Resources

About Us

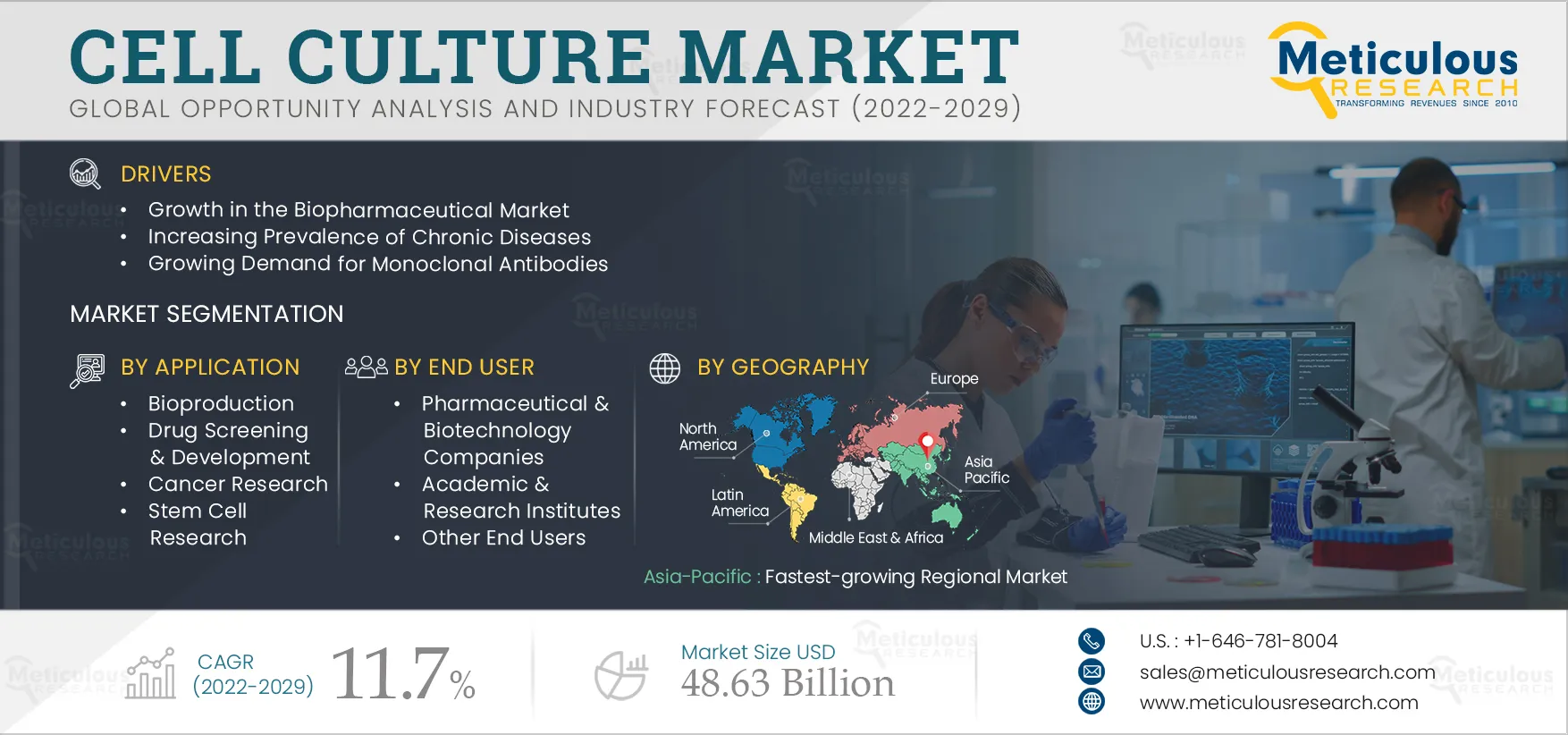

Cell Culture Market by Product [Consumables (Media, Reagents, Sera, Cell Lines), Equipment (Bioreactor, Centrifuge, Cell Counter)], Application (Bioproduction, Cancer Research, Stem Cell, Diagnostic), End User (Pharma, academic) - Global Forecast to 2029

Report ID: MRHC - 104127 Pages: 338 Dec-2022 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe cell culture market comprises various consumables and equipment required at different stages of the cell culture technique to understand the basic biology and biochemistry of cells. It acts as a model system and can be used for various applications such as bioproduction, cancer research, stem cell research, diagnostics, and drug screening.

The growth of this market is driven by factors such as the growth in biopharmaceutical market, increasing prevalence of chronic diseases, growing demand for monoclonal antibodies, increase in research funding, and rising adoption of single-use technologies. However, disposal of plastic waste generated from single-use technologies, cell line misidentification, and cross-contamination hamper the growth of this market to a notable extent.

Major pharmaceutical and biotech companies collaborated to find vaccines and treatment methods during the pandemic. The idea behind the collaboration was to come together and find a solution as quickly as possible during the pandemic, which could not be possible alone. Collaborations also took place within companies and universities to speed up the research and production process. Outsourcing pharmaceutical and biotechnological research to contract research organizations (CROs) also increased during the pandemic. Below are some of the instances:

Hence, the growing collaborations in the pharma sector for research and development for drug manufacturing increased the usage of cell culture products.

Click here to: Get Free Sample Copy of this report

Cell-based research studies help understand cells' responses to any chemical and identify novel components that can be used for people's well-being. Additionally, these studies are continued for a long time as standardization is needed when finding novel therapies. Such studies require investments that further support innovations in the medical field. For instance:

These investments and support for cell-based research activities drive the demand for cell culture products.

Based on product, in 2022, the consumables segment is estimated to account for the largest share of the cell culture market. The frequent use of cell culture consumables such as media, reagents, and sera in large quantities for various applications supports this segment's large market share. Due to its usage in various applications, new formulations in the cell culture media are also being developed for precise cell culturing.

Based on application, in 2022, the bioproduction segment is estimated to account for the largest share of the cell culture market. The major factors contributing to the large market share of this segment are the consumption of cell culture products for research and commercial bioproduction, the increasing demand for pharma and biopharma products, and the availability of funds for carrying out research activities.

The Pharmaceutical & Biotechnology Companies Segment to Dominate Cell Culture Market in 2022

Based on end user, in 2022, the pharmaceutical & biotechnology companies segment is estimated to account for the largest share of the cell culture market. Factors driving the large market share of this segment are the high consumption of cell culture products in commercial and research bioproduction and relatively greater purchasing power than other end users.

Asia-Pacific: Fastest-growing Regional Market

Based on geography, Asia-Pacific is expected to register the highest growth rate during the forecast period. The growth of this regional market is driven by the growing recognition of the region as a major outsourcing destination for pharmaceuticals & biopharmaceuticals companies, rapidly developing economies, and growing aging population coupled with the rising prevalence of chronic diseases and developing research infrastructure in this region.

The key players profiled in the cell culture market study are Merck KGaA (Germany), Thermo Fisher Scientific Inc. (U.S.), Cytiva (U.S.), Lonza Group Ltd. (Switzerland), Corning Incorporated (U.S.), Becton, Dickinson and Company (U.S.), Avantor, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), HiMedia Laboratories (India), Sartorius AG (Germany), Eppendorf SE (Germany), FUJIFILM Holdings Corporation (Japan), Agilent Technologies, Inc. (U.S.), Getinge AB (Sweden), Greiner Bio-One GmbH (Austria), and Miltenyi Biotec B.V. & Co. KG (Germany).

Cell Culture Market, by Product

Cell Culture Market, by Application

Cell Culture Market, by End User

Cell Culture Market, by Geography

Key questions answered in the report:

The Cell Culture Market includes the production and use of cell culture products like consumables and equipment necessary for growing cells in controlled environments. It is applied in drug production, cancer research, diagnostics, gene therapy, vaccine production, and stem cell research.

In 2022, the Cell Culture Market was valued at approximately $25-30 billion and is projected to grow to $48.63 billion by 2029.

The market is expected to grow at a CAGR of 11.7% from 2022 to 2029, driven by demand in biopharmaceuticals, monoclonal antibodies, research funding, and technological advances in single-use systems.

The market size is projected to reach $48.63 billion by 2029, reflecting significant expansion from its 2022 valuation.

Key players include Merck KGaA (Germany), Thermo Fisher Scientific (U.S.), Cytiva (U.S.), Lonza Group (Switzerland), Corning Incorporated (U.S.), BD (U.S.), Sartorius AG (Germany), and FUJIFILM Holdings (Japan).

Key trends include the rise of single-use technologies, growing use of monoclonal antibodies, an increase in outsourcing research to CROs, and greater collaborations in biopharmaceutical production.

Market growth is driven by:

The market is segmented by product, application, end user, and geography. Products include consumables (e.g., media, reagents, vessels) and equipment (e.g., bioreactors, incubators). Applications range from bioproduction to stem cell research.

The market is expected to see strong global growth, especially in regions like Asia-Pacific due to outsourcing opportunities and an aging population. Investments in biotechnology are also expanding worldwide.

The global Cell Culture Market is projected to reach $48.63 billion by 2029, growing at a CAGR of 11.7% from 2022, driven by biopharma demand and research funding.

The Cell Culture Market is expected to grow at a CAGR of 11.7%, driven by increasing demand in biopharma, monoclonal antibodies, and rising research funding by 2029.

In 2022, North America held the largest share of the Cell Culture Market. However, Asia-Pacific is expected to be the fastest-growing region during the forecast period.

Published Date: Jan-2025

Published Date: Jul-2023

Published Date: Jul-2022

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates