Resources

About Us

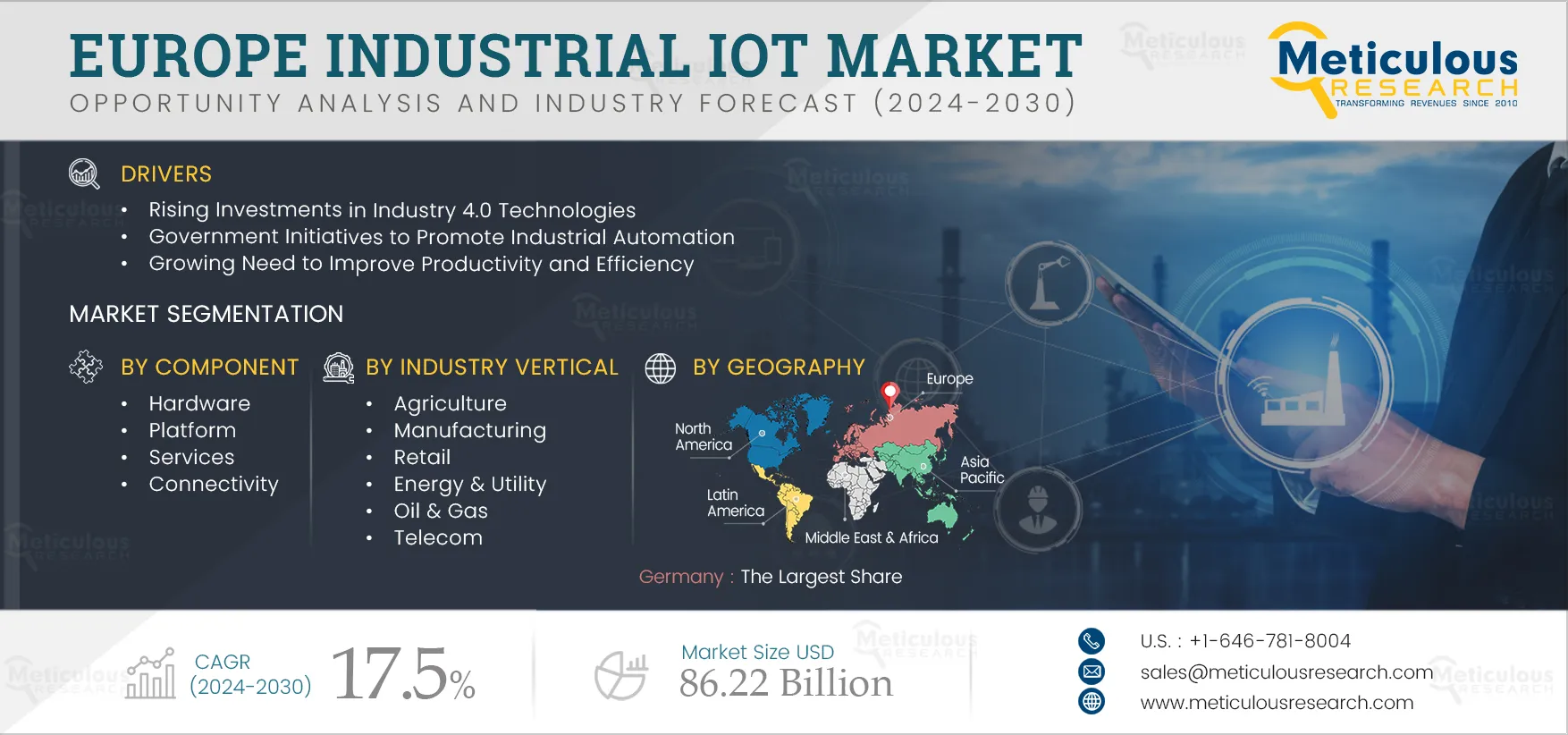

Europe Industrial IoT Market by Component (Hardware, Platform, Services, Connectivity), Industry Vertical (Agriculture, Manufacturing, Energy & Utilities, Oil & Gas, Aerospace, Retail, Transportation & Logistics, Others) Geography - Forecast to 2032

Report ID: MRICT - 104893 Pages: 200 Jan-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportMajor factors driving this market's growth are rising investments in Industry 4.0 technologies, government initiatives to promote industrial automation, and the growing need to improve productivity and efficiency. However, the lack of standardization and high capital & OpEx requirements restrain the growth of the IIoT market.

The use of industrial IoT for predictive maintenance and the proliferation of data centers are expected to create market growth opportunities. However, vulnerability issues with IoT devices and the lack of skilled professionals are major challenges for market growth. Additionally, the rising popularity of IIoT digital twins, the emergence of edge computing, and the rising adoption of smart manufacturing-as-a-service are some of the major trends in this market.

Click here to: Get Free Sample Pages of this Report

Industry 4.0 technologies offer enhanced productivity, efficiency, knowledge sharing & collaborative working, flexibility, and agility, reducing production costs. These benefits have encouraged public and private sector players to invest heavily in transforming their manufacturing facilities. Industry 4.0 has increased the adoption of digital technologies, such as automation, data analytics, and IIoT, transforming economies, production systems, and the delivery of goods and services. This transformation has important implications in terms of industrial development, skill requirements, and global value chains.

In March 2022, the World Economic Forum announced adding 13 new sites to its Global Lighthouse Network, a community of 103 world-leading manufacturing facilities and value chains using Fourth Industrial Revolution technologies to increase operational performance and environmental sustainability. In this global network, 66% of lighthouse companies, including Janssen (Italy), Sanofi (France), BOE Technology Group (China), Schneider Electric (India), and Unilever (India), made sustainability improvements by reducing consumption, resource waste, and carbon emissions, and increased productivity by 82%.

From 2021 to 2027, the European Commission (EU) plans to invest USD 10.8 billion (EUR 9.2 billion) to shape and support the digital transformation of Europe’s society and economy. The program will boost investments in AI, IoT, cybersecurity, and advanced digital skills, ensuring wider use of digital technologies. Similarly, in June 2021, Intel Corporation (U.S.) collaborated with EXOR International (Italy), JMA Wireless (U.S.), and TIM (Italy) to build an end-to-end smart factory in Verona, Italy. This smart factory provides industrial Internet of Things (IIoT) technologies such as artificial intelligence (AI) and 5G to reduce maintenance and energy costs and improve workforce productivity. Such investments are expected to drive market growth during the forecast period.

Based on component, the Europe industrial IoT market is segmented into hardware, platforms, services, and connectivity. In 2025, the hardware segment is expected to account for the largest share of the Europe industrial IoT market. The large market share of this segment is attributed to factors such as consistent engagement of the industrial sector in improving efficiency, reducing costs, and increasing the Overall Equipment Effectiveness (OEE) through better access to information from real-time solutions.

In addition, rising investment in the digital transformation of industries is expected to boost the demand for IIoT hardware. For instance, in January 2021, Microsoft Switzerland partnered with Swiss Smart Factory to accelerate digital transformation in the manufacturing industry in Switzerland. However, the platforms segment is slated to record the highest CAGR during the forecasted period.

Based on industry vertical, the Europe industrial IoT market is segmented into agriculture, manufacturing, retail, energy & utilities, oil & gas, aerospace, transportation & logistics, telecom, and other industry verticals. In 2025, the manufacturing segment is expected to account for the largest share of the Europe industrial IoT market. The manufacturing industry is adopting automation and robotics systems extensively throughout production lines to enhance product quality, reduce work-in-progress time, and improve equipment reliability. IIoT can transform traditional, linear manufacturing supply chains into dynamic, interconnected systems—a digital supply network (DSN)—that can more readily incorporate ecosystem partners.

Thus, the growing need for centralized monitoring and predictive maintenance of assets, the increasing number of smart factories, the advent of Industry 4.0, and the increasing adoption of autonomous robots for industrial automation drive the growth of this segment. Some of the recent developments:

Based on geography, the Europe industrial IoT market is segmented into Germany, the U.K., France, Italy, Spain, Poland, the Netherlands, and the Rest of Europe. In 2025, Germany is expected to account for the largest share of the Europe industrial IoT market.

Industrial organizations in Germany are rapidly adopting IoT solutions. The manufacturing and automotive industries are taking the lead, while other German businesses seek IoT service providers to help them roll out data-driven analytics and other industrial tools. With Germany’s massive automotive industry, companies are incorporating IoT to develop solutions related to vehicle maintenance, passenger infotainment, automated driving assistance, and vehicle-to-vehicle communications, among other applications.

Along with the Industry 4.0 trend, Germany is also increasing the adoption of IIoT technology to boost the productivity of its manufacturing sector. Digital twin technology is being adopted increasingly among German manufacturers to improve productivity and operational efficiency. Thus, the increasing dominance of the automotive and manufacturing industries in the country's digital economy, extensive usage of innovative technologies such as digital twins, and a high potential for smart city projects are driving market growth in the country. However, Poland is expected to grow with the highest CAGR during the forecasted period.

The key players operating in the Europe industrial IoT market are ABB Ltd. (Switzerland), General Electric Company (U.S.), Emerson Electric Co. (U.S.), Intel Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), IBM Corporation (U.S.), Honeywell International Inc. (U.S.), Amazon Web Services, Inc. (U.S.), Siemens AG (Germany), Huawei Technologies Co, Ltd. (China), Rockwell Automation, Inc. (U.S.), PTC, Inc. (U.S.), Dassault Systemes (France), Robert Bosch GmbH (Germany), KUKA AG (Germany), Microsoft Corporation (U.S.), Schneider Electric SE (France), Advantech Co., Ltd. (Taiwan), and C3.ai, Inc. (U.S.)

The Europe industrial IoT market is projected to reach $86.22 billion by 2032, at a CAGR of 17.5% during the forecast period.

Major factors driving this market's growth are rising investments in Industry 4.0 technologies, government initiatives to promote industrial automation, and the growing need to improve productivity and efficiency. In addition, The use of Industrial IoT for predictive maintenance and the proliferation of data centers are expected to create market growth opportunities.

The key players operating in the Europe industrial IoT market are ABB Ltd. (Switzerland), General Electric Company (U.S.), Emerson Electric Co. (U.S.), Intel Corporation (U.S.), Cisco Systems, Inc. (U.S.), SAP SE (Germany), IBM Corporation (U.S.), Honeywell International Inc. (U.S.), Amazon Web Services, Inc. (U.S.), Siemens AG (Germany), Huawei Technologies Co, Ltd. (China), Rockwell Automation, Inc. (U.S.), PTC, Inc. (U.S.), Dassault Systemes (France), Robert Bosch GmbH (Germany), KUKA AG (Germany), Microsoft Corporation (U.S.), Schneider Electric SE (France), Advantech Co., Ltd. (Taiwan), and C3.ai, Inc. (U.S.)

Based on component, the hardware segment is expected to account for the largest share of the Europe industrial IoT market.

Based on the industry vertical, the manufacturing segment is expected to record the highest CAGR during the forecast period

Vulnerability issues with IoT devices and the lack of skilled professionals are major challenges for market growth.

Published Date: Oct-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates