Resources

About Us

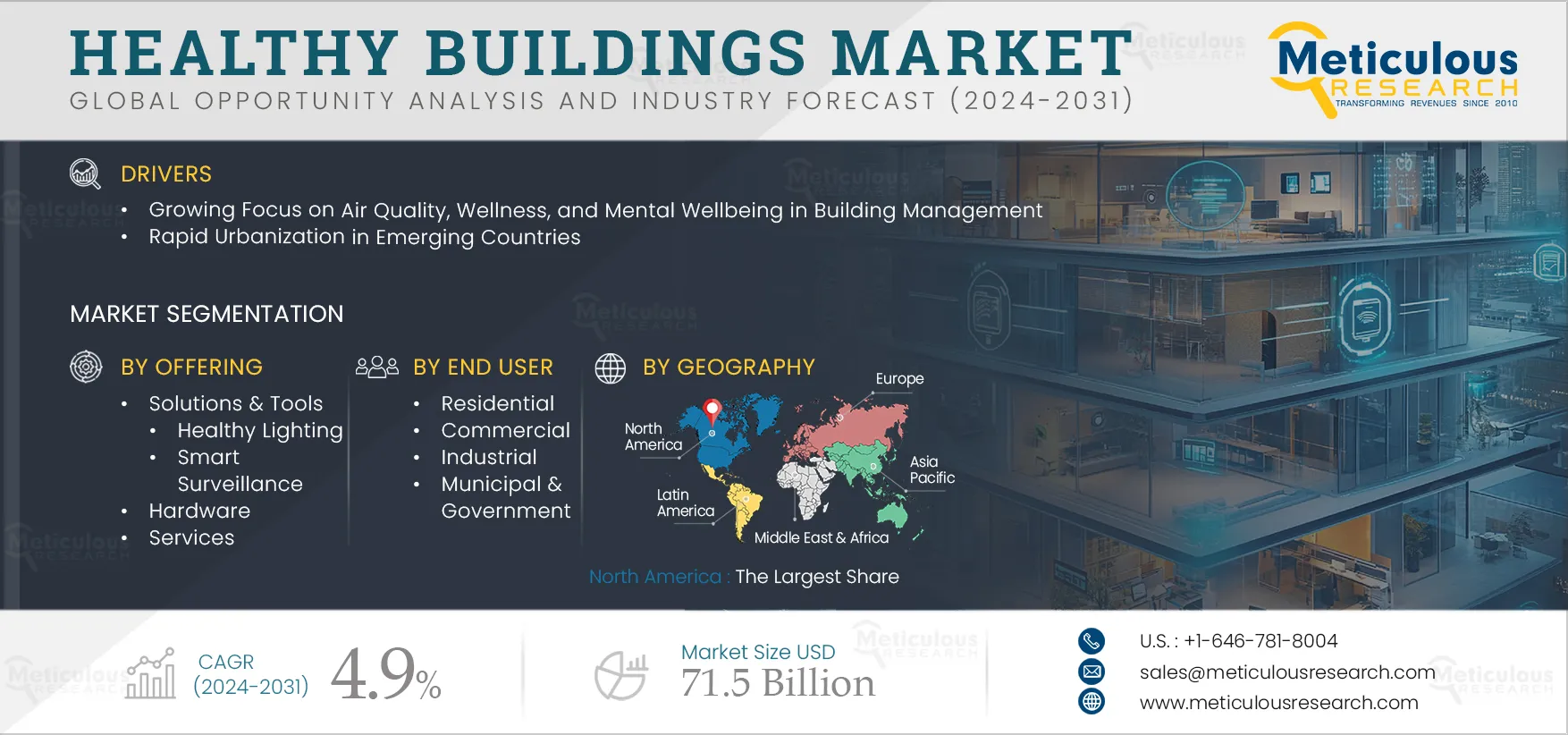

Healthy Buildings Market Size, Share, Forecast, & Trends Analysis Offering (Solutions & Tools, Hardware, Services), End User (Residential, Commercial, Industrial, Municipal & Government), and Geography - Global Forecast to 2032

Report ID: MRICT - 1041327 Pages: 250 Oct-2024 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe primary drivers of this market's growth include rising awareness of indoor air quality, wellness, and mental wellbeing, and rapid urbanization in emerging economies. However, the high implementation costs are anticipated to restrain its growth.

The increased emphasis on patient-centered design and innovative technologies in healthcare facilities, combined with an increase in demand from construction companies for green building certifications that focus on sustainability and health, are expected to generate growth opportunities for the players operating in this market.

On the other hand, integration with existing systems is a major challenge for market stakeholders. Moreover, the integration of IoT and AI in building management, the growing emphasis on green city initiatives, and the shift toward sustainable and smart buildings are prominent trends shaping the healthy buildings market.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

In recent years, increasing awareness of air quality, wellness, and mental wellbeing within buildings has become a top priority for both citizens and the construction industry. As concerns grow, the construction industry is increasingly adopting healthy building solutions to enhance ventilation systems and ensure superior indoor air quality. These solutions help minimize indoor contaminants and maintain optimal air conditions. Many providers are incorporating high-efficiency particulate air (HEPA) filters and UV light systems to eliminate airborne pathogens and allergens, contributing to cleaner air. Additionally, modern buildings are integrating plants, green walls, and natural materials into their designs, fostering environments that promote relaxation, focus, and overall well-being.

To address these concerns, numerous companies are introducing smart sensors designed to monitor indoor air quality and personalized controllers that manage the immediate environment, including temperature and lighting. These innovations enhance air quality and support wellness and mental health in buildings. For example, in February 2022, Honeywell International Inc. (U.S.) launched an Indoor Air Quality (IAQ) monitor that alerts building owners and operators to potential issues, enabling proactive measures to improve indoor air quality and reduce the risk of airborne contaminants. Such advancements are driving the increasing demand for healthy building solutions in recent years.

Construction companies are increasingly pursuing green building certifications to enhance both the sustainability and health of their buildings. The rising adoption of healthy building solutions is driving demand for these certifications, which comply with rigorous energy efficiency standards, helping companies reduce carbon emissions and contribute to climate change mitigation. Certifications that focus on ventilation, air filtration, and the use of low-VOC materials play a critical role in improving indoor air quality and occupant well-being. Many construction firms are adopting green building certifications to prioritize the health and well-being of their customers. As a result, the growing demand for green building certifications is expected to further accelerate the adoption of healthy building solutions, enhancing air quality, water quality, and lighting in buildings.

Additionally, numerous governments are offering incentives for green building practices, including tax breaks, grants, and expedited permitting processes, which encourage construction companies to pursue certifications. These incentives not only reduce costs but also accelerate the adoption of sustainable building practices. Some of the widely recognized green building certifications include:

The growing availability and increasing use of green building certification in buildings will help increase the demand for healthy building solutions, hardware, and services in the coming years.

Based on offering, the healthy buildings market is segmented into solutions & tools, hardware, and services. In 2025, the solutions & tools segment is expected to account for the largest share of the healthy buildings market. This segment's large market share is driven by the increasing adoption of advanced HVAC systems and air purification technologies aimed at reducing pollutants and airborne pathogens to ensure clean indoor air. Additionally, the growing integration of smart climate control systems, which optimize temperature and humidity levels in buildings, contributes to this expansion. The rising use of health-focused lighting in commercial spaces also enhances employee mood and focus, resulting in improved productivity.

However, the services segment is expected to register a higher CAGR during the forecast period. This segment's growth is driven by the growing adoption of health-focused building services that monitor and regulate temperature and humidity to improve occupant comfort. Furthermore, the increased use of energy efficiency solutions is helping to lower operational costs, reduce environmental impact, and support sustainability objectives.

Based on end user, the healthy buildings market is segmented into residential, commercial, industrial, and municipal & government. In 2025, the commercial segment is expected to account for the largest share of over 43.0% of the healthy buildings market. This segment's large market share is driven by the increasing adoption of healthy building solutions in commercial spaces aimed at improving overall health outcomes and promoting a healthier workforce. Additionally, there is a rising demand for patient-centered designs and technology solutions within healthcare facilities. The growing use of health-focused lighting in educational institutions further supports this trend, enhancing mood, concentration, and productivity among students.

Moreover, the commercial segment is expected to register a higher CAGR during the forecast period.

In 2025, North America is expected to account for the largest share of over 38.0% of the global healthy buildings market. North America's large market share is driven by the growing adoption of healthy building solutions by organizations seeking to create healthier work environments, boost productivity, and integrate IoT devices for monitoring air quality, occupancy, and energy usage to enhance building performance. Additionally, hospitals and clinics across the region are increasingly implementing healthy building practices to improve patient outcomes and support staff well-being.

However, Asia-Pacific is expected to register the highest CAGR of over 6.0% during the forecast period. This regional market’s growth is fueled by increasing investments from key players in green and sustainable building initiatives. Office spaces across Asia-Pacific are increasingly incorporating health-focused features, including natural lighting, air quality management systems, and wellness amenities.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the healthy buildings market are Honeywell International Inc. (U.S.), DAIKIN Airconditioning (Singapore) Pte Ltd. (A Subsidiary of Daikin Industries, Ltd.) (Singapore), Johnson Controls International plc (Ireland), Schneider Electric SE (France), Siemens Corporation (Germany), Bosch Sicherheitssysteme GmbH (Germany), Delta Electronics, Inc. (Taiwan), Automated Logic Corporation (A Subsidiary of Carrier Global Corporation) (U.S.), Buildings IOT (U.S.), UL Solutions Inc.(U.S.), 9 Foundations, Inc. (U.S.), Allegion Plc. (Ireland), Kaiterra (Switzerland), and BuildingLogiX (U.S.).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.9% |

|

Market Size (Value) |

USD 71.5 Billion by 2032 |

|

Segments Covered |

By Offering

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Netherlands, Sweden, and Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Singapore, Australia & New Zealand, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, Israel, and Rest of Middle East & Africa). |

|

Key Companies |

Honeywell International Inc. (U.S.), DAIKIN Airconditioning (Singapore) Pte Ltd. (A Subsidiary of Daikin Industries, Ltd.) (Singapore), Johnson Controls International plc (Ireland), Schneider Electric SE (France), Siemens Corporation (Germany), Bosch Sicherheitssysteme GmbH (Germany), Delta Electronics, Inc.(Taiwan), Automated Logic Corporation (A Subsidiary of Carrier Global Corporation) (U.S.), Buildings IOT (U.S.), UL Solutions Inc.(U.S.), 9 Foundations, Inc. (U.S.), Allegion Plc. (Ireland), Kaiterra (Switzerland), and BuildingLogiX (U.S.). |

The healthy buildings market study focuses on market assessment and opportunity analysis through the sales of healthy buildings across different regions and countries across different market segmentations. This study is also focused on competitive analysis for healthy buildings based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The healthy buildings market is projected to reach $71.5 billion by 2032, at a CAGR of 4.9% from 2025 to 2032.

In 2025, the solutions/tools segment is expected to account for the largest share of the global healthy buildings market. This segment's large market share is attributed to the high growth in healthy building tools to enhance energy efficiency, reduce operational costs and environmental impact, and increase the adoption of air quality solutions in buildings to monitor indoor air quality.

The commercial segment is expected to register the highest CAGR during the forecast period. This segment's high growth is attributed to the growing adoption of healthy lighting solutions in hotels and hospitality to create a welcoming ambiance and enhance customers' moods and buying behavior and the rising use of health building solutions in retail stores to provide healthy environments, foster customer loyalty, encourage repeat visits, and generate positive reviews.

Rising concerns about air quality, wellness, and mental health in buildings and rapid urbanization in emerging countries drive the growth of this market. The increasing patient-centered designs and technologies in healthcare facilities and construction companies increasingly seeking green building certifications for sustainability and building health are expected to create market growth opportunities.

The key players operating in the healthy buildings market are Honeywell International Inc. (U.S.), DAIKIN Airconditioning (Singapore) Pte Ltd. (A Subsidiary of Daikin Industries, Ltd.) (Singapore), Johnson Controls International plc (Ireland), Schneider Electric SE (France), Siemens Corporation (Germany), Bosch Sicherheitssysteme GmbH (Germany), Delta Electronics, Inc.(Taiwan), Automated Logic Corporation (A Subsidiary of Carrier Global Corporation) (U.S.), Buildings IOT (U.S.), UL Solutions Inc.(U.S.), 9 Foundations, Inc. (U.S.), Allegion Plc. (Ireland), Kaiterra (Switzerland), and BuildingLogiX (U.S.).

Asia-Pacific is expected to register the highest CAGR of over 6.0% during the forecast period. The high growth of this regional market is attributed to the growing urbanization, evolving regulations, increasing public demand for healthier environments, and increasing healthy building principles in residential projects in Asia-Pacific to provide natural light, green spaces, and better air quality.

Published Date: May-2024

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates