Resources

About Us

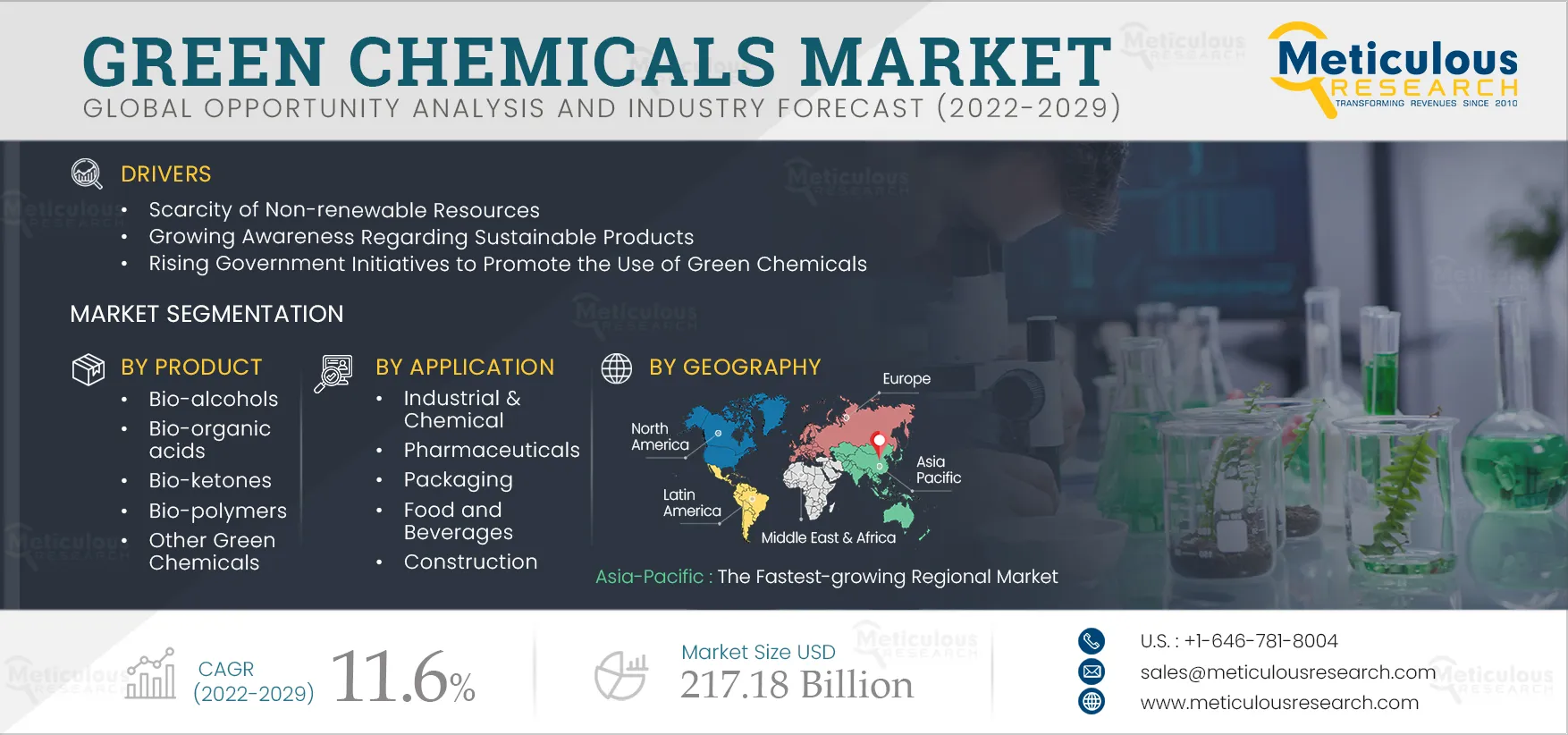

Green Chemicals Market by Type (Bio-alcohols, Bio-polymers, Bio-organic acids, Bio-ketones, Others), Application (Industrial & Chemical, Food & Beverages, Pharmaceuticals, Packaging, Construction, Automotive, Other Industries) - Global Forecasts to 2029

Report ID: MRCHM - 104114 Pages: 167 May-2022 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe Green Chemicals Market is expected to reach a value of $217.18 billion by 2029, at a CAGR of 11.6% during the forecast period 2022–2029. Scarcity of non-renewable resources, growing awareness regarding sustainable products, rising government initiatives to promote the use of green chemicals, growing environmental concerns & the rising demand for bioethanol, and the growing demand for biodiesel as an alternative fuel are the key factors driving the growth of the green chemicals market. The regulations & legislation supporting the use of bioplastics and the growing focus on R&D for algae-based biofuel production provide significant growth opportunities for market players in the coming years.

The COVID-19 pandemic severely affected human health and wellbeing. To control the spread of this disease, governments worldwide announced partial or complete lockdowns, severely impacting many industries, including food & beverage, animal feed, packaging, construction, and automotive, among others.

The lockdowns forced the temporary closure of manufacturing facilities. Governments also enforced restrictions on operating capacities to ensure social distancing and curb the spread of the infection. Supply chains were disrupted, resulting in production limitations, complications in raw materials sourcing, and higher delivery costs, impacting the overall green chemicals market. Moreover, governments announced a temporary ban on foreign air travel. These factors temporarily affected the sales of green chemicals.

The COVID-19 pandemic had a major impact on energy systems worldwide, curbing investments and threatening to slow the expansion of key clean energy technologies. The pandemic slowed the expansion of the biofuel market, as the automotive industry was majorly impacted due to lockdowns, social distances, and the closing of production plants worldwide. For instance, the COVID-19 crisis radically changed the global context for biofuels, with production contracting by 20 billion liters (13%) in 2020, returning to 2017 output levels (Source: BAC-TO-FUEL). Similarly, the textile business was no exception due to enforced lockdowns and imposed limits by individual regulating bodies. Numerous textile businesses were either temporarily halted or operated with a small staff. This element negatively impacted the textile industry's market growth.

The pandemic, like other industries, also impacted the bioplastic industry. During the COVID-19 pandemic, there were unavoidable negative shifts due to a surge in demand for single-use plastics for manufacturing face shields or personal protective equipment and food and groceries delivery packaging. The Japanese Ministry of Finance, Trade, and Industry recorded that more than 600 million face masks were required in April 2020. Also, according to the World Health Organization, an increase of 40% in manufacturing capacity was needed due to the increased demand for surgical masks, examination gloves, and goggles when the COVID-19 pandemic was at its peak. Furthermore, virgin plastic became cheaper than biodegradable plastics due to a decline in oil prices in 2020, negatively impacting the demand for bioplastics.

However, COVID-19 has had a favorable impact on some industries. The demand and use of green chemicals increased in industries like home care products, food, animal feeds, and pharmaceuticals due to increased awareness of a healthy lifestyle. Green cleaning products do not contain chemicals that cause air or water pollution and are often in recyclable or recycled packaging. The impact on some home care products, like surface disinfectants and laundry care, nutraceuticals & dietary supplements, and some pharmaceuticals was particularly high during 2020 and 2021. The sale of these products went up to 96%.

Click here to: Get Free Request Sample Copy of this report

Some of the related examples of the impact on sales and production in the home care products category are as follows:

Moreover, the pandemic underlined the necessity of consuming good, nutritious foods. The clean label trend is evolved in light of COVID-19. The sales of clean label ingredients are estimated to grow by 6.75% annually by 2024 (Source: Sensient Colors LLC). Further, the food and beverage companies are focusing on the healthier, sustainably sourced, and responsibly packaged products, as the consumers are interested in both the sustainability profile of the packaging and where a product's ingredients come from.

Therefore, strong demand for pharmaceuticals, food & beverages, and home care products due to COVID-19 will support the growth of the green chemicals market.

Growing Environmental Concerns & the Rising Demand for Bioethanol Drives the Growth of the Green Chemicals Market

Climate change, pollution, environmental degradation, and resource depletion are major environmental issues. Moreover, the global demand for energy has increased rapidly in recent years. This demand is associated with the increasing human population and its growing needs. With fossil fuels being the dominant energy source, greenhouse gas emissions have become the most significant environmental problem. Upon combustion, all fossil fuels emit carbon dioxide, greenhouse gases, and other harmful air pollutants. Greenhouse gases trap heat in the atmosphere, causing global warming. However, increasing the supply of renewable energy sources can help replace fossil fuels and fulfill the world’s future energy requirements. Hence, developing and utilizing renewable energy sources, such as solar, wind, and bioenergy, have become critical to solving environmental problems.

Bioethanol is a renewable alternative to fossil fuels, produced through the hydrolysis of cellulose from lignocellulosic biomass and fermentation of sugars from different lignocellulosic sources. Bioethanol is a clean-burning fuel considered environmentally safe as its greenhouse gas emissions are significantly lower than fossil fuels. Bioethanol is also cheaper and more environmentally friendly. For instance, according to the International Energy Agency, global ethanol production is anticipated to reach 119 billion liters between 2023 and 2025, with Brazil, China, and India being the key growth markets during this period. Biofuels are expected to meet around 5.4% of road transport energy requirements by 2025, rising from just under 4.8% in 2019.

Hence, growing environmental concerns and the rising demand for bioethanol drive the growth of the green chemicals market.

The Bio-alcohols Segment to Dominate the Green Chemicals Market in 2022

Based on product, the bio-alcohols segment is expected to account for the largest share of the green chemicals market in 2022. The large share of this segment is mainly attributed to the abundant availability of raw materials, rapid urbanization, rising crude oil prices, stringent emission regulations imposed by governments of various countries, and increasing energy consumption.

The Bio-ethanol Segment to Witness the Largest Demand Through 2029

The bio-ethanol segment is expected to account for the largest share of the bio-alcohols market in 2022. The large share of this segment is mainly attributed to the growing environmental concerns that lead to the inclination of manufacturers towards bio-ethanol production, low cost, and abundant raw material availability. However, the bio-butanol segment is expected to grow at the highest CAGR during the forecast period.

The Industrial & Chemicals Segment to Dominate the Green Chemicals Market in 2022

Based on application, the industrial & chemicals segment is expected to account for the larger share of the green chemicals market in 2022. The large share of this segment is mainly attributed to the growing industrialization and urbanization, increasing energy demand across the globe, increase in chemical transparency across the supply chain, and ban on the production and usage of hazardous substances. However, the packaging segment is expected to witness significant growth owing to the growing demand for biodegradable packaging due to their low environmental impact, growing focus on recyclability and sustainability, government emphasis on efficient packaging management, and rising consumer awareness, coupled with increasing bans on single-use plastic.

Asia-Pacific to be the Fastest-growing Regional Market

The European region is expected to account for the largest share of the green chemicals market in 2022, followed by North America, Asia-Pacific, Latin America, and the Middle East & Africa. The large share of this region is primarily attributed to the growing demand for sustainable products, coupled with the presence of prominent players in the region and the rising adoption of green chemicals across different industries, including food & beverages, personal care, automotive, and packaging. In addition, the chemicals industry of the region is increasingly focusing on the production of green chemicals to develop sustainable and eco-friendly solutions.

However, the Asia-Pacific region is expected to witness rapid growth during the forecast period. The growth of this region is mainly driven by the rising consumer and industrial interest in the utilization of clean energy resources to preserve the environment, government actions to ban conventional non-degradable plastics, and investments and initiatives taken by the governments to promote green chemicals.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategies adopted by the leading market participants in the green chemicals market over the last four years. The key players profiled in the green chemicals market are Cargill, Incorporated (U.S.), Mitsubishi Chemical Holdings Corporation (Japan), BASF SE (Germany), DuPont de Nemours, Inc. (U.S.), Koninklijke DSM N.V. (Netherlands), Evonik Industries AG (Germany), SECOS Group Ltd (Australia), Braskem SA (Brazil), Aemetis, Inc. (U.S.), and Albemarle Corporation (U.S.), among others.

Scope of the Report

Green Chemicals Market, by Product

Green Chemicals Market, by Application

Green Chemicals Market, by Geography

Key Questions Answered in the Report:

Published Date: May-2025

Published Date: Apr-2025

Published Date: Feb-2025

Published Date: Aug-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates