Resources

About Us

Grid Edge Intelligence & Analytics Market Size, Share, & Forecast by Data Source (Smart Meters, Sensors, DERs), AI/ML Capability, and Application (Fault Detection, Forecasting) - Global Forecast to 2036

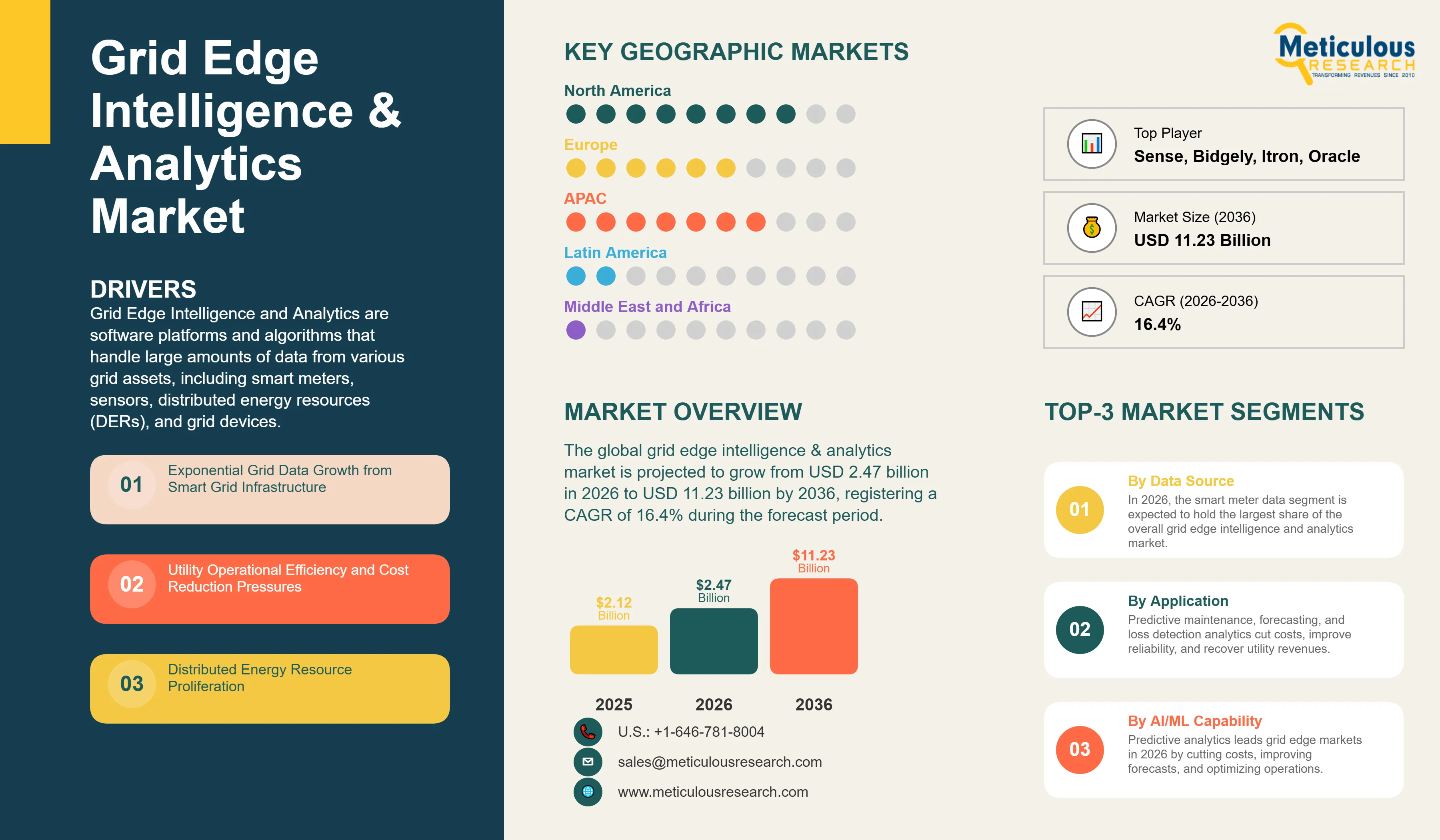

Report ID: MREP - 1041685 Pages: 277 Jan-2026 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportThe global grid edge intelligence & analytics market is expected to reach USD 11.23 billion by 2036 from USD 2.47 billion in 2026, at a CAGR of 16.4% from 2026 to 2036.

Grid Edge Intelligence and Analytics are software platforms and algorithms that handle large amounts of data from various grid assets, including smart meters, sensors, distributed energy resources (DERs), and grid devices. They provide real-time insights, predictions, and automated actions to optimize grid operations, increase reliability, and allow for new utility services. These systems aim to turn raw grid data into useful intelligence. They help manage the grid proactively, predict equipment failures before they happen, optimize the use of distributed energy resources, detect anomalies and fraud, and support better decision-making.

These AI-driven systems use various technologies, such as machine learning for recognizing patterns and making predictions, big data analytics to process billions of data points, and artificial intelligence for making independent decisions. They also employ edge computing for local real-time processing, predictive analytics to forecast grid conditions and failures, deep learning for identifying complex patterns, and cloud-based data lakes for storing historical grid information. Grid edge intelligence systems can spot early signs of equipment failures days or weeks in advance, identify energy theft and non-technical losses, accurately forecast renewable generation and load, optimize volt-VAR control for efficiency, enable predictive maintenance to cut costs, and offer actionable insights from large data sets.

These systems give utilities better situational awareness, help reduce operational costs, improve reliability metrics, optimize asset use, and create new revenue opportunities. This shift allows utilities to move from reactive to proactive operations. They can better manage the complexities of distributed energy, enhance customer service, decrease operational costs, and maximize the value from smart grid investments.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Grid Edge Intelligence and Analytics platforms act as the "brain" that extracts value from significant investments in smart grid data infrastructure. Utilities have installed hundreds of millions of smart meters, thousands of grid sensors, and extensive monitoring equipment, producing petabytes of data each year. However, data by itself offers limited value. The real benefits come from analyzing this data, which leads to operational improvements, cost savings, and new capabilities. Grid edge analytics turns raw data into actionable insights. These insights include indicators of equipment health that predict failures, consumption patterns that allow for demand forecasting, anomaly detection that identifies theft and meter issues, predictions of distributed resource outputs that aid integration, grid state estimation for operational visibility, and customer segmentation to enable targeted programs. By combining analytics algorithms, machine learning models, big data processing infrastructure, and specialized knowledge, grid edge intelligence platforms help utilities see a return on their smart grid investments, optimize operations, improve reliability, and offer better customer experiences.

Several key trends are changing the grid edge intelligence and analytics market. These trends include the rapid advancement of artificial intelligence and machine learning that allows for more sophisticated analysis, a shift from centralized cloud analytics to distributed edge computing for real-time processing, integration of analytics with operational systems enabling automated actions, a broader focus from utility operations to customer-facing analytics and engagement, and the rise of analytics-as-a-service business models that make these capabilities available to smaller utilities. The combination of rapid data growth from grid digitization, the maturation of AI technology for practical use, pressure on utilities to improve operational efficiency, the complexity of distributed energy requiring intelligence, and proven returns on analytics investments has sped up the shift from pilot projects to mainstream utility operations across different regions and utility sizes.

The grid edge intelligence and analytics market is evolving quickly toward comprehensive, AI-driven platforms that offer end-to-end data-to-action capabilities. Modern implementations go beyond basic reporting dashboards. They create complex intelligence ecosystems that include real-time streaming analytics processing sensor data as it is generated, predictive models forecasting equipment failures and power generation, prescriptive analytics recommending optimal actions rather than just predictions, automated decision systems executing responses without human involvement, federated learning that trains models across different data sources while preserving privacy, explainable AI offering transparency into model decisions for regulatory compliance, and digital twin models simulating grid behavior for scenario analysis and planning. The evolution from descriptive analytics (what happened) through diagnostic analytics (why it happened) and predictive analytics (what will happen) to prescriptive and autonomous analytics (what should we do) marks a significant change in capability and value delivery.

Edge computing is becoming vital for grid analytics, working alongside cloud-based platforms. While cloud infrastructure offers affordable storage and processing for historical analysis and complex model training, edge computing enables features such as real-time responses with millisecond latency for protection and control, reduced data transmission by processing data locally and sending only necessary insights, resilience during communication outages by maintaining local intelligence, privacy preservation by keeping sensitive data close, and scalability by distributing processing across many edge locations. Modern grid edge intelligence architectures use hierarchical analytics, with edge devices performing real-time analysis and local actions, fog/regional nodes gathering insights from various edge locations, and cloud platforms managing enterprise-wide analytics, model training, and strategic planning. This distributed intelligence architecture enhances performance, cost, and functionality.

The merging of grid edge intelligence with operational systems is changing analytics from passive insights to active grid management. Modern implementations integrate analytics with SCADA, ADMS, DERMS, and other operational systems, enabling closed-loop automation. This includes predictive maintenance analytics that automatically generate work orders, demand forecasting analytics that adjust dispatch schedules, DER output predictions that optimize grid settings, anomaly detection that triggers investigation workflows, and customer engagement analytics that automatically start targeted programs. This integration changes analytics from tools to support decisions to autonomous systems that optimize the grid, continuously learning and adapting. The value shifts from offering information to utility staff to automating decisions and actions that enhance operations.

|

Parameter |

Details |

|

Market Size Value in 2026 |

USD 2.47 Billion |

|

Revenue Forecast in 2036 |

USD 11.23 Billion |

|

Growth Rate |

CAGR of 16.4% from 2026 to 2036 |

|

Base Year for Estimation |

2025 |

|

Historical Data |

2021–2025 |

|

Forecast Period |

2026–2036 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2026 to 2036 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Data Source, AI/ML Capability, Application, Deployment Model, Analytics Type, Utility Function, Region |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, Singapore, Brazil, Chile, Saudi Arabia, UAE, South Africa |

|

Key Companies Profiled |

C3.ai Inc., Oracle Corporation, Itron Inc., Landis+Gyr Group AG, AutoGrid Systems Inc., Bidgely Inc., Sense (Sense Labs Inc.), Grid4C (Innowatts), Space-Time Insight (Nokia), Uplight Inc., Copper Labs Inc., OhmConnect Inc., Whisker Labs Inc., Open Systems International Inc. (Emerson), General Electric Company, Siemens AG, Schneider Electric SE, ABB Ltd., Hitachi Energy Ltd., Eaton Corporation |

Driver: Exponential Grid Data Growth from Smart Grid Infrastructure

The rise of smart meters, sensors, and grid monitoring devices is creating huge amounts of operational data that overwhelm traditional utility analytics. This growth drives the demand for better intelligence platforms. Modern utilities generate massive data volumes. Large utilities with millions of smart meters collecting 15-minute interval data produce terabytes each month. Distribution grid sensors monitor voltage, current, power factor, and harmonics, adding significant data streams. Distributed energy resources report generation, consumption, and status, creating millions of data points. Grid equipment equipped with condition monitoring sensors generate continuous health data. Traditional utility IT systems, designed for monthly billing data and periodic readings, struggle to process, store, or analyze these data volumes. Advanced grid edge intelligence platforms that use big data architectures, distributed processing, machine learning algorithms, and cloud infrastructure are vital for extracting value from these data streams. The growth of data is speeding up as utilities deploy more sensors, upgrade to next-generation smart meters with higher data resolution, and add monitoring to previously unmonitored grid assets. This rapid data growth creates essential needs for advanced analytics, ensuring ongoing market expansion.

Driver: Utility Operational Efficiency and Cost Reduction Pressures

Utilities face constant pressure to cut operational costs while maintaining or improving service quality. This situation drives the adoption of analytics platforms that optimize operations and encourage proactive management. Utilities encounter various cost pressures: an aging workforce that needs efficiency improvements to maintain service with fewer experienced staff, capital constraints limiting infrastructure development that require optimization of existing assets, regulatory pressures for cost control amid rate case scrutiny and performance-based regulation, competition from distributed resources that push for operational excellence, and public expectations for reliable service with minimal rate increases. Grid edge analytics help address these pressures by enabling predictive maintenance that reduces emergency repair costs by 20-40% through proactive intervention. Load forecasting optimization reduces peak capacity needs and energy costs. Non-technical loss detection recovers 1-3% of revenue lost to theft and meter errors. Optimizing asset utilization can delay capital investment through better management, and operational automation reduces manual tasks and labor costs. These operational advantages create a strong return on investment, often achieving payback in 2-4 years, making analytics investments appealing, even for cost-constrained utilities. The proven benefits of cost reduction ensure ongoing utility investments in grid edge intelligence platforms.

Opportunity: Distributed Energy Resource Integration and Optimization

The rapid growth of distributed solar, storage, and other distributed energy resources (DERs) creates challenges that require analytics and opportunities for advanced intelligence platforms. Distribution grids dealing with millions of solar installations, thousands of battery systems, increasing electric vehicle charging loads, and other distributed resources face complexities such as intermittent generation creating uncertainty, reverse power flow affecting voltage regulation, coordination challenges with distributed control, visibility gaps into behind-the-meter resources, and forecasting difficulties due to variable weather-dependent output. Advanced grid edge analytics tackle these challenges through DER output forecasting, which predicts solar and wind generation for operational planning. Hosting capacity analysis helps determine optimal locations for DER connections. Aggregating and coordinating enhances collective DER behavior for grid support. Anomaly detection identifies DER malfunctions or negative impacts on the grid, while optimization algorithms dispatch flexible DERs for peak shaving and grid services. These analytics capabilities focused on DERs present high-value use cases with clear operational benefits. Improved forecast accuracy cuts down on reserves needed and reduces costs; optimizing hosting capacity supports greater renewable integration; and coordinating DER provides flexibility that avoids infrastructure investment. As DER penetration speeds up globally, analytics platforms with advanced DER capabilities will see strong demand growth.

Opportunity: Emerging Markets Utility Digital Transformation

Utilities in emerging markets seeking digital transformation and smart grid deployment present significant growth opportunities for grid edge intelligence vendors. Utilities in regions such as Asia-Pacific, Latin America, the Middle East, and Africa are modernizing infrastructure, deploying smart meters, and implementing digital platforms on an unprecedented scale. These markets have advantages like greenfield opportunities that don't come with legacy system constraints. This allows for optimal architectures. Government initiatives to promote smart grids provide policy support and funding. Rapid technology adoption in these areas allows for leveraging the latest capabilities without passing through intermediate generations. Additionally, growing utility sophistication recognizes the value of analytics. China and India offer especially large opportunities. China's State Grid and Southern Power Grid operate the world's largest distribution networks, featuring extensive smart meter deployments backed by government mandates for intelligent grid management. In India, smart city programs and utility modernization efforts, including the Smart Grid Mission, create considerable demand. These emerging markets increasingly want advanced analytics capabilities right from deployment rather than tacking them onto existing systems later, leading to opportunities for comprehensive platform implementations. As utilities in emerging markets digitize their operations, demand for grid edge intelligence will rise significantly.

By Data Source:

In 2026, the smart meter data segment is expected to hold the largest share of the overall grid edge intelligence and analytics market. Smart meters are the most common data source, with over 1 billion deployed worldwide, generating large volumes of data. Smart meter data offers detailed consumption information at 15-minute, hourly, or daily intervals, depending on its setup. This capability supports various analytics applications, including load forecasting based on detailed consumption patterns, detecting non-technical losses through consumption anomalies, segmenting customers by usage patterns, measuring demand response baselines, analyzing distributed generation net metering, and identifying billing errors for revenue assurance. The established analytics value from smart meter data, widespread deployment, and well-defined use cases make smart meter data the main source for grid edge intelligence. Leading analytics vendors such as Oracle, Itron, Landis+Gyr, as well as specialized companies like Bidgely and AutoGrid, have developed smart meter analytics platforms that process billions of meter reads.

The sensor and monitoring data segment includes data from distribution grid sensors, substation monitoring equipment, transformer monitors, capacitor bank controllers, and similar devices. This operational data offers insights into grid conditions like voltage, current, power factor, harmonics, temperature, and equipment status. Analytics applications focus on monitoring asset health, predicting maintenance needs, analyzing power quality, and estimating grid state.

The distributed energy resource data segment includes generation data from solar inverters, telemetry from battery storage systems, information from EV chargers, and other operational data related to DER. DER analytics support forecasting, optimizing, aggregation, and grid impact analysis, which become more important as DER penetration increases.

By AI/ML Capability:

The predictive analytics segment is expected to lead the market in 2026, reflecting high-value use cases that offer clear operational benefits and returns on investment. Predictive analytics uses machine learning algorithms trained on historical data to forecast future conditions, events, or equipment states. Key grid applications include predicting equipment failures, such as transformers, breakers, or cables days to weeks in advance, which allows for proactive replacements. Other applications include load forecasting for operational planning, renewable generation forecasting to manage solar and wind output, customer behavior prediction for program participation or electric vehicle adoption, and anomaly prediction to spot issues before they escalate. Predictive analytics significantly reduces maintenance costs by 20-40% through proactive measures, improves capacity planning through accurate load forecasts, and optimizes renewable integration using generation predictions. The established returns on investment and mature implementations make predictive analytics the leading capability in grid edge intelligence.

The prescriptive analytics segment goes a step further by recommending optimal actions. Prescriptive systems analyze various scenarios, optimize across goals and constraints, and provide actionable recommendations like maintenance scheduling, DER dispatch suggestions, outage restoration priorities, and optimizing demand response events.

By Application:

The asset health monitoring and predictive maintenance segment is projected to experience substantial growth during the forecast period due to aging infrastructure, pressure on maintenance costs, and proven analytics value. Utilities manage hundreds of thousands to millions of grid assets, such as transformers, breakers, regulators, and cables, which require maintenance and eventual replacement. Traditional time-based or reactive maintenance is costly and inefficient. Replacing assets based solely on age wastes useful life, while waiting for failures leads to outages and emergency repairs. Predictive maintenance analytics monitor asset health using operational data such as load, voltage, and temperature. They identify degradation patterns that indicate potential failures, predict remaining useful life, and recommend proactive actions. Advanced implementations include techniques such as thermal analysis to detect hot spots, partial discharge monitoring to identify insulation issues, load pattern analysis to highlight stress, and oil analysis for transformer health. Benefits include reducing maintenance costs by 20-40%, cutting unplanned outages by 30-50%, and extending asset life by 15-25% through timely interventions. These savings and reliability improvements make predictive maintenance a compelling analytics application.

The load and renewable forecasting segment provides essential operational value for managing the grid effectively. Accurate short-term load forecasts, offered hours in advance, improve unit commitment and dispatch. Medium-term forecasts, available days ahead, assist with maintenance scheduling and resource planning, while long-term forecasts, covering months or years, support capacity planning. Forecasting renewable generation, like solar and wind, becomes increasingly important as renewable energy grows. Achieving improvements of 10-20% in forecasting accuracy can lead to operational advantages, such as lower reserve requirements, optimized energy purchasing, and better integration of renewables.

The non-technical loss detection segment uncovers revenue losses from theft, meter malfunctions, and billing errors. Analytics algorithms identify consumption anomalies, compare patterns among similar customers, detect unreasonable consumption changes, and flag suspicious actions. Utilities typically recover 1-3% of revenue through comprehensive loss detection programs, providing strong financial support for these initiatives

In 2026, North America is expected to have the largest share of the global grid edge intelligence and analytics market. This leadership comes from a well-developed smart grid infrastructure with a wide deployment of smart meters, sensors, and monitoring equipment that generate large amounts of data. Many major utilities are adopting advanced analytics by implementing complete platforms. The region also has a strong vendor ecosystem that includes Oracle, Itron, C3.ai, AutoGrid, and specialized startups. Utilities are focusing on data-driven operations, which is highlighted in their strategic plans, supported by regulatory frameworks that encourage grid modernization and innovation. U.S. utilities, in particular, lead in analytics adoption. This trend is driven by competitive pressure for operational efficiency, aging infrastructure that needs predictive management, regulatory incentives for improving reliability, and venture capital that backs analytics startups. Major deployments feature utilities using comprehensive platforms for operational, customer, and grid analytics. These efforts create reference implementations and use case libraries.

Asia-Pacific is expected to grow the fastest during this period. This growth is driven by extensive smart meter deployments in China and India, which create a vast data infrastructure. Grid modernization initiatives require advanced analytics. There is also significant development of AI and analytics technology, especially in China. Government smart grid policies mandate intelligence features, and utility digital transformation strategies are in place. China leads regional growth, thanks to State Grid Corporation and Southern Power Grid deploying advanced analytics platforms. Government policies require intelligent grid management. Domestic analytics vendors are developing competitive solutions, and analytics are being integrated with a complete smart grid infrastructure. In India, the Smart Grid Mission, utility modernization programs, and significant planned smart meter deployments offer substantial analytics opportunities. Utilities in Japan, South Korea, and Singapore are focusing on innovation and adopting analytics.

Europe represents a significant market characterized by the need for renewable integration analytics. The high penetration of solar and wind energy calls for sophisticated forecasting and optimization, along with managing the complexity of distributed energy resources. The Energiewende and the broader energy transition require grid intelligence. A culture of utility innovation, especially in Northern Europe, supports this market, along with advanced metering infrastructure maturity. Germany leads the European market, with utilities implementing comprehensive analytics for renewable integration, grid optimization, and customer engagement. Nordic utilities focus on advanced analytics for managing distributed generation and automating the grid. UK utilities are deploying analytics for innovation projects and meeting regulatory requirements.

The major players in the grid edge intelligence & analytics market include C3.ai Inc. (U.S.), Oracle Corporation (U.S.), Itron Inc. (U.S.), Landis+Gyr Group AG (Switzerland), AutoGrid Systems Inc. (U.S.), Bidgely Inc. (U.S.), Sense (Sense Labs Inc.) (U.S.), Grid4C (Innowatts) (Israel/U.S.), Space-Time Insight (Nokia) (U.S./Finland), Uplight Inc. (U.S.), Copper Labs Inc. (U.S.), OhmConnect Inc. (U.S.), Whisker Labs Inc. (U.S.), Open Systems International Inc. (Emerson) (U.S.), General Electric Company (U.S.), Siemens AG (Germany), Schneider Electric SE (France), ABB Ltd. (Switzerland), Hitachi Energy Ltd. (Switzerland), and Eaton Corporation (Ireland/U.S.), among others.

The grid edge intelligence & analytics market is expected to grow from USD 2.47 billion in 2026 to USD 11.23 billion by 2036.

The grid edge intelligence & analytics market is expected to grow at a CAGR of 16.4% from 2026 to 2036.

The major players include C3.ai Inc., Oracle Corporation, Itron Inc., Landis+Gyr Group AG, AutoGrid Systems Inc., Bidgely Inc., Sense, Grid4C (Innowatts), Space-Time Insight (Nokia), Uplight Inc., Copper Labs Inc., OhmConnect Inc., Whisker Labs Inc., OSI (Emerson), General Electric Company, Siemens AG, Schneider Electric SE, ABB Ltd., Hitachi Energy Ltd., and Eaton Corporation, among others.

The main factors driving the grid edge intelligence & analytics market include exponential grid data growth from smart meter and sensor deployments, utility operational efficiency and cost reduction pressures (20-40% maintenance cost savings), distributed energy resource proliferation requiring intelligent coordination, aging infrastructure requiring predictive management, load and renewable forecasting optimization needs, non-technical loss detection recovering 1-3% revenue, emerging markets utility digital transformation, and continuous advancements in AI/ML algorithms, edge computing architectures, big data processing, and cloud analytics platforms.

North America region will lead the global grid edge intelligence & analytics market in 2026 due to mature smart grid data infrastructure and advanced analytics adoption, while Asia-Pacific region is expected to register the highest growth rate during the forecast period 2026 to 2036.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency and Limitations

1.3.1. Currency

1.3.2. Limitations

1.4. Key Stakeholder

2. Research Methodology

2.1. Research Approach

2.2. Data Collection & Validation

2.2.1. Secondary Research

2.2.2. Primary Research

2.3. Market Assessment

2.3.1. Market Size Estimation

2.3.2. Bottom-Up Approach

2.3.3. Top-Down Approach

2.3.4. Growth Forecast

2.4. Assumptions for the Stud

3. Executive Summary

3.1. Overview

3.2. Market Analysis, by Data Source

3.3. Market Analysis, by AI/ML Capability

3.4. Market Analysis, by Application

3.5. Market Analysis, by Deployment Model

3.6. Market Analysis, by Analytics Type

3.7. Market Analysis, by Utility Function

3.8. Market Analysis, by Geography

3.9. Competitive Analysis

4. Market Insights

4.1. Introduction

4.2. Global Grid Edge Intelligence & Analytics Market: Impact Analysis of Market Drivers (2026–2036)

4.2.1. Exponential Grid Data Growth from Smart Grid Infrastructure

4.2.2. Utility Operational Efficiency and Cost Reduction Pressures

4.2.3. Distributed Energy Resource Proliferation

4.3. Global Grid Edge Intelligence & Analytics Market: Impact Analysis of Market Restraints (2026–2036)

4.3.1. Data Quality and Integration Challenges

4.3.2. Utility IT/OT Skillset and Change Management

4.4. Global Grid Edge Intelligence & Analytics Market: Impact Analysis of Market Opportunities (2026–2036)

4.4.1. Distributed Energy Resource Integration and Optimization

4.4.2. Emerging Markets Utility Digital Transformation

4.5. Global Grid Edge Intelligence & Analytics Market: Impact Analysis of Market Challenges (2026–2036)

4.5.1. Model Explainability and Regulatory Acceptance

4.5.2. Cybersecurity and Data Privacy

4.6. Global Grid Edge Intelligence & Analytics Market: Impact Analysis of Market Trends (2026–2036)

4.6.1. Evolution from Cloud to Edge Computing Analytics

4.6.2. Integration with Operational Systems for Closed-Loop Automation

4.7. Porter's Five Forces Analysis

4.7.1. Threat of New Entrants

4.7.2. Bargaining Power of Suppliers

4.7.3. Bargaining Power of Buyers

4.7.4. Threat of Substitute Products

4.7.5. Competitive Rivalry

5. Grid Edge Intelligence Technologies and AI/ML Architectures

5.1. Introduction to Grid Edge Analytics

5.2. Machine Learning Algorithms for Grid Applications

5.3. Big Data Processing Architectures

5.4. Edge Computing and Distributed Analytics

5.5. Predictive Modeling and Forecasting Techniques

5.6. Deep Learning and Neural Networks

5.7. Digital Twin and Simulation Models

5.8. Explainable AI and Model Interpretability

5.9. Impact on Market Growth and Technology Adoption

6. Competitive Landscape

6.1. Introduction

6.2. Key Growth Strategies

6.2.1. Market Differentiators

6.2.2. Synergy Analysis: Major Deals & Strategic Alliances

6.3. Competitive Dashboard

6.3.1. Industry Leaders

6.3.2. Market Differentiators

6.3.3. Vanguards

6.3.4. Emerging Companies

6.4. Vendor Market Positioning

6.5. Market Share/Ranking by Key Player

7. Global Grid Edge Intelligence & Analytics Market, by Data Source

7.1. Introduction

7.2. Smart Meter Data

7.2.1. Interval Consumption Data (15-min, Hourly)

7.2.2. Voltage and Power Quality Data

7.2.3. Meter Event and Status Data

7.3. Sensor and Monitoring Data

7.3.1. Substation Monitoring

7.3.2. Feeder and Line Sensors

7.3.3. Transformer Monitoring

7.4. Distributed Energy Resource Data

7.4.1. Solar Inverter Data

7.4.2. Battery Storage Telemetry

7.4.3. EV Charger Data

7.5. Weather and Environmental Data

7.6. Customer and GIS Data

7.7. Integrated Multi-Source Analytic

8. Global Grid Edge Intelligence & Analytics Market, by AI/ML Capability

8.1. Introduction

8.2. Predictive Analytics

8.2.1. Equipment Failure Prediction

8.2.2. Load Forecasting

8.2.3. Renewable Generation Forecasting

8.3. Prescriptive Analytics

8.3.1. Optimization Recommendations

8.3.2. Scenario Analysis

8.4. Anomaly Detection

8.4.1. Equipment Anomaly Detection

8.4.2. Consumption Anomaly Detection

8.5. Pattern Recognition and Classification

8.6. Deep Learning and Neural Networks

8.7. Reinforcement Learning for Optimization

9. Global Grid Edge Intelligence & Analytics Market, by Application

9.1. Introduction

9.2. Asset Health Monitoring and Predictive Maintenance

9.2.1. Transformer Health Monitoring

9.2.2. Breaker and Switch Monitoring

9.2.3. Cable and Conductor Analysis

9.3. Load and Renewable Forecasting

9.3.1. Short-Term Load Forecasting

9.3.2. Medium and Long-Term Forecasting

9.3.3. Solar and Wind Forecasting

9.4. Non-Technical Loss Detection

9.4.1. Energy Theft Detection

9.4.2. Meter Malfunction Identification

9.4.3. Billing Error Detection

9.5. Grid Optimization and Volt-VAR Control

9.6. Outage Prediction and Prevention

9.7. Demand Response and Load Management

9.8. DER Integration and Optimization

9.9. Customer Analytics and Engagement

10. Global Grid Edge Intelligence & Analytics Market, by Deployment Model

10.1. Introduction

10.2. Cloud-Based Analytics

10.2.1. Public Cloud Platforms

10.2.2. Private Cloud Solutions

10.3. On-Premise Analytics

10.4. Hybrid Cloud-Edge Architecture

10.5. Edge Computing Analytics

10.5.1. Substation Edge Analytics

10.5.2. Meter and Device Edge Processing

11. Global Grid Edge Intelligence & Analytics Market, by Analytics Type

11.1. Introduction

11.2. Descriptive Analytics (Historical Analysis)

11.3. Diagnostic Analytics (Root Cause Analysis)

11.4. Predictive Analytics (Forecasting)

11.5. Prescriptive Analytics (Optimization)

11.6. Real-Time Streaming Analytics

11.7. Batch Processing Analytic

12. Global Grid Edge Intelligence & Analytics Market, by Utility Function

12.1. Introduction

12.2. Operations and Engineering

12.3. Asset Management

12.4. Customer Service and Engagement

12.5. Revenue Assurance

12.6. Regulatory Compliance and Reporting

12.7. Strategic Planning

13. Grid Edge Intelligence & Analytics Market, by Geography

13.1. Introduction

13.2. North America

13.2.1. U.S.

13.2.2. Canada

13.2.3. Mexico

13.3. Europe

13.3.1. Germany

13.3.2. U.K.

13.3.3. France

13.3.4. Italy

13.3.5. Spain

13.3.6. Netherlands

13.3.7. Nordics

13.3.8. Rest of Europe

13.4. Asia-Pacific

13.4.1. China

13.4.2. India

13.4.3. Japan

13.4.4. South Korea

13.4.5. Australia

13.4.6. Singapore

13.4.7. Rest of Asia-Pacific

13.5. Latin America

13.5.1. Brazil

13.5.2. Chile

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Middle East & Africa

13.6.1. Saudi Arabia

13.6.2. UAE

13.6.3. South Africa

13.6.4. Rest of Middle East & Afric

14. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

14.1. C3.ai Inc.

14.2. Oracle Corporation

14.3. Itron Inc.

14.4. Landis+Gyr Group AG

14.5. AutoGrid Systems Inc.

14.6. Bidgely Inc.

14.7. Sense (Sense Labs Inc.)

14.8. Grid4C (Innowatts)

14.9. Space-Time Insight (Nokia)

14.10. Uplight Inc.

14.11. Copper Labs Inc.

14.12. OhmConnect Inc.

14.13. Whisker Labs Inc.

14.14. Open Systems International Inc. (Emerson)

14.15. General Electric Company

14.16. Siemens AG

14.17. Schneider Electric SE

14.18. ABB Ltd.

14.19. Hitachi Energy Ltd.

14.20. Eaton Corporation

14.21. Other

15. Appendix

15.1. Questionnaire

15.2. Available Customization

Published Date: Jun-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates