Resources

About Us

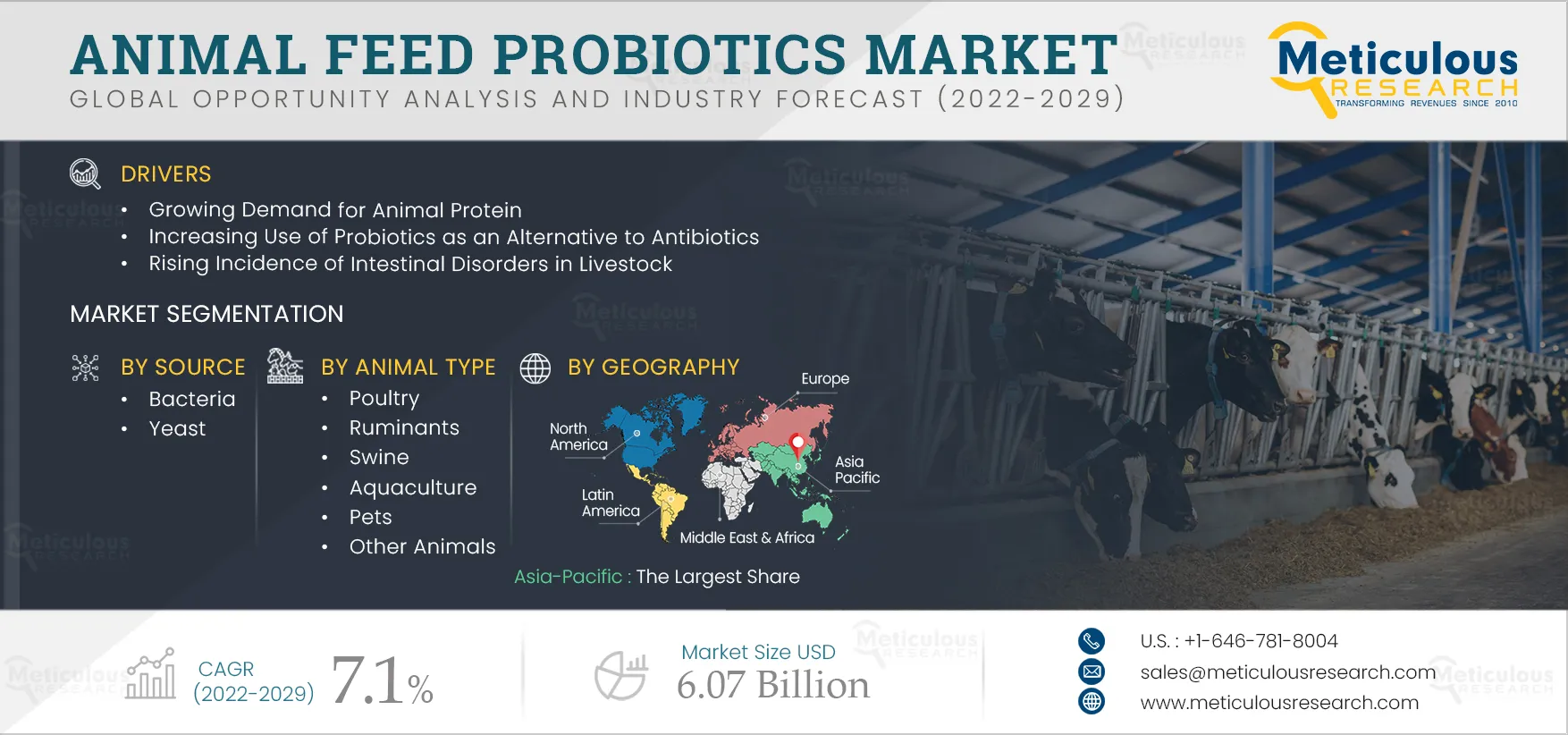

Animal Feed Probiotics Market by Source (Bacteria [Lactobacillus, Bifidobacterium, Streptococcus thermophilus, Bacillus]), Animal Type (Poultry, Ruminants, Swine, Aquaculture, Pets, Other Animals), Form (Liquid), and Geography - Global Forecast to 2029

Report ID: MRFB - 104602 Pages: 231 Jun-2022 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe Probiotics in Animal Feed Market is expected to reach $6.07 billion by 2029, at a CAGR of 7.1% during the forecast period 2022 to 2029. The growth of this market is attributed to the growing demand for animal protein, the increasing use of probiotics as an alternative to antibiotics, the rising incidence of intestinal disorders in livestock, and the increasing production of compound feed.

Furthermore, the shift toward natural growth promoters is expected to create lucrative opportunities for players operating in this market. However, the complex regulations regarding the use of probiotics in animal feed products are expected to hinder the growth of this market to a notable extent.

The outbreak of the COVID-19 pandemic significantly impacted public health and the supply chain across various industries. Since the COVID-19 outbreak in December 2019, the disease has spread to almost 100 countries worldwide, with the World Health Organization declaring it a public health emergency. The COVID-19 pandemic significantly affected the animal feed probiotics market in 2020.

The global export of chicken, beef, and pork witnessed a significant decline due to the challenges posed by the outbreak of the COVID-19 pandemic. Furthermore, the U.S. government imposed curfews, resulting in many farmers resorting to panic-buying of animal feed to avoid potential shortages. Additionally, the transportation & logistics sector was significantly affected due to employees contracting COVID-19, which reduced deliveries and compelled farmers to stock their animal feed supplies

In addition, truncated air freight capacity, port congestion, roadblocks, and logistic disruptions in Southeast Asia escalated as governments implemented strict measures to curb the spread of COVID-19. The consumption of fish, poultry, pork, and beef declined in Southeast Asian economies during the second quarter of 2020. Thus, the decline in fish consumption, poultry, pork, and beef reduced the market demand for animal feed probiotics

Therefore, the adverse effects on the transportation & logistics industry and reduced production due to lockdowns worldwide negatively affected the animal feed probiotics market in terms of volume sales in 2020 and 2021.

Click here to: Get Free Sample Copy of this report

Increasing use of Probiotics as an Alternative to Antibiotics Fuels the Growth of the Probiotics in Animal Feed Market

Probiotics are live bacteria and yeasts which induce various health benefits. They restore and balance good bacteria in the digestive system. Probiotics are considered a safe and efficient alternative to antibiotics. According to the Natural Resources Defense Council, in the U.S., antibiotic resistance causes more than 2.8 million infections and leads to between 35,000 and 162,000 deaths of animals each year. Thus, alternative control and management measures are required to effectively manage antibiotic resistance. The increasing need for alternative control and management measures has boosted the demand for environmentally friendly treatments to control antibiotic-resistant diseases in animals, driving the demand for probiotics.

Furthermore, the ban on the use of antibiotics in Europe and the U.S. has created a high demand for natural growth promoters. The Farm Animal Investment Risk and Return Initiative (FAIRR) focuses on protecting public health and creating long-term value. This initiative has convinced 20 global food companies to limit the use of antibiotics in global supply chains. This can be achieved by establishing an antibiotics policy to phase out routine, prophylactic use across all supply chains, specifying clear targets and timelines for implementation, and increasing transparency by reporting on implementation and data verification.

In addition, probiotics are increasingly used in compound animal feed for cattle and poultry to improve animal performance and health. Furthermore, probiotics also help reduce feed intake, feed conversion ratio, and increase feed efficiency. The weekly use of 0.5% of Bifidobacterium and 0.25% of Lactobacillus in poultry feed results in the lowest feed intake is 112.11–112.19 g/day, and the highest egg weight is 60.28 g in the first week (Source: Veterinary World Organization). Additionally, it also increases feed efficiency by 44-45%. Hence, probiotics in the poultry industry help increase production, which is expected to accelerate its demand in the animal feed industry.

Yeast Segment to Grow at a Higher CAGR During the Forecast Period

Based on source, the probiotics in animal feed market is segmented into bacteria and yeast. The yeast segment is expected to grow at a higher CAGR during the forecast period of 2022–2029. The growth of this segment is attributed to the stringent regulations on the use of antibiotics in animal feed in several European and North American countries. Furthermore, the use of yeast strain probiotics in animal feed improves fiber digestibility and animal performance, which increases milk and egg production.

Poultry Segment to Dominate the Animal Feed Probiotics Market in 2022

Based on animal type, the probiotics in animal feed market is segmented into poultry, ruminants, swine, aquaculture, pets, and other animals. In 2022, the poultry segment is estimated to account for the largest share of the animal feed probiotics market. The large market share of this segment is attributed to the increasing consumption of poultry meat and the growing demand for antibiotic-free poultry products. Furthermore, the high demand and production of poultry meat in developing countries increase the demand for probiotics to improve yield and safety, boosting the demand for probiotics in the poultry sector.

Dry Segment to Grow at a Higher CAGR During the Forecast Period

Based on form, the animal feed probiotics market is segmented into liquid and dry. The dry segment is expected to grow at a higher CAGR during the forecast period of 2022–2029. The dry form of probiotics is mainly preferred in animal feed applications due to ease of storage & transportation, low storage costs, and longer shelf life. Thus, the benefits offered by dry probiotics drive their demand in the market.

Asia-Pacific: To Dominate the Animal Feed Probiotics Market in 2022

Based on geography, the probiotics in animal feed market is segmented into five major geographies: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2022, Asia-Pacific is expected to account for the largest share of the animal feed probiotics market. Asia-Pacific's large market share is attributed to factors such as increased consumer awareness about various diseases, the large production of poultry and cattle meat in countries such as China and India, and the rising number of innovations in probiotic formulations.

In addition, the growing demand for safe and nutritional animal feed and the stringent regulations on the use of antibiotics in feed supplements are expected to offer lucrative opportunities for key players operating in this market.

Key Players

The key players operating in the animal feed probiotics market include The Archer-Daniels-Midland Company (U.S.), Chr. Hansen Holding A/S (Denmark), Lallemand Inc. (Canada), Dupont de Nemours, Inc. (U.S.), Evonik Industries AG (Germany), Koninklijke DSM N.V. (Netherlands), Orffa International Holding B.V. (Netherlands), Novozymes A/S (Denmark), Kemin Industries (U.S.), and Provita Eurotech Ltd (U.K.).

Scope of the Report:

Animal Feed Probiotics Market, by Source

Animal Feed Probiotics Market, by Animal Type

Animal Feed Probiotics Market, by Form

Animal Feed Probiotics Market, by Geography

Key Questions Answered in the Report-

Published Date: Aug-2024

Published Date: May-2024

Published Date: May-2024

Published Date: Jan-2024

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates