Resources

About Us

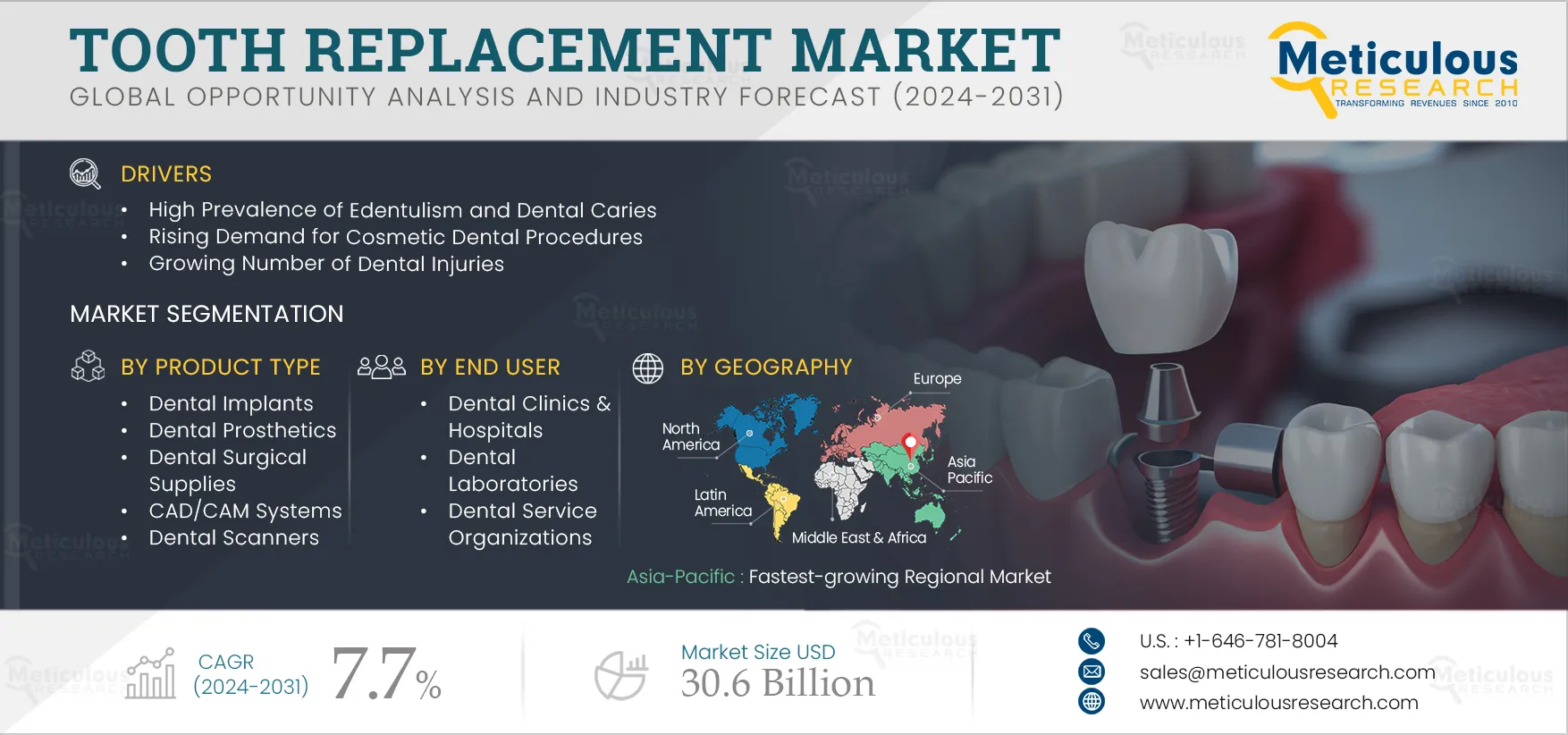

Tooth Replacement Market by Product [Dental Implants (Titanium, Zirconium), Dental Prosthetics (Bridges, Crowns, Dentures, Veneers, Abutments), Bone Graft, Sutures, CAD/CAM, Scanner], End User [Dental Laboratory, Clinic, DSO] - Global Forecast to 2032

Report ID: MRHC - 10485 Pages: 310 Feb-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportTeeth are essential for carrying out daily tasks such as eating and speaking, along with high self-esteem and confidence. The high prevalence of dental disorders, which may lead to tooth loss, leads people to opt for tooth restoration procedures.

Further, the adoption of digital technologies in dentistry, such as X-rays, intraoral scanners, digital impressions, and CAD/CAM, among others, has led to improved accuracy and efficiency in diagnosis, improved treatment planning, reduction of human error, and personalized treatment solutions. Due to improved patient outcomes, people are more confident than before about opting for tooth replacement procedures.

Dental and oral diseases have a huge burden on the global population, especially edentulism and dental caries. Edentulism, known as toothlessness, is the state of an individual with no natural teeth. One of the major reasons for edentulism is dental caries. Dental caries is caused when the oral bacteria metabolize the sugars to form acids, which demineralize the hard tissue of the teeth, including enamel and bones. The high prevalence of dental caries and edentulism has created a huge demand for dental implants and dental prosthetics, including dental crowns and dental bridges.

According to the World Health Organization (WHO), untreated dental caries or tooth decay is one of the leading oral diseases affecting the global population. WHO Global Oral Health Status Report (2022) estimated that oral diseases affect close to 3.5 billion people worldwide, with 3 out of 4 people affected living in middle-income countries. Globally, an estimated 2 billion people suffer from caries of permanent teeth, and 514 million children suffer from caries of primary teeth.

Edentulism is the end point of any dental disorder where the teeth fall out. This occurs due to dental carries, periodontal diseases, or dental trauma and injuries. According to the WHO, the global prevalence of complete tooth loss is 7% in people aged 20 years and older and 23% for people aged 60 years and above. Moreover, over 36 million Americans are fully edentate, and over 120 million are partially edentate (Source: American College of Prosthodontists). Adequate dentition is essential for maintaining a person’s well-being and quality of life. Edentulism is one of the public health burdens for older adults and affects primary care. Edentulism is a devastating and irreversible condition, described as the final marker of disease burden for oral health. Thus, the large burden of dental caries and edentulism drives the demand for tooth replacement procedures.

Click here to: Get Free Sample Pages of this Report

3D printing technology has accelerated progress in the dental sector, mainly due to advancements in computer-aided design (CAD) and enhanced imaging techniques such as cone beam computed tomography (CBCT) and magnetic resonance imaging (MRI). These techniques allow for planning and printing dental and maxillofacial prostheses to restore and replace lost structures. Previously, dentistry was mainly influenced by subtractive manufacturing, also known as milling. However, it could not reproduce complex models as it did not consider internal structures. Modern CAD software uses intricate algorithmic designs and artificial intelligence to help model any object or tissue to reproduce it as required.

With 3D printing technology, dentists can customize treatments, including the customization of dental implants, surgical guides, and anatomic models.

Dental implants and crowns are commonly manufactured using 3D printing. The technology is expected to meet more than 60% of all dental production needs by 2025 and enhance dental modeling (Source: SmarTech). Significant improvements in 3D printing technology have boosted its adoption in dentistry. For instance, 3D printers have become faster and more versatile than ever before and can handle and combine an expanding variety of materials. Advances in software have amplified the power of 3D printing technology. 3D printing produces a final result that is indistinguishable from real teeth. A 3D-printed prosthetic tooth’s shape, size, color, and location ensure a perfect fit. Dentists may use solid blocks of durable ceramics to build the strongest dental crowns and dental implants for dental restorations using reduction printing.

3D-printed products are high-quality and cost-competitive, which drives the adoption of 3D printing technology in the dental sector. Additionally, today’s advanced 3D printing technology can directly print a transparent product, eliminating the grinding and buffing steps required with older 3D-printed dental products. Earlier, dental practices had to contract a third party to fulfill various applications; however, currently, many practices can handle their 3D printing needs in-house or through lower-cost avenues.

Based on type, the dental prosthetics segment is further segmented into crowns & bridges, dentures, abutments, veneers, and inlays & onlays. In 2025, the crowns & bridges segment is expected to dominate the dental prosthetics market. The large share of this segment is attributed to the high prevalence of tooth decay, accident/injury, gum disease, and congenital conditions.

Tooth decay is mainly a diet-related disease. It is caused by bacteria in the mouth that metabolizes sugar to turn it into energy, producing acid that damages the teeth. The rise in sugar consumption amongst the population increases the risk of tooth decay, which is expected to drive the adoption of dental bridges. According to the Organization for Economic Cooperation and Development (OECD), sugar consumption in Asia is estimated to increase to 1,10,808 kilotonnes from 84,016 kilotonnes in 2018-20.

Based on end user, the dental clinics & hospitals segment is expected to account for the largest share of the tooth replacement market. The large market share of this segment is attributed to the increasing incidence of dental diseases, rising demand for cosmetic dentistry, increasing awareness of oral hygiene, and growing medical tourism.

There has been a growing trend of consolidating dental practices in recent years. The consolidation of dental clinics by capital ventures and invisible service organizations supports dental practitioners with financial and strategic resources to expand their practices under one roof. For instance, in February 2024, Innova Capital (Poland), a private equity firm, acquired United Clinics (Poland), a dental consolidator in Central and Eastern Europe.

In 2025, North America is expected to account for the largest share of the tooth replacement market, while Asia-Pacific is expected to record the highest CAGR during the forecast period. The high growth of the Asia-Pacific tooth replacement market is attributed to the increasing prevalence of oral diseases, rising awareness regarding oral health, rising geriatric population, growth in medical tourism, initiatives by governments and organizations for improving dental health, the growing number of practicing dentists, and increasing expenditure on dental services.

The report offers a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presence, and key strategic developments adopted by leading market players in this market in the last three to four years. The key players profiled in the tooth replacement market are Institut Straumann AG (Switzerland), Dentsply Sirona Inc. (U.S.), ZimVie Inc. (U.S.), Envista Holdings, Corporation (U.S.), OSSTEM IMPLANT CO. LTD (South Korea), Dentium CO. LTD. 9South Korea), Kulzer GmbH (Germany), Ultradent Products, Inc. (U.S.), Ivoclar Vivadent AG (Liechtenstein), COLTENE Group (Switzerland), Bicon LLC (U.S.) Implant Direct Corporation (U.S.), 3SHAPE A/S (Denmark), Midmark Corporation (U.S.), PLANMECA OY (Finland), Align Technology Inc. (U.S.), Condor Technologies NV (Belgium), CAMLOG Biotechnologies GmbH (Switzerland), AVINENT IMPLANT SYSTEM, S.L.U. (Spain), and Neoss Ltd. (U.K.).

|

Particular |

Details |

|

Page No |

~310 |

|

Format |

|

|

Forecast Period |

2025-2032 |

|

Base Year |

2024 |

|

CAGR |

7.7% |

|

2032 Market Size (Value) |

$30.6 billion by 2032 |

|

Segments Covered |

By Product Type

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Spain, Italy, Switzerland, Netherlands, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of APAC), Latin America (Brazil, Mexico, Rest of LATAM), Middle East & Africa (Saudi Arabia, UAE, Rest of MEA). |

|

Key Companies |

Institut Straumann AG (Switzerland), Dentsply Sirona Inc. (U.S.), ZimVie Inc. (U.S.), Envista Holdings, Corporation (U.S.), OSSTEM IMPLANT CO. LTD (South Korea), Dentium CO. LTD. (South Korea), Kulzer GmbH (Germany), Ultradent Products, Inc. (U.S.), Ivoclar Vivadent AG (Liechtenstein), COLTENE Group (Switzerland), Bicon LLC (U.S.) Implant Direct Corporation (U.S.), 3SHAPE A/S (Denmark), Midmark Corporation (U.S.), PLANMECA OY (Finland), Align Technology Inc. (U.S.), Condor Technologies NV (Belgium), CAMLOG Biotechnologies GmbH (Switzerland), AVINENT IMPLANT SYSTEM, S.L.U. (Spain), and Neoss Ltd. (U.K.). |

The tooth replacement market report covers market sizes & forecasts for dental implants, dental prosthetics, and dental surgical supplies. The study also includes the value analysis of various segments and subsegments of the tooth replacement market at the regional and country levels.

The tooth replacement market is projected to reach $30.6 billion by 2032, at a CAGR of 7.7% from 2025 to 2032.

The dental prosthetics segment is estimated to account for the largest share of the tooth replacement market in 2025. Moreover, this segment is expected to record the highest CAGR during the forecast period.

The hospitals & clinics segment is projected to gain more traction in the tooth replacement market.

The high growth of the tooth replacement market is mainly attributed to the high prevalence of dental caries & edentulism and the rising demand for cosmetic dental procedures.

Furthermore, the growing demand for tooth replacement procedures in developing countries and the adoption of digital technologies in dental practices are expected to generate growth opportunities for the players operating in this market.

The key players operating in the tooth replacement market are Institut Straumann AG (Switzerland), Dentsply Sirona Inc. (U.S.), ZimVie Inc. (U.S.), Envista Holdings, Corporation (U.S.), OSSTEM IMPLANT CO. LTD (South Korea), Dentium CO. LTD. 9South Korea), Kulzer GmbH (Germany), Ultradent Products, Inc. (U.S.), Ivoclar Vivadent AG (Liechtenstein), COLTENE Group (Switzerland), and Bicon LLC (U.S.).

China and India are expected to offer significant growth opportunities to the market players. This can be attributed to the high burden of dental disorders, growing awareness regarding oral diseases, increase in sugar consumption, rising disposable incomes, and growing demand for quality health.

Published Date: May-2024

Published Date: Apr-2025

Published Date: Nov-2024

Published Date: Jan-2025

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates