Resources

About Us

Gaming NFT Market Size, Share, Forecast & Trends NFT Type (In-Game Assets, Virtual Real Estate), Blockchain Platform (Ethereum Ecosystem, Binance Smart Chain), Device - Global Forecast to 2035

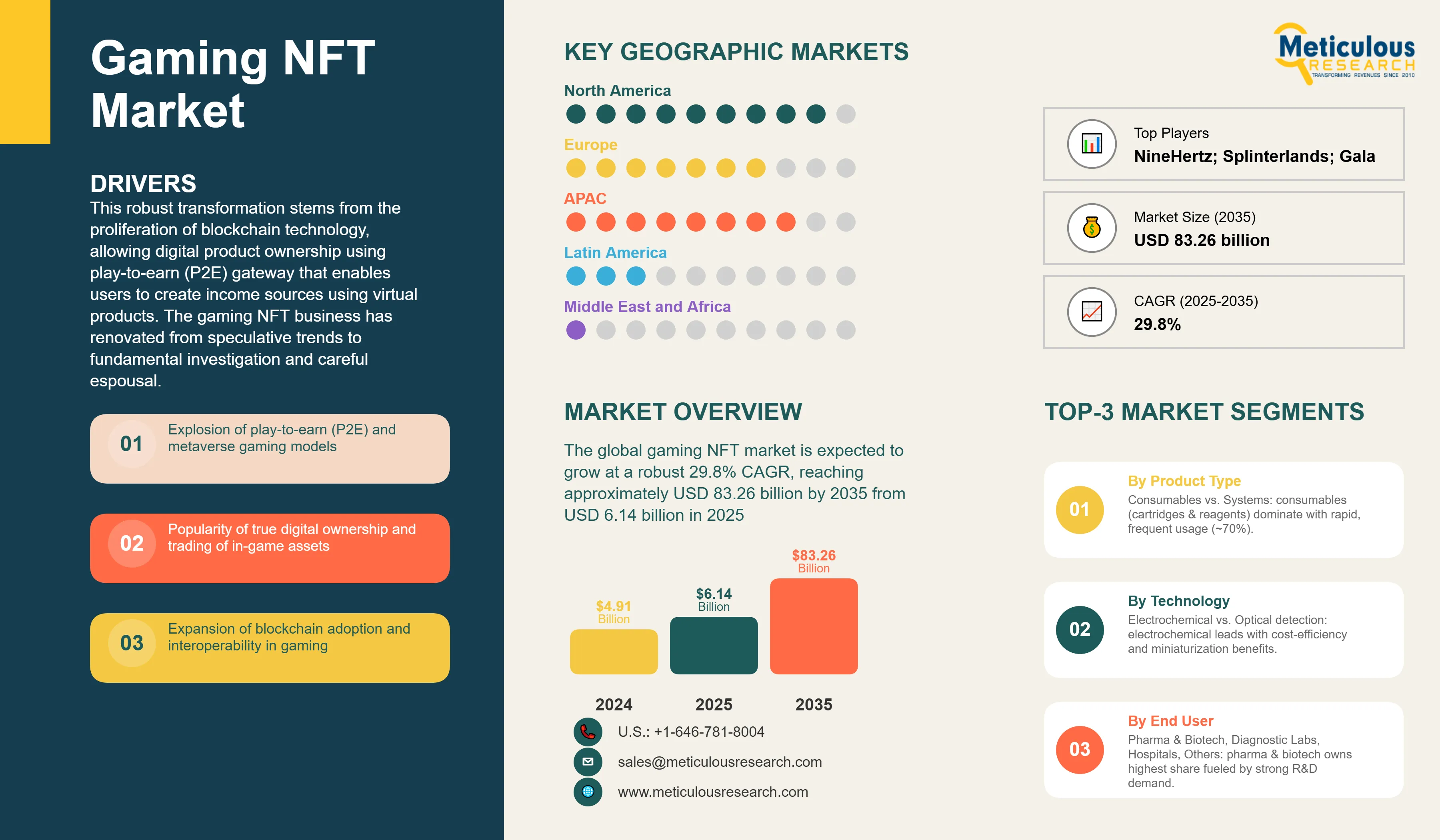

Report ID: MRICT - 1041560 Pages: 230 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global gaming NFT market was valued at USD 4.91 billion in 2024. This market is expected to grow at a robust 29.8% CAGR, reaching approximately USD 83.26 billion by 2035 from USD 6.14 billion in 2025.

This robust transformation stems from the proliferation of blockchain technology, allowing digital product ownership using play-to-earn (P2E) gateway that enables users to create income sources using virtual products. The gaming NFT business has renovated from speculative trends to fundamental investigation and careful espousal. The market witnessed several phases of transformation, with the initial phase was empowered by crypto-based advancements, while the ongoing stage is driven by selective incorporation in the mainstream gaming pathways. In 2024, DappRadar’s data stated that more than 38% of blockchain-based gaming ventures incorporated NFT-based products, highlighting a transition towards utility-powered mock-ups including the in-game product ownership, cross-platform functionality, and player-driven monetary models. Additionally, the NFT wallets users interrelating with gaming NFTs surged by approximately 17% in the first quarter of 2025, highlighting sustained usage. Also, increasing establishment of regulatory frameworks in geographies such as the Japan and the EU has legalized the NFT use in gaming. In the near future, as the NFT infrastructure reaches maturity phase, with continued user experience enhancement, NFTs are progressively seen as a product for improving digital asset liquidity, diversification, and user retention.

Click here to: Get Free Sample Pages of this Report

The gaming NFT market is balanced amalgamation of blockchain-based platforms and conventional gaming studios. Companies such as Gala Games, Ronin, and Immutable hold substantial dominance in the infrastructure and marketplace advancement. For instance, Gala Games extended its model with additional 12 titles and an exclusive NFT platform. On the other hand, market players such as Ubisoft, Square Enix, and Epic Games have unveiled NFT-based marketplaces, indicating institutional interest. Competitive differentiation is surging as these market players compete on parameters such as gameplay quality, product liquidity, and compliance with regulatory authority & policies. Collaborations with NFT wallet developers and Layer 2 systems are also driving scalability and user engagement.

Recent Developments

Epic games expand NFT visibility through blockchain game marketplace integration

Animoca Brands enters racing genre with NFT-driven Eden Games acquisition

Key Market Drivers

Key Market Restraints

Base CAGR: 29.8%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Play-to-Earn Model Adoption and Economic Incentives |

Increased player monetization |

Mainstream P2E gaming adoption |

▲ +8.5% |

|

2. Institutional Investment and Corporate Integration |

Major funding and partnerships |

Enterprise blockchain gaming |

▲ +7.2% |

|

|

3. Integration with Web3 Wallets and Identity Systems |

Seamless onboarding experiences |

Universal digital asset management |

▲ +6.8% |

|

|

Restraints |

1. Regulatory Uncertainty and Legal Challenges |

Market hesitation and delays |

Clearer regulatory frameworks |

▼ −3.2% |

|

2. User Scepticism and Gameplay Quality |

Player retention challenges |

Quality-first game development |

▼ −2.7% |

|

|

Opportunities |

1. Integration of NFTs in AR/VR and cross-game/multiverse experiences |

Immersive gaming pilots |

Cross-platform asset interoperability |

▲ +6.5% |

|

2. New monetization models: royalty mechanisms, staking, DAO game governances |

Revenue diversification experiments |

Community-driven gaming economies |

▲ +6.0% |

|

|

Trends |

1. Rise of “gaming guilds” and community-funded initiatives in NFT games |

Guild-based player organization |

Structured gaming investment models |

▲ +4.8% |

|

Challenges |

1. Scalability and high transaction (gas) fees on major blockchains |

Layer-2 adoption increases |

Efficient blockchain solutions mature |

▼ −2.1% |

North America Leads Corporate Innovation and Investment Infrastructure

In 2025, North America is estimated to account for a share of 35% of the global market. This was primarily due to the high adoption of cryptocurrency and the development of advanced digital infrastructure. Venture capital, developer talent, and platform infrastructure continue to propel North America as a critical center for gaming NFT innovation. According to CB Insights, the United States was the headquarters of more than 45% of global blockchain gaming startups in 2024. Mythical Games and Sky Mavis, among other major studios, have expanded their operations in California and Texas, citing the favorable tech ecosystems. Nevertheless, regulatory ambiguity persists in its influence on token design and monetization strategies. Ontario's securities commission has initiated a pilot program for NFT gaming compliance, indicating that Canada is transitioning to a regulatory sandbox.

Asia-Pacific Drives Mass Adoption Through Economic Necessity and Mobile Gaming

The Asia-Pacific region is the fastest-growing region for Gaming NFTs, with 35% CAGR. This growth is driven by government-backed digital initiatives, crypto adoption, and mobile-first gaming cultures. Wemade, a company based in South Korea, introduced its WEMIX3.0 platform in 2023. This platform is capable of supporting more than 50 NFT games and has attracted a monthly active user base of 2 million. Clear guidelines for NFT classification were issued by Japan's Financial Services Agency, which allowed studios such as Konami and Bandai Namco to experiment with blockchain assets. By mid-2024, Axie Infinity anticipates that Vietnam and the Philippines will have more than 1.5 million active wallets in Southeast Asia following grassroots adoption. China maintains a cautious stance, with restrictions on crypto trading. The Asia-Pacific region is a strategic growth zone for NFT gaming due to its combination of regulatory clarity, mobile penetration, and developer activity.

Country-level Analysis

United States: Enterprise Integration and Premium Market Development

The U.S. has established itself as a key player in the gaming NFT market. NFT gaming is undergoing regulatory scrutiny, but it continues to be a hub for innovation. In 2024, Mythical Games introduced "NFL Rivals," an officially licensed football game featuring NFT-based player cards. The game garnered more than 500,000 downloads in its inaugural month. The SEC's inquiries into the monetization models of NFTs have led studios to adopt utility-first designs and refrain from speculative tokenomics. Despite the uncertainty surrounding policy, the developer ecosystem and platform diversity of the country continue to encourage experimentation.

China: Government-Backed Infrastructure and Massive User Bases

China’s gaming NFT market is projected at 37% CAGR through 2035. China's approach to gaming NFTs has been selective and evolving. The government has permitted limited experimentation with digital collectibles, even though crypto trading remains restricted. “Huanhe,” a platform for NFT-based music and art assets, was initially launched by Tencent in 2023. Subsequently, the platform was expanded to encompass gaming skins and avatars. The Ministry of Industry and Information Technology is conducting pilot programs in Shanghai and Shenzhen to investigate the potential of blockchain technology for asset licensing and IP protection. China's substantial gaming population and technological infrastructure render it a potential pivot point for compliant NFT models, despite regulatory constraints.

Germany: Regulatory Leadership and Technical Excellence

Germany holds significant market share in the Europe region. Germany is becoming a European leader in the regulation and experimentation of NFT gaming. The Federal Financial Supervisory Authority (BaFin) published guidelines for NFT classification in 2024, which allowed developers to introduce compliant asset models. Ubisoft's Berlin studio is currently conducting a pilot program to integrate NFTs into sandbox games, while local startups such as Spielworks are developing NFT marketplaces that prioritize compliance and utility. The design of responsible NFTs is being influenced by Germany's emphasis on data privacy and consumer protection, which has established it as a model for the EU's adoption.

In-Game Assets Dominate Revenue While Collectibles Drive Engagement

Based on NFT type, in-game assets represent the largest market segment and is estimated to capture 42% market share in 2025. These assets represent the bulk of NFT transactions in gaming, with platforms like OpenSea and Immutable X reporting over USD 500 million in cumulative trades by mid-2024. Games like “Illuvium” and “Big Time” have built economies around collectible and upgradeable items, with rarity and customization driving value. Developers are increasingly using dynamic NFTs that evolve based on gameplay, enhancing engagement. This segment is expected to grow as interoperability and asset liquidity improve across ecosystems.

Mobile Gaming Leads Accessibility While PC Gaming Commands Premium Pricing

Based on device, mobile gaming platforms is estimated hold approximately 50% market share in 2025, driven by smartphone ubiquity and lower barriers to entry for blockchain gaming adoption. Mobile NFT games require minimal technical knowledge, enabling mass market participation through simplified wallet integration and streamlined user interfaces. App store distribution channels facilitate discovery and adoption, though platform policies regarding blockchain content create regulatory challenges. Revenue models emphasize microtransactions and frequent engagement rather than high-value individual purchases.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 6.14 billion |

|

Revenue forecast in 2035 |

USD 83.26 billion |

|

CAGR (2025-2035) |

29.8% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

NFT Type (In-game assets, virtual real estate), Blockchain Platform (Ethereum Ecosystem, Binance Smart Chain), Device, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Animoca Brands; Sky Mavis; Dapper Labs; Immutable Pty Ltd; Gala Games; Mythical Games; Yuga Labs; Sorare; Decentraland Foundation; Horizon Blockchain Games; Wemade Co., Ltd.; Splinterlands; Double Jump.Tokyo; Vulcan Forged; Gamee; PolkaFantasy; EverdreamSoft; The NineHertz; Blockchain App Factory; Game Ace |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The Gaming NFT Market size is estimated to be USD 6.14 billion in 2025 and grow at a CAGR of 29.8% to reach USD 83.26 billion by 2035.

In 2024, the Gaming NFT Market size was estimated at USD 4.91 billion, with projections to reach USD 6.14 billion in 2025.

Animoca Brands, Sky Mavis, Dapper Labs, Immutable Pty Ltd, Gala Games, Mythical Games, Yuga Labs, Sorare, Decentraland Foundation, Wemade Co., Ltd., and Splinterlands among others are some of the major companies operating in the Gaming NFT Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

In-game assets represent the largest segment and is estimated to hold around 42% market share in 2025.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Feb-2023

Published Date: Jun-2024

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates