Resources

About Us

Power Tiller and Cultivator Market by Product Type (Two-Wheel, Four-Wheel, Rotary, Mini, Handheld Tillers, Cultivators), Fuel Type (Diesel, Gasoline, Electric), Horsepower, Tilling Width, Mechanism, Application – Global Industry Analysis & Forecast 2025-2035

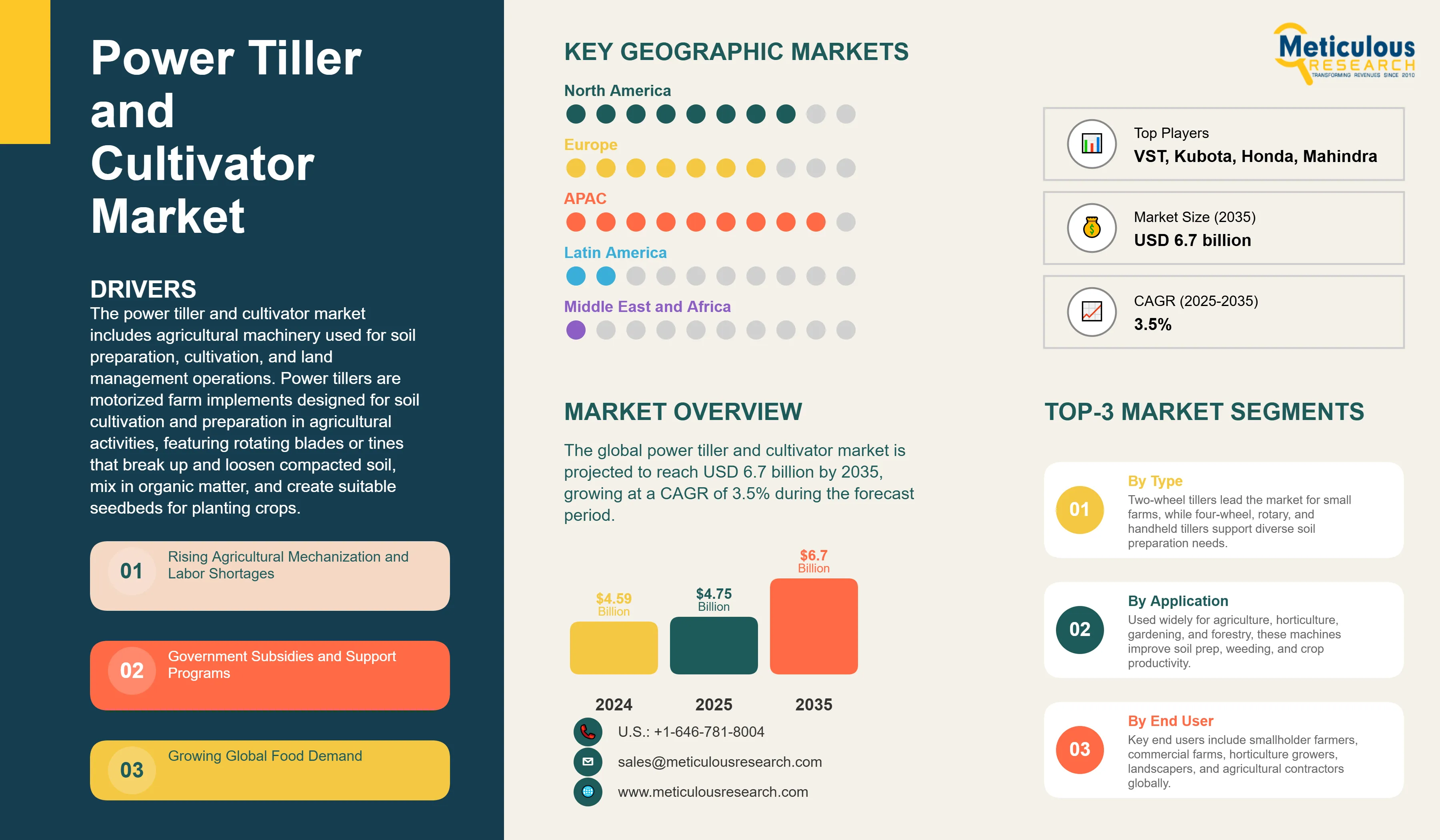

Report ID: MRAGR - 1041635 Pages: 227 Dec-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe global power tiller and cultivator market is valued at USD 4.75 billion in 2025 and is projected to reach USD 6.7 billion by 2035, growing at a CAGR of 3.5% during the forecast period.

What is the Power Tiller and Cultivator Market?

The power tiller and cultivator market includes agricultural machinery used for soil preparation, cultivation, and land management operations. Power tillers are motorized farm implements designed for soil cultivation and preparation in agricultural activities, featuring rotating blades or tines that break up and loosen compacted soil, mix in organic matter, and create suitable seedbeds for planting crops. Cultivators are agricultural implements designed to till the soil, control weeds, and prepare seedbeds for planting, available in various sizes, configurations, and power options to accommodate different farming systems, crop types, and field conditions.

Power tillers typically feature a single axle that dictates the direction of travel and can be walk-behind or riding attachment types, making them ideal for small and marginal farms. These versatile machines can also be coupled to a trailer for transporting goods and products. Cultivators serve multiple purposes including removing unwanted weeds, aerating soil, and loosening the ground after crop cultivation. The market serves diverse end-users ranging from individual gardeners and smallholder farmers to larger agricultural entities, with applications spanning seedbed preparation, weeding, and mixing compost or fertilizers into the soil.

The global power tiller and cultivator market has emerged as an essential segment of the agricultural machinery industry, driven by increasing mechanization in agriculture, rising labor costs, and the need for efficient farming techniques. The market growth is attributed to the expansion of the agriculture sector, advanced development in technology, and rising government initiatives promoting farm mechanization. These machines have gained popularity in both developed and developing countries due to their efficiency, ease of use, and ability to boost agricultural productivity while reducing manual labor requirements.

The global power tiller and cultivator market is valued at USD 4.75 billion in 2025 and is projected to reach USD 6.70 billion by 2035, growing at a CAGR of 3.5% during the forecast period.

|

Parameter |

Details |

|

Market Size (2025) |

USD 4.75 Billion |

|

Market Size (2034) |

USD 6.7 Billion |

|

CAGR (2025-2034) |

3.5% |

|

Base Year |

2024 |

|

Forecast Period |

2025-2035 |

|

Largest Regional Market |

Asia-Pacific |

|

Fastest Growing Region |

Latin America |

|

Dominant Product Type |

Two-Wheel Power Tillers |

|

Leading Fuel Type |

Diesel |

|

Top Horsepower Segment |

10-20 HP |

|

Key Application |

Agriculture |

|

Major Players |

VST Tillers, Kubota, Honda, Mahindra, Yanmar, Deere & Company, TAFE, AGCO, CNH Industrial |

|

Key Growth Drivers |

Agricultural mechanization, labor shortages, government subsidies, rising food demand, technological advancements |

Click here to: Get Free Sample Pages of this Report

What are the major trends shaping up in the power tiller and cultivator market?

Rise of the Electric and Hybrid Power Tillers

The global push for sustainable agriculture is accelerating the adoption of electric and hybrid power tillers, driven by concerns over environmental sustainability and rising fuel costs. Electric power tillers produce lower emissions and often have reduced operational costs compared to their fossil fuel counterparts. In November 2025, VST Tillers Tractors Ltd. unveiled India's first EV Power Tiller and EV Power Weeder at EIMA Agrimach 2025, marking a significant milestone in the transition to clean energy farming solutions. The electric segment is projected to grow at the highest CAGR during the forecast period, fueled by environmental concerns and decreasing battery costs.

Integration of GPS, IoT, and Smart Farming Technologies

The growth of precision agriculture is driving integration of advanced technologies into tiller machines, including GPS-guided navigation, IoT sensors, and AI-powered decision-making systems. Modern tillers equipped with smart features offer adjustable tilling depths, user-friendly controls, and lightweight materials that enhance maneuverability. The development of smart tillers with GPS and remote-control capabilities is enabling improved farm efficiency and data-driven farming solutions.

Developing Fuel-Efficient and Ergonomic Designs

Manufacturers are prioritizing designs that minimize fuel consumption and reduce emissions while improving operator comfort. Advanced features include self-start functionality, improved suspension seats, air cleaners with indicators, and LED headlights. In June 2022, Kirloskar Oil Engines Limited (KOEL) launched power tillers featuring K-Cool technology engines with self-start capabilities in 12 HP and 15 HP variants, ensuring smooth and continuous operation. The lightweight nature of modern tillers (approximately 60-70 kg for weeders and 200-500 kg for tillers) makes them suitable for use in hilly terrain and fragmented land holdings.Recently, VST Tillers Tractors Ltd. launched India's first EV Power Tiller and EV Power Weeder in November 2025, emphasizing sustainable, emission-free operation similar to KOEL's efficiency focus.

Emphasis on multi-purpose compact tillers

There is growing demand for versatile, multi-functional power tillers that can perform multiple agricultural tasks including plowing, harrowing, cultivating, seeding, and spraying. Compact and lightweight tillers are gaining popularity, particularly for small-scale farming and horticulture applications. The trend toward automation includes the development of autonomous power tillers designed to perform farming operations with minimal human intervention, enabling precision agriculture especially in regions facing labor shortages.

What are the dynamics of the power tiller and cultivator market?

Market Drivers

Increasing Agricultural Mechanization and Shortages of Labor

The global trend toward farm mechanization is a primary driver of market growth. As land, water resources, and labor force shrink, the demand for farm mechanization rises significantly, particularly in developing regions. In India, the number of agricultural laborers declined by nearly 15% between 2011-2021, while the agricultural workforce is projected to decline by 25.7% by 2050. Mechanization via implements reduces labor hours by 30-50% and is increasingly necessary as global farm labor availability declines. Over 65% of global farm operations now rely on some form of mechanization, up from 52% in 2015.

Government Subsidies and Support Programs

Government policies offering subsidies, interest-free loans, and financial assistance are fueling the adoption of farm equipment globally. India's Sub-Mission on Agricultural Mechanization provides subsidies of 25% to 50% of equipment cost under various schemes. The U.S. Department of Agriculture (USDA) offers loans to farmers for purchasing farm machinery, and the European Union's Common Agricultural Policy (CAP) provides financial assistance. In Brazil, approximately 50% of implement purchases are incentivized by government subsidies. China allocated 10 billion yuan (USD 1.46 billion) in 2023 for agricultural machinery subsidies.

Growing Global Food Demand

Rising global population, expected to reach approximately 9.7 billion by 2050, is driving the need for increased food production and efficient agricultural practices. This demographic pressure necessitates advanced agricultural technologies that improve productivity while reducing manual labor requirements. The mechanization of farming operations results in increased production and profitability by achieving timeliness in farming operations, preserving farm produce, and reducing post-harvest losses. Power tillers help farmers enhance productivity and streamline agricultural operations.

What are the key segments of the power tiller and cultivator market?

By Product Type

By Fuel Type

By Horsepower HP

By Tillage Width

By Mechanism Type

By Application

Which region leads in the power tiller and cultivator market?

Asia-Pacific dominates the global power tiller and cultivator market in 2025. The largest share of this region is mainly attributed to the high prevalence of small and fragmented landholdings in countries such as India, China, and Vietnam, where power tillers serve as the primary mechanization tool for millions of farmers.

China is the dominant force in the region, accounting for majority of the consumption and production. The Chinese government emphasizes farm mechanization through programs like the Agricultural Machinery Purchase Subsidy, while farm mechanization rate reached approximately 75% by 2020. India represents the second-largest market with significant growth potential, driven by the Sub-Mission on Agricultural Mechanization (SMAM) scheme providing subsidies of up to 50% for small and marginal farmers.

North America holds around 25-30% share of the global power tiller and cultivator market in 2025, with the U.S. market contributing the largest share of this market. The region exhibits a niche presence due to large farms and advanced mechanization, with precision agriculture technologies and ergonomic designs being significant trends.

Europe is focusing heavily on emissions and noise control with Germany, France, and Italy leading the market in 2025. The region's Farm to Fork Strategy and Green Deal mandate reductions in emissions, driving demand for sustainable mechanization solutions.

Latin America is projected to register the highest CAGR during the forecast period. The region's rapid agricultural modernization, coupled with increasing investments in rural infrastructure, creates lucrative opportunities for power tiller manufacturers.

Who are the Major Players in the Power Tiller and Cultivator Market?

The global power tiller and cultivator market features a diverse competitive landscape with the presence of several major players and regional manufacturers. The market is characterized by intense competition, with companies focusing on product innovation, technological advancements, strategic partnerships, and geographical expansion to maintain their market positions.

V.S.T. Tillers Tractors Ltd. (India)

V.S.T. Tillers Tractors Ltd. is one of India's most trusted names in compact farming equipment and a pioneer in the power tiller segment. In November 2025, the company unveiled India's first EV Power Tiller and EV Power Weeder at EIMA Agrimach 2025, developed and manufactured in-house. The company reported 37,297 power tiller sales in FY25, slightly higher than 36,480 units in FY24.

Kubota Corporation (Japan)

Kubota Corporation is a global leader in agricultural machinery, offering a wide range of power tillers from walk-behind to large self-propelled models. Known for reliability, durability, and ease of use, Kubota has a strong presence across Asia, North America, and Europe. The company's extensive distribution network and strong brand recognition contribute to its market leadership. Kubota maintains focus on advanced technology, innovation, and sustainability in agricultural equipment.

Honda Power Equipment (Japan)

Honda Power Equipment offers reliable, high-quality tillers known for fuel efficiency and durability. The company focuses on consumer-friendly designs suitable for both residential and commercial applications. Honda is investing in research to improve battery efficiency of electric tillers, positioning for growth in the sustainable equipment segment.

Mahindra & Mahindra Ltd. (India)

Mahindra & Mahindra is a leading farm equipment manufacturer known for durable and affordable solutions that are widely adopted in emerging markets. In FY2025, the company’s Farm Equipment Sector achieved its highest-ever annual domestic tractor sales, reaching 407,094 units, reflecting 12% year-on-year growth. Mahindra continues to hold its position as the world’s largest tractor manufacturer by volume, supported by strong global demand. In addition to tractors, the company also offers power tillers and farm implements aimed at improving mechanization access for small and medium farmers.

Yanmar Co., Ltd. (Japan)

Yanmar is a pioneer in agricultural automation, offering innovative tiller solutions with advanced features. The company focuses on precision farming technologies and efficient engine design. Yanmar has established strong distribution networks across Asia and other global markets.

Deere & Company (USA)

John Deere is among the world’s leading agritech and farm-machinery companies, offering advanced solutions including digital/precision-agriculture tools and “autonomy-ready” tractors. The company has committed to invest USD 20 billion over the next decade in U.S. manufacturing and production upgrades, a move that supports long-term development of new products and advanced technology. John Deere aims to launch its first all-electric, autonomous-capable tractor (75–100 HP) by 2026.

Other Key Players

Other significant players include TAFE (Tractors and Farm Equipment Limited), Kirloskar Oil Engines Limited, AGCO Corporation, CNH Industrial N.V., Husqvarna AB, Bucher Industries AG, KAMCO (Kerala Agro Machinery Corporation Ltd.), Greaves Cotton Limited, ISEKI & Co. Ltd., CLAAS KGaA mbH, Kuhn Group, BCS America, Schiller Grounds Care Inc., Bull Agro, Escorts Kubota Ltd., Daedong Industrial Co. Ltd., and numerous regional manufacturers.

The global power tiller and cultivator market is valued at USD 4.75 billion in 2025 and is projected to reach USD 6.7 billion by 2035, growing at a CAGR of 3.5% during the forecast period.

Asia-Pacific dominates the market, driven by extensive agricultural sectors and high prevalence of small and fragmented landholdings in countries like India, China, and Vietnam.

Key drivers include rising agricultural mechanization, labor shortages in farming, government subsidies and support programs, growing global food demand, and technological advancements in farm equipment.

The diesel segment holds the largest share of the overall market in 2025, due to its efficiency, power, and suitability for heavy-duty agricultural applications.

The 10-20 HP segment dominates with the highest market share in 2025, driven by the increasing prevalence of small and fragmented land holdings globally.

Major players include V.S.T. Tillers Tractors Ltd., Kubota Corporation, Honda Power Equipment, Mahindra & Mahindra Ltd., Yanmar Co. Ltd., Deere & Company, TAFE, Kirloskar Oil Engines Limited, AGCO Corporation, and CNH Industrial N.V.

1. Introduction

1.1 Market Definition

1.2 Market Ecosystem

1.3 Currency and Study Limitations

1.4 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Data Collection and Validation Process

2.2.1 Secondary Research

2.2.2 Primary Research (Industry Stakeholder Interviews)

2.3 Market Sizing and Forecast Framework

2.3.1 Market Size Estimation Process

2.3.2 Forecasting Methodology

2.4 Study Assumptions

3. Executive Summary

3.1 Market Overview

3.2 Market Analysis, by Product Type

3.3 Market Analysis, by Fuel Type

3.4 Market Analysis, by Horsepower

3.5 Market Analysis, by Application

3.6 Market Analysis, by Geography

3.7 Competitive Overview

4. Market Insights

4.1 Overview

4.2 Factors Influencing Market Growth

4.2.1 Impact of Market Drivers

4.2.1.1 Rising Agricultural Mechanization and Labor Shortages

4.2.1.2 Government Subsidies and Support Programs

4.2.1.3 Growing Global Food Demand

4.2.1.4 Advancements in Farm Mechanization Technology

4.2.2 Impact of Market Restraints

4.2.2.1 High Initial Investment and Maintenance Costs

4.2.2.2 Limited Adoption Among Small and Marginal Farmers

4.2.3 Impact of Market Opportunities

4.2.3.1 Mechanization Demand in Emerging Economies

4.2.3.2 Product Innovation and Electrification Trends

4.2.3.3 Increasing Demand for Compact, Multi-Purpose Machinery

4.3 Value Chain Analysis

4.4 Regulatory and Subsidy Assessment

4.5 Porter’s Five Forces Analysis

4.6 Pricing Analysis

4.7 Technology Landscape (Electric, Hybrid, Smart Sensors, IoT, Automation)

5. Impact of Mechanization, Electrification & Precision Agriculture Trends

5.1 Overview

5.2 Mechanization Roadmap in Small- to Mid-Scale Agriculture

5.3 Impact of Electric and Hybrid Power Tillers

5.4 Autonomous and GPS-Enabled Farm Equipment

5.5 Regional Mechanization Maturity and Adoption Barriers

5.6 Strategic Developments and Innovation Outlook

6. Global Power Tiller & Cultivator Market, by Product Type

6.1 Overview

6.2 Two-Wheel Power Tillers

6.3 Four-Wheel Power Tillers

6.4 Rotary Tillers

6.5 Mini Tillers / Mini Cultivators

6.6 Handheld Power Tillers

6.7 Cultivators

6.7.1 Chisel Cultivators

6.7.2 Triangular Cultivators

6.7.3 Reversible Cultivators

7. Global Power Tiller & Cultivator Market, by Fuel Type

7.1 Overview

7.2 Diesel

7.3 Gasoline / Petrol

7.4 Electric

7.5 Hybrid

8. Global Power Tiller & Cultivator Market, by Horsepower

8.1 Overview

8.2 Below 10 HP

8.3 10–20 HP

8.4 20–30 HP

8.5 30–40 HP

8.6 Above 40 HP

9. Global Power Tiller & Cultivator Market, by Application

9.1 Overview

9.2 Agriculture

9.3 Horticulture / Gardening

9.4 Forestry

9.5 Landscaping

10. Global Power Tiller & Cultivator Market, by Geography

10.1 Overview

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 Spain

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Indonesia

10.4.6 Thailand

10.4.7 Vietnam

10.4.8 Rest of Asia-Pacific

10.5 Latin America

10.5.1 Brazil

10.5.2 Mexico

10.5.3 Argentina

10.5.4 Rest of Latin America

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.2 UAE

10.6.3 South Africa

10.6.4 Nigeria

10.6.5 Rest of Middle East & Africa

11. Competitive Landscape

11.1 Overview

11.2 Key Growth Strategies

11.3 Competitive Dashboard

11.3.1 Market Leaders

11.3.2 Innovators

11.3.3 Emerging Players

11.4 Vendor Positioning Matrix

11.5 Market Share Analysis

12. Company Profiles

(Business Overview, Financial Summary, Product Portfolio, Key Developments, SWOT Analysis)

12.1 V.S.T Tillers Tractors Ltd.

12.2 Kubota Corporation

12.3 Honda Power Equipment

12.4 Mahindra & Mahindra Ltd.

12.5 Yanmar Co., Ltd.

12.6 Deere & Company

12.7 TAFE Ltd.

12.8 Kirloskar Oil Engines Limited

12.9 AGCO Corporation

12.10 CNH Industrial N.V.

12.11 Husqvarna Group

12.12 Bucher Industries AG

12.13 KAMCO

12.14 Greaves Cotton Limited

12.15 ISEKI & Co. Ltd.

12.16 CLAAS KGaA mbH

12.17 Kuhn Group

12.18 BCS America

12.19 Schiller Grounds Care Inc.

12.20 Bull Agro Implements

12.21 Others

13. Appendix

13.1 Available Customization Options

13.2 Related Reports

Published Date: Jan-2026

Published Date: Jan-2026

Published Date: Jan-2026

Published Date: Dec-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates