Resources

About Us

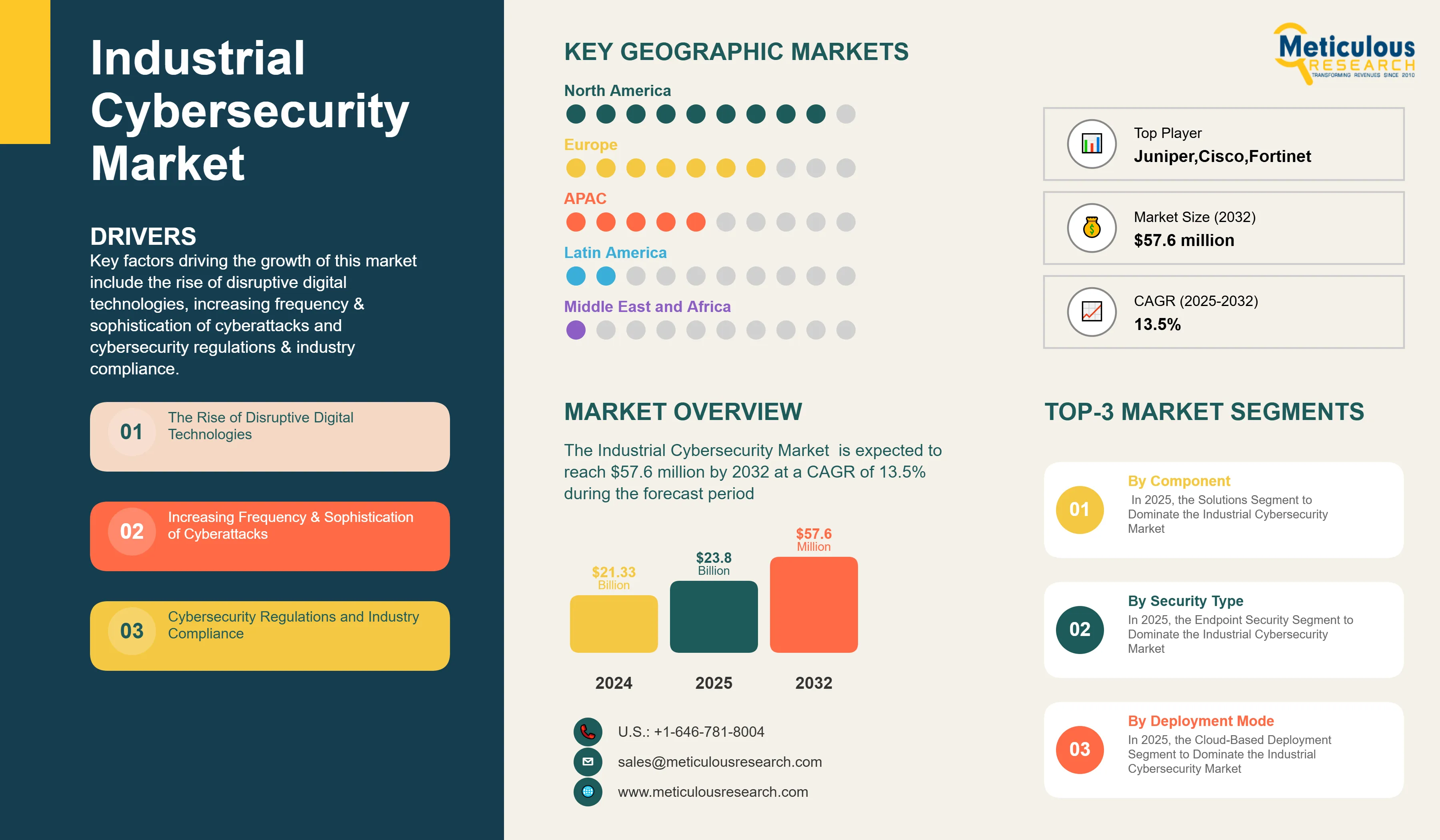

Industrial Cybersecurity Market Size, Share, Forecast & Trend Analysis by Component (Solutions, Services), Security Type (Endpoint Security, Network Security), End User (Industrial Manufacturing, Transportation & Logistics) & Geography - Forecast to 2032

Report ID: MRICT - 104630 Pages: 300 Feb-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportKey factors driving the growth of this market include the rise of disruptive digital technologies, increasing frequency & sophistication of cyberattacks and cybersecurity regulations & industry compliance. However, the shortage of skilled professionals and complexity of securing of environments restrain this market’s growth.

The growing interest in cloud-based security solutions and AL & ML for threat detection is expected to generate market growth opportunities for the stakeholders operating in this market. Furthermore, the rising adoption of cloud technologies is a major trend in the industrial cybersecurity market.

Click here to: Get Free Sample Pages of this Report

As industries across the globe continue to embrace digital transformation, the adoption of disruptive technologies has led to significant improvements in operational efficiency, productivity, and cost reductions. However, this rapid advancement has also introduced a greater number of cybersecurity challenges. The industrial sector, in particular, is becoming increasingly vulnerable to cyber threats due to the integration of advanced technologies such as the Industrial Internet of Things (IIoT), artificial intelligence (AI), machine learning (ML), data analytics, robotics, and cloud computing. While these technologies provide substantial benefits in terms of automation, real-time data analytics, and enhanced decision-making, they also increase the attack surface for cybercriminals, exposing critical infrastructure to a wide array of vulnerabilities.

Governments and organizations around the world have recognized this and are taking steps to facilitate the widespread adoption of Industry 4.0 technologies to drive innovation and efficiency. For example, in November 2024, ADNOC, the UAE's energy giant, announced plans to deploy highly autonomous agentic artificial intelligence (AI) in the energy sector for the first time. This initiative, in collaboration with G42, Microsoft, and AIQ, aims to enhance operational efficiencies, such as speeding up seismic surveys and improving production forecast accuracy.

The increasing frequency and sophistication of cyberattacks targeting the industrial sector have underscored the urgent need for robust cybersecurity measures. In recent reports, the number of cyber incidents in manufacturing environments continues to rise. For instance, a 2023 report by Ponemon Institute revealed that 53% of manufacturing organizations experienced a significant cyberattack, causing disruptions such as production halts, financial losses, and the theft of sensitive data. As industries continue to adopt advanced technologies like machine learning, robotics, and the Internet of Things (IoT), the attack surface grows larger, creating more vulnerabilities. The integration of these technologies into critical infrastructure increases the complexity of industrial environments, making traditional security systems inadequate in combating emerging threats. This shift has driven industries to adopt more sophisticated security strategies, including real-time threat monitoring, advanced access control protocols, and comprehensive surveillance systems to strengthen defense mechanisms and mitigate potential cyber risks.

In response, the industrial sector is adopting next-generation cybersecurity solutions that can proactively defend against the evolving threat landscape. AI and ML technologies, in particular, have become instrumental in detecting potential threats and providing real-time protection by analyzing vast amounts of data for anomalies. Additionally, new security frameworks, such as zero-trust architecture and network segmentation, are being implemented to safeguard sensitive operational systems from unauthorized access. Given the growing reliance on IIoT devices and connected infrastructure, comprehensive endpoint security solutions are essential to prevent cybercriminals from exploiting vulnerabilities in industrial networks.

Overall, the rise of disruptive digital technologies in the industrial sector has created an urgent need for advanced cybersecurity solutions. As these technologies continue to evolve, industries must prioritize securing their systems against a broad range of cyber threats to ensure the safety and continuity of their operations. The continued development of innovative security solutions, coupled with strategic industry partnerships and investment in specialized cybersecurity talent, will be critical in safeguarding the digital future of the industrial sector.

The increasing frequency and sophistication of cyberattacks targeting the industrial sector is a primary driver of the growing demand for industrial cybersecurity solutions. The industrial sector, which includes critical infrastructure, manufacturing, energy, utilities, and transportation, has become a prime target for cybercriminals due to the high value of operational technologies (OT) and the potential for widespread disruptions. In 2023, the Cost of a Data Breach report by IBM revealed that industrial organizations face some of the highest data breach costs globally, averaging USD 4.5 million per incident. These breaches not only result in financial losses but also lead to significant disruptions, such as production downtime, loss of intellectual property, and reputational damage. The need for enhanced cybersecurity is further underscored by high-profile attacks like the 2021 ransomware attack on Colonial Pipeline, which resulted in fuel shortages and widespread operational disruptions, costing the company millions of dollars.

As industrial operations increasingly adopt technologies like IoT, AI, robotics, and machine learning, the attack surface expands, introducing new vulnerabilities. According to a 2023 Check Point Software Technologies survey, 72% of manufacturing and energy organizations reported an uptick in cyberattacks, with multi-vector threats targeting both IT and OT systems. Traditional security solutions are often ill-equipped to handle the complexity of modern industrial networks, making it essential to invest in integrated security frameworks. The rise in sophisticated attacks, such as the manipulation of physical systems seen in past incidents like the Stuxnet worm, highlights the need for specialized OT security solutions capable of defending against evolving threats.

This increasing frequency of cyberattacks is propelling the industrial cybersecurity market. Several factors contribute to this growth, including the increasing investment in OT security solutions that integrate both IT and OT systems. The rise of AI-driven cybersecurity tools is also fueling market demand, as these tools offer real-time threat detection and advanced monitoring capabilities. Additionally, heightened regulatory pressures, such as the EU’s Network and Information Systems (NIS) Directive and the U.S. Executive Order 14028, are compelling organizations to adopt more robust cybersecurity practices, further driving the market for compliant solutions. Smaller industrial companies are increasingly turning to cybersecurity-as-a-service (CaaS) models, which provide scalable, expert-driven protection while helping to address budget and resource limitations. The widespread adoption of IoT and edge computing technologies also requires specialized security solutions, as these technologies create new attack vectors. The integration of advanced security measures for these connected devices is another key driver of the industrial cybersecurity market.

Overall, the rising sophistication of cyberattacks on industrial organizations is reshaping the cybersecurity landscape, with increasing investments in advanced security technologies. The industrial cybersecurity market is expected to grow rapidly, driven by the need for integrated, AI-powered solutions, compliance with evolving regulations, and the protection of critical infrastructure and connected systems. As cyber threats continue to evolve, both established players and newcomers to the cybersecurity market must prioritize innovation and proactive threat management to safeguard industrial operations.

The shift toward cloud technologies is accelerating across industries, with organizations of all sizes—from small and medium-sized enterprises (SMEs) to large corporations—embracing the cloud to enhance operational efficiency, reduce costs, and improve scalability. This trend is expected to persist as businesses increasingly rely on cloud solutions to drive digital transformation, streamline workflows, and accelerate time to market. Additionally, the growing adoption of emerging technologies such as the Internet of Things (IoT) has significantly contributed to the surge in data being stored and processed on the cloud. As businesses continue to embrace trends like Bring Your Own Device (BYOD) and as internet connectivity expands into new markets, the demand for cloud-based solutions is rising, driving a parallel need for enhanced cloud cybersecurity.

However, the rapid increase in cloud adoption has introduced new cybersecurity challenges, particularly in light of the substantial amount of sensitive data now being stored and accessed on cloud platforms. The expansion of cloud infrastructure has made it a prime target for cybercriminals. For example, according to Fintech News, cloud-based cyberattacks surged by an alarming 630% between January and April 2020. This spike in attacks highlights the vulnerability of cloud environments and the growing risks associated with cloud data storage and management. As a result, organizations are prioritizing cloud security to protect sensitive information, mitigate the risks of data breaches, and ensure compliance with industry regulations.

To address these evolving threats, many cybersecurity vendors are focusing on developing and deploying comprehensive security solutions tailored specifically for cloud environments. These solutions often include advanced threat detection, real-time monitoring, access controls, and data encryption, all designed to safeguard cloud-based applications and networks. Furthermore, organizations are increasingly adopting cloud-level security monitoring systems to detect vulnerabilities and prevent potential security breaches in their industrial operations. The growing dependence on cloud technologies and the heightened risks associated with their use are propelling the demand for robust cloud security solutions and services, presenting significant growth opportunities for cybersecurity providers in this space. As more organizations transition to the cloud, securing cloud environments will continue to be a critical focus, shaping the future of industrial cybersecurity.

The growing trend of digital transformation is not limited to large enterprises but is increasingly embraced by small and medium-sized enterprises (SMEs) as well. SMEs are progressively becoming prime targets for cyberattacks due to their increasing adoption of digital technologies and connected devices in their operations. This shift has prompted a surge in demand for cloud-based security solutions, as these technologies offer flexibility, scalability, and cost-effective data storage options. Cloud-based security solutions are critical in safeguarding sensitive data by providing robust protection against theft, loss, and leakage. Key security features, such as penetration testing, firewalls, tokenization, and virtual private networks (VPNs), are integrated into cloud services to ensure data integrity and confidentiality.

Moreover, cloud security solutions offer significant advantages, including real-time threat detection, powerful policy enforcement, and adaptable architectures that can scale as the organization grows. These features are especially appealing to SMEs that may not have the resources for extensive on-premise security infrastructure. The growing adoption of Internet of Things (IoT) devices and policies like BYOD (Bring Your Own Device) within SMEs further fuels the demand for cloud security solutions, as these organizations seek ways to secure increasingly decentralized and interconnected networks.

The rise in cyberattacks targeting SMEs has created a pressing need for advanced cybersecurity solutions. A 2023 Symantec report revealed that SMEs are facing cyberattacks at an unprecedented rate, with 43% of all cyberattacks now targeting small businesses. In response, cloud security providers are collaborating with various organizations to deliver affordable, comprehensive security services tailored to SMEs. For instance, in 2023, Microsoft Azure partnered with cloud security firms to provide advanced security services to SMEs, while offering scalable solutions that cater to their specific needs. Similarly, Amazon Web Services (AWS) continues to expand its cloud security offerings to support SMEs in protecting their infrastructure and data.

As SMEs adopt more cloud-based technologies and integrate digital services into their operations, the demand for robust cloud security solutions will continue to rise, offering significant growth opportunities for cybersecurity vendors. This trend is expected to drive the expansion of the industrial cybersecurity market, as SMEs recognize the importance of protecting their digital assets from increasingly sophisticated cyber threats.

Based on components, the global industrial cybersecurity market is primarily segmented into two key components: solutions and services. In 2025, the solutions segment held the dominant share of 56.4%, reflecting its critical role in addressing the growing challenges of data security and privacy. The prominence of this segment can be attributed to the heightened concerns over cybersecurity risks in industrial operations, as well as the consistent efforts by industrial stakeholders to enhance operational efficiency, reduce costs, and ensure a resilient security framework.

Moreover, this segment is also further projected to record a higher CAGR of 15.1% during the forecast period of 2025– 2032.

Based on security type, the global industrial cybersecurity market categorized by security type into network security, application security, cloud security, endpoint security, and other security types. In 2025, the endpoint security segment is expected to account for the larger share of 40.3% of the global industrial cybersecurity market. This segment’s large market share is attributed to the increasing need for organizations to protect their expanding network perimeters, which now include a wide variety of endpoints, such as computers, mobile devices, and IoT devices.

Based on deployment mode, the global industrial cybersecurity market is segmented based on deployment mode into on-premises deployment and cloud-based deployment. In 2025, the cloud-based deployment segment is expected to account for the largest share of 54.7% of the global industrial cybersecurity market. This segment’s large market share is attributed to the rapid evolution of cloud technologies, which offer enhanced flexibility, scalability, and cost-efficiency. The affordability and superior scalability of cloud-based solutions, coupled with the increasing adoption of cloud platforms by small and medium-sized enterprises (SMEs), are key factors driving this segment's growth.

Moreover, this segment is also further projected to register the highest CAGR during the forecast period of 2025–2032. The increasing reliance on cloud-based environments and the scalability offered by these platforms are expected to further drive this segment's dominance within the global industrial cybersecurity market.

Based on end-user, the global industrial cybersecurity market is segmented by end user into industrial manufacturing, energy & utilities, transportation & logistics, and other end users. In 2025, industrial manufacturing is expected to account for the largest share of 65.4% of the global industrial cybersecurity market. This segment’s large market share is attributed to the growing demand for real-time security monitoring, rising cybersecurity incidents, and the increasing integration of smart devices and IoT technologies in manufacturing processes.

Based on geography, the industrial cybersecurity market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, North America is expected to account for the largest share of 36.1% of the global industrial cybersecurity market. This market is projected to reach USD 8.58 billion in 2025. North America’s significant market share can be attributed to several key factors, including This dominant share can be attributed to several factors, including robust government initiatives to enhance cybersecurity, the rapid adoption of advanced technologies, and the rising number of cyberattacks targeting industrial sectors in the region.

However, Asia-Pacific is expected to register the highest growth rate, with a projected CAGR of 15.0% during the forecast period. The growth in this region is driven by the widespread integration of connected devices across industries, the rise of Industry 4.0 technologies, increasing cloud-based solution adoption, and the growing frequency of cyberattacks within the Asia-Pacific industrial sector.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the Industrial Cybersecurity Market are Fortinet, Inc. (U.S.), Cisco Systems, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Palo Alto Networks, Inc. (U.S.), IBM Corporation (U.S.), Check Point Software Technologies Ltd. (Israel), F5, Inc. (U.S.), Mandiant, Inc. (U.S.), Broadcom, Inc. (U.S.), Oracle Corporation (U.S.), Microsoft Corporation (U.S.), Intel Corporation (U.S.), Imperva, Inc. (U.S.), Cyberark Software Ltd. (U.S.), and RSA Security LLC (U.S.).

|

Particulars |

Details |

|

Number of Pages |

~300 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR |

13.5% |

|

Market Size (2025) |

$23.8 billion |

|

Market Size (2032) |

$57.6 billion |

|

Segments Covered |

By Component

By Security Type

By Deployment Mode

By End-User

|

|

Countries/Regions Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Taiwan, Singapore and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Fortinet, Inc. (U.S.), Cisco Systems, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Palo Alto Networks, Inc. (U.S.), IBM Corporation (U.S.), Check Point Software Technologies Ltd. (Israel), F5, Inc. (U.S.), Mandiant, Inc. (U.S.), Broadcom, Inc. (U.S.), Oracle Corporation (U.S.), Microsoft Corporation (U.S.), Intel Corporation (U.S.), Imperva, Inc. (U.S.), Cyberark Software Ltd. (U.S.), and RSA Security LLC (U.S.). |

The Industrial Cybersecurity market study focuses on market assessment and opportunity analysis through sales of industrial cybersecurity solutions and services across different regions and countries. This study is also focused on competitive analysis for industrial cybersecurity based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The Industrial Cybersecurity Market is expected to reach $57.6 million by 2032 from an estimated $23.8 billion in 2025, at a CAGR of 13.5% during the forecast period 2025-2032.

In 2025, the Solutions segment is expected to hold the largest share of the Industrial Cybersecurity Market

The Cloud-Based Deployment Segment is expected to register the highest CAGR during the forecast period.

In 2025, the Endpoint Security Segment is expected to hold the largest share of the Industrial Cybersecurity Market

In 2025, the Industrial Manufacturing Segment is expected to hold the largest share of the Industrial Cybersecurity Market

The growth of the industrial cybersecurity market is driven by the rise of disruptive digital technologies, increasing frequency & sophistication of cyberattacks and cybersecurity regulations & industry compliance. Furthermore, the growing interest in cloud-based security solutions and AL & ML for threat detection is expected to generate market growth opportunities for the stakeholders operating in this market.

Key players operating in the Industrial Cybersecurity Market are Fortinet, Inc. (U.S.), Cisco Systems, Inc. (U.S.), Juniper Networks, Inc. (U.S.), Palo Alto Networks, Inc. (U.S.), IBM Corporation (U.S.), Check Point Software Technologies Ltd. (Israel), F5, Inc. (U.S.), Mandiant, Inc. (U.S.), Broadcom, Inc. (U.S.), Oracle Corporation (U.S.), Microsoft Corporation (U.S.), Intel Corporation (U.S.), Imperva, Inc. (U.S.), Cyberark Software Ltd. (U.S.), and RSA Security LLC (U.S.).

Asia-Pacific is expected to register a higher CAGR during the forecast period.

1. Introduction

1.1. Market Definition & Scope

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast

2.4. Assumptions for the Study

3. Executive Summary

3.1. Market Overview

3.2. Market Analysis, By Component

3.3. Market Analysis, By Security Type

3.4. Market Analysis, By Deployment Mode

3.5. Market Analysis, By Inspection Mode

3.6. Market Analysis, By End User

3.7. Market Analysis, By Geography

3.8. Competition Analysis

4. Market Insights

4.1. Overview

4.2. Market Dynamics

4.3. Factors Affecting Market Growth

4.3.1. Drivers

4.3.1.1. The Rise of Disruptive Digital Technologies

4.3.1.2. Increasing Frequency & Sophistication of Cyberattacks

4.3.1.3. Cybersecurity Regulations and Industry Compliance

4.3.2. Restraints

4.3.2.1. Shortage of Skilled Professionals

4.3.2.2. Complexity of Securing OT Environments

4.3.3. Opportunities

4.3.3.1. Cloud-based Security Solutions

4.3.3.2. AI and ML For Threat Detection

4.3.4. Challenges

4.3.4.1. Increasing use of Mobile Devices as Attack Vector

4.3.4.2. Vulnerability Issues with IoT Devices

4.3.5. Trends

4.3.5.1. Rising Adoption of Cloud Technologies

4.3.5.2. Industrial Cybersecurity As-A-Service

4.4. Regulatory Analysis

4.4.1. North America

4.4.1.1. U.S.

4.4.1.2. Canada

4.4.2. Europe

4.4.3. Asia-Pacific

4.5. Case Study

4.6. Porter’s Five Forces Analysis

4.6.1. Threat of new entrants

4.6.2. Threat of substitutes

4.6.3. Bargaining power of buyers

4.6.4. Bargaining power of suppliers

4.6.5. Degree of competition

5. Industrial Cybersecurity Market Assessment – By Component

5.1. Overview

5.2. Solutions

5.2.1. Intrusion Detection/Prevention Systems

5.2.2. Identity & Access Management

5.2.3. Security & Vulnerability Management

5.2.4. Antivirus/Antimalware

5.2.5. Disaster Recovery

5.2.6. Firewalls

5.2.7. Unified Threat Management

5.2.8. Encryption

5.2.9. Risk & Compliance Management

5.2.10. Web Filtering

5.2.11. Data Loss Prevention

5.2.12. DDoS Management

5.3. Services

5.3.1. Professional Services

5.3.2. Managed Services

6. Industrial Cybersecurity Market Assessment – By Security Type

6.1. Overview

6.2. Endpoint Security

6.3. Network Security

6.4. Application Security

6.5. Cloud Security

6.6. Other Security Types

7. Industrial Cybersecurity Market Assessment – By Deployment Mode

7.1. Overview

7.2. Cloud-based Deployment

7.3. On-premise Deployment

8. Industrial Cybersecurity Market Assessment – By End User

8.1. Overview

8.2. Industrial Manufacturing

8.2.1. Automotive

8.2.2. Heavy Metals & Machinery

8.2.3. Aerospace & Defense

8.2.4. Electronics & Electrical

8.2.5. FMCG

8.2.6. Chemicals

8.2.7. Other Manufacturing Industries

8.3. Transportation & Logistics

8.4. Energy & Utilities

8.5. Other End Users

9. Industrial Cybersecurity Market Assessment – By Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. U.K.

9.3.2. Germany

9.3.3. France

9.3.4. Spain

9.3.5. Italy

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. India

9.4.2. China

9.4.3. Japan

9.4.4. South Korea

9.4.5. Taiwan

9.4.6. Singapore

9.4.7. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. UAE

9.6.2. Israel

9.6.3. Rest of Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Ranking by Key Players

11. Company Profiles (Company Overview, Financial Overview, Product Portfolio, Strategic Developments)

11.1. Fortinet, Inc.

11.2. Cisco Systems, Inc.

11.3. Juniper Networks, Inc.

11.4. Palo Alto Networks, Inc.

11.5. IBM Corporation

11.6. Check Point Software Technologies Ltd.

11.7. F5, Inc.

11.8. Mandiant, Inc.

11.9. Oracle Corporation

11.10. Microsoft Corporation

11.11. Intel Corporation

11.12. Imperva, Inc.

11.13. Cyberark Software Ltd.

11.14. RSA Security LLC

(Note: SWOT analysis of the top 5 companies will be provided.)

12. Appendix

12.1. Available Customizations

12.2. Related Reports

List of Tables

Table 1 Global Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 2 Global Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD MILLION)

Table 3 Global Industrial Cybersecurity Solutions Market, BY Country/Region, (USD MILLION)

Table 4 Global Industrial Cybersecurity Solutions Market For Intrusion Detection/Prevention Systems, By Country/Region, 2023–2032 (USD Million)

Table 5 Global Industrial Cybersecurity Solutions Market For Identity & Access Management, BY Country/Region, 2023–2032 (USD Million)

Table 6 Global Industrial Cybersecurity Solutions Market Size For Security & Vulnerability Management, BY Country/Region, 2023–2032 (USD Million)

Table 7 Global Industrial Cybersecurity Solutions Market For Antivirus/ Antimalware, BY Country/Region, 2023–2032 (USD Million)

Table 8 Global Industrial Cybersecurity Solutions Market For Disaster Recovery, BY Country/Region, 2023–2032 (USD Million)

Table 9 Global Industrial Cybersecurity Solutions Market For Firewalls, BY Country/Region, 2023–2032 (USD Million)

Table 10 Global Industrial Cybersecurity Solutions Market For Unified Threat Management, By Country/Region, 2023–2032 (USD Million)

Table 11 Global Industrial Cybersecurity Solutions Market For Encryption, By Country/Region, 2023–2032 (USD Million)

Table 12 Global Industrial Cybersecurity Solutions Market For Risk & Compliance Management, By Country/Region, 2023–2032 (USD Million)

Table 13 Global Industrial Cybersecurity Solutions Market For Web Filtering, By Country/Region, 2023–2032 (USD Million)

Table 14 Global Industrial Cybersecurity Solutions Market For Data Loss Prevention/Region, By Country/Region, 2023–2032 (USD Million)

Table 15 Global Industrial Cybersecurity Solutions Market For Dds Management, By Country/Region, 2023–2032 (USD Million)

Table 16 Global Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 17 Global Industrial Cybersecurity Services Market, By Country/Region, 2023–2032 (USD Million)

Table 18 Global Industrial Cybersecurity Services Market For Professional Services, By Country/Region, 2023–2032 (USD Million)

Table 19 Global Industrial Cybersecurity Services Market For Managed Services, By Country/Region, 2023–2032 (USD Million)

Table 20 Global Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 21 Global Industrial Cybersecurity Market For Endpoint Security, By Country/Region, 2023–2032 (USD Million)

Table 22 Global Industrial Cybersecurity Market For Network Security, By Country/Region, 2023–2032 (USD Million)

Table 23 Global Industrial Cybersecurity Market For Application Security, By Country/Region, 2023–2032 (USD Million)

Table 24 Global Industrial Cybersecurity Market For Cloud Security, By Country/Region, 2023–2032 (USD Million)

Table 25 Global Industrial Cybersecurity Market For Other Security Types, By Country/Region, 2023–2032 (USD Million)

Table 26 Global Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 27 Global Cloud-Based Deployment Industrial Cybersecurity Market, By Country/Region, 2023–2032 (USD Million)

Table 28 Global On-Premise Deployment Industrial Cybersecurity Market, By Country/Region, 2023–2032 (USD Million)

Table 29 Global Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 30 Global Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 31 Global Industrial Cybersecurity Market For Industrial Manufacturing, By Country/Region, 2023–2032 (USD Million)

Table 32 Global Industrial Cybersecurity Market For Automotive, By Country/Region, 2023–2032 (USD Million)

Table 33 Global Industrial Cybersecurity Market For Heavy Metals & Machinery, By Country/Region, 2023–2032 (USD Million)

Table 34 Global Industrial Cybersecurity Market For Aerospace & Defense, By Country/Region, 2023–2032 (USD Million)

Table 35 Global Industrial Cybersecurity Market For Electronics & Electrical, By Country/Region, 2023–2032 (USD Million)

Table 36 Global Industrial Cybersecurity Market For Fmcg, By Country/Region, (USD Million)

Table 37 Global Industrial Cybersecurity Market For Chemicals, By Country/ Region, 2023–2032 (USD Million)

Table 38 Global Industrial Cybersecurity Market For Other Manufacturing Industries, By Country/Region, 2023–2032 (USD Million)

Table 39 Global Industrial Cybersecurity Market For Transportation & Logistics, By Country/Region, 2023–2032 (USD Million)

Table 40 Global Industrial Cybersecurity Market For Energy & Utilities, By Country/Region, 2023–2032 (USD Million)

Table 41 Global Industrial Cybersecurity Market For Other End Users, By Country/ Region, 2023–2032 (USD Million)

Table 42 Global Industrial Cybersecurity Market, By Country/Region, 2023–2032 (USD Million)

Table 43 North America: Industrial Cybersecurity Market, By Country, 2023–2032 (USD Million)

Table 44 North America: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 45 North America: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 46 North America: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 47 North America: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 48 North America: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 49 North America: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 50 North America: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 51 U.S.: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 52 U.S.: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 53 U.S.: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 54 U.S.: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 55 U.S.: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 56 U.S.: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 57 U.S.: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 58 Canada: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 59 Canada: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 60 Canada: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 61 Canada: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 62 Canada: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 63 Canada: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 64 Canada: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 65 Europe: Industrial Cybersecurity Market, By Country/Region, 2023–2032 (USD Million)

Table 66 Europe: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 67 Europe: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 68 Europe: Industrial Cybersecurity Services Market, By Type, 2023–2032

Table 69 Europe: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 70 Europe: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 71 Europe: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 72 Europe: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 73 U.K.: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 74 U.K.: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 75 U.K.: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 76 U.K.: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 77 U.K.: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 78 U.K.: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 79 U.K.: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 80 Germany: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 81 Germany: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 82 Germany: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 83 Germany: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 84 Germany: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 85 Germany: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 86 Germany: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 87 France: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 88 France: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 89 France: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 90 France: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 91 France: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 92 France: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 93 France: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 94 Spain: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 95 Spain: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 96 Spain: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 97 Spain: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 98 Spain: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 99 Spain: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 100 Spain: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 101 Italy: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 102 Italy: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 103 Italy: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 104 Italy: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 105 Italy: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 106 Italy: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 107 Italy: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 108 Rest of Europe: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 109 Rest of Europe: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 110 Rest of Europe: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 111 Rest of Europe: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 112 Rest of Europe: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 113 Rest of Europe: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 114 Rest of Europe: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 115 Asia-Pacific: Industrial Cybersecurity Market, By Country/Region, 2023–2032 (USD Million)

TABLE 116 Asia-Pacific: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 117 Asia-Pacific: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 118 Asia-Pacific: Industrial Cybersecurity Services Market, By Type, 2023–2032

Table 119 Asia-Pacific: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 120 Asia-Pacific: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 121 Asia-Pacific: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 122 Asia-Pacific: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 123 India: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 124 India: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 125 India: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 126 India: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 127 India: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 128 India: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 129 India: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 130 China: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 131 China: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 132 China: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 133 China: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 134 China: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 135 China: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 136 China: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 137 Japan: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 138 Japan: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 139 Japan: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 140 Japan: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 141 Japan: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 142 Japan: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 143 Japan: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 144 South Korea: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 145 South Korea: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 146 South Korea: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 147 South Korea: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 148 South Korea: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 149 South Korea: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 150 South Korea: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 151 Taiwan: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 152 Taiwan: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 153 Taiwan: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 154 Taiwan: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 155 Taiwan: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 156 Taiwan: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 157 Taiwan: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 158 Singapore: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 159 Singapore: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 160 Singapore: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 161 Singapore: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 162 Singapore: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 163 Singapore: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 164 Singapore: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 165 Rest of Asia-Pacific: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 166 Rest of Asia-Pacific: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 167 Rest of Asia-Pacific: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 168 Rest of Asia-Pacific: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 169 Rest of Asia-Pacific: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 170 Rest of Asia-Pacific: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 171 Rest of Asia-Pacific: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 172 Latin America: Industrial Cybersecurity Market, By Country/Region, 2023–2032 (USD Million)

Table 173 Latin America: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 174 Latin America: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 175 Latin America: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 176 Latin America: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 177 Latin America: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 178 Latin America: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 179 Latin America: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 180 Brazil: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 181 Brazil: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 182 Brazil: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 183 Brazil: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 184 Brazil: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 185 Brazil: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 186 Brazil: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 187 Mexico: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 188 Mexico: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 189 Mexico: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 190 Mexico: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 191 Mexico: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 192 Mexico: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 193 Mexico: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 194 Rest of Latin America: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 195 Rest of Latin America: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 196 Rest of Latin America: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 197 Rest of Latin America: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 198 Rest of Latin America: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 199 Rest of Latin America: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 200 Rest of Latin America: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 201 Middle East & Africa: Industrial Cybersecurity Market, By Country/ Region, 2023–2032 (USD Million)

Table 202 Middle East & Africa: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 203 Middle East & Africa: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 204 Middle East & Africa: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 205 Middle East & Africa: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 206 Middle East & Africa: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 207 Middle East & Africa: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 208 Middle East & Africa: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 209 Uae: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 210 Uae: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 211 Uae: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 212 Uae: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 213 Uae: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 214 UAE: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 215 Uae: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 216 Israel: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 217 Israel: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 218 Israel: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 219 Israel: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 220 Israel: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 221 Israel: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 222 Israel: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 223 Rest of Middle East & Africa: Industrial Cybersecurity Market, By Component, 2023–2032 (USD Million)

Table 224 Rest of Middle East & Africa: Industrial Cybersecurity Solutions Market, By Type, 2023–2032 (USD Million)

Table 225 Rest of Middle East & Africa: Industrial Cybersecurity Services Market, By Type, 2023–2032 (USD Million)

Table 226 Rest of Middle East & Africa: Industrial Cybersecurity Market, By Security Type, 2023–2032 (USD Million)

Table 227 Rest of Middle East & Africa: Industrial Cybersecurity Market, By Deployment Mode, 2023–2032 (USD Million)

Table 228 Rest of Middle East & Africa: Industrial Cybersecurity Market, By End User, 2023–2032 (USD Million)

Table 229 Rest of Middle East & Africa: Industrial Cybersecurity Market For Industrial Manufacturing, By Type, 2023–2032 (USD Million)

Table 230 Recent Developments By Major Market Players (2021–2025)

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key executives interviewed

Figure 5 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 6 Market Sizing and Growth Forecast Approach

Figure 7 In 2025, The Solution Segment Is Expected To Dominate The Market

Figure 8 In 2025, The Endpoint Security Segment Is Expected To Dominate The Market

Figure 9 In 2025, The Cloud-Based Deployment Segment Is Expected To Dominate The Market

Figure 10 In 2025, The Industrial Manufacturing Segment Is Expected To Dominate The Market

Figure 11 In 2025, North America is Expected To Dominate The Market

Figure 12 Impact Analysis of Market Dynamics

Figure 13 Porter's Five Forces Analysis

Figure 14 Global Industrial Cybersecurity Market, by Component, 2025 Vs. 2032 (USD Million)

Figure 15 Global Industrial Cybersecurity Market, by Security Type, 2025 Vs. 2032 (USD Million)

Figure 16 Global Industrial Cybersecurity Market, by Deployment Mode, 2025 Vs. 2032 (USD Million)

Figure 17 Global Industrial Cybersecurity Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 18 Global industrial cybersecurity Market, by Region, 2025 Vs 2032 (USD Million)

Figure 19 North America: Industrial Cybersecurity Market Snapshot

Figure 20 Europe: Industrial Cybersecurity Market Snapshot

Figure 21 Asia-Pacific: Industrial Cybersecurity Market snapshot

Figure 22 Latin America: Industrial Cybersecurity Market Snapshot

Figure 23 Middle East & Africa: Industrial Cybersecurity Market Snapshot

Figure 24 Growth Strategies Adopted By Leading Market players (2021–2025)

Figure 25 COMPETITIVE DASHBOARD: Industrial cybersecurity market

Figure 26 Vendor market positioning analysis

Figure 27 Market Share Analysis: Industrial cybersecurity Market (2024)

Figure 28 Fortinet, inc.: Financial Overview (2023)

Figure 29 Cisco Systems, Inc.: Financial Overview (2024)

Figure 30 Juniper Networks, Inc.: Financial Overview (2023)

Figure 31 Palo Alto Networks, Inc.: Financial Overview (2024)

Figure 32 IBM Corporation: Financial Overview (2023)

Figure 33 check point software technologies ltd.: financial overview (2023)

Figure 34 F5, Inc.: financial overview (2024)

Figure 35 alphabet inc.: financial overview (2023)

Figure 36 Broadcom, Inc.: financial overview (2024)

Figure 37 CYBERARK SOFTWARE LTD.: Financial Overview (2023)

Figure 38 Intel Corporation: Financial Overview (2024)

Figure 39 Microsoft corporation: Financial Overview (2024)

Figure 40 Oracle Corporation: Financial Overview (2024)

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: May-2024

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates