Resources

About Us

Industrial Hemp Market: Size & Forecast by Product Type (Hemp Seeds, Hemp Fiber, Hemp Oil), Source (Conventional, Organic), End-Use Industry (Food & Beverage, Textile, Construction) & Region - Global Forecast and Analysis to 2035

Report ID: MRFB - 1041498 Pages: 176 May-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThis comprehensive market research report analyzes the rapidly evolving Industrial Hemp market, evaluating how emerging cultivation technologies, processing innovations, and expanding applications are revolutionizing various industries including textiles, construction, food and beverage, personal care, and pharmaceuticals. The report provides a strategic analysis of market dynamics, growth projections till 2035, and competitive positioning across global and regional/country-level markets.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

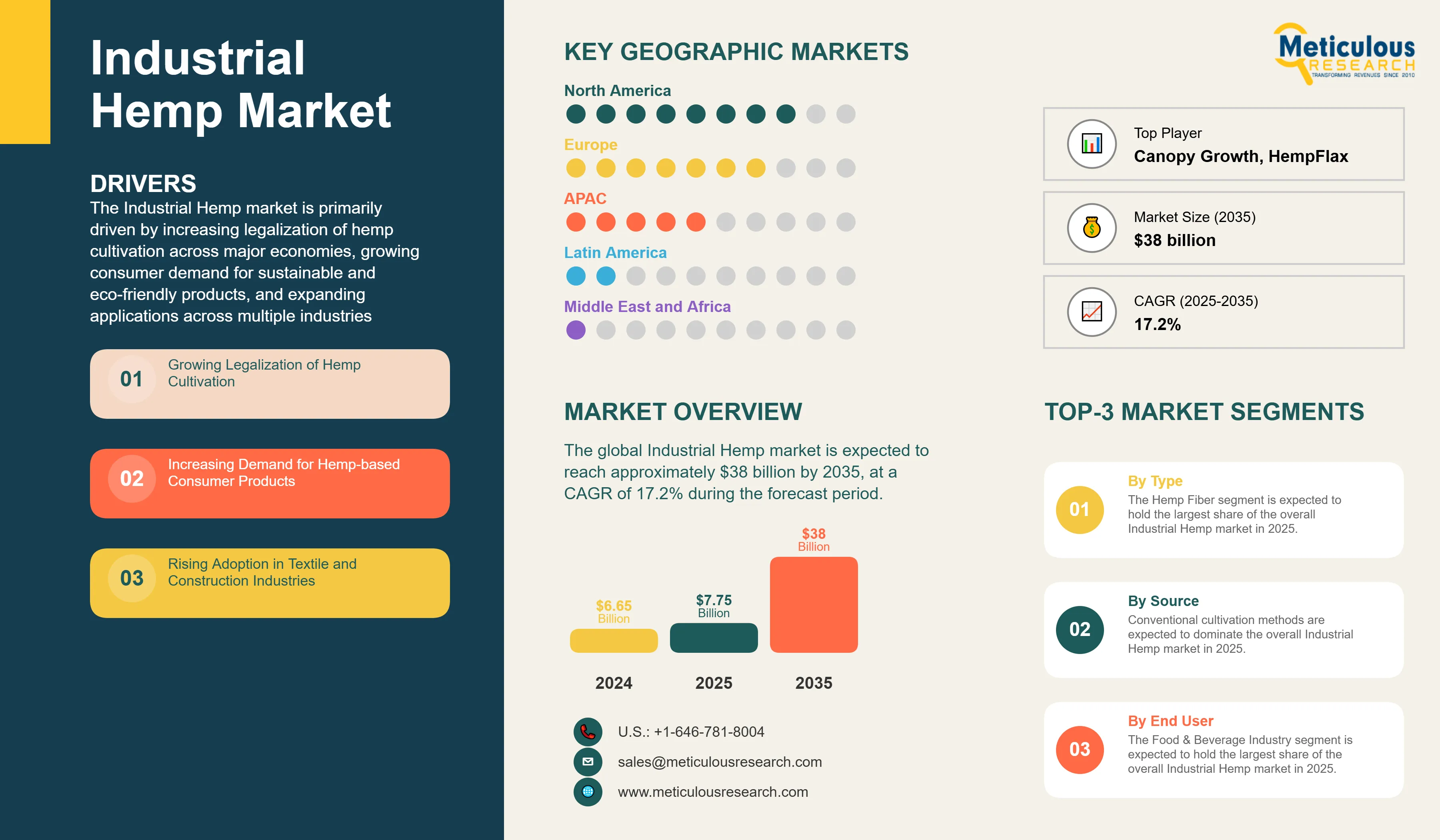

The Industrial Hemp market is primarily driven by increasing legalization of hemp cultivation across major economies, growing consumer demand for sustainable and eco-friendly products, and expanding applications across multiple industries. Significant advancements in hemp processing technologies are improving extraction efficiency and product quality, while substantial investments from both agricultural conglomerates and new entrants are fueling market growth. The increasing focus on sustainability benefits, including hemp's carbon sequestration properties, is driving adoption in textile and construction industries. Additionally, the expanding applications in pharmaceutical and wellness sectors, particularly for CBD-based products, are further accelerating market growth, especially in North America and Europe.

Key Challenges

Despite significant growth potential, the overall Industrial Hemp market faces challenges including regulatory uncertainties and compliance challenges that vary across regions, lengthening market entry timelines. Limited processing infrastructure represents a significant barrier to widespread adoption, particularly in emerging markets. Banking and financial service limitations continue to pose challenges for industry participants in some regions. Additionally, high initial investment costs for specialized harvesting and processing equipment are limiting immediate economic viability for smaller producers. Supply chain fragmentation and standardization issues in hemp quality present additional barriers, potentially slowing down market adoption in different regions across the globe. Consumer education and market awareness remain challenges in distinguishing industrial hemp from cannabis products.

Growth Opportunities

The Industrial Hemp market offers several high-growth opportunities. Development of advanced hemp-based bioplastics presents a significant opportunity to create sustainable alternatives to petroleum-based plastics. The emerging markets and applications in developing economies, particularly in Asia-Pacific and Latin America, can diversify revenue streams. Integration with sustainable agriculture practices represents a substantial growth area as farmers seek crop rotation options with environmental benefits. Advancements in R&D for hemp-based nanomaterials and composites could dramatically expand industrial applications and enhance product performance. Additionally, the rise of organic and regenerative hemp farming practices and premium branding of hemp-derived products presents untapped market potential, as organizations increasingly seek innovative sustainable solutions.

Market Segmentation Highlights

By Product Type

The Hemp Fiber segment is expected to hold the largest share of the overall Industrial Hemp market in 2025, due to its versatility across textile, construction, and automotive applications. However, Hemp Oil market is projected to grow at the fastest CAGR through 2035 as food, cosmetic, and wellness companies seek to capitalize on its nutritional and therapeutic properties. Hemp Protein also shows significant growth potential at a CAGR of 18.8% due to increasing demand for plant-based protein sources in functional foods and supplements.

By Source

Conventional cultivation methods are expected to dominate the overall Industrial Hemp market in 2025, driven by established farming practices and lower production costs. Organic hemp cultivation is expected to grow at a faster CAGR during the forecast period as consumer demand for certified organic hemp products increases across food, beverage, and personal care applications. This growth is supported by premium pricing opportunities and alignment with sustainable agriculture trends, especially in mature markets across North America and Europe.

By End-Use Industry

The Food & Beverage Industry segment is expected to hold the largest share of the overall Industrial Hemp market in 2025, with Functional Foods being the dominant subsegment due to strong consumer interest in hemp seeds, protein, and oil as nutritional ingredients. However, the Construction Industry applications are projected to grow at the highest CAGR during the forecast period as builders and architects recognize the benefits of hempcrete and other hemp-based building materials. The Pharmaceutical Industry also shows strong growth potential as research into cannabinoids expands and regulatory frameworks evolve.

By Geography

North America is expected to hold the largest share of the global Industrial Hemp market in 2025, followed by Europe. This is mainly driven by progressive regulatory frameworks, substantial investment in processing infrastructure, and strong consumer demand for hemp-derived products. The U.S. represents the largest market globally of total market value, while France leads the adoption in the European region due to its long history of hemp cultivation and processing. However, the Asia-Pacific region, particularly China, Australia, and India, is projected to witness the highest CAGR during the forecast period 2025-2035, driven by expanding legalization, agricultural diversification initiatives, and significant investments in hemp processing facilities. The Latin American region shows promising growth potential as countries like Brazil, Mexico, and Chile develop regulatory frameworks supporting industrial hemp cultivation as part of their agricultural modernization strategies.

Competitive Landscape

The global Industrial Hemp market features a diverse, competitive landscape with established agricultural producers competing alongside specialized hemp cultivation and processing companies.

The competitive landscape is categorized into integrated hemp producers and specialized processors, with each group employing distinctive strategies to maintain competitive advantage. Leading providers are focusing on vertical integration that combines cultivation, processing, and product development while addressing complex regulatory challenges across different regions.

The key players operating in the global Industrial Hemp market are Canopy Growth Corporation, Charlotte's Web Holdings, Inc., Hempco Food and Fiber Inc. (Aurora Cannabis), Hemp Inc., HempFlax Group B.V., Konoplex Group, Ecofibre Limited, GenCanna Global USA, Inc., Hemp Oil Canada Inc., Nutiva Inc., Manitoba Harvest Hemp Foods, South Hemp Tecno, MH Medical Hemp GmbH, Dun Agro Hemp Group, and Colorado Hemp Works, among others.

|

Particulars |

Details |

|

Number of Pages |

176 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

17.2% |

|

Market Size (Value)in 2025 |

$7.75 billion |

|

Market Size (Value) in 2035 |

$38 billion |

|

Segments Covered |

By Product Type

By Source

By End-Use Industry

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, U.K., Netherlands, Italy, Switzerland, Rest of Europe), Asia-Pacific (China, Australia, Japan, South Korea, India, Thailand, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Chile, Rest of Latin America), Middle East & Africa (Israel, South Africa, Morocco, Rest of Middle East & Africa) |

|

Key Companies |

Integrated Hemp Producers: Canopy Growth Corporation, Charlotte's Web Holdings, Inc., Hempco Food and Fiber Inc. (Aurora Cannabis), Ecofibre Limited, Manitoba Harvest Hemp Foods Specialized Processors: Hemp Inc., HempFlax Group B.V., Konoplex Group, GenCanna Global USA, Inc., Hemp Oil Canada Inc., Nutiva Inc., South Hemp Tecno, MH Medical Hemp GmbH, Dun Agro Hemp Group, Colorado Hemp Works |

The global Industrial Hemp market was valued at $6.65 billion in 2024. This market is expected to reach approximately $38 billion by 2035, growing from an estimated $7.75 billion in 2025, at a CAGR of 17.2% during the forecast period of 2025-2035.

The global Industrial Hemp market is expected to grow at a CAGR of 17.2% during the forecast period of 2025-2035.

The global Industrial Hemp market is expected to reach approximately $38 billion by 2035, growing from an estimated $7.75 billion in 2025, at a CAGR of 17.2% during the forecast period of 2025-2035.

The key companies operating in this market include Canopy Growth Corporation, Charlotte's Web Holdings, Inc., Hempco Food and Fiber Inc. (Aurora Cannabis), Hemp Inc., HempFlax Group B.V., Konoplex Group, Ecofibre Limited, GenCanna Global USA, Inc., Hemp Oil Canada Inc., Nutiva Inc., Manitoba Harvest Hemp Foods, South Hemp Tecno, MH Medical Hemp GmbH, Dun Agro Hemp Group, and Colorado Hemp Works among others.

Major trends shaping the market include vertical integration among market players, rise of organic and regenerative hemp farming, technological advancements in hemp processing, premium branding of hemp-derived products, and increasing partnerships between cultivators and end-product manufacturers.

• In 2025, the Hemp Fiber segment is expected to dominate the overall Industrial Hemp market by product type.

• Based on source, Conventional cultivation methods are expected to hold the largest share of the overall Industrial Hemp market in 2025.

• Based on end-use industry, the Food & Beverage Industry segment is expected to hold the largest share of the global Industrial Hemp market in 2025, with Functional Foods being the dominant subsegment.

• Hemp Oil is projected to grow at the highest CAGR in the product type segment through 2035.

• Organic hemp cultivation is expected to grow at the highest CAGR during the forecast period.

• The Construction Industry is projected to grow at the highest CAGR among end-use industries during the forecast period.

North America is expected to hold the largest share of the global Industrial Hemp market in 2025, followed by Europe. This is driven by progressive regulatory frameworks, substantial investment in processing infrastructure, and strong consumer demand. However, the Asia-Pacific region is projected to grow at the highest CAGR during the forecast period.

The growth of this market is driven by increasing legalization of hemp cultivation across major economies, growing consumer demand for sustainable products, expanding applications across multiple industries, advancements in hemp processing technologies, and the increasing focus on sustainability benefits, including carbon sequestration properties.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency & Pricing

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Bottom-up Approach

2.3.3. Top-down Approach

2.3.4. Growth Forecast Approach

2.3.5. Assumptions for the Study

3. Executive Summary

3.1. Market Overview

3.2. Segmental Analysis

3.2.1. Industrial Hemp Market, by Product Type

3.2.2. Industrial Hemp Market, by Source

3.2.3. Industrial Hemp Market, by End-Use Industry

3.2.4. Industrial Hemp Market, by Geography

3.3. Competitive Landscape

4. Market Insights

4.1. Market Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Growing Legalization of Hemp Cultivation

4.2.1.2. Increasing Demand for Hemp-based Consumer Products

4.2.1.3. Rising Adoption in Textile and Construction Industries

4.2.1.4. Sustainability Benefits and Carbon Sequestration Properties

4.2.1.5. Expanding Applications in Pharmaceutical and Wellness Sectors

4.2.2. Restraints

4.2.2.1. Regulatory Uncertainties and Compliance Challenges

4.2.2.2. Limited Processing Infrastructure

4.2.2.3. High Initial Investment Costs

4.2.2.4. Supply Chain Fragmentation

4.2.3. Opportunities

4.2.3.1. Development of Advanced Hemp-based Bioplastics

4.2.3.2. Emerging Markets and Applications in Developing Economies

4.2.3.3. Integration with Sustainable Agriculture Practices

4.2.3.4. R&D in Hemp-based Nanomaterials and Composites

4.2.4. Trends

4.2.4.1. Vertical Integration Among Market Players

4.2.4.2. Rise of Organic and Regenerative Hemp Farming

4.2.4.3. Technological Advancements in Hemp Processing

4.2.4.4. Premium Branding of Hemp-derived Products

4.2.5. Challenges

4.2.5.1. Standardization Issues in Hemp Quality

4.2.5.2. Banking and Financial Service Limitations

4.2.5.3. Consumer Education and Market Awareness

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Impact of Sustainability on the Industrial Hemp Market

4.4.1. Environmental Impact Assessment

4.4.2. Sustainable Cultivation Practices

4.4.3. Life Cycle Analysis of Hemp Products

4.4.4. Carbon Footprint Reduction Initiatives

5. Industrial Hemp Market Assessment—by Product Type

5.1. Hemp Seeds

5.2. Hemp Fiber

5.3. Hemp Oil

5.4. Hemp Protein

5.5. Hemp Hurd/Shivs

6. Industrial Hemp Market Assessment—by Source

6.1. Conventional

6.2. Organic

7. Industrial Hemp Market Assessment—by End-Use Industry

7.1. Food & Beverage Industry

7.1.1. Functional Foods

7.1.2. Protein Supplements

7.1.3. Beverages

7.1.4. Cooking Oils

7.2. Textile Industry

7.3. Construction Industry

7.4. Personal Care Industry

7.5. Pharmaceutical Industry

7.6. Paper Industry

7.7. Automotive Industry

7.8. Animal Feed Industry

7.9. Other End-use Industries

8. Industrial Hemp Market Assessment—by Geography

8.1. Overview

8.2. North America

8.2.1. U.S.

8.2.2. Canada

8.3. Europe

8.3.1. France

8.3.2. Germany

8.3.3. U.K.

8.3.4. Netherlands

8.3.5. Italy

8.3.6. Switzerland

8.3.7. Rest of Europe (RoE)

8.4. Asia-Pacific

8.4.1. China

8.4.2. Australia

8.4.3. Japan

8.4.4. South Korea

8.4.5. India

8.4.6. Thailand

8.4.7. Rest of Asia-Pacific (RoAPAC)

8.5. Latin America

8.5.1. Brazil

8.5.2. Mexico

8.5.3. Chile

8.5.4. Rest of Latin America (RoLATAM)

8.6. Middle East & Africa

8.6.1. Israel

8.6.2. South Africa

8.6.3. Morocco

8.6.4. Rest of Middle East & Africa (RoMEA)

9. Competitive Landscape

9.1. Overview

9.2. Key Growth Strategies

9.3. Competitive Benchmarking

9.4. Competitive Dashboard

9.4.1. Industry Leaders

9.4.2. Market Differentiators

9.4.3. Vanguards

9.4.4. Emerging Players

9.5. Market Share/Ranking Analysis, by Key Players, 2024

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

10.1. Canopy Growth Corporation

10.2. Charlotte's Web Holdings, Inc.

10.3. Hempco Food and Fiber Inc. (Aurora Cannabis)

10.4. Hemp Inc.

10.5. HempFlax Group B.V.

10.6. Konoplex Group

10.7. Ecofibre Limited

10.8. GenCanna Global USA, Inc.

10.9. Hemp Oil Canada Inc.

10.10. Nutiva Inc.

10.11. Manitoba Harvest Hemp Foods

10.12. South Hemp Tecno

10.13. MH Medical Hemp GmbH

10.14. Dun Agro Hemp Group

10.15. Colorado Hemp Works

11. Appendix

11.1. Available Customizations

11.2. Related Reports

List of Tables

Global Market Overview

Table 1: Global Industrial Hemp Market, 2023-2035 (USD Million)

Table 2: Global Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 3: Global Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 4: Global Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Table 5: Global Industrial Hemp Market, by Region/Country, 2023-2035 (USD Million)

Product Type Segment

Table 6: Global Hemp Seeds Market, by Region/Country, 2023-2035 (USD Million)

Table 7: Global Hemp Fiber Market, by Region/Country, 2023-2035 (USD Million)

Table 8: Global Hemp Oil Market, by Region/Country, 2023-2035 (USD Million)

Table 9: Global Hemp Protein Market, by Region/Country, 2023-2035 (USD Million)

Table 10: Global Hemp Hurd/Shivs Market, by Region/Country, 2023-2035 (USD Million)

Source Segment

Table 11: Global Conventional Hemp Market, by Region/Country, 2023-2035 (USD Million)

Table 12: Global Organic Hemp Market, by Region/Country, 2023-2035 (USD Million)

End-Use Industry Segment

Table 13: Global Industrial Hemp Market for Food & Beverage Industry, by Region/Country, 2023-2035 (USD Million)

Table 14: Global Industrial Hemp Market for Functional Foods, by Region/Country, 2023-2035 (USD Million)

Table 15: Global Industrial Hemp Market for Protein Supplements, by Region/Country, 2023-2035 (USD Million)

Table 16: Global Industrial Hemp Market for Beverages, by Region/Country, 2023-2035 (USD Million)

Table 17: Global Industrial Hemp Market for Cooking Oils, by Region/Country, 2023-2035 (USD Million)

Table 18: Global Industrial Hemp Market for Textile Industry, by Region/Country, 2023-2035 (USD Million)

Table 19: Global Industrial Hemp Market for Construction Industry, by Region/Country, 2023-2035 (USD Million)

Table 20: Global Industrial Hemp Market for Personal Care Industry, by Region/Country, 2023-2035 (USD Million)

Table 21: Global Industrial Hemp Market for Pharmaceutical Industry, by Region/Country, 2023-2035 (USD Million)

Table 22: Global Industrial Hemp Market for Paper Industry, by Region/Country, 2023-2035 (USD Million)

Table 23: Global Industrial Hemp Market for Automotive Industry, by Region/Country, 2023-2035 (USD Million)

Table 24: Global Industrial Hemp Market for Animal Feed Industry, by Region/Country, 2023-2035 (USD Million)

North America Market

Table 25: North America Industrial Hemp Market, 2023-2035 (USD Million)

Table 26: North America Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 27: North America Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 28: North America Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Table 29: North America Industrial Hemp Market, by Country, 2023-2035 (USD Million)

U.S. Market

Table 30: U.S. Industrial Hemp Market, 2023-2035 (USD Million)

Table 31: U.S. Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 32: U.S. Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 33: U.S. Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Canada Market

Table 34: Canada Industrial Hemp Market, 2023-2035 (USD Million)

Table 35: Canada Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 36: Canada Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 37: Canada Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Europe Market

Table 38: Europe Industrial Hemp Market, 2023-2035 (USD Million)

Table 39: Europe Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 40: Europe Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 41: Europe Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Table 42: Europe Industrial Hemp Market, by Country, 2023-2035 (USD Million)

France Market

Table 43: France Industrial Hemp Market, 2023-2035 (USD Million)

Table 44: France Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 45: France Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 46: France Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Germany Market

Table 47: Germany Industrial Hemp Market, 2023-2035 (USD Million)

Table 48: Germany Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 49: Germany Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 50: Germany Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

U.K. Market

Table 51: U.K. Industrial Hemp Market, 2023-2035 (USD Million)

Table 52: U.K. Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 53: U.K. Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 54: U.K. Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Netherlands Market

Table 55: Netherlands Industrial Hemp Market, 2023-2035 (USD Million)

Table 56: Netherlands Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 57: Netherlands Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 58: Netherlands Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Italy Market

Table 59: Italy Industrial Hemp Market, 2023-2035 (USD Million)

Table 60: Italy Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 61: Italy Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 62: Italy Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Switzerland Market

Table 63: Switzerland Industrial Hemp Market, 2023-2035 (USD Million)

Table 64: Switzerland Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 65: Switzerland Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 66: Switzerland Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Rest of Europe Market

Table 67: Rest of Europe Industrial Hemp Market, 2023-2035 (USD Million)

Table 68: Rest of Europe Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 69: Rest of Europe Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 70: Rest of Europe Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Asia-Pacific Market

Table 71: Asia-Pacific Industrial Hemp Market, 2023-2035 (USD Million)

Table 72: Asia-Pacific Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 73: Asia-Pacific Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 74: Asia-Pacific Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Table 75: Asia-Pacific Industrial Hemp Market, by Country, 2023-2035 (USD Million)

China Market

Table 76: China Industrial Hemp Market, 2023-2035 (USD Million)

Table 77: China Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 78: China Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 79: China Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Australia Market

Table 80: Australia Industrial Hemp Market, 2023-2035 (USD Million)

Table 81: Australia Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 82: Australia Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 83: Australia Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Japan Market

Table 84: Japan Industrial Hemp Market, 2023-2035 (USD Million)

Table 85: Japan Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 86: Japan Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 87: Japan Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

South Korea Market

Table 88: South Korea Industrial Hemp Market, 2023-2035 (USD Million)

Table 89: South Korea Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 90: South Korea Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 91: South Korea Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

India Market

Table 92: India Industrial Hemp Market, 2023-2035 (USD Million)

Table 93: India Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 94: India Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 95: India Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Thailand Market

Table 96: Thailand Industrial Hemp Market, 2023-2035 (USD Million)

Table 97: Thailand Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 98: Thailand Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 99: Thailand Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Rest of Asia-Pacific Market

Table 100: Rest of Asia-Pacific Industrial Hemp Market, 2023-2035 (USD Million)

Table 101: Rest of Asia-Pacific Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 102: Rest of Asia-Pacific Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 103: Rest of Asia-Pacific Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Latin America Market

Table 104: Latin America Industrial Hemp Market, 2023-2035 (USD Million)

Table 105: Latin America Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 106: Latin America Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 107: Latin America Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Table 108: Latin America Industrial Hemp Market, by Country, 2023-2035 (USD Million)

Brazil Market

Table 109: Brazil Industrial Hemp Market, 2023-2035 (USD Million)

Table 110: Brazil Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 111: Brazil Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 112: Brazil Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Mexico Market

Table 113: Mexico Industrial Hemp Market, 2023-2035 (USD Million)

Table 114: Mexico Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 115: Mexico Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 116: Mexico Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Chile Market

Table 117: Chile Industrial Hemp Market, 2023-2035 (USD Million)

Table 118: Chile Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 119: Chile Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 120: Chile Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Rest of Latin America Market

Table 121: Rest of Latin America Industrial Hemp Market, 2023-2035 (USD Million)

Table 122: Rest of Latin America Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 123: Rest of Latin America Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 124: Rest of Latin America Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Middle East & Africa Market

Table 125: Middle East & Africa Industrial Hemp Market, 2023-2035 (USD Million)

Table 126: Middle East & Africa Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 127: Middle East & Africa Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 128: Middle East & Africa Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Table 129: Middle East & Africa Industrial Hemp Market, by Country, 2023-2035 (USD Million)

Israel Market

Table 130: Israel Industrial Hemp Market, 2023-2035 (USD Million)

Table 131: Israel Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 132: Israel Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 133: Israel Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

South Africa Market

Table 134: South Africa Industrial Hemp Market, 2023-2035 (USD Million)

Table 135: South Africa Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 136: South Africa Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 137: South Africa Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Morocco Market

Table 138: Morocco Industrial Hemp Market, 2023-2035 (USD Million)

Table 139: Morocco Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 140: Morocco Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 141: Morocco Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

Rest of Middle East & Africa Market

Table 142: Rest of Middle East & Africa Industrial Hemp Market, 2023-2035 (USD Million)

Table 143: Rest of Middle East & Africa Industrial Hemp Market, by Product Type, 2023-2035 (USD Million)

Table 144: Rest of Middle East & Africa Industrial Hemp Market, by Source, 2023-2035 (USD Million)

Table 145: Rest of Middle East & Africa Industrial Hemp Market, by End-Use Industry, 2023-2035 (USD Million)

List of Figures

Figure 1: Global Industrial Hemp Market Size, 2023-2035 (USD Million)

Figure 2: Global Industrial Hemp Market Growth, Y-o-Y % Growth, 2025-2035

Figure 3: Global Industrial Hemp Market, by Product Type, 2025 vs. 2035 (%)

Figure 4: Global Industrial Hemp Market, by Source, 2025 vs. 2035 (%)

Figure 5: Global Industrial Hemp Market, by End-Use Industry, 2025 vs. 2035 (%)

Figure 6: Global Industrial Hemp Market, by Region/Country, 2025 vs. 2035 (%)

Figure 7: Impact Assessment of Market Drivers on Global Industrial Hemp Market (2025-2035)

Figure 8: Impact Assessment of Market Restraints on Global Industrial Hemp Market (2025-2035)

Figure 9: Impact Assessment of Market Opportunities on Global Industrial Hemp Market (2025-2035)

Figure 10: Porter's Five Forces Analysis: Global Industrial Hemp Market

Figure 11: Hemp Cultivation Acreage by Region, 2024

Figure 12: Key Regulatory Frameworks for Hemp Cultivation by Region

Figure 13: Investment Trends in Hemp Processing Technology, 2022-2025

Figure 14: Hemp Usage by Application, 2024

Figure 15: Hemp Yield Comparison by Variety, 2023-2024

Figure 16: Sustainability Impact: Hemp vs. Traditional Crops

Figure 17: Hemp Product Price Trends by Category, 2022-2025

Figure 18: North America Industrial Hemp Market Snapshot, 2025-2035 (USD Million)

Figure 19: North America Industrial Hemp Market Share, by Country, 2025 vs. 2035 (%)

Figure 20: Europe Industrial Hemp Market Snapshot, 2025-2035 (USD Million)

Figure 21: Europe Industrial Hemp Market Share, by Country, 2025 vs. 2035 (%)

Figure 22: Asia-Pacific Industrial Hemp Market Snapshot, 2025-2035 (USD Million)

Figure 23: Asia Pacific Industrial Hemp Market Share, by Country, 2025 vs. 2035 (%)

Figure 24: Latin America Industrial Hemp Market Snapshot, 2025-2035 (USD Million)

Figure 25: Latin America Industrial Hemp Market Share, by Country, 2025 vs. 2035 (%)

Figure 26: Middle East & Africa Industrial Hemp Market Snapshot, 2025-2035 (USD Million)

Figure 28: Middle East & Africa Green Ammonia Market Share, by Country, 2025 vs. 2035 (%)

Published Date: Jun-2024

Published Date: May-2023

Published Date: Mar-2025

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates