Resources

About Us

Industrial Computers Market by Type, Technology, Storage Medium, Sales Channel, End-use Industry (Process Industries and Discrete Industries), and Geography - Global Forecast to 2032

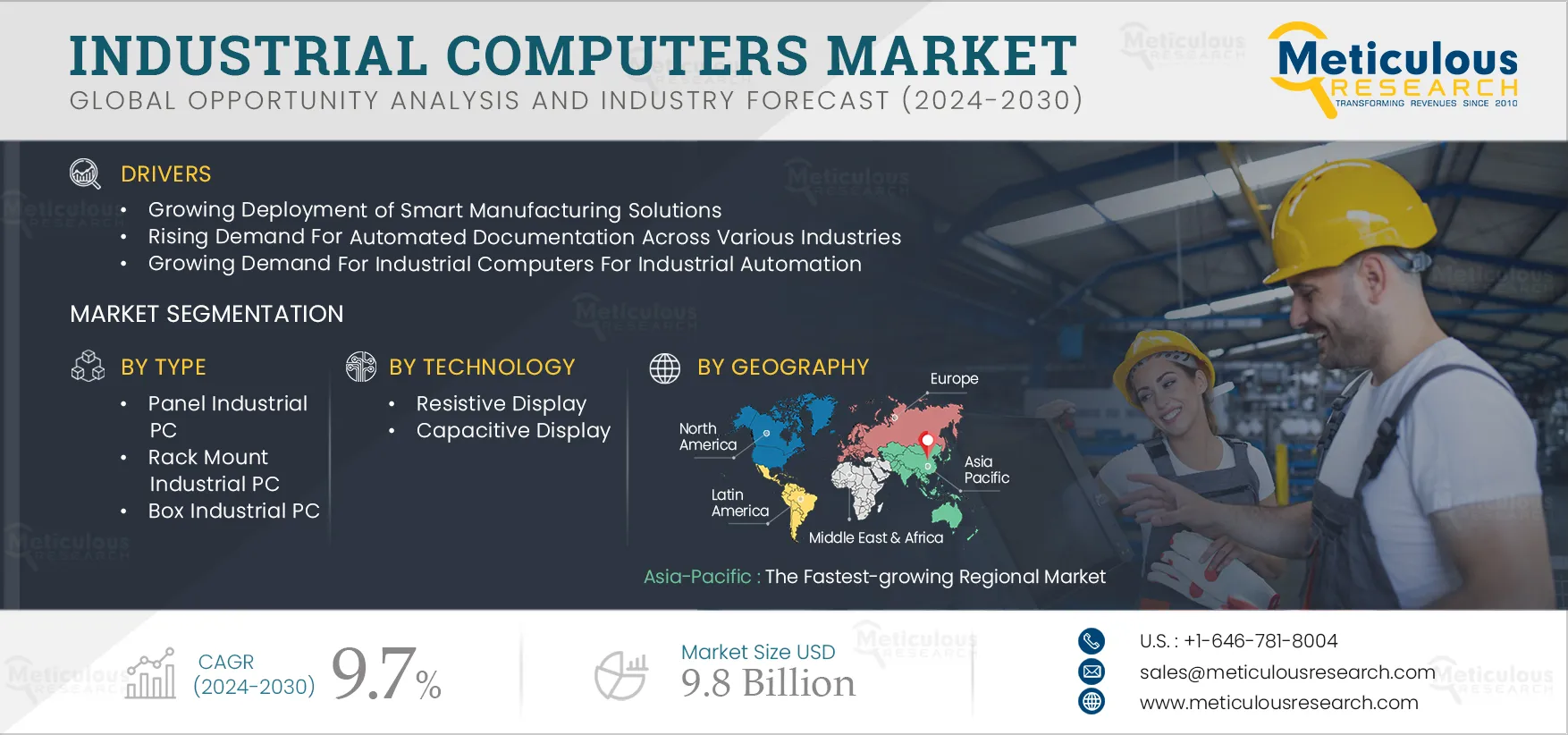

Report ID: MRICT - 104730 Pages: 250 Jan-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe Industrial Computers Market is projected to reach $9.8 billion by 2032, at a CAGR of 9.7% from 2025 to 2032. The growth of this market is driven by the growing deployment of smart manufacturing solutions, rising demand for automated documentation across various industries, and growing demand for industrial computers for industrial automation. However, the high initial investment may restrain the market’s growth. The increased proliferation of industrial computers in industrial automation and increasing demand for upgrading industrial PC cybersecurity in the manufacturing industry are expected to offer significant growth opportunities for the stakeholders in the industrial computers market. Furthermore, the security risks associated with industrial computer networks are expected to pose challenges to the growth of the industrial computers market. The latest trends in the global industrial computers market are touch screen industrial panel PCs and customizable features.

The COVID-19 pandemic created several challenges for the industrial computers market due to the lockdowns imposed during the second and third quarters of 2020. The pandemic lowered consumers' financial potential, which decreased the sales of different industrial computers. However, in 2021, many process and discrete industries started recovering from the economic setbacks triggered by the pandemic. The COVID-19 pandemic moderately impacted the industrial computers market due to delayed orders for panel industrial PC, rack mount industrial PC, box industrial PC, embedded industrial PC, and DIN rail industrial PC. However, it started recovering rapidly in the last quarter of 2020.

The following factors have contributed to the growth of the industrial computers market since the COVID-19 pandemic:

Click here to: Get Free Sample Copy of this report

Growing Demand for Industrial Computers for Industrial Automation to Fuel the Market Growth

Factory automation is the implementation of technology and systems to automate a manufacturing process with the ultimate goal of increasing productivity and reducing costs. In recent years, various industries are implementing industrial computers to offer automation across various operations. Industrial computer systems have many benefits, such as durability, quality control, product tracking, factory automation, and cost savings.

Following are the major use cases of industrial computers for industrial automation:

The increasing proliferation of industrial computers across various industries is expected to increase the demand for industrial computers.

Based on Type, in 2022, the Panel Industrial PC Segment Accounted for the Largest Share of the Market

Based on type, in 2022, the panel industrial PC segment accounted for the largest share of the global industrial computers market. The large market share of this segment is attributed to the surge in demand for panel industrial PC with enhanced durability and rich I/O flexibility for harsh industrial environments, the increasing need to replace old-fashioned control panels to provide a more user-friendly interface for new machines, and the growing demand for higher-quality components.

Based on Storage Medium, the Rotating Hard Drive Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on storage medium, the rotating hard drive segment is projected to register the highest CAGR during the forecast period. The growing demand for rotating hard drive-enabled computers to offer large storage space and fast data access, increasing deployments of HDD-enabled industrial computers for factory automation, and the rising need for computer systems that do not need to be accessed frequently are improving the demand for rotating hard drive enabled industrial computers.

Based on technology, the Capacitive Display Segment is Projected to Register the Higher CAGR During the Forecast Period

Based on technology, the capacitive display segment is projected to register the highest CAGR during the forecast period. The growth of the capacitive display segment is driven by factors such as the compatibility with a wide range of consumer electronics devices, growing demand for capacitive displays to offer flexible and robust performance in harsh environments, and growing demand for optimal quality computers that supports the viewing of high-quality images, video, and software content.

Asia-Pacific: The Fastest-growing Regional Market

Asia-Pacific is projected to register the highest CAGR during the forecast period. The rapid growth of industrial computers in the Asia-Pacific region is attributed to the increasing deployment of industrial computers across manufacturing units, the rising number of government initiatives for the adoption of industrial computers, and the steady shift towards digitalized manufacturing from traditional manufacturing. Emerging countries such as Japan and China show a high pace of technological advancements for industrial computers, which helps to stimulate the growth of the regional market. Furthermore, surging awareness for resource optimization in manufacturing industries and increasing demand for improved process flexibility and efficient information flow across production facilities and harmonized production processes for optimum supply chain management is encouraging industries to use industrial computers, fueling the growth of the industrial computers market in Asia-Pacific.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants between 2020 and 2022. The key players operating in the global industrial computers market are Siemens AG (Germany), Advantech Co., Ltd. (Taiwan), Beckhoff Automation GmbH & Co. KG (Germany), Captec Ltd. (U.K.), Industrial PC, Inc (U.S.), IEI Integration Corp. (Taiwan), Kontron AG (Germany), NEXCOM International Co., Ltd. (Taiwan), DFI Inc. (Taiwan), American Portwell Technology, Inc. (U.S.), Rockwell Automation, Inc. (U.S.), Schneider Electric SE (France), Mitsubishi Electric Corporation (Japan), Avalue Technology Incorporation (Taiwan), and Panasonic Holdings Corporation (Japan).

Scope of the Report:

Industrial Computers Market, by Type

Industrial Computers Market, by Technology

Industrial Computers Market, by Storage Medium

Industrial Computers Market, by Sales Channel

Industrial Computers Market, by End-use Industry

Industrial Computers Market, by Geography

Key questions answered in the report:

The global industrial computers market is projected to reach $9.8 billion by 2032, at a CAGR of 9.7% during the forecast period.

In 2022, the process industries segment accounted for the largest share of the global industrial computers market. The large market share of this segment is mainly attributed to the rising demand for industrial computers by food processing industries for formulation control and process deviation calculations and the surge in demand for industrial machine-to-machine human interface systems by the chemical industry. Furthermore, the growing demand for increased visibility and control directly from the factory floor to enhance productivity, plant safety, and product quality is increasing the demand for industrial computers across the process industries.

The direct sales segment is projected to register the highest CAGR during the forecast period due to the demand for industrial computers by different end-users, the rising emphasis on the personal sales approach when engaging with customers to better understand customer needs, and increasing elimination of the middlemen, such as wholesalers and regional distribution centers.

The growth of this market is driven by the growing deployment of smart manufacturing solutions, rising demand for automated documentation across various industries, and growing demand for industrial computers for industrial automation. Furthermore, the increased proliferation of industrial computers in industrial automation and increasing demand for upgrading industrial PC cybersecurity in the manufacturing industry are expected to offer significant growth opportunities for the stakeholders in the industrial computers market.

The key players operating in the global industrial computers market are Siemens AG (Germany), Advantech Co., Ltd. (Taiwan), Beckhoff Automation GmbH & Co. KG (Germany), Captec Ltd. (U.K.), Industrial PC, Inc (U.S.), IEI Integration Corp. (Taiwan), Kontron AG (Germany), NEXCOM International Co., Ltd. (Taiwan), DFI Inc. (Taiwan), American Portwell Technology, Inc. (U.S.), Rockwell Automation, Inc. (U.S.), Schneider Electric SE (France), Mitsubishi Electric Corporation (Japan), Avalue Technology Incorporation (Taiwan), and Panasonic Holdings Corporation (Japan).

At present, North America dominates the global industrial computers market. However, Germany, Japan, China, India, South Korea, the Netherlands, and the U.K. are expected to witness strong growth in demand for industrial computers in the coming years.

Published Date: Jul-2024

Published Date: Sep-2022

Published Date: Jan-2025

Published Date: Sep-2024

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates