Resources

About Us

Natural Fiber Composites Market by Fiber Type (Wood, Hemp, Flax, Jute, Kenaf), Matrix Type (Thermoplastic, Thermoset, Bio-based Polymers), Technology (Compression Molding, Injection Molding, RTM, Vacuum Infusion), Application, and Geography—Global Forecast to 2035

Report ID: MRCHM - 1041610 Pages: 203 Oct-2025 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportWhat is the Natural Fiber Composites Market Size?

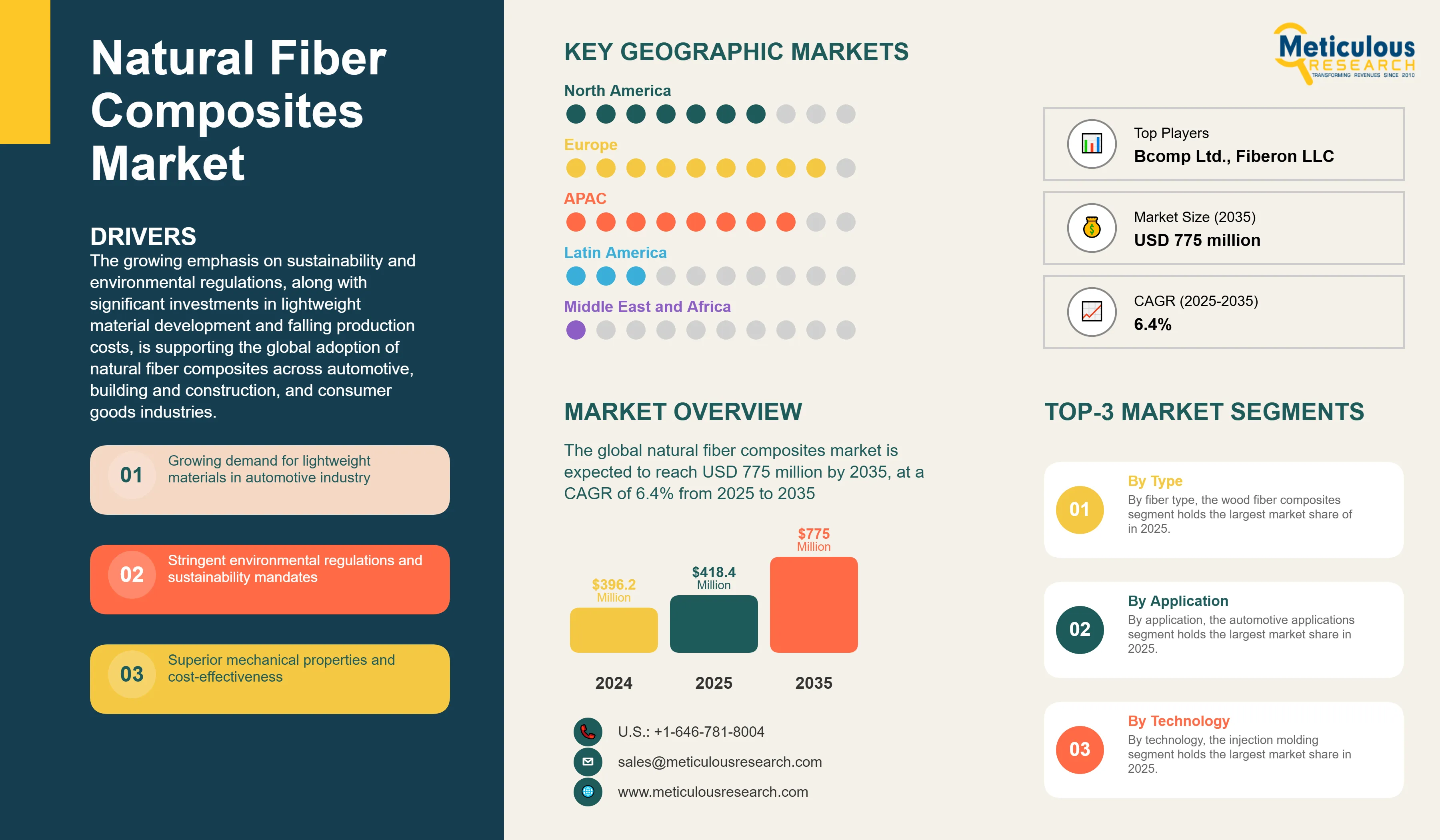

The global natural fiber composites market was valued at USD 396.2 million in 2024. This market is expected to reach USD 775 million by 2035 from USD 418.4 million in 2025, at a CAGR of 6.4% from 2025 to 2035. The growing emphasis on sustainability and environmental regulations, along with significant investments in lightweight material development and falling production costs, is supporting the global adoption of natural fiber composites across automotive, building and construction, and consumer goods industries.

Market Highlights: Natural Fiber Composites

Click here to: Get Free Sample Pages of this Report

The natural fiber composites market includes the design, development, manufacturing, and use of composite materials reinforced with natural fibers. These composites mix plant-based fibers, such as flax, hemp, jute, kenaf, wood, or other cellulosic materials, with polymer matrices (thermoplastic, thermoset, or bio-based). This combination creates lightweight, strong, and environmentally sustainable alternatives to traditional synthetic fiber composites. The manufacturing processes involve compression molding, injection molding, resin transfer molding, pultrusion, and extrusion.

Natural fiber composites offer several environmental advantages over traditional glass or carbon fiber composites. They have a lower carbon footprint, are biodegradable, can be sourced renewably, use less energy during production, and can be recycled at the end of their life. The market is growing due to strict environmental regulations that support sustainable materials. The automotive industry is also focused on weight reduction for improved fuel efficiency. Additionally, there is a rising consumer demand for eco-friendly products, government incentives for bio-based materials, and increased awareness of circular economy principles in important sectors like building and construction, automotive, consumer goods, and packaging.

What are the Key Trends in the Natural Fiber Composites Market?

Hybrid composite systems: A major trend in the natural fiber composites market is the development of hybrid materials that mix natural fibers with synthetic fibers or different types of natural fibers. Companies are creating products that combine flax or hemp with glass fibers to improve sustainability, quality, and cost. This method overcomes some limitations of pure natural fiber composites while keeping their environmental benefits. Hybrid systems provide better resistance to water absorption, stronger mechanical properties for construction uses, better dimensional stability, and wider applications—especially in automotive structural components and high-performance areas where pure natural fiber composites may not perform well.

Circular economy integration: A major trend driving market growth is the use of natural fiber composites in circular economy models. Some manufacturers are creating fully recyclable and biodegradable composites by combining bio-based matrices with natural fibers. This significantly reduces environmental waste. These products are made for easy disassembly and are supported by emerging recycling networks. They are opening up new markets for materials recovered from recycled natural fiber composites.

Automakers and construction companies are starting take-back programs and using recycled natural fiber composites in new products. This circular approach not only improves the environmental value of products but also helps satisfy extended producer responsibility regulations. It encourages new business models focused on reclaiming and reusing materials.

Market Scope

|

Report Coverage |

Details |

|

Market Size by 2035 |

USD 775.0 Million |

|

Market Size in 2025 |

USD 418.4 Million |

|

Market Size in 2024 |

USD 396.2 Million |

|

Market Growth Rate from 2025 to 2035 |

CAGR of 6.4% |

|

Dominating Region |

Europe |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2035 |

|

Segments Covered |

Fiber Type, Matrix Type, Technology, Application, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Lightweight Materials in Automotive Industry

A key factor driving the rapid growth of the natural fiber composites market is the urgent need for lightweight materials in the automotive industry to meet stricter fuel efficiency and emission standards. Natural fiber composites offer significant weight savings, being about 30-40% lighter than conventional materials while still maintaining mechanical strength and durability.

With regulations such as the EU’s CO2 emission target of 95g/km for passenger cars and the U.S. Corporate Average Fuel Economy (CAFE) standards tightening vehicle weight limits, manufacturers face increasing pressure to reduce weight. Even a 10% reduction in vehicle weight can boost fuel efficiency by 6-8%.

Many major automotive OEMs, including BMW, Mercedes-Benz, Ford, Toyota, and Volkswagen, are now using natural fiber composites in various car parts such as interior door panels, dashboards, seat backs, trunk liners, and underbody shields. The shift toward electric vehicles is intensifying this trend. Reducing vehicle weight directly improves battery range and overall performance. This opens up even greater opportunities for natural fiber composites in structural and semi-structural automotive components.

Stringent Environmental Regulations and Sustainability Mandates

Stricter environmental laws around the world are a key factor driving the increased use of natural fiber composites. For instance, the European Union’s End-of-Life Vehicles Directive requires vehicles to be 95% recyclable by weight, which favors biodegradable natural fiber materials. Additionally, REACH regulations limit hazardous substances, making bio-based composites a safer and more practical option. The EU’s Circular Economy Action Plan encourages sustainable design and material reuse, while regulations like California’s Advanced Clean Cars II are advancing automotive sustainability worldwide.

Building codes have changed to require environmentally friendly products backed by Environmental Product Declarations (EPDs) and Life Cycle Assessments (LCAs). Natural fiber composites are notable in this regard, as they have a carbon footprint that is 30-50% lower than traditional glass fiber composites. Leading global brands advocate for sustainability, which affects purchasing decisions and sets higher standards for sustainable material sourcing.

Moreover, policies such as carbon pricing and extended producer responsibility help make natural fiber composites more competitive. Government incentives, including tax credits, grants, and special procurement for bio-based materials, are also promoting adoption in the automotive, construction, and consumer goods sectors.

Opportunity

Expansion in Aerospace and Defense Applications

The increasing interest in sustainable aviation and lightweight defense solutions is creating significant opportunities for the natural fiber composites market. Aircraft manufacturers are investigating these materials for interior cabin panels, overhead bins, seat structures, and secondary components to cut down fuel use and emissions. With the aviation industry aiming for net-zero carbon emissions by 2050, the shift towards bio-based materials is gaining strong traction. Natural fiber composites can provide 20-30% weight savings compared to traditional aluminum structures while maintaining enough strength for many non-critical applications.

In defense, natural fiber composites are being looked at for lightweight armored systems, protective gear, temporary structures, and unmanned aerial vehicle (UAV) parts as environmental sustainability becomes more important. Researchers are working to certify flax-epoxy and hemp-epoxy systems for aerospace applications. Furthermore, the non-conductive nature of natural fibers helps prevent electromagnetic interference (EMI), which is a valuable benefit.

Government efforts aimed at sustainability and lowering the military's environmental impact are creating new procurement opportunities. Although aviation certification requires thorough testing and documentation, achieving it opens access to high-value market segments with strict performance standards, allowing suppliers to charge higher prices.

Fiber Type Insights

Why are Wood Fiber Composites Preferred for Volume Applications?

In 2025, wood fiber composites are expected to hold the largest share of the natural fiber composites market. Their dominance comes from abundant supply, mature processing, cost-effectiveness, and reliable, sustainable sourcing from sawmill residues and recycled wood. Wood-plastic composites (WPC), combining wood fibers with thermoplastics, are especially popular in building and construction, favored for their strong mechanical properties, stability, natural look, and outdoor durability. WPCs are widely used in decking and railing as superior alternatives to pressure-treated lumber, benefiting from established manufacturing infrastructure and testing standards.

Meanwhile, hemp fiber composites are poised for the fastest growth during the forecast period. Hemp’s high tensile strength, excellent vibration damping, fast growth cycle, and low input needs make it an attractive material. The easing of hemp cultivation laws in the U.S., Europe, and Asia has expanded supply. Hemp composites are gaining ground in automotive interiors due to their mechanical strength and performance, supported by advances in processing and farming infrastructure. Emerging applications in semi-structural automotive parts and aerospace interiors highlight hemp’s potential beyond traditional natural fiber uses.

Matrix Type Insights

How do Thermoplastic Matrices Support Market Growth?

In 2025, thermoplastic matrices will dominate the natural fiber composites market because they process quickly, are easily recyclable, and are cost-effective for mass production. Polypropylene (PP) and polyethylene (PE) are particularly popular as they work well with injection molding and extrusion, which are key processes in the automotive and consumer goods industries. Improvements like coupling agents enhance bonding between natural fibers and thermoplastics, leading to strong, moisture-resistant products. The automotive sector’s increasing use of thermoplastic composites in interiors, driven by recycling needs and production efficiency, helps keep this segment strong. New developments in long fiber thermoplastics (LFT) are also broadening their applications in structural uses.

At the same time, bio-based polymers like PLA, PHA, bio-based polyamide, and epoxy are expected to grow the fastest through 2035. When mixed with natural fibers, these polymers create fully sustainable composites that are biodegradable and support circular economy goals. This significantly lowers greenhouse gas emissions. The demand from eco-conscious brands, advancing technology that narrows the performance gap with traditional polymers, and supportive government policies are fueling this growth. As production increases and costs decrease, bio-based composites are becoming more competitive, especially in packaging and consumer goods, where consumers prefer eco-friendly products. Combining natural fibers with bio-based matrices marks a crucial step toward truly sustainable composite materials.

Technology Insights

How Injection Molding Dominates Natural Fiber Composite Manufacturing?

In 2025, injection molding holds the largest share of the overall natural fiber composites market due to its high production efficiency, precise dimensional control, ability to handle complex shapes, and cost-effectiveness for producing high-volume automotive and consumer goods parts. Natural fiber injection molding compounds allow for rapid cycles of 60 to 180 seconds, making them ideal for mass production. Improvements in long fiber injection molding, which can use fibers up to 25 mm long, are boosting mechanical strength and expanding its use in structural parts. This process also reduces barrel wear and energy use compared to glass fibers, benefiting existing automotive manufacturing setups with minimal additional investment.

At the same time, compression molding segment is expected to grow significantly. It is well-suited for larger structural components and high-performance applications where maintaining longer fiber lengths is essential. Compression molding can handle natural fiber mats, woven fabrics, and long fiber compounds, which allow for stronger parts with complex shapes in fewer steps. It is increasingly being used for automotive underbody shields, electric vehicle battery enclosures, and structural floor panels. With lower tooling costs for medium volumes and new fast-curing bio-based resins that cut cycle times, compression molding is becoming a strong option for electric vehicle platforms and high-end applications.

Application Insights

How Automotive Applications Drive the Natural Fiber Composites Market?

In 2025, the automotive sector is at the forefront of the natural fiber composites market. This shift is due to the industry's need for lighter vehicles that improve fuel efficiency and meet emission standards. European carmakers like Mercedes-Benz, BMW, Audi, and Volkswagen are incorporating natural fiber composites into doors, dashboards, seat backs, trunk liners, and underbody shields. These materials can cut interior component weight by 30-40% while keeping crash safety and sound performance intact.

At the same time, the aerospace and defense sector is projected to grow at the fastest CAGR from 2025 to 2035. The aviation industry aims for net-zero carbon emissions by 2050, leading to more interest in sustainable lightweight materials like natural fiber composites for cabin panels, overhead bins, seat structures, and galley components. Ongoing research and testing are bringing these composites closer to aerospace certification. In defense, lightweight protective gear, temporary structures, and unmanned aerial vehicle components are increasingly using eco-friendly solutions, aided by the EMI resistance of natural fibers. Government sustainability mandates are pushing for the use of bio-based materials in defense. Although certification remains difficult and time-consuming, achieving it opens doors to high-value markets and better pricing, justifying further development in demanding aerospace settings.

How is Europe Leading the Natural Fiber Composites Market Dominantly Across the Globe?

Europe holds the largest share of the natural fiber composites market in 2025, driven by some of the world’s strictest environmental laws. Key regulations like the End-of-Life Vehicles Directive (95% recyclability), REACH chemical restrictions, and the ambitious targets under the European Green Deal push sustainability forward. European automotive OEMs, led by German giants BMW, Mercedes-Benz, Audi, and Volkswagen, have been pioneers in using natural fiber composites since the 1990s and continue to expand their applications.

Supportive policies such as the Circular Economy Action Plan and Bioeconomy Strategy provide funding and foster bio-based material development. Strong agricultural sectors in France, the Netherlands, and Germany supply ample flax, hemp, and other natural fibers, backed by established processing infrastructure.

Eco-conscious European consumers actively drive demand, allowing premium pricing for sustainable products. The region’s many universities and research centers continuously innovate in natural fiber composites. Green building initiatives boost LEED and BREEAM ratings, increasing demand for sustainable materials. Government policies favor bio-based products in public procurement, while advanced composting and recycling infrastructure ensure these composites remain practical and cost-effective throughout their lifecycle.

Which Factors Support the Asia-Pacific Natural Fiber Composites Market Growth?

The Asia-Pacific region is projected to grow at the fastest CAGR from 2025 to 2035. Rapid expansion in the automotive industries in China, India, Thailand, and Indonesia, along with growing environmental regulations, is driving demand for sustainable materials. China's New Energy Vehicle policy fuels electric vehicle production, increasing the need for lightweight composites. India benefits from abundant, low-cost natural fibers like jute, coir, and bamboo, supported by government-backed industrial and academic partnerships.

A construction boom across the region also boosts demand for natural fiber composites in building materials, while a rising middle class drives growth in consumer goods seeking sustainable alternatives. Japan leads in composite materials science, and South Korea’s Hyundai and Kia use natural fiber composites to reduce vehicle weight. Low labor costs keep manufacturing competitive on the global stage.

Environmental awareness is growing, encouraging shifts toward biodegradable materials. Government investments support farmers growing industrial fiber crops, helping diversify agriculture and lower raw material costs throughout the region.

Value Chain Analysis

Recent Developments

Segments Covered in the Report

By Fiber Type

By Matrix Type

By Technology

By Application

By Region

The natural fiber composites market is expected to increase from USD 418.4 million in 2025 to USD 775 million by 2035.

The natural fiber composites market is expected to grow at a CAGR of 6.4% from 2025 to 2035.

The major players in the natural fiber composites market include Bcomp Ltd., Polyvlies Franz Beyer GmbH, Trex Company Inc., James Hardie Industries plc, UPM-Kymmene Corporation, FlexForm Technologies LLC, Fiberon LLC, TECNARO GmbH, Green Dot Bioplastics Inc., Procotex Corporation SA, Amorim Cork Composites S.A., Oldcastle APG Inc., Avient Corporation, GreenGran BN, BASF SE, DuPont de Nemours Inc., Weyerhaeuser Company, Sumitomo Bakelite Co. Ltd., UFP Industries Inc., Meshlin Composites Zrt, NPSP BV, International Paper, and JELU-WERK J. Ehrler GmbH & Co. KG among others.

The main factors driving the natural fiber composites market include the growing demand for lightweight materials in the automotive industry to meet fuel efficiency and emission standards. There are stringent environmental regulations promoting sustainable materials. Superior mechanical properties and cost-effectiveness compared to conventional materials are attracting adoption. Additionally, increasing awareness of carbon footprint reduction and circular economy principles is accelerating market growth.

Europe region will lead the global natural fiber composites market during the forecast period 2025 to 2035, driven by the most stringent environmental regulations, pioneering automotive OEM adoption, strong policy support for bioeconomy, and well-established natural fiber supply chains.

Published Date: Jan-2025

Published Date: Apr-2024

Published Date: Oct-2024

Published Date: May-2024

Published Date: Mar-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates