Resources

About Us

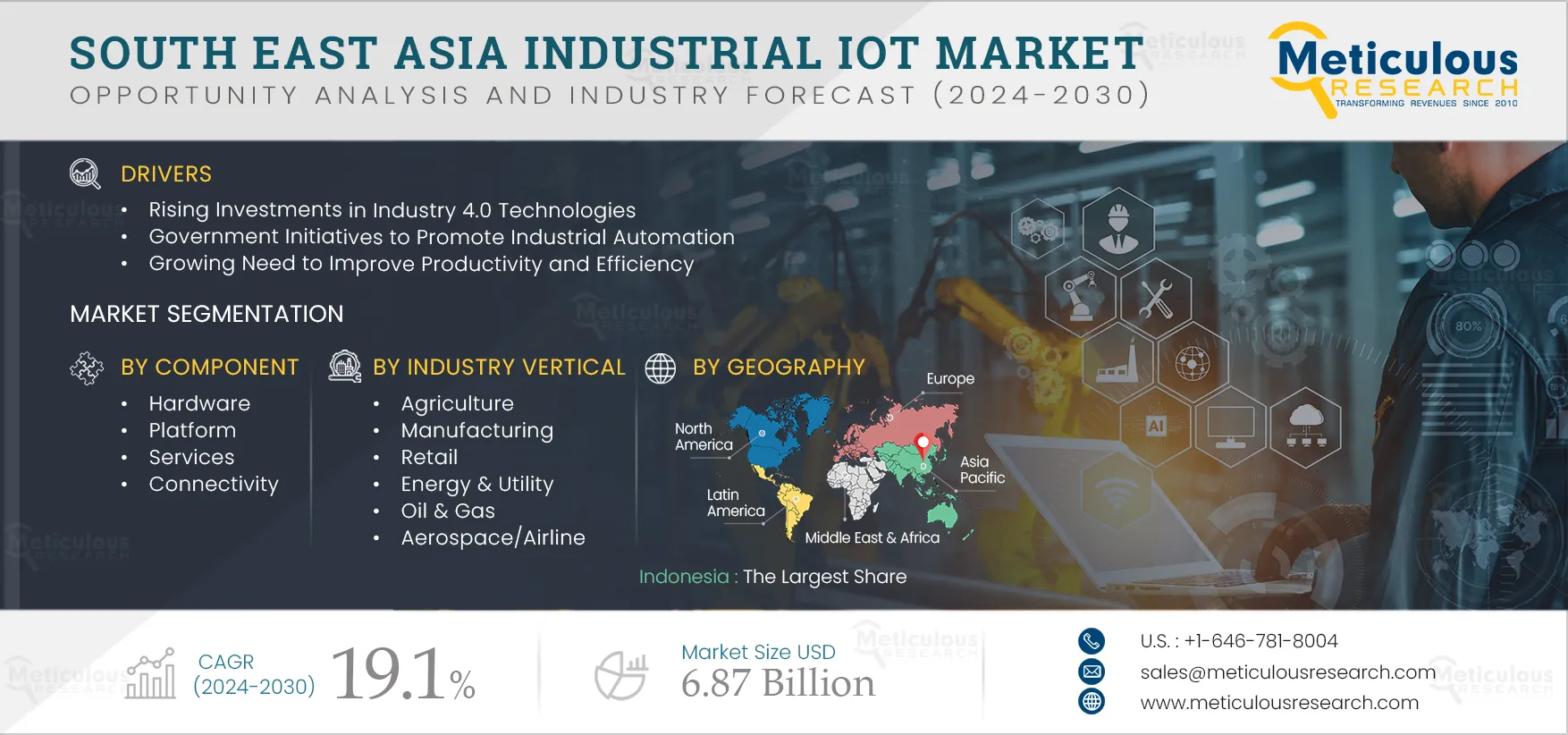

South East Asia Industrial IoT Market by Component (Hardware, Platform, Services, Connectivity), Industry (Agriculture, Manufacturing, Energy & Utilities, Oil & Gas, Aerospace, Retail, Transportation & Logistics, Others), and Geography - Forecast to 2032

Report ID: MRICT - 1041056 Pages: 180 Jan-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe South East Asia Industrial IoT Market is projected to reach $6.87 billion by 2032, at a CAGR of 19.1% during the forecast period 2025–2032. Some of the major factors driving the growth of this market are rising investments in Industry 4.0 technologies, government initiatives to promote industrial automation, and the growing need to improve productivity and efficiency. However, the lack of standardization and high capital & OpEx requirements restrain the growth of the South East Asia IIoT market.

The use of Industrial IoT for predictive maintenance and the proliferation of data centers are expected to create market growth opportunities. However, vulnerability issues with IoT devices and the lack of skilled professionals are major challenges for market growth. Additionally, the rising popularity of IIoT digital twins, the emergence of edge computing, and the rising adoption of smart manufacturing-as-a-service are some of the major trends in this market.

Click here to: Get Free Sample Pages of this Report

Major economies across the region are implementing Industry 4.0 technologies, including IoT, artificial intelligence, robotics, cloud, and analytics, to transition to smart manufacturing. Incorporating industrial IoT technology improves connectivity, output, and resource utilization, resulting in higher efficiency. Therefore, governments across the region are encouraging the adoption of disruptive technologies to promote industrial automation. Initiatives such as tax benefits, R&D investments, and the organization of promotional ventures & platforms are some of the several steps taken by governments to promote industrial IoT technology.

Apart from policy charting, governments across the region have also announced investments in Industry 4.0. For instance, in October 2021, the Thailand Board of Investment (BOI) approved incentives to encourage companies to speed up their Industry 4.0 transformation. Besides, the industrial sector in Singapore has witnessed a boost from the government and private companies to strengthen the production capabilities that support market growth. For instance, in 2020, the Singapore Industrial Automation Association (SIAA) signed a memorandum of understanding (MoU) with OPC Hub ASEAN to help the SIAA members expand the Industry 4.0 capabilities across various manufacturing facilities. Thus, all such initiatives are expected to drive the market growth.

In 2025, the Hardware Segment is Expected to Dominate the South East Asia Industrial IoT Market

Based on component, the South East Asia Industrial IoT market is segmented into hardware, platforms, services, and connectivity. In 2025, the hardware segment is expected to account for the largest share of the South East Asia Industrial IoT market. The large market share of this segment is attributed to factors such as consistent engagement of the industrial sector in improving efficiency, reducing costs, and increasing the Overall Equipment Effectiveness (OEE) through better access to information from real-time solutions.

The Manufacturing Segment is Expected to Dominate the South East Asia Industrial IoT Market

Based on industry vertical, the South East Asia Industrial IoT market is segmented into agriculture, manufacturing, retail, energy & utilities, oil & gas, aerospace, transportation & logistics, telecom, and other industry verticals. In 2025, the manufacturing segment is expected to account for the largest share of the South East Asia Industrial IoT market. The large share of the segment is attributed to factors such as the growing need for centralized monitoring and predictive maintenance of assets, the increasing number of smart factories, the advent of Industry 4.0, and the increasing adoption of autonomous robots for industrial automation. Following are some of the recent developments:

Based on geography, the South East Asia Industrial IoT market is segmented into Indonesia, Vietnam, Thailand, Malaysia, Singapore, Philippines, rest of South East Asia. In 2025, Indonesia is expected to account for the largest share of the South East industrial IoT market.

Indonesia’s government has ambitious plans to propel the country into the top ten biggest economies in the world by 2032, with manufacturing at the heart of this goal. The government of Indonesia is supportive of the adoption of smart manufacturing, and the government has also introduced many initiatives in order to encourage manufacturers to adopt these technologies. The Making Indonesia 4.0 roadmap was launched to accelerate the implementation of Industry 4.0 technologies in Indonesia. In addition, global tech companies, such as Tesla, Google, and Amazon, are considering investments to develop an industrial footprint in Indonesia.

Furthermore, rising investment in smart factories is expected to drive market growth in the country. For instance, in December 2021, Yili Indonesia Dairy (Indonesia), a subsidiary of China-based Yili Group, started operations of the first phase of its smart factory, which features technologies such as the Internet of Things (IoT) and big data analytics.

Key Players:

The key players operating in the South East Asia Industrial IoT market are ABB Ltd. (Switzerland), General Electric Company (U.S.), Emerson Electric Co. (U.S.), Intel Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), IBM Corporation (U.S.), Honeywell International Inc. (U.S.), Amazon Web Services, Inc. (U.S.), Siemens AG (Germany), Huawei Technologies Co, Ltd. (China), Rockwell Automation, Inc. (U.S.), PTC, Inc. (U.S.), Dassault Systemes (France), Robert Bosch GmbH (Germany), KUKA AG (Germany), Microsoft Corporation (U.S.), Schneider Electric SE (France), Advantech Co., Ltd. (Taiwan), and C3.ai, Inc. (U.S.).

Scope of the Report:

South East Asia Industrial IoT Market, by Component

South East Asia Industrial IoT Market, by Industry Vertical

South East Asia Industrial IoT Market, by Country/Region

Key questions answered in the report:

The South East Asia Industrial IoT market is projected to reach $6.87 billion by 2032, at a CAGR of 19.1% during the forecast period.

Some of the major factors driving the growth of this market are rising investments in Industry 4.0 technologies, government initiatives to promote industrial automation, and the growing need to improve productivity and efficiency. In addition, The use of Industrial IoT for predictive maintenance and the proliferation of data centers are expected to create market growth opportunities.

The key players operating in the South East Asia Industrial IoT market are ABB Ltd. (Switzerland), General Electric Company (U.S.), Emerson Electric Co. (U.S.), Intel Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), IBM Corporation (U.S.), Honeywell International Inc. (U.S.), Amazon Web Services, Inc. (U.S.), Siemens AG (Germany), Huawei Technologies Co, Ltd. (China), Rockwell Automation, Inc. (U.S.), PTC, Inc. (U.S.), Dassault Systemes (France), Robert Bosch GmbH (Germany), KUKA AG (Germany), Microsoft Corporation (U.S.), Schneider Electric SE (France), Advantech Co., Ltd. (Taiwan), and C3.ai, Inc. (U.S.)

Based on component, the hardware segment is expected to account for the largest share of the South East Asia Industrial IoT market.

Based on industry vertical, the manufacturing segment is expected to record the highest CAGR during the forecast period.

Vulnerability issues with IoT devices and the lack of skilled professionals are major challenges for market growth.

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates