Resources

About Us

Organic Spirulina Market Size, Share & Forecast 2025-2035 | Growth Analysis by Product Type, Applications & Geography

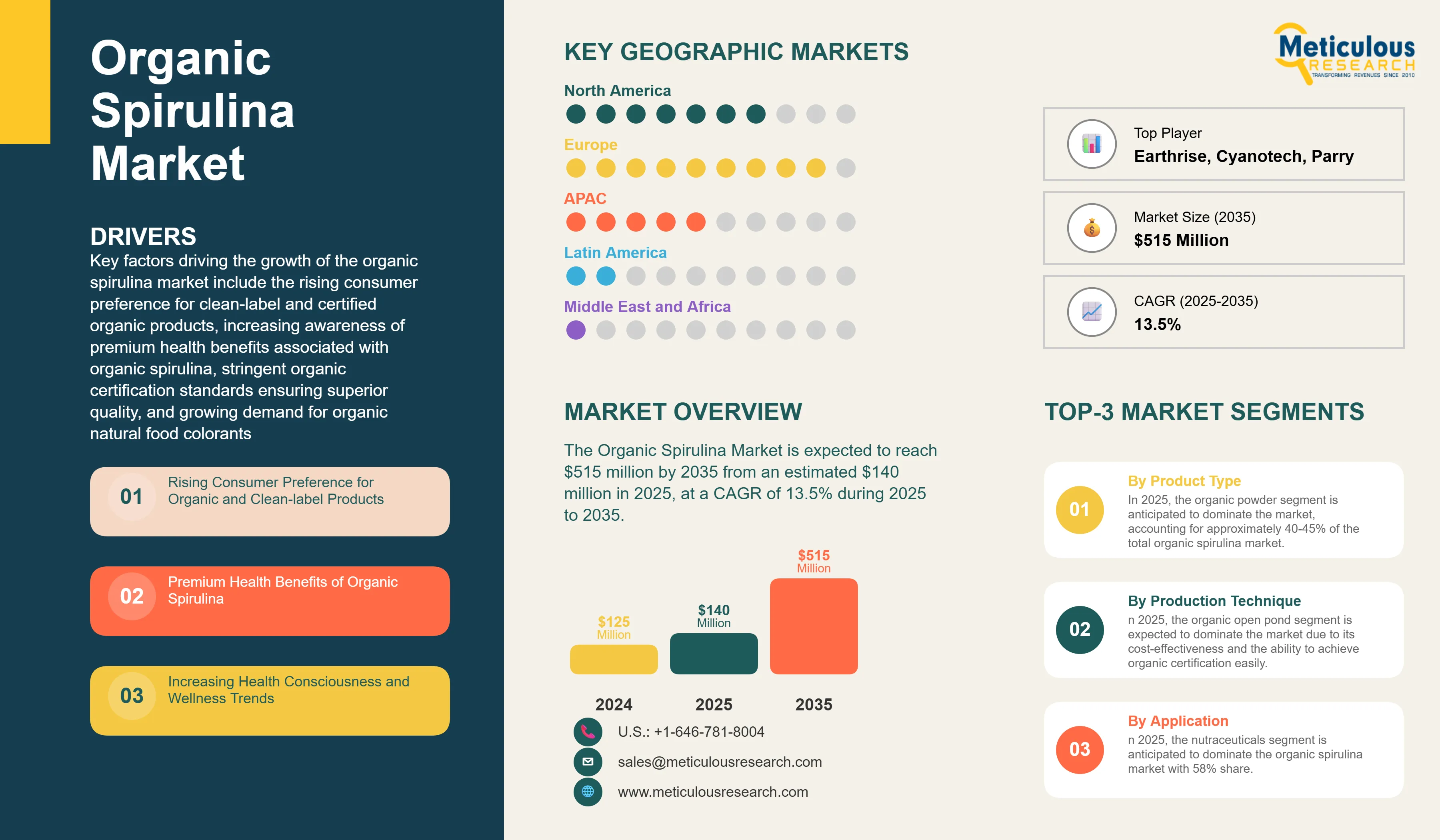

Report ID: MRFB - 1041511 Pages: 145 Jun-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportKey factors driving the growth of the organic spirulina market include the rising consumer preference for clean-label and certified organic products, increasing awareness of premium health benefits associated with organic spirulina, stringent organic certification standards ensuring superior quality, growing demand for organic natural food colorants, expanding organic nutraceuticals industry, and rising willingness to pay premium prices for sustainable and environmentally-friendly products. However, this growth is restrained by higher production costs and premium pricing, limited organic certified production capacity, complex organic certification processes, and lower yields compared to conventional spirulina cultivation.

Additionally, untapped markets in developing regions with growing organic awareness, development of innovative organic product formulations, expansion of direct-to-consumer organic sales channels, integration with the broader organic food ecosystem, and rising demand for organic aquaculture applications are poised to offer significant growth opportunities for market players. The adoption of sustainable packaging for organic products and vertical integration in organic supply chains are emerging as notable trends in this market.

Market Drivers

Rising Consumer Preference for Organic and Clean-Label Products

The demand for organic spirulina is experiencing unprecedented growth due to increasing consumer awareness about the benefits of organic products and the growing preference for clean-label ingredients. Modern consumers are increasingly concerned about synthetic additives, pesticide residues, and chemical contaminants in their food and supplements, driving them toward certified organic alternatives. The organic spirulina market benefits from this trend as consumers seek products that are free from synthetic fertilizers, pesticides, and genetic modifications.

The adverse effects of synthetic additives, coupled with a rise in health consciousness and a preference for environmentally friendly products, are driving this trend. Organic spirulina, being produced without synthetic inputs and under strict organic certification standards, appeals to health-conscious consumers who prioritize product purity and safety. This preference is particularly strong among millennials and Gen Z consumers who are willing to pay premium prices for products that align with their health and environmental values.

The clean-label movement has gained significant momentum in recent years, with consumers demanding transparency in product ingredients and production methods. Organic spirulina, with its simple ingredient profile and certified organic status, perfectly aligns with these consumer expectations, driving its adoption across various applications.

Premium Health Benefits and Superior Nutritional Profile

Organic spirulina offers enhanced health benefits compared to conventional spirulina due to its purer cultivation environment and absence of synthetic contaminants. The organic production process, which prohibits the use of synthetic fertilizers and chemicals, results in a cleaner product with potentially higher bioavailability of nutrients. Research suggests that organic spirulina may contain higher levels of certain antioxidants and beneficial compounds due to the stress-response mechanisms activated in organic cultivation environments.

Spirulina is regarded as a nutritional powerhouse due to its high protein content, which includes all eight essential amino acids in balanced proportions. It is also rich in beta-carotene, vitamin E, and iron. Organic spirulina maintains these nutritional benefits while providing additional assurance of purity and safety, making it particularly attractive to health-conscious consumers, athletes, and individuals with dietary restrictions.

The growing body of research supporting spirulina's health benefits, combined with the premium positioning of organic variants, has led to increased adoption among consumers seeking natural alternatives to synthetic supplements and functional foods.

Expanding Organic Nutraceuticals Industry

In recent decades, the use of dietary supplements, including vitamins, minerals, and nutritional and herbal supplements, has been on the rise. This trend was further accelerated during the COVID-19 pandemic, with a notable increase in supplement sales. The organic segment of the nutraceuticals industry is experiencing even faster growth as consumers increasingly prioritize natural and certified organic ingredients in their health and wellness routines.

The organic nutraceuticals market is being driven by an aging population with heightened health awareness, increased focus on preventive healthcare, and growing consumer education about the benefits of organic supplements. Organic spirulina, being recognized as a complete superfood with multiple health benefits, is positioned to capture a significant share of this growing market.

Furthermore, healthcare professionals and nutritionists are increasingly recommending organic supplements due to their perceived safety and efficacy advantages, further driving the demand for organic spirulina products.

Market Segmentation Analysis

By Product Type

Based on product type, the organic spirulina market is segmented into powder, tablets, capsules, flakes, phycocyanin, and fresh/frozen spirulina. In 2025, the organic powder segment is anticipated to dominate the market, accounting for approximately 40-45% of the total organic spirulina market. The dominance of organic powder is attributed to its versatility in application, cost-effectiveness for manufacturers, and consumer preference for customizable dosing in smoothies, functional foods, and DIY health preparations.

However, the organic phycocyanin segment is projected to record the highest CAGR during the forecast period of 2025-2035. This exceptional growth is driven by the premium pricing of organic phycocyanin, its increasing use in high-end natural food coloring applications, growing demand in organic cosmetics formulations, and its positioning as a super-premium ingredient in the organic health and wellness market.

The organic capsules segment is also experiencing robust growth due to consumer preference for convenient, standardized dosing and the premium positioning of organic supplements in the dietary supplements market.

By Production Technique

The organic spirulina market is segmented into organic open pond systems, organic photobioreactor systems, and organic hybrid production systems. In 2025, the organic open pond segment is expected to dominate the market due to its cost-effectiveness and the ability to achieve organic certification more easily compared to complex closed systems.

However, the organic photobioreactor segment is anticipated to record the highest growth rate during the forecast period, driven by its ability to produce ultra-premium organic spirulina with consistent quality, reduced contamination risks, and higher productivity per unit area. The controlled environment of photobioreactors aligns well with the stringent requirements of organic certification while enabling year-round production regardless of climatic conditions.

By Distribution Channel

Based on distribution channel, the organic spirulina market is segmented into business channel (B2B) and consumer channel (B2C). Unlike the overall spirulina market where B2B dominates, the organic spirulina market shows a more balanced distribution with the B2C segment accounting for approximately half of the market in 2025. This is attributed to the premium nature of organic spirulina products, consumer willingness to pay premium prices, and the direct-to-consumer marketing strategies employed by organic brands.

The B2C segment is further driven by the growth of organic specialty stores, health food retailers, e-commerce platforms specializing in organic products, and the increasing availability of organic spirulina in mainstream retail channels.

By Application

The organic spirulina market is segmented into nutraceuticals, food & beverages, cosmetics, animal feed, and agriculture. In 2025, the nutraceuticals segment is anticipated to dominate the organic spirulina market with a share of 58%, higher than the overall spirulina market due to the premium positioning of organic supplements and the willingness of health-conscious consumers to pay premium prices for certified organic products.

The organic food & beverages segment is projected to record the highest CAGR of 14.8% during the forecast period of 2025-2035, driven by the rapid expansion of the organic food industry, increasing use of organic spirulina as a natural colorant in premium food products, and growing consumer demand for organic functional foods and beverages.

Regional Analysis

Based on geography, the organic spirulina market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Europe is anticipated to account for the major share of around 45% of the organic spirulina market, reflecting the region's well-established organic food culture, stringent organic regulations, and high consumer awareness about organic products.

The market in Europe is slated to record a strong CAGR of 13.2% during the forecast period of 2025–2035. This growth is fueled by the shift towards natural colorants, an increased emphasis on preventive health measures, a rising consumption of functional foods, and a growing demand for environmentally sustainable products. For organic spirulina specifically, Europe's leadership is further strengthened by the EU's comprehensive organic certification framework, high consumer purchasing power, and strong demand for premium organic products.

North America follows as the second-largest market, driven by the USDA Organic certification program, high health consciousness among consumers, and the presence of leading organic spirulina brands. The region's strong e-commerce infrastructure and direct-to-consumer organic brands contribute significantly to market growth.

Asia-Pacific is emerging as the fastest-growing region for organic spirulina, with a projected CAGR of 16.4% during 2025-2035, driven by increasing organic awareness in countries like Japan, Australia, and urban areas of China and India, rising disposable incomes, and growing health consciousness among the middle class.

Competitive Landscape

The organic spirulina market is characterized by a mix of specialized organic producers, conventional spirulina manufacturers with organic divisions, and premium health and wellness brands. Leading players in the global organic spirulina market include Earthrise Nutritionals LLC, Cyanotech Corporation, Parry Nutraceuticals, Algosource SA, Allmicroalgae Natural Products S.A., Sea & Sun Organic GmbH, Far East Bio-Tec Co., Ltd., Organic Spirulina India Pvt. Ltd., Australian Organic Spirulina Co., Pond Technologies Inc., Algae Health Sciences, DIC Corporation, and Hydrolina Biotech among others. These companies are focusing on strategies such as organic certification expansion, premium product development, sustainable packaging initiatives, direct-to-consumer marketing, and partnerships with organic food manufacturers to strengthen their market position.

|

Particulars |

Details |

|

Number of Pages |

145 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

13.5% |

|

Market Size 2024 |

USD 125 million |

|

Market Size 2025 |

USD 140 million |

|

Market Size 2035 |

USD 515 million |

|

Segments Covered |

By Product Type, Production Technique, Distribution Channel, Application |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Netherlands, Spain, Denmark, Sweden, and Rest of Europe), Asia-Pacific (Japan, Australia, India, China, Thailand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (South Africa, UAE, Egypt, and Rest of Middle East & Africa) |

The organic spirulina market is projected to reach USD 515 million by 2035 from USD 140 million in 2025, at a CAGR of 13.5% during the forecast period.

In 2025, the organic powder segment is projected to hold the major share of the organic spirulina market.

The organic food & beverages segment is slated to record the highest growth rate during the forecast period of 2025–2035.

Key factors driving the growth include rising consumer preference for clean-label and certified organic products, increasing awareness of premium health benefits, stringent organic certification standards ensuring quality, growing demand for organic natural food colorants, expanding organic nutraceuticals industry, and rising willingness to pay premium prices for sustainable products.

Major opportunities include untapped markets in developing regions, development of innovative organic product formulations, expansion of direct-to-consumer organic sales channels, integration with the broader organic food ecosystem, and rising demand for organic aquaculture applications.

Europe leads the market with the highest share, while Asia-Pacific is projected to record the highest growth rate during the forecast period, offering significant opportunities for organic spirulina vendors.

1. Introduction

1.1. Market Definition & Scope

1.2. Organic Spirulina Market Ecosystem

1.3. Currency and Units

1.4. Key Stakeholders in Organic Spirulina Value Chain

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Organic Spirulina Market Analysis: by Product Type

3.2.2. Organic Spirulina Market Analysis: by Production Technique

3.2.3. Organic Spirulina Market Analysis: by Distribution Channel

3.2.4. Organic Spirulina Market Analysis: by Application

3.3. Organic Spirulina Market, by Regional Analysis

3.4. Competitive Landscape & Market Competitors

4. Industry Insights

4.1. Overview

4.2. Organic Spirulina Nutritional Profile

4.2.1. Organic vs. Conventional Spirulina: Nutritional Comparison

4.2.2. Organic Certification Standards and Requirements

4.3. Value Chain Analysis

4.3.1. Overview

4.3.2. Organic Inputs/Suppliers

4.3.3. Organic Cultivation and Processing

4.3.3.1. Key Organic Spirulina Producers, by Size

4.3.3.1.1. Small-scale Organic Farmers (<5 Tons/Year)

4.3.3.1.2. Medium-scale Organic Producers (5-50 Tons/Year)

4.3.3.1.3. Large-scale Organic Producers (50-500 Tons/Year)

4.3.3.1.4. Industrial Organic Producers (More Than 500 Tons/Year)

4.3.4. Organic Certification and Quality Control

4.3.5. Packaging, Storage, and Logistics for Organic Products

4.3.6. Distribution Channel (B2B & B2C)

4.3.7. End-use Applications and Consumer Base

4.4. Pricing Analysis

4.4.1. Organic Spirulina Powder

4.4.2. Organic Spirulina Tablets

4.4.3. Organic Spirulina Capsules

4.4.4. Organic Spirulina Flakes

4.4.5. Organic Phycocyanin

4.4.6. Premium Organic Spirulina Products

4.5. Porter's Five Forces Analysis

4.5.1. Bargaining Power of Organic Input Suppliers

4.5.2. Bargaining Power of Organic Product Buyers

4.5.3. Threat of Conventional Spirulina Substitutes

4.5.4. Threat of New Organic Entrants

4.5.5. Degree of Competition in Organic Segment

5. Market Insights

5.1. Overview

5.2. Factors Affecting Market Growth

5.2.1. Drivers

5.2.1.1. Rising Consumer Preference for Organic and Clean-label Products

5.2.1.2. Premium Health Benefits of Organic Spirulina

5.2.1.3. Increasing Health Consciousness and Wellness Trends

5.2.1.4. Growing Demand for Organic Natural Food Colors

5.2.1.5. Strict Organic Certification Standards Ensuring Quality

5.2.1.6. Environmental Sustainability of Organic Farming Practices

5.2.1.7. Rising Purchasing Power and Willingness to Pay Premium

5.2.1.8. Expansion of Organic Distribution Channels

5.2.2. Restraints

5.2.2.1. Higher Production Costs and Premium Pricing

5.2.2.2. Limited Availability and Supply Chain Challenges

5.2.2.3. Complex Organic Certification Process

5.2.2.4. Lower Yields Compared to Conventional Production

5.2.2.5. Consumer Price Sensitivity in Developing Markets

5.2.3. Opportunities

5.2.3.1. Untapped Markets in Developing Regions

5.2.3.2. New Organic Product Formulations and Applications

5.2.3.3. Direct-to-Consumer Organic Sales Channels

5.2.3.4. Integration with Organic Food and Beverage Industry

5.2.3.5. Development of Organic Aquaculture Applications

5.3. Trends

5.3.1. Adoption of Advanced Organic Production Technologies

5.3.2. Vertical Integration in Organic Supply Chain

5.3.3. Sustainable Packaging for Organic Products

5.4. Standards and Regulations

5.4.1. Global Organic Certification Standards

5.4.2. Regional Organic Regulations

5.4.2.1. North America (USDA Organic, Health Canada)

5.4.2.2. Europe (EU Organic Regulation)

5.4.2.3. Asia-Pacific (JAS Organic, India Organic)

5.4.2.4. Latin America (Organic Certification Bodies)

5.4.2.5. Middle East & Africa (Regional Organic Standards)

5.5. Organic Product Adoption Trends Across Applications

6. Organic Spirulina Market Assessment—by Product Type

6.1. Overview

6.2. Organic Spirulina Powder

6.3. Organic Spirulina Tablets

6.4. Organic Spirulina Capsules

6.5. Organic Spirulina Flakes

6.6. Organic Phycocyanin

6.7. Organic Fresh/Frozen Spirulina

6.8. Organic Spirulina Extract and Concentrates

7. Organic Spirulina Market Assessment—by Production Technique

7.1. Overview

7.2. Organic Open Pond Systems

7.3. Organic Photobioreactor Systems

7.4. Organic Hybrid Production Systems

8. Organic Spirulina Market Assessment—by Distribution Channel

8.1. Overview

8.2. Business Channel (B2B)

8.2.1. Direct Sales to Manufacturers

8.2.2. Organic Ingredient Suppliers

8.2.3. Wholesale Distributors

8.3. Consumer Channel (B2C)

8.3.1. Organic Specialty Stores

8.3.2. Health Food Stores

8.3.3. Online Platforms

8.3.4. Pharmacies and Retail Chains

9. Organic Spirulina Market Assessment—by Application

9.1. Overview

9.2. Nutraceuticals and Dietary Supplements

9.2.1. Organic Multivitamin Supplements

9.2.2. Organic Protein Supplements

9.2.3. Organic Detox and Wellness Products

9.3. Organic Food & Beverages

9.3.1. Organic Functional Foods

9.3.2. Organic Beverages and Smoothies

9.3.3. Organic Natural Food Coloring

9.3.4. Organic Bakery and Confectionery

9.4. Organic Cosmetics and Personal Care

9.5. Organic Animal Feed and Pet Food

9.6. Organic Agriculture and Bio-fertilizers

10. Organic Spirulina Market Assessment—by Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. U.K.

10.3.4. Italy

10.3.5. Netherlands

10.3.6. Spain

10.3.7. Denmark

10.3.8. Sweden

10.3.9. Rest of Europe (RoE)

10.4. Asia-Pacific

10.4.1. Japan

10.4.2. Australia

10.4.3. India

10.4.4. China

10.4.5. Thailand

10.4.6. Rest of Asia-Pacific (RoAPAC)

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Rest of Latin America (RoLATAM)

10.6. Middle East & Africa

10.6.1. South Africa

10.6.2. UAE

10.6.3. Egypt

10.6.4. Rest of Middle East & Africa

11. Competition Analysis

11.1. Overview

11.2. Key Growth Strategies in Organic Spirulina Market

11.3. Competitive Benchmarking

11.4. Competitive Dashboard

11.4.1. Organic Market Leaders

11.4.2. Organic Product Innovators

11.4.3. Emerging Organic Producers

11.4.4. Regional Organic Specialists

11.5. Market Ranking/Positioning Analysis of Key Organic Players, 2024

12. Company Profiles (Company Overview, Financial Overview, Organic Product Portfolio, and Strategic Developments)

12.1 Leading Organic Spirulina Producers

12.1.1 Earthrise Nutritionals LLC (USA)

12.1.2 Cyanotech Corporation (USA/Hawaii)

12.1.3 Parry Nutraceuticals (E.I.D. Parry, India)

12.1.4 Algosource SA (France)

12.1.5 Allmicroalgae Natural Products S.A. (Portugal)

12.1.6 Sea & Sun Organic GmbH (Germany)

12.1.7 Far East Bio-Tec Co., Ltd. (Febico, Taiwan)

12.1.8 Organic Spirulina India Pvt. Ltd. (India)

12.1.9 Australian Organic Spirulina Co. (Australia)

12.1.10 Pond Technologies Inc. (Canada)

12.1.11 Algae Health Sciences (USA)

12.1.12 DIC Corporation (Japan)

12.1.13 Hydrolina Biotech (China/Global)

12.1.14 Others

(Note: SWOT Analysis of Top 5 Organic Spirulina Companies Will Be Provided)

13. Appendix

13.1. Available Customization

13.2. Related Reports

13.3. Organic Certification Bodies and Standards

13.4. Glossary of Organic Spirulina Terms

List of Tables

Table 1 Organic vs. Conventional Spirulina: Nutritional Comparison

Table 2 Global Organic Certification Standards for Spirulina

Table 3 Indicative List of Organic Spirulina Supplement Providers and their Product Formulations

Table 4 List of Organic Spirulina Small-scale Producers (<5 Tons/Year)

Table 5 List of Medium-scale Organic Spirulina Producers (5-50 Tons/Year)

Table 6 List of Large-scale Organic Spirulina Producers (50-500 Tons/Year)

Table 7 List of Industrial Organic Spirulina Producers (>500 Tons/Year)

Table 8 Average Selling Prices of Organic Spirulina Powder, by Country, 2023-2035(USD/Ton)

Table 9 Average Selling Prices of Organic Spirulina Tablets, by Country, 2023-2035(USD/Ton)

Table 10 Average Selling Prices of Organic Spirulina Capsules, by Country, 2023-2035(USD/Ton)

Table 11 Average Selling Prices of Organic Spirulina Flakes, by Country, 2023-2035(USD/Ton)

Table 12 Average Selling Prices of Organic Phycocyanin, by Country, 2023-2035(USD/Ton)

Table 13 Average Selling Prices of Organic Fresh/Frozen Spirulina, by Country, 2023-2035(USD/Ton)

Table 14 Average Selling Prices of Organic Spirulina Extract, by Country, 2023-2035(USD/Ton)

Table 15 Organic vs. Conventional Spirulina Production Costs Comparison

Table 16 Organic Certification Requirements by Region

Table 17 Organic Spirulina Production Costs and Energy Consumption for Different Techniques

Table 18 Europe: Organic Microalgae Approved for Food Use

Table 19 Global Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 20 Global Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 21 Global Organic Spirulina Powder Market, by Country, 2023-2035 (USD Million)

Table 22 Global Organic Spirulina Powder Market, by Country, 2023-2035 (Tons)

Table 23 Global Organic Spirulina Tablets Market, by Country, 2023-2035 (USD Million)

Table 24 Global Organic Spirulina Tablets Market, by Country, 2023-2035 (Tons)

Table 25 Global Organic Spirulina Capsules Market, by Country, 2023-2035 (USD Million)

Table 26 Global Organic Spirulina Capsules Market, by Country, 2023-2035 (Tons)

Table 27 Global Organic Spirulina Flakes Market, by Country, 2023-2035 (USD Million)

Table 28 Global Organic Spirulina Flakes Market, by Country, 2023-2035 (Tons)

Table 29 Global Organic Phycocyanin Market, by Country, 2023-2035 (USD Million)

Table 30 Global Organic Phycocyanin Market, by Country, 2023-2035 (Tons)

Table 31 Global Organic Fresh/Frozen Spirulina Market, by Country, 2023-2035 (USD Million)

Table 32 Global Organic Fresh/Frozen Spirulina Market, by Country, 2023-2035 (Tons)

Table 33 Global Organic Spirulina Extract Market, by Country, 2023-2035 (USD Million)

Table 34 Global Organic Spirulina Extract Market, by Country, 2023-2035 (Tons)

Table 35 Global Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 36 Global Organic Open Pond-produced Spirulina Market, by Country, 2023-2035 (USD Million)

Table 37 Global Organic Photobioreactor-produced Spirulina Market, by Country, 2023-2035 (USD Million)

Table 38 Global Organic Hybrid System-produced Spirulina Market, by Country, 2023-2035 (USD Million)

Table 39 Global Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 40 Global Organic Spirulina Market for Business Channel, by Country, 2023-2035 (USD Million)

Table 41 Global Organic Spirulina Market for Consumer Channel, by Country, 2023-2035 (USD Million)

Table 42 Global Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 43 Global Organic Spirulina Market for Nutraceuticals, by Country, 2023-2035 (USD Million)

Table 44 Comparison of Organic vs. Conventional Spirulina Protein Content

Table 45 Global Organic Spirulina Market for Food & Beverages, by Country, 2023-2035 (USD Million)

Table 46 Global Organic Spirulina Market for Cosmetics, by Country, 2023-2035 (USD Million)

Table 47 Global Organic Spirulina Market for Animal Feed, by Country, 2023-2035 (USD Million)

Table 48 Global Organic Spirulina Market for Agriculture, by Country, 2023-2035 (USD Million)

Table 49 Global Organic Spirulina Market, by Region, 2023-2035 (USD Million)

Table 50 Global Organic Spirulina Market, by Region, 2023-2035 (Tons)

Table 51 Key Organic Spirulina Buyers in North America

Table 52 North America: Organic Spirulina Market, by Country, 2023-2035 (USD Million)

Table 53 North America: Organic Spirulina Market, by Country, 2023-2035 (Tons)

Table 54 North America: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 55 North America: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 56 North America: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 57 North America: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 58 North America: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 59 U.S.: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 60 U.S.: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 61 U.S.: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 62 U.S.: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 63 U.S.: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 64 Canada: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 65 Canada: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 66 Canada: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 67 Canada: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 68 Canada: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 69 Europe: Organic Spirulina Market, by Country/Region, 2023-2035 (USD Million)

Table 70 Europe: Organic Spirulina Market, by Country/Region, 2023-2035 (Tons)

Table 71 Europe: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 72 Europe: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 73 Europe: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 74 Europe: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 75 Europe: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 76 Germany: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 77 Germany: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 78 Germany: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 79 Germany: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 80 Germany: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 81 France: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 82 France: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 83 France: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 84 France: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 85 France: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 86 U.K.: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 87 U.K.: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 88 U.K.: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 89 U.K.: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 90 U.K.: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 91 Italy: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 92 Italy: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 93 Italy: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 94 Italy: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 95 Italy: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 96 Netherlands: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 97 Netherlands: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 98 Netherlands: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 99 Netherlands: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 100 Netherlands: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 101 Spain: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 102 Spain: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 103 Spain: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 104 Spain: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 105 Spain: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 106 Denmark: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 107 Denmark: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 108 Denmark: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 109 Denmark: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 110 Denmark: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 111 Sweden: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 112 Sweden: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 113 Sweden: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 114 Sweden: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 115 Sweden: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 116 Rest of Europe: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 117 Rest of Europe: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 118 Rest of Europe: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 119 Rest of Europe: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 120 Rest of Europe: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 121 Asia-Pacific: Organic Spirulina Market, by Country/Region, 2023-2035 (USD Million)

Table 122 Asia-Pacific: Organic Spirulina Market, by Country/Region, 2023-2035 (Tons)

Table 123 Asia-Pacific: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 124 Asia-Pacific: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 125 Asia-Pacific: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 126 Asia-Pacific: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 127 Asia-Pacific: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 128 Japan: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 129 Japan: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 130 Japan: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 131 Japan: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 132 Japan: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 133 Australia: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 134 Australia: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 135 Australia: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 136 Australia: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 137 Australia: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 138 India: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 139 India: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 140 India: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 141 India: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 142 India: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 143 China: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 144 China: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 145 China: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 146 China: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 147 China: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 148 Thailand: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 149 Thailand: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 150 Thailand: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 151 Thailand: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 152 Thailand: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 153 Rest of Asia-Pacific: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 154 Rest of Asia-Pacific: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 155 Rest of Asia-Pacific: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 156 Rest of Asia-Pacific: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 157 Rest of Asia-Pacific: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 158 Latin America: Organic Spirulina Market, by Country/Region, 2023-2035 (USD Million)

Table 159 Latin America: Organic Spirulina Market, by Country/Region, 2023-2035 (Tons)

Table 160 Latin America: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 161 Latin America: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 162 Latin America: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 163 Latin America: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 164 Latin America: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 165 Brazil: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 166 Brazil: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 167 Brazil: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 168 Brazil: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 169 Brazil: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 170 Mexico: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 171 Mexico: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 172 Mexico: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 173 Mexico: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 174 Mexico: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 175 Argentina: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 176 Argentina: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 177 Argentina: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 178 Argentina: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 179 Argentina: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 180 Rest of Latin America: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 181 Rest of Latin America: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 182 Rest of Latin America: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 183 Rest of Latin America: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 184 Rest of Latin America: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 185 Middle East & Africa: Organic Spirulina Market, by Country/Region, 2023-2035 (USD Million)

Table 186 Middle East & Africa: Organic Spirulina Market, by Country/Region, 2023-2035 (Tons)

Table 187 Middle East & Africa: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 188 Middle East & Africa: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 189 Middle East & Africa: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 190 Middle East & Africa: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 191 Middle East & Africa: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 192 South Africa: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 193 South Africa: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 194 South Africa: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 195 South Africa: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 196 South Africa: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 197 UAE: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 198 UAE: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 199 UAE: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 200 UAE: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 201 UAE: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 202 Egypt: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 203 Egypt: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 204 Egypt: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 205 Egypt: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 206 Egypt: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

Table 207 Rest of Middle East & Africa: Organic Spirulina Market, by Product Type, 2023-2035 (USD Million)

Table 208 Rest of Middle East & Africa: Organic Spirulina Market, by Product Type, 2023-2035(Tons)

Table 209 Rest of Middle East & Africa: Organic Spirulina Market, by Production Technique, 2023-2035 (USD Million)

Table 210 Rest of Middle East & Africa: Organic Spirulina Market, by Distribution Channel, 2023-2035 (USD Million)

Table 211 Rest of Middle East & Africa: Organic Spirulina Market, by Application, 2023-2035 (USD Million)

List of Figures

Figure 1 Research Process for Organic Spirulina Market

Figure 2 Secondary Sources Referenced for Organic Spirulina Study

Figure 3 Primary Research Techniques for Organic Market Analysis

Figure 4 Key Executives Interviewed in Organic Spirulina Industry

Figure 5 Breakdown of Primary Interviews (Organic Supply Side & Demand Side)

Figure 6 Market Sizing and Growth Forecast Approach for Organic Spirulina

Figure 7 In 2024, the Organic Powder Segment to Dominate the Global Organic Spirulina Market

Figure 8 In 2024, the Organic Open Pond Segment to Dominate the Organic Spirulina Production

Figure 9 In 2024, the Consumer Channel Segment to Show Higher Growth in Organic Distribution

Figure 10 In 2024, the Nutraceuticals Segment to Dominate the Organic Spirulina Market

Figure 11 Europe and North America Lead the Organic Spirulina Market Growth

Figure 12 Benefits of Consuming 3-5 Grams of Organic Spirulina Daily

Figure 13 Organic Spirulina Supplements: Premium Dosage Forms

Figure 14 Organic Spirulina Market: Value Chain Analysis

Figure 15 Organic Spirulina Market: Porter's Five Forces Analysis

Figure 16 Impact Analysis of Organic Market Dynamics

Figure 17 Organic Spirulina vs. Conventional Spirulina: Nutrient Profile Comparison

Figure 18 Global Organic Spirulina Market, by Product Type, 2025 Vs. 2032 (USD Million)

Figure 19 Global Organic Spirulina Market, by Product Type, 2025 Vs. 2032 (Tons)

Figure 20 Global Organic Spirulina Market, by Production Technique, 2025 Vs. 2032 (USD Million)

Figure 21 Organic Spirulina: Business Channel Distribution Flow

Figure 22 Organic Spirulina: Consumer Channel Distribution Flow

Figure 23 Global Organic Spirulina Market, by Distribution Channel, 2025 Vs. 2032 (USD Million)

Figure 24 Global Organic Spirulina Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 25 Possible Effect of Organic Spirulina Extract on Sustainable Agriculture

Figure 26 Global Organic Spirulina Market, by Region, 2025 Vs. 2032 (USD Million)

Figure 27 Global Organic Spirulina Market, by Region, 2025 Vs. 2032 (Tons)

Figure 28 North America: Organic Spirulina Market Snapshot (2024)

Figure 29 Europe: Organic Spirulina Market Snapshot (2025)

Figure 30 Asia-Pacific: Organic Spirulina Market Snapshot (2025)

Figure 31 Latin America: Organic Spirulina Market Snapshot (2025)

Figure 32 Middle East & Africa: Organic Spirulina Market Snapshot (2025)

Figure 33 Key Growth Strategies Adopted by Leading Organic Players (2022–2025)

Figure 34 Global Organic Spirulina Market Competitive Benchmarking, by Application

Figure 35 Competitive Dashboard: Global Organic Spirulina Market

Figure 36 Global Organic Spirulina Market Ranking/Positioning of Key Players, 2025

Figure 37 Earthrise Nutritionals LLC: Financial Overview (2024)

Figure 38 Cyanotech Corporation (Organic Division): Financial Overview (2024)

Figure 39 Parry Nutraceuticals (Organic Products): Financial Overview (2024)

Figure 40 Sunfood Superfoods: Financial Overview (2024)

Figure 41 Organic vs. Conventional Spirulina: Price Premium Analysis (2024)

Figure 42 Organic Certification Process Timeline and Costs

Figure 43 Organic Spirulina Production: Environmental Impact Comparison

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Sep-2024

Published Date: Apr-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates