Resources

About Us

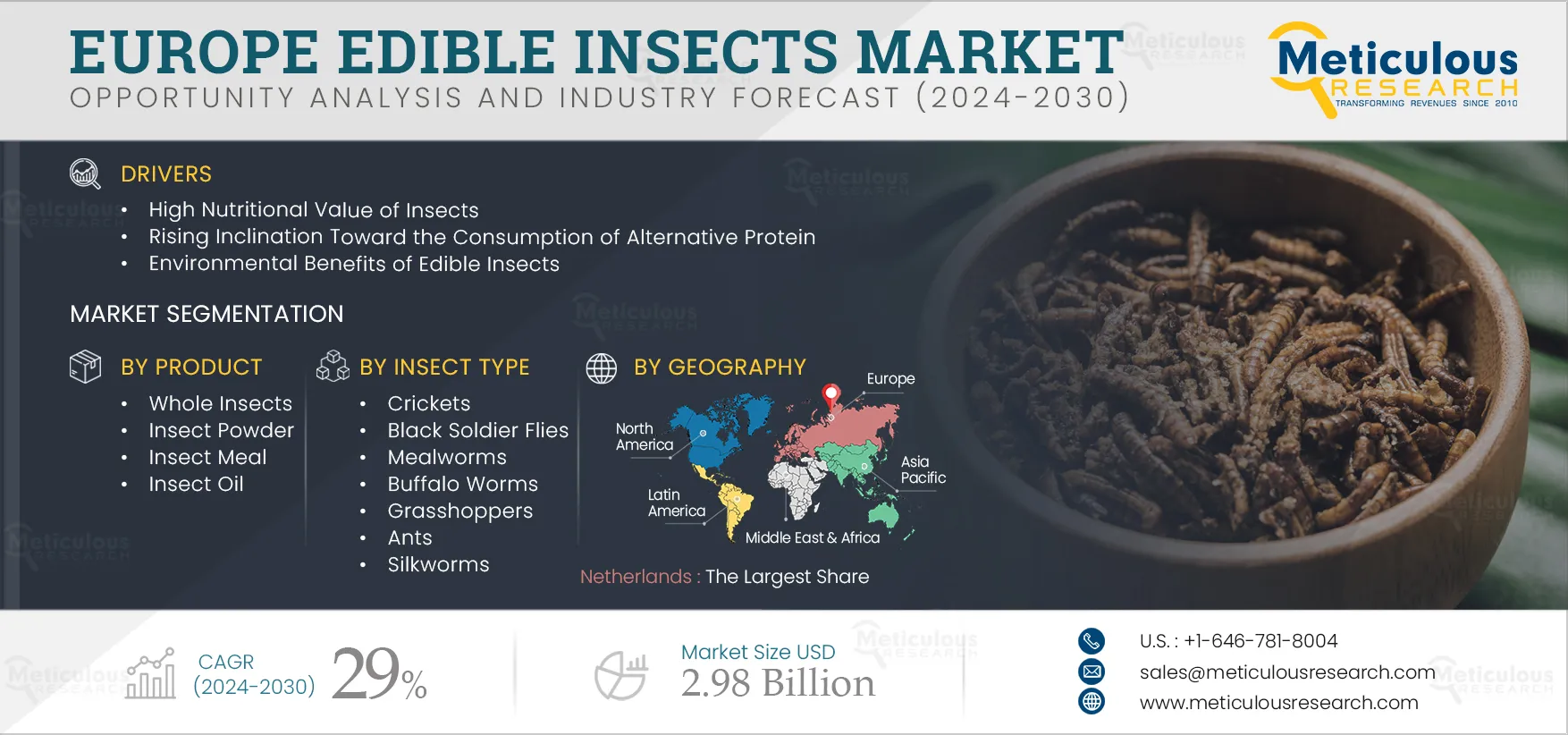

Europe Edible Insects Market by Product (Insect Powder, Insect Meal, Insect Oil), Insect Type (Crickets, Black Soldier Fly, Mealworms, Ants, Grasshoppers), Application (Animal Feed, Pet Food, Protein Bar & Shakes, Bakery, Confectionery) - Forecast to 2032

Report ID: MRFB - 104881 Pages: 160 Jan-2025 Formats*: PDF Category: Food and Beverages Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Edible Insects Market is expected to reach $2.98 billion by 2032, at a CAGR of 29% from 2025 to 2032. In terms of volume, the Europe Edible Insects Market is expected to reach 7,85,042.7 tones by 2032, at a CAGR of 32% during the forecast period 2025–2032. The growth of this market is attributed to the rising inclination towards the consumption of alternative protein food; the high nutritional value of insects; the environmental benefits of edible insects; and the rising demand for fish feed. Additionally, growing investments in the edible insect sector and rising demand for high-protein food have significant growth opportunities for edible insect vendors in Europe. However, the high cost of insect production and the stringent regulatory framework as food restrains the edible insects market growth in Europe. Low consumer acceptance of entomophagy is a major challenge for the growth of Europe’s edible insects market.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments by leading market participants in the industry. Some of the key players operating in the Europe edible insects market are Ÿnsect (SAS) (France), Protix B.V. (Netherlands), InnovaFeed SAS (France), EnviroFlight, LLC (U.S.), Hargol FoodTech (Israel), Aspire Food Group (U.S.), All Things Bugs LLC (U.S.), EntoCube OY (Finland), Global Bugs Asia Co., Ltd (Thailand), JR Unique Foods Ltd (Thailand), Cricket Lab Limited (U.K.), BIOFLYTECH S.L. (Spain), TEBRIO (Spain), nextProtein SA (France), Hexafly (Ireland), Enorm Biofactory A/S (Denmark), HiProMine S.A. (Poland), SFly Comgraf SAS (France), and Protenga Pte. Ltd. (Singapore).

The population of Europe is expected to increase from 446.7 million in 2022 to 453.3 million by 2026 (Source: Eurostat). A rising population is further expected to increase the food demand in the region. Additionally, proteins are essential to a healthy diet in most European countries. Earlier, meat products were considered the main source of protein in most European countries; however, in recent years, changing consumer preferences and rising concern for health and the environment have boosted the demand for alternative protein sources in the region.

Nowadays, many edible varieties of insects are gaining attention which also contain high-quality protein, vitamins, amino acids, unsaturated fatty acids, and minerals. These insects are processed and utilized in food and beverages, feed, pet food, pharmaceutical, and cosmetic sectors. Additionally, insects have a larger amount of protein in comparison to conventional sources of protein such as beef, poultry, and pork. They have a high feed conversion efficiency ratio and require less water. Moreover, they also produce around 80 times less methane than ruminants. They provide more high-quality protein for food products such as cookies, breads, desserts, soups, chips, and other snacks.

A protein-rich diet can alleviate several health concerns. Consumers are increasingly becoming aware of the need to incorporate a certain amount of protein into their daily diets, driven by their increasing health consciousness. According to research from the European Association for the Study of Diabetes (EASD), high-protein diets can improve blood sugar control in patients with Type 2 diabetes without any adverse effects on kidney function. High-protein diets have no adverse effects on kidney parameters. Moreover, there is a growing demand for high-protein food for sports nutrition, dietetic food, or food supplements, which creates opportunities for insect-derived ingredients. Thus, the rising inclination towards the consumption of alternative protein food is expected to drive the Europe edible insect market in the coming years.

Click here to: Get a Free Sample Copy of this Report

In 2025, the Whole Insects Segment to Dominate the Europe Edible Insects Market

Based on product, the Europe edible insects market is segmented into whole insects, insect powder, insect meal, and insect oil. In 2025, the whole insects segment is expected to account for the largest share of the Europe edible insects market. The large share of this segment is attributed to the growing demand for whole insects in various culinary applications, the abundant availability of edible insects, the lower cost of insects than their processed forms, edible insects being high in protein content, and the higher demand for whole insects from protein ingredients and food manufacturers for further processing and use in various applications.

However, the insect powder segment is expected to register the highest CAGR during the forecast period of 2025–2032 due to the increasing inclination of consumers toward fitness & wellness and the growing demand for protein-rich food. In addition, in January 2025, the European Union’s approval for selling house crickets and larvae insects for human consumption in powder and other dried forms is further anticipated to boost the growth of this market in the region.

In 2025, the Crickets Segment to Dominate the Europe Edible Insects Market

Based on insect type, the Europe edible insects market is segmented into crickets, mealworms, black soldier flies, buffalo worms, grasshoppers, ants, silkworms, cicadas, and other edible insects. In 2025, the crickets segment is expected to account for the largest share of the Europe edible insects market. The large market share of this segment is attributed to the high nutritional value and easy farming & processing of crickets, rising demand for cricket-based products such as protein powders, protein bars, and snacks, and cricket as a lower carbon alternative than meat. In addition, in January 2025, the European Union’s approval for house crickets and their larvae for human consumption in powder and other dried forms is further anticipated to propel the growth of the crickets market in upcoming years across Europe.

However, the black soldier flies (BSF) segment is slated to register the highest CAGR during the forecast period of 2025–2032 owing to the rising government support for insect meal as a livestock feed and growing venture investments in the European BSF industry. Additionally, black soldier flies are gaining popularity in the European Union due to their ability to convert waste into protein, which is anticipated to further boost the growth of this market in the region.

In 2025, the Food and Beverages Segment to Dominate the Europe Edible Insects Market

Based on application, the Europe edible insects market is segmented into food & beverages and feed. In 2025, the food and beverages segment is expected to account for the largest share of the Europe edible insects market. The large share of this segment is mainly attributed to the growing demand for insect-infused food & beverages, the increasing consumption of processed whole insects as food, and the increasing demand for high-quality alternative protein. Moreover, the growing demand for high-protein ingredients for sports nutrition, dietetic food, or food supplements is further expected to create market growth opportunities for stakeholders in this market.

In 2025, the Human Consumption Segment to Dominate the Europe Edible Insects Market

Based on end use, the Europe edible insects market is segmented into human consumption and animal nutrition. In 2025, the human consumption segment is expected to account for the larger share of the Europe edible insects market. The large market share of this segment is attributed to factors such as the growing demand for protein-rich food, the increasing demand for insect-based food products such as protein powders, protein bars, and snacks, and the rising awareness about the nutritional benefits of insects in human nutrition. This segment is also expected to register the highest CAGR during the forecast period of 2025–2032.

The Netherlands to Dominate the Europe Edible Insects Market, while France to Lead in Growth

The Europe edible insects market is segmented into the Netherlands, Belgium, France, Denmark, Finland, Germany, and the rest of Europe. In 2025, the Netherlands is expected to account for the largest share of the Europe edible insects market. The large share of this market is mainly driven by the presence of key insect manufacturers and growing initiatives from the government and other institutions to create awareness about insect foods in the Netherlands. Wageningen University and Research Centre (WUR) in the Netherlands is a long-standing hub of research and advocacy relating to entomophagy. Since 2006, the university has actively focused on increasing awareness about insect foods through hosting several insect events, exhibitions, and activities in the country and is further expected to support the growth of the edible insects market in the Netherlands in upcoming years.

However, France is slated to register the highest CAGR during the forecast period of 2025–2032 owing to the growing venture investment in the edible insects sector, rising use of insect protein, and increasing demand for edible insects from food and beverage companies.

Scope of the Report:

Europe Edible Insects Market Assessment, by Product

Europe Edible Insects Market Assessment, by Insect Type

Europe Edible Insects Market Assessment, by Application

Europe Edible Insects Market Assessment, by End Use

Europe Edible Insects Market Assessment, by Country

Key Questions Answered in the Report:

The Europe Edible Insects Market is projected to reach $2.98 billion by 2032, at a CAGR of 29% from 2025 to 2032.

In 2025, the whole insects segment is expected to account for the largest share of the Europe edible insects market owing to the rising government support for insect meal as a livestock feed and growing venture investments in the European BSF industry.

The Black Soldier Flies (BSF) segment is slated to register the highest CAGR during the forecast period and provide significant opportunities for players operating in this market.

The major key players operating in the Europe Edible Insects Market are Ÿnsect (SAS) (France), Protix B.V. (Netherlands), InnovaFeed SAS (France), EnviroFlight, LLC (U.S.), Hargol FoodTech (Israel), Aspire Food Group (U.S.), All Things Bugs LLC (U.S.), EntoCube OY (Finland), Global Bugs Asia Co., Ltd (Thailand), JR Unique Foods Ltd (Thailand), Cricket Lab Limited (U.K.), BIOFLYTECH S.L. (Spain), TEBRIO (Spain), nextProtein SA (France), Hexafly (Ireland), Enorm Biofactory A/S (Denmark), HiProMine S.A. (Poland), SFly Comgraf SAS (France) and Protenga Pte. Ltd. (Singapore).

France is slated to register the highest CAGR during the forecast period. The rapid growth of this region is mainly attributed to the growing venture investment in the edible insects sector and the rising use of insect protein in food and beverages.

1. Introduction

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segment Analysis

3.2.1. Europe Edible Insects Market, by Product

3.2.2. Europe Edible Insects Market, by Insect Type

3.2.3. Europe Edible Insects Market, by Application

3.2.4. Europe Edible Insects Market, by End Use

3.2.5. Europe Edible Insects Market, by Geography

3.3. Competitive Landscape & Market Competitors

4. Market Insights

4.1. Overview

4.2. Drivers

4.2.1. High Nutritional Value of Insects

4.2.2. Rising Inclination Toward the Consumption of Alternative Protein

4.2.3. Environmental Benefits of Edible Insects

4.2.4. Rising Demand for Fish Feed

4.3. Restraints

4.3.1. Stringent Regulatory Framework

4.3.2. High Cost of Insect Production

4.4. Opportunities

4.4.1. Growing Investment in the Insect Sector

4.4.2. Rising Demand for High-protein Food

4.5. Challenges

4.5.1. Low Consumer Acceptance of Entomophagy

4.6. Pricing Analysis

4.6.1. Overview

4.6.2. Whole Insects

4.6.3. Insect Powder

4.6.4. Insect Meal

4.6.5. Insect Oil

4.7. Key Edible Insect Companies and Their Production Capacities (Tonnes/Year)

4.8. Regulatory Analysis

4.8.1. Netherlands

4.8.2. Belgium

4.8.3. France

4.8.4. Denmark

4.8.5. Finland

4.8.6. Germany

4.8.7. U.K.

4.8.8. Spain

4.8.9. Poland

4.8.10. Ireland

4.8.11. Rest of Europe (RoE)

4.9. Edible Insects Market: Venture Investments/Funding Scenario

5. Europe Edible Insects Market Assessment,by Product

5.1. Overview

5.2. Whole Insects

5.3. Insect Powder

5.4. Insect Meal

5.5. Insect Oil

6. Europe Edible Insects Market Assessment, by Insect Type

6.1. Overview

6.2. Crickets

6.3. Black Soldier Fly

6.4. Mealworms

6.5. Buffalo Worms

6.6. Grasshoppers

6.7. Ants

6.8. Silkworms

6.9. Cicadas

6.10. Other Edible Insects

7. Europe Edible Insects Market Assessment, by Application

7.1. Overview

7.2. Food & Beverages

7.2.1. Processed Whole Insects

7.2.2. Processed Insect Powder

7.2.3. Protein Bars & Protein Shakes

7.2.4. Baked Products & Snacks

7.2.5. Insect Confectioneries

7.2.6. Insect Beverages

7.2.7. Other Food & Beverage Applications

7.3. Feed

7.3.1. Animal Feed

7.3.2. Aquaculture Feed

7.3.3. Pet Food

8. Europe Edible Insects Market Assessment, by End Use

8.1. Overview

8.2. Human Consumption

8.3. Animal Nutrition

9. Europe Edible Insects Market Assessment, by Country

9.1. Overview

9.2. Netherlands

9.3. Belgium

9.4. France

9.5. Denmark

9.6. Finland

9.7. Germany

9.8. U.K.

9.9. Spain

9.10. Poland

9.11. Ireland

9.12. Rest of Europe (RoE)

10. Competition Analysis

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Dashboard

10.3.1. Industry Leaders

10.3.2. Market Differentiators

10.3.3. Vanguards

10.3.4. Emerging Companies

10.4. Vendor Market Positioning

11. Company Profile (Business Overview, Financial Overview, SWOT Analysis for the Top 5 Companies, Product Portfolio, Strategic Developments)

11.1. Ÿnsect (SAS)

11.2. Protix B.V.

11.3. InnovaFeed SAS

11.4. EnviroFlight, LLC

11.5. Hargol FoodTech

11.6. Aspire Food Group

11.7. All Things Bugs, LLC

11.8. EntoCube Oy

11.9. Global Bugs Asia Co., Ltd.

11.10. Jr Unique Foods Ltd.

11.11. Cricket Lab Limited

11.12. BIOFLYTECH S.L.

11.13. Tebrio

11.14. nextProtein SA

11.15. Enorm Biofactory A/S

11.16. Hexafly

11.17. HiProMine S.A.

11.18. SFly Comgraf SAS

11.19. Protenga Pte Ltd.

12. Appendix

12.1. Available Customization

12.2. Related Reports

List of Tables

Table 1 Average Selling Prices of Whole Insect, by Country, 2021–2032 (USD/Kg)

Table 2 Average Selling Prices of Insect Powder, by Country, 2021–2032 (USD/Kg)

Table 3 Average Selling Prices of Insect Meal, by Country, 2021–2032 (USD/Kg)

Table 4 Average Selling Prices of Insect Oil, by Country, 2021–2032 (USD/Kg)

Table 5 Insect Application and Approval Status

Table 6 Europe Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 7 Europe Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 8 Europe Edible Whole Insects Market, by Country, 2021–2032 (USD Million)

Table 9 Europe Edible Whole Insects Market Volume, by Country, 2021–2032 (Tonnes)

Table 10 Europe Edible Insect Powder Market, by Country, 2021–2032 (USD Million)

Table 11 Europe Edible Insect Powder Market Volume, by Country, 2021–2032 (Tonnes)

Table 12 Europe Edible Insect Meal Market, by Country, 2021–2032 (USD Million)

Table 13 Europe Edible Insect Meal Market Volume, by Country, 2021–2032 (Tonnes)

Table 14 Europe Edible Insect Oil Market, by Country, 2021–2032 (USD Million)

Table 15 Europe Edible Insect Oil Market Volume, by Country, 2021–2032 (Tonnes)

Table 16 Europe Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 17 Cricket Species as Feed for Animals and Pets

Table 18 Europe Crickets Market, by Country, 2021–2032 (USD Million)

Table 19 Europe Black Soldier Flies Market, by Country, 2021–2032 (USD Million)

Table 20 Europe Mealworms Market, by Country, 2021–2032 (USD Million)

Table 21 Europe Buffalo Worms Market, by Country, 2021–2032 (USD Million)

Table 22 Europe Grasshoppers Market, by Country, 2021–2032 (USD Million)

Table 23 Europe Ants Market, by Country, 2021–2032 (USD Million)

Table 24 Europe Silkworms Market, by Country, 2021–2032 (USD Million)

Table 25 Europe Cicadas Market, by Country, 2021–2032 (USD Million)

Table 26 Europe Other Edible Insects Market, by Country, 2021–2032 (USD Million)

Table 27 Europe Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 28 Europe Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 29 Europe Edible Insects Market for Food and Beverage, by Country, 2021–2032 (USD Million)

Table 30 Europe Edible Insects Market for Processed Whole Insects, by Country, 2021–2032 (USD Million)

Table 31 Europe Edible Insects Market for Processed Insect Powder, by Country, 2021–2032 (USD Million)

Table 32 Europe Edible Insects Market for Protein Bars and Protein Shakes, by Country, 2021–2032 (USD Million)

Table 33 Europe Edible Insects Market for Baked Products and Snacks, by Country, 2021–2032 (USD Million)

Table 34 Europe Edible Insects Market for Insect Confectioneries, by Country, 2021–2032 (USD Million)

Table 35 Europe Edible Insects Market for Insect Beverages, by Country, 2021–2032 (USD Million)

Table 36 Europe Edible Insects Market for Other Food and Beverage Applications, by Country, 2021–2032 (USD Million)

Table 37 Europe Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 38 Europe Edible Insects Market for Feed, by Country, 2021–2032 (USD Million)

Table 39 Europe Edible Insects Market for Animal Feed, by Country, 2021–2032 (USD Million)

Table 40 Europe Edible Insects Market for Aquaculture Feed, by Country, 2021–2032 (USD Million)

Table 41 Europe Edible Insects Market Size for Pet Food, by Country, 2021–2032 (USD Million)

Table 42 Europe Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 43 Key Players Offering Insect-based Products for Human Consumption

Table 44 Europe Edible Insects Market for Human Consumption, by Country, 2021–2032 (USD Million)

Table 45 Key Players Offering Insect-Based Products for Animal Nutrition

Table 46 Europe Edible Insects Market for Animal Nutrition, by Country, 2021–2032 (USD Million)

Table 47 Edible Insects Market, by Country, 2021–2032 (USD Million)

Table 48 Europe: Edible Insects Market, by Country, 2021–2032 (USD Million)

Table 49 Europe: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 50 Europe: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 51 Europe: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 52 Europe: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 53 Europe: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 54 Europe: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 55 Europe: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 56 The Netherlands: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 57 The Netherlands: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 58 The Netherlands: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 59 The Netherlands: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 60 The Netherlands: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 61 The Netherlands: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 62 The Netherlands: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 63 Belgium: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 64 Belgium: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 65 Belgium: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 66 Belgium: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 67 Belgium: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 68 Belgium: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 69 Belgium: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 70 France: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 71 France: Edible Insects Market, by Product, 2021–2032 (USD Tonnes)

Table 72 France: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 73 France: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 74 France: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 75 France: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 76 France: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 77 Denmark: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 78 Denmark: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 79 Denmark: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 80 Denmark: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 81 Denmark: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 82 Denmark: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 83 Denmark: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 84 Finland: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 85 Finland: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 86 Finland: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 87 Finland: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 88 Finland: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 89 Finland: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 90 Finland: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 91 Germany: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 92 Germany: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 93 Germany: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 94 Germany: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 95 Germany: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 96 Germany: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 97 Germany: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 98 U.K.: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 99 U.K.: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 100 U.K.: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 101 U.K.: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 102 U.K.: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 103 U.K.: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 104 U.K.: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 105 Spain: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 106 Spain: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 107 Spain: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 108 Spain: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 109 Spain: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 110 Spain: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 111 Spain: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 112 Poland: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 113 Poland: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 114 Poland: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 115 Poland: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 116 Poland: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 117 Poland: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 118 Poland: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 119 Ireland: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 120 Ireland: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 121 Ireland: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 122 Ireland: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 123 Ireland: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 124 Ireland: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 125 Ireland: Edible Insects Market, by End Use, 2021–2032 (USD Million)

Table 126 Rest of Europe: Edible Insects Market, by Product, 2021–2032 (USD Million)

Table 127 Rest of Europe: Edible Insects Market Volume, by Product, 2021–2032 (Tonnes)

Table 128 Rest of Europe: Edible Insects Market, by Insect Type, 2021–2032 (USD Million)

Table 129 Rest of Europe: Edible Insects Market, by Application, 2021–2032 (USD Million)

Table 130 Rest of Europe: Edible Insects Market for Food and Beverage, by Product Type, 2021–2032 (USD Million)

Table 131 Rest of Europe: Edible Insects Market for Feed, by Product Type, 2021–2032 (USD Million)

Table 132 Rest of Europe: Edible Insects Market, by End Use, 2021–2032 (USD Million)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Research Process

Figure 3 Key Secondary Sources

Figure 4 Primary Research Techniques

Figure 5 Key Executives Interviewed

Figure 6 Breakdown of Primary Interviews (Supply Side & Demand Side)

Figure 7 Market Size Estimation Approach

Figure 8 The Whole Insect Segment to Dominate the Europe Edible Insects Market in 2025

Figure 9 The Crickets Segment to Dominate the Europe Edible Insects Market in 2025

Figure 10 In 2025, the Food and Beverage Segment to Dominate the Europe Edible Insects Market

Figure 11 In 2025, the Human Consumption Segment to Dominate the Europe Edible Insects Market

Figure 12 The Netherlands Dominates the Europe Edible Insects Market, While France Leads in Growth

Figure 13 Factors Affecting Market Growth

Figure 14 Resources Required: Livestock Farming Vs. Insect Farming

Figure 15 Novel Food Authorization Workflow

Figure 16 Europe: Regulatory Approval for Insect Use in Animal Feed

Figure 17 Europe Edible Insects Market, by Product, 2025 Vs. 2032 (USD Million)

Figure 18 Europe Edible Insects Market Volume, by Product, 2025 Vs. 2032 (Tonnes)

Figure 19 Europe Edible Insects Market, by Insect Type, 2025 Vs. 2032 (USD Million)

Figure 20 Europe Edible Insects Market, by Application, 2025 Vs. 2032 (USD Million)

Figure 21 Europe Edible Insects Market, by End Use, 2025 Vs. 2032 (USD Million)

Figure 22 Europe: Edible Insects Market Snapshot (2025)

Figure 23 Europe Edible Insects Market, by Country, 2025 Vs. 2032 (USD Million)

Figure 24 Europe Edible Insects Market Volume, by Country, 2025 Vs. 2032 (Tonnes)

Figure 25 Key Growth Strategies Adopted by Leading Players, 2020–2025

Figure 26 Europe Edible Insects Market: Competitive Benchmarking, by Product Type

Published Date: May-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates