Resources

About Us

Closed Loop Chillers Market Size, Share, Forecast & Trends by Type (Small, Medium, Large), Configuration (Packaged, Modular, Split), End-Use (Pharmaceuticals, Food, Data Centers) - Global Forecast to 2035

Report ID: MREP - 1041580 Pages: 185 Sep-2025 Formats*: PDF Category: Energy and Power Delivery: 24 to 72 Hours Download Free Sample ReportClosed Loop Chillers Market Size

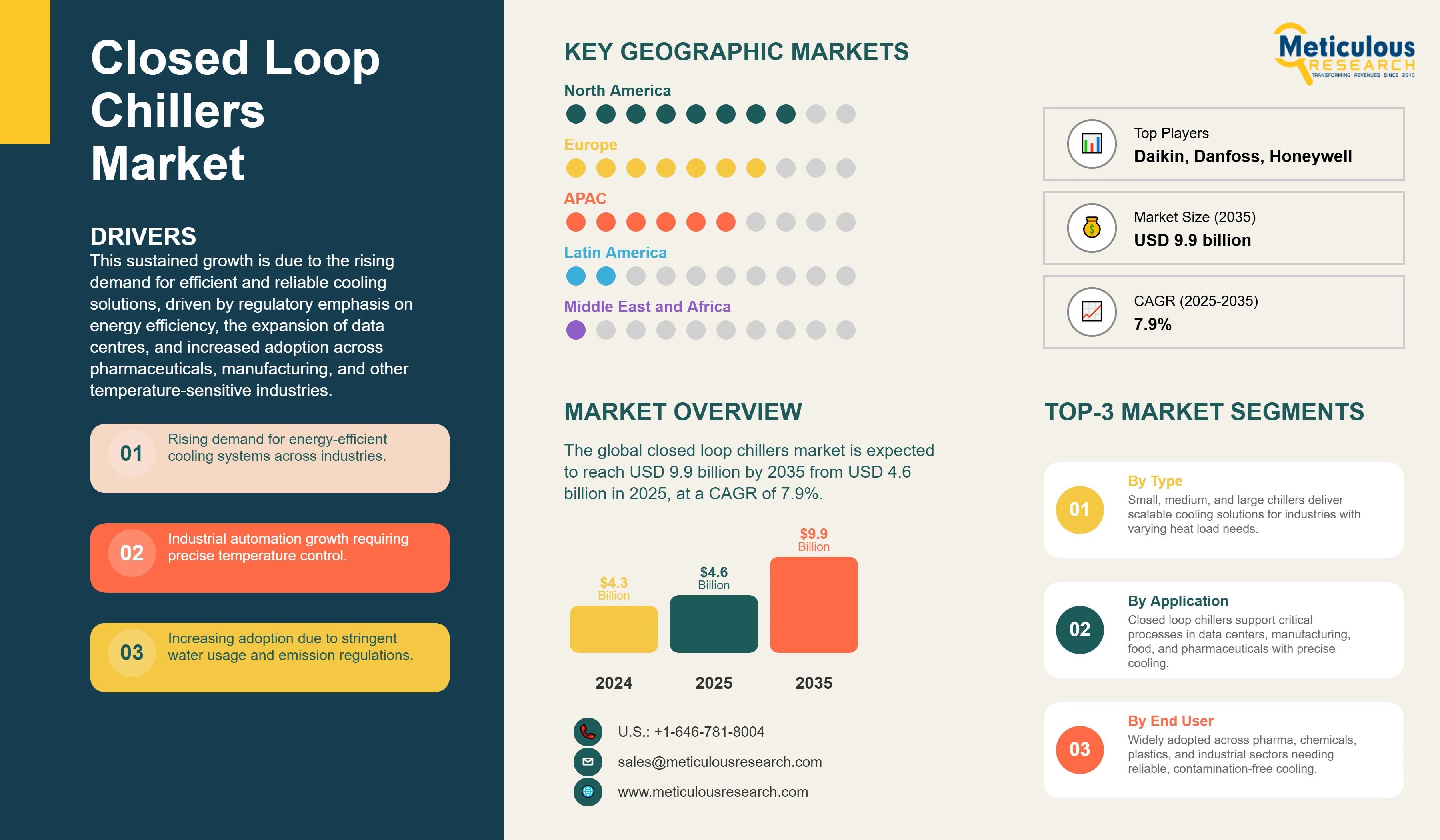

The global closed loop chillers market was valued at USD 4.3 billion in 2024. The market is expected to reach USD 9.9 billion by 2035 from USD 4.6 billion in 2025, at a CAGR of 7.9%. This sustained growth is due to the rising demand for efficient and reliable cooling solutions, driven by regulatory emphasis on energy efficiency, the expansion of data centres, and increased adoption across pharmaceuticals, manufacturing, and other temperature-sensitive industries.

Other key growth drivers of the overall closed loop chillers market include stringent environmental regulations, rising adoption of IoT-enabled monitoring systems, and expansion of pharmaceuticals, biotechnology, and data center industries requiring contamination-free cooling operations. The industry outlook indicates steady growth, while the long-term forecast signals accelerated adoption as organizations prioritize sustainability and operational resilience.

Recent Developments in the Closed Loop Chillers Market and Insights

Click here to: Get Free Sample Pages of this Report

Daikin Launches Glycol-Free Closed Loop System in TZ D Chiller Range

In October 2024, Daikin launched a zoned cooling system that no longer requires the use of glycol, improving operational effectiveness and serviceability. The system belongs to the TZ D air-cooled free-cooling line of chillers and potentially spans capacities as small as around 180 kW and up to 2,150 kW, depending on models, thus being suitable for large-scale installations with substantial heat load requirements.

Carrier India Introduces 30RB Air-Cooled Modular Scroll Chiller for Local Market

In May 2024, Carrier India has launched the 30RB Air-Cooled Modular Scroll Chiller, which is specifically designed for the Indian market. This chiller is highly efficient and reliable, supporting a wide range of industrial processes and contributing to the Indian government's "Vocal for Local" initiative.

Closed Loop Chillers Market Drivers

Base CAGR: 7.9%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Rising Demand for Energy-Efficient Cooling Systems |

Increased adoption in the manufacturing, food & beverage, and electronics industries |

Industry-wide shift to low-energy, high-efficiency closed loop chillers |

▲ +2.2% |

|

2. Growth in Data Centers and Industrial Automation |

Greater need for precise temperature control in mission-critical facilities |

Integration with smart building management systems for automated cooling |

▲ +2.0% |

|

|

3. Expansion of automation in industry |

The rising installation of automation-driven production lines, creating a steady demand for precision cooling. |

Accelerated integration of robotics, AI, and smart factories; higher reliance on closed-loop chillers for uptime and efficiency. |

▲ +1.8% |

|

|

Restraints |

1. High Initial Capital Investment |

Slows adoption in small and mid-sized enterprises |

Cost reduction through economies of scale and improved manufacturing |

▼ −1.5% |

|

2. Specialized Maintenance Requirements |

Dependence on skilled technicians limits market penetration |

Growth of third-party service providers reduces downtime risks |

▼ −1.3% |

|

|

Opportunities |

1. Expansion in Green Building Projects |

Adoption in LEED-certified commercial and industrial projects |

Integration into net-zero energy building infrastructure |

▲ +1.9% |

|

2. IoT and AI Integration in Chiller Systems |

Improved operational efficiency via predictive maintenance |

Full automation and remote control as standard industry practices |

▲ +1.7% |

|

|

Trends |

1. Adoption of Eco-Friendly Refrigerants |

Industry shift to low-GWP refrigerants to meet global compliance |

Complete phase-out of high-GWP refrigerants worldwide |

▲ +1.5% |

|

Challenges |

1. Competition from Alternative Cooling Technologies |

Slows market penetration in cost-sensitive sectors |

Differentiation through superior efficiency and sustainability features |

▼ −1.0% |

Closed Loop Chillers Market Analysis

North America Leads the Closed Loop Chillers Market

North America closed loop chillers market is growing at a CAGR of 6.8% CAGR through 2035. This growth is primarily attributed to its advanced industrial infrastructure, particularly in high-tech sectors like data centres and pharmaceuticals, which require highly reliable and precise cooling.

This combination of a mature industrial base, supportive regulations, and technological developments solidifies North America's position in closed-loop chillers market.

Advanced Manufacturing Excellence and Energy Efficiency Leadership Drive Closed Loop Chillers Market in Japan

Japan's closed loop chillers market is expected to grow at a steady CAGR of 7.6% through 2035, owing to the country's advanced manufacturing ecosystem and technological leadership in precision industries.

Thus, the market forecasts project that the country is expected to witness sustained growth, supported by smart manufacturing initiatives, sustainability regulations, and increasing investments in precision manufacturing technologies across multiple sectors.

Closed Loop Chillers Market Segmental Analysis

By Configuration, the Packaged Segment Dominates the Overall Closed Loop Chillers Market with a 40-45% Share in 2025

The packaged segment holds the largest share of 40-45% of the overall closed loop chillers market in 2025. This dominance mainly comes from its compact design, quick installation, and minimal on-site assembly needs. A key trend in the packaged chillers segment is the growing integration of smart technologies. Industry leaders are adding IoT-powered monitoring solutions and AI-based predictive maintenance features to improve performance and operational efficiency. For example, Factech offers facility maintenance software that uses IoT and AI to optimize chiller plant operations. This system provides real-time performance data and allows operators to adjust settings remotely, leading to significant energy savings and less maintenance time.

By End-Use Industry, the Pharmaceuticals Segment Holds 25-30% Share of the Closed Loop Chillers Market

The pharmaceuticals end user segment is expected to account for 25-30% of the overall closed loop chillers market in 2025. This substantial share comes mainly from the strict environmental standards in pharmaceutical manufacturing. These standards require careful control of temperature, humidity, and contamination-free conditions. Pharmaceutical facilities prefer closed loop chillers because they offer stable and consistent temperature control, high energy efficiency, and low maintenance needs. These features are vital for following Good Manufacturing Practices (GMP) and ensuring product quality. Keeping controlled environments with temperatures around 15°C to 25°C and tightly controlled humidity levels is crucial. This helps preserve the integrity and effectiveness of pharmaceutical products, prevents microbial contamination, and meets regulatory requirements.

New technological developments, such as IoT-based real-time condition monitoring and predictive maintenance using artificial intelligence, have sped up the adoption of closed loop chillers. For example, Johnson Controls’ OpenBlue Connected Chillers have shown energy consumption cuts of up to 10% and maintenance cost savings of 67% in corporate pharmaceutical facilities. This digital platform uses AI-driven analytics to provide insights that improve chiller performance, reduce downtime, and cut operational costs.

Similarly, AI-powered platforms from Carnot Innovations have achieved steady annual energy savings of about 10% in various industrial and commercial facilities. This demonstrates how intelligent systems can promote sustainability and save money.

Report Specifications:

|

Report Attribute |

Details |

|

Market size (2025) |

USD 4.6 billion |

|

Revenue forecast in 2035 |

USD 9.9 billion |

|

CAGR (2025-2035) |

7.9% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers, and restraints |

|

Segments covered |

Capacity (Small (20 tons), Medium (20-100 tons), and Large (>100 tons)), Configuration (Packaged, Modular, and Split system), End-Use Industry, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

|

Key companies profiled |

Blue Star Limited, Airedale International Air Conditioning, Carrier Corporation, Bosch Thermotechnology, Johnson Controls, Daikin Applied, Danfoss, Honeywell International, Hitachi Air Conditioning, Ingersoll Rand, and Other Key Players. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models. |

The Closed Loop Chillers Market is estimated to be USD 4.6 billion in 2025 and grow at a CAGR of 7.9% to reach USD 9.9 billion by 2035.

In 2024, the Closed Loop Chillers Market was valued at USD 4.3 billion, with projections to reach USD 4.6 billion in 2025.

Blue Star Limited, Airedale International Air Conditioning, Carrier Corporation, and Bosch Thermotechnology are the major companies operating in the Closed Loop Chillers Market Analysis and Forecast.

The Asia Pacific region is projected to grow at the fastest CAGR over the forecast period (2025-2035).

By configuration, in 2025, packaged closed loop chillers account for the largest share of the overall closed loop chillers market.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Closed Loop Chillers Market, by Capacity

3.2.2. Closed Loop Chillers Market, by Configuration

3.2.3. Closed Loop Chillers Market, by End-Use Industry

3.2.4. Closed Loop Chillers Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. Rising demand for energy-efficient cooling systems across industries.

4.2.1.2. Industrial automation growth requiring precise temperature control.

4.2.1.3. Increasing adoption due to stringent water usage and emission regulations.

4.2.2. Restraints

4.2.2.1. High initial capital investment compared to open systems.

4.2.2.2. Specialized maintenance requirements and skilled labor shortage.

4.2.2.3. Limited adoption in low-budget, small-scale industries.

4.2.3. Opportunities

4.2.3.1. Expansion in renewable energy and green building projects.

4.2.3.2. Integration of IoT-enabled smart control systems in chillers.

4.2.4. Trends

4.2.4.1. Shift toward eco-friendly refrigerants and sustainable cooling.

4.2.4.2. Increasing use of glycol-free closed loop designs for easier maintenance.

4.2.5. Challenges

4.2.5.1. Fluctuating raw material prices impacting manufacturing costs.

4.2.5.2. Competition from alternative cooling technologies like adiabatic systems.

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technological Impact on Closed Loop Chillers Market

4.4.1. IoT-Enabled Monitoring & Control

4.4.1.1. Real-time performance tracking via connected sensors.

4.4.1.2. Predictive maintenance to reduce downtime.

4.4.1.3. Remote system optimization for energy savings.

4.4.2. Advanced Heat Exchanger Designs

4.4.2.1. Improved thermal transfer efficiency.

4.4.2.2. Compact designs for space-constrained facilities.

4.4.2.3. Enhanced corrosion resistance for longer lifespan.

5. Impact of Sustainability on Closed Loop Chillers Market

5.1. AI for combating misinformation & fostering digital trust

5.2. Promoting ethical AI frameworks for algorithmic transparency

5.3. Diversity & inclusion challenges in training datasets

5.4. Bias mitigation in AI-driven content curation

5.5. Energy-efficient AI models for large-scale End-Use Industry

5.6. Community wellbeing: Reducing toxicity and improving digital environments

5.7. Corporate Sustainability Strategies in Closed Loop Chillers Sector

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Closed Loop Chillers Market Assessment—By Type

7.1. Overview

7.2. Small (20 tons)

7.3. Medium (20-100 tons)

7.4. Large (>100 tons)

8. Closed Loop Chillers Market Assessment—By Configuration

8.1. Overview

8.2. Packaged

8.3. Modular

8.4. Split system

9. Closed Loop Chillers Market Assessment—By End-Use Industry

9.1. Overview

9.2. Food & beverages

9.3. Plastics

9.4. Pharmaceuticals

9.5. Data centers

9.6. Industrial manufacturing

9.7. Chemicals & petrochemicals

9.8. Other End-Use Industries

10. Closed Loop Chillers Market Assessment—By Geography

10.1. Overview

10.2. North America

10.2.1. U.S.

10.2.2. Canada

10.3. Europe

10.3.1. Germany

10.3.2. U.K.

10.3.3. France

10.3.4. Netherlands

10.3.5. Switzerland

10.3.6. Rest of Europe

10.4. Asia-Pacific

10.4.1. China

10.4.2. Japan

10.4.3. South Korea

10.4.4. Taiwan

10.4.5. India

10.4.6. Singapore

10.4.7. Australia

10.4.8. Rest of Asia-Pacific

10.5. Latin America

10.5.1. Brazil

10.5.2. Mexico

10.5.3. Argentina

10.5.4. Rest of Latin America

10.6. Middle East & Africa

10.6.1. UAE

10.6.2. Saudi Arabia

10.6.3. Israel

10.6.4. South Africa

10.6.5. Rest of Middle East & Africa

11. Company Profiles (Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

11.1. Blue Star Limited

11.2. Airedale International Air Conditioning

11.3. Carrier Corporation

11.4. Bosch Thermotechnology

11.5. Johnson Controls

11.6. Daikin Applied

11.7. Danfoss

11.8. Honeywell International

11.9. Hitachi Air Conditioning

11.10. Ingersoll Rand

11.11. Other Key Players

12. Appendix

12.1. Available Customization

12.2. Related Reports

Published Date: Jul-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates