Resources

About Us

Water and Wastewater Treatment Market Size, Share, Forecast, & Trends Analysis by Type (Wastewater Treatment, Water Treatment), Offering (Treatment Technology, Treatment Chemicals), Application (Municipal, Industrial), and Geography - Global Forecast to 2034

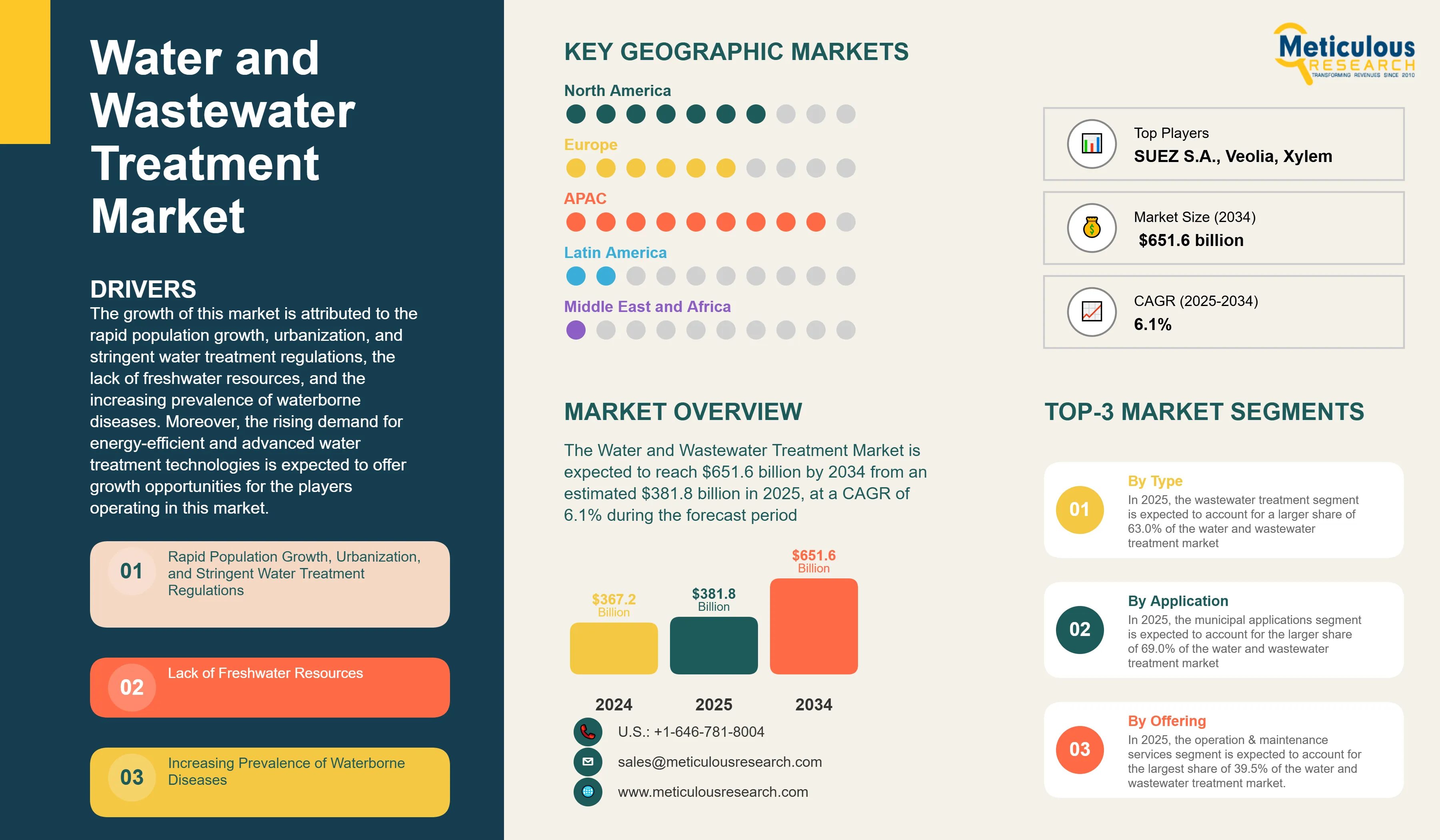

Report ID: MRSE - 104326 Pages: 407 Apr-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market is attributed to the rapid population growth, urbanization, and stringent water treatment regulations, the lack of freshwater resources, and the increasing prevalence of waterborne diseases. Moreover, the rising demand for energy-efficient and advanced water treatment technologies is expected to offer growth opportunities for the players operating in this market.

Click here to: Get Free Sample Pages of this Report

With rapid population growth and urbanization, the global demand for water supply and sanitation services is also increasing. According to the World Health Organization, in 2022, 57% of the global population, or 4.6 billion people, used safely managed sanitation services, while 33% (2.7 billion people) used private sanitation facilities connected to sewers from which wastewater was treated. Thus, the significant use of water supply and sanitation services is driving the adoption of water and wastewater treatment technologies globally.

Furthermore, the growing population has led to an increase in industrial production. Most industries heavily depend on water for the processing, cooling, and disposal of waste products. The demand for water in industrial applications is rising due to increased industrialization. Many industries worldwide are facing a water shortage and are increasingly looking for ways to reduce water consumption and reclaim and reuse wastewater. The planned use of treated wastewater can increase resource efficiency and benefit the environment, improving the sustainability of industrial development. Thus, industrialization, population growth, and urbanization are driving the adoption of water and wastewater treatment solutions, supporting market growth.

Additionally, stringent water treatment regulations are pushing industries and municipalities to adopt advanced water and wastewater treatment solutions. Governments are implementing stricter environmental standards, encouraging technological innovation, and fostering investments in sustainable water management practices, further accelerating market growth and ensuring long-term water resource availability.

Demographic changes, economic development, urbanization, and pollution are increasing the burden on the world’s water resources. According to the World Health Organization (WHO), as of March 2023, approximately 2 billion people worldwide lacked access to safe drinking water, of which 771 million people lacked access even to basic drinking water. The demand for water is projected to exceed the available supply by 40% within the next 20 years, primarily due to issues related to poor sanitation and water management.

Furthermore, companies operating across various industries are investing in water and wastewater treatment solutions. For instance, in September 2022, LANXESS AG (Germany), a chemical manufacturer, commissioned a new wastewater treatment plant at its Belgium site, with an investment of around USD 13.0 million (EUR 12 million). The plant has a treatment capacity of around 260,000 liters of wastewater per hour.

Moreover, rising water pollution has led to a decline in the availability of freshwater necessary for various industrial applications, such as processing, washing, diluting, and cooling. The rapid depletion of freshwater resources, coupled with industrialization and pollution, has resulted in a water crisis in many parts of the world, especially underdeveloped and developing countries. This water crisis is boosting the demand for water and wastewater treatment solutions, driving the growth of this market.

Water and energy have always been crucial for socioeconomic growth; their supply and use must be sustainable. Water provisioning and use require energy in all phases. Water gets treated to drinking water standards through various processes, including filtration, sedimentation, and disinfection, which require energy. Additionally, wastewater treatment plants are essential for ensuring that communities have access to clean water. However, these plants are notorious for being energy-intensive facilities that consume large amounts of electricity. According to the US Environmental Protection Agency (EPA), wastewater treatment plants are the third-largest energy consumers in municipalities, accounting for up to 35% of a city's total energy consumption. Therefore, it is crucial to find ways to increase energy efficiency at these facilities to reduce operating costs and minimize the environmental impact.

Proper maintenance and operation help ensure that motors, pumps, and overall pump systems work efficiently. Pump optimization with SCADA systems or pump optimization software is a secondary consideration. Furthermore, supplying energy-efficient ballasts for plant fluorescent fixtures and ultraviolet disinfection or pretreatment systems can reduce energy consumption.

As energy efficiency becomes a priority, stakeholders are increasingly investing in innovative technologies such as membrane bioreactors, solar-powered desalination, and energy recovery systems. These advancements not only reduce operational costs but also align with global sustainability goals. Moreover, regulatory incentives and public demand for eco-friendly solutions are motivating market players to prioritize the development of energy-efficient water treatment systems, opening new growth avenues and expanding their market presence.

As urban populations expand and industrial zones emerge in remote or underserved regions, decentralized water treatment offers a cost-effective, scalable, and efficient solution compared to traditional centralized systems. These systems are gaining traction in rural areas, industrial clusters, and developing economies where infrastructure is limited or costly to implement.

Simultaneously, the integration of digital technologies such as IoT-enabled sensors, AI-powered analytics, and cloud-based monitoring platforms is transforming water management practices. These smart systems enable real-time monitoring, predictive maintenance, and efficient resource management—offering enhanced transparency, compliance, and operational optimization. Stakeholders that invest in modular, tech-driven, and sustainable solutions will benefit from increasing demand across municipal, industrial, and commercial segments, especially in regions facing water stress, aging infrastructure, and regulatory pressure to enhance water efficiency and quality.

Based on type, the water and wastewater treatment market is segmented into wastewater treatment and water treatment. In 2025, the wastewater treatment segment is expected to account for a larger share of 63.0% of the water and wastewater treatment market. The large market share of this segment is attributed to the rising focus on water quality and public health, the growing prevalence of water-borne diseases and stringent governmental regulations, and the rising expansion of industrialization and urbanization.

Also, this segment is expected to register the highest CAGR during the forecast period due to technological advancements, increased regulatory pressure, rising environmental concerns, enhanced wastewater recycling initiatives, and growing demand for sustainable solutions.

Based on offering, the water and wastewater treatment market is segmented into treatment technologies, treatment chemicals, process control and automation, design, engineering, and construction services, and operation and maintenance services. In 2025, the operation & maintenance services segment is expected to account for the largest share of 39.5% of the water and wastewater treatment market. The segment’s large market share is attributed to the growing need to ensure the production of the desired quality and quantity of treated water, the increasing complexities of water and wastewater treatment facilities, and the adoption of innovative solutions and stringent regulatory standards.

However, the process control & automation segment is projected to register the highest CAGR during the forecast period. The growth of this segment is attributed to the rising concerns regarding water scarcity, declining water quality, rising expenses associated with water supply, and the growing digitalization facilitated by advanced data analysis programs.

Based on application, the water and wastewater treatment market is segmented into municipal applications and industrial applications. In 2025, the municipal applications segment is expected to account for the larger share of 69.0% of the water and wastewater treatment market. The segment’s large market share is attributed to the increasing challenge faced by municipalities in providing safe drinking water to their communities, the rising global population, advancements in treatment processes enabling wastewater recycling for reuse, and the growing adoption of advanced technologies for wastewater treatment, drinking-water production, and trace contaminant removal.

However, the industrial applications segment is expected to register a higher CAGR during the forecast period. The growth of this segment is attributed to the increasing demand for water reuse, regulatory compliance, and sustainable operations across diverse industries. Sectors such as chemicals, power generation, pharmaceuticals, textiles, and food & beverages produce large volumes of contaminated wastewater that require advanced treatment before discharge or reuse. Stricter environmental regulations and growing public scrutiny are compelling industries to invest in modern treatment technologies like membrane filtration, advanced oxidation, and zero-liquid discharge systems. Furthermore, rising water scarcity and the high cost of fresh water are driving industries to adopt water recycling and reuse practices to ensure long-term operational continuity and cost-efficiency. Rapid industrialization in emerging economies, particularly in Asia-Pacific and Latin America, is also fueling demand. Additionally, digital transformation and the integration of smart monitoring systems are making industrial water treatment more efficient, scalable, and responsive, accelerating its adoption across global manufacturing hubs.

In 2025, Asia-Pacific is expected to account for the largest share of above 42.8% of the water and wastewater treatment market. The market growth in Asia-Pacific is driven by the growing need for the advanced treatment of residential water, advances in membrane technology, increased environmental deterioration, declining availability of clean water, and growing research & development expenditures. Countries like China, India, Indonesia, and Vietnam are undergoing significant demographic transitions, with millions migrating to urban areas. This surge in urban population has placed immense pressure on municipal water systems, increasing the demand for clean drinking water and efficient wastewater treatment infrastructure.

Asia-Pacific’s leadership in this market is also reinforced by strong foreign investments and international collaborations. Multinational companies and development organizations are increasingly partnering with local governments and firms to deploy advanced water treatment technologies. Countries like Singapore are setting global benchmarks in integrated water management, showcasing the region's potential for innovation and technology adoption. As a result, Asia-Pacific continues to lead the global water and wastewater treatment market, driven by necessity, policy support, and a growing focus on sustainability.

Moreover, this region is also projected to record the highest CAGR during the forecast period, owing to advancements in membrane technology, rising environmental concerns, decreasing clean water availability, increased public-sector investment in water infrastructure, and a focus on innovative research and development for enhanced treatment solutions, driving rapid market growth.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the water and wastewater treatment market are SUEZ S.A. (France), Veolia Environnement (France), Xylem Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), 3M Company (U.S.), Pentair plc (U.K.), Kingspan Group plc (U.K.), Dow Inc. (U.S.), BASF SE (Germany), Kurita Water Industries, Ltd. (Japan), BioMicrobics, Inc (U.S.), Calgon Carbon Corporation (U.S.), Trojan Technologies (Canada), Kemira Oyj (Finland), Thermax Limited (India), Wog Technologies (Singapore), WSP Global Inc. (Canada), SWA Water Australia (Australia), Burns & McDonnell (U.S.), Adroit Associates Private Limited (India), Sauber Environmental Solutions Pvt. Ltd. (India), SPEC INDIA (India), Ecolab, Inc. (U.S.), GFL Environmental Inc. (Canada), and Clean TeQ Water Limited (Australia).

|

Particulars |

Details |

|

Number of Pages |

407 |

|

Format |

|

|

Forecast Period |

2025–2034 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.1% |

|

Market Size (Value) in 2025 |

USD 381.8 Billion |

|

Market Size (Value) in 2034 |

USD 651.6 Billion |

|

Segments Covered |

By Type

By Offering

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Poland, Switzerland, Sweden, Belgium, Denmark, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Indonesia, Malaysia, Australia, Thailand, Vietnam, Singapore, New Zealand, Philippines, Taiwan, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Chile, Argentina, Rest of Latin America), and the Middle East & Africa (South Africa, Saudi Arabia, UAE, Iran, Kuwait, Rest of Middle East & Africa) |

|

Key Companies |

SUEZ S.A. (France), Veolia Environnement (France), Xylem Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), 3M Company (U.S.), Pentair plc (U.K.), Kingspan Group plc (U.K.), Dow Inc. (U.S.), BASF SE (Germany), Kurita Water Industries, Ltd. (Japan), BioMicrobics, Inc (U.S.), Calgon Carbon Corporation (U.S.), Trojan Technologies (Canada), Kemira Oyj (Finland), Thermax Limited (India), Wog Technologies (Singapore), WSP Global Inc. (Canada), SWA Water Australia (Australia), Burns & McDonnell (U.S.), Adroit Associates Private Limited (India), Sauber Environmental Solutions Pvt. Ltd. (India), SPEC INDIA (India), Ecolab, Inc. (U.S.), GFL Environmental Inc. (Canada), and Clean TeQ Water Limited (Australia) |

The water and wastewater treatment market study focuses on market assessment and opportunity analysis through the sales of water and wastewater treatment across different regions and countries across different market segmentations. This study is also focused on competitive analysis for water and wastewater treatment based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The water and wastewater treatment market is projected to reach $651.6 billion by 2034, at a CAGR of 6.1% during the forecast period.

In 2025, the operation & maintenance services segment is expected to account for the largest share of above 39.5% of the water and wastewater treatment market.

Based on application, the industrial applications segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the rapid population growth, urbanization, and stringent water treatment regulations, the lack of freshwater resources, and the increasing prevalence of waterborne diseases. Moreover, the rising demand for energy-efficient and advanced water treatment technologies is expected to offer growth opportunities for the players operating in this market.

The key players operating in the water and wastewater treatment market are SUEZ S.A. (France), Veolia Environnement (France), Xylem Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), 3M Company (U.S.), Pentair plc (U.K.), Kingspan Group plc (U.K.), Dow Inc. (U.S.), BASF SE (Germany), Kurita Water Industries, Ltd. (Japan), BioMicrobics, Inc (U.S.), Calgon Carbon Corporation (U.S.), Trojan Technologies (Canada), Kemira Oyj (Finland), Thermax Limited (India), Wog Technologies (Singapore), WSP Global Inc. (Canada), SWA Water Australia (Australia), Burns & McDonnell (U.S.), Adroit Associates Private Limited (India), Sauber Environmental Solutions Pvt. Ltd. (India), SPEC INDIA (India), Ecolab, Inc. (U.S.), GFL Environmental Inc. (Canada), and Clean TeQ Water Limited (Australia).

Asia-Pacific is projected to register the highest CAGR of above 6.4% during the forecast period.

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates