Resources

About Us

Computer Vision in Healthcare Market by Component (Hardware, Software, Services), Application (Medical Imaging & Diagnostics, Surgical Assistance & Robotics, Patient Monitoring & Safety, Drug Discovery & Research Support, Healthcare Operations Management), Imaging Modality (X-ray, CT, MRI, Ultrasound, Endoscopy, Pathology/Microscopy), Deployment Mode, and End User - Global Forecast to 2036

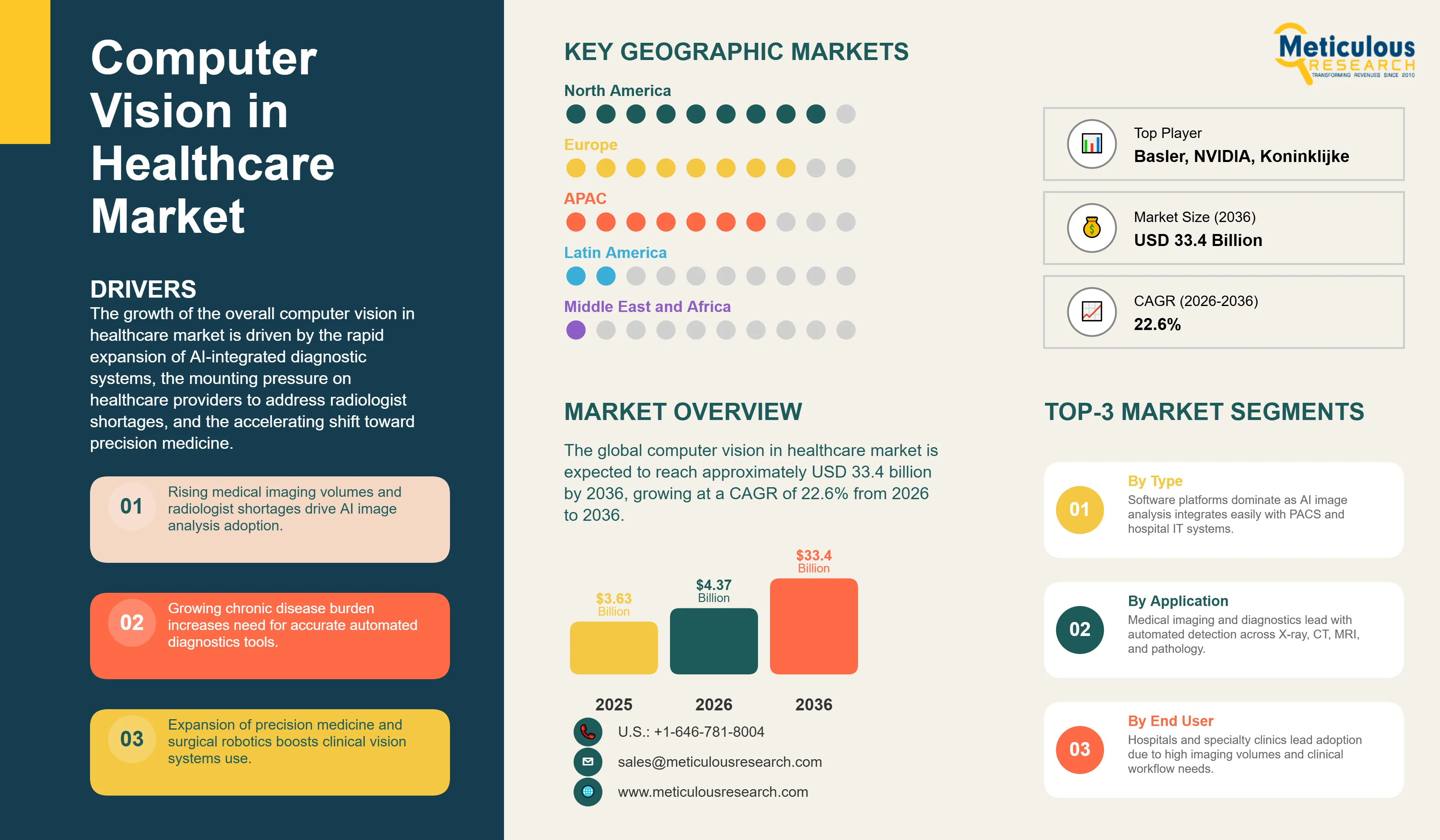

Report ID: MRHC - 1041789 Pages: 307 Feb-2026 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe global computer vision in healthcare market was valued at USD 3.63 billion in 2025. The market is expected to reach approximately USD 33.4 billion by 2036 from USD 4.37 billion in 2026, growing at a CAGR of 22.6% from 2026 to 2036. The growth of the overall computer vision in healthcare market is driven by the rapid expansion of AI-integrated diagnostic systems, the mounting pressure on healthcare providers to address radiologist shortages, and the accelerating shift toward precision medicine. As healthcare institutions increasingly integrate intelligent imaging and automation into their clinical workflows, computer vision has become a foundational technology for improving diagnostic accuracy, surgical safety, and patient monitoring across all care settings. The sustained rise in medical imaging volumes globally, the growing burden of chronic disease, and the rapid maturation of deep-learning algorithms continue to fuel significant growth across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Computer vision in healthcare refers to the application of artificial intelligence algorithms, particularly deep learning and machine learning, that enable computing systems to analyze, interpret, and derive clinically meaningful insights from visual data such as medical images, surgical video feeds, and patient monitoring streams. These systems range from AI-powered radiology platforms that automatically detect lesions on CT and MRI scans to real-time surgical intelligence tools that guide minimally invasive procedures and computer vision software that continuously monitors patients for falls, deterioration, or medication adherence. The market is defined by solutions that measurably reduce diagnostic error rates, accelerate clinical workflows, and allow healthcare providers to scale high-quality care delivery in environments facing persistent workforce shortages.

The market encompasses a broad spectrum of offerings, from standalone image analysis software and AI inference hardware to fully integrated clinical workflow platforms. Solutions are increasingly delivered via cloud-based deployment models that allow healthcare organizations to scale rapidly without heavy upfront infrastructure investment, while on-premise deployments remain critical in environments with stringent data privacy requirements. Manufacturers such as GE HealthCare and Siemens Healthineers have built expansive ecosystems where hardware imaging modalities and AI software layers operate as unified platforms, enabling seamless end-to-end intelligent diagnostics. At the same time, technology platform providers such as NVIDIA Corporation and Microsoft Corporation deliver the foundational computing infrastructure and developer ecosystems that power a wide range of healthcare-specific computer vision applications built by specialized software companies.

The global healthcare sector is navigating a period of profound transformation as providers grapple with aging populations, rising volumes of imaging examinations, and a chronic shortage of skilled radiologists and imaging technologists. According to data from the American Society of Radiologic Technologists, vacancy rates for radiographers and sonographers in the U.S. nearly tripled between 2021 and 2023, with 2023 vacancy rates reaching 18.1% for radiography and 16.7% for sonography. This structural challenge has created powerful institutional incentives to adopt computer vision solutions that automate time-consuming image review tasks, triage critical findings, and augment the capacity of existing clinical staff. Regulatory frameworks, including FDA clearance pathways for AI/ML-enabled medical devices, are providing clearer routes to market for software manufacturers, further encouraging investment and adoption.

Rise of Autonomous Diagnostic Imaging and AI-Driven Radiology Platforms

Healthcare providers and imaging equipment manufacturers are moving rapidly beyond basic AI-assisted reading tools toward genuinely autonomous diagnostic imaging systems. GE HealthCare and NVIDIA announced an expansion of their long-standing collaboration at GTC 2025, focusing on developing fully autonomous X-ray and ultrasound systems powered by NVIDIA's Isaac for Healthcare platform and synthetic data simulation capabilities. These systems are designed to manage patient interaction, positioning, image acquisition, and quality validation with minimal human involvement, directly addressing the global radiologist and imaging technologist shortage. On a parallel track, Siemens Healthineers continues to deepen the AI integration within its imaging hardware and clinical workflow software, with its AI-Rad Companion portfolio offering automated detection and quantification across body regions including the brain, chest, and cardiovascular system, and its AI-Pathway Companion connecting imaging data with molecular and laboratory information for precision oncology. Koninklijke Philips N.V. is extending its IntelliSpace portal capabilities to connect imaging devices, clinical data, and AI-powered analytics across its HealthSuite digital platform, creating a connected ecosystem for continuous care improvement. These developments reflect a broad industry shift toward computer vision solutions that are not just analytical tools but operational infrastructure deeply embedded in the clinical care pathway.

Integration of Edge Computing and Real-Time Surgical Intelligence

The convergence of edge computing with real-time computer vision is opening a new frontier for intraoperative applications and point-of-care diagnostics. Manufacturers are increasingly designing computer vision hardware and software stacks that can process high-resolution imaging data directly on-device or at the network edge, reducing latency to levels compatible with live surgical guidance and real-time patient monitoring. Solutions in this space include AI-powered endoscopic platforms that assess polyp detection rates during colonoscopy procedures, intraoperative imaging systems that use hyperspectral imaging combined with computer vision algorithms to help surgeons differentiate tumor margins from healthy tissue, and wearable camera-based monitoring systems that continuously analyze patient movement and vital signs outside of formal clinical settings. NVIDIA's Clara Imaging SDK and its partnerships with specialized healthcare software providers enable the deployment of these edge-native AI solutions across a wide range of imaging and monitoring hardware. Basler AG, a significant manufacturer of industrial and medical imaging cameras, is advancing its MED ace camera series and pylon AI software platform to support precision imaging in diagnostics and academic research environments. As healthcare organizations invest in smart hospital infrastructure, real-time computer vision is becoming central to operational safety and quality assurance programs well beyond traditional radiology departments.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 33.4 Billion |

|

Market Size in 2026 |

USD 4.37 Billion |

|

Market Size in 2025 |

USD 3.63 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 22.6% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Component, Application, Imaging Modality, Deployment Mode, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Surging Medical Imaging Volumes and Chronic Workforce Shortages

A key driver of the computer vision in healthcare market is the widening gap between the global volume of medical imaging examinations and the availability of qualified personnel to interpret them. With more than 4.2 billion medical imaging examinations performed annually worldwide, and the prevalence of chronic conditions such as cardiovascular disease, cancer, and diabetes continuing to rise, the demand for faster and more accurate diagnostic interpretation has never been greater. Healthcare systems in mature markets face acute radiology staffing constraints, while providers in lower-income regions often have no reliable access to specialist interpretation at all. Computer vision solutions directly address this imbalance by automating routine image analysis tasks, intelligently triaging critical findings for priority review, and enabling remote or asynchronous diagnostic workflows. The FDA's ongoing framework for AI/ML-enabled medical device submissions provides the regulatory clarity that encourages software manufacturers to invest in clinical validation and commercialization, further accelerating adoption across hospital systems and diagnostic networks.

Opportunity: Expansion of AI-Enabled Surgical Robotics and Precision Medicine

The rapid growth of robotic-assisted surgery and the broader movement toward precision medicine present significant opportunities for the computer vision in healthcare market. Surgical procedures increasingly rely on real-time visual intelligence to guide instrumentation, provide anatomical overlays, and alert surgical teams to potential complications during minimally invasive operations. As robotic surgical platforms from manufacturers such as Intuitive Surgical become standard infrastructure in major hospitals globally, the computer vision software ecosystems that power their imaging and guidance capabilities represent a growing and competitively significant market. Beyond the operating room, the integration of computer vision with multi-omics data in pharmaceutical research is accelerating drug discovery timelines, with AI-driven pathology image analysis platforms enabling researchers to identify biomarkers and characterize disease states in tissue samples at scale. These precision medicine applications create durable, high-value demand for computer vision software from pharmaceutical companies and research institutions that is structurally distinct from the imaging-volume-driven demand in clinical settings.

Why Does the Software Segment Lead the Market?

The software segment accounts for the largest share of the overall computer vision in healthcare market in 2026. This dominance reflects the healthcare industry's strong preference for deploying AI capabilities through cloud-based and hybrid software platforms that integrate with existing picture archiving and communication systems (PACS), radiology information systems (RIS), and electronic health record (EHR) platforms without requiring wholesale hardware replacement. Image analysis software and deep learning platforms allow healthcare organizations to adopt computer vision capabilities incrementally, update algorithms as clinical evidence evolves, and scale usage across multiple sites through enterprise licensing models. Major technology companies including Microsoft Corporation, through its Azure Health Data Services and Nuance AI-powered clinical documentation tools, and Google LLC, through its AI imaging capabilities deployed in NHS hospital systems for breast cancer detection, have established significant positions in this software layer. However, the hardware segment, encompassing imaging cameras, medical-grade sensors, and AI inference processors from manufacturers such as NVIDIA, Intel Corporation, and Advanced Micro Devices, Inc. (AMD), is expected to grow at a strong pace during the forecast period, driven by demand for edge-computing infrastructure and the integration of AI processing directly into new imaging modality hardware by manufacturers such as GE HealthCare and Siemens Healthineers.

How Does the Medical Imaging & Diagnostics Segment Maintain Dominance?

The medical imaging & diagnostics segment holds the largest share of the global computer vision in healthcare market in 2026. Medical images, including X-rays, CT scans, MRIs, ultrasounds, pathology slides, and retinal scans, account for approximately 90% of all healthcare data generated, creating the richest and most structured dataset for AI-driven visual analysis in any industry. Established manufacturers such as Siemens Healthineers, GE HealthCare, Koninklijke Philips N.V., Canon Medical Systems Corporation, Fujifilm Holdings Corporation, and Hologic, Inc. have embedded AI-powered computer vision directly into their imaging platforms, enabling automated detection, segmentation, and quantification of clinical findings at the point of image acquisition. Specialized software companies including iCAD, Inc., which focuses on AI-based cancer detection, and Aidoc Medical Ltd., which provides AI triage and notification solutions for radiological emergencies, have built focused offerings within this segment that complement the broader platforms of major imaging equipment manufacturers.

The surgical assistance & robotics segment is expected to grow at the fastest CAGR during the forecast period, as hospitals expand their robotic surgery programs and demand for real-time intraoperative imaging intelligence increases across surgical specialties.

Why Does the X-ray Segment Command the Largest Share?

The X-ray modality segment holds the largest share within the global computer vision in healthcare market in 2026. X-ray remains the most widely performed medical imaging examination globally, used extensively in chest screening, orthopaedics, emergency medicine, and pulmonology. The high volume, standardized image format, and well-established clinical protocols associated with X-ray imaging make it an ideal modality for AI automation, and manufacturers including GE HealthCare have prioritized autonomous X-ray as a key development frontier. The CT segment holds the second-largest share, driven by intensive AI development for oncology, neurological, and cardiovascular applications where multi-slice imaging data benefits substantially from automated analysis. The MRI segment is expected to grow steadily, supported by AI-powered image reconstruction technologies such as Siemens Healthineers' Deep Resolve and GE HealthCare's AIR Recon DL, which dramatically reduce scan acquisition times while maintaining diagnostic image quality.

Why Does the Hospitals & Specialty Clinics Segment Lead the Market?

The hospitals & specialty clinics segment commands the largest share of the global computer vision in healthcare market in 2026. These settings are the primary sites for advanced diagnostic imaging, surgical procedures, and complex patient monitoring, making them the central hubs for deploying and scaling computer vision technologies across radiology, cardiology, oncology, neurology, and ophthalmology departments. Hospitals typically have the IT infrastructure, budget authority, reimbursement access, and multi-specialty clinical expertise needed to evaluate and implement enterprise-scale AI solutions. The diagnostic imaging centers segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing outsourcing of imaging interpretation services and the growing adoption of AI-assisted reading platforms that allow independent imaging networks to manage higher scan volumes with lean radiologist teams.

How Does North America Maintain Dominance in the Global Computer Vision in Healthcare Market?

North America holds the largest share of the global computer vision in healthcare market in 2026. The region's leadership is built on the combination of the world's most advanced healthcare IT infrastructure, the highest per-capita medical imaging volumes among major economies, a clear regulatory pathway through FDA clearance for AI-enabled medical devices, and deep venture capital ecosystems that fund AI health technology companies at scale. The United States is home to leading manufacturers and platform providers including GE HealthCare, NVIDIA Corporation, Microsoft Corporation, Intel Corporation, Google LLC, iCAD, Inc., and Hologic, Inc., all of which maintain significant research and commercial operations in the country. In January 2025, GE HealthCare signed an AI imaging services agreement valued at over USD 249 million with a 31-hospital system, illustrating the scale of enterprise adoption underway in the U.S. market. Canada is also demonstrating strong institutional commitment to AI-driven healthcare; in 2025, Siemens Healthineers secured a USD 560 million agreement with the Canadian government to upgrade imaging infrastructure across Alberta province, including the establishment of AI and machine learning centers of excellence.

Which Factors Support Asia-Pacific's Rapid Growth?

Asia-Pacific is expected to register the fastest growth rate in the global computer vision in healthcare market during the forecast period. The region benefits from a combination of large and rapidly growing patient populations, significant government investment in healthcare digitalization, and the presence of major technology manufacturers and an expanding base of AI health technology companies. China is a particularly dynamic market, with domestic manufacturers and platform providers developing AI imaging solutions tailored to the country's high-volume hospital environment, and government programs actively encouraging the integration of AI into national healthcare infrastructure. Japan and South Korea have well-established medical device manufacturing ecosystems, with companies such as Canon Medical Systems Corporation, KEYENCE CORPORATION, and Fujifilm Holdings Corporation advancing AI-enhanced imaging platforms for both domestic and global markets. India represents a significant emerging opportunity, where the scale of the country's unmet diagnostic imaging needs is driving rapid adoption of cloud-based and mobile computer vision solutions that can extend quality diagnostic services to populations in underserved regions.

Which Factors Support Europe's Market Growth?

Europe accounts for a substantial share of the global computer vision in healthcare market, with growth supported by strong regulatory frameworks, advanced national healthcare systems, and active investment in AI-driven medical technology by both the public sector and major industrial companies. Germany is home to Siemens Healthineers AG and Basler AG, two manufacturers with significant global footprints in AI-enabled medical imaging and industrial-grade healthcare cameras respectively. The European Society of Radiology has been actively engaging with manufacturers to promote AI adoption and establish best practices for integrating computer vision tools into radiology workflows, reflecting the continent's coordinated approach to technology-driven healthcare modernization. The United Kingdom's National Health Service has been among the most prominent early adopters of healthcare AI globally, including Google Health's deployment of AI-powered computer vision for breast cancer screening across NHS facilities.

Companies such as GE HealthCare Technologies, Inc., Siemens Healthineers AG, Koninklijke Philips N.V., NVIDIA Corporation, and Microsoft Corporation lead the global computer vision in healthcare market with comprehensive hardware, software, and platform offerings spanning diagnostic imaging, surgical assistance, and clinical workflow management. Meanwhile, manufacturers including Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hologic, Inc., and Basler AG bring specialized imaging hardware and AI-enhanced modality solutions targeting radiology, pathology, and point-of-care applications. Specialized software and solutions providers such as iCAD, Inc., Aidoc Medical Ltd., AiCure, Butterfly Network, Inc., and Nano-X Imaging Ltd. are strengthening the market through innovations in AI-based disease detection, patient engagement, and accessible diagnostic platforms. Technology infrastructure providers including Intel Corporation, Advanced Micro Devices, Inc. (AMD), and Google LLC continue to expand the foundational computing and cloud ecosystems that underpin a growing range of healthcare-specific computer vision deployments by clinical and research organizations worldwide.

The global computer vision in healthcare market is expected to grow from USD 4.37 billion in 2026 to USD 33.4 billion by 2036.

The global computer vision in healthcare market is projected to grow at a CAGR of 22.6% from 2026 to 2036.

The software segment is expected to dominate the market in 2026 due to its scalability, ease of integration with existing clinical systems, and growing preference for cloud-based AI platforms. However, the hardware segment is projected to grow at a strong pace over the forecast period, driven by the embedding of AI inference capabilities directly into new imaging modality equipment and the expansion of edge-computing infrastructure in hospitals and point-of-care settings.

Autonomous imaging and real-time surgical intelligence are shifting the industry's value proposition from AI as a reading assistant to AI as an operational platform. Developments such as the GE HealthCare and NVIDIA collaboration on fully autonomous X-ray and ultrasound systems, and the integration of AI-Rad Companion and Deep Resolve technologies by Siemens Healthineers into clinical modalities, are moving computer vision from supporting human decisions to actively managing imaging workflows and intraoperative guidance with minimal operator involvement.

North America holds the largest share of the global computer vision in healthcare market in 2026, driven by advanced healthcare IT infrastructure, high imaging volumes, clear FDA regulatory pathways, and the concentration of leading manufacturers and technology platform providers. Asia-Pacific is expected to be the fastest-growing region through 2036.

The leading companies include GE HealthCare Technologies, Inc., Siemens Healthineers AG, Koninklijke Philips N.V., NVIDIA Corporation, Microsoft Corporation, Canon Medical Systems Corporation, and iCAD, Inc.

1. Introduction

1.1. Market Definition

1.2. Market Scope

1.3. Research Methodology

1.4. Assumptions & Limitations

2. Executive Summary

3. Market Overview

3.1. Introduction

3.2. Market Dynamics

3.2.1. Drivers

3.2.2. Restraints

3.2.3. Opportunities

3.2.4. Challenges

3.3. Impact of AI and Deep Learning on Clinical Workflows

3.4. Regulatory Landscape & FDA/CE Approval Pathways for AI-Enabled Medical Devices

3.5. Porter's Five Forces Analysis

4. Global Computer Vision in Healthcare Market, by Component

4.1. Introduction

4.2. Hardware

4.2.1. Medical-Grade Cameras & Imaging Sensors

4.2.2. AI Inference Processors & GPUs

4.2.3. Edge Computing Devices & Embedded Systems

4.3. Software

4.3.1. Image Analysis & AI Diagnostic Software

4.3.2. Deep Learning & Machine Learning Platforms

4.3.3. Clinical Workflow & Decision Support Software

4.4. Services

4.4.1. Integration & Deployment Services

4.4.2. Training & Education Services

4.4.3. Support & Maintenance Services

5. Global Computer Vision in Healthcare Market, by Application

5.1. Introduction

5.2. Medical Imaging & Diagnostics

5.2.1. Radiology AI & Automated Image Analysis

5.2.2. AI-Powered Pathology & Digital Slide Analysis

5.2.3. Ophthalmology Imaging & Retinal Analysis

5.2.4. Cardiology Imaging & Echocardiography Analysis

5.3. Surgical Assistance & Robotics

5.3.1. Intraoperative Imaging & Navigation

5.3.2. Robotic-Assisted Surgical Guidance

5.3.3. Augmented Reality Surgical Overlays

5.4. Patient Monitoring & Safety

5.4.1. AI-Based Fall Detection & Prevention

5.4.2. Remote Patient Monitoring & Behavioral Analysis

5.4.3. ICU & Critical Care Monitoring

5.5. Drug Discovery & Research Support

5.5.1. AI-Driven Histopathology & Biomarker Analysis

5.5.2. Cell Imaging & High-Content Screening

5.6. Healthcare Operations Management

5.6.1. Patient & Staff Tracking

5.6.2. Inventory & Asset Management

5.6.3. Workflow & Scheduling Optimization

6. Global Computer Vision in Healthcare Market, by Imaging Modality

6.1. Introduction

6.2. X-ray

6.3. Computed Tomography (CT)

6.4. Magnetic Resonance Imaging (MRI)

6.5. Ultrasound

6.6. Endoscopy

6.7. Pathology / Microscopy

6.8. Others (PET, Nuclear Medicine)

7. Global Computer Vision in Healthcare Market, by Deployment Mode

7.1. Introduction

7.2. Cloud-based

7.3. On-premise

7.4. Hybrid

8. Global Computer Vision in Healthcare Market, by End User

8.1. Introduction

8.2. Hospitals & Specialty Clinics

8.2.1. Academic Medical Centers & Teaching Hospitals

8.2.2. Specialty Hospitals (Oncology, Cardiology, Neurology, etc.)

8.3. Diagnostic Imaging Centers

8.4. Pharmaceutical & Biotechnology Companies

8.5. Research & Academic Institutes

8.6. Ambulatory Care Centers & Physician Groups

9. Global Computer Vision in Healthcare Market, by Region

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. France

9.3.3. U.K.

9.3.4. Italy

9.3.5. Spain

9.3.6. Netherlands

9.3.7. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. India

9.4.3. Japan

9.4.4. South Korea

9.4.5. Southeast Asia

9.4.6. Australia

9.4.7. Rest of Asia-Pacific

9.5. Latin America

9.5.1. Brazil

9.5.2. Mexico

9.5.3. Rest of Latin America

9.6. Middle East & Africa

9.6.1. Saudi Arabia

9.6.2. UAE

9.6.3. South Africa

9.6.4. Rest of Middle East & Africa

10. Competitive Landscape

10.1. Overview

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Ranking / Positioning Analysis of Key Players, 2025

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, SWOT Analysis)

11.1. GE HealthCare Technologies, Inc.

11.2. Siemens Healthineers AG

11.3. Koninklijke Philips N.V.

11.4. NVIDIA Corporation

11.5. Microsoft Corporation

11.6. Intel Corporation

11.7. Canon Medical Systems Corporation

11.8. Fujifilm Holdings Corporation

11.9. Hologic, Inc.

11.10. Basler AG

11.11. iCAD, Inc.

11.12. Advanced Micro Devices, Inc. (AMD)

11.13. Google LLC

11.14. Aidoc Medical Ltd.

11.15. Butterfly Network, Inc.

12. Appendix

12.1. Questionnaire

12.2. Related Reports

Published Date: Jan-2025

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates