Resources

About Us

Hemostats Market Size, Share, Forecast, & Trends Analysis by Type (Gelatin, Collagen, Thrombin, Fibrin, Synthetic Sealant, Gauze) Form (Sheet, Powder, Gel) Application (Orthopedic, General, Cardiovascular, Dental, Trauma) End User - Global Forecast to 2032

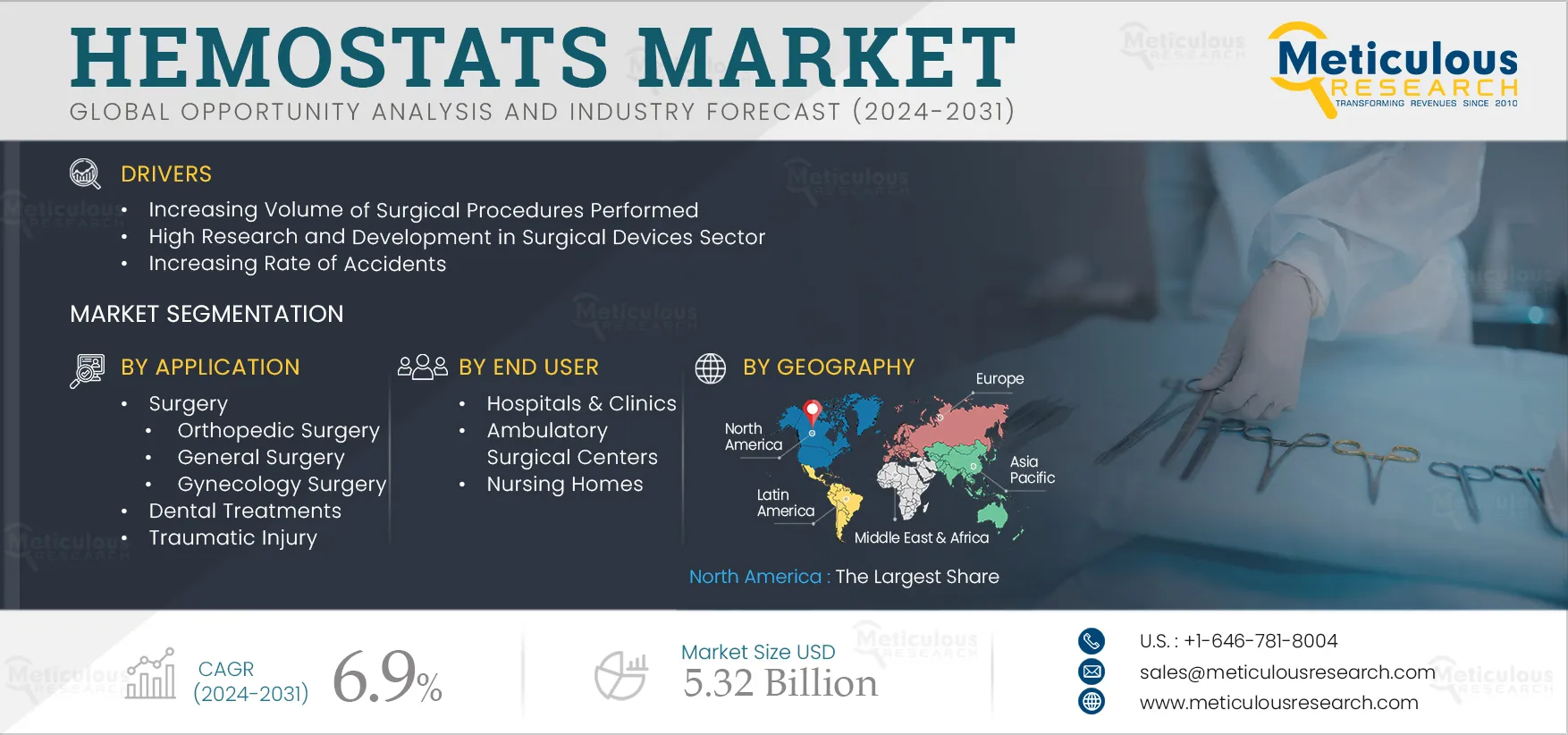

Report ID: MRHC - 1041150 Pages: 280 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by the increasing prevalence of chronic diseases such as cancer, cardiovascular, orthopedic, and neurological diseases and subsequent increase in the volume of surgical procedures; increasing rate of accidents; rise in the number of cesarean deliveries, fatal injuries, and organ transplantation; increased R&D activities; rising healthcare spending; and growing preference for minimally invasive surgical procedures. Additionally, the increasing use of advanced hemostats, advancements in dental hemostatic agents, and increasing demand for preloaded applicators and ready-to-use hemostats are expected to offer significant market growth opportunities.

However, allergic reactions caused by the material used in making hemostats restrain the growth of this market. Additionally, the high manufacturing price for hemostats poses a significant challenge to the market's growth. Furthermore, biopolymer-based hemostats and dual-action hemostatic technology are trends prevailing in the hemostats market.

The rate of accidents has increased over the years. As per the U.S. Department of Health & Human Services, January 2024 report, road traffic crashes are among the leading causes of death in the U.S. Similarly, approximately 20,653 people were killed in road accidents in the EU, an increase of 3.7% compared to 2021 (Source: European Commission, Directorate-General for Communication). The increasing number of accidents has increased the number of hospital visits by patients for minor and major surgeries and wound care, driving the demand for hemostatic products in hospitals & clinics.

The rate of minimally invasive surgeries (MIS) has been increasing in recent years. These surgeries necessitate tiny incisions, which creates demand for advanced hemostatic agents or tamponing agents to control blood loss.

With developments in minimally invasive surgery (MIS) approaches and technologies, MIS is becoming more popular in a variety of surgical disciplines, particularly cardiac surgery for coronary artery bypass surgery (CABG), valve surgery, and orthopedic surgery for hip and knee replacements. Furthermore, the adoption of minimally invasive surgeries is growing due to the benefits offered over traditional surgeries, such as easy and faster blood flow control, leading to shorter healing time and hospital stay, fewer complications, and less pain. Hemostats act as a powerful tool for surgeons to achieve hemostasis in these complicated surgeries. According to the American Society of Plastic Surgeons, in 2022, 682,932 non-invasive fat reduction surgeries and 408,970 non-invasive skin tightening surgeries were conducted in the U.S. Minimally invasive techniques frequently require operating complex cases as doctors limit the size and number of cuts or incisions. Hemostats created expressly for these procedures provide precision bleeding control, enabling surgeons to accomplish correct hemostasis.

Click here to: Get Free Sample Pages of this Report

Biopolymer-based hemostats are becoming popular in surgical hemostasis. These materials may assist with bleeding and come in a variety of forms, including particles, powder, sponges, sheets, foams, films, and hydrogels. Biopolymers have proven their applications as hemostatic materials due to their capabilities as biodegradable, biocompatible, and bioactive.

Biopolymer-based hemostats are meant to be biocompatible, which means the body easily absorbs them and does not trigger adverse reactions. The materials implemented in hemostats are selected with care to reduce the chance of immunological reactions and inflammation. Biopolymer-based hemostats provide a possible alternative to conventional hemostatic approaches. Their biocompatibility, absorbability, and hemostatic effectiveness make them particularly suitable choices for surgical treatments. As biopolymer technology research and development progresses, it is expected to bring more advances and higher adoption of biopolymer-based hemostats in clinical practice.

Dual-action hemostatic technology effectively and promptly controls gingival bleeding. This technology approach ensures a comprehensive solution for managing bleeding during dental treatments. Dual-action hemostatic technology characteristics include effectivity and reliability, pose no biological risk in-vivo, are free from side effects, and stop bleeding quickly. Dual-action hemostatic technology achieves hemostasis in deep and complex wounds with secluded hemorrhagic sites. Additionally, the sealing capabilities provide suture support in vascular surgery, which is highly demanded by surgeons. Additionally, the rising preference for these hemostats is due to their dual mechanism of action, which involves the interaction of two different components which include collagen mediation of intrinsic hemostatic action liable to form fibrin clots and speedy adherence to applied tissue due to the electrophilic cross-linking with a protein-reactive polyethylene glycol monomer. Such advantages of dual-action hemostatic technology are expected to drive the hemostats market.

The use of hemostat products in dental procedures is a growing area of interest due to the advantages offered by various hemostatic agents, including gelatin-based hemostatic agents, owing to their biocompatibility, biodegradability, and low cost of raw materials. Many dental procedures, including exodontia, endosseous implantation, tissue biopsies, and periodontal surgery, have benefited due to the use of hemostats to control blood flow and its ability to reach inaccessible areas. Additionally, hemostats have been flexible to adapt to the wound and be removed easily without disintegrating into the bloodstream, owing to their increased demand in dental procedures. Furthermore, hemostats have been highly preferred by healthcare professionals to reduce increased healthcare expenditures for the patient and avoid unwanted postsurgical repair/infections associated with uncontrolled surgical bleeding. These factors have contributed to the growth of hemostats in dental procedures.

Based on type, the hemostats market is segmented into absorbable hemostats and non-absorbable hemostats. In 2025, the absorbable hemostats segment is expected to account for the largest share of 58.6% of the hemostats market. The segment’s large share is attributed to the advantages offered by absorbable hemostats, such as controlling bleeding from fistula-puncture sites, achieving hemostasis during vascular surgery, controlling capillary bleeding, availability of versatile forms of hemostats, and rapid embolization.

However, the non-absorbable hemostats segment is projected to witness the highest growth rate of 7.6% during the forecast period of 2022–2032. This growth is driven by the growing use of fibrin sealants as hemostats by surgeons during surgery to physically provide an effective barrier for controlling blood flow. These sealants offer high biocompatibility, less time needed for clot formation, and the use of non-absorbable hemostats in high blood flow cases.

Based on application, the hemostats market is segmented into surgery, dental treatments, and traumatic injury. In 2025, the surgery segment is expected to account for the largest share of the hemostats market. The segment’s large share is attributed to the recurrent use of various hemostatic agents in the increasing number of orthopedic, general, gynecological, and cardiovascular surgeries, the rising number of accidents and traumatic injuries leading to surgical treatments, and the use of advanced hemostats and advance sealants by healthcare professionals in minimally invasive surgeries for controlling the blood flow.

Based on form, the hemostats market is segmented into sponges and dressings, sheets and pads, powder, tools, and matrix and gel. In 2025, the matrix and gel segment is expected to account for the largest share of 41.3% of the hemostats market. The segment’s large share is attributed to advantages offered by matrix and gel hemostatic agents, such as the formation of a physical matrix, promoting activation of the clotting pathway; their wide applications in patients with intact coagulation cascade; availability of bioactive and biocompatible gels; and cost efficiency.

This segment is also projected to witness the highest growth rate of 7.2% during the forecast period of 2022–2032.

Based on hospitals & clinics, the hemostats market is segmented into hospitals & clinics, ambulatory surgical centers, and nursing homes. In 2025, the hospitals & clinics segment is expected to account for the largest share of the hemostats market. The significant market share of this segment is attributed to the rising number of patient visits for surgical procedures and traumatic injury treatment in hospitals, the increasing number of surgeries, the willingness to spend on advance hemostats by hospitals, and favorable reimbursement policies.

In 2025, North America is expected to account for the largest share of 32.9% of the hemostats market, followed by Europe and Asia-Pacific. In North America, the U.S. accounted for the largest share in 2025. The significant market share of the U.S. can be attributed to several key factors including the presence of key market players in the U.S., a well-established and technologically advanced healthcare infrastructure, and favorable government policies in the country.

Moreover, the market in Asia-Pacific is slated to register the highest growth rate (CAGR 7.8%) due to significantly growing markets such as India and China. The growth of this market is attributed to an increase in the number of acute injuries and accidents, an increase in surgical procedures in the countries, rising medical tourism, rising healthcare expenditures, and the focus of major players in these countries due to increasing market potential.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, financial growth, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the hemostats market are Baxter International Inc. (U.S.), Pfizer Inc. (U.S.), B. Braun Melsungen AG (Germany), C. R. Bard, Inc.(U.S.), Integra LifeSciences (U.S.), Medtronic plc (Ireland), CSL Behring (U.K.), Gelita Medical GmbH (Germany), Grifols, S.A. (Spain), Abbott Laboratories (U.S.), CryoLife (U.S.), Ethicon, Inc. (U.S.) (Subsidiary of Johnson & Johnson.), Medtronic plc (Ireland), Becton, Dickinson and Company (BD) (U.S.), and Advanced Medical Solutions Group plc (U.K.). The Hemostats market is consolidated in nature, and the top 5-6 players accounted for a combined share of 40-50% in 2024.

|

Particulars |

Details |

|

Number of Pages |

~ 280 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.9% |

|

Market Size (Value) |

USD 5.32 Billion by 2032 |

|

Segments Covered |

By Type

By Application

By Form

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, U.K., Italy, Spain, Switzerland, Netherlands, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa |

|

Key Companies |

Baxter International Inc. (U.S.), Pfizer Inc. (U.S.), B. Braun Melsungen AG (Germany), C. R. Bard, Inc. (U.S.), Integra LifeSciences (U.S.), Medtronic plc (Ireland), CSL Behring (U.K.), Gelita Medical GmbH (Germany), Grifols, S.A. (Spain), Abbott Laboratories (U.S.), CryoLife (U.S.), Ethicon, Inc. (U.S.) (Subsidiary of Johnson & Johnson.), Medtronic plc (Ireland), Becton, Dickinson and Company (BD) (U.S.), and Advanced Medical Solutions Group plc (U.K.). |

This study offers a detailed assessment of the hemostats market, including the market sizes & forecasts for market segments such as type, application, form, and end user. It also provides an in-depth analysis of various segments & subsegments of the hemostats market at the regional and country levels.

The hemostats market is projected to reach $5.32 billion by 2032, at a CAGR of 6.9% during the forecast period.

In 2025, the absorbable hemostats segment is expected to account for the largest market share. This segment's significant market share is attributed to its low cost, no risk of blood-borne diseases, super absorbent capacity, and use in dental procedures.

In 2025, the surgery segment is expected to provide high growth, which can be attributed to factors such as the increasing number of surgeries in hospitals and ambulatory surgery centers, the increasing number of accidents, and the rise in cosmetic/plastic surgical procedures.

The growth of this market is driven by the increasing volume of surgical procedures performed, high research and development in the surgical devices sector, increasing rate of accidents, increase in cesarean deliveries, fatal injuries, and organ transplantation, increased R&D activities by government organizations and the private sector, rising government healthcare spending, and growing adoption of minimally invasive surgical procedures.

The key players profiled in the Hemostats market study are Baxter International Inc. (U.S.), Pfizer Inc. (U.S.), B. Braun Melsungen AG (Germany), C. R. Bard, Inc.(U.S.), Integra LifeSciences (U.S.), Medtronic plc (Ireland), CSL Behring (U.K.), Gelita Medical GmbH (Germany), Grifols, S.A. (Spain), Abbott Laboratories (U.S.), CryoLife (U.S.), Ethicon, Inc. (U.S.) (Subsidiary of Johnson & Johnson.), Medtronic plc (Ireland), Becton, Dickinson and Company (BD) (U.S.), and Advanced Medical Solutions Group plc (U.K.).

Countries such as India and China are expected to offer significant growth opportunities for the vendors in this market due to factors such as the increasing adoption of hemostat solutions for surgical procedures, rising healthcare expenditures along with medical tourism in these countries, and the increasing number of accidents and chronic injuries.

1. Introduction

1.1. Market Definition & Scope

1.2. Market Ecosystem

1.3. Currency & Limitations

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Data Collection and Validation Process

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecasting

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

4. Factors Affecting Market Growth

4.1. Overview

4.2. Drivers

4.2.1. Increasing Volume of Surgical Procedures Performed

4.2.2. High Research and Development in Surgical Devices Sector

4.2.3. Increasing Rate of Accidents

4.2.4. Increase in Cesarean Deliveries, Fatal Injuries, and Organ Transplantation

4.2.5. Increasing R&D Activities by Government Organizations and the Private Sector

4.2.6. Rising Government Healthcare Spending

4.2.7. Growing Adoption of Minimally Invasive Surgical Procedures

4.3. Restraints

4.3.1. Allergic Reactions Caused by the Material Used in Making Hemostats

4.4. Opportunities

4.4.1. Increasing Need to Control Blood Loss by Using Advanced Hemostats

4.4.2. Advancements in Dental Hemostatic Agents

4.4.3. Increasing Demand for Preloaded Applicators and Ready-to-Use Hemostats

4.5. Challenges

4.5.1. High Manufacturing Cost for Hemostasis

4.5.2. High Cost of Advanced Antimicrobial Hemostatic Agents

4.6. Trends

4.6.1. Biopolymer-based Hemostats

4.6.2. Dual-Action Hemostatic Technology

4.7. Factor Analysis

4.8. Regulatory Analysis

4.9. Pricing Analysis

4.10. Case Studies

4.11. Porter’s Five Forces Analysis

5. Hemostats Market Assessment—by Type

5.1. Overview

5.2. Absorbable Hemostats

5.2.1. Mechanical or Passive Agents

5.2.1.1. Gelatin-based Hemostat

5.2.1.2. Collagen Hemostat

5.2.1.3. Oxidized Regenerated Cellulose Hemostat

5.2.2. Flowable and Active Agents

5.2.2.1. Thrombin-based Hemostat

5.2.2.2. Combination Hemostat

5.2.3. Other Absorbable Hemostats

5.3. Non-absorbable Hemostats

5.3.1. Fibrin Sealants

5.3.2. Synthetic Sealants

5.3.3. Hemostatic Gauze

5.3.4. Hemostatic Forceps

6. Hemostats Market Assessment—by Application

6.1. Overview

6.2. Surgery

6.2.1. Orthopedic Surgery

6.2.2. General Surgery

6.2.3. Gynecology Surgery

6.2.4. Cardiovascular Surgery

6.2.5. Neurosurgery

6.2.6. Plastic Surgery

6.2.7. Other Surgeries

6.3. Dental Treatments

6.4. Traumatic Injury

7. Hemostats Market Assessment—by Form

7.1. Overview

7.2. Sponges and Dressings

7.3. Sheets and Pads

7.4. Powder

7.5. Matrix and Gel

7.6. Tools

8. Hemostats Market Assessment—by End User

8.1. Overview

8.2. Hospitals & Clinics

8.3. Ambulatory Surgical Centers

8.4. Nursing Homes

9. Hemostats Market Assessment—by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Switzerland

9.3.7. Netherlands

9.3.8. Rest of Europe (RoE)

9.4. Asia-Pacific

9.4.1. Japan

9.4.2. China

9.4.3. India

9.4.4. Australia

9.4.5 South Korea

9.4.6. Rest of Asia-Pacific (RoAPAC)

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America (RoLATAM)

9.6. Middle East & Africa

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Share Analysis/Market Rankings of Key Players (2024)

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

11.1. Baxter International Inc. (U.S.)

11.2. Pfizer Inc. (U.S.)

11.3. B. Braun Melsungen AG (Germany)

11.4. C. R. Bard, Inc.(U.S.)

11.5. Integra LifeSciences (U.S.)

11.6. Medtronic plc (Ireland)

11.7. CSL Behring (U.K.)

11.8. Gelita Medical GmbH (Germany)

11.9. Grifols, S.A. (Spain)

11.10. Abbott Laboratories (U.S.)

11.11. CryoLife (U.S.)

11.12. Ethicon, Inc. (U.S.) (a subsidiary of Johnson & Johnson.)

11.13. Medtronic plc (Ireland)

11.14. Becton, Dickinson and Company (BD) (U.S.)

11.15. Advanced Medical Solutions Group plc (U.K.)

(Note: SWOT analysis of the top 5 companies will be provided.)

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Global Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 2 Global Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 3 Global Absorbable Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 4 Global Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 5 Global Mechanical or Passive Hemostatic Agents Market Size, by Country/Region, 2022–2032 (USD Million)

Table 6 Global Gelatin-based Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 7 Global Collagen Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 8 Global Oxidized Regenerated Cellulose Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 9 Global Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 10 Global Flowable and Active Hemostatic Agents Market Size, by Country/Region, 2022–2032 (USD Million)

Table 11 Global Thrombin-based Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 12 Global Combination Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 13 Global Other Absorbable Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 14 Global Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 15 Global Non-absorbable Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 16 Global Fibrin Sealants Market Size, by Country/Region, 2022–2032 (USD Million)

Table 17 Global Synthetic Sealants Market Size, by Country/Region, 2022–2032 (USD Million)

Table 18 Global Hemostatic Gauze Market Size, by Country/Region, 2022–2032 (USD Million)

Table 19 Global Hemostatic Forceps Market Size, by Country/Region, 2022–2032 (USD Million)

Table 20 Global Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 21 Global Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 22 Global Hemostats Market Size for Surgery, by Country/Region, 2022–2032 (USD Million)

Table 23 Global Hemostats Market Size for Orthopedic Surgery, by Country/Region, 2022–2032 (USD Million)

Table 24 Global Hemostats Market Size for General Surgery, by Country/Region, 2022–2032 (USD Million)

Table 25 Global Hemostats Market Size for Gynecology Surgery, by Country/Region, 2022–2032 (USD Million)

Table 26 Global Hemostats Market Size for Cardiovascular Surgery, by Country/Region, 2022–2032 (USD Million)

Table 27 Global Hemostats Market Size for Neurosurgery, by Country/Region, 2022–2032 (USD Million)

Table 28 Global Hemostats Market Size for Plastic Surgery, by Country/Region, 2022–2032 (USD Million)

Table 29 Global Hemostats Market Size for Other Surgeries, by Country/Region, 2022–2032 (USD Million)

Table 30 Global Hemostats Market Size for Dental Treatments, by Country/Region, 2022–2032 (USD Million)

Table 31 Global Hemostats Market Size for Traumatic Injury, by Country/Region, 2022–2032 (USD Million)

Table 32 Global Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 33 Global Hemostatic Sponges and Dressings Market Size, by Country/Region, 2022–2032 (USD Million)

Table 34 Global Hemostatic Sheets and Pads Market Size, by Country/Region, 2022–2032 (USD Million)

Table 35 Global Hemostatic Powders Market Size, by Country/Region, 2022–2032 (USD Million)

Table 36 Global Hemostatic Matrix and Gels Market Size, by Country/Region, 2022–2032 (USD Million)

Table 37 Global Hemostatic Tools Market Size, by Country/Region, 2022–2032 (USD Million)

Table 38 Global Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 39 Global Hemostats Market Size for Hospitals & Clinics, by Country/Region, 2022–2032 (USD Million)

Table 40 Global Hemostats Market Size for Ambulatory Surgical Centers, by Country/Region, 2022–2032 (USD Million)

Table 41 Global Hemostats Market Size for Nursing Homes, by Country/Region, 2022–2032 (USD Million)

Table 42 Global Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 43 North America: Hemostats Market Size, by Country, 2022–2032 (USD Million)

Table 44 North America: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 45 North America: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 46 North America: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 47 North America: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 48 North America: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 49 North America: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 50 North America: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 51 North America: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 52 North America: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 53 U.S.: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 54 U.S.: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 55 U.S.: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 56 U.S.: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 57 U.S.: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 58 U.S.: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 59 U.S.: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 60 U.S.: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 61 U.S.: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 62 Canada: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 63 Canada: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 64 Canada: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 65 Canada: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 66 Canada: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 67 Canada: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 68 Canada: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 69 Canada: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 70 Canada: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 71 Europe: Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 72 Europe: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 73 Europe: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 74 Europe: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 75 Europe: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 76 Europe: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 77 Europe: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 78 Europe: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 79 Europe: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 80 Europe: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 81 Germany: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 82 Germany: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 83 Germany: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 84 Germany: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 85 Germany: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 86 Germany: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 87 Germany: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 88 Germany: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 89 Germany: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 90 France: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 91 France: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 92 France: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 93 France: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 94 France: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 95 France: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 96 France: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 97 France: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 98 France: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 99 U.K.: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 100 U.K.: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 101 U.K.: Mechanical or Passive Hemostats Agentic Market Size, by Type, 2022–2032 (USD Million)

Table 102 U.K.: Flowable and Active Hemostats Agentic Market Size, by Type, 2022–2032 (USD Million)

Table 103 U.K.: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 104 U.K.: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 105 U.K.: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 106 U.K.: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 107 U.K.: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 108 Italy: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 109 Italy: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 110 Italy: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 111 Italy: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 112 Italy: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 113 Italy: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 114 Italy: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 115 Italy: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 116 Italy: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 117 Spain: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 118 Spain: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 119 Spain: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 120 Spain: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 121 Spain: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 122 Spain: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 123 Spain: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 124 Spain: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 125 Spain: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 126 Netherlands: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 127 Netherlands: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 128 Netherlands: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 129 Netherlands: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 130 Netherlands: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 131 Netherlands: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 132 Netherlands: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 133 Netherlands: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 134 Netherlands: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 135 Switzerland: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 136 Switzerland: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 137 Switzerland: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 138 Switzerland: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 139 Switzerland: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 140 Switzerland: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 141 Switzerland: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 142 Switzerland: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 143 Switzerland: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 144 Rest of Europe (RoE): Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 145 Rest of Europe (RoE): Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 146 Rest of Europe (RoE): Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 147 Rest of Europe (RoE): Flowable and Active Hemostats Agentic Market Size, by Type, 2022–2032 (USD Million)

Table 148 Rest of Europe (RoE): Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 149 Rest of Europe (RoE): Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 150 Rest of Europe (RoE): Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 151 Rest of Europe (RoE): Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 152 Rest of Europe (RoE): Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 153 Asia-Pacific: Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 154 Asia-Pacific: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 155 Asia-Pacific: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 156 Asia-Pacific: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 157 Asia-Pacific: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 158 Asia-Pacific: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 159 Asia-Pacific: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 160 Asia-Pacific: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 161 Asia-Pacific: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 162 Asia-Pacific: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 163 Japan: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 164 Japan: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 165 Japan: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 166 Japan: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 167 Japan: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 168 Japan: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 169 Japan: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 170 Japan: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 171 Japan: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 172 China: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 173 China: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 174 China: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 175 China: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 176 China: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 177 China: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 178 China: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 179 China: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 180 China: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 181 India: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 182 India: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 183 India: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 184 India: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 185 India: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 186 India: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 187 India: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 188 India: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 189 India: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 190 Australia: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 191 Australia: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 192 Australia: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 193 Australia: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 194 Australia: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 195 Australia: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 196 Australia: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 197 Australia: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 198 Australia: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 199 South Korea: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 200 South Korea: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 201 South Korea: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 202 South Korea: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 203 South Korea: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 204 South Korea: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 205 South Korea: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 206 South Korea: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 207 South Korea: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 208 Rest of Asia-Pacific (RoAPAC): Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 209 Rest of Asia-Pacific (RoAPAC): Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 210 Rest of Asia-Pacific (RoAPAC): Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 211 Rest of Asia-Pacific (RoAPAC): Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 212 Rest of Asia-Pacific (RoAPAC): Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 213 Rest of Asia-Pacific (RoAPAC): Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 214 Rest of Asia-Pacific (RoAPAC): Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 215 Rest of Asia-Pacific (RoAPAC): Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 216 Rest of Asia-Pacific (RoAPAC): Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 217 Latin America: Hemostats Market Size, by Country/Region, 2022–2032 (USD Million)

Table 218 Latin America: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 219 Latin America: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 220 Latin America: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 221 Latin America: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 222 Latin America: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 223 Latin America: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 224 Latin America: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 225 Latin America: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 226 Latin America: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 227 Brazil: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 228 Brazil: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 229 Brazil: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 230 Brazil: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 231 Brazil: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 232 Brazil: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 233 Brazil: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 234 Brazil: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 235 Brazil: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 236 Mexico: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 237 Mexico: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 238 Mexico: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 239 Mexico: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 240 Mexico: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 241 Mexico: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 242 Mexico: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 243 Mexico: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 244 Mexico: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 245 Rest of Latin America (RoLA): Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 246 Rest of Latin America (RoLA): Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 247 Rest of Latin America (RoLA): Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 248 Rest of Latin America (RoLA): Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 249 Rest of Latin America (RoLA): Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 250 Rest of Latin America (RoLA): Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 251 Rest of Latin America (RoLA): Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 252 Rest of Latin America (RoLA): Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 253 Rest of Latin America (RoLA): Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 254 Middle East & Africa: Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 255 Middle East & Africa: Absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 256 Middle East & Africa: Mechanical or Passive Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 257 Middle East & Africa: Flowable and Active Hemostatic Agents Market Size, by Type, 2022–2032 (USD Million)

Table 258 Middle East & Africa: Non-absorbable Hemostats Market Size, by Type, 2022–2032 (USD Million)

Table 259 Middle East & Africa: Hemostats Market Size, by Application, 2022–2032 (USD Million)

Table 260 Middle East & Africa: Hemostats Market Size for Surgery, by Type, 2022–2032 (USD Million)

Table 261 Middle East & Africa: Hemostats Market Size, by Form, 2022–2032 (USD Million)

Table 262 Middle East & Africa: Hemostats Market Size, by End User, 2022–2032 (USD Million)

Table 263 Recent Developments, by Company, 2020–2025

List of Figures

Figure 1 Research Process

Figure 2 Key Secondary Sources

Figure 3 Primary Research Techniques

Figure 4 Key Executives Interviewed

Figure 5 Breakdown of Primary Interviews (Supply-side & Demand-side)

Figure 6 Market Size Estimation Approach

Figure 7 Global Hemostats Market, by Type, 2025 Vs. 2032 (USD Million)

Figure 8 Global Hemostats Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 9 Global Hemostats Market, by Form, 2025 Vs. 2032 (USD Million)

Figure 10 Global Hemostats Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 11 Global Hemostats Market, by Geography

Figure 12 Impact Analysis: Hemostats Market

Figure 13 Global Hemostats Market, by Type, 2025 Vs. 2032 (USD Million)

Figure 14 Global Hemostats Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 15 Global Hemostats Market, by Form, 2025 Vs. 2032 (USD Million)

Figure 16 Global Hemostats Market, by End User, 2025 Vs. 2032 (USD Million)

Figure 17 Global Market, by Geography, 2025 Vs. 2032 (USD Million)

Figure 18 North America: Hemostats Market Snapshot

Figure 19 Europe: Hemostats Market Snapshot

Figure 20 Asia-Pacific: Hemostats Market Snapshot

Figure 21 Latin America: Hemostats Market Snapshot

Figure 22 Key Growth Strategies Adopted by Leading Players (2020–2025)

Figure 23 Global Hemostats Market: Competitive Benchmarking, by Product

Figure 24 Global Hemostats Market: Competitive Benchmarking, by Geography

Figure 25 Global Hemostats Market: Vendor Dashboard

Figure 26 Global Hemostats Market: Market Share Analysis (2024)

Figure 27 Baxter International Inc.: Financial Overview (2024)

Figure 28 Pfizer Inc.: Financial Overview (2024)

Figure 29 B. Braun Melsungen AG: Financial Overview (2024)

Figure 30 Integra LifeSciences: Financial Overview (2024)

Figure 31 Medtronic plc: Financial Overview (2024)

Figure 32 CSL Behring: Financial Overview (2024)

Figure 33 Gelita Medical GmbH: Financial Overview (2024)

Figure 34 Grifols, S.A.: Financial Overview (2024)

Figure 35 Abbott Laboratories, Inc.: Financial Overview (2024)

Figure 36 CryoLife, Inc.: Financial Overview (2024)

Figure 37 Ethicon, Inc. (U.S.) (Subsidiary of Johnson & Johnson): Financial Overview (2024)

Figure 38 Becton, Dickinson and Company (BD): Financial Overview (2024)

Figure 39 Advanced Medical Solutions Group plc: Financial Overview (2024)

Published Date: Apr-2023

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Feb-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates