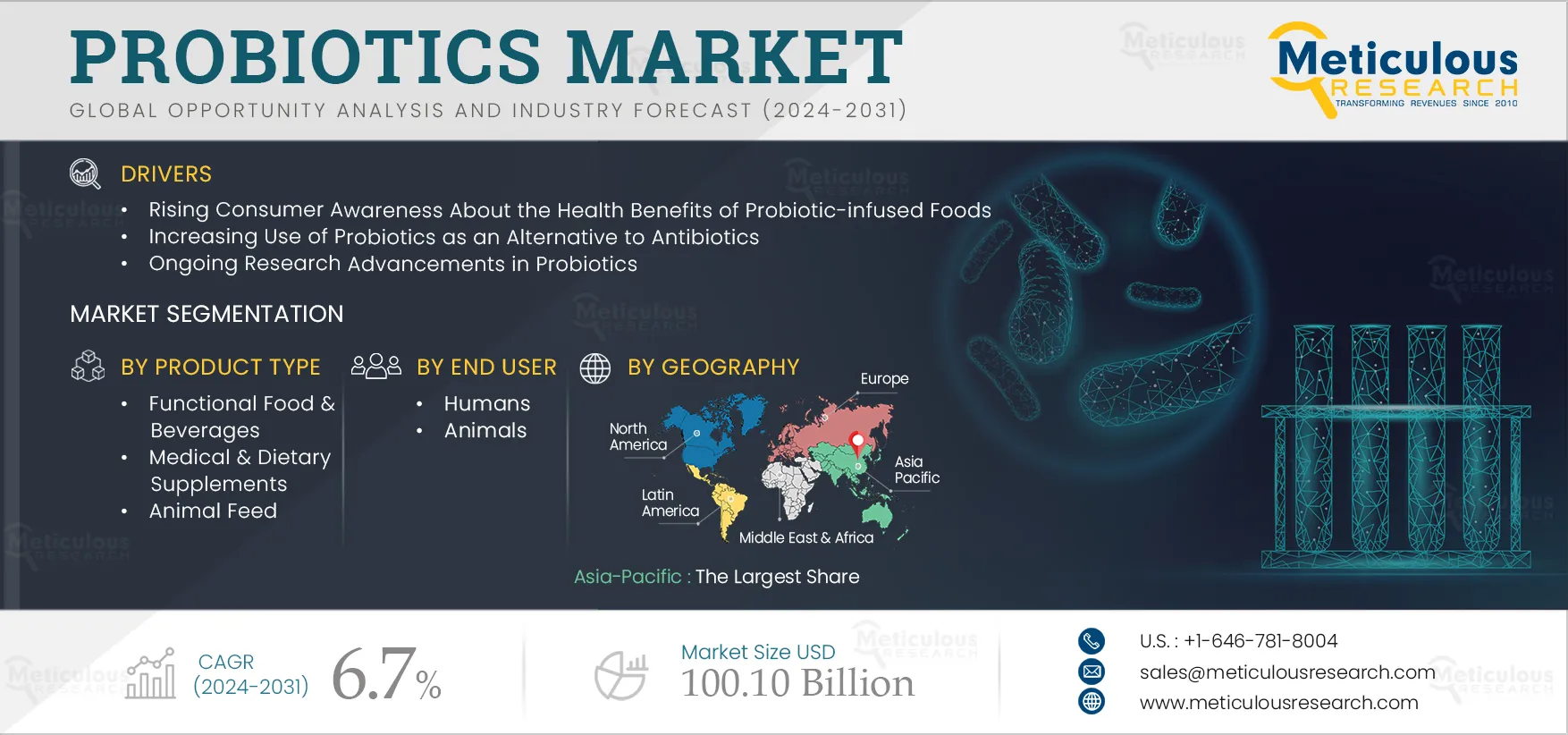

Probiotics Market Size, Share, Forecast, & Trends Analysis by Strain (Bacillus), Product Type (Dairy {Yogurt}, Baked Food}, Animal Feed), Form (Liquid), Sales Channel (Super Markets), End User (Human {Adults, Senior}, Animal) - Global Forecast to 2031

Report ID: MRFB - 104417 Pages: 325 May-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of the probiotics market is driven by the rising consumer awareness about the health benefits of probiotic-infused foods, the increasing use of probiotics as an alternative to antibiotics, and ongoing research advancements in probiotics. However, stringent regulatory frameworks pertaining to probiotics may restrain market growth. Furthermore, the utilization of probiotics in infant nutrition is expected to create market growth opportunities. Additionally, the rise of e-commerce is a prominent trend in this market.

As emerging technologies enable better analysis of the human microbiome, research into gut flora and probiotics is rising significantly. In recent years, there has been a significant increase in research on probiotics, with a growing number of studies exploring the role of probiotics in maintaining human health and treating various diseases. Research findings also show the potential health benefits of probiotics for certain metabolic syndromes and mental disorders. These results have led to an increase in the development of probiotics for new indications.

Beyond traditional uses, such as in yogurt, new areas like application in vaginal and urinary tract disorders are gaining traction, driven by the rising preference for antibiotic-free treatments. Lactobacillus bacterial strains play a crucial role in enhancing vaginal health. As scientific research expands into probiotics' applications for various health issues, including vaginal & urinary tract disorders, the demand for probiotics is anticipated to increase in the coming years.

Click here to: Get a Free Sample Copy of this Report

Amid growing concerns about antibiotic resistance and the need for sustainable healthcare approaches, the use of probiotics as an alternative to antibiotics has gained popularity in recent years. Probiotics, comprising live bacteria and yeasts, offer various health benefits by restoring and balancing beneficial bacteria in the digestive system.

Probiotics are considered a safe and efficient antibiotic alternative and have garnered attention, particularly with the ban on the use of antibiotics to promote livestock growth in Europe and the U.S., leading to heightened demand for natural growth promoters. Initiatives like the Farm Animal Investment Risk and Return Initiative (FAIRR) aim to safeguard public health while fostering long-term value by advocating for reduced antibiotic use in global food supply chains. This involves establishing antibiotic policies to phase out routine prophylactic use, setting clear targets and timelines for implementation, and enhancing transparency through reporting and data verification.

Furthermore, probiotics are increasingly integrated into compound animal feed for cattle and poultry, aiming to enhance animal performance and overall health. Studies indicate that weekly use of Bifidobacterium and Lactobacillus in poultry feed significantly reduces feed intake, improves feed conversion ratio, and boosts feed efficiency. For instance, according to the Veterinary World Organization, incorporating 0.5% Bifidobacterium and 0.25% Lactobacillus in poultry feed leads to optimal results, including lower feed intake and higher egg weight in the first week, along with a substantial increase in feed efficiency.

Consumer spending on probiotic products through online distribution channels is experiencing significant growth. The growing health consciousness and the increasing demand for supplements to support healthy lifestyles have significantly fueled the demand for probiotics. Moreover, the convenience offered by online purchases compared to traditional retail channels has led to a surge in online probiotic sales.

Furthermore, major companies are expanding their e-commerce presence into other countries to tap into growing markets. For instance, the South Korean probiotic brand Youguth is extending its reach in Singapore through e-commerce.

Additionally, numerous companies are targeting e-commerce sales for their products. For instance, BioGaia has partnered with e-commerce giants such as Amazon (U.S.) and Alibaba (China) to employ a flexible business model that targets both healthcare professionals through medical marketing and end consumers through major e-commerce platforms.

Moreover, the emergence of direct-to-consumer (DTC) probiotics brands has disrupted the market by offering personalized products, subscription-based services, and enhanced customer experiences. These factors collectively drive the demand for probiotics.

In recent years, the inclusion of probiotic supplementation in food and their promotion as dietary supplements has become increasingly common. During childhood and adolescence, obtaining adequate nutrients is crucial for ensuring optimal health. While most children receive sufficient nutrients from a balanced diet, probiotics can play a vital role in nurturing their bodies. Moreover, incorporating probiotic ingredients into infant formula may aid newborns in combating infections (source: Journal of Parenteral and Enteral Nutrition). However, evidence regarding the effectiveness of probiotics for various infant conditions remains mixed.

Furthermore, the rising number of child deaths due to undernutrition and the rising prevalence of obesity in this age group are anticipated to fuel the demand for external nutritional supplements, consequently driving the demand for high-nutritional probiotics, particularly in low- and middle-income countries.

Based on strain, the probiotics market is segmented into bacteria yeast strain products and yeast strain products. In 2024, the bacteria strain products segment is expected to account for the larger share of 86.4% of the probiotics market. This segment’s large market share can be attributed to the widespread incorporation of bacteria strain probiotics in various commercial dairy products such as sour and fresh milk, yogurt, and cheese. Moreover, the increasing prevalence of gastrointestinal and extraintestinal disorders, coupled with a growing awareness and preference for nutrient-rich foods, are expected to drive the growth of this segment.

Based on product type, the probiotics market is segmented into functional food & beverages, medical & dietary supplements, and animal feed. In 2024, the functional food & beverage segment is expected to account for the largest share of 68.5% of the probiotics market. This segment’s large market share can be attributed to the growing consumer interest in functional food, particularly probiotics that can support digestive health, rising health and wellness trends, and the growing application of probiotics in yogurt.

However, the medical & dietary supplements segment is projected to register the highest CAGR of 9.2% during the forecast period. The growth of this segment is driven by the rising prevalence of gut-related diseases and growing awareness regarding the health benefits of supplements.

Based on form, the probiotics market is segmented into liquid probiotics and dry probiotics. In 2024, the liquid probiotics segment is expected to account for the larger share of 60.0% of the probiotics market. This segment’s large market share can be attributed to the versatility of liquid probiotics, available in various forms such as liquid supplements and probiotic-enriched beverages. Additionally, liquid probiotics are favored by demographics such as infants, older adults, and individuals who face difficulty swallowing tablets.

However, the dry probiotics segment is projected to register a higher CAGR of 8.5% during the forecast period. The growth of this segment can be attributed to the advantages offered by dry probiotics compared to the liquid form, including a longer shelf life, better handling and transport capabilities, ease of use, and cost-effectiveness.

Based on sales channel, the probiotics market is segmented into online sales and offline sales. In 2024, the offline sales segment is expected to account for the largest share of 75.3% of the probiotics market. This segment’s large market share can be attributed to the increasing per capita disposable incomes, rising adoption of healthy eating habits, and the growing urban population. Additionally, the proliferation of pharmacies and the rapid growth of the probiotic supplements industry are expected to offer significant growth opportunities for players operating in the offline market.

However, the online sales segment is projected to register a higher CAGR of 10.0% during the forecast period. The growth of this segment is driven by the rising consumer preference for online shopping, driven by the numerous benefits offered by online platforms, including convenience, personalization options, contactless shopping experiences, easy comparison of prices between brands, availability of diverse brands, and greater discounts compared to offline stores.

Based on end user, the probiotics market is segmented into humans and animals. In 2024, the humans segment is expected to account for the largest share of 93.3% of the probiotics market. Scientific research and technological advancements in the field of human-grade probiotics have expanded the range of products suitable for human consumption. This development has prompted leading market players to incorporate novel human-grade ingredients into juices and other non-milk-based applications. Furthermore, the utilization of probiotics for addressing digestive tract issues in humans has increased the demand for probiotic products. These factors contribute to the large market share of this segment.

However, the animal segment is projected to register a higher CAGR of 7.7% during the forecast period. This growth can be attributed to several factors, including increasing pressure to reduce the use of antibiotics in feed and the rising demand for meat and meat products, which are expected to drive the demand for probiotics in animal feed formulations.

Based on region, the probiotics market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia-Pacific region is expected to command the largest share of 45.6% of the probiotics market. Asia-Pacific’s probiotics market is estimated to be worth USD 29.0 billion in 2024. Asia-Pacific’s significant market share can be attributed to the increasing shift towards the adoption of non-dairy probiotic food (cereal-based fruit and vegetable juices), coupled with the presence of many companies in the Chinese digestive health ingredient market. Additionally, the rising consumer interest in probiotic supplements and a growing focus on improving immune health, driven by the understanding of the links between microbial activities in the gut and their effects on immunity, contributes to the increasing demand for probiotics across the region.

However, the Middle East & Africa is expected to record the highest CAGR of 9.7% during the forecast period. The growth of this regional market is mainly attributed to the increasing disposable incomes, initiatives by market players to promote the use of probiotics, rising health-conscious consumers, growing demand for functional food, and increasing demand for meat.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the probiotics market are Probi AB (Sweden), BioGaia AB (Sweden), Nestlé S.A. (Switzerland), Novonesis Group (Denmark), Danone S.A. (France), Yakult Honsha Co., Ltd. (Japan), Lallemand Inc. (Canada), Lifeway Foods Inc. (U.S.), International Flavors & Fragrances Inc. (U.S.), Kerry Group plc (Ireland), Archer-Daniels-Midland Company (U.S.), KeVita, Inc. (a part of PepsiCo Inc.) (U.S.), Infinant Health Inc. (U.S.), Cell Biotech Co., Ltd. (Korea), and Probiotical S.p.A. (Italy).

|

Particulars |

Details |

|

Number of Pages |

325 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

6.7% |

|

Market Size (Value) |

USD 100.10 Billion by 2031 |

|

Segments Covered |

By Strain

By Product Type

By Form

By Sales Channel

By End User

|

|

Countries Covered |

North America (U.S., Canada), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Europe (France, Germany, Italy, Spain, U.K., Russia, and Rest of Europe), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa. |

|

Key Companies |

Probi AB (Sweden), BioGaia AB (Sweden), Nestlé S.A. (Switzerland), Novonesis Group (Denmark), Danone S.A. (France), Yakult Honsha Co., Ltd. (Japan), Lallemand Inc. (Canada), Lifeway Foods Inc. (U.S.), International Flavors & Fragrances Inc. (U.S.), Kerry Group plc (Ireland), Archer-Daniels-Midland Co. (U.S.), KeVita, Inc. (a part of PepsiCo Inc.) (U.S.), Infinant Health Inc. (U.S.), Cell Biotech Co., Ltd. (Korea), and Probiotical S.p.A. (Italy). |

The probiotics market refers to the global industry for products containing live microorganisms, primarily bacteria and yeasts, which provide health benefits when consumed. Probiotics are commonly found in foods like yogurt, supplements, and animal feed, and they are used to improve digestive health, immune function, and more.

As of 2023, the probiotics market is valued at $59.99 billion.

The probiotics market is projected to grow to $100.1 billion by 2031, expanding from $63.62 billion in 2024 at a CAGR of 6.7% from 2024 to 2031.

The market size in 2023 is $59.99 billion and is expected to reach $100.1 billion by 2031.

Major companies in the probiotics market include:

A major trend in the probiotics market is the rise of e-commerce as a distribution channel, along with the growing popularity of direct-to-consumer brands offering personalized probiotics and subscription services.

Key drivers include:

The probiotics market is segmented by:

The global outlook is strong, with significant growth expected in Asia-Pacific, which holds the largest market share, followed by Europe and North America. The Middle East & Africa region is expected to grow the fastest at a 9.7% CAGR.

The probiotics market is projected to grow at a CAGR of 6.7% during the forecast period from 2024 to 2031.

The probiotics market is expected to grow at a CAGR of 6.7% from 2024 to 2031.

The Asia-Pacific region holds the largest share of the probiotics market, accounting for 45.6% of the total market in 2024.

Published Date: May-2023

Published Date: Jun-2022

Published Date: Jun-2023

Published Date: Jan-2025

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates