Resources

About Us

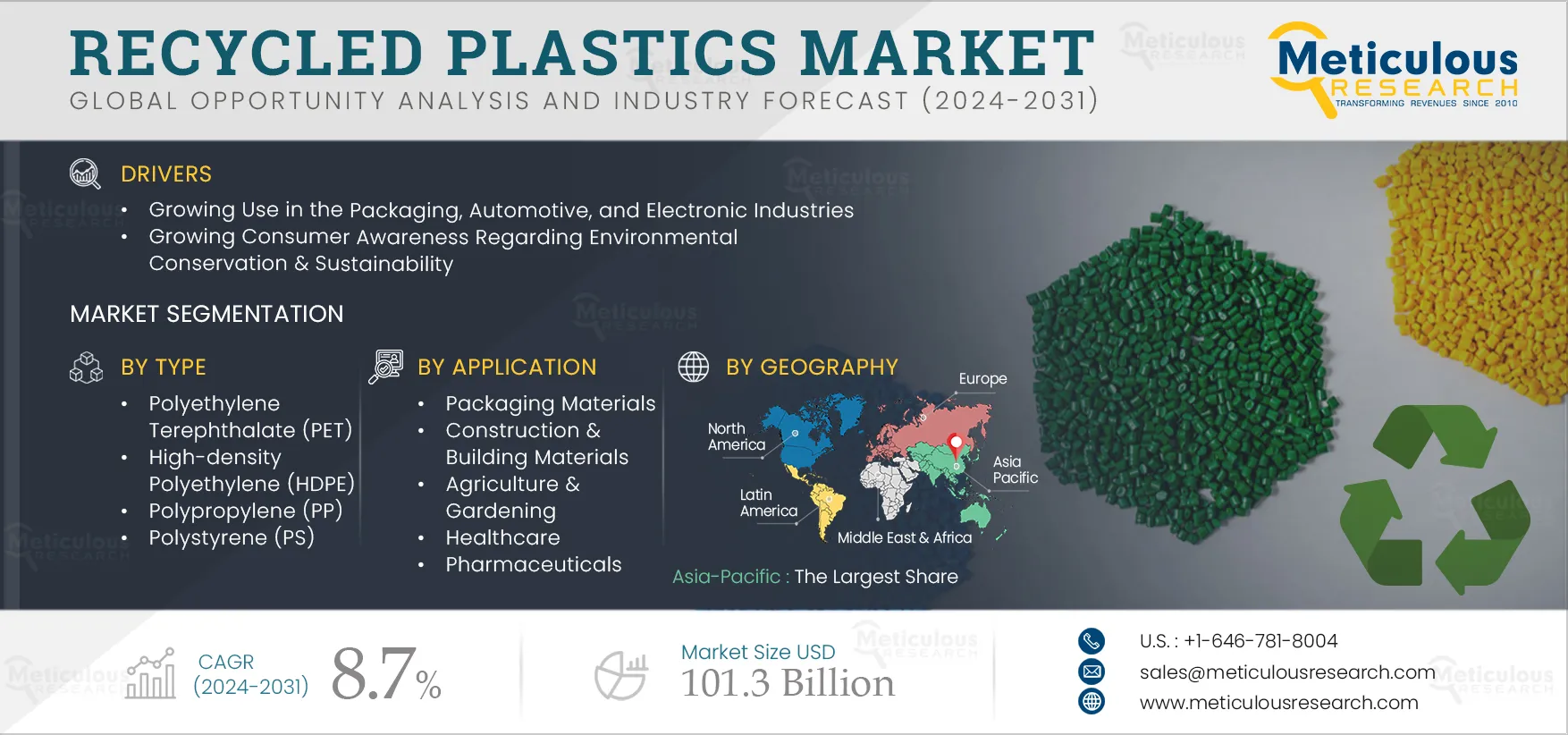

Recycled Plastics Market Size, Share, Forecast, & Trends Analysis by Type (Polyvinyl Chloride, High-density Polyethylene, Polyethylene Terephthalate), Process (Mechanical, Chemical), Application (Packaging Materials, Construction & Building Materials), and Geography - Global Forecast to 2032

Report ID: MRCHM - 1041316 Pages: 200 Sep-2024 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the recycled plastics market is driven by the growing utilization of recycled plastics in the packaging, automotive, and electronics industries, and consumers' growing awareness regarding environmental conservation & sustainability. Furthermore, increasing policies & regulations for recycling & reducing plastic waste are expected to generate growth opportunities for the players operating in this market.

Due to rising environmental awareness and innovation in recent years, recycled plastics have been widely used in various industries, such as packaging, automotive, and electronics. In the automotive industry, recycled plastics lower production costs, reduce vehicle weight & emissions, and improve fuel efficiency. Recycled plastics are also used in interior parts of vehicles such as dashboards, bumpers & fenders, and seat covers. The growing environmental benefits and the lower manufacturing costs of recycled plastics compared to virgin plastics are boosting the demand for recycled plastics in the automotive industry.

The electronics industry is increasingly incorporating recycled plastics into the casings & components of consumer electronics, including smartphones, laptops, and televisions. This practice helps reduce the electronic waste footprint by minimizing the need for new plastic production and encouraging the use of recycled plastics.

Technological innovations in recycled plastics have greatly improved their performance to fulfill the demands of contemporary electronic devices, including heat resistance, durability, and impact resistance. By incorporating high-quality recycled plastics, electronics manufacturers are enhancing the lifecycle of their products while supporting environmental sustainability. This shift toward more sustainable materials demonstrates the industry’s increasing dedication to addressing environmental issues and fostering responsible manufacturing practices.

Several flexible food packaging companies are working toward launching new, high-quality snack packaging products made from recycled plastic to meet rigorous food contact standards. For example, in March 2025, INEOS AG (U.K.), PepsiCo, Inc. (U.S.), and Amcor plc (Australia) teamed up to introduce premium film packaging containing 50% recycled plastic. Brands and retailers use flexible film packaging to preserve food freshness and reduce food waste. Additionally, the recycled polymer content has been certified under the International Sustainability and Carbon Certification (ISCC PLUS) scheme. These developments are anticipated to boost the demand for recycled plastics across various industries during the forecast period.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Chemical recycling is the process of changing the chemical structure of polymeric waste to convert it into raw material for the manufacture of plastic products. The process uses various techniques such as pyrolysis, gasification, hydro-cracking, and depolymerization.

Chemical recycling is an environment-friendly and sustainable solution for plastic waste management. Several companies are developing advanced chemical processes to enhance their plastic recycling capabilities to reduce the volume of plastic waste that ends up in landfills.

For instance, in April 2024, Asahi Kasei Corporation (Japan) and Microwave Chemical Co., Ltd. (Japan) launched a joint demonstration project to commercialize a chemical recycling process for Polyamide 66 using microwave technology to depolymerize PA 66 and directly obtain the monomers Hexamethylenediamine (HMD) and Adipic Acid (ADA) at high yield with low energy consumption. In the demonstration, scraps from manufacturing and post-use waste material of PA66 for airbags and automobile parts were depolymerized. Such advancements in plastic recycling processes are expected to drive the growth of this in the coming years.

Based on type, the recycled plastics market is segmented into Polyethylene Terephthalate (PET), High-density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Low-density Polyethylene (LDPE), Polypropylene (PP), and Polystyrene (PS).

In 2025, the Polyvinyl Chloride (PVC) segment is expected to account for the largest share of over 28.0% of the recycled plastics market. This segment's large market share is attributed to the growing preference for PVC plastic due to its high resistance against deformation, the increasing use of PVC due to its excellent tensile strength, the ability to resist abrasion and wear & tear, and the rising demand for PVC for its high vapor barrier capacity and dielectric strength.

However, the High-density Polyethylene (HDPE) segment is expected to register the highest CAGR during the forecast period. The growth of this segment is driven by the increasing adoption of HDPE in petroleum thermoplastics due to its resistance to chemical solvents, the growing use of HDPE in blow-molding applications such as food & beverage containers due to its high dispersibility, and the rising adoption of HDPE plastic due to its malleability, which is beneficial for various applications such as containers, corrosion-resistant pipes, and playground equipment.

Based on process, the recycled plastics market is segmented into mechanical, chemical, and other processes. In 2025, the mechanical segment is expected to account for the largest share of over 44.0% of the recycled plastics market. This segment's large market share is attributed to the adoption of mechanical processes for plastic recycling due to its cost-effective, simple, and less energy consumption, the increasing need to reduce plastic waste in landfills during the recycling process, and the rising use of the mechanical process for plastic recycling to reduce greenhouse gas emission.

However, the chemical process segment is expected to register the highest CAGR during the forecast period. This segment's growth is driven by the growing use of advanced chemicals in plastic recycling, the increasing use of chemical processes to produce high-value alternatives to fossil-based plastic, and the rising focus on lowering plastic products' carbon footprints.

Based on application, the global recycled plastics market is segmented into packaging materials, construction & building materials, automotive & transportation, electrical & electronic devices, agriculture & gardening, healthcare, consumer products, pharmaceuticals, and other applications. In 2025, the packaging materials segment is expected to account for the largest share of over 39.0% of the recycled plastics market. The segment's large market share is attributed to the growing adoption of recycled plastic as it is cheaper to produce compared to virgin plastic and companies’ increasing utilization of recycled plastics in packaging. This growing trend reflects the effort to reduce waste, conserve resources, and lower carbon footprints by adopting recycled plastics in packaging materials.

However, the construction & building materials segment is expected to register the highest CAGR during the forecast period. The growth of this segment is driven by the increasing adoption of recycled plastic materials due to their cost-efficiency, durability, water & corrosion resistance, and lightweight properties.

In 2025, Asia-Pacific is expected to account for the largest share of over 61.0% of the recycled plastics market. Asia-Pacific’s large market share is attributed to the increasing government initiatives for environmental sustainability, the rising need to reduce plastic waste, the growing demand for recycled plastic in various end-use industries such as packaging, automotive, construction, and consumer goods, and the growing advancements in recycling technologies such as chemical recycling and improved sorting systems.

Also, Asia-Pacific is expected to register the highest CAGR of over 10.0% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the recycled plastics market are Loop Industries, Inc. (U.S.), Stericycle, Inc. (U.S.), Covestro AG (Germany), KW Plastics (U.S.), Custom Polymers, Inc. (U.S.), Plastipak Holdings, Inc. (U.S.), ReVital Polymers (Canada), MBA Polymers Inc. (U.S.), Alpek Polyester USA, LLC (U.S.), Biffa Ltd (U.K.), Ultra-Poly Corporation (U.S.), B. Schoenberg & Co., Inc. (U.S.), RJM International Inc. (U.S.), Fresh Pak (U.S.), and B & B Plastics Inc. (U.S.).

In April 2024, Indorama Ventures Public Company Limited (Thailand) partnered with Evertis Ibérica, S.A. (Portugal) to use flake from recycled PET trays to produce PET film suitable for food packaging trays. The partnership was an important step in diverting PET trays from landfills or incineration to support the EU’s

|

Particulars |

Details |

|

Number of Pages |

200 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

8.7% |

|

Market Size (Value) |

$101.3 Billion by 2032 |

|

Segments Covered |

By Type

By Process

By Application

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Netherlands, Spain, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, Australia & New Zealand, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (Saudi Arabia, UAE, Israel, and Rest of the Middle East & Africa) |

|

Key Companies |

Loop Industries, Inc. (U.S.), Stericycle, Inc. (U.S.), Covestro AG (Germany), KW Plastics (U.S.), Custom Polymers, Inc. (U.S.), Plastipak Holdings, Inc. (U.S.), ReVital Polymers (Canada), MBA Polymers Inc. (U.S.), Alpek Polyester USA, LLC (U.S.), Biffa Ltd (U.K.), Ultra-Poly Corporation (U.S.), B. Schoenberg & Co., Inc. (U.S.), RJM International Inc. (U.S.), Fresh Pak (U.S.), and B & B Plastics Inc. (U.S.). |

The recycled plastics market study focuses on market assessment and opportunity analysis based on the sales of recycled plastics across different regions and countries and market segmentations. This study is also focused on competitive analysis for recycled plastics based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The recycled plastics market is projected to reach $101.3 billion by 2032, at a CAGR of 8.7% from 2025 to 2032.

In 2025, the Polyvinyl Chloride (PVC) segment is expected to account for the largest share of over 28.0% of the recycled plastics market. The segment's large market share is attributed to the growing adoption of PVC plastic as its high density allows it to resist impact deformation compared to other plastics; the increasing use of PVC due to its excellent tensile strength, the ability to resist abrasion and wear & tear, and the rising demand of PVC for its cost-effective, durable, and versatile properties.

The construction & building materials segment is expected to register the highest CAGR during the forecast period. The growth of this segment is driven by the increasing use of recycled plastic in construction due to its lightweight and easier transportation, lifting, and installation compared to other materials such as concrete, wood, and aggregates. Additionally, the rising use of recycled plastic materials due to their water and corrosion-resistant attributes.

This market's growth is driven by the growing use of recycled plastics in the packaging, automotive, and electronics industries and the growing consumer awareness of environmental conservation and sustainability. Furthermore, the increasing policies and regulations for recycling and reducing plastic waste are encouraging manufacturers to produce recycled plastics, which is expected to generate growth opportunities for the players operating in this market.

The key players operating in the recycled plastics market are Loop Industries, Inc. (U.S.), Stericycle, Inc. (U.S.), Covestro AG (Germany), KW Plastics (U.S.), Custom Polymers, Inc. (U.S.), Plastipak Holdings, Inc. (U.S.), ReVital Polymers (Canada), MBA Polymers Inc. (U.S.), Alpek Polyester USA, LLC (U.S.), Biffa Ltd (U.K.), Ultra-Poly Corporation (U.S.), B. Schoenberg & Co., Inc. (U.S.), RJM International Inc. (U.S.), Fresh Pak (U.S.), and B & B Plastics Inc. (U.S.).

The Asia-Pacific market is expected to register the highest CAGR of over 10.0% during the forecast period. The growing government initiatives for environmental sustainability, the increasing need to reduce plastic waste, the rising demand for recycled plastic in various end-use industries such as packaging, automotive, construction, and consumer goods, and the growing advancements in recycling technologies such as chemical recycling and improved sorting systems are supporting the growth of the recycled plastics market in the Asia-Pacific region.

Published Date: Jan-2026

Published Date: Dec-2025

Published Date: May-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates