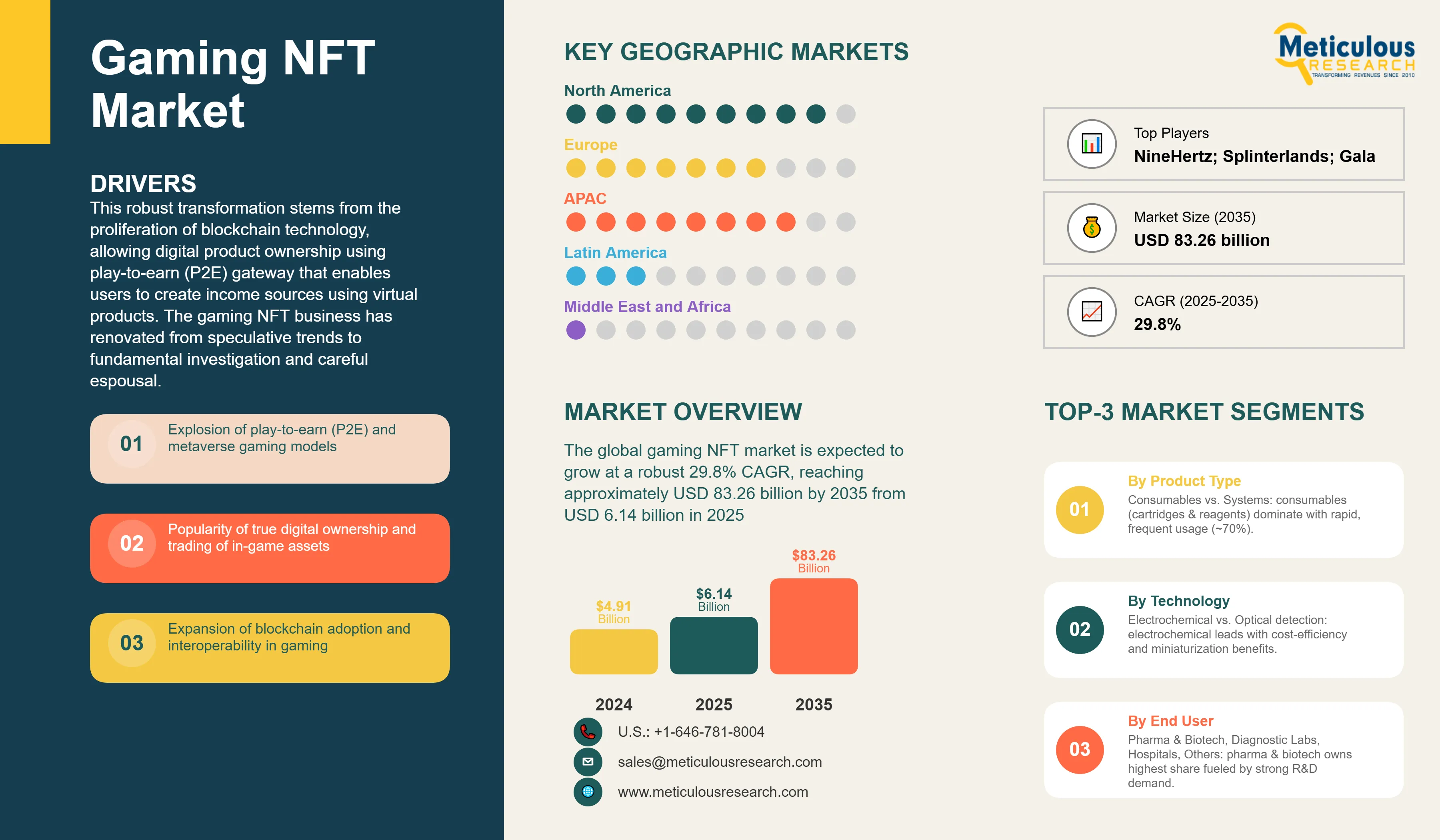

The global gaming NFT market was valued at USD 4.91 billion in 2024. This market is expected to grow at a robust 29.8% CAGR, reaching approximately USD 83.26 billion by 2035 from USD 6.14 billion in 2025.

This robust transformation stems from the proliferation of blockchain technology, allowing digital product ownership using play-to-earn (P2E) gateway that enables users to create income sources using virtual products. The gaming NFT business has renovated from speculative trends to fundamental investigation and careful espousal. The market witnessed several phases of transformation, with the initial phase was empowered by crypto-based advancements, while the ongoing stage is driven by selective incorporation in the mainstream gaming pathways. In 2024, DappRadar’s data stated that more than 38% of blockchain-based gaming ventures incorporated NFT-based products, highlighting a transition towards utility-powered mock-ups including the in-game product ownership, cross-platform functionality, and player-driven monetary models. Additionally, the NFT wallets users interrelating with gaming NFTs surged by approximately 17% in the first quarter of 2025, highlighting sustained usage. Also, increasing establishment of regulatory frameworks in geographies such as the Japan and the EU has legalized the NFT use in gaming. In the near future, as the NFT infrastructure reaches maturity phase, with continued user experience enhancement, NFTs are progressively seen as a product for improving digital asset liquidity, diversification, and user retention.

Competitive Scenario and Insights

Click here to: Get Free Sample Pages of this Report

The gaming NFT market is balanced amalgamation of blockchain-based platforms and conventional gaming studios. Companies such as Gala Games, Ronin, and Immutable hold substantial dominance in the infrastructure and marketplace advancement. For instance, Gala Games extended its model with additional 12 titles and an exclusive NFT platform. On the other hand, market players such as Ubisoft, Square Enix, and Epic Games have unveiled NFT-based marketplaces, indicating institutional interest. Competitive differentiation is surging as these market players compete on parameters such as gameplay quality, product liquidity, and compliance with regulatory authority & policies. Collaborations with NFT wallet developers and Layer 2 systems are also driving scalability and user engagement.

Recent Developments

Epic games expand NFT visibility through blockchain game marketplace integration

- In 2024, Epic Games introduced more than 20 blockchain-based games to its marketplace, including titles from Gala Games and Mythical Games. This marked a significant shift in mainstream distribution, with Epic emphasizing that it would not restrict NFT-based content as long as it complied with platform policies. The move enabled broader visibility and access for NFT games, with over 1 million downloads recorded in the first quarter post-launch.

Animoca Brands enters racing genre with NFT-driven Eden Games acquisition

- In 2023, Animoca Brands acquired Eden Games, a racing game creator, to incorporate its NFT-based modules and tracks into its REVV mechanism. The acquisition enabled Animoca to extend its portfolio into high-fidelity racing space, with NFT-product such as cars generating more than USD 5 million in secondary market trades within six months. This highlights a transition towards combining conventional gaming sections with blockchain asset models.

Key Market Drivers

- Play-to-Earn Model Adoption and Economic Incentives: The proliferation of economies that are owned by players is a significant growth contributor. Conventional gaming structures imply significant restrictions on asset ownership; while the NFTs enables players to create, buy, sell, and earn through in-game assets. For instance, Immutable X reported that in 2024, its platform traded over USD 300 million in gaming NFT-based products, with over 65% of trades involving skins, weapons, and collectibles. This transformation is profoundly experienced in role-playing and first-person shooting games, where the value is prejudiced through dearth of resources and asset hyper-personalization. This model influences both casual and professional users, reinstating sustainable game-drive economies that prioritize monetary rewards and are directly proportional to skill and time investment.

- Institutional Investment and Corporate Integration: Infrastructure investment and venture capital is injecting capital into early-stage startups and helping them scale their operations. In 2025, venture capital investment in NFT gaming projects amounted to USD 4.2 billion, with more than 180 startups obtaining seed funding. Major institutions, such as Andreessen Horowitz, allocated USD 600 million to NFT infrastructure, while Animoca Brands supported over 70 projects worldwide. PitchBook reports that over USD 2.5 billion was invested in blockchain gaming startups in 2023, with a substantial portion of the funds allocated to NFT infrastructure. Each of the following projects, including Animoca Brands and Mythical Games, raised more than USD 100 million to enhance developer tools and NFT marketplaces. This capital infusion is expediting the development of anti-fraud mechanisms, asset minting, and royalty management, thereby rendering NFTs more viable for mainstream studios.

- Integration with Web3 Wallets and Identity Systems: Integration with Web3 wallets and identity systems is the third driver, fuelling the business growth. According to Chainstack, in 2024, more than 60% of blockchain games facilitated wallet-based asset management and login. This facilitates seamless asset tracking and minimizes onboarding friction. A 22% increase in daily active users across supported titles has been achieved by platforms such as Ronin and Phantom, which have optimized wallet UX for gamers. A more personalized and secure gaming experience is being generated by the convergence of identity, ownership, and gameplay.

Key Market Restraints

- Regulatory Uncertainty and Legal Challenges: Regulatory uncertainty regarding the classification of digital assets is a significant constraint. The U.S. Securities and Exchange Commission (SEC) initiated investigations into numerous NFT gaming platforms in 2024 due to potential securities violations, which caused developers to hesitate. Cross-border scalability is restricted by the ambiguity that exists in North America and certain regions of Asia. This uncertainty delays the broader adoption of tokenomics by affecting its design, royalty structures, and secondary market operations.

- User Scepticism and Gameplay Quality: User scepticism and gameplay quality are additional constraints. Poor retention was a consequence of the fact that numerous early NFT games prioritized monetization over gameplay. According to a 2023 survey conducted by Newzoo, 42% of gamers perceived the integration of NFTs as "gimmicky" or "exploitative." This perception is gradually changing as AAA studios enter the market; however, scepticism continues to serve as an obstacle.

Table: Key Factors Impacting Global Gaming NFT Market (2025–2035)

Base CAGR: 29.8%

|

Category

|

Key Factor

|

Short-Term Impact (2025–2028)

|

Long-Term Impact (2029–2035)

|

Estimated CAGR Impact

|

|

Drivers

|

1. Play-to-Earn Model Adoption and Economic Incentives

|

Increased player monetization

|

Mainstream P2E gaming adoption

|

▲ +8.5%

|

| |

2. Institutional Investment and Corporate Integration

|

Major funding and partnerships

|

Enterprise blockchain gaming

|

▲ +7.2%

|

| |

3. Integration with Web3 Wallets and Identity Systems

|

Seamless onboarding experiences

|

Universal digital asset management

|

▲ +6.8%

|

|

Restraints

|

1. Regulatory Uncertainty and Legal Challenges

|

Market hesitation and delays

|

Clearer regulatory frameworks

|

▼ −3.2%

|

| |

2. User Scepticism and Gameplay Quality

|

Player retention challenges

|

Quality-first game development

|

▼ −2.7%

|

|

Opportunities

|

1. Integration of NFTs in AR/VR and cross-game/multiverse experiences

|

Immersive gaming pilots

|

Cross-platform asset interoperability

|

▲ +6.5%

|

| |

2. New monetization models: royalty mechanisms, staking, DAO game governances

|

Revenue diversification experiments

|

Community-driven gaming economies

|

▲ +6.0%

|

|

Trends

|

1. Rise of “gaming guilds” and community-funded initiatives in NFT games

|

Guild-based player organization

|

Structured gaming investment models

|

▲ +4.8%

|

|

Challenges

|

1. Scalability and high transaction (gas) fees on major blockchains

|

Layer-2 adoption increases

|

Efficient blockchain solutions mature

|

▼ −2.1%

|

Regional Analysis

North America Leads Corporate Innovation and Investment Infrastructure

In 2025, North America is estimated to account for a share of 35% of the global market. This was primarily due to the high adoption of cryptocurrency and the development of advanced digital infrastructure. Venture capital, developer talent, and platform infrastructure continue to propel North America as a critical center for gaming NFT innovation. According to CB Insights, the United States was the headquarters of more than 45% of global blockchain gaming startups in 2024. Mythical Games and Sky Mavis, among other major studios, have expanded their operations in California and Texas, citing the favorable tech ecosystems. Nevertheless, regulatory ambiguity persists in its influence on token design and monetization strategies. Ontario's securities commission has initiated a pilot program for NFT gaming compliance, indicating that Canada is transitioning to a regulatory sandbox.

Asia-Pacific Drives Mass Adoption Through Economic Necessity and Mobile Gaming

The Asia-Pacific region is the fastest-growing region for Gaming NFTs, with 35% CAGR. This growth is driven by government-backed digital initiatives, crypto adoption, and mobile-first gaming cultures. Wemade, a company based in South Korea, introduced its WEMIX3.0 platform in 2023. This platform is capable of supporting more than 50 NFT games and has attracted a monthly active user base of 2 million. Clear guidelines for NFT classification were issued by Japan's Financial Services Agency, which allowed studios such as Konami and Bandai Namco to experiment with blockchain assets. By mid-2024, Axie Infinity anticipates that Vietnam and the Philippines will have more than 1.5 million active wallets in Southeast Asia following grassroots adoption. China maintains a cautious stance, with restrictions on crypto trading. The Asia-Pacific region is a strategic growth zone for NFT gaming due to its combination of regulatory clarity, mobile penetration, and developer activity.

Country-level Analysis

United States: Enterprise Integration and Premium Market Development

The U.S. has established itself as a key player in the gaming NFT market. NFT gaming is undergoing regulatory scrutiny, but it continues to be a hub for innovation. In 2024, Mythical Games introduced "NFL Rivals," an officially licensed football game featuring NFT-based player cards. The game garnered more than 500,000 downloads in its inaugural month. The SEC's inquiries into the monetization models of NFTs have led studios to adopt utility-first designs and refrain from speculative tokenomics. Despite the uncertainty surrounding policy, the developer ecosystem and platform diversity of the country continue to encourage experimentation.

China: Government-Backed Infrastructure and Massive User Bases

China’s gaming NFT market is projected at 37% CAGR through 2035. China's approach to gaming NFTs has been selective and evolving. The government has permitted limited experimentation with digital collectibles, even though crypto trading remains restricted. “Huanhe,” a platform for NFT-based music and art assets, was initially launched by Tencent in 2023. Subsequently, the platform was expanded to encompass gaming skins and avatars. The Ministry of Industry and Information Technology is conducting pilot programs in Shanghai and Shenzhen to investigate the potential of blockchain technology for asset licensing and IP protection. China's substantial gaming population and technological infrastructure render it a potential pivot point for compliant NFT models, despite regulatory constraints.

Germany: Regulatory Leadership and Technical Excellence

Germany holds significant market share in the Europe region. Germany is becoming a European leader in the regulation and experimentation of NFT gaming. The Federal Financial Supervisory Authority (BaFin) published guidelines for NFT classification in 2024, which allowed developers to introduce compliant asset models. Ubisoft's Berlin studio is currently conducting a pilot program to integrate NFTs into sandbox games, while local startups such as Spielworks are developing NFT marketplaces that prioritize compliance and utility. The design of responsible NFTs is being influenced by Germany's emphasis on data privacy and consumer protection, which has established it as a model for the EU's adoption.

Segmental Analysis

In-Game Assets Dominate Revenue While Collectibles Drive Engagement

Based on NFT type, in-game assets represent the largest market segment and is estimated to capture 42% market share in 2025. These assets represent the bulk of NFT transactions in gaming, with platforms like OpenSea and Immutable X reporting over USD 500 million in cumulative trades by mid-2024. Games like “Illuvium” and “Big Time” have built economies around collectible and upgradeable items, with rarity and customization driving value. Developers are increasingly using dynamic NFTs that evolve based on gameplay, enhancing engagement. This segment is expected to grow as interoperability and asset liquidity improve across ecosystems.

Mobile Gaming Leads Accessibility While PC Gaming Commands Premium Pricing

Based on device, mobile gaming platforms is estimated hold approximately 50% market share in 2025, driven by smartphone ubiquity and lower barriers to entry for blockchain gaming adoption. Mobile NFT games require minimal technical knowledge, enabling mass market participation through simplified wallet integration and streamlined user interfaces. App store distribution channels facilitate discovery and adoption, though platform policies regarding blockchain content create regulatory challenges. Revenue models emphasize microtransactions and frequent engagement rather than high-value individual purchases.

Report Specifications:

|

Report Attribute

|

Details

|

|

Market size (2025)

|

USD 6.14 billion

|

|

Revenue forecast in 2035

|

USD 83.26 billion

|

|

CAGR (2025-2035)

|

29.8%

|

|

Base Year

|

2024

|

|

Forecast period

|

2025 – 2035

|

|

Report coverage

|

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints

|

|

Segments covered

|

NFT Type (In-game assets, virtual real estate), Blockchain Platform (Ethereum Ecosystem, Binance Smart Chain), Device, Geography

|

|

Regional scope

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

|

Key companies profiled

|

Animoca Brands; Sky Mavis; Dapper Labs; Immutable Pty Ltd; Gala Games; Mythical Games; Yuga Labs; Sorare; Decentraland Foundation; Horizon Blockchain Games; Wemade Co., Ltd.; Splinterlands; Double Jump.Tokyo; Vulcan Forged; Gamee; PolkaFantasy; EverdreamSoft; The NineHertz; Blockchain App Factory; Game Ace

|

|

Customization

|

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available

|

|

Pricing Details

|

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models

|

Market Segmentation

- By NFT Type

- In-game assets

- Collectibles & Trading Cards

- Virtual real estate

- Crypto tokens and currencies

- Metaverse and social NFTs

- By Blockchain Platform

- Ethereum Ecosystem

- Binance Smart Chain

- Solana

- Others

- By Device

- PC Games

- Mobile Games (iOS, Android)

- Console Games

- AR/VR & Web-based Games

- Others

Key Questions Answered in the Report: