Resources

About Us

Precision Agriculture Market by Offering (Hardware, Software, Services), Technology (Variable Rate, Guidance, Remote Sensing, Others), Application (Field Mapping, Seeding & Spraying, Crop Monitoring, Others), & Geography - Global Forecast to 2031

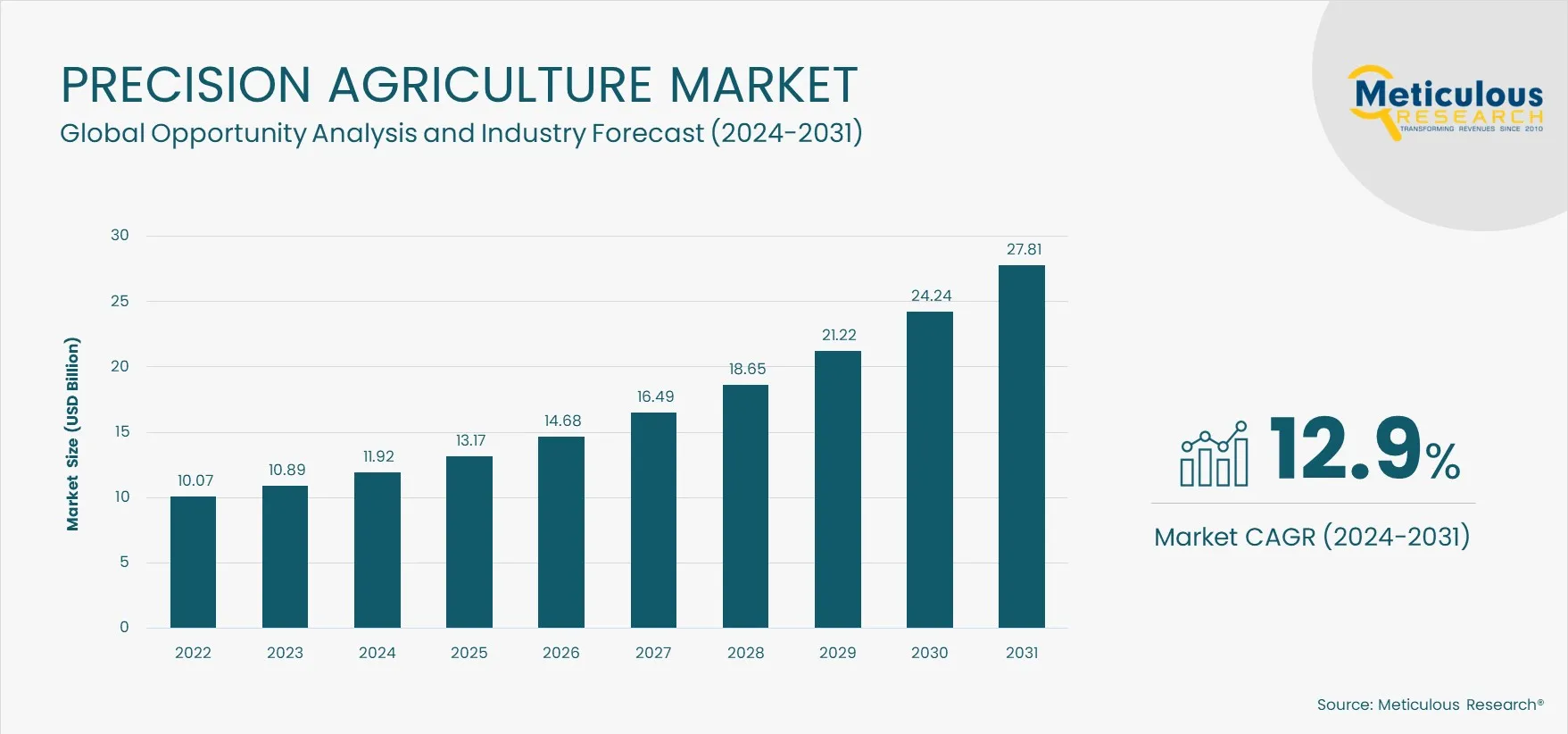

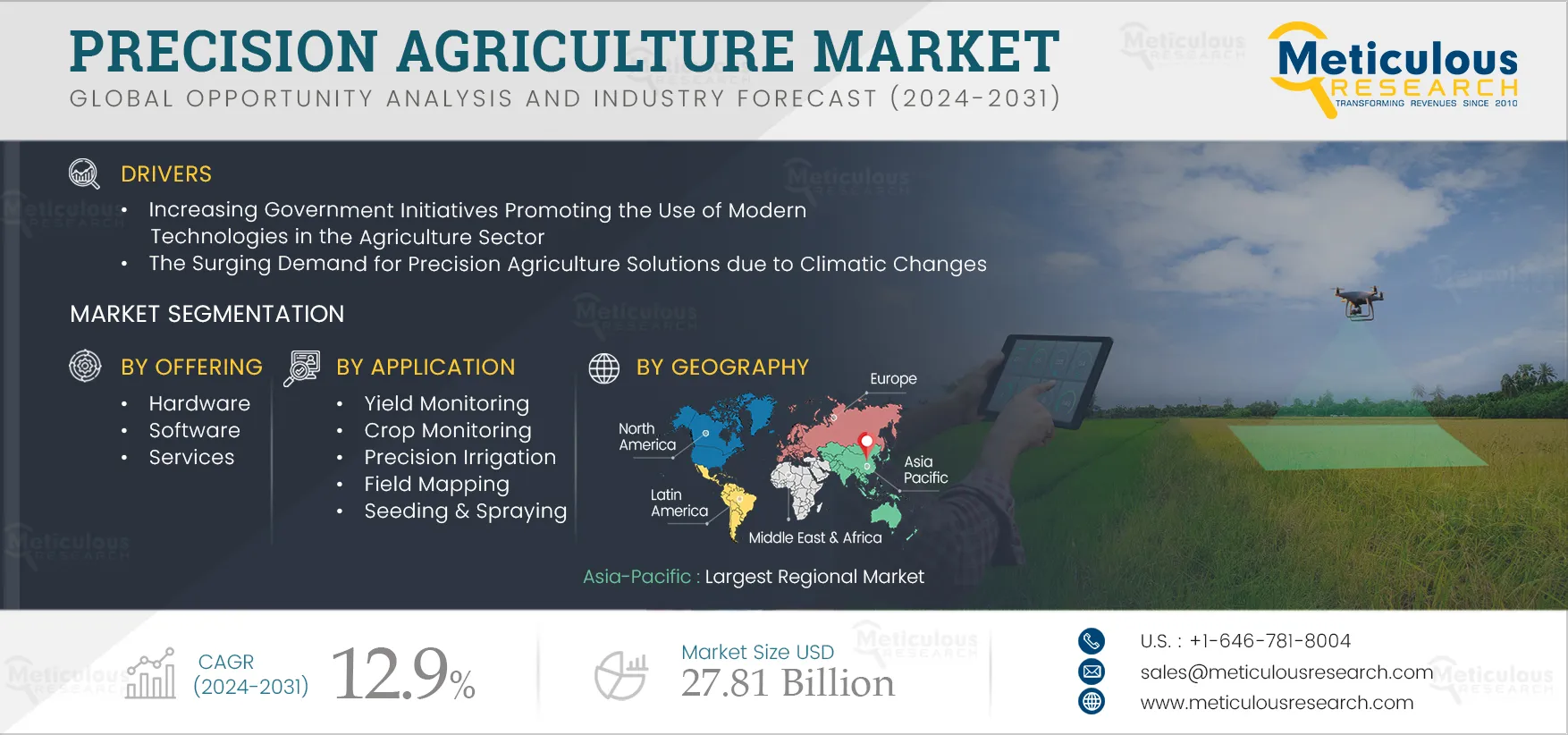

Report ID: MRAGR - 1041102 Pages: 252 Feb-2024 Formats*: PDF Category: Agriculture Delivery: 2 to 4 Hours Download Free Sample ReportThe Precision Agriculture Market is projected to reach $27.81 billion by 2031, at a CAGR of 12.9% from 2024 to 2031. The growth of the precision agriculture market is driven by increasing government initiatives promoting the use of modern technologies in the agriculture sector and the surging demand for precision agriculture solutions due to climatic changes. However, the lack of connectivity and infrastructure in rural areas restrains the growth of this market.

Governments worldwide are recognizing the need to support farmers in adopting sustainable practices and investing in agricultural technologies to build resilience in the agricultural sector. Precision agriculture is an approach where inputs are utilized in precise amounts to get increased average yields compared to traditional cultivation techniques. Governments around the globe are undertaking initiatives to raise awareness among farmers and promote the use of advanced technologies in farming practices.

Government bodies in various countries are focused on launching awareness programs, reforming policies, and forming tie-ups with private sector companies to promote the use of modern technologies in farming. For instance, India’s Ministry of Agriculture & Farmers’ Welfare has undertaken several initiatives, including the National e-Governance Plan in Agriculture (NeGPA), wherein funds are being provided to facilitate the use of modern technologies such as Artificial Intelligence (AI), Machine Learning (ML), robotics, drones, data analytics, and blockchain to encourage digital agriculture in the country.

In addition, international organizations are also scaling up efforts and investing in supporting the agriculture sector. For instance, the World Bank Group’s Climate Change Action Plan (2021-2025) is increasingly supporting climate-smart agriculture across the agriculture and food value chains via policy and technological interventions to enhance productivity, improve resilience, and reduce GHG emissions.

Several governments around the world are encouraging the adoption of disruptive technologies in agricultural applications by providing funding and subsidies to farmers. For instance, in August 2023, Canada’s Ministry of Agriculture and Agri-Food announced investing up to USD 31,796.0 under the Adoption Stream of the Agricultural Clean Technology (ACT) Program to support the François Delorme farm in purchasing fertilizer spreader equipment with variable rate technology. Furthermore, in June 2021, the Victorian Minister for Agriculture (Australia) launched the USD 10 million Digital Agriculture Investment Scheme as part of the Enabling the Digital Agriculture Revolution Program. Grants of up to USD 50,000 were made available to enable eligible farm businesses to invest in on-farm digital technology projects to improve the productivity, resilience, and long-term viability of their farms. Such government initiatives are boosting the adoption of precision agriculture solutions among farmers, driving the growth of this market.

Click here to: Get Free Sample Pages of this Report

Based on offering, the global precision agriculture market is broadly segmented into hardware, software, and services. In 2024, the hardware segment is expected to account for the largest share of the global precision agriculture market. The large market share of this segment is attributed to factors such as increased use of sensing and monitoring devices to obtain real-time information about crop yield, increased need to monitor agriculture data for decision making, and increased partnership between companies to increase adoption of robot platforms.

In addition, governments worldwide are providing funding for agriculture projects, contributing to the increased adoption of precision agriculture hardware in the agricultural sector. For instance, in February 2023, the government of Jammu and Kashmir (India) approved a project worth USD 3.68 million (INR 304.0 million) named "Sensor-based Smart Agriculture." This project aims to integrate agriculture with technology, utilizing artificial insemination and the Internet of Things (IoT) for the automation of practices, improved resource use efficiency, and enhanced profitability.

Based on technology, the global precision agriculture market is segmented into guidance technology, variable rate technology, remote sensing technology, and other technologies. In 2024, the guidance technology segment is expected to account for the largest share of the global precision agriculture market. The large market share of this segment is attributed to factors such as the increasing use of guidance technology for achieving a high degree of accuracy and automation in farming equipment, and growing initiatives of companies on product development and expanding distribution of guidance systems.

Based on application, the global precision agriculture market is segmented into field mapping, seeding & spraying, crop monitoring, yield monitoring, precision irrigation, and other applications. In 2024, the yield monitoring segment is expected to account for the largest share of the global precision agriculture market. The large market share of this segment is attributed to the increasing development of yield monitors for gathering a huge amount of yield information and the growing integration of yield monitors on harvester equipment.

Based on geography, the precision agriculture market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of the global precision agriculture market. The large market share of this segment is attributed to the increased use of precision agriculture solutions to address the growing labor scarcity issue in the region and increased pressure on the food supply chain.

In addition, the increasing use of precision agriculture technologies for improving agricultural services in the region is contributing to the market’s growth in the region. For instance, in April 2022, Chinese meteorologists launched monitoring and assessment services for winter wheat distribution across the country based on remote sensing satellite technology.

Some of the key players operating in the precision agriculture market are Deere & Company (U.S.), AGCO Corporation (U.S.), Topcon Corporation (Japan), Trimble Inc. (U.S.), Raven Industries, Inc. (U.S.) CropX Inc. (Israel), AgEagle Aerial Systems Inc. (U.S.), Netafim Ltd. (Israel), Farmers Edge Inc. (Canada), AgJunction LLC (U.S.), AMVAC Chemical Corporation (U.S.), YANMAR HOLDINGS CO., LTD. (Japan), Ag Leader Technology (U.S.), Ecorobotix SA (Switzerland), BASF SE (Germany), Climate LLC (U.S.), TeeJet Technologies (U.S.), DICKEY-john (U.S.), XMachines (India), Naïo Technologies (France), Robotics Plus Limited (New Zealand), FieldBee (Netherlands), Agremo (Serbia), Verdant Robotics (U.S.), Agrobot (Spain), SZ DJI Technology Co., Ltd. (China), XAG Co., Ltd. (China), and Terra Drone Corporation (Japan).

|

Particulars |

Details |

|

Number of Pages |

252 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

12.9% |

|

Estimated Market Size (Value) |

$27.81 billion by 2031 |

|

Segments Covered |

By Offering

By Technology

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), Latin America, and the Middle East & Africa. |

|

Key Companies |

Deere & Company (U.S.), AGCO Corporation (U.S.), Topcon Corporation (Japan), Trimble Inc. (U.S.), Raven Industries, Inc. (U.S.) CropX Inc. (Israel), AgEagle Aerial Systems Inc. (U.S.), Netafim Ltd. (Israel), Farmers Edge Inc. (Canada), AgJunction LLC (U.S.), AMVAC Chemical Corporation (U.S.), YANMAR HOLDINGS CO., LTD. (Japan), Ag Leader Technology (U.S.), Ecorobotix SA (Switzerland), BASF SE (Germany), Climate LLC (U.S.), TeeJet Technologies (U.S.), DICKEY-john (U.S.), XMachines (India), Naïo Technologies (France), Robotics Plus Limited (New Zealand), FieldBee (Netherlands), Agremo (Serbia), Verdant Robotics (U.S.), Agrobot (Spain), SZ DJI Technology Co., Ltd. (China), XAG Co., Ltd. (China), and Terra Drone Corporation (Japan) |

The global precision agriculture market is projected to reach $27.81 billion by 2031, at a CAGR of 12.9% during the forecast period.

The growth of the precision agriculture market is driven by increasing government initiatives promoting the use of modern technologies in the agriculture sector and the surging demand for precision agriculture solutions due to climatic changes.

Some of the key players operating in the precision agriculture market are Deere & Company (U.S.), AGCO Corporation (U.S.), Topcon Corporation (Japan), Trimble Inc. (U.S.), Raven Industries, Inc. (U.S.) CropX Inc. (Israel), AgEagle Aerial Systems Inc. (U.S.), Netafim Ltd. (Israel), Farmers Edge Inc. (Canada), AgJunction LLC (U.S.), AMVAC Chemical Corporation (U.S.), YANMAR HOLDINGS CO., LTD. (Japan), Ag Leader Technology (U.S.), Ecorobotix SA (Switzerland), BASF SE (Germany), Climate LLC (U.S.), TeeJet Technologies (U.S.), DICKEY-john (U.S.), XMachines (India), Naïo Technologies (France), Robotics Plus Limited (New Zealand), FieldBee (Netherlands), Agremo (Serbia), Verdant Robotics (U.S.), Agrobot (Spain), SZ DJI Technology Co., Ltd. (China), XAG Co., Ltd. (China), and Terra Drone Corporation (Japan).

The hardware segment is expected to account for the largest share of the global precision agriculture market.

Based on technology, which segment is expected to grow with the highest CAGR in the forecast period?

The variable rate technology segment is expected to register the highest CAGR during the forecast period.

The precision irrigation segment is expected to register the highest CAGR during the forecast period.

Published Date: Jan-2025

Published Date: Jun-2023

Published Date: Jun-2023

Published Date: Oct-2020

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates