Resources

About Us

Industrial IoT Edge Gateway Market by Type (Hardware, Software), Connectivity (Wired, Wireless), Protocol Support, Component, Deployment Mode, Application, End User, and Geography—Global Forecast to 2034

Report ID: MRICT - 1041612 Pages: 210 Oct-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Industrial IoT Edge Gateway Market Size?

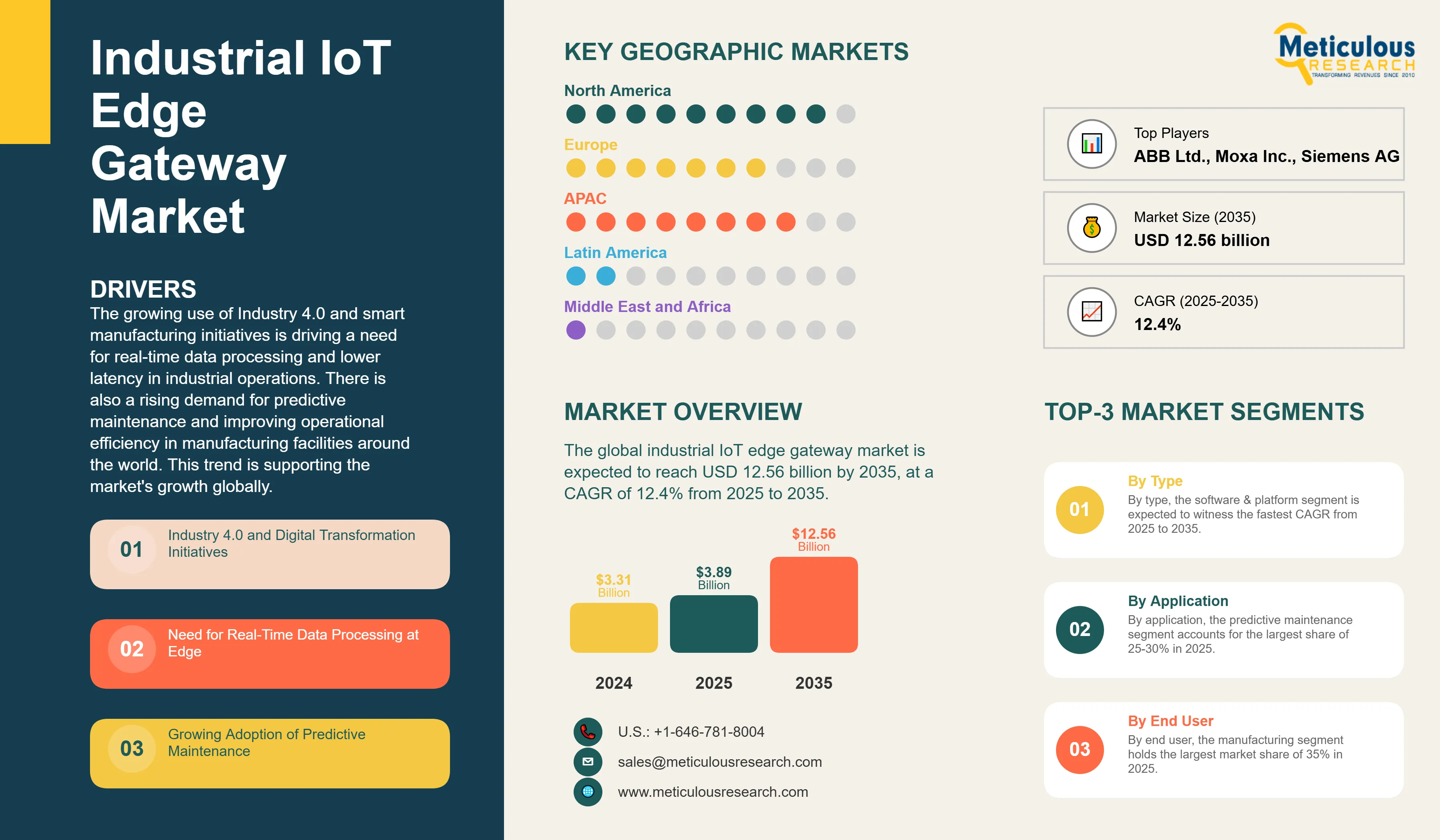

The global industrial IoT edge gateway market was valued at USD 3.31 billion in 2024. This is expected to reach USD 12.56 billion by 2035 from USD 3.89 billion in 2025, at a CAGR of 12.4% from 2025 to 2035. The growing use of Industry 4.0 and smart manufacturing initiatives is driving a need for real-time data processing and lower latency in industrial operations. There is also a rising demand for predictive maintenance and improving operational efficiency in manufacturing facilities around the world. This trend is supporting the market's growth globally.

Industrial IoT Edge Gateway Market Key Takeaways

Click here to: Get Free Sample Pages of this Report

Industrial IoT edge gateways are smart devices that connect factory equipment and machines to business IT systems. They don’t just move data; they process and analyze it on-site. This allows businesses to make quicker decisions and cut network costs.

This technology helps companies link older machinery with new digital platforms, improve security, and enable real-time monitoring and control. The market is growing as businesses pursue digital transformation, adopt AI and machine learning, and want better remote management of operations.

In short, investing in industrial IoT edge gateways provides organizations with faster insights, improved security, and higher operational efficiency. This makes them essential for modernizing industrial operations.

How is AI Transforming the Industrial IoT Edge Gateway Market?

Integrating artificial intelligence into industrial IoT edge gateways is changing how companies operate. With AI, these gateways can automatically filter data, detect equipment issues early, and predict potential failures. This helps reduce downtime by up to 50%.

Machine learning helps determine which data should be sent to the cloud right away and which should remain local, cutting bandwidth costs by as much as 60%. AI-powered gateways can perform tasks like visual quality checks, safety monitoring, and asset tracking, all without needing constant cloud access.

This technology allows for flexible manufacturing by automatically adjusting production based on quality and demand. It can improve overall equipment effectiveness by 20 to 25%. It also keeps data secure and ensures quick responses for critical business operations. In summary, AI integration at the edge provides better reliability, efficiency, and smarter decision-making for industrial businesses.

What are the Key Trends in the Industrial IoT Edge Gateway Market?

5G and TSN for ultra-reliable connectivity:

Industrial IoT edge gateways are using 5G and Time-Sensitive Networking (TSN) to provide fast, reliable, and synchronized communications. This allows companies to connect thousands of devices and ensures that critical data is delivered instantly and securely. This is essential for precision manufacturing and robotics, where every millisecond matters.

Containerization and edge-native applications:

Businesses are using container technology and orchestration tools like Kubernetes to run multiple applications from different vendors on the same edge gateway. This approach simplifies software deployment and updates, lowers infrastructure costs, makes better use of hardware, and enhances both security and flexibility.

With 5G, TSN, and containerization, industrial IoT edge gateways are becoming smarter, faster, and more cost-effective. This enables businesses to scale up quickly, operate efficiently, and maintain highly reliable, real-time industrial operations.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 12.56 Billion |

|

Market Size in 2025 |

USD 3.89 Billion |

|

Market Size in 2024 |

USD 3.31 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 12.4% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Type, Connectivity, Protocol Support, Component, Deployment Mode, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Industry 4.0 and Smart Factory Initiatives

The industrial IoT edge gateway market is growing rapidly due to the global shift toward Industry 4.0 and smart manufacturing, driven by billions in investments from governments and businesses. Manufacturers are installing thousands of IoT sensors to monitor equipment, track production, and improve supply chains, leading to massive data volumes that require edge processing. Edge gateways connect older industrial equipment with modern IoT platforms by converting protocols like Modbus, PROFIBUS, EtherNet/IP, and OPC UA into standard formats.

Making real-time decisions on automated production lines needs edge computing with sub-millisecond latency. Cloud-only systems cannot provide this. Initiatives such as Germany’s Industrie 4.0, China’s Made in China 2025, and the US Advanced Manufacturing Partnership offer funding and regulatory support, which speeds up the adoption of these technologies. As companies face increasing pressure to improve efficiency, reduce costs, and allow for mass customization, edge gateways have become essential for staying competitive in manufacturing.

Restraint

Integration Complexity and Interoperability Challenges

Despite rising demand, the industrial IoT edge gateway market faces significant challenges. Integrating different systems that use various protocols, data formats, and security needs is complicated. Older equipment often lacks standard interfaces, which leads to the need for custom development and thorough testing to ensure reliable data flow. The mixed protocol environment and lack of universal standards create interoperability issues among vendors.

Cybersecurity is essential. It requires strong encryption, authentication, and intrusion detection, which adds to the complexity and costs. There is also a shortage of skilled workers who understand both operational technology (OT) and IT, which limits deployments and raises risks. High upfront costs for hardware, software, integration, and training can deter small and medium manufacturers, even though the long-term benefits are significant.

Opportunity

Edge AI and Autonomous Operations

The combination of edge computing and AI is creating new chances for industrial IoT gateways. This technology allows for autonomous operations and local intelligence. Edge AI enables real-time video analysis for quality checks, handles predictive maintenance on-site, and provides adaptive controls that improve processes without human involvement. Installing and updating machine learning models at the edge supports ongoing process improvement based on local information.

The rise in digital twins increases the demand for gateways that keep virtual models of assets perfectly aligned with minimal delays. The growth in renewable energy and distributed resources opens opportunities for smart gateways that manage microgrids and optimize energy use. New fields such as self-driving cars, drones, and robots depend on edge gateways for real-time navigation and obstacle avoidance.

Type Insights

Why does Hardware Dominate the Market?

The hardware segment holds the largest share of 60-65% of the overall industrial edge gateway market in 2025. Industrial environments require tough, reliable devices that can handle extreme temperatures, vibrations, dust, and interference. Hardware gateways provide essential physical connections through different ports, such as serial, Ethernet, and wireless. They also supply the processing power, memory, and storage necessary for complex edge analytics and multiple connections. Features like fanless designs, DIN rail mounting, and backup power supplies ensure reliability in critical settings. Long equipment replacement cycles of 10 to 20 years also keep hardware demand steady.

At the same time, the software and platform segment is expected to grow the fastest. This growth is fueled by the shift to software-defined infrastructure and flexible edge computing solutions. Platforms for container orchestration, device management, and analytics offer valuable features beyond basic connectivity.

Connectivity Insights

How does Wireless Connectivity Support Industrial IoT?

The wireless segment leads the market with nearly 55-60% share in 2025, thanks to technologies like Wi-Fi, cellular (4G/5G), LoRaWAN, and industrial wireless protocols. Wireless connectivity offers flexible deployment without costly cabling. It supports the growing use of wireless sensors and mobile equipment in industrial sites. Wireless gateways allow easy retrofitting of existing facilities without major disruptions. The rise of private 5G networks provides secure, high-bandwidth wireless options with guaranteed performance. Wireless is especially valuable for monitoring remote assets, mobile machines, and hazardous zones where wires aren’t feasible.

The hybrid segment, which combines wired and wireless connections, is expected to grow the fastest. This mix balances the reliability of wired links for critical systems with the flexibility of wireless for sensors and mobility. This makes it ideal for complex industrial environments.

Protocol Support Insights

How does MQTT Lead Protocol Adoption?

The MQTT segment holds the largest market share of around 30-35% in 2025. Its lightweight publish-subscribe design works well for industrial IoT with thousands of sensors. It uses little bandwidth and manages unreliable networks effectively. MQTT is widely used in cloud platforms, which ensures it is compatible with many systems. Features like quality of service levels and retained messages support both real-time and historical data needs. Open-source options and a strong developer community make it easy to deploy and customize.

The OPC UA segment is expected to grow the fastest. Its rich information modeling, built-in security, and strong compatibility are driving this growth. More companies are adopting it for Industry 4.0 applications that need standardized, secure communication.

Deployment Mode Insights

Why do On-Premises Deployments Dominate?

The on-premises segment holds the largest market share in 2025. This is because industrial operations often require data sovereignty and low-latency processing, especially for critical control and safety systems. Industries such as pharmaceuticals and chemicals need local data storage for regulatory compliance. On-premises setups also ensure continuous operation during internet outages and lower the risk of online security threats. Local deployments attract organizations with specific needs by providing full control and customization.

At the same time, the cloud-based segment is expected to grow at the fastest CAGR through 2035. This growth is driven by increasing acceptance of cloud benefits, such as scalability, reduced IT workload, and better access to analytics. Hybrid cloud models combine local processing with cloud analytics, providing flexible solutions for many companies.

Application Insights

Why does Predictive Maintenance Lead Applications?

The predictive maintenance segment commands the largest share of 25-30% of the overall market in 2025. It provides quick returns on investment by reducing expensive unplanned downtime in industrial facilities. Edge gateways enable real-time vibration analysis, temperature monitoring, and anomaly detection without needing constant cloud access. Predicting equipment failures weeks in advance allows for maintenance during planned downtime and reduces disruptions. Integrating with CMMS and ERP systems through edge gateways simplifies workflows and parts management. The increasing number of aging industrial assets drives the demand for these solutions.

The digital twin segment is expected to grow rapidly, driven by the need for real-time syncing between physical assets and virtual models. This increases the demand for high-performance edge gateways that can manage large data volumes with little delay.

End User Insights

Why does Manufacturing Sector Lead Adoption?

The manufacturing segment leads the market with around 30-35% share in 2025. Facilities equipped with thousands of machines and sensors create vast amounts of data that require edge processing for real-time optimization. Competitive pressure to reduce costs, improve quality, and increase flexibility drives digital transformation through industrial IoT. From discrete assembly to continuous processing, manufacturers depend on edge gateways for monitoring, control, and optimization. The combination of legacy systems that need protocol translation and modern demands for real-time analytics keeps the demand high. Government incentives and industry initiatives also speed up the adoption of smart manufacturing.

The smart cities and buildings segment is expected to grow the fastest during the forecast period. This growth is fueled by large-scale sensor deployments for traffic, environmental, and infrastructure monitoring. Intelligent building systems that manage HVAC, lighting, security, and energy also depend on edge gateways for local processing and coordination.

U.S. Industrial IoT Edge Gateway Market Size and Growth 2025 to 2035

The U.S. industrial IoT edge gateway market is projected to be worth around USD 4.28 billion by 2035, growing at a CAGR of 12.2% from 2025 to 2035.

How is the North America Industrial IoT Edge Gateway Market Growing Dominantly Across the Globe?

North America holds the largest share of around 35-40% of the global industrial IoT edge gateway market in 2025. This growth is mainly attributed to the early adoption of Industry 4.0, significant investments in manufacturing digitalization, and major tech companies like Cisco, Dell, and HPE. Key sectors such as automotive, aerospace, pharmaceuticals, and semiconductors drive the demand for improved edge computing. Reshoring and localizing supply chains are leading to new smart factories that require modern IoT infrastructure. A strong network of system integrators and technology partners backs these complex deployments. Supportive regulations and programs like Manufacturing USA offer funding and motivation. The region's established cloud services and rollout of 5G allow for advanced hybrid edge-cloud solutions.

Which Factors Support the Asia Pacific Industrial IoT Edge Gateway Market Growth?

Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2035. This growth is driven by large manufacturing centers in China, Japan, South Korea, and fast-developing economies. Government initiatives like China’s Industrial Internet Plan, Japan’s Society 5.0, and India’s Smart Manufacturing provide strong policy and funding support. The leadership of this region in electronics manufacturing supports the supply of key components and the demand for smart manufacturing solutions.

Rapid 5G rollouts, especially in China and South Korea, enable industrial IoT applications. A stronger focus on quality and efficiency in competitive markets accelerates adoption. The growing automotive, semiconductor, and consumer electronics industries need advanced edge computing for quality control and process improvement. Local vendors that offer affordable, customized solutions also contribute to market growth.

Value Chain Analysis

Recent Developments

Segments Covered in the Report

By Type

By Connectivity

By Protocol Support

By Component

By Deployment Mode

By Application

By End User

By Region

The industrial IoT edge gateway market is expected to increase from USD 3.31 billion in 2024 to USD 12.56 billion by 2035.

The industrial IoT edge gateway market is expected to grow at a compound annual growth rate (CAGR) of around 12.4% from 2025 to 2035.

The major players in the industrial IoT edge gateway market include Cisco Systems Inc., Dell Technologies Inc., Hewlett Packard Enterprise, Siemens AG, Schneider Electric SE, ABB Ltd., Advantech Co. Ltd., Huawei Technologies Co. Ltd., Microsoft Corporation, Amazon Web Services, Intel Corporation, IBM Corporation, Rockwell Automation Inc., Honeywell International Inc., Emerson Electric Co., Mitsubishi Electric Corporation, Omron Corporation, Bosch Rexroth AG, Moxa Inc., and Eurotech S.p.A.

The driving factors of the industrial IoT edge gateway market are the increasing adoption of Industry 4.0 and smart manufacturing initiatives, growing need for real-time data processing and reduced latency in industrial operations, and rising demand for predictive maintenance and operational efficiency optimization across manufacturing facilities globally.

North America region will lead the global industrial IoT edge gateway market during the forecast period 2025 to 2035.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Market Analysis, By Type

3.3. Market Analysis, By Connectivity

3.4. Market Analysis, By Protocol Support

3.5. Market Analysis, By Deployment Mode

3.6. Market Analysis, By Application

3.7. Market Analysis, By End User

3.8. Market Analysis, By Geography

3.9. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Industrial IoT Edge Gateway Market: Impact Analysis of Market Drivers (2025–2035)

4.2.1. Industry 4.0 and Digital Transformation Initiatives

4.2.2. Need for Real-Time Data Processing at Edge

4.2.3. Growing Adoption of Predictive Maintenance

4.3. Global Industrial IoT Edge Gateway Market: Impact Analysis of Market Restraints (2025–2035)

4.3.1. High Implementation Costs and Complexity

4.3.2. Cybersecurity Concerns

4.4. Global Industrial IoT Edge Gateway Market: Impact Analysis of Market Opportunities (2025–2035)

4.4.1. Edge AI and Machine Learning Integration

4.4.2. 5G Network Deployment

4.5. Global Industrial IoT Edge Gateway Market: Impact Analysis of Market Challenges (2025–2035)

4.5.1. Interoperability and Standardization Issues

4.5.2. Skilled Workforce Shortage

4.6. Global Industrial IoT Edge Gateway Market: Impact Analysis of Market Trends (2025–2035)

4.6.1. Containerization and Cloud-Native Edge Computing

4.6.2. Time-Sensitive Networking Integration

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. The Impact of Sustainability on the Global Industrial IoT Edge Gateway Market

5.1. Introduction to Sustainable Manufacturing

5.2. Energy Efficiency Through Edge Computing

5.3. Carbon Footprint Reduction in Industrial Operations

5.4. Circular Economy and Resource Optimization

5.5. Green Manufacturing Initiatives

5.6. Environmental Regulations and Compliance

5.7. Corporate Sustainability Goals Impact

5.8. Market Growth Through Sustainability Innovation

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Ranking by Key Players

7. Global Industrial IoT Edge Gateway Market, By Type

7.1. Introduction

7.2. Hardware

7.2.1. Processor/Controller Units

7.2.2. Communication Modules

7.2.3. Storage Components

7.3. Software & Platform

7.3.1. Edge Computing Platform

7.3.2. Device Management Software

7.3.3. Analytics Software

7.3.4. Security Software

8. Global Industrial IoT Edge Gateway Market, By Connectivity

8.1. Introduction

8.2. Wired

8.2.1. Ethernet

8.2.2. Serial (RS-232/485)

8.2.3. Fieldbus

8.3. Wireless

8.3.1. Wi-Fi

8.3.2. Cellular (4G/5G)

8.3.3. LoRaWAN

8.3.4. Zigbee

8.3.5. Others

8.4. Hybrid (Wired + Wireless)

9. Global Industrial IoT Edge Gateway Market, By Protocol Support

9.1. Introduction

9.2. MQTT

9.3. OPC UA

9.4. Modbus

9.5. PROFINET

9.6. EtherNet/IP

9.7. CoAP

9.8. DDS

9.9. Others

10. Global Industrial IoT Edge Gateway Market, By Deployment Mode

10.1. Introduction

10.2. On-Premises

10.3. Cloud-Based

10.4. Hybrid

11. Global Industrial IoT Edge Gateway Market, By Application

11.1. Introduction

11.2. Predictive Maintenance

11.3. Asset Tracking & Management

11.4. Remote Monitoring & Control

11.5. Energy Management

11.6. Quality Control

11.7. Digital Twin Implementation

11.8. Process Optimization

11.9. Others

12. Global Industrial IoT Edge Gateway Market, By End User

12.1. Introduction

12.2. Manufacturing

12.2.1. Discrete Manufacturing

12.2.2. Process Manufacturing

12.3. Energy & Utilities

12.4. Oil & Gas

12.5. Transportation & Logistics

12.6. Healthcare

12.7. Retail

12.8. Agriculture

12.9. Smart Cities & Buildings

12.10. Others

13. Industrial IoT Edge Gateway Market, By Geography

13.1. Introduction

13.2. North America

13.2.1. U.S.

13.2.2. Canada

13.3. Asia-Pacific

13.3.1. China

13.3.2. Japan

13.3.3. India

13.3.4. South Korea

13.3.5. Singapore

13.3.6. Taiwan

13.3.7. Rest of Asia-Pacific

13.4. Europe

13.4.1. Germany

13.4.2. U.K.

13.4.3. France

13.4.4. Italy

13.4.5. Netherlands

13.4.6. Sweden

13.4.7. Rest of Europe

13.5. Latin America

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Chile

13.5.5. Rest of Latin America

13.6. Middle East & Africa

13.6.1. UAE

13.6.2. Saudi Arabia

13.6.3. Israel

13.6.4. South Africa

13.6.5. Rest of Middle East & Africa

14. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

14.1. Cisco Systems Inc.

14.2. Dell Technologies Inc.

14.3. Hewlett Packard Enterprise

14.4. Siemens AG

14.5. Schneider Electric SE

14.6. ABB Ltd.

14.7. Advantech Co. Ltd.

14.8. Huawei Technologies Co. Ltd.

14.9. Microsoft Corporation

14.10. Amazon Web Services (AWS)

14.11. Intel Corporation

14.12. IBM Corporation

14.13. Rockwell Automation Inc.

14.14. Honeywell International Inc.

14.15. Emerson Electric Co.

14.16. Mitsubishi Electric Corporation

14.17. Omron Corporation

14.18. Bosch Rexroth AG (Robert Bosch GmbH)

14.19. Moxa Inc.

14.20. Eurotech S.p.A.

14.21. Others

15. Appendix

15.1. Questionnaire

15.2. Available Customization

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates