What is the Global Building Information Modeling Market Size?

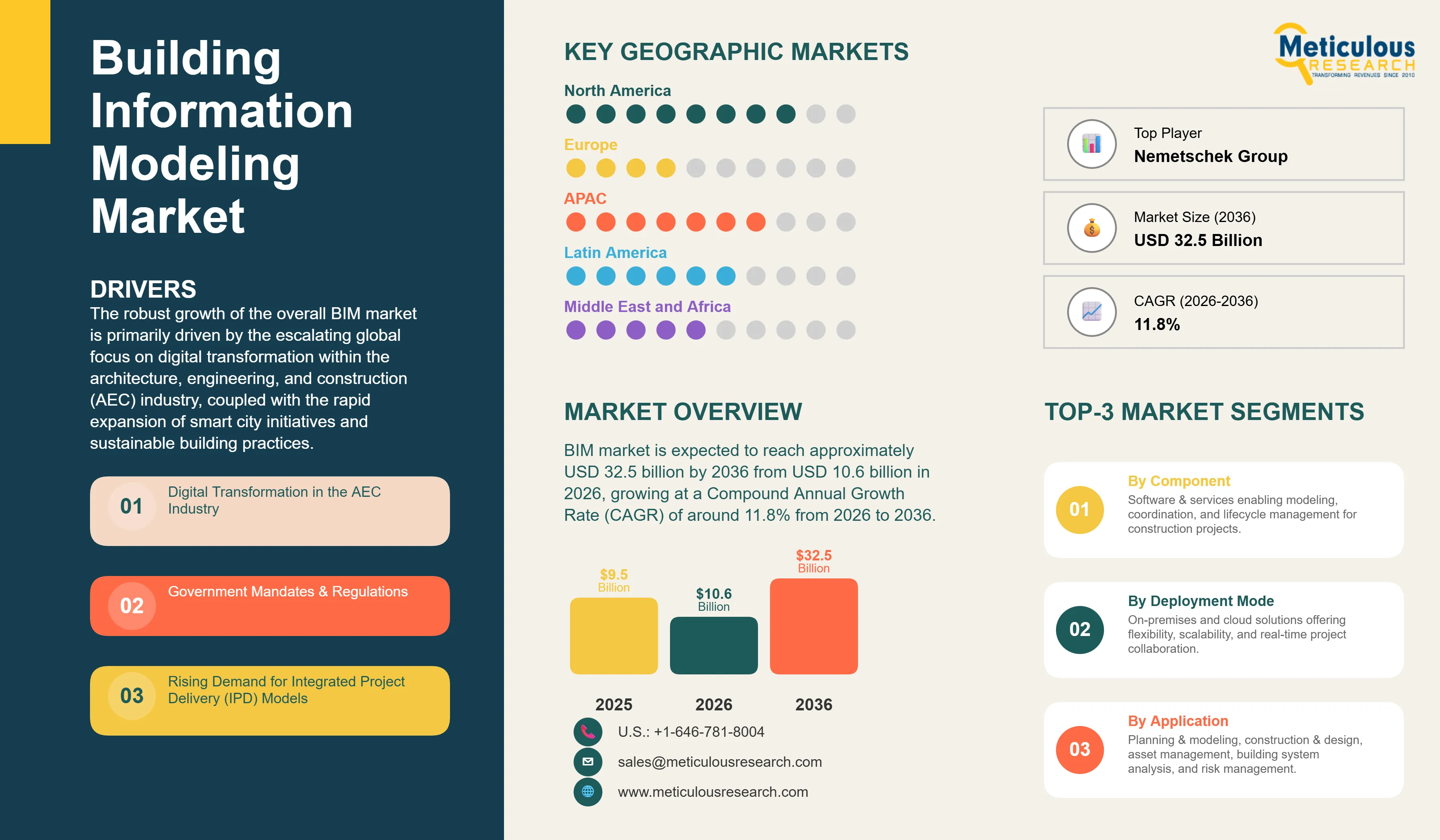

The global Building Information Modeling (BIM) market was valued at approximately USD 9.5 billion in 2025. The market is expected to reach approximately USD 32.5 billion by 2036 from USD 10.6 billion in 2026, growing at a Compound Annual Growth Rate (CAGR) of around 11.8% from 2026 to 2036. The robust growth of the overall BIM market is primarily driven by the escalating global focus on digital transformation within the architecture, engineering, and construction (AEC) industry, coupled with the rapid expansion of smart city initiatives and sustainable building practices. As industry stakeholders increasingly seek to integrate advanced digital workflows and enhance project collaboration, BIM solutions have become indispensable for optimizing design, construction, and operational phases of building and infrastructure projects. The rapid evolution of cloud-based platforms and the increasing demand for integrated project delivery (IPD) models continue to fuel significant market expansion across all major geographic regions.

Market Highlights: Global Building Information Modeling Market

- In terms of revenue, the global BIM market is projected to reach USD 32.5 billion by 2036.

- The market is expected to grow at a CAGR of 11.8% from 2026 to 2036.

- North America is anticipated to maintain a significant share of the global BIM market in 2026, driven by early adoption of advanced construction technologies and substantial investments in infrastructure development. [1]

- Asia-Pacific is expected to witness the fastest growth during the forecast period, supported by massive urbanization, government mandates for BIM adoption, and rapid infrastructure expansion in countries like China, India, and Southeast Asian nations.

- By component, the software segment is projected to hold the largest market share in 2026, attributed to the widespread use of BIM authoring and analysis tools across the project lifecycle.

- By deployment mode, cloud-based solutions are expected to exhibit the highest growth rate, owing to their flexibility, scalability, and enhanced collaboration capabilities.

Market Overview and Insights

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Building Information Modeling (BIM) represents a critical digital process for creating and managing information across the lifecycle of a built asset. These sophisticated systems integrate multi-disciplinary data to produce a comprehensive digital representation of a project, encompassing everything from architectural design and structural engineering to mechanical, electrical, and plumbing (MEP) systems. BIM solutions are defined by their ability to facilitate real-time collaboration, improve project predictability, and reduce costs through clash detection, quantity take-offs, and lifecycle management. They are indispensable for AEC firms seeking to optimize their project delivery frameworks and meet aggressive sustainability and efficiency targets.

The market encompasses a diverse range of solutions, from specialized authoring software for detailed modeling to integrated platforms for project coordination and facility management. These systems are increasingly augmented with advanced technologies such as artificial intelligence (AI), machine learning (ML), and digital twins, providing enhanced capabilities for predictive analytics, generative design, and automated compliance checking. The ability to deliver high-precision, data-rich models while streamlining complex workflows has made advanced BIM solutions the technology of choice for industries where project efficiency, cost control, and long-term asset performance are paramount.

The global construction sector is undergoing a profound digital transformation, driven by the imperative to modernize traditional practices and meet the demands of increasingly complex projects. This shift has accelerated the adoption of BIM, with governments worldwide implementing mandates and incentives to promote its use. Concurrently, the rapid growth in infrastructure development and the increasing emphasis on sustainable and resilient buildings are amplifying the need for robust, integrated BIM platforms that can support the entire project ecosystem.

What are the Key Trends in the Global Building Information Modeling Market?

Integration of AI and Machine Learning for Enhanced Automation

Manufacturers across the BIM ecosystem are rapidly integrating AI and ML capabilities to automate repetitive tasks, optimize design alternatives, and improve predictive analytics. Solutions from industry leaders like Autodesk and Bentley Systems are leveraging AI for generative design, allowing for rapid exploration of design options, and for automated clash detection, significantly reducing errors and rework. The real transformative impact comes with AI-driven insights into building performance, enabling more sustainable and energy-efficient designs. These advancements make high-precision, data-driven decision-making practical and cost-effective for stakeholders ranging from small architectural firms to large-scale construction enterprises.

Proliferation of Cloud-Based BIM and Collaborative Platforms

Innovation in cloud-based BIM platforms is rapidly driving market growth, as project teams become more geographically dispersed and demand seamless collaboration. Software providers are now designing platforms that combine the robust modeling capabilities of traditional desktop applications with the accessibility and scalability of cloud environments. These systems often involve advanced data management and version control, capable of handling large, complex models without compromising data integrity or project security. This shift supports agile project delivery and enhances real-time communication among architects, engineers, contractors, and owners.

At the same time, growing focus on digital twins and lifecycle asset management is pushing manufacturers to develop BIM solutions tailored for operational phases. These systems help reduce operational costs and improve facility performance through continuous monitoring, predictive maintenance, and optimized space utilization. By combining advanced modeling with real-time operational data, these new designs support both technological advancement and long-term asset value, strengthening the resilience of the broader built environment.

Market Summary:

|

Parameter

|

Details

|

|

Market Size by 2036

|

USD 32.5 Billion

|

|

Market Size in 2026

|

USD 10.6 Billion

|

|

Market Size in 2025

|

USD 9.5 Billion

|

|

Market Growth Rate (2026-2036)

|

CAGR of 11.8%

|

|

Dominating Region

|

North America

|

|

Fastest Growing Region

|

Asia-Pacific

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026 to 2036

|

|

Segments Covered

|

Component, Deployment Mode, Project Lifecycle, Building Type, Application, End-User, and Region

|

|

Regions Covered

|

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

|

Market Dynamics

Drivers: Digital Transformation and Government Mandates

A key driver of the BIM market is the rapid acceleration of digital transformation initiatives within the global AEC industry. Global demand for enhanced project efficiency, reduced construction costs, and improved collaboration has created significant incentives for the adoption of BIM solutions. The trend toward integrated project delivery (IPD) and the increasing complexity of modern construction projects drive stakeholders toward scalable solutions that BIM uniquely provides. It is estimated that as government mandates for BIM adoption become more widespread and the benefits of digital workflows become more evident through 2036, the need for robust, integrated BIM platforms will increase significantly; therefore, software and services, with their ability to ensure comprehensive project management, are considered crucial enablers of modern construction design strategies.

Opportunity: Smart City Development and Sustainable Construction

The rapid growth of smart city initiatives and the increasing emphasis on sustainable construction practices provide significant opportunities for the BIM market. Indeed, the global surge in urban development and the imperative to create environmentally friendly buildings have created a compelling demand for systems that can support complex urban planning, energy efficiency analysis, and lifecycle assessment. These applications require high data accuracy, interoperability, and the ability to handle large-scale urban models, all attributes that are met with advanced BIM solutions. The smart city market is set to expand significantly through 2036, with BIM solutions poised for an expanding share as stakeholders seek to maximize urban resilience and minimize environmental impact. Furthermore, the increasing demand for digital twins and advanced building performance analytics is stimulating demand for modular BIM solutions that provide real-time operational insights and design flexibility.

Component Insights

Why Does the Software Segment Lead the Market?

The software segment accounts for a significant portion of the overall Building Information Modeling market in 2026. This is mainly attributed to the foundational role of BIM software in creating, managing, and analyzing digital models throughout the project lifecycle. These tools offer comprehensive functionalities for 3D modeling, documentation, visualization, and data management, making them indispensable for architects, engineers, and contractors. The mass adoption of industry-standard platforms like Autodesk Revit and Bentley OpenBuildings, particularly in North America and Europe, demonstrates the technology’s capability to handle complex design and construction requirements. However, the services segment is expected to grow at a rapid CAGR during the forecast period, driven by the increasing need for specialized consulting, implementation, and training to maximize the value of BIM investments.

Deployment Mode Insights

Why is Cloud-based Deployment Gaining Traction?

The on-premise segment currently holds a substantial share of the global BIM market in 2026, primarily due to the historical preference for local data control and security within large enterprises. This deployment model offers complete ownership and customization capabilities, which are critical for projects with stringent data sovereignty requirements. However, the cloud-based segment is poised for significant growth through 2036. This surge is fueled by the increasing demand for enhanced collaboration, remote access, and scalability, particularly for geographically dispersed project teams. Cloud solutions enable real-time data sharing, reduce IT infrastructure costs, and facilitate seamless integration with other digital tools, making them increasingly attractive for agile project delivery and digital transformation initiatives.

Project Lifecycle Insights

How Does Pre-construction Drive Early Adoption?

The pre-construction phase, encompassing planning, design, cost estimation, and scheduling, significantly drives the early adoption of BIM solutions. In 2026, this segment accounts for a substantial portion of BIM usage, as stakeholders leverage BIM for accurate visualization, clash detection, and optimized resource allocation before physical construction begins. The ability to identify and resolve potential issues virtually saves considerable time and cost during later stages. The construction phase also represents a critical application area, with BIM tools facilitating construction management, site logistics, and fabrication. Furthermore, the operations phase, including facility management and asset management, is expected to witness robust growth as the industry increasingly focuses on the long-term value and performance of built assets.

Building Type Insights

Why Do Commercial Buildings Dominate BIM Adoption?

The commercial buildings segment commands the largest share of BIM adoption in 2026. This dominance stems from the inherent complexity of commercial projects, which often involve multiple stakeholders, intricate designs, and strict regulatory compliance. BIM solutions provide essential tools for managing these complexities, from optimizing energy performance in office towers to coordinating diverse systems in healthcare facilities. Infrastructure projects, including roads, bridges, and railways, are also rapidly increasing their adoption of BIM, driven by government mandates and the need for efficient management of large-scale public works. Residential buildings and industrial facilities also contribute significantly to the market, leveraging BIM for streamlined design, cost control, and improved project delivery.

Application Insights

How Does Planning & Modeling Remain Central to BIM?

The planning & modeling application segment remains central to the Building Information Modeling market in 2026. This is primarily due to BIM’s core capability in creating detailed 3D models and facilitating comprehensive project planning from inception. These applications are crucial for conceptual design, spatial analysis, and generating accurate documentation, forming the backbone of any BIM-enabled project. Construction & design applications also hold a significant share, leveraging BIM for detailed engineering, clash detection, and construction sequencing. The asset management application is expected to witness substantial growth, driven by the increasing focus on optimizing the operational performance and lifecycle value of built assets through digital twins and predictive maintenance.

End-User Insights

Why are Architects and Engineers Key Adopters?

Architects and engineers represent key end-users and significant adopters of Building Information Modeling solutions in 2026. Their role in conceptualizing, designing, and analyzing building projects necessitates advanced tools for precision, collaboration, and compliance. BIM software enables them to create detailed models, perform structural and MEP analyses, and ensure design integrity. Contractors are also rapidly increasing their adoption of BIM, leveraging it for improved project coordination, cost estimation, and construction sequencing. Furthermore, facility managers and owners are increasingly utilizing BIM for operational efficiency, asset management, and long-term maintenance planning, recognizing the value of data-rich models throughout the asset’s lifecycle.

Regional Insights

How is North America Maintaining a Leading Position in the Global BIM Market?

North America is anticipated to hold a significant share of the global Building Information Modeling market in 2026. This leading position is primarily attributed to the region’s early and widespread adoption of advanced construction technologies, substantial investments in infrastructure development, and a mature regulatory environment that encourages BIM implementation. The presence of major BIM software providers and a strong ecosystem of AEC firms further solidify its market leadership. The U.S. and Canada are at the forefront, with continuous innovation in cloud-based BIM and digital twin technologies.

Which Factors Support Asia-Pacific’s Rapid Growth?

Asia-Pacific is expected to witness the fastest growth during the forecast period. This rapid expansion is fueled by massive urbanization, ambitious infrastructure projects, and increasing government mandates for BIM adoption in countries like China, India, Japan, and South Korea. The region’s growing construction sector and the drive for digital transformation are creating a fertile ground for BIM solutions. Southeast Asian nations are also emerging as key growth markets, with increasing investments in smart city initiatives and sustainable building practices.

What are the Emerging Opportunities in Latin America and Middle East & Africa?

Latin America is poised for steady growth, driven by infrastructure modernization programs and increasing government initiatives to promote BIM adoption in countries such as Brazil, Mexico, Chile, and Colombia. The region’s expanding construction sector and the need for improved project efficiency are accelerating the uptake of BIM solutions. Similarly, the Middle East & Africa (MEA) region is witnessing significant opportunities, particularly in the GCC countries (Saudi Arabia, UAE, Qatar) due to mega-projects like NEOM and Vision 2030 initiatives. BIM is becoming integral to these large-scale developments, focusing on smart cities and sustainable infrastructure. Countries like South Africa, Egypt, and Nigeria are also showing increasing interest in BIM to modernize their construction industries and enhance project delivery capabilities.

Key Questions Answered in the Report: