Resources

About Us

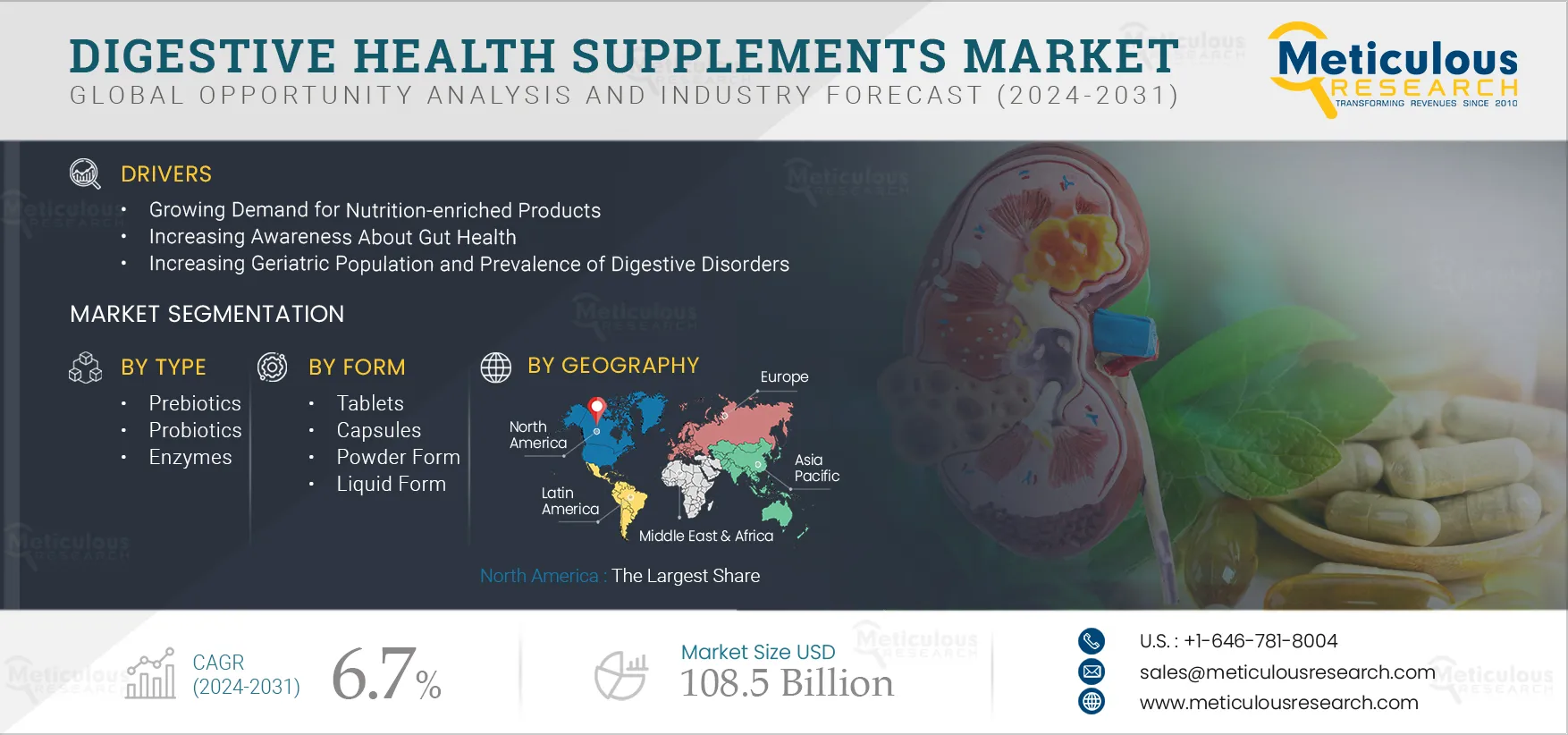

Digestive Health Supplements Market by Type (Probiotics, Prebiotics, Enzymes), Form (Tablets, Capsules, Powder, Liquid), Distribution Channel (Convenience Store, Supermarkets, Pharmacies, E-commerce), and Geography - Global Forecast to 2032

Report ID: MRFB - 1041096 Pages: 250 Aug-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe surge in popularity of digestive food supplements aligns with the societal shift towards reducing animal cruelty. The market for these supplements is propelled by a rising appetite for nutritionally enhanced products, heightened awareness concerning gut health, a growing elderly demographic, and a prevalence of digestive disorders. Additionally, ongoing innovations and the introduction of new products contribute to the market's expansion. Despite these factors, the growth of the market may face challenges due to stringent regulations and the elevated cost of these products.

As individuals age, there is a gradual decline in the structure and function of organs. According to the United Nations and data from World Population Prospects, the proportion of people aged 65 and above is projected to increase significantly by 2050, reaching one in six globally. This is a notable rise from one in eleven in 2019. Europe and Northern America could see one in four individuals being 65 or older by 2050. A historic shift occurred in 2018 when the global population of those aged 65 and above exceeded that of children under five for the first time. Furthermore, the number of individuals aged 80 and above is expected to triple, soaring from 143 million in 2019 to 426 million in 2050.

Click here to: Get Free Sample Pages of this Report

The elderly population is particularly susceptible to various digestive disorders, including dyspepsia, irritable bowel syndrome, and inflammatory bowel disease. Considering this broader context, the escalating geriatric demographic and the heightened prevalence of digestive disorders are anticipated to drive the demand for digestive health supplements in the foreseeable future.

Nutrition and diet are important factors in the maintenance and promotion of good health throughout the entire life course. Digestive disorders are largely preventable diseases, and their prevention by modification in diet is a better option than expensive treatments. Supplements can prevent many diseases and provide essential human nutrients. Hence, with the rising digestive disorders burden, the demand for digestive supplements is growing, fueling the growth of the digestive health supplements market.

Furthermore, the rise in the incidence of digestive disorders has also led to increased interest in personalized nutrition, which involves tailoring dietary recommendations to an individual's specific needs and health concerns. Health supplements products can be a key in personalized nutrition, providing targeted health benefits based on an individual's health needs.

Thus, the increasing geriatric population, lifestyle changes, and rise in incidences of digestive disorders have increased the demand for digestive health supplements that support better health.

Based on type, the digestive health supplements market is segmented into probiotics, prebiotics, enzymes, and other products. In 2025, the probiotics segment is expected to account for the largest share of the digestive health supplements market. The segment’s large market share is attributed to the increasing use of probiotics as an alternative to antibiotics, the growing use of probiotics for children, increasing research and development activities on probiotics, and the prevalence of digestive disorders.

Based on form, the digestive health supplements market is segmented into tablets, capsules, powder form, liquid form, and other forms. In 2025, the tablets segment is expected to account for the largest share of the digestive health supplements market. The large market share of this segment is attributed to ease of consumption, preserving the nutritional value with no bad taste, low cost, and higher shelf life.

Based on distribution channel, the digestive health supplements market is segmented into supermarkets & hypermarkets, convenience stores, specialty stores, pharmacies & drug stores, e-commerce, and other distribution channels. In 2025, the supermarkets & hypermarkets segment is expected to account for the largest share of the digestive health supplements market. The large market share of this segment is attributed to rapid urbanization, rising per capita disposable incomes, growing number of supermarkets and hypermarkets, and increased sales of health supplements in well-established supermarkets and hypermarkets.

The digestive health supplements market is segmented into five major regions—North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of the digestive health supplements market. North America’s large share is attributed to the increasing aging population, growing lifestyle-related diseases, increasing digestive-related disorders, and the presence of the leading key players in the region.

However, Asia-Pacific is slated to register the highest CAGR during the forecast period. The growth of this regional market is driven by increasing disposable incomes, growing awareness about the benefits of dietary supplements, and rising health wellness trends. Also, changes in lifestyle in countries such as China, Japan, and India further support the growth of this market in the region.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments of leading market players. Some of the key players operating in the digestive health supplements market are Nestlé S.A. (Switzerland), Bayer AG (Germany), Herbalife Nutrition Ltd. (U.S.), Pfizer Inc. (U.S.), Abbott Laboratories (U.S.), Amway Corporation (U.S.), Danone S.A. (France), NOW Foods (U.S.), PrecisionBiotics (Ireland), and BioGaia (Sweden).

|

Particular |

Details |

|

Page No. |

~250 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2022 |

|

CAGR |

6.7% |

|

Market Size (Value) |

$108.5 Billion |

|

Market Size (Volume) |

NA |

|

Segments Covered |

By Type

By Form

By Distribution Channel

By Region

|

|

Countries/Regions Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Nestlé S.A. (Switzerland), Bayer AG (Germany), Herbalife Nutrition Ltd. (U.S.), Pfizer Inc. (U.S.), Abbott Laboratories (U.S.), Amway Corporation (U.S.), Danone S.A. (France), NOW Foods (U.S.), PrecisionBiotics (Ireland), and BioGaia (Sweden) |

The digestive health supplements market is projected to reach $108.5 billion by 2032, at a CAGR of 6.7% from 2025 to 2032.

The prebiotics segment is slated to register the highest growth rate during the forecast period and provide significant opportunities for the players operating in this market.

The e-commerce segment is slated to register the highest growth rate during the forecast period and provide significant opportunities for the players operating in this market.

The major players operating in the digestive health supplement market are Nestlé S.A. (Switzerland), Bayer AG (Germany), Herbalife Nutrition Ltd. (U.S.), Pfizer Inc. (U.S.), Abbott Laboratories (U.S.), Amway Corporation (U.S.), Danone S.A. (France), NOW Foods (U.S.), PrecisionBiotics (Ireland), and BioGaia (Sweden).

Asia-Pacific is slated to register the highest CAGR during the forecast period. The growth of this regional market is driven by increasing disposable incomes, growing awareness about the benefits of dietary supplements, and rising health wellness trends. Also, changes in lifestyle in countries such as China, Japan, and India further support the growth of this market in the region.

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Nov-2024

Published Date: Oct-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates