Resources

About Us

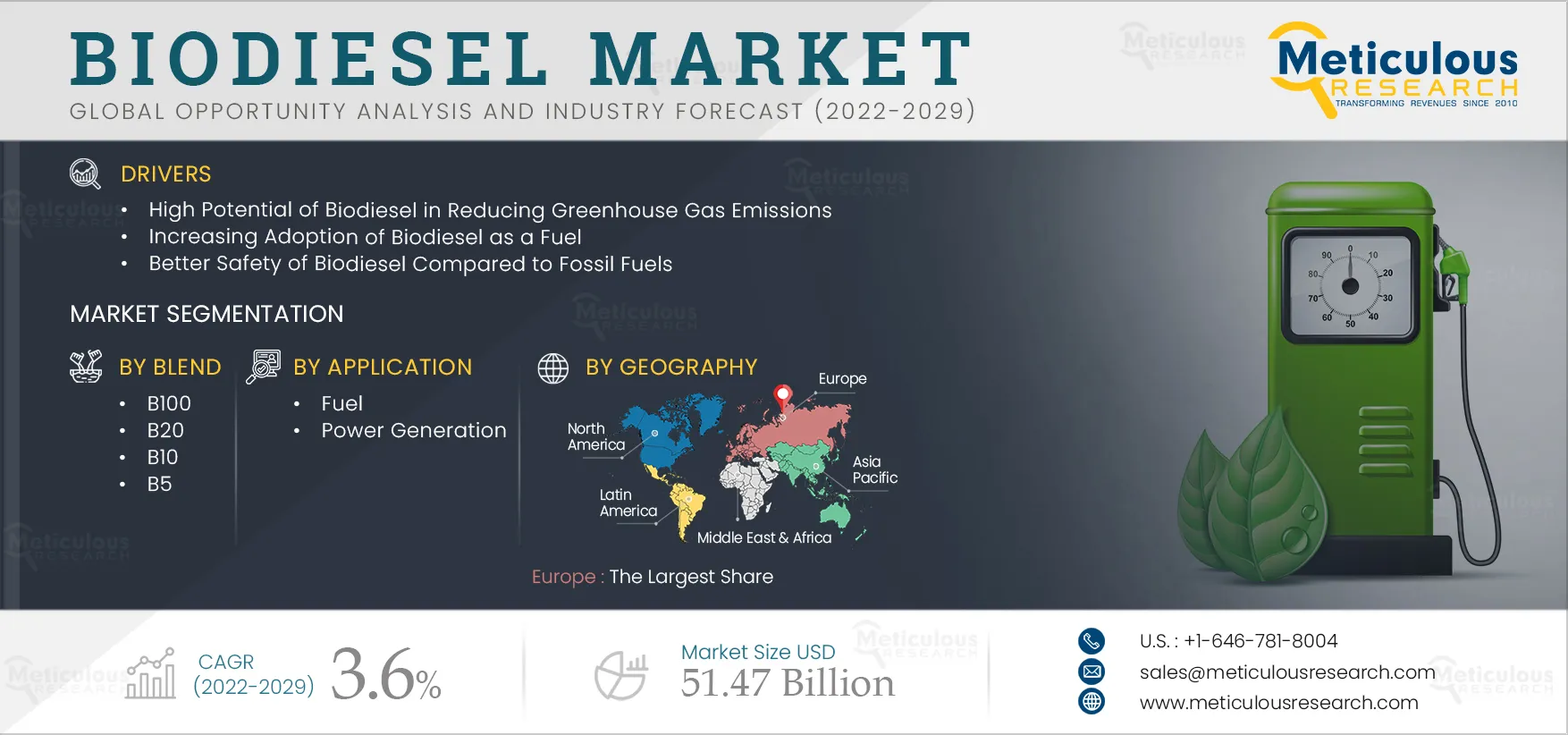

Biodiesel Market by Blend (B100, B20, B10, B5), Feedstock (Vegetable Oils {Rapeseed Oil, Palm Oil}, Animal Fats {Poultry, Tallow}), Application (Fuel {Automotive, Marine, Agriculture}), and Geography - Global Forecast to 2029

Report ID: MRCHM - 104663 Pages: 284 Oct-2022 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market is driven by the increase in consumption of biodiesel, the rising environmental concerns, and the increasing demand for sustainable fuels in transportation and power generation. However, performance concerns in diesel engines are expected to hinder the growth of this market to a certain extent. Moreover, government support from North America, Latin America, Europe, and Asia-Pacific countries is expected to offer significant growth opportunities for players operating in the biodiesel market.

The COVID-19 pandemic adversely hit many economies. Complete lockdown and quarantine to curb the spread of the virus adversely impacted many industries globally. Manufacturing facilities worldwide were shut down during the initial stages of the pandemic. The automotive industry was among the most affected industries during the pandemic. Along with logistics and freight transportation, the biodiesel market registered interruptions in the value chain, from raw materials supply to government shortages and distribution.

The movement restrictions of workers during the pandemic declined the demand for biodiesel from the automotive industry, resulting in the closure of production facilities. The production and trade movements were also affected due to the repeated lockdowns. The decline in business for a few initial months in 2020, coupled with lower demand from a few major markets, put pressure on the profitability of biodiesel manufacturers and vendors.

The effects of the COVID-19 pandemic on this market were felt in the Latin America region, starting in 2020. The region is one of the largest biodiesel consumers.

Therefore, a complete halt in the transportation and logistics industry and reduced production in some countries due to lockdowns adversely affected the global biodiesel market in terms of volume sales in 2020 and 2021. For instance, according to the OECD/FAO, the global biodiesel consumption reduced to 48.22 billion liter in 2020 and 49.11 billion liter in 2021, from 49.61 billion liter in 2019. However, with the ease of lockdown restrictions, there has been a sudden demand for industrialization activities, likely to boost the biodiesel market's growth.

Click here to : Get Free Sample Pages of this Report

The increasing adoption of biodiesel as an alternative for fossil fuels by automotive and power generation sectors and the rising awareness regarding environmental concerns such as greenhouse gas emissions, etc., are major factors driving the growth of the global biodiesel market.

Transportation fuels are used to power vehicles such as cars, trucks, buses, and trains. They are non-toxic and biodegradable and have a high energy density. Furthermore, they can be easily transported from one place to another. According to lowa Renewable Fuels Association, biodiesel reduces particulate matter by 47% and hydrocarbon emissions by up to 67%. Additionally, the production of biodiesel, instead of petroleum diesel, reduces wastewater by 79% and hazardous waste by 96%. Each gallon of biodiesel usage saves 4 gallons of fossil fuels. According to the National Biodiesel Board, approximately 3 billion gallons of biodiesel were consumed in the U.S. in 2019. This reduced carbon emissions by more than 25 Million Metric Tons. The rising usage of biodiesel to replace fossil fuels in transportation is a major factor driving the growth of the biodiesel market.

Industrial fuels are used in a variety of industries, such as power generation and heating oil. Biodiesel is used as heating oil in commercial & domestic broilers. Using B100 blends in power generation helps generators eliminate the byproducts which result in smog, ozone, and sulfur emissions. These generators are used in residential areas around schools and hospitals to reduce poisonous emissions. The rising usage of biodiesel to replace conventional fossil fuels in automotive and power generation applications is estimated to drive the growth of the biodiesel market.

Based on blend, the biodiesel market is segmented into B100, B20, B10, and B5. The B100 segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the higher preference for B100 due to its benefits, such as lesser flammability than petroleum diesel, low-pressure storage at ambient temperatures, and safer handling and transport. Furthermore, compared to the remaining biodiesel blends, the B100 biodiesel emits less carbon dioxide, carbon monoxide, sulfur, particulates and hydrocarbons.

Based on feedstock, the market is segmented into vegetable oils, animal fats, used cooking oil (UCO), and others. In 2022, the vegetable oils segment is expected to account for the largest share of the global biodiesel market. The large market share of this segment is attributed to factors such as the higher use of vegetable oil as a renewable resource for biodiesel production, less greenhouse gas emissions, high oil yield, and less percentage of saturated fat, hence reducing the cost of production. Most biodiesel products come from vegetable oils; however, the source of vegetable oil varies considerably with location. For instance, soybean oil is the most common feedstock used in biodiesel production in the U.S., whereas rapeseed oil is commonly used in many European countries for biodiesel production. Furthermore, palm oil has been widely used in the production of biodiesel in countries such as Indonesia, Thailand, Germany, France, and Colombia.

Based on application, the biodiesel market is segmented into fuel, power generation, and other applications. The power generation segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing use of biodiesel in generators to reduce poisonous carbon monoxide and particulate matter. Moreover, the increasing attempts by governments to adopt renewable energy sources to generate power are expected to offer significant growth opportunities for players operating in the biodiesel market.

Based on geography, the biodiesel market is segmented into five major geographies: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2022, Europe is expected to account for the largest share of the global biodiesel market. The large share of this regional market is attributed to the increasing support from the government and the growing preferences for renewable energy sources. Moreover, the growing demand for biodiesel from end-users, including automotive, power generation, marine, railway, and agriculture, is expected to boost the biodiesel market growth in Europe.

Key Players

The key players operating in the global biodiesel market are Archer-Daniels-Midland Company (U.S.), Ag Processing Inc (U.S.), Avril Group (France), Biodiesel Bilbao S.L. (a subsidiary of Bunge Limited) (Spain), Cargill Inc (U.S.), Emami Agrotech Ltd (part of Emami Limited), FutureFuel Chemical Company (U.S.), G-Energetic Biofuels Private Limited (India), Louis Dreyfus Company (Netherlands), Münzer Bioindustrie GmbH (Austria), Renewable Energy Group (U.S), VERBIO Vereinigte BioEnergie AG (Germany), Wilmar International Limited (Singapore), and World Energy LLC (U.S.).

Key Questions Answered in the Report-

Biodiesel is non-toxic, clean-burning, biodegradable, made from renewable resources, and an environmentally friendly alternative fuel. This biodiesel market study provides valuable insights across various key segments, such as market by blend, feedstock, application, and geography.

The biodiesel market is projected to reach $51.47 billion by 2029, at a CAGR of 3.6% during the forecast period.

The power generation segment is slated to register the fastest growth rate during the forecast period. The growth of this market is attributed to the increasing use of generators to reduce poisonous carbon monoxide and particulate matter. Moreover, the increasing government attempt to adopt renewable energy sources to generate power is expected to offer significant growth opportunities for players operating in the biodiesel market.

The growth of this market is driven by the increase in consumption of biodiesel, the rising environmental concerns, and the increasing demand for biodiesel to replace fuels in transportation and power generation.

Performance concerns in diesel engines are expected to hinder the growth of this market to a certain extent.

The key players operating in the global biodiesel market are Archer-Daniels-Midland Company (U.S.), Ag Processing Inc (U.S.), Avril Group (France), Biodiesel Bilbao S.L. (a subsidiary of Bunge Limited) (Spain), Cargill Inc (U.S.), Emami Agrotech Ltd (part of Emami Limited), FutureFuel Chemical Company (U.S.), G-Energetic Biofuels Private Limited (India), Louis Dreyfus Company (Netherlands), Münzer Bioindustrie GmbH (Austria), Renewable Energy Group (U.S), VERBIO Vereinigte BioEnergie AG (Germany), Wilmar International Limited (Singapore), and World Energy LLC (U.S.).

Asia-Pacific is slated to register the highest CAGR during the forecast period of 2022—2029. The fast growth of this market is attributed to factors such as the increasing government blend mandates and environmental concerns over petroleum diesel usage. Furthermore, the growing preference for replacing fossil fuels, which are related to higher greenhouse gas emissions, is persuading demand growth in these countries. Hence, with the increasing blend percentage in countries such as Indonesia, Thailand, Malaysia, and India, the Asia-Pacific region is projected to witness the fastest growth rate during the forecast period.

List of Tables

Table 1 Global Biodiesel Market: Impact Analysis of Market Drivers (2022–2029)

Table 2 The Impact of Biodiesel on Exhaust Emissions

Table 3 Diesel Vs Biodiesel: Quality Comparison

Table 4 Global Biodiesel Market: Impact Analysis of Market Restraints (2022–2029)

Table 5 Adoption of Zero-Emission Vehicles Among Leading Private Sector Companies

Table 6 Global Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 7 Global Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 8 B10-Approved Passenger Cars in Europe

Table 9 B10-Approved Passenger Cars in Thailand & Malaysia

Table 10 Global B10 Biodiesel Market Size, by Country/Region, 2020–2029 (USD Million)

Table 11 Global B10 Biodiesel Market Size, by Country/Region, 2020–2029 (Million Liters)

Table 12 Approval List of B20 Passenger Cars

Table 13 Global B20 Biodiesel Market Size, by Country/Region, 2020–2029 (USD Million)

Table 14 Global B20 Biodiesel Market Size, by Country/Region, 2020–2029 (Million Liters)

Table 15 Global B5 Biodiesel Market Size, by Country/Region, 2020–2029 (USD Million)

Table 16 Global B5 Biodiesel Market Size, by Country/Region, 2020–2029 (Million Liters)

Table 17 Approval List of B100 Commercial Vehicles in Europe

Table 18 Global B100 Biodiesel Market Size, by Country/Region, 2020–2029 (USD Million)

Table 19 Global B100 Biodiesel Market Size, by Country/Region, 2020–2029 (Million Liters)

Table 20 Global Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 21 Different Feedstocks Used Across Various Countries/Regions During Biodiesel Production

Table 22 Consumption of Vegetable Oils by the Biodiesel Industry, in Million Metric Tonnes (2016–2021)

Table 23 Global Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 24 Biodiesel Market Size for Vegetable Oils, by Country/Region, 2020–2029 (USD Million)

Table 25 Biodiesel Market Size for Soybean Oil, by Country/Region, 2020–2029 (USD Million)

Table 26 Biodiesel Market Size for Palm Oil, by Country/Region, 2020–2029 (USD Million)

Table 27 Biodiesel Market Size for Rapeseed/Canola Oil, by Country/Region, 2020–2029 (USD Million)

Table 28 Biodiesel Market Size for Corn Oil, by Country/Region, 2020–2029 (USD Million)

Table 29 Biodiesel Market Size for Other Vegetable Oils, by Country/Region, 2020–2029 (USD Million)

Table 30 Global Biodiesel Market Size for Used Cooking Oil, 2020–2029 (USD Million)

Table 31 Global Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 32 Biodiesel Market Size for Animal Fats, by Country/Region, 2020–2029 (USD Million)

Table 33 Biodiesel Market Size for Tallow, by Country/Region, 2020–2029 (USD Million)

Table 34 Biodiesel Market Size for White Grease, by Country/Region, 2020–2029 (USD Million)

Table 35 Biodiesel Market Size for Poultry, by Country/Region, 2020–2029 (USD Million)

Table 36 Biodiesel Market Size for Other Animal Fats, by Country/Region, 2020–2029 (USD Million)

Table 37 Biodiesel Market Size for Other Feedstock, by Country/Region, 2020–2029 (USD Million)

Table 38 Global Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 39 Global Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 40 Global Biodiesel Market Size for Fuel, by Country/Region, 2020–2029 (USD Million)

Table 41 Global Biodiesel Market Size for Automotive, by Country/Region, 2020–2029 (USD Million)

Table 42 Carbon Footprint from the Marine Vehicles

Table 43 Global Biodiesel Market Size for Marine, by Country/Region, 2020–2029 (USD Million)

Table 44 Global Biodiesel Market Size for Agriculture, by Country/Region, 2020–2029 (USD Million)

Table 45 Global Biodiesel Market Size for Other Fuels, by Country/Region, 2020–2029 (USD Million)

Table 46 Global Biodiesel Market Size for Power Generation, by Country/Region, 2020–2029 (USD Million)

Table 47 Global Biodiesel Market Size for Other Applications, by Country/Region, 2020–2029 (USD Million)

Table 48 Biodiesel Market Size, by Region, 2020–2029 (USD Million)

Table 49 Biodiesel Market Size, by Region, 2020–2029 (Million Liters)

Table 50 Europe: Biodiesel Market Size, by Country/Region, 2020–2029 (USD Million)

Table 51 Europe: Biodiesel Market Size, by Country/Region, 2020–2029 (Million Liters)

Table 52 Europe: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 53 Europe: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 54 Europe: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 55 Europe: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 56 Europe: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 57 Europe: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 58 Europe: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 59 France: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 60 France: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 61 France: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 62 France: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 63 France: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 64 France: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 65 France: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 66 Germany: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 67 Germany: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 68 Germany: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 69 Germany: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 70 Germany: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 71 Germany: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 72 Germany: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 73 Spain: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 74 Spain: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 75 Spain: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 76 Spain: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 77 Spain: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 78 Spain: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 79 Spain: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 80 U.K: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 81 U.K: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 82 U.K: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 83 U.K: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 84 U.K: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 85 U.K: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 86 U.K: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 87 Italy: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 88 Italy: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 89 Italy: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 90 Italy: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 91 Italy: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 92 Italy: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 93 Italy: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 94 Poland: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 95 Poland: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 96 Poland: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 97 Poland: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 98 Poland: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 99 Poland: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 100 Poland: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 101 Netherlands: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 102 Netherlands: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 103 Netherlands: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 104 Netherlands: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 105 Netherlands: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 106 Netherlands: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 107 Netherlands: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 108 Austria: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 109 Austria: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 110 Austria: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 111 Austria: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 112 Austria: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 113 Austria: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 114 Austria: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 115 Rest of Europe: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 116 Rest of Europe: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 117 Rest of Europe: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 118 Rest of Europe: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 119 Rest of Europe: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 120 Rest of Europe: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 121 Rest of Europe: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 122 Asia-Pacific: Biodiesel Market Size, by Country/Region, 2020–2029 (USD Million)

Table 123 Asia-Pacific: Biodiesel Market Size, by Country/Region, 2020–2029 (Million Liters)

Table 124 Asia-Pacific: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 125 Asia-Pacific: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 126 Asia-Pacific: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 127 Asia-Pacific: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 128 Asia-Pacific: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 129 Asia-Pacific: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 130 Asia-Pacific: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 131 Indonesia: Biodiesel Mandatory Targets

Table 132 Indonesia: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 133 Indonesia: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 134 Indonesia: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 135 Indonesia: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 136 Indonesia: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 137 Indonesia: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 138 Indonesia: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 139 Thailand: Diesel Consumption (Million Liters)

Table 140 Thailand: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 141 Thailand: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 142 Thailand: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 143 Thailand: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 144 Thailand: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 145 Thailand: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 146 Thailand: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 147 Export of Biodiesel to Major Countries by Thailand, 2020/2019 (Million Liters)

Table 148 Malaysia: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 149 Malaysia: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 150 Malaysia: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 151 Malaysia: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 152 Malaysia: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 153 Malaysia: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 154 Malaysia: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 155 China: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 156 China: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 157 China: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 158 China: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 159 China: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 160 China: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 161 China: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 162 India: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 163 India: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 164 India: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 165 India: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 166 India: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 167 India: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 168 India: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 169 Philippines: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 170 Philippines: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 171 Philippines: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 172 Philippines: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 173 Philippines: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 174 Philippines: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 175 Philippines: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 176 Rest of Asia-Pacific: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 177 Rest of Asia-Pacific: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 178 Rest of Asia-Pacific: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 179 Rest of Asia-Pacific: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 180 Rest of Asia-Pacific: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 181 Rest of Asia-Pacific: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 182 Rest of Asia-Pacific: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 183 North America: Biodiesel Market Size, by Country, 2020–2029 (USD Million)

Table 184 North America: Biodiesel Market Size, by Country, 2020–2029 (Million Liters)

Table 185 North America: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 186 North America: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 187 North America: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 188 North America: Microbial Biodiesel Market Size, for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 189 North America: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 190 North America: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 191 North America: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 192 U.S.: Biodiesel Data (2021)

Table 193 U.S: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 194 U.S: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 195 U.S: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 196 U.S: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 197 U.S: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 198 U.S: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 199 U.S: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 200 Canada: Biodiesel Consumption, Imports, And Exports (2019–2021)

Table 201 Canada: Biodiesel Production Capacity (2019–2021)

Table 202 Canada: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 203 Canada: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 204 Canada: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 205 Canada: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 206 Canada: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 207 Canada: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 208 Canada: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 209 Latin America: Biodiesel Market Size, by Country, 2020–2029 (USD Million)

Table 210 Latin America: Biodiesel Market Size, by Country, 2020–2029 (Million Liters)

Table 211 Latin America: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 212 Latin America: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 213 Latin America: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 214 Latin America: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 215 Latin America: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 216 Latin America: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 217 Latin America: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 218 Biodiesel Use Mandate in Brazil

Table 219 Brazil: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 220 Brazil: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 221 Brazil: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 222 Brazil: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 223 Brazil: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 224 Brazil: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 225 Brazil: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 226 Colombia: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 227 Colombia: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 228 Colombia: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 229 Colombia: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 230 Colombia: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 231 Colombia: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 232 Colombia: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 233 Argentina: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 234 Argentina: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 235 Argentina: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 236 Argentina: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 237 Argentina: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 238 Argentina: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 239 Argentina: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 240 Mexico: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 241 Mexico: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 242 Mexico: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 243 Mexico: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 244 Mexico: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 245 Mexico: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 246 Mexico: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 247 Rest of Latin America: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 248 Rest of Latin America: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 249 Rest of Latin America: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 250 Rest of Latin America: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 251 Rest of Latin America: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 252 Rest of Latin America: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 253 Rest of Latin America: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 254 Middle East & Africa: Biodiesel Market Size, by Blend, 2020–2029 (USD Million)

Table 255 Middle East & Africa: Biodiesel Market Size, by Blend, 2020–2029 (Million Liters)

Table 256 Middle East & Africa: Biodiesel Market Size, by Feedstock, 2020–2029 (USD Million)

Table 257 Middle East & Africa: Biodiesel Market Size for Vegetable Oils, by Type, 2020–2029 (USD Million)

Table 258 Middle East & Africa: Biodiesel Market Size for Animal Fats, by Type, 2020–2029 (USD Million)

Table 259 Middle East & Africa: Biodiesel Market Size, by Application, 2020–2029 (USD Million)

Table 260 Middle East & Africa: Biodiesel Market Size for Fuel, by Type, 2020–2029 (USD Million)

Table 261 Number of Developments by Major Players During 2019–2022

Table 262 Archer Daniels Midland Biodiesel Production in U.S.

Table 263 Ag Processing Inc Biodiesel Production

Table 264 Avril Group Biodiesel Production Capacity

Table 265 Bunge Biodiesel Production

Table 266 Cargill, Incorporated: Biodiesel Production

Table 267 Emami Limited Biodiesel Production

Table 268 Futurefuel Corporation Biodiesel Production

Table 269 Louis Dreyfus Company B.V. Biodiesel Production

Table 270 Münzer Bioindustrie Gmbh Biodiesel Production

Table 271 Renewable Energy Group, Inc Biodiesel Production

Table 272 Verbio Vereinigte Bioenergie Ag Biodiesel Production

Table 273 Wilmar International Limited Biodiesel Production

Table 274 World Energy LLC Biodiesel Production

List of Figures

Figure 1 Market Ecosystem

Figure 2 Research Process

Figure 3 Key Secondary Sources

Figure 4 Primary Research Techniques

Figure 5 Key Executives Interviewed

Figure 6 Breakdown of Primary Interviews (Supply-Side & Demand-Side)

Figure 7 Market Size Estimation

Figure 8 The B10 Segment is Expected to Register the Highest CAGR

Figure 9 The Vegetable Oil Segment is Expected to Register the Highest CAGR

Figure 10 The Fuel Segment is Expected to Register the Highest CAGR

Figure 11 Europe is Expected to Be the Largest Biodiesel Market by 2029

Figure 12 Market Dynamics

Figure 13 Life Cycle Emissions for Petroleum Diesel and Biodiesel Blends

Figure 14 Global Biodiesel Consumption, 2015–2021(Million Liters)

Figure 15 Global Electric Car Fleet, 2015–2021

Figure 16 Global Biodiesel Market Size, by Blend, 2022 Vs. 2029 (USD Million)

Figure 17 Global Biodiesel Market Size, by Blend, 2022 Vs. 2029 (Million Liters)

Figure 18 Global Biodiesel Market Size, by Feedstock, 2022 Vs. 2029 (USD Million)

Figure 19 Global Biodiesel Market Size, by Application, 2022 Vs. 2029 (USD Million)

Figure 20 New Passenger Vehicle Registration, by Region (2021)

Figure 21 Biodiesel Market Size, by Region, 2022–2029 (USD Million)

Figure 22 Biodiesel Market Size, by Region, 2020–2029 (Million Liters)

Figure 23 Europe: Biodiesel Production in Million Liters (2015–2021)

Figure 24 Europe: Biodiesel Market Snapshot

Figure 25 France: Biodiesel Production in Million Liters (2015–2021)

Figure 26 Germany: Biodiesel Production in Million Liters (2015–2021)

Figure 27 Spain: Biodiesel Production in Million Liters (2015–2021)

Figure 28 U.K: Biodiesel Production in Million Liters (2015–2021)

Figure 29 U.K: Biodiesel Consumption in the Transport Sector (2015–2021) (Million Liters)

Figure 30 Italy: Import of Biodiesel from Other Countries, 2020 (Tons)

Figure 31 Italy: Biodiesel Production in Million Liters (2015–2021)

Figure 32 Poland: Biodiesel Production in Million Liters (2015–2021)

Figure 33 Netherlands: Biodiesel Production in Million Liters (2015–2021)

Figure 34 Austria Biodiesel Production in Million Liters (2015–2021)

Figure 35 Asia-Pacific: Biodiesel Production in Million Liters (2015–2021)

Figure 36 Asia-Pacific: Biodiesel Market Snapshot

Figure 37 Indonesia: Biodiesel Production in Million Liters (2015–2021)

Figure 38 Thailand: Biodiesel Production in Million Liters (2015–2021)

Figure 39 Malaysia: Biodiesel Production in Million Liters (2015–2021)

Figure 40 China: Biodiesel Production in Million Liters (2015–2021)

Figure 41 China: Biodiesel Exports (2016–2020)

Figure 42 India: Biodiesel Production in Million Liters (2015–2021)

Figure 43 Biodiesel Plant Capacity Utilization in the Philippines, 2015–2021 (In Million Liters)

Figure 44 North America: Biodiesel Production in Million Liters (2015–2021)

Figure 45 North America: Biodiesel Market Snapshot

Figure 46 U.S.: Biodiesel Production in Million Liters (2015–2021)

Figure 47 Canada: Biodiesel Production in Million Liters (2015–2021)

Figure 48 Latin America: Biodiesel Production in Million Liters (2015–2021)

Figure 49 Latin America: Biodiesel Market Snapshot

Figure 50 Brazil: Biodiesel Production in Million Liters (2015–2021)

Figure 51 Colombia: Biodiesel Production in Million Liters (2015–2021)

Figure 52 Argentina: Biodiesel Production in Million Liters (2015–2021)

Figure 53 Middle East & Africa: Biodiesel Production in Million Liters (2015–2021)

Figure 54 Middle East & Africa: Biodiesel Market Snapshot

Figure 55 Key Growth Strategies Adopted by Leading Players, 2019-2022

Figure 56 Global Biodiesel Market: Competitive Benchmarking

Figure 57 Global Biodiesel Market Share Analysis, by Key Players (2021)

Figure 58 Archer Daniels Midland Co: Financial Overview, 2021

Figure 59 Avril Group: Financial Overview, 2021

Figure 60 Bunge Limited: Financial Overview, 2021

Figure 61 Cargill, Incorporated: Financial Overview, 2021

Figure 62 Emami Limited: Financial Overview, 2021

Figure 63 Futurefuel Corporation: Financial Overview, 2021

Figure 64 Louis Dreyfus Company B.V.: Financial Overview, 2021

Figure 65 Renewable Energy Group, Inc: Financial Overview, 2021

Figure 66 Verbio Vereinigte Bioenergie Ag: Financial Overview, 2021

Figure 67 Wilmar International Limited: Financial Overview, 2021

Published Date: May-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates