Resources

About Us

Battery Passport Software Market Size, Share, Forecast & Trends by Solution Type (Digital Product Passport, Supply Chain Traceability, Compliance Management) Deployment Mode (Cloud-Based, On-Premises, SaaS), and End-Use Industry - Global Forecast to 2035

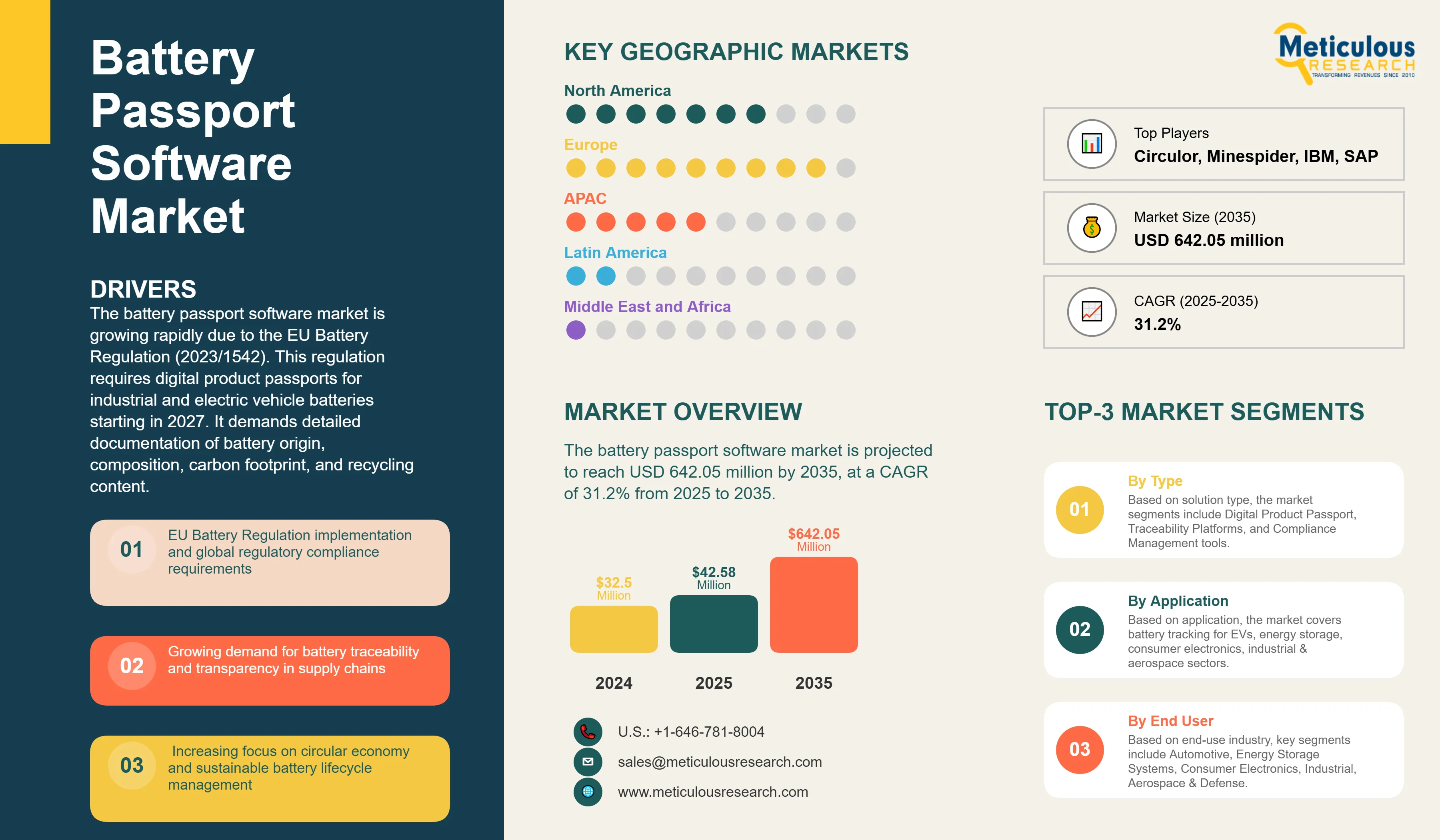

Report ID: MRICT - 1041574 Pages: 260 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe battery passport software market was worth USD 32.50 million in 2024. The market is estimated to be valued at USD 42.58 million in 2025 and is projected to reach USD 642.05 million by 2035, at a CAGR of 31.2% from 2025 to 2035.

Battery Passport Software Market - Key Highlights

|

Metric |

Value |

|

Market Value (2025) |

USD 42.58 million |

|

Market Value (2035) |

USD 642.05 million |

|

CAGR (2025-2035) |

31.2% |

|

Largest Solution Segment |

Digital Product Passport (35-40% share) |

|

Fastest Growing Solution |

Lifecycle Management Solutions (24.2% CAGR) |

|

Leading Deployment Mode |

Cloud-Based Solutions (45-50% share) |

|

Dominant End-Use Industry |

Automotive Industry (40-45% share) |

|

Fastest Growth Region |

Europe (24.8% CAGR) |

|

Top Country by CAGR |

Germany (26.5%) |

|

Market Concentration |

Top 5 players hold 35-40% share |

Battery Passport Software Market Overview

Click here to: Get Free Sample Pages of this Report

Why is the Global Battery Passport Software Market Growing?

The battery passport software market is growing rapidly due to the EU Battery Regulation (2023/1542). This regulation requires digital product passports for industrial and electric vehicle batteries starting in 2027. It demands detailed documentation of battery origin, composition, carbon footprint, and recycling content. As a result, there is a significant need for tracking solutions. The shift to electric vehicles is speeding up this demand. Over 14 million EVs will be sold worldwide in 2024, and each one needs detailed battery documentation for compliance and warranty management.

The market growth is also supported by strict ESG reporting requirements and corporate sustainability goals that require clear supply chain visibility. Major automotive manufacturers like BMW, Mercedes-Benz, and Volkswagen are investing heavily in battery traceability systems. Each implementation costs between USD 50-100 million. The global move towards circular economy principles is increasing the need for tracking throughout a battery's lifecycle. This helps improve battery recycling and second-life applications.

Technological advancements in blockchain, artificial intelligence, and IoT integration are improving solution capabilities while lowering implementation costs. Real-time monitoring systems, predictive analytics for battery health, and automated compliance reporting are boosting efficiency. The rising focus on human rights due diligence in battery supply chains, especially with regards to cobalt and lithium mining, is opening up further market opportunities for effective traceability solutions.

Battery Passport Software Market Size and Forecast

|

Metric |

Value |

|

Battery Passport Software Market Value in (2025) |

USD 42.58 million |

|

Battery Passport Software Market Forecast Value in (2035 F) |

USD 642.05 million |

|

Forecast CAGR (2025 to 2035) |

31.2% |

Market Segmentation

The battery passport software market has been segmented based on solution type, deployment mode, component, battery type, end-use industry, enterprise size, and geography. Based on solution type, the market is segmented into Digital Product Passport, Supply Chain Traceability Platforms, Compliance Management Systems, Lifecycle Management Solutions, Carbon Footprint Tracking, and Due Diligence Tools. By deployment mode, the market is segmented into Cloud-Based, On-Premises, and Software-as-a-Service (SaaS). The battery passport software market is segmented by region into Europe, North America, Asia-Pacific, Latin America, and the Middle East & Africa.

Digital Product Passport Solutions Lead Battery Passport Software Market with 35-40% Share

Digital Product Passport (DPP) solutions hold a strong position in the battery passport software market with a share of 35-40%. They serve as the main technology for meeting regulations and ensuring supply chain transparency. These solutions create unique digital identities for batteries using QR codes, RFID, or NFC technologies. They store detailed information including manufacturing details, material composition, performance metrics, and sustainability data throughout the battery's lifecycle.

The technology segment leads because it is a requirement under EU regulations. There is also a growing adoption by automotive manufacturers as they prepare for compliance deadlines in 2027. DPP solutions work with current manufacturing systems, capturing real-time production data and allowing smooth information flow across supply chains. Leading platforms support various data formats and international standards. This ensures that operations around the world can work together while keeping data secure and private.

The rise in adoption is driven by improvements in data visualization and user interface design. These make complicated battery information easier to access for different groups, including manufacturers, regulators, recyclers, and end consumers. As regulations grow globally and sustainability reporting becomes more common, Digital Product Passport solutions will remain the key technology for ensuring battery transparency and traceability.

Automotive Industry Application Dominates Battery Passport Software Market with 40-45% Share in 2025

The automotive sector leads the battery passport software market with a 40-45% share. This growth is driven by the fast shift to electric vehicles and strict requirements for EV battery documentation. Major car manufacturers are committed to carbon neutrality. Companies like General Motors, Ford, and Stellantis are investing billions in electric vehicle production and need solid battery tracking systems.

The automotive segment keeps expanding due to increased EV production capacity worldwide. More than 200 new battery manufacturing plants are planned between 2025 and 2030. Original Equipment Manufacturers (OEMs) are putting in place battery passport systems that cost between USD 75-150 million for each major facility. These systems track batteries from raw material extraction, through manufacturing and use, to recycling at the end of their life. They help manage warranties, improve performance, and support second-life uses for automotive batteries.

The growth is also sped up by the spread of EV manufacturing. New plants are being set up in North America and Europe to lessen reliance on Asian supply chains. The outlook for automotive applications remains positive, as global EV sales are expected to hit 40 million units by 2030. Battery passport systems will help meet regional regulations, support circular economy initiatives, and offer competitive advantages through better sustainability credentials.

What are the Drivers, Restraints, and Key Trends of the Battery Passport Software Market?

The battery passport software market is expanding due to regulatory compliance requirements, ESG reporting mandates, supply chain transparency demands, and circular economy initiatives. Additionally, technological advancements in blockchain, AI-powered analytics, and IoT integration are enhancing solution capabilities while reducing implementation complexity.

Impact of Key Growth Drivers and Restraints on Battery Passport Software Market

Base CAGR: 31.2%

|

Driver |

CAGR Impact |

Key Factors |

|

EU Battery Regulation |

+6.8% |

• Mandatory compliance by 2027 |

|

EV Market Growth |

+4.5% |

• 40M+ EV sales by 2030 |

|

ESG Reporting Requirements |

+3.2% |

• Corporate sustainability goals |

|

Circular Economy Initiatives |

+2.4% |

• Battery recycling mandates |

Market Restraints

|

Restraint |

CAGR Impact |

Mitigation Trends |

|

High Implementation Costs |

-2.3% |

• SaaS deployment models |

|

Data Privacy Concerns |

-1.2% |

• Privacy-by-design solutions |

|

Technical Complexity |

-0.8% |

• User-friendly interfaces |

EU Battery Regulation Implementation Accelerates Market Growth

The European Union's Battery Regulation (2023/1542) is the main driver for adopting battery passport software. It requires digital product passports for industrial batteries over 2 kWh and electric vehicle batteries starting in February 2027. The regulation demands detailed documentation, including carbon footprint declarations, recycled content percentages, due diligence information, and performance data throughout each battery's lifecycle. Penalties for non-compliance can reach up to 4% of annual global turnover, which is pushing the industry to implement these changes urgently.

Battery manufacturers and automotive OEMs are making significant investments in compliance infrastructure. Leading companies are putting USD 100-300 million into traceability systems. The regulation specifies certain data points, such as the manufacturing location, date, batch numbers, chemical composition, capacity, power capability, and expected lifespan. Furthermore, batteries must have QR codes or similar data carriers that provide access to passport information. This requirement is increasing the demand for integrated hardware and software solutions

The regulation's phased rollout creates a clear market opportunity. Carbon footprint declarations start in 2025, followed by recycled content declarations in 2026, and full digital passports in 2027. This timeline is driving market growth as companies set up systems and processes before enforcement. The regulation is also affecting the global market, as multinational companies standardize their systems across regions, widening the addressable market beyond Europe.

Corporate Sustainability and ESG Reporting Drive Advanced Traceability Solutions

Corporate Environmental, Social, and Governance (ESG) commitments are driving the need for better battery traceability solutions beyond just meeting regulations. Major companies are setting ambitious carbon neutrality goals. For example, Microsoft, Apple, and Amazon now ask for detailed supply chain carbon footprints from suppliers, including battery manufacturers and electric vehicle producers. These demands promote the adoption of better carbon footprint tracking and lifecycle assessment features within battery passport systems.

The rising focus on human rights due diligence in battery supply chains creates a need for detailed material sourcing documentation, especially for cobalt, lithium, and nickel extraction. Companies are adopting solutions that trace materials from mine to battery. These solutions document labor practices, environmental impacts, and community involvement throughout the supply chain. This thorough approach needs integration with supplier systems, third-party verification platforms, and blockchain-based tracking for provenance.

Pressure from the investment community is increasing these trends. Major asset managers like BlackRock and Vanguard require detailed ESG disclosures from their portfolio companies. Industries that depend on batteries are responding by putting in place complete traceability systems that support TCFD reporting, GRI standards, and SASB metrics. The market opportunity goes beyond compliance; it offers a chance for competitive advantage. Companies with strong sustainability credentials attract higher valuations and customer preference.

Circular Economy Initiatives and Battery Recycling Drive Lifecycle Management Solutions

The shift toward circular economy principles offers significant opportunities for effective battery lifecycle management solutions. These solutions facilitate efficient recycling, refurbishment, and second-life applications. Global battery recycling capacity is growing quickly. More than USD 18 billion is planned for recycling facility investments through 2030, and each facility requires detailed battery history data to optimize recycling processes and material recovery rates.

Battery passport systems are becoming necessary for supporting second-life applications. Electric vehicle batteries with 70-80% remaining capacity can be repurposed for stationary energy storage. Companies like BMW and Nissan are creating battery tracking systems. These systems monitor performance degradation, predict remaining useful life, and help transition batteries to second-life applications. They need to integrate with battery management systems, predictive analytics, and marketplace platforms that connect battery suppliers with second-life buyers.

The increasing focus on securing critical materials is driving the need for effective material tracking and recovery improvement. Battery passport systems allow precise tracking of lithium, cobalt, nickel, and rare earth elements throughout their lifecycle. This supports strategic stockpiling decisions and supply chain risk management. New systems use optimization algorithms powered by AI to maximize material recovery rates and reduce processing costs. This creates extra value for recycling operations and supports the economic sustainability of circular battery ecosystems.

Competitive Landscape

The battery passport software market includes a mix of established tech companies, specialized sustainability providers, and emerging blockchain platforms. These groups compete through technological innovation, industry partnerships, and wide-ranging services. Leading companies are heavily investing in research and development to create integrated platforms that combine regulatory compliance, supply chain traceability, and predictive analytics, all while ensuring data security and smooth operation across global supply chains.

Major tech firms like IBM, SAP, and Microsoft are using their existing enterprise software and cloud services to offer battery passport solutions. These solutions integrate with current manufacturing and supply chain management systems. These companies are forming partnerships with battery makers, automotive original equipment manufacturers, and compliance experts to speed up market entry and solution development.

Specialized providers such as Circulor and Minespider focus on supply chain traceability and material tracking. They are developing blockchain solutions that offer reliable record-keeping and clear visibility in the supply chain. These companies set themselves apart by having deep industry knowledge, especially in mining and raw material tracking. They are also building partnerships with major battery manufacturers and automotive firms to expand their solutions worldwide.

Battery Passport Software Market Growth, By Key Regions/Countries

|

Country |

CAGR |

|

Germany |

34.2% |

|

France |

32.1% |

|

Netherlands |

31.8% |

|

United States |

29.8% |

|

China |

28.5% |

|

United Kingdom |

27.9% |

|

Japan |

26.4% |

The global battery passport software market is projected to grow at a CAGR of 31.2% from 2025 through 2035, with Europe showing the highest growth rates due to the EU Battery Regulation implementation and advanced sustainability initiatives. Germany leads with the highest projected growth at 26.5% CAGR, driven by its position as Europe's largest automotive market and home to major battery manufacturers like CATL Europe and automotive OEMs requiring comprehensive compliance solutions.

France follows with 32.1% growth, supported by substantial government investments in electric vehicle manufacturing and battery production, including major facilities from Stellantis and Renault. The Netherlands exhibits 31.8% growth, leveraging its position as a European logistics hub and early adoption of sustainability technologies across industries.

The United States shows strong 29.8% growth, driven by the Inflation Reduction Act incentives for domestic battery manufacturing and growing corporate sustainability commitments. China demonstrates 28.5% growth as the world's largest battery manufacturer, with companies implementing comprehensive traceability systems to support global supply chains and export market requirements.

Country-Specific Growth Analysis

Germany's Battery Passport Software Market Accelerates at 34.2% CAGR (2025-2035)

Germany's battery passport software market is growing rapidly, with a 34.2% CAGR. This growth is fueled by the country’s role as Europe's automotive manufacturing center and its early adoption of battery traceability systems. Major German carmakers, including BMW, Mercedes-Benz, and Volkswagen Group, are investing over EUR 2 billion combined in battery passport infrastructure to meet EU regulations and support their carbon neutrality goals for 2030-2035.

The market's growth is also boosted by significant investments in battery manufacturing. More than EUR 20 billion has been dedicated to domestic battery production facilities by companies like CATL, Northvolt, and various automotive manufacturers. Each major facility needs battery passport systems, which cost between EUR 75 million and EUR 150 million. These systems must integrate with current manufacturing execution systems and allow for real-time compliance monitoring. Germany’s strong manufacturing capabilities and its Industry 4.0 adoption provide a solid base for advanced battery tracking solutions.

Government backing through the Important Projects of Common European Interest (IPCEI) program is offering extra funding for developing the battery value chain, including the digital infrastructure needed for traceability and compliance. The German market benefits from effective regulatory enforcement and early use of sustainable technologies. This creates a premium market for advanced battery passport solutions with detailed analytics and predictive features.

United States Battery Passport Market Driven by Domestic Manufacturing and Corporate Sustainability

The US battery passport software market is expected to grow at a 29.8% CAGR from 2025 to 2035. This growth is fueled by the Inflation Reduction Act's domestic content requirements and significant investments in American battery manufacturing capacity. Major companies like LG Energy Solution, SK Innovation, and Panasonic need detailed tracking systems to show compliance with domestic content rules and help optimize their supply chains. The cost of individual implementations can reach USD 100-200 million.

Corporate sustainability commitments are increasing demand as American companies like General Motors, Ford, and Tesla adopt battery traceability systems to meet their carbon neutrality goals and ESG reporting needs. The US market is strong due to its technology infrastructure and analytics capabilities. This allows for advanced predictive maintenance and performance improvements in battery passport platforms.

The rising emphasis on critical material security and supply chain resilience is creating a need for detailed tracking solutions. These solutions help with strategic stockpiling and diversifying suppliers. American companies are turning to blockchain-based systems that offer clear supply chain visibility while ensuring data security and protecting intellectual property. This supports the growth of secure domestic battery supply chains.

Key Players in Battery Passport Software Market Expand Global Reach with Innovative Technology

Leading companies in the global battery passport software market are developing platforms that combine regulatory compliance, supply chain tracking, and analytics to meet various industry needs. Companies like IBM and SAP use their software expertise and global networks to offer integrated solutions. These solutions connect seamlessly with existing manufacturing and supply chain systems, providing complete visibility and automated compliance reporting.

Specialized providers including Circulor and Minespider are improving blockchain-based tracking solutions. They offer secure record-keeping and clear supply chain visibility from raw material extraction to battery disposal. Their advantages include strong industry knowledge in mining and material tracing, along with established ties to major battery makers and automotive manufacturers.

Microsoft and Oracle are growing their cloud-based services with industry-focused solutions. These solutions combine AI-driven analytics, predictive maintenance, and compliance management. They work with IoT sensors and battery management systems to enable real-time monitoring and automatic data collection. This reduces implementation challenges and operational costs. Companies focus on partnerships with car manufacturers, battery makers, and regulatory tech providers to build complete ecosystem solutions.

Recent Developments in the Global Battery Passport Software Market

In Q1 2025, Circulor secured USD 150 million in Series C funding to accelerate global expansion of its blockchain-based battery traceability platform, with major investments from automotive industry partners including BMW i Ventures and Mercedes-Benz Venture Capital. The funding supports the development of AI-powered predictive analytics capabilities and expansion into North American and Asian markets ahead of anticipated regulatory requirements.

|

Item |

Value |

|

Market Size (2025) |

USD 42.58 Million |

|

Solution Type |

Digital Product Passport, Supply Chain Traceability, Compliance Management, Lifecycle Management, Carbon Footprint Tracking, Due Diligence Tools |

|

Deployment Mode |

Cloud-Based, On-Premises, Software-as-a-Service (SaaS) |

|

End-Use Industry |

Automotive, Energy Storage Systems, Consumer Electronics, Industrial Applications, Aerospace & Defense |

|

Regions Covered |

Europe, North America, Asia-Pacific, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Circulor, Minespider, IBM, SAP, Microsoft, Oracle, Accenture, PwC, Deloitte, KPMG, EY, Everledger |

|

Additional Attributes |

Porter's Five Forces Analysis, regulatory impact analysis, technology roadmap assessment, competitive benchmarking, blockchain implementation trends, ESG reporting requirements, circular economy impact models |

The global battery passport software market is estimated to be valued at USD 42.58 million in 2025.

The market size for battery passport software is projected to reach USD 642.05 million by 2035.

The battery passport software market is expected to grow at 31.2% CAGR between 2025 and 2035.

Digital Product Passport solutions command the largest share at 35-40% due to their fundamental role in regulatory compliance and battery identification.

The automotive industry represents 40-45% of market demand, driven by EV adoption and regulatory compliance requirements for battery documentation.

1. Market Definition & Scope

1.1. Market Definition

1.2. Market Ecosystem

1.3. Currency

1.4. Key Stakeholders

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders from the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.1.1. Bottom-up Approach

2.3.1.2. Top-down Approach

2.3.2. Growth Forecast Approach

2.3.3. Assumptions for the Study

3. Executive Summary

3.1. Overview

3.2. Segmental Analysis

3.2.1. Battery Passport Software Market, by Solution Type

3.2.2. Battery Passport Software Market, by Deployment Mode

3.2.3. Battery Passport Software Market, by Component

3.2.4. Battery Passport Software Market, by Battery Type

3.2.5. Battery Passport Software Market, by End-Use Industry

3.2.6. Battery Passport Software Market, by Enterprise Size

3.2.7. Battery Passport Software Market, by Region

3.3. Competitive Landscape

3.4. Strategic Recommendations

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Drivers

4.2.1.1. EU Battery Regulation implementation and global regulatory compliance requirements

4.2.1.2. Growing demand for battery traceability and transparency in supply chains

4.2.1.3. Increasing focus on circular economy and sustainable battery lifecycle management

4.2.1.4. Rising adoption of electric vehicles and energy storage systems

4.2.1.5. Corporate sustainability reporting and ESG compliance requirements

4.2.2. Restraints

4.2.2.1. High implementation costs and complex integration requirements

4.2.2.2. Data privacy and security concerns across global supply chains

4.2.2.3. Lack of standardized protocols and interoperability challenges

4.2.2.4. Limited awareness and technical expertise in emerging markets

4.2.3. Opportunities

4.2.3.1. Integration with emerging technologies (AI, blockchain, IoT)

4.2.3.2. Expansion into developing markets with growing battery manufacturing

4.2.3.3. Development of industry-specific solutions and customization

4.2.3.4. Strategic partnerships with battery manufacturers and OEMs

4.2.4. Trends

4.2.4.1. Adoption of blockchain technology for immutable data records

4.2.4.2. Real-time monitoring and predictive analytics integration

4.2.4.3. Cloud-native and SaaS-based solution deployment

4.2.4.4. Mobile and web-based user interface development

4.2.5. Challenges

4.2.5.1. Ensuring data accuracy and integrity across complex supply chains

4.2.5.2. Managing multi-stakeholder coordination and data sharing

4.2.5.3. Adapting to evolving regulatory requirements globally

4.3. Porter's Five Forces Analysis

4.3.1. Bargaining Power of Suppliers

4.3.2. Bargaining Power of Buyers

4.3.3. Threat of Substitutes

4.3.4. Threat of New Entrants

4.3.5. Degree of Competition

4.4. Technology Impact on Battery Passport Software Market

4.4.1. Blockchain and Distributed Ledger Technologies

4.4.1.1. Immutable record keeping and transparency

4.4.1.2. Smart contracts for automated compliance

4.4.1.3. Decentralized data management systems

4.4.2. Artificial Intelligence and Machine Learning

4.4.2.1. Predictive analytics for battery performance

4.4.2.2. Automated data validation and anomaly detection

4.4.2.3. Intelligent reporting and compliance monitoring

4.4.3. Internet of Things (IoT) Integration

4.4.3.1. Real-time battery monitoring sensors

4.4.3.2. Automated data collection and transmission

4.4.3.3. Edge computing for local data processing

5. Impact of Regulatory Framework on Battery Passport Software Market

5.1. EU Battery Regulation (2023/1542) requirements and timeline

5.2. Global regulatory landscape and harmonization efforts

5.3. Due diligence and human rights compliance requirements

5.4. Carbon footprint calculation and reporting standards

5.5. Recycling and circular economy mandates

5.6. Data protection and cybersecurity regulations

5.7. International trade and customs compliance

6. Competitive Landscape

6.1. Overview

6.2. Key Growth Strategies

6.3. Competitive Benchmarking

6.4. Competitive Dashboard

6.4.1. Industry Leaders

6.4.2. Market Differentiators

6.4.3. Vanguards

6.4.4. Contemporary Stalwarts

6.5. Market Share/Ranking Analysis, by Key Players, 2024

7. Battery Passport Software Market Assessment—By Solution Type

7.1. Overview

7.2. Digital Product Passport (DPP) Solutions

7.2.1. QR Code-Based Passports

7.2.2. RFID-Enabled Passports

7.2.3. NFC-Based Passports

7.3. Supply Chain Traceability Platforms

7.3.1. Raw Material Tracking

7.3.2. Manufacturing Process Monitoring

7.3.3. Distribution and Logistics Tracking

7.4. Compliance Management Systems

7.4.1. Regulatory Reporting Modules

7.4.2. Audit Trail Management

7.4.3. Documentation Management

7.5. Lifecycle Management Solutions

7.5.1. Battery Health Monitoring

7.5.2. Performance Analytics

7.5.3. End-of-Life Management

7.6. Carbon Footprint Tracking Solutions

7.7. Due Diligence and Risk Assessment Tools

7.8. Others

8. Battery Passport Software Market Assessment—By Deployment Mode

8.1. Overview

8.2. Cloud-Based Solutions

8.2.1. Public Cloud

8.2.2. Private Cloud

8.2.3. Hybrid Cloud

8.3. On-Premises Solutions

8.4. Software-as-a-Service (SaaS)

9. Battery Passport Software Market Assessment—By Component

9.1. Overview

9.2. Software Platforms

9.2.1. Core Passport Management Systems

9.2.2. Data Analytics and Reporting Tools

9.2.3. Integration and API Management

9.3. Services

9.3.1. Implementation and Integration Services

9.3.2. Consulting and Advisory Services

9.3.3. Support and Maintenance Services

9.3.4. Training and Education Services

9.4. Hardware Components

9.4.1. Data Capture Devices

9.4.2. Sensors and Monitoring Equipment

9.4.3. Storage and Networking Infrastructure

10. Battery Passport Software Market Assessment—By Battery Type

10.1. Overview

10.2. Lithium-Ion Batteries

10.2.1. Lithium Iron Phosphate (LFP)

10.2.2. Nickel Manganese Cobalt (NMC)

10.2.3. Nickel Cobalt Aluminum (NCA)

10.3. Lead-Acid Batteries

10.4. Nickel-Metal Hydride Batteries

10.5. Solid-State Batteries

10.6. Other Battery Chemistries

11. Battery Passport Software Market Assessment—By End-Use Industry

11.1. Overview

11.2. Automotive Industry

11.2.1. Electric Vehicles (EVs)

11.2.2. Hybrid Electric Vehicles (HEVs)

11.2.3. Commercial Vehicles

11.3. Energy Storage Systems

11.3.1. Grid-Scale Storage

11.3.2. Residential Energy Storage

11.3.3. Commercial Energy Storage

11.4. Consumer Electronics

11.4.1. Smartphones and Tablets

11.4.2. Laptops and Computers

11.4.3. Wearable Devices

11.5. Industrial Applications

11.5.1. Material Handling Equipment

11.5.2. Backup Power Systems

11.5.3. Telecommunications

11.6. Aerospace and Defense

11.7. Marine and Maritime

11.8. Others

12. Battery Passport Software Market Assessment—By Enterprise Size

12.1. Overview

12.2. Large Enterprises

12.3. Small and Medium Enterprises (SMEs)

13. Battery Passport Software Market Assessment—By Geography

13.1. Overview

13.2. Europe

13.2.1. Germany

13.2.2. France

13.2.3. Netherlands

13.2.4. Sweden

13.2.5. Italy

13.2.6. United Kingdom

13.2.7. Rest of Europe

13.3. North America

13.3.1. United States

13.3.2. Canada

13.4. Asia-Pacific

13.4.1. China

13.4.2. Japan

13.4.3. South Korea

13.4.4. India

13.4.5. Australia

13.4.6. Singapore

13.4.7. Rest of Asia-Pacific

13.5. Latin America

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Middle East & Africa

13.6.1. UAE

13.6.2. Saudi Arabia

13.6.3. South Africa

13.6.4. Israel

13.6.5. Rest of Middle East & Africa

14. Company Profiles

(Business Overview, Financial Overview, Product Portfolio, Strategic Developments, and SWOT Analysis)

14.1. Circulor Ltd.

14.2. Minespider GmbH

14.3. Responsible Minerals Initiative (RMI)

14.4. Everledger Ltd.

14.5. IBM Corporation

14.6. SAP SE

14.7. Microsoft Corporation

14.8. Oracle Corporation

14.9. Accenture plc

14.10. PwC (PricewaterhouseCoopers)

14.11. Deloitte Touche Tohmatsu Limited

14.12. KPMG International

14.13. EY (Ernst & Young)

14.14. Transparency-One (Groupe SEB)

14.15. Supply Shift Inc.

14.16. Sourcemap Inc.

14.17. Battery Passport Initiative

14.18. Global Battery Alliance (GBA)

14.19. Other Key Players

15. Appendix

15.1. Available Customization

15.2. Related Reports

Published Date: Aug-2025

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates