Resources

About Us

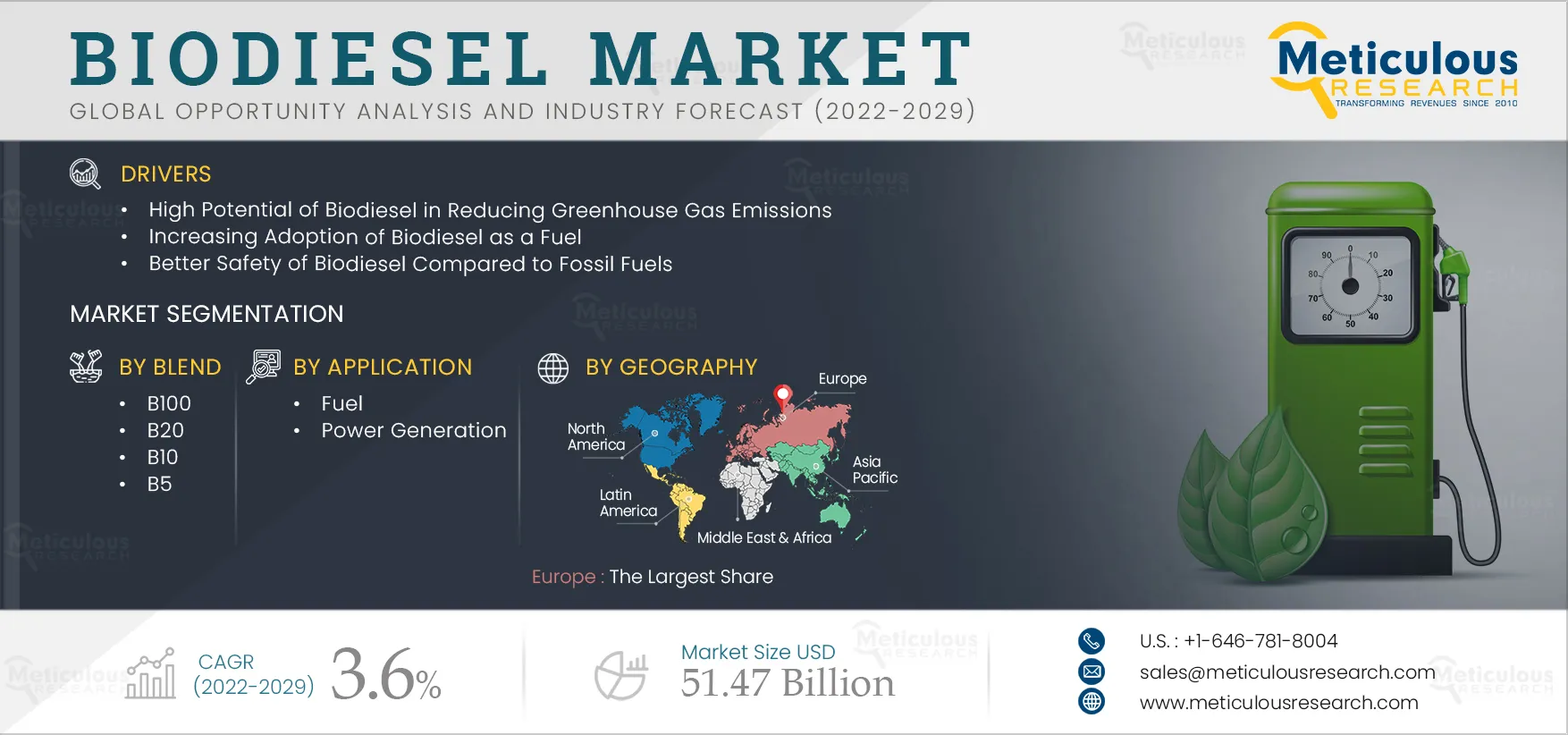

Biodiesel Market by Blend (B100, B20, B10, B5), Feedstock (Vegetable Oils {Rapeseed Oil, Palm Oil}, Animal Fats {Poultry, Tallow}), Application (Fuel {Automotive, Marine, Agriculture}), and Geography - Global Forecast to 2029

Report ID: MRCHM - 104663 Pages: 284 Oct-2022 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of this market is driven by the increase in consumption of biodiesel, the rising environmental concerns, and the increasing demand for sustainable fuels in transportation and power generation. However, performance concerns in diesel engines are expected to hinder the growth of this market to a certain extent. Moreover, government support from North America, Latin America, Europe, and Asia-Pacific countries is expected to offer significant growth opportunities for players operating in the biodiesel market.

The COVID-19 pandemic adversely hit many economies. Complete lockdown and quarantine to curb the spread of the virus adversely impacted many industries globally. Manufacturing facilities worldwide were shut down during the initial stages of the pandemic. The automotive industry was among the most affected industries during the pandemic. Along with logistics and freight transportation, the biodiesel market registered interruptions in the value chain, from raw materials supply to government shortages and distribution.

The movement restrictions of workers during the pandemic declined the demand for biodiesel from the automotive industry, resulting in the closure of production facilities. The production and trade movements were also affected due to the repeated lockdowns. The decline in business for a few initial months in 2020, coupled with lower demand from a few major markets, put pressure on the profitability of biodiesel manufacturers and vendors.

The effects of the COVID-19 pandemic on this market were felt in the Latin America region, starting in 2020. The region is one of the largest biodiesel consumers.

Therefore, a complete halt in the transportation and logistics industry and reduced production in some countries due to lockdowns adversely affected the global biodiesel market in terms of volume sales in 2020 and 2021. For instance, according to the OECD/FAO, the global biodiesel consumption reduced to 48.22 billion liter in 2020 and 49.11 billion liter in 2021, from 49.61 billion liter in 2019. However, with the ease of lockdown restrictions, there has been a sudden demand for industrialization activities, likely to boost the biodiesel market's growth.

Click here to : Get Free Sample Pages of this Report

The increasing adoption of biodiesel as an alternative for fossil fuels by automotive and power generation sectors and the rising awareness regarding environmental concerns such as greenhouse gas emissions, etc., are major factors driving the growth of the global biodiesel market.

Transportation fuels are used to power vehicles such as cars, trucks, buses, and trains. They are non-toxic and biodegradable and have a high energy density. Furthermore, they can be easily transported from one place to another. According to lowa Renewable Fuels Association, biodiesel reduces particulate matter by 47% and hydrocarbon emissions by up to 67%. Additionally, the production of biodiesel, instead of petroleum diesel, reduces wastewater by 79% and hazardous waste by 96%. Each gallon of biodiesel usage saves 4 gallons of fossil fuels. According to the National Biodiesel Board, approximately 3 billion gallons of biodiesel were consumed in the U.S. in 2019. This reduced carbon emissions by more than 25 Million Metric Tons. The rising usage of biodiesel to replace fossil fuels in transportation is a major factor driving the growth of the biodiesel market.

Industrial fuels are used in a variety of industries, such as power generation and heating oil. Biodiesel is used as heating oil in commercial & domestic broilers. Using B100 blends in power generation helps generators eliminate the byproducts which result in smog, ozone, and sulfur emissions. These generators are used in residential areas around schools and hospitals to reduce poisonous emissions. The rising usage of biodiesel to replace conventional fossil fuels in automotive and power generation applications is estimated to drive the growth of the biodiesel market.

Based on blend, the biodiesel market is segmented into B100, B20, B10, and B5. The B100 segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the higher preference for B100 due to its benefits, such as lesser flammability than petroleum diesel, low-pressure storage at ambient temperatures, and safer handling and transport. Furthermore, compared to the remaining biodiesel blends, the B100 biodiesel emits less carbon dioxide, carbon monoxide, sulfur, particulates and hydrocarbons.

Based on feedstock, the market is segmented into vegetable oils, animal fats, used cooking oil (UCO), and others. In 2022, the vegetable oils segment is expected to account for the largest share of the global biodiesel market. The large market share of this segment is attributed to factors such as the higher use of vegetable oil as a renewable resource for biodiesel production, less greenhouse gas emissions, high oil yield, and less percentage of saturated fat, hence reducing the cost of production. Most biodiesel products come from vegetable oils; however, the source of vegetable oil varies considerably with location. For instance, soybean oil is the most common feedstock used in biodiesel production in the U.S., whereas rapeseed oil is commonly used in many European countries for biodiesel production. Furthermore, palm oil has been widely used in the production of biodiesel in countries such as Indonesia, Thailand, Germany, France, and Colombia.

Based on application, the biodiesel market is segmented into fuel, power generation, and other applications. The power generation segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing use of biodiesel in generators to reduce poisonous carbon monoxide and particulate matter. Moreover, the increasing attempts by governments to adopt renewable energy sources to generate power are expected to offer significant growth opportunities for players operating in the biodiesel market.

Based on geography, the biodiesel market is segmented into five major geographies: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2022, Europe is expected to account for the largest share of the global biodiesel market. The large share of this regional market is attributed to the increasing support from the government and the growing preferences for renewable energy sources. Moreover, the growing demand for biodiesel from end-users, including automotive, power generation, marine, railway, and agriculture, is expected to boost the biodiesel market growth in Europe.

Key Players

The key players operating in the global biodiesel market are Archer-Daniels-Midland Company (U.S.), Ag Processing Inc (U.S.), Avril Group (France), Biodiesel Bilbao S.L. (a subsidiary of Bunge Limited) (Spain), Cargill Inc (U.S.), Emami Agrotech Ltd (part of Emami Limited), FutureFuel Chemical Company (U.S.), G-Energetic Biofuels Private Limited (India), Louis Dreyfus Company (Netherlands), Münzer Bioindustrie GmbH (Austria), Renewable Energy Group (U.S), VERBIO Vereinigte BioEnergie AG (Germany), Wilmar International Limited (Singapore), and World Energy LLC (U.S.).

Key Questions Answered in the Report-

Biodiesel is non-toxic, clean-burning, biodegradable, made from renewable resources, and an environmentally friendly alternative fuel. This biodiesel market study provides valuable insights across various key segments, such as market by blend, feedstock, application, and geography.

The biodiesel market is projected to reach $51.47 billion by 2029, at a CAGR of 3.6% during the forecast period.

The power generation segment is slated to register the fastest growth rate during the forecast period. The growth of this market is attributed to the increasing use of generators to reduce poisonous carbon monoxide and particulate matter. Moreover, the increasing government attempt to adopt renewable energy sources to generate power is expected to offer significant growth opportunities for players operating in the biodiesel market.

The growth of this market is driven by the increase in consumption of biodiesel, the rising environmental concerns, and the increasing demand for biodiesel to replace fuels in transportation and power generation.

Performance concerns in diesel engines are expected to hinder the growth of this market to a certain extent.

The key players operating in the global biodiesel market are Archer-Daniels-Midland Company (U.S.), Ag Processing Inc (U.S.), Avril Group (France), Biodiesel Bilbao S.L. (a subsidiary of Bunge Limited) (Spain), Cargill Inc (U.S.), Emami Agrotech Ltd (part of Emami Limited), FutureFuel Chemical Company (U.S.), G-Energetic Biofuels Private Limited (India), Louis Dreyfus Company (Netherlands), Münzer Bioindustrie GmbH (Austria), Renewable Energy Group (U.S), VERBIO Vereinigte BioEnergie AG (Germany), Wilmar International Limited (Singapore), and World Energy LLC (U.S.).

Asia-Pacific is slated to register the highest CAGR during the forecast period of 2022—2029. The fast growth of this market is attributed to factors such as the increasing government blend mandates and environmental concerns over petroleum diesel usage. Furthermore, the growing preference for replacing fossil fuels, which are related to higher greenhouse gas emissions, is persuading demand growth in these countries. Hence, with the increasing blend percentage in countries such as Indonesia, Thailand, Malaysia, and India, the Asia-Pacific region is projected to witness the fastest growth rate during the forecast period.

Published Date: May-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates