Resources

About Us

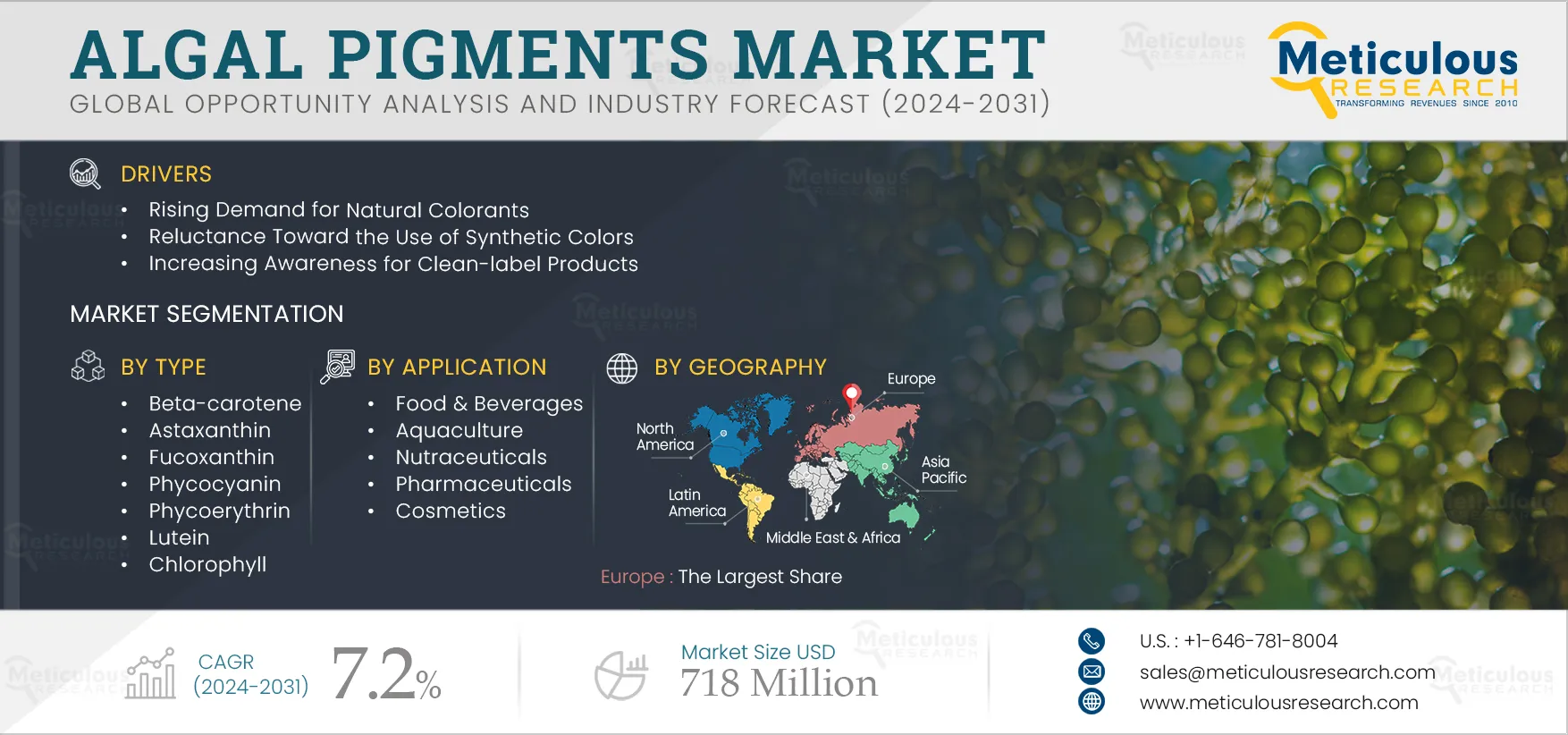

Algal Pigments Market Size, Share, Forecast, & Trends Analysis by Type (Beta-Carotene, Astaxanthin, Phycocyanin), Form (Powder), Source (Microalgae, Macroalgae), Application (Food & Beverages, Nutraceuticals, Pharmaceuticals)—Global Forecast to 2032

Report ID: MRFB - 104360 Pages: 180 Feb-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThis market's growth is driven by the increasing utilization of algal pigments for therapeutic and nutritional purposes, expanding awareness of clean-label products, growing demand for natural colorants, reluctance to use synthetic colors, and the rising need to enhance product appeal. The risk of algal contamination during cultivation, the complex procedures involved in producing algae, and the high cost of natural colors are anticipated to restrain the market's growth.

The growing demand for phycocyanin and the increasing use of natural astaxanthin in poultry and aquaculture feeds are expected to create market growth opportunities.

The growing preference for natural food colors over synthetic alternatives underscores a shift in consumer preferences. With heightened awareness of the health risks associated with synthetic colors and the benefits of natural options, consumers are increasingly driving the market toward healthier and more natural choices. Rising health consciousness and a preference for environmentally friendly products are significant factors fueling global demand for naturally sourced food products. As a result, food manufacturers are increasingly adopting natural food colors to enhance product appeal post-processing, aligning with consumer preferences and supporting a healthier market trend.

Natural food colors or dyes derived from algae, plants, animals, fruits, and minerals are considered safe as food additives due to their minimal harmful side effects. Their non-toxic or less toxic nature, coupled with fewer side effects, is driving their increasing therapeutic use. Governments worldwide are endorsing the use of natural food colors due to their biodegradability and lack of environmental pollution after disposal. Additionally, numerous regulations have been enacted to favor natural colors over synthetic alternatives, further boosting global demand. For example, the Food Safety and Standards Authority of India (FSSAI) has outlined permissible food coloring and flavoring agents and their standards in the Food Safety and Standards (Food Product Standards and Food Additives) Regulations, 2011, including beta-carotene, chlorophyll, caramel, riboflavin, curcumin, and saffron. Conversely, the Food Safety and Standards Act of 2006 (India) has banned artificial colors due to their potential long-term health risks.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Governments worldwide are increasingly supporting the use of natural food colors due to their biodegradability and minimal environmental impact. For example, the European Commission has banned titanium dioxide (E171) as a food additive effective August 7, 2022, and various regulations across regions are restricting the use of synthetic food colors.

The Australian Organic Market Report highlights that, in 2024, the Australian organic industry contributed USD 851 million directly to the economy. Denmark led global organic food sales with a 13.0% market share in 2020, followed by Austria with 11.3%, and Switzerland with 10.3% (source: Danish Agriculture & Food Council). This rising demand for organic foods is driven by consumer perceptions of their health benefits and safety compared to conventional options. Organic food production excludes synthetic fertilizers, pesticides, growth hormones, antibiotics, and GMOs, leading to increased use of natural food colors to enhance product appeal.

Furthermore, the growth of the food and beverage industry positively impacts the global natural food colors market. As natural food consumption rises globally, the demand for natural food colorants is increasing, thus driving the growth of the algal pigments market.

In recent years, the use of synthetic color additives in food, beverage, pharmaceutical, and cosmetic products has decreased due to stringent regulations and rising consumer awareness about the health hazards of synthetic colors.

Strict regulations imposed by federal organizations in various countries limit the use of synthetic dyes in food and beverage products. In the U.S., the Food and Drug Administration (FDA) is the primary authority overseeing food additives, including synthetic food colors. The FDA regulates their use due to potential health risks, establishing maximum allowable limits for different food categories. The FDA's responsibilities include listing new synthetic color additives or new uses for approved color additives deemed safe for their intended purposes in the Code of Federal Regulations (CFR), conducting certification programs for color additive batches that must be certified before sale, and monitoring synthetic color usage and product labeling. Synthetic color additives in food, drugs, and cosmetics must adhere to specific regulations issued by the FDA. Currently, synthetic food colors are prohibited in over 200 food products in the U.S.

In Europe, all food additives, including colorants, must receive authorization under European legislation before they can be used in food products. Authorized food colors are listed in Regulation EC 1333/2008, which outlines their approved uses and conditions.

Synthetic colors, valued for their versatility, are widely used across the food and beverage, pharmaceutical, and cosmetics industries. However, research by the California Office of Environmental Health Hazard Assessment (OEHHA) and other organizations has highlighted potential health risks associated with synthetic colorants. These include allergic reactions, skin irritation, and digestive issues. For example, synthetic orange-red colorants have been linked to allergy-like reactions and hyperactivity in children. Some studies suggest that eliminating artificial colors from children's diets may alleviate symptoms of attention-related disorders and other behavioral issues. Additionally, the African Journal of Biotechnology notes that high consumption of tartrazine is associated with cancer risks and can trigger asthma attacks, hazy vision, eczema, and skin reactions.

Therefore, the reluctance to use synthetic colors is expected to increase the demand for natural colors, driving the growth of this market.

Phycocyanin is a pigment-protein complex produced by blue-green microalgae such as Arthrospira (spirulina). It is predominantly utilized as a natural coloring agent in the food industry. Research has shown that this natural pigment offers various health benefits. The marketability of phycocyanin is significantly influenced by its price, which is largely determined by the cost of culturing the algae, particularly the expense associated with the growth substrate.

Phycocyanin is employed as a natural food coloring agent and is recognized for its antioxidant properties, demonstrated both in vivo and in vitro, making it a valuable nutraceutical compound. It is frequently used as a dietary supplement and exhibits various pharmacological benefits. Additionally, phycocyanin serves as a natural blue dye in food and cosmetics. Factors influencing the extraction process include the biomass content of phycocyanin, particle size distribution, solvent type, extraction time, temperature, mixing rate, and biomass-to-solvent ratio. The overall cost of phycocyanin production is primarily determined by the expense of spirulina cultivation, with the mineral medium used representing the largest cost component.

The benefits driving the consumption of phycocyanin include its stability, safety, bioavailability, interactions with food matrix components, and health-promoting effects. The demand for phycocyanin as a natural blue food colorant has increased notably over the past five years, particularly following the FDA's approval of spirulina extract as a food colorant for gum and candy.

In the U.S., the FDA Code of Federal Regulations approves spirulina extract as a color additive and exempts it from certification. This extract, derived from the filtered aqueous extraction of dried Spirulina platensis biomass, contains phycocyanin as its principal coloring agent. Linablue became the first natural blue food coloring to receive FDA approval, reflecting a significant shift in consumer preference from artificial to natural food colorants, especially in North America and Europe. Linablue is gaining attention from food safety and security perspectives due to its vibrant color and natural origin.

Phycocyanin (C-PC) is also increasingly utilized as a natural colorant in alcoholic beverages, such as FIRKIN Blue gin, and in cosmetics, including lipsticks, eyeliners, and eye shadows. Furthermore, C-phycocyanin and its bilin chromophore hold significant potential in food technology as a safe food colorant, functional food additive, and nutraceutical and dietary supplement, thanks to its excellent health benefits and the possibility of sustainable and cost-effective mass production. These attributes are anticipated to create growth opportunities for companies in the global spirulina market.

Based on type, the algal pigments market is segmented into beta-carotene, astaxanthin, fucoxanthin, phycocyanin, phycoerythrin, lutein, chlorophyll, and other types. In 2025, the beta-carotene segment is expected to account for the largest share of 22.3% of the algal pigments market. The significant market share of this segment is largely driven by the numerous benefits of beta-carotene, increasing demand for natural ingredients in the dietary supplement and food industries, extensive use of beta-carotene in food and beverages, cosmetics, and animal feed, and rising demand for dietary supplements due to beta-carotene’s antioxidant properties and its role in enhancing immunity.

However, the phycocyanin segment is expected to register the highest CAGR of 20.0% during the forecast period. This segment's growth is driven by the growing adoption of phycocyanin for nutraceutical and nutritional applications, resistance to synthetic colors, rising demand for natural blue colorants, increasing venture investments in phycocyanin production, the high potential of phycocyanin in pharmaceutical applications, and rising consumer awareness of clean-label products.

Based on form, the algal pigments market is segmented into powder and liquid. In 2025, the powder segment is expected to account for the larger share of the algal pigments market. This segment’s substantial share is attributed to its ease of measurement, handling, and integration into formulations. Additionally, its longer shelf life and enhanced stability reduce the risk of degradation over time. These advantages have increased its utilization across a range of products, including food and beverages, cosmetics, pharmaceuticals, and animal feeds.

Based on source, the global algal pigments market is segmented into microalgae (spirulina, haematococcus pluvialis, dunaliella salina, chlorella, and other microalgae), macroalgae/seaweed (red seaweed, brown seaweed, and green seaweed). In 2025, the microalgae segment is expected to account for the larger share of the algal pigments market. This segment's substantial market share is primarily attributed to the growing preference for microalgae-sourced products, heightened consumer interest in health and wellness trends, the expanding dietary supplement industry, rising demand for natural food colors, and the increasing growth of the nutraceuticals sector.

Based on application, the global algal pigments market is segmented into nutraceuticals, food & beverages, aquaculture, pharmaceuticals, cosmetics, and other applications. In 2025, the nutraceuticals segment is expected to account for the largest share of 38.2% of the algal pigments market. The substantial market share of this segment is primarily driven by growing health consciousness among consumers, the increasing prevalence of chronic diseases, an aging population, and rising demand for natural ingredients in dietary supplements. Moreover, this segment is expected to register the highest CAGR during the forecast period.

Based on geography, the algal pigments market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Europe is expected to account for the largest share of 32.1% of the algal pigments market, followed by North America and Asia-Pacific. The Europe Algal Pigments market is estimated to be worth USD 141.7 million in 2025. Europe's significant market share is driven by several key factors, such as the extensive food and beverage industry, stringent regulations prohibiting synthetic colors, increasing health and wellness trends, high demand for natural colorants across multiple end-use sectors, a substantial number of algal pigment manufacturers, and growing governmental emphasis on the algae industry.

However, Asia-Pacific is expected to record the highest CAGR of 9.6% during the forecast period. This rapid growth is attributed to the rising number of local and regional players providing algal pigments, increasing consumption of natural food ingredients, various government initiatives supporting the use of algae, growing demand for algal pigments within the food and beverage industry, and an increased consumer preference for natural ingredients.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the algal pigments market are Bluetec Naturals Co., Ltd (China), E.I.D. - Parry (India) Limited (A Subsidiary Of M/S. Ambadi Investments Limited) (India), DIC Corporation (Japan), Cyanotech Corporation (U.S.), AstaReal Co., Ltd. (Japan), Algatechologies Ltd. (Israel), Zhejiang Binmei Biotechnology Co., Ltd (China), Algae Health Sciences (U.S.), Sochim International S.p.A. (Italy), Givaudan SA (Switzerland), Merck KGaA (Germany), Sensient Technologies Corporation (U.S.), Tianjin Norland Biotech Co., Ltd (China), Shaivaa Algaetech LLP (India), and Divi's Laboratories Limited (India).

|

Particulars |

Details |

|

Number of Pages |

180 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2025 |

|

CAGR (Value) |

7.2% |

|

Market Size (Value) |

USD 718.0 million by 2032 |

|

Segments Covered |

By Type

By Form

By Source

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, U.K., Italy, Spain, Netherlands, Denmark, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Thailand, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (Egypt, Saudi Arabia, South Africa, UAE, and Rest of Middle East & Africa) |

|

Key Companies |

Bluetec Naturals Co., Ltd (China), E.I.D. - Parry (India) Limited (A Subsidiary Of M/S. Ambadi Investments Limited) (India), DIC Corporation (Japan), Cyanotech Corporation (U.S.), AstaReal Co., Ltd. (Japan), Algatechologies Ltd. (Israel), Zhejiang Binmei Biotechnology Co., Ltd (China), Algae Health Sciences (U.S.), Sochim International S.p.A. (Italy), Givaudan SA (Switzerland), DIC Corporation (Japan), Merck KGaA (Germany), Sensient Technologies Corporation (U.S.), Tianjin Norland Biotech Co., Ltd (China), Shaivaa Algaetech LLP (India), and Divi's Laboratories Limited (India) |

Key questions answered in the algal pigments market report:

Algal pigments are natural pigments or colorants derived from algae mainly including various microalgae and macroalgae. The different types of algae pigments are beta-carotene, astaxanthin, fucoxanthin, phycocyanin, phycoerythrin, lutein, chlorophyll, and other types of algal pigments. These pigments are derived in powdered and liquid form. There is increasing application of these pigments in various food and beverage products, aquaculture, nutraceuticals, pharmaceuticals, and cosmetics.

The algal pigments market study provides valuable insights, market sizes, and forecasts in terms of value by type, form, source, application, and geography.

The algal pigments market is projected to reach $718 million in value by 2032, at a CAGR of 7.2% during the forecast period.

In 2025, the beta-carotene segment is expected to hold a major share of the algal pigments market.

The nutraceuticals segment is expected to witness the fastest growth during the forecast period of 2025–2032.

The growth of this algal pigment market is primarily driven by the rising demand for natural colorants, a growing reluctance to use synthetic colors, the increased adoption of algal pigments for therapeutic and nutritional purposes, heightened awareness of clean-label products, and the need to enhance product appeal. Additionally, the expanding demand for phycocyanin and the increasing use of natural astaxanthin in poultry and aquaculture feed create opportunities for players operating in this market.

The key players operating in the algal pigments market are Bluetec Naturals Co., Ltd (China), E.I.D. - Parry (India) Limited (A Subsidiary Of M/S. Ambadi Investments Limited) (India), DIC Corporation (Japan), Cyanotech Corporation (U.S.), AstaReal Co., Ltd. (Japan), Algatechologies Ltd. (Israel), Zhejiang Binmei Biotechnology Co., Ltd (China), Algae Health Sciences (U.S.), Sochim International S.p.A. (Italy), Givaudan SA (Switzerland), DIC Corporation (Japan), Merck KGaA (Germany), Sensient Technologies Corporation (U.S.), Tianjin Norland Biotech Co., Ltd (China), Shaivaa Algaetech LLP (India), and Divi's Laboratories Limited (India).

Asia-Pacific is expected to witness significant growth during the forecast period of 2025–2032, mainly due to the increasing presence of numerous local and regional players offering algal pigments, rising demand for natural food ingredients, various government initiatives to promote the use of algae, increasing demand for algal pigments from the food and beverage industry, and growing consumer preference for natural ingredients.

Published Date: Jan-2025

Published Date: Jan-2024

Published Date: Jun-2024

Published Date: Aug-2024

Published Date: May-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates