Resources

About Us

Smart Coatings Market by Type (Self-Healing, Self-Cleaning, Anti-Corrosion, Anti-Microbial, Anti-Icing, Thermochromic, Electrochromic), Technology (Nanotechnology-Based), Application (Automotive, Aerospace, Construction, Marine,), End User, and Geography- Global Forecast to 2035

Report ID: MRCHM - 1041602 Pages: 256 Sep-2025 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Smart Coatings Market Size?

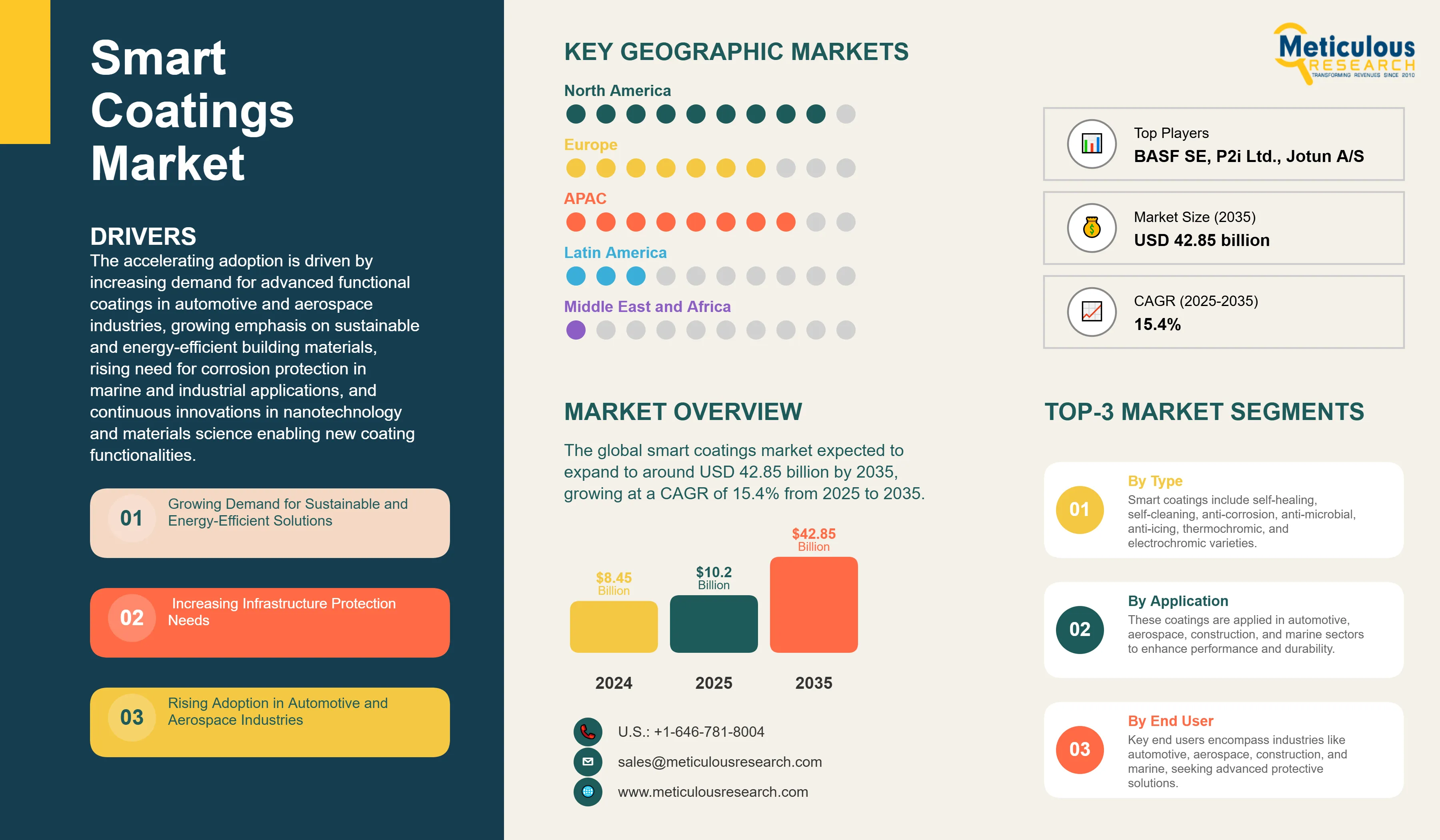

The global smart coatings market was valued at USD 8.45 billion in 2024. This market is expected to reach USD 42.85 billion by 2035 from USD 10.2 billion in 2025, at a CAGR of 15.4% from 2025 to 2035. The growth of this market is driven by increasing demand for advanced functional coatings in automotive and aerospace industries, growing emphasis on sustainable and energy-efficient building materials, rising need for corrosion protection in marine and industrial applications, and continuous innovations in nanotechnology and materials science enabling new coating functionalities.

Market Highlights: Smart Coatings

Click here to: Get Free Sample Pages of this Report

The smart coatings market involves developing, producing, and applying innovative coating materials that react to environmental changes or offer improved features beyond standard coatings. These intelligent surface treatments use responsive materials, nanoparticles, microencapsulated compounds, or biomimetic structures. This technology enables self-repair, adjustable optical properties, better protection, or active surface changes. Smart coatings can heal scratches, repel water and dirt, change color based on temperature or light, stop microbial growth, prevent ice buildup, or resist corrosion effectively.

The technology builds on new developments in materials science, nanotechnology, polymer chemistry, and surface engineering. Smart coatings have programmable features that allow them to actively engage with their surroundings for better performance. Unlike regular coatings that only provide a protective barrier or visual appeal, smart coatings interact with their environment. The market is driven by strict environmental rules pushing for eco-friendly coatings, rising infrastructure maintenance costs that create a need for durable solutions, a growing consumer desire for low-maintenance products, expanding uses in areas like renewable energy and medical devices, and significant research investments from chemical companies and research institutions that improve coating options.

What are the Key Trends in the Smart Coatings Market?

Bio-inspired and biomimetic coatings: A big trend in the smart coatings market is creating bio-inspired coatings that copy natural mechanisms found in plants, animals, and microorganisms. Researchers are making coatings that mimic lotus leaf superhydrophobicity for self-cleaning surfaces; shark skin microstructures for anti-fouling marine uses; butterfly wing nanostructures for generating structural color; and gecko foot adhesion for reversible bonding. These biomimetic methods often provide better performance with less environmental impact compared to traditional chemical options. The trend meets growing sustainability demands and opens new use cases in architecture, transportation, and consumer products.

Multifunctional hybrid coatings: Another major trend driving market growth is combining various smart features into a single coating system. Manufacturers are creating hybrid coatings that offer self-healing, anti-corrosion, anti-fouling, and UV protection at the same time, eliminating the need for multiple layers. These multifunctional solutions simplify application, lower overall costs, and enhance performance. New formulation techniques allow the combining of previously incompatible features, such as electrochromic properties with self-cleaning features for smart windows. This trend is especially valuable in aerospace and automotive fields, where weight, space, and performance optimization are crucial.

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 42.85 Billion |

|

Market Size in 2025 |

USD 10.20 Billion |

|

Market Size in 2024 |

USD 8.45 Billion |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 15.4% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Type, Technology, Application, End User, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Sustainable and Energy-Efficient Solutions

A key factor driving the smart coatings market is the growing global focus on sustainability and energy efficiency in various industries. Governments around the world are enforcing stricter building energy codes. These codes require better thermal management and lower HVAC use, which promotes the use of thermochromic and electrochromic window coatings that control solar heat gain. The construction sector is turning to self-cleaning coatings that lower water use and eliminate the need for harsh chemical cleaners. This helps support green building certifications like LEED and BREEAM. Self-healing coatings also extend product lifespans, which cuts down on material waste and reduces the environmental impact of making replacements. Anti-corrosion smart coatings protect infrastructure and industrial equipment from material breakdown, decreasing the need for maintenance. The automotive industry is using smart coatings to boost fuel efficiency by cutting drag with hydrophobic coatings, improve durability, and support lighter material strategies. These applications driven by sustainability meet corporate ESG commitments and regulatory pressures, creating strong demand across many sectors.

Restraint

High Initial Costs and Limited Awareness

Despite its significant growth potential, the smart coatings market has challenges related to high costs and a lack of market education. Smart coatings often cost 2-5 times more than traditional coatings. This is due to expensive materials like nanoparticles, special polymers, and particular additives. The manufacturing processes are also complex, requiring precise control and quality checks. This price gap makes cost-sensitive customers and industries hesitant, especially in competitive areas like residential construction and consumer products. Many potential end users do not understand what smart coatings can do and the long-term benefits they offer. They tend to focus only on initial costs rather than benefits such as lower maintenance, longer durability, and better performance.

The technical complexity of certain smart coating applications needs special equipment and skilled workers, making it hard for smaller companies to adopt them. Additionally, worries about the long-term durability of new technologies, such as self-healing coatings, cause some customers to hesitate without thorough field testing. Guidelines and certification processes for many smart coating types are still developing, leading to uncertainty for those making specifications and purchases. These issues collectively slow down market growth, even with proven technical advantages.

Opportunity

Expanding Healthcare and Medical Device Applications

The healthcare sector offers a rapidly growing opportunity for smart coatings, especially antimicrobial and infection-preventing formulations. Each year, millions of patients are affected by hospital-acquired infections. This drives the demand for antimicrobial coatings on medical equipment, hospital surfaces, door handles, bed rails, and surgical instruments. Smart coatings can provide lasting antimicrobial activity without encouraging bacterial resistance. This addresses a crucial need, especially as antibiotic-resistant pathogens increase. Medical device manufacturers are adding smart coatings to prevent biofilm formation on implants, catheters, and prosthetics. This reduces the risk of infection and improves patient outcomes.

The COVID-19 pandemic raised awareness of surface transmission and the need for antimicrobial protection. This accelerated adoption in healthcare facilities, public transportation, schools, and commercial buildings. Self-cleaning coatings are also used in medical settings, helping to reduce contamination risks and simplify sterilization procedures. The aging global population is increasing the demand for implantable medical devices, which expands the market for biocompatible smart coatings. Regulatory approvals for antimicrobial coatings in medical uses build market trust and support wider adoption. This combination of healthcare needs, regulatory backing, and proven effectiveness positions medical applications as a high-growth area.

Type Insights

Why Do Self-Healing Coatings Lead Market Adoption?

The self-healing coatings segment has the largest share, making up 22-26% of the overall smart coatings market in 2025. This leadership comes from their wide use in automotive, aerospace, marine, and industrial sectors. These coatings address surface damage from scratches, abrasion, and environmental exposure, which can hurt appearance and protective functionality. They contain microencapsulated healing agents or reversible polymer networks that automatically fix minor damage when activated by heat, UV light, or mechanical stress. This process extends the coating's life and keeps its appearance intact without needing manual work.

The automotive industry drives high demand since self-healing clear coats protect vehicle paint from minor scratches and swirl marks. This helps preserve resale value and lowers repainting costs. In aerospace, self-healing coatings are valued for protecting aircraft surfaces from erosion and environmental damage during flight. This technology offers significant savings by reducing maintenance costs and lengthening recoating intervals, which justifies the higher prices. Ongoing innovations are improving healing efficiency, shortening healing times, and widening the types of damage that can be repaired automatically.

The anti-microbial coatings segment is set to grow at the fastest rate through 2035. This growth is due to increased health awareness after the pandemic, more investments in healthcare infrastructure, and broader applications beyond hospitals to schools, public transportation, food processing facilities, and commercial buildings. Regulatory support and efficacy certifications are building trust in the market, while innovations in long-lasting antimicrobial mechanisms are addressing previous concerns about how long they work effectively.

Technology Insights

How Does Nanotechnology Drive Smart Coatings Innovation?

The nanotechnology-based segment holds the largest share of 48-52% of the overall smart coatings market in 2025. Nanotechnology leads because it allows precise control over coating properties at the molecular level, creating features that traditional chemistry cannot achieve. Nanoparticles such as titanium dioxide, silicon dioxide, zinc oxide, and silver offer photocatalytic self-cleaning, excellent UV protection, improved mechanical strength, and antimicrobial properties. Nanostructured surfaces can create superhydrophobic (water-repelling) or superoleophobic (oil-repelling) traits through carefully designed surface textures that mimic natural effects like the lotus effect.

Carbon nanotubes and graphene improve electrical conductivity for anti-static and electromagnetic shielding uses, while also boosting mechanical properties. Nano-encapsulation technology shields reactive components in self-healing formulas until damage prompts their release. This technology's flexibility allows coatings to be customized for specific performance needs across various applications. Major chemical companies have started dedicated research programs in nanotechnology, regularly introducing better nanomaterials that perform well and cost less. As manufacturing processes improve and economies of scale grow, nanotechnology-based coatings are becoming more available to a wider market.

The nanotechnology-based segment is set to keep its leading position throughout the forecast period. Ongoing innovations in nanomaterial creation, safety measures addressing health issues, and a wider range of application options help maintain the technology's top spot. New nanomaterials like metal-organic frameworks (MOFs) and quantum dots hold the potential for added features and improved performance.

Application Insights

How Does the Automotive Sector Drive Smart Coatings Demand?

The automotive segment holds the largest market share, making up about 28 to 32% in 2025. The leadership in the automotive industry comes from its ongoing quest for uniqueness through new materials, strict durability standards, and large research and development budgets that support the adoption of premium features. Automotive manufacturers use self-healing coatings to keep paint looking good and to lower warranty claims for minor damages. Hydrophobic coatings improve visibility in the rain and cut down on cleaning needs, which boosts both safety and convenience. Anti-corrosion smart coatings guard vehicle underbodies and parts against road salt and environmental wear, helping to extend the life of vehicles in tough climates.

Thermochromic coatings allow for aesthetic customization and show temperature changes, while anti-icing coatings enhance safety in cold weather by stopping ice from building up on mirrors, sensors, and windows. The shift toward electric vehicles opens up new chances, as manufacturers work to set EVs apart with premium features, including advanced coatings. The development of autonomous vehicles increases the need for coatings that keep sensors and cameras clean and functional in all conditions. Efforts to reduce weight for longer EV range require protective coatings for aluminum, carbon fiber, and composites. The automotive aftermarket also shows strong demand for DIY-friendly smart coatings that provide professional-grade protection.

The healthcare segment is projected to grow the fastest during the forecast period. Post-pandemic concerns about infection control, an aging population that needs more medical devices, and the growth of healthcare infrastructure in developing markets drive rapid adoption. Regulatory approvals for antimicrobial coatings in medical environments and proven effectiveness in reducing hospital-acquired infections speed up growth in the healthcare sector.

End User Insights

Why Do Automotive OEMs Represent the Largest Smart Coatings End User?

The automotive OEMs segment will hold the largest share of around 24 to 28% in 2025. Original equipment manufacturers lead smart coatings consumption because of high production scales, their role in assembly lines, and their use as premium features in competitive markets. Major automakers like BMW, Mercedes-Benz, Tesla, Toyota, and Audi use self-healing clear coats and advanced protective coatings in their premium models. This technology is gradually trickling down to mainstream vehicles as costs decrease.

OEMs benefit from established relationships with coating suppliers and collaborative development programs that create customized formulations. They can also validate performance through extensive testing before mass production. The segment's purchasing power allows them to negotiate better pricing, even though smart coatings are expensive. By integrating smart coatings during manufacturing, they can ensure the best application and curing conditions for maximum performance. OEMs also use smart coatings as marketing tools, emphasizing advanced features in customer communications and warranty programs. The shift toward electric and autonomous vehicles boosts OEM interest in innovative material technologies, including smart coatings.

The medical device manufacturers segment is expected to grow at the fastest rate through 2035. This rapid growth comes from the increasing complexity of devices, the rising number of implants for aging populations, regulatory focus on infection prevention, and the proven benefits of antimicrobial and anti-fouling coatings for patient outcomes. Medical device companies are actively investing in smart coating integration to set their products apart, extend device lifespan, and tackle clinical challenges like biofilm formation and implant-related infections. The high value of medical devices and the critical need for performance make the premium costs of smart coatings more acceptable, especially compared to price-sensitive sectors.

U.S. Smart Coatings Market Size and Growth 2025 to 2035

The U.S. smart coatings market is projected to be worth around USD 14.50 billion by 2035, growing at a CAGR of 14.8% from 2025 to 2035.

How Does North America Lead the Global Smart Coatings Market?

North America holds the largest market share at nearly 38 to 42% in 2025. The region's dominance comes from several factors, including significant R&D investments by chemical giants like PPG Industries, 3M, Sherwin-Williams, and Axalta Coating Systems, all based in the U.S. These companies run research facilities that develop smart coating technologies and maintain strong intellectual property portfolios. The region also benefits from close collaboration among coating manufacturers, automotive OEMs in Detroit, aerospace firms like Boeing and Lockheed Martin, and leading research universities that focus on materials science.

Strong regulatory frameworks that support green building standards drive the use of energy-efficient coatings in commercial construction. The U.S. Department of Defense and the aerospace sector invest heavily in advanced coatings for military and civilian aircraft, ships, and equipment that need superior protection in tough environments. North America's wealthy consumer base is willing to pay extra for better durability, low maintenance, and improved features, which aids market growth. Well-established distribution networks and technical support help with adoption across various industries. The region's healthcare sector, focused on infection control and quality, boosts the use of antimicrobial coatings in hospitals and medical facilities.

Which Factors Support Asia Pacific Smart Coatings Market Growth?

Asia Pacific is set to grow the fastest from 2025 to 2035. This growth comes from rapid industrialization, a surge in construction in China, India, and Southeast Asian countries, and increased automotive production in the area. China's role as the world’s largest automotive market and manufacturing center creates a huge demand for smart coatings in vehicle production and industrial uses. The country's focus on protecting the environment and promoting sustainable development encourages the use of eco-friendly coatings.

India's Smart Cities initiative and infrastructure projects boost the need for durable, low-maintenance coatings in buildings and transport systems. Japan and South Korea are at the forefront of technological innovation, with companies like Nippon Paint and KCC Corporation creating new smart coating formulations. The region's growing middle class drives demand for premium consumer goods that include smart coatings. Marine applications are important due to the long coastlines and large shipping industries, leading to a need for anti-fouling and anti-corrosion coatings. Government policies supporting renewable energy encourage the use of coatings for solar panels, while the electronics industry requires special protective coatings. Lower manufacturing costs in the region attract investments in coating production, making them more available and affordable.

Key Players:

Recent Developments

Segments Covered in the Report

By Type

By Technology

By Application

By End User

By Region

The smart coatings market size is expected to increase from USD 10.20 billion in 2025 to USD 42.85 billion by 2035.

The smart coatings market is expected to grow at a CAGR of 15.4% from 2025 to 2035.

The major players in the smart coatings market include PPG Industries Inc., Sherwin-Williams Company, Akzo Nobel N.V., Axalta Coating Systems, BASF SE, RPM International Inc., Nippon Paint Holdings Co. Ltd., Jotun A/S, Hempel A/S, Kansai Paint Co. Ltd., Asian Paints Limited, NEI Corporation, Nanopool GmbH, Tesla Nanocoatings Inc., Integran Technologies Inc., Duraseal Coatings Company, CG2 NanoCoatings Inc., Nanogate SE, P2i Ltd., and Reactive Surfaces Ltd. among others.

The main factors driving the smart coatings market include increasing demand for sustainable and energy-efficient solutions, growing emphasis on infrastructure protection and maintenance cost reduction, rising adoption in automotive and aerospace industries, continuous innovations in nanotechnology and materials science, and expanding applications in healthcare and medical devices.

North America region will lead the global smart coatings market during the forecast period 2025 to 2035.

Published Date: Oct-2024

Published Date: Sep-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates