Resources

About Us

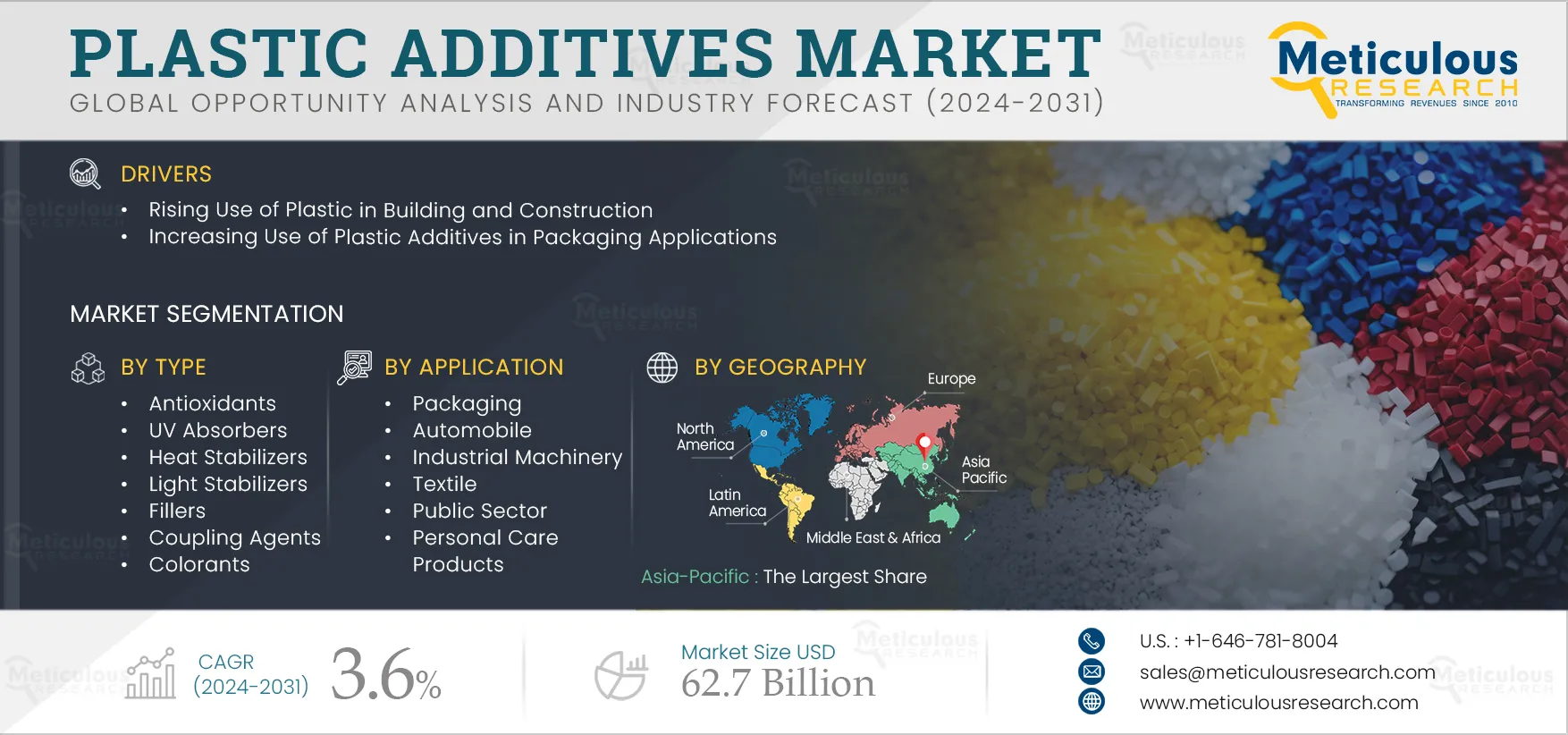

Plastic Additives Market Size, Share, Forecast, & Trends Analysis by Type (Plasticizer, Fillers, Flame Retardants, Colorants, Antimicrobials, Foaming Agent, Nucleating Agents, Others), Application (Building and Construction, Packaging, Automobile, Others), Geography - Global Forecast to 2032

Report ID: MRCHM - 1041157 Pages: 200 May-2024 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe Plastic Additives Market is expected to reach $62.7 billion by 2032, at a CAGR of 3.6% from 2025 to 2032. The growth of this market is driven by the rising use of plastic in buildings and construction and the increasing use of plastic additives in packaging applications. In addition, the cost-effectiveness and commercialization of plastics and the rising expansion of the automotive and aerospace industries are expected to provide opportunities for market growth. However, stringent government regulations governing the plastic industry and the negative effect of plastic additives on health and the environment can restrain the growth of the market. The volatility of raw material prices poses a challenge to market growth.

Packaging is one of the main applications of plastic materials globally, constituting a considerable share of the total plastic production. Plastics have become essential to the global packaging industry due to their versatility, durability, low cost, and lightweight properties. Plastics play a vital role in maintaining the quality of a wide range of products during shipping, handling, storage, and shelf time. According to UNEP (Kenya), approximately 36% of all plastics produced are used in packaging, including single-use plastic products for food and beverage containers, approximately 85% of which ends up in landfills or as unregulated waste.

In the packaging industry, plastic additives play a crucial role in enhancing the performance, durability, and sustainability of plastic materials. They address various challenges associated with packaging, such as shelf life, processability, and meeting regulatory requirements.

The rising need for plastic additives to protect plastic materials from degradation, improve their flexibility and workability, enhance the fire resistance of plastic packaging, ensure compliance with safety standards and regulations, and add visual appeal to packaging is expected to drive market growth.

Click here to: Get Free Sample Pages of this Report

As the building and construction industry continues to evolve, plastic additives play an integral role in improving polymer performance and durability across a wide range of applications. Furthermore, industry standards for the building and construction market are increasingly becoming stringent. For example, outdoor weathering requirements now necessitate products to last for several decades. In some applications, products must meet more demanding thermal stability standards. The end user's demand for products that provide less maintenance with the same visual appeal as traditional construction materials is propelling the demand.

Plastic additives protect building and construction plastics against thermal, ultraviolet, and oxidative degradation. Polyolefins and plastic materials contain various performance additives and stabilizers to improve plastic composites' overall durability, weather resistance, and endurance in building and construction applications. Therefore, stringent UV and thermal specifications, combined with demanding cost-performance needs, are driving the demand for plastic additives in these applications.

Plastic polymers are naturally long-lasting, and additives such as plasticizers, stabilizers, and flame retardants are frequently used to achieve heat resistance, flexibility, and fire resistance. These additives help plastic survive longer by making it resistant to breakdown in natural conditions. As plastic degrades, these components get released into the environment, resulting in various environmental problems.

To date, it has been estimated that around 13,000 chemicals are used to produce plastic, with the most used being monomers, processing aids, and additives. Of these, only 3,200 are verified, while the hazard data are missing for 6,000 chemicals that can potentially be harmful to health and the environment. Some plastic additives have been identified as endocrine disruptors, even at low concentrations. They can be associated with different diseases, including cancer, obesity, and reproductive disorders. Fetuses and young children are particularly vulnerable as their endocrine systems are still in development. Such factors are expected to challenge the growth of the plastic additives market.

The growing automotive industry and the widespread adoption of lightweight materials to improve fuel efficiency and reduce emissions are influencing the market growth. Moreover, the development of advanced thermoplastic composites, which reduce the weight of vehicles and enhance their structural integrity, augment the growth of this segment. Furthermore, plastic additives are essential in improving the UV resistance and durability of plastic components used in automobiles, ensuring their longevity and performance, thus providing opportunities for market growth.

The growing aerospace industry, rising development of high-strength, high-quality plastics and polymers, and the escalating demand for lightweight and high-performance materials to enhance aircraft efficiency and safety are expected to provide opportunities for the plastic additives market growth. Subsequently, plastic additives are used to manufacture aircraft components, as they offer flame retardancy, impact resistance, and thermal stability to plastic materials used in aircraft interiors and exteriors, thus providing opportunities for market growth.

Based on type, the plastic additives market is segmented into plasticizers, antioxidants, UV absorbers, heat stabilizers, light stabilizers, fillers, coupling agents, cross-linking agents, foaming agents, nucleating agents, colorants, antimicrobials, flame retardants, antistatic agents, and other plastic additives. In 2025, the plasticizers segment is expected to account for the largest share of above 52.0% of the plastic additives market. The large market share of this segment is attributed to the increasing use of plasticizers to improve the flexibility, viscosity, softness, friction level, and plasticity of materials, rising demand for flexible PVC in different applications, increasing adoption of non-phthalate and high molecular weight phthalate plasticizers, and growing packaging industry.

The rising focus of market players on strengthening their product offerings is expected to drive segment growth. For instance, in January 2022, Evonik Industries AG (Germany) launched ELATUR® DINCD - a new plasticizer for durable products. ELATUR® DINCD is easy to process due to its low viscosity and is particularly suitable for demanding exterior and interior applications, such as textile fabrics, roofing membranes, floor coverings, adhesives, and sealants, as well as paints and coatings.

However, the antimicrobials segment is expected to register the highest CAGR during the forecast period. The rising use of antimicrobial additives to reduce illness and infection-causing bacteria, resist the growth of unpleasant mold and mildew, minimize stain and odor-causing bacteria, and inhibit physical degradation from bacteria and fungi that feed on plastics and their additives drive the segment’s growth. In addition, the rising focus of market players on innovative product offerings is expected to drive segment growth. For instance, in February 2024, Microban International (U.S.) launched a new built-in antibacterial technology, MicroGuard, specially developed for polymer materials, including polyvinyl chloride (PVC), polyurethane (PU) and ethylene-vinyl acetate copolymer (EVA) foam.

Based on application, the plastic additives market is segmented into building and construction, packaging, automobile, home appliances & electronics, industrial machinery, personal care products, textile, public sector, and other applications. In 2025, the packaging segment is expected to account for the largest share of above 38.0% of the plastic additives market. The large market share of this segment is attributed to the rising demand for plastic packaging to maintain the quality of a wide range of products during shipping, handling, storage, and shelf time, increasing awareness of the benefits of using additives in packaging applications. In addition, due to increased awareness of the circular economy, manufacturers are turning to additives that allow recycling in packaging, which is also expected to drive the demand for plastic additives for packaging applications.

However, the home appliances & electronics segment is expected to register the highest CAGR during the forecast period. The rising need for plastic additives to provide unique performance to home appliances & electronics products, such as lightweight, thermal management, and protecting critical assets, is expected to drive the segment growth.

In 2025, Asia-Pacific is expected to account for the largest share of above 45.0% of the plastic additives market. The economic expansion is driving up demand for plastic products, which in return is driving up demand for plastic additives. The region is also rapidly urbanizing, with an increasing number of people moving to cities. This urbanization is driving up demand for plastic products in a wide range of industries, including packaging, construction, and consumer goods. Moreover, the Asia-Pacific region is expected to register the highest CAGR of above 5.0% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the plastic additives market are Songwon Industrial Co. Ltd. (South Korea), Clariant AG (Switzerland), BASF SE (Germany), Dow Chemical Company (U.S.), Evonik Industries AG (Germany), Kaneka Corporation (Japan), LANXESS AG (Germany), Croda International PLC (U.K.), Exxon Mobil Corporation (U.S.), Mitsui Chemicals, Inc. (Japan), Nouryon (Netherland), ADEKA CORPORATION (Japan), Arkema (France), PMC Group, Inc. (U.S.), and Astra Polymers (Saudi Arabia).

|

Particulars |

Details |

|

Number of Pages |

200 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR |

3.6% |

|

Market Size (Value) |

USD 62.7 Billion by 2032 |

|

Segments Covered |

By Type

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Switzerland, Netherlands, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Singapore, Malaysia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Songwon Industrial Co. Ltd. (South Korea), Clariant AG (Switzerland), BASF SE (Germany), Dow Chemical Company (U.S.), Evonik Industries AG (Germany), Kaneka Corporation (Japan), LANXESS AG (Germany), Croda International PLC (U.K.), Exxon Mobil Corporation (U.S.), Mitsui Chemicals, Inc. (Japan), Nouryon (Netherland), ADEKA CORPORATION (Japan), Arkema (France), PMC Group, Inc.(U.S.), and Astra Polymers (Saudi Arabia) |

The plastic additives market study focuses on market assessment and opportunity analysis through the sales of plastic additives across different regions and different market segmentations. This study is also focused on competitive analysis for plastic additives based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The plastic additives market is projected to reach $62.7 billion by 2032, at a CAGR of 3.6% during the forecast period.

Based on type, the plasticizers segment is expected to account for the largest share of the plastic additives market.

Based on application, the packaging segment is expected to account for the largest share of the plastic additives market.

The growth in this market is driven by the rising use of plastic in building and construction and the increasing use of plastic additives in packaging applications. In addition, the cost-effectiveness and commercialization of plastics and the rising expansion of the automotive and aerospace industries are expected to provide opportunities for market growth.

The key players operating in the plastic additives market are Songwon Industrial Co. Ltd. (South Korea), Clariant AG (Switzerland), BASF SE (Germany), Dow Chemical Company (U.S.), Evonik Industries AG (Germany), Kaneka Corporation (Japan), LANXESS AG (Germany), Croda International PLC (U.K.), Exxon Mobil Corporation (U.S.), Mitsui Chemicals, Inc. (Japan), Nouryon (Netherland), ADEKA CORPORATION (Japan), Arkema (France), PMC Group, Inc.(U.S.), and Astra Polymers (Saudi Arabia).

Asia-Pacific is projected to register the highest growth rate over the coming years.

Published Date: Jan-2026

Published Date: Dec-2025

Published Date: Sep-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates